Cable Ads Lose Audience As Cord Cutting Accelerates

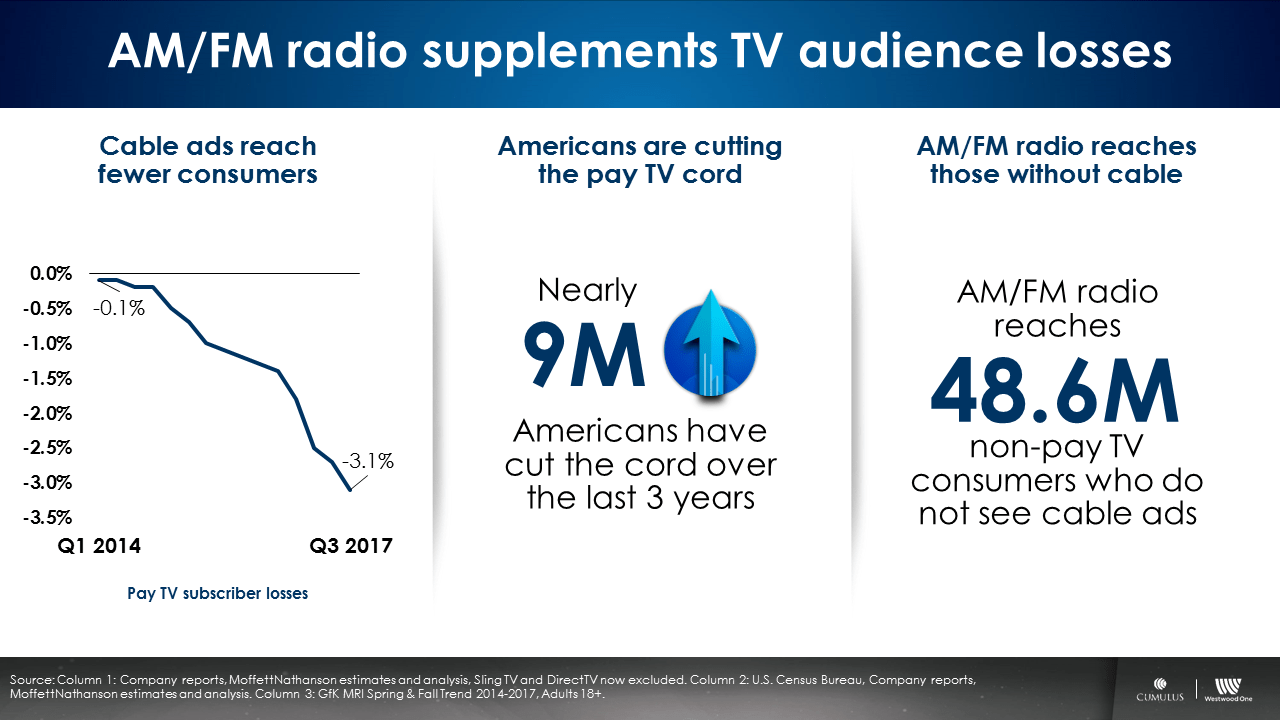

Wall Street Media Analyst MoffettNathanson recently released an analysis of Q3 2017 cable cord cutting. The news for cable advertisers is not good:

“It won’t surprise anyone that the shift from linear TV to OTT alternatives gathered momentum in the third quarter. The only question was how fast. Well, now we know. The rate of decline did meaningfully accelerate.”

Since 2014, MoffettNathanson estimates 9 million Americans have cut the cord. As of Q3 2017, pay TV subscriber losses have increased to -3.1%.

Whether you’re a local advertiser who buys local cable ads or a national advertiser buying network cable, media plans are gradually losing TV GRPs and reach. As 2018 media plans come together, how can advertisers replace lost cable TV audiences?

AM/FM radio.

According to GfK MRI, AM/FM radio reaches 48.6 million Americans who don’t have pay TV and don’t see cable ads. AM/FM radio also reaches 17% more adults than cable networks.

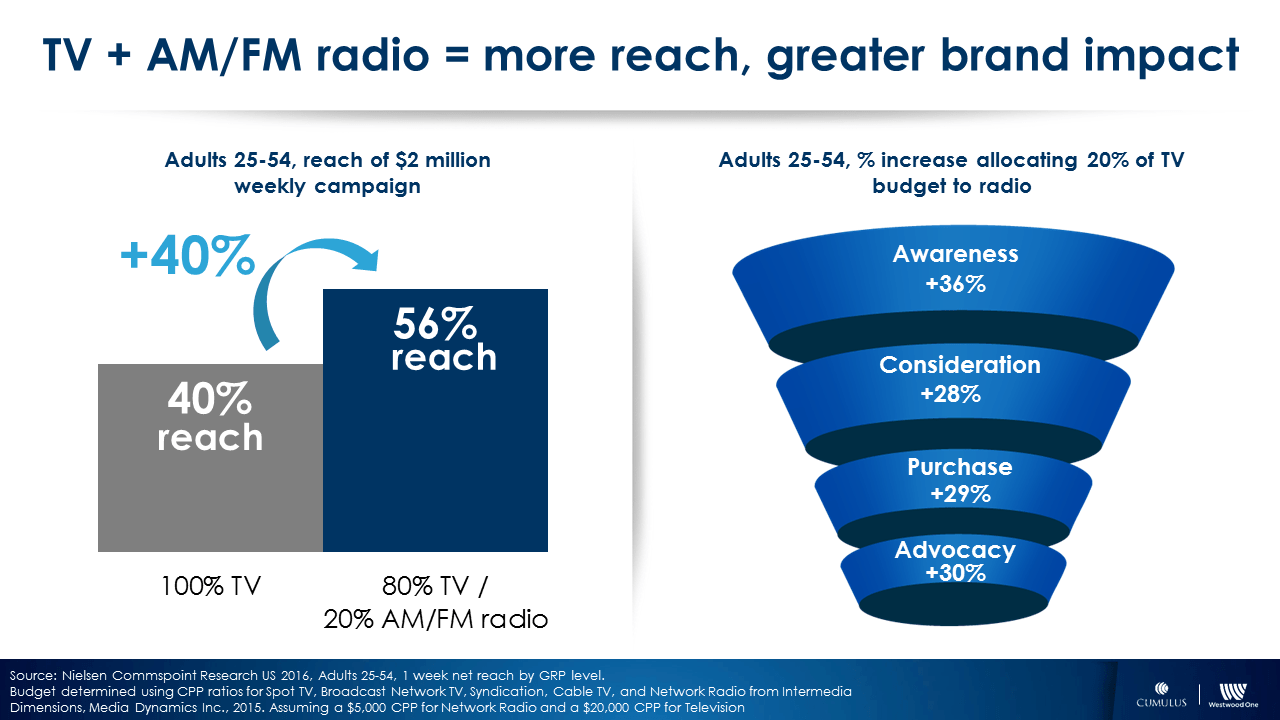

TV and AM/FM radio work together

Allocating 20% of a TV budget to AM/FM radio increases campaign reach by 40%. The addition of AM/FM radio into the media plan also boosts advertiser awareness, consideration, purchase, and brand advocacy.

Key takeaways:

- Pay TV losses accelerated in Q3 2017

- 9 million Americans have cut the cord over the last three years

- AM/FM radio reaches 48.6 million consumers who don’t have pay TV and don’t see cable ads

- Allocating 20% of a TV budget to AM/FM radio increases reach by 40% and boosts advertiser awareness, consideration, purchase, and brand advocacy

Pierre Bouvard is Chief Insights Officer at Cumulus | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.