Westwood One And LeadsRx Debut First-Ever Direct-To-Consumer Media Attribution And Awareness Report

Direct-to-consumer brands are an exciting new breed of advertisers that have burst onto the scene. Terence Kawaja, CEO of investment bank LUMA Partners, explains, “These direct-to-consumer brands – referred to as D2C or DTC – have done just what the name implies: cut out the middle man to go directly to the consumer.” Examples of products from direct-to-consumer companies include Blue Apron meal kits, Warby Parker eyewear, and Glossier skincare and beauty products.

Colin Lewis, CMO of OpenJaw Technologies, says, “The attractions of DTC brands are pretty clear: brand control through product, packaging, brand message and digital merchandising; proposition control through aligning the brand with the customer experience; insight through having direct access to the consumer; and no messy negotiations with retailer that can cause delays, interruptions and margin reduction.”

Kawaja says the emergence of direct-to-consumer brands “is one of the biggest changes going on in marketing. Despite struggles of traditional marketers to achieve growth, here’s a category of relatively young startups in a relatively short period of time with relatively little capital that are garnering double-digit market share away from category incumbents that have been building brand equity, [and] brand loyalty for decades.”

Kawaja has plotted direct-to-consumer companies on his famed “LUMAscape” which visualizes direct-to-consumer categories and brands.

First-ever direct-to-consumer media attribution and awareness study: LeadsRx and MARU/Matchbox

To understand the marketing effectiveness of direct-to-consumer firms and the state of their brand equity, Westwood One, America’s largest radio network, created the Direct-To-Consumer Media Attribution and Awareness Report.

For the report, LeadsRx, a leading multi-touch attribution firm, conducted a major attribution and awareness study. They measured advertising campaigns of 62 different direct-to-consumer retailers covering the categories of home, auto, events, entertainment, food, pet, apparel, and marketplace/online auction sites. LeadsRx measured the site traffic lift of the 62 direct-to-consumer brands generated by advertising on Google/Facebook, AM/FM radio, and television.

Separately, Westwood One also commissioned MARU/Matchbox to field a national awareness study in January 2019 of 252 direct-to-consumer brands selected across a variety of categories. 1,334 consumers were surveyed.

Reinforcing Westwood One’s commitment to understanding the impact of audio and using its power to drive sales results, the report is being released by the Westwood One ROI Guarantee Audio Insights platform.

Here’s what the report reveals:

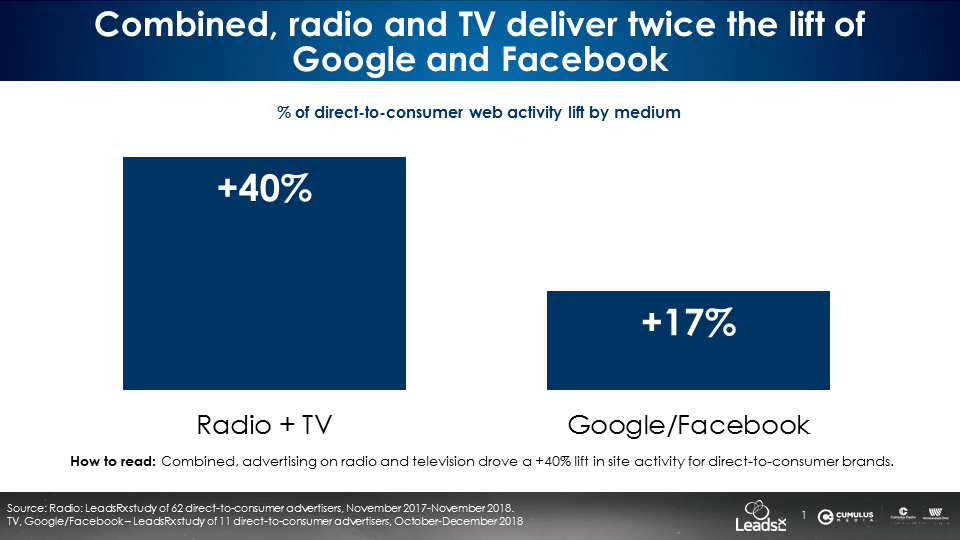

Combined, TV and AM/FM radio ads generate twice the site traffic lift of Google/Facebook ads

While direct-to-consumer brands launched in digital and use their first party data to drive performance-based marketing, their spending in TV and radio generates impact. LeadsRx found that TV and AM/FM radio drove a combined 40% site traffic lift compared to 17% for Google/Facebook.

Rachel Tipograph, founder and CEO of social commerce platform MikMak, tells Laura Correnti and Alexis Christon on their ADLANDIA podcast that “(Facebook’s) cost per customer acquisition is getting really high in a lot of the main popular consumer categories, so now you need to diversify.”

Terence Kawaja concurs, saying, “DTC brands are approaching an inflection point where it’s necessary to move outside of the digital channel to maintain the growth that has made these brands successful thus far. Coupled with increased media costs on Facebook and Instagram, and it becomes an imperative for DTC brands to find additional marketing channels to extend reach and remain cost-effective.”

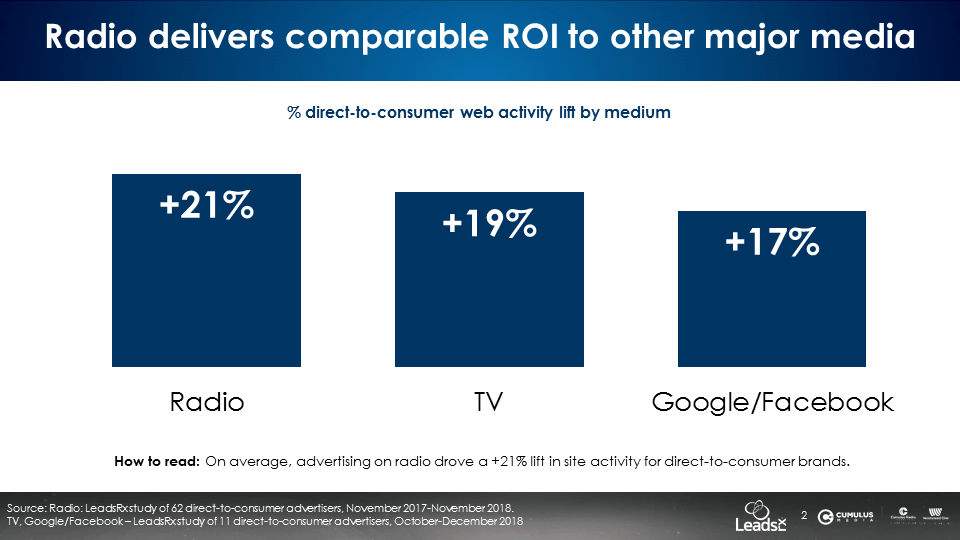

AM/FM radio generates the same lift as television and Google/Facebook, despite lower investment

Direct-to-consumer brands were born in digital so naturally, their marketing priority is Google/Facebook. According to Social Capital, “Startups spend almost 40 cents of every VC (venture capital) dollar on Google, Facebook, and Amazon.” After that, direct-to-consumer brands turn to television. AM/FM radio receives less attention.

The impressive performance of radio in the LeadsRx attribution data is significant. AM/FM radio drives just as much site traffic as Google/Facebook and television despite far lower levels of investment. If the AM/FM radio investment is increased, it stands to reason that direct-to-consumer site traffic growth will follow.

“DTC brands often think first of Google and Facebook when allocating ad spend,” said AJ Brown, CEO of LeadsRx. “However, this study conclusively shows that broadcast media like television and AM/FM radio play an equal role in delivering shoppers or web lift. More importantly, in our experience attributing full-funnel conversions with DTC brands, broadcast is often a more cost-effective channel for delivering actual buyers.”

“Two-thirds of podcast advertisers today are DTC brands and they report stunning sales effect and spectacular ROI with podcasts,” said Suzanne Grimes, EVP, Marketing for CUMULUS MEDIA and President, Westwood One. “With this report, we now have hard evidence that AM/FM radio generates significant impact for DTC brands too.”

Podcasting is beloved by direct-to-consumer brands

Direct-to-consumer brands represent a large percentage of podcast advertisers. Direct-to-consumer brands report the sales effects of podcast ads are impressive and the return on ad spend rivals many other media platforms.

Consider the top 20 advertisers who ran the most podcast ads in 2018 from Magellan Audio, the firm that tracks advertising occurrences in podcast programming:

| Brand | 2018 podcast ad occurrences |

| Ziprecruiter | 1667 |

| Squarespace | 789 |

| Quicken Loans | 684 |

| Amazon | 634 |

| SimpliSafe | 549 |

| Square | 526 |

| Stamps.com | 494 |

| Quip | 396 |

| Blue Apron | 349 |

| Comcast | 290 |

| Casper | 286 |

| SeatGeek | 282 |

| Unilever | 217 |

| FreshBooks | 215 |

| Madison Reed | 213 |

| Geico | 210 |

| Talkspace | 188 |

| MeUndies | 184 |

| Robinhood | 181 |

| Booz Allen Hamilton | 176 |

Cameron Hendrix, co-founder of Magellan Audio, reports: “2/3 of the top 50 podcast advertisers in 2018 are direct-to-consumer brands tracking performance with coupon codes, many of whom didn’t exist just a few years ago. DTC brands clearly value the authentic connection between podcast host and listener – over 60% of the ads that Magellan picked up for those DTC brands during the 2018 holiday season were host-read.”

Why is the site traffic lift generated by podcast ads not exploding in dashboards of attribution platforms like LeadsRx?

Attribution measurement requires the exact day/date/time of ads airing on TV, in Facebook, or on AM/FM radio. Credit is given to a portion of site traffic that occurs within a narrow time window after ad airing.

No one knows when consumers actually hear podcast ads. As such, podcasting cannot be quantified in attribution services like LeadsRx.

However, the use of direct response host codes and custom site landing pages provide strong evidence of sales effect and ROI.

Firms are working on solutions. Podsights and Qualia, for example, have the capability to connect those who download a podcast to the visitation of an advertiser’s site.

The site traffic lift of television, AM/FM radio, and Google/Facebook each occur on different days

LeadsRx finds there is a remarkable day-to-day consistency in site traffic generated by Google/Facebook. Television ads generate higher site traffic Saturday through Monday while AM/FM radio ads drive higher direct-to-consumer site traffic Tuesday through Thursdays.

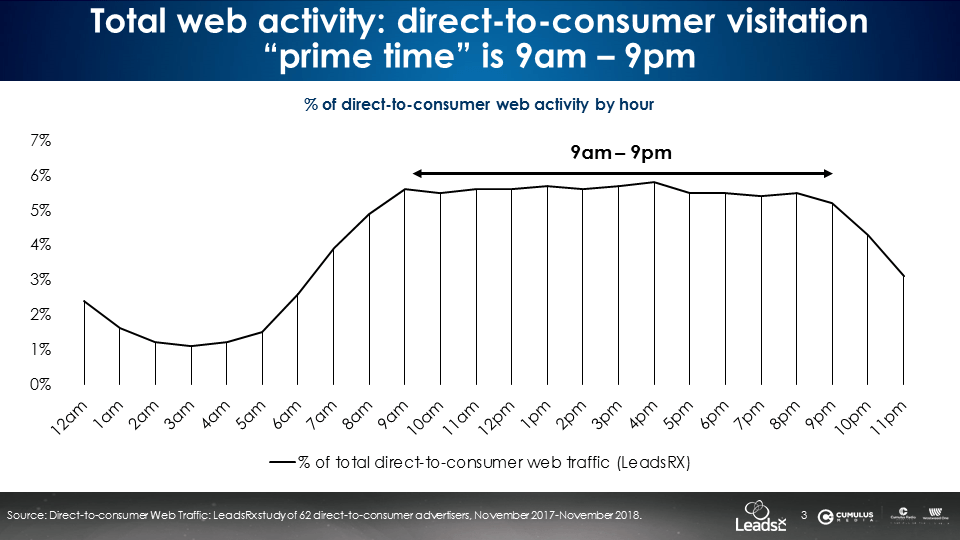

Total direct-to-consumer site traffic “prime time” is 9AM to 9PM

Direct-to-consumer categories see different site traffic patterns. Home goods sites see the largest site activity 10AM-7PM. Entertainment sites have the greatest visitation 3PM to midnight. To reach consumers during times of greatest category use, campaign weight could be strategically aligned.

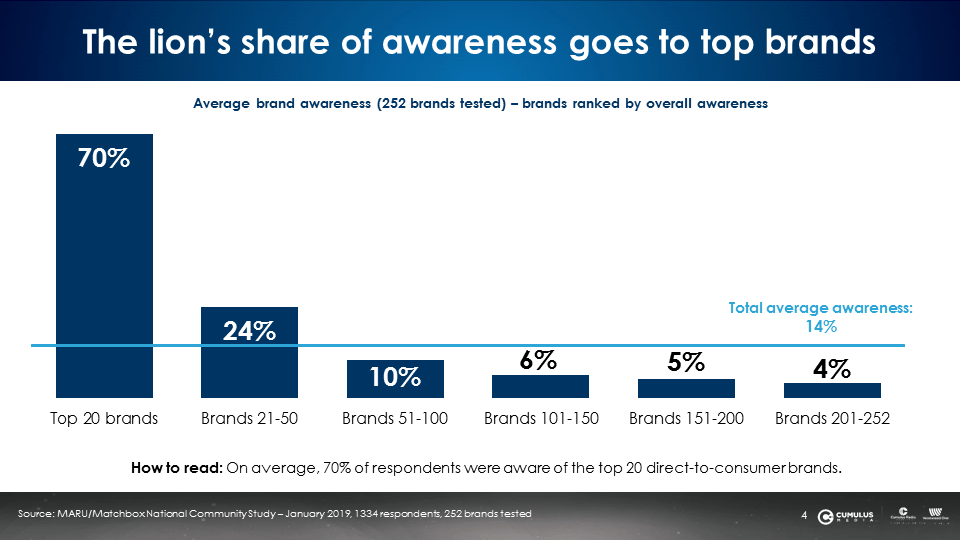

The MARU/Matchbox national awareness study found direct-to-consumer brands have a long way to go in building mass consumer awareness

Of the 252 brands measured, only 17 have over a 50% awareness. No doubt, most of these brands are only a few years old.

The top 20 direct-to-consumer brands have an average awareness of 70%. The next 30 brands have an awareness of 24%. The remaining 200 brands have an average awareness of less than 10%.

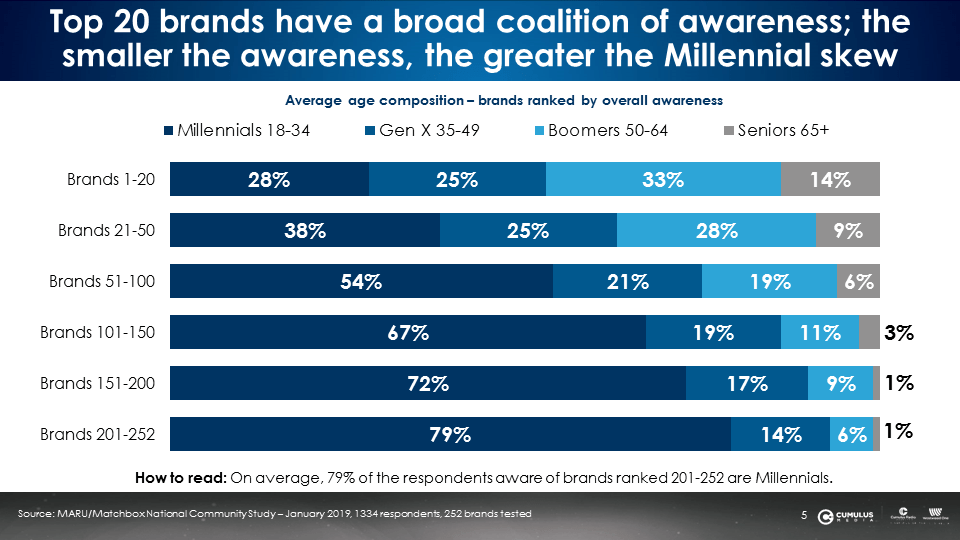

Awareness of direct-to-consumer brands is highest among 18-34 Millennials and drops sharply in older demographics

Top 20 brands, those using mass reach media like television and radio, have broad awareness across demographics. Outside the top 20, brand awareness is centered among 18-34s.

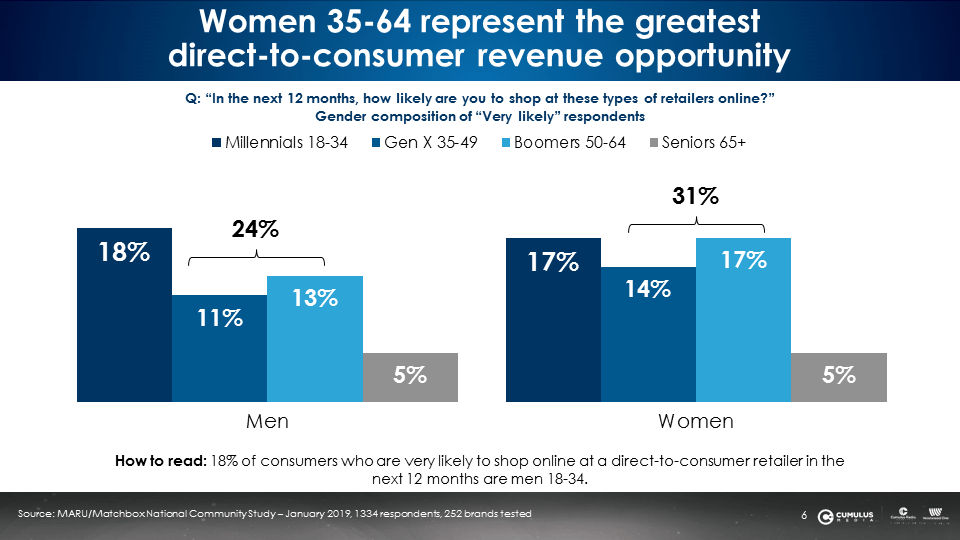

Women 35-64 represent the greatest direct-to-consumer revenue opportunity

Among those that say they are “very likely” to shop with online retailers, 55% are 35-64. 35% are 18-34.

Women represent the largest potential source of direct-to-consumer growth. Among those that say they are very likely to shop online retailers, 31% are women 35-64 versus 24% for men 35-64.

Click here for the MARU/Matchbox brand awareness rankings by category

Direct-to-consumer firms need to focus on brand building

The leading authorities on marketing effectiveness indicate in order to be successful, direct-to-consumer brands must shift from narrow targeting to mass reach brand building.

Les Binet and Peter Field, the godfathers of marketing effectiveness, in their new book Effectiveness in Context: A Manual for Brand Building, conclude, “The gradual shift to online distribution for brands means that the importance of strong brands is growing. The crowded and competitive world of e-commerce is no place for the weak. The more online research that consumers conduct, the more important it is to invest in strong brands to prime choice in advance of purchasing – last minute purchase activation is no substitute for brand building. Without brand strengthening, growth will be weaker, pricing power will not improve and profitability growth will be severely reduced.”

Ideal budget mix for e-commerce brands: 74% brand building, 26% sales activation

The Binet and Field analysis of marketing effectiveness data reveals an optimum budget allocation of 74% towards brand building communications and 26% on short-term sales activation for e-commerce brands.

“DTC brands often over-emphasize the ROI power of bottom-funnel tactics like social and display, remarketing, and brand SEM. Scaling efficient channels with the mass reach of television and AM/FM radio feeds the funnel from the top and amplifies awareness and brand impact,” said John Leeman, President & CMO of Brand Value Growth LLC, an owner of a diversified portfolio of direct-to-consumer brands.

The second act of direct-to-consumer: looking ahead to marketing maturity

Shane O’Leary, Consumer Strategy Director at Mindshare believes the direct-to-consumer space is evolving from its “first act” to “second act.”

Where direct-to-consumer brands once looked to target and attract early adopters, in the second act they will “attempt to grow through market penetration and attracting the masses.” Other shifts will include a business model attracting light category buyers, favoring traditional media and brand building over digital direct response options, and creating relationships with consumers, and developing physical retail experiences.

O’Leary sums up: “The reality is that it’s still incredibly hard to create a profitable, mass market business if you try to do it without mass media, physical retail and distribution. VC money, hype and early adopters will only get you so far. To build a business you need a mix of old and new. Traditional and digital. Direct and through retail.”

To summarize:

- Direct-to-consumer brands represent a new way of thinking about the consumer experience.

- LeadsRx found TV and AM/FM radio drive direct-to-consumer site traffic at a rate of 2X Google/Facebook.

- Despite seeing light direct-to-consumer investment, AM/FM radio generates comparable site traffic lift to Google/Facebook and TV.

- Few direct-to-consumer brands have strong awareness. The majority of awareness is centered among 18-34s while the greatest opportunity lies with women 35-64.

- Marketing effectiveness data reveals the need to shift from niche targeting to mass reach brand building.

Click here to read additional coverage of this story on MediaPost

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.