Westwood One And Audience Insights Inc.’s Podcast Download – Spring 2019 Report Highlights: Podcast Usage Habits, Advertiser Insights, Podcast Discovery, and More

In May 2018, Audience Insights Inc. released The Canadian Podcast Listener 2018, a comprehensive study of 1500+ monthly Canadian podcast listeners. The study covered topics such as podcast origin timeline, podcast publishers, listener demographics, podcast discovery, listener behavior, and more.

In America, podcasting has rapidly become a popular medium for both consumers and advertisers. According to Edison Research’s annual Infinite Dial study, monthly podcast listening among Americans has grown +23% – from 26% in 2018 to 32% in 2019. Podcast ad revenues are also soaring. According to the IAB, podcast advertising grew 53% in 2018.

As a major thought leader on podcast listening behavior, trends, and sentiment, Westwood One partnered with Audience Insights Inc. to replicate The Canadian Podcast Listener 2018 for the United States. The new collaborative study powered by Westwood One and Audience Insights Inc. featured only American monthly podcast listeners and was created in conjunction with MARU/Matchbox, a nationally recognized leader in consumer research.

The results, now revealed in the Westwood One and Audience Insights Inc.’s Podcast Download – Spring 2019 Report, is part of the industry-leading Westwood One ROI Guarantee Audio Insights platform. Fielded in March 2019, the report examines the podcast consumption habits of 1,407 monthly podcast listeners and focuses on four distinct segments based on when people began listening to podcasts. These segments include “Podcast Pioneers” who started listening four or more years ago, those who began listening 2-3 years ago, those who began listening in the past 7-12 months, and “Podcast Newcomers” who began listening within the last six months.

“This new Podcast Download Report expands on much of what we’ve seen as we put our microscope on Canadian podcast listeners,” says Jeff Vidler, President of Audience Insights Inc. and Study Director of The Canadian Podcast Listener study, with its third annual report scheduled for release this Fall. “Podcasting is uniquely engaging — on trend with on-demand content platforms like Netflix or paid music streaming services, but the only one accessible to advertisers.”

Here are a few of the key findings:

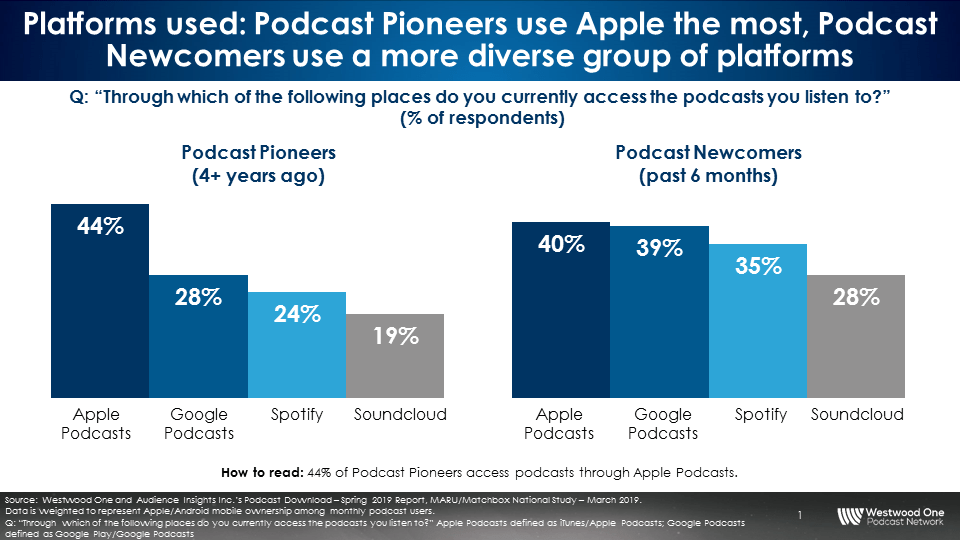

Podcast access: Spotify and Google are attracting consumers who recently began listening to podcasts

Among Podcast Pioneers, those who have been listening to podcasts over four years, Apple is the leading destination (44%). More recent podcast listeners, the Podcast Newcomers, use a much broader and diverse group of platforms to access podcasts in addition to Apple (40%), including Google (39%), Spotify (35%), and Soundcloud (28%).

While the average monthly podcast listener accesses 2.7 podcast platforms, Podcast Newcomers use 3.5 platforms, mirroring “Power” podcast listeners who use 3.8 platforms.

“The finding that emerging podcast listeners are using a diverse number of platforms signals a turning point for the podcast industry,” said Suzanne Grimes, EVP, Marketing for CUMULUS MEDIA and President, Westwood One. “When compared to the Podcast Pioneers, who use Apple Podcasts almost exclusively, Podcast Newcomers are open to using multiple platforms to access podcasts.”

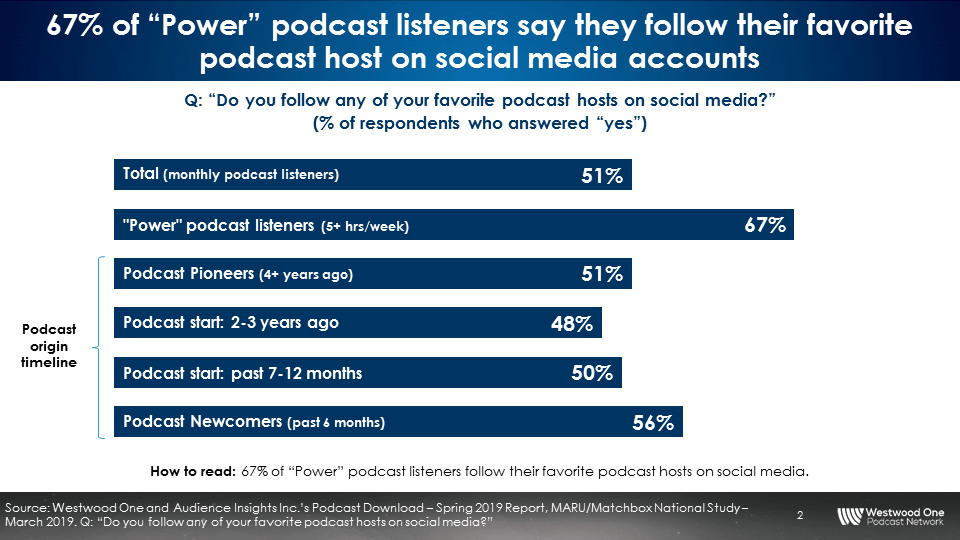

A stunning 67% of “Power” podcast listeners (those who listen to 5+ hours per week) follow their favorite podcast hosts on social media

Listeners are invested in their favorite podcasts and follow their favorite hosts on social media. Half of monthly listeners follow their favorite hosts on social media. That number grows to a massive 67% among “Power” listeners.

There is an opportunity for podcast advertisers to extend their podcast investments into social media buys that align with the podcast hosts. There is a rich concentration of fans interacting with their favorite hosts on social media.

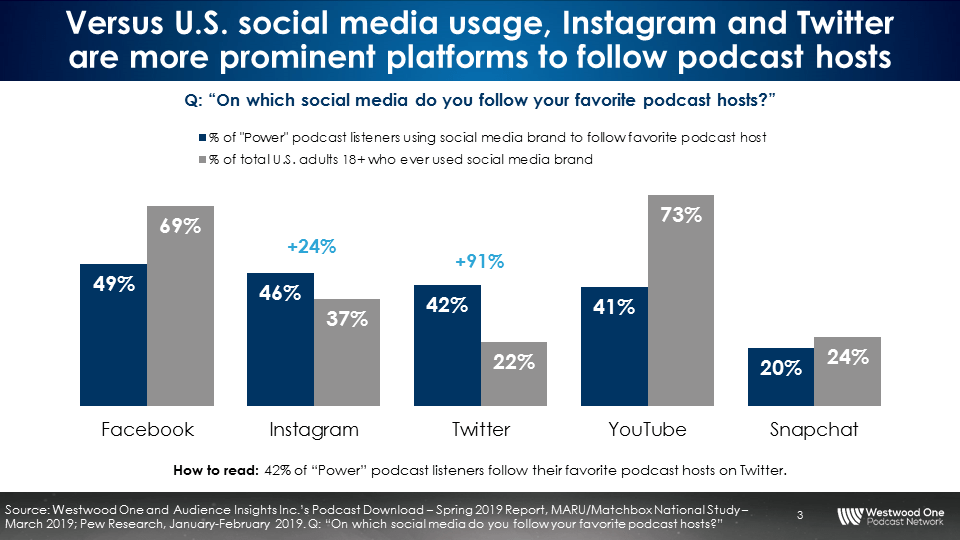

“Power” podcast listeners equally use Facebook, Instagram, Twitter, and YouTube to follow their favorite hosts

It’s not enough to just be on one social channel. Podcast hosts must maintain their presence on all four social platforms to engage with their audience as “Power” listeners follow on multiple channels.

Twitter is an important social media platform for following podcast hosts. 42% of “Power” podcast listeners follow their favorite podcast host on Twitter compared to the 22% of U.S. adults who ever use Twitter. Instagram is also a social environment where “Power” podcast listeners are more engaged. 46% of “Power” podcast listeners use Instagram to follow hosts versus the 37% of Americans who ever use Instagram.

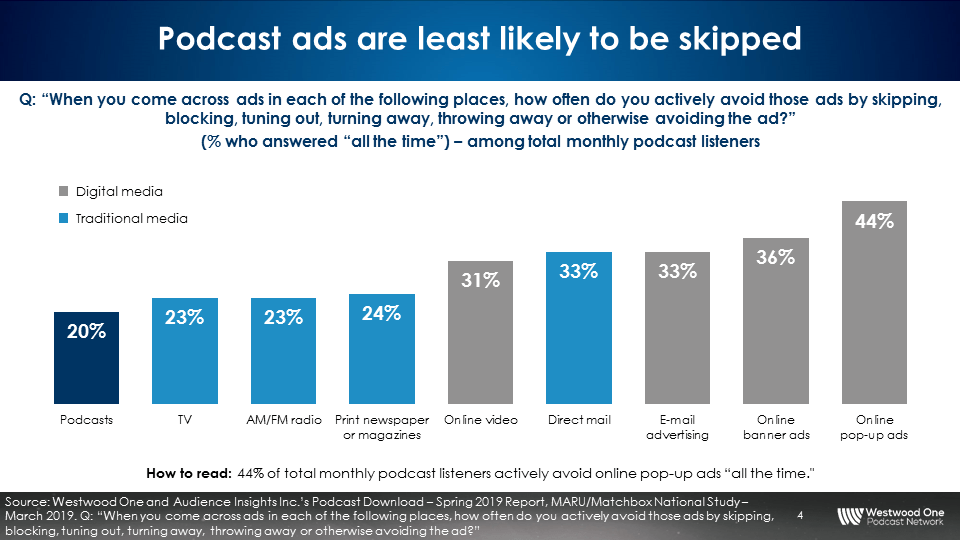

Podcast ads are the least likely to be skipped among all media

Podcast listeners are hearing podcast ads. Only one in five monthly podcast listeners say they skip ads compared to online pop-up ads (44%), online banner ads (36%), and e-mail advertising ads (33%). This puts podcasting among the lower ad skip rates of more traditional media like television and AM/FM radio, each at 23%.

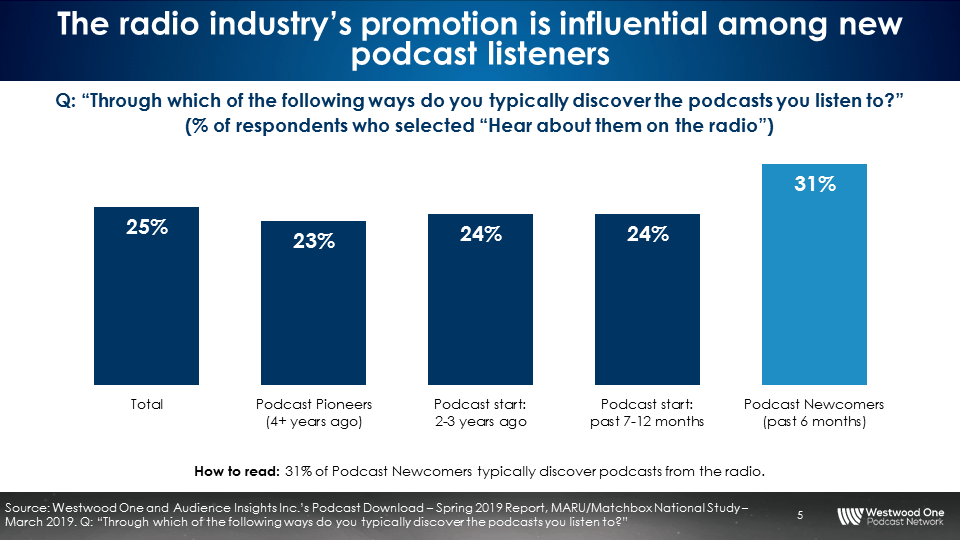

Podcast promotion on AM/FM radio is being noticed

AM/FM radio has emerged as an influencer for podcast discovery. A quarter of monthly podcast listeners cite AM/FM radio ads as the way they heard about the podcast they listen to. The percentage grows to 31% of Podcast Newcomers who typically discover podcasts by hearing about them on AM/FM radio. Why?

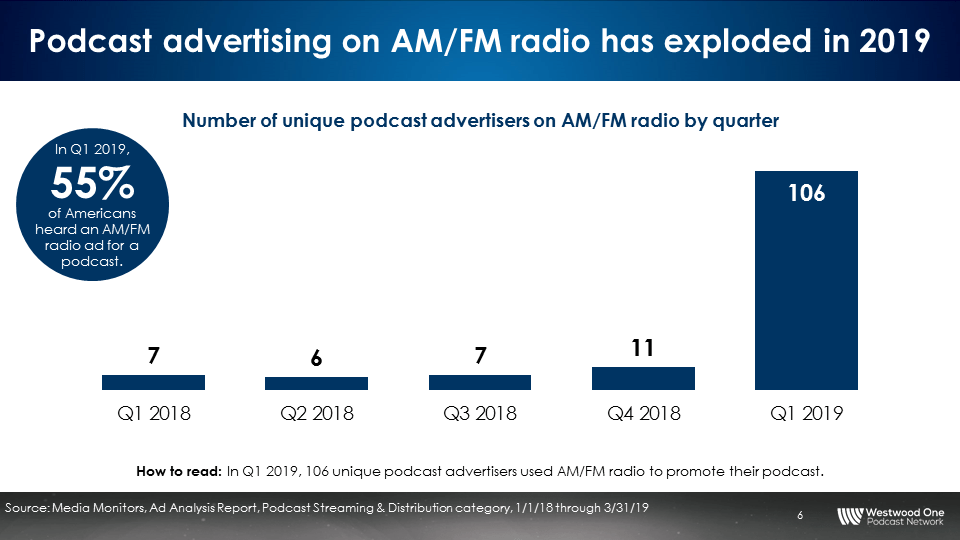

The number of podcasts being promoted on AM/FM radio is skyrocketing

According to Media Monitors, the ad occurrence measurement service, less than ten podcasts were promoted Q1, Q2, and Q3 of 2018. Eleven were promoted in Q4 2018. Q1 2019 saw an explosion in podcasts promoted on AM/FM radio with 106 unique podcasts advertised. This heightened on-air promotion for podcasts is making an impact on podcast discovery.

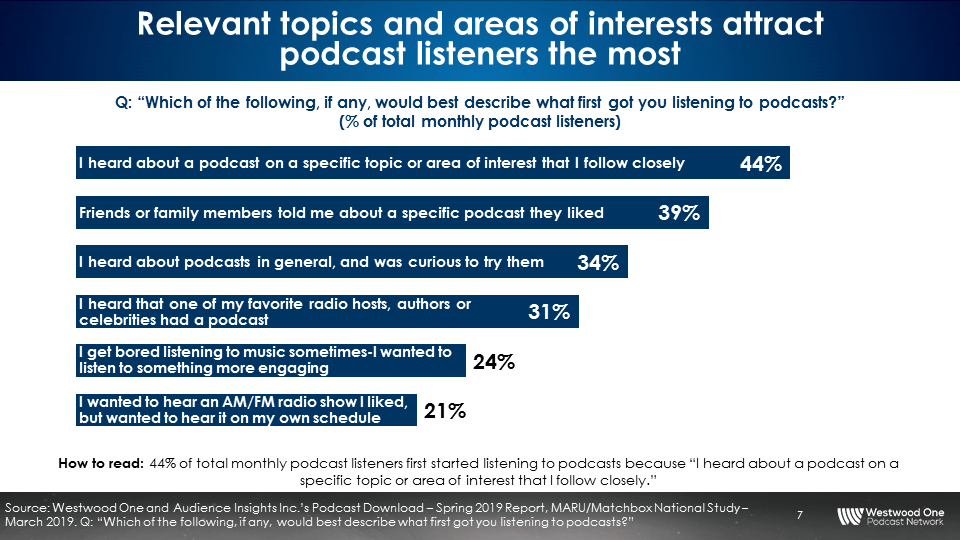

The topic and area of interest covered in a podcast is what attracts listeners

Whether Podcast Pioneer or Podcast Newcomer, the most important factor bringing listeners to a podcast is the topic or area of interest covered. 44% of monthly podcast listeners first start listening to a podcast because of the content.

For podcast creators new to the space, this means putting the topic of their podcast front and center in order to be discovered by listeners. As a best practice, generic descriptions should be avoided in favor of highlighting what specific topic will be covered in order to pique the interest of podcast consumers.

Westwood One Podcast Network offers growing audiences diverse programming options

Westwood One and Audience Insights Inc.’s Podcast Download – Spring 2019 Report is validation of key findings revealed in the Fall 2018 Report – podcasting is now a major part of the American audio experience.

There are more heavy podcast listeners than ever, the appetite for podcasts is growing, and advertisers are discussing podcasting at a growing rate. With our own Westwood One Podcast Network offering a portfolio of diverse content, Westwood One is ready to answer advertiser needs and feed expanding audiences of “Power” podcast listeners, Podcast Pioneers, Podcast Newcomers, and all those in between.

Key takeaways:

- Spotify and Google Podcasts are attracting consumers who recently began listening to podcasts

- A stunning 67% of “Power” podcast listeners (those who listen to 5+ hours per week) follow their favorite podcast hosts on social media

- Podcast listeners equally use Facebook, Instagram, Twitter, and YouTube to follow their favorite hosts

- Podcast ads are the least likely to be skipped among all media

- Podcast promotion on AM/FM radio is being noticed

- The number of podcasts being promoted on AM/FM radio is skyrocketing

- The topic and area of interest covered in a podcast is what attracts listeners

- Westwood One Podcast Network offers growing audiences diverse programming options

Click here to download the full report

Pierre Bouvard is Chief Insights Officer at Cumulus | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.