Westwood One’s Podcast Download – Fall 2019 Report: Women Close The Gap, Podcast Events Gain Traction, Podcast Listening On Smart Speakers Hits A Speed Bump, And Podcast Ad Appeal Shifts

Today, a sea of advertisers, agencies, entertainment companies, and content providers, including our own Westwood One Podcast Network, are once again converging in New York City for the fifth annual Interactive Advertising Bureau Podcast Upfront. This union of great minds is a testament to the power and strength of podcast advertising.

This major event in the podcast industry also marks the publication of Westwood One’s Podcast Download – Fall 2019 Report, now in its third annual release. Westwood One retained MARU/Matchbox to conduct a study of the weekly podcast listener. This third chapter in Westwood One’s Podcast Download Fall series highlights trends from prior studies as well as new ones. You can download a full copy of the report here.

Here’s what we found:

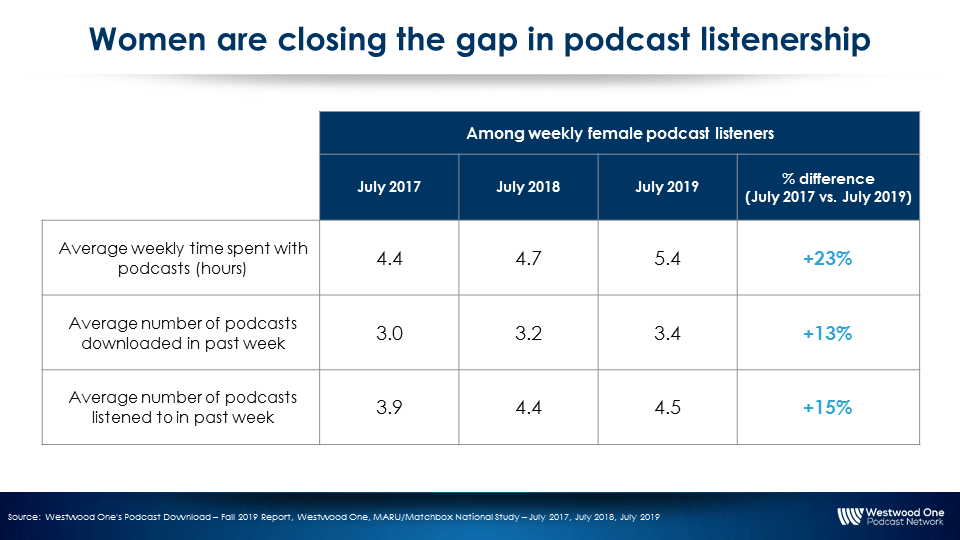

Women continue to close the gap in podcasting: Growth in time spent, podcasts downloaded, and listened

+23% increase in female listening: For the second consecutive year, podcast listenership is up among women. Compared to July 2017, weekly female podcast listeners are spending +23% more time with podcasts. This growth in time spent is 3X that of total weekly podcast listeners.

Weekly female podcast listeners have downloaded +13% more podcasts, and they listened to +15% more podcasts compared to July 2017.

New podcast listeners skew heavily female: Besides an increase in listenership, more women are becoming podcast listeners. Women represent 63% of weekly podcast listeners who started listening in the past 7-12 months and 57% who started listening in the past six months (Podcast Newcomers).

Unique content desires: Women have different podcast preferences than men, from the content they enjoy, how they access their podcasts, and how they like to hear podcast ads:

- Content-type: Storytelling/drama is the top podcast content type among weekly female podcast listeners as 51% say they listen to it regularly (versus 33% of men)

- Platform access: 36% of weekly female podcast listeners use Apple Podcasts the most to access podcasts, twice that of men (17%)

- Ad preference: Both male and female weekly podcast listeners prefer host-read ads over pre-produced ads, but women prefer them at a much higher rate as 65% of women would choose a host-voiced ad over a pre-produced ad compared to 52% of men (25% difference)

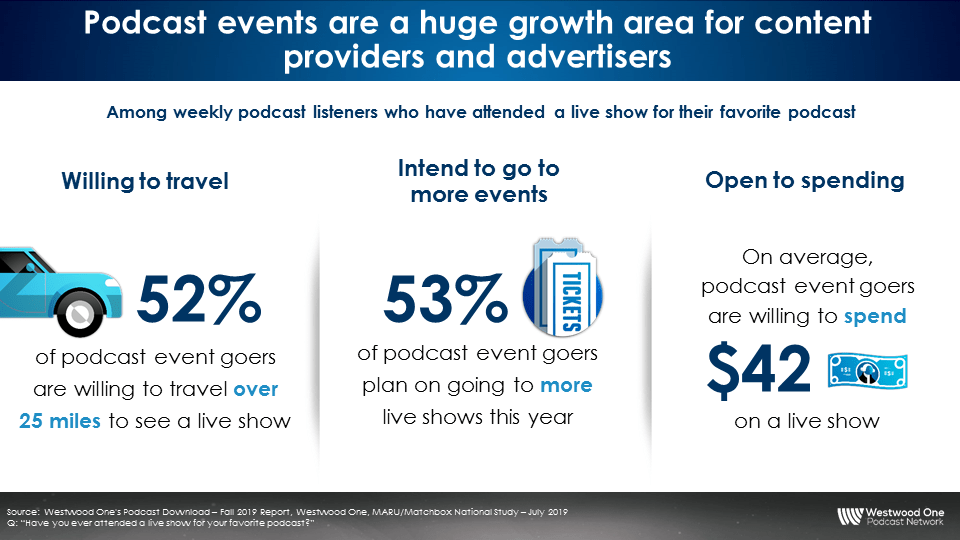

Podcast events are a huge growth opportunity for content providers and advertisers: Podcast listeners are willing to travel, intend to go to more events, and are open to spending

Podcast listeners love events and want more of them: According to Nielsen Scarborough, monthly podcast listeners are 50% more likely to attend an event/place than the average U.S. adult. Since podcast listeners are an active group, hosting live podcast events would make sense as the next big initiative in podcasting.

These podcast event-goers skew male, Millennial 18-34, and are heavy podcast and audio users. One out of five heavy podcast listeners (19%) reported attending a live podcast show. 52% of podcast event-goers are willing to travel over 25 miles to see a live show. Event-goers are willing to spend an average of $42 for tickets.

Attendance for live podcast events will also grow: Over half of podcast event-goers (53%) plan on going to more shows versus last year. Live podcast events present a major opportunity for brands, podcast shows, and content providers. Live podcast events open up the door to on-site integrations for brands, strengthening connections between hosts and listeners with meet and greets, and building awareness for the podcast shows.

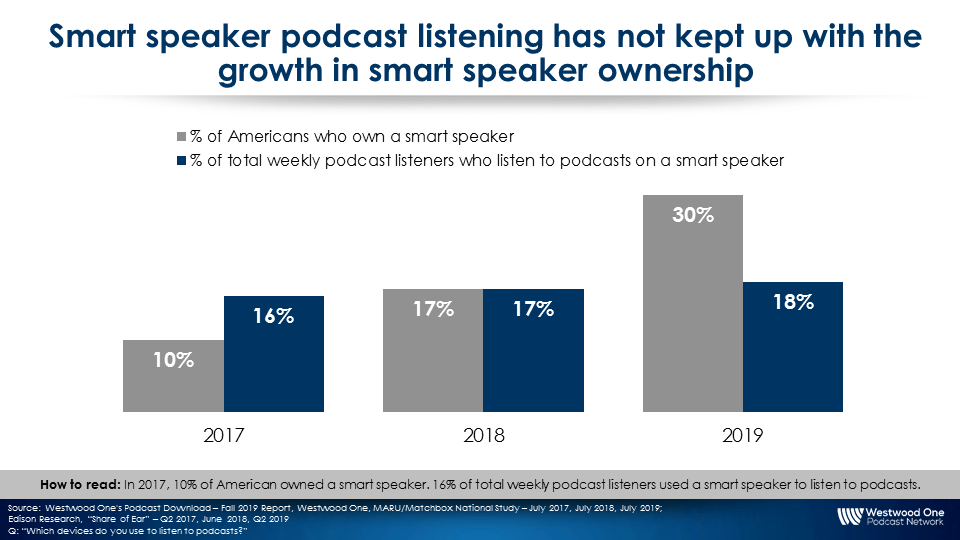

A disconnect exists between smart speaker ownership and smart speaker usage for podcasts: While smart speaker ownership has skyrocketed among podcast fans, not much podcast listening is occurring on smart speakers

Since its introduction to the voice-assistant marketplace, smart speaker ownership has had a meteoric rise. According to Edison Research’s Q2 2019 “Share of Ear,” 30% of Americans own a smart speaker, tripling in a mere two years. “Share of Ear” also reports that two out of five podcast listeners (40%) are smart speaker owners.

Although podcast listeners are 33% more likely to own a smart speaker, their device ownership is not translating into smart speaker podcast listening. From 2017 to 2019, the number of weekly podcast listeners who use smart speakers to listen to podcasts only grew from 16% to 18%.

Why so little podcast time spent on smart speakers? There could be a couple of factors at play here. The act of podcast listening might mesh better with devices that provide limitless mobility, i.e. cellphones. While podcast listening on smart speakers inched up from 2017 to 2019, listening on devices like PCs, laptops, and tablets plummeted.

Podcast listeners could also be unaware of the option to listen to podcasts on a smart speaker or incorrectly state the name of the podcast show when speaking to their device. Podcast shows could improve their promotion explaining how to listen to their podcasts on a smart speaker.

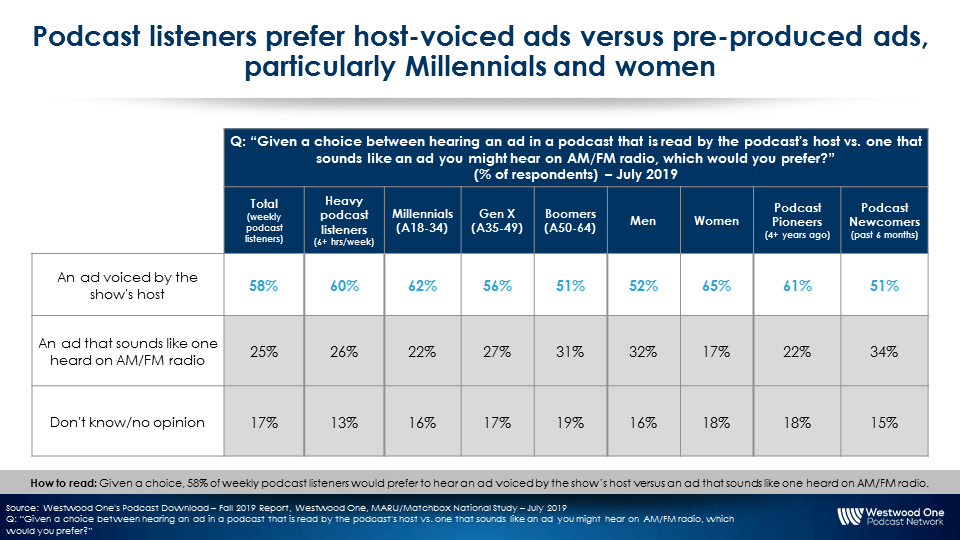

Podcast ad preferences for the industry and listeners are at a crossroads: Podcast listeners prefer host-read ads while the use of pre-produced podcast commercials is rising

Organic host-read podcast ads are one of the key value propositions touted by podcast shows and content providers, as well as being valued by brands. Since 2017, weekly podcast listeners stated they favor host-voiced ads over pre-produced ads. This is particularly true for Millennials 18-34 and women.

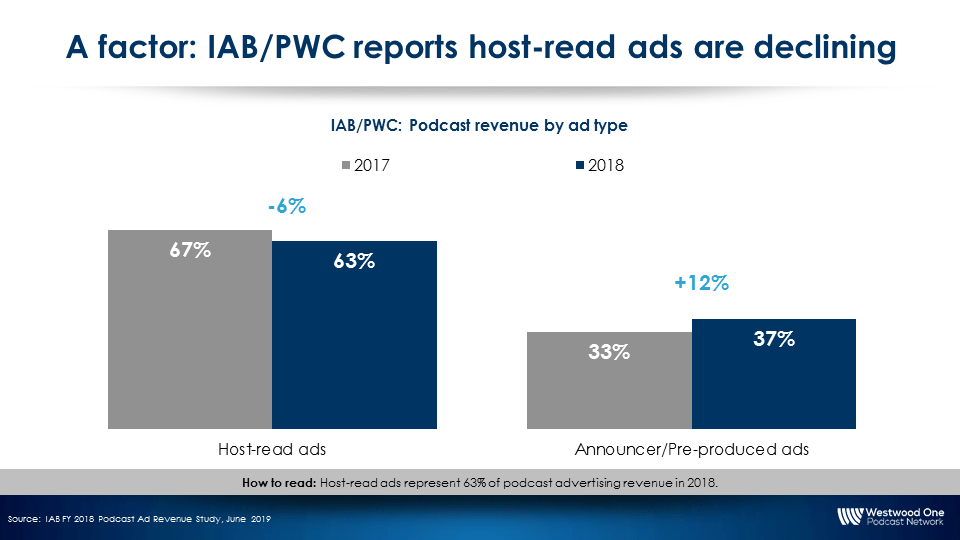

The recently released “Full Year 2018 Podcast Ad Revenue Study” from IAB/PWC reported that usage of host-read ads is falling while pre-produced ads are growing. In 2017, host-read ads represented 67% of the podcast ads delivered. That fell to 63% in 2018, a decrease of -6%. Meanwhile, pre-produced ads have grown +12% between 2017 and 2018.

Erosion of podcast ad appeal is a possible side effect of conflicting ad preferences: Among weekly podcast listeners, creative ad measures such as likeability, relevance, engagement, and memorability have all dipped from 2017.

According to a Nielsen sales lift study of 500 advertising campaigns, not only was advertising creative the biggest sales driver but it generates nearly 50% of sales lift. Delivering ads that resonate with podcast listeners matters, especially because podcast listeners are an engaged audience likely to take an action after hearing a podcast ad (79% of weekly listeners). With podcast ad appeal trending slightly downwards among weekly podcast listeners, it’s crucial to find a proper balance between host-read ads and pre-produced ads.

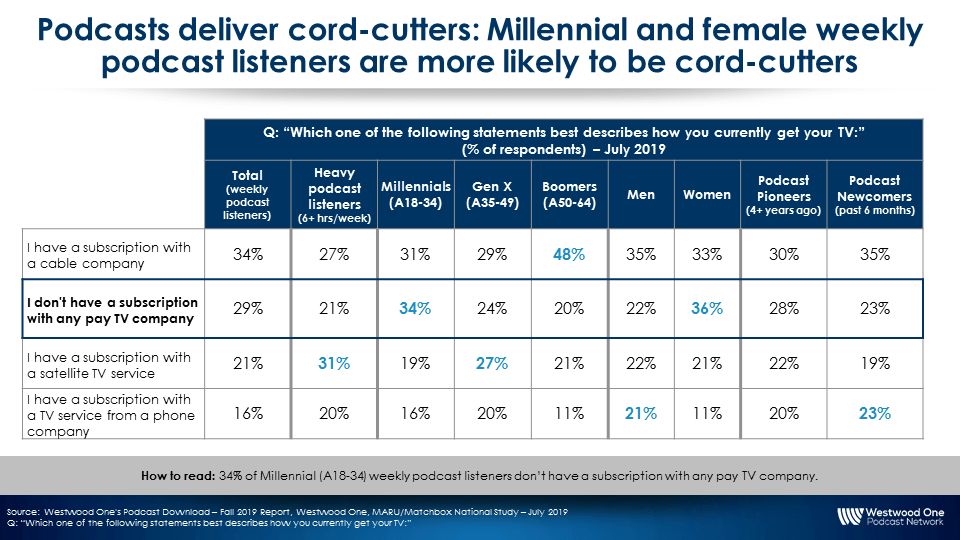

Brands looking to reach cord-cutters can find them in podcast audiences: Millennials 18-34 and female weekly podcast listeners are more likely to be cord-cutters

Brands that traditionally advertise in television might be able to achieve scale, but there are still red flags. Broadcast audiences are down, and streaming platforms are gaining popularity. With platforms like Netflix and Hulu becoming mainstays in American households, cord-cutting is more common, making it harder for brands in linear television to reach their audiences.

Podcast audiences provide a new way of reaching cord-cutters. Among weekly podcast listeners, 29% don’t have a subscription with any pay TV company, and it grows among Millennials 18-34 (34%) and women (36%). To reach lost audiences who have cut the cord on their pay-TV packages, advertisers can now turn to podcasts.

Key takeaways:

- Women continue to close the gap in podcasting: Growth in time spent with podcasts and the majority of new podcast listeners are women

- Podcast events are a huge growth opportunity for content providers and advertisers: Podcast listeners are willing to travel, intend to go to more events, and open to spending

- A disconnect exists between smart speaker ownership and smart speaker usage for podcasts: While smart speaker ownership has increased, there is little podcast listening on smart speakers

- Podcast ad preferences for the industry and listeners are at a crossroads: Podcast listeners prefer host-read ads while pre-produced podcast commercials are increasing

- Brands looking to reach cord-cutters can find them in podcast audiences: Millennials 18-34 and female weekly podcast listeners are more likely to be cord-cutters

Click the link below to download a copy of the full report:

Westwood One’s Podcast Download – Fall 2019 Report

Brittany Faison is the Insights Manager at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.