Rideshare Giants Uber And Lyft Find Ideal Customer Base In AM/FM Radio Listeners

Rideshare companies seem to be everywhere with major names like Uber and Lyft being just another part of the cultural conversation. But is awareness of these brands as high as it seems? If so, how can these rideshare giants expand their customer base and use their reward incentive programs to increase usage?

To understand the awareness and usage of Uber and Lyft and their customer loyalty programs, CUMULUS MEDIA | Westwood One commissioned a national MARU/Matchbox study of 800 adults 18-49. We also analyzed rideshare usage in GfK’s MRI study.

Here’s what we found:

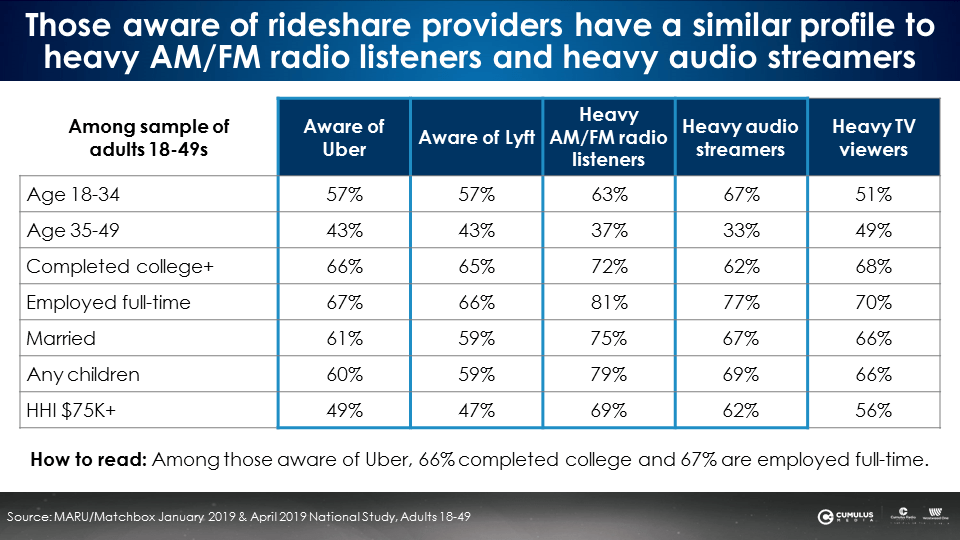

Those aware of rideshare providers have a similar profile to heavy AM/FM radio listeners and heavy audio streamers

Among adults 18-49, the profiles of those aware of Uber and Lyft were similar to heavy AM/FM radio listeners and heavy audio streamers. The profiles align in age, education level, employment, marriage, and presence of children. AM/FM radio and audio streams deliver the ideal rideshare customer profile.

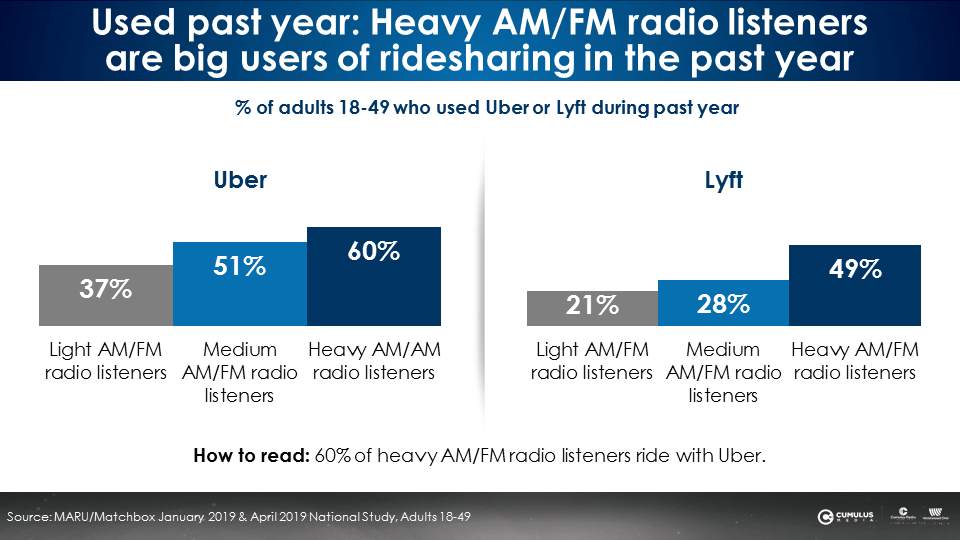

Past year usage: Heavy AM/FM radio listeners are big users of ridesharing

60% of heavy AM/FM radio listeners used Uber in the past year compared to 37% of light AM/FM radio listeners. A greater proportion of heavy AM/FM radio listeners used Lyft in the last year (49%) versus only 21% of light AM/FM radio listeners. The greater the listening to AM/FM radio, the more ridesharing companies are used.

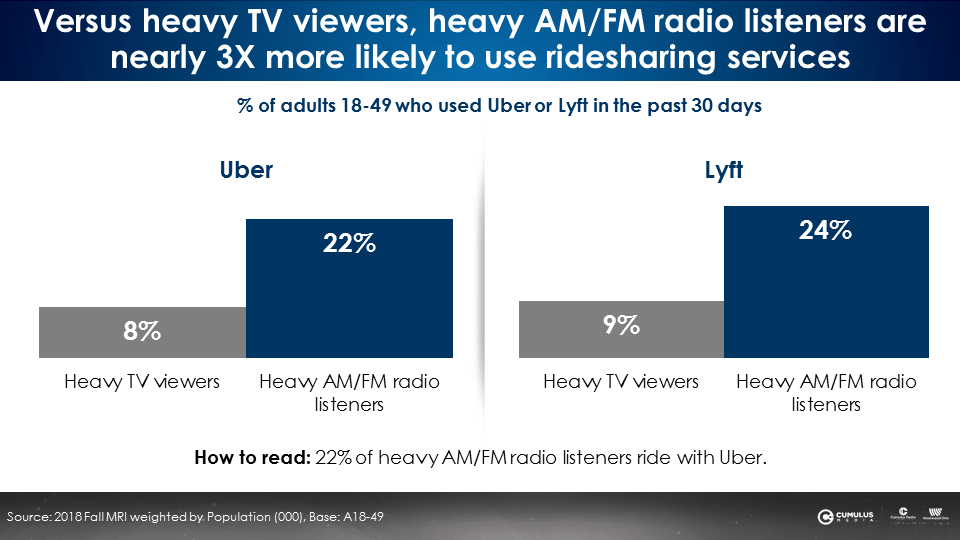

Used past month: Versus heavy TV viewers, heavy AM/FM radio listeners are nearly 3X more likely to use ridesharing services

An MRI analysis of adults 18-49 who used Uber or Lyft in the past 30 days reveals that heavy AM/FM radio listeners are much more likely to use rideshare firms compared to heavy TV viewers.

22% of heavy AM/FM radio listeners have used Uber in the last 30 days compared to only 8% of heavy TV viewers. 24% of heavy AM/FM radio listeners used Lyft in the last 30 days compared to only 9% of heavy TV viewers.

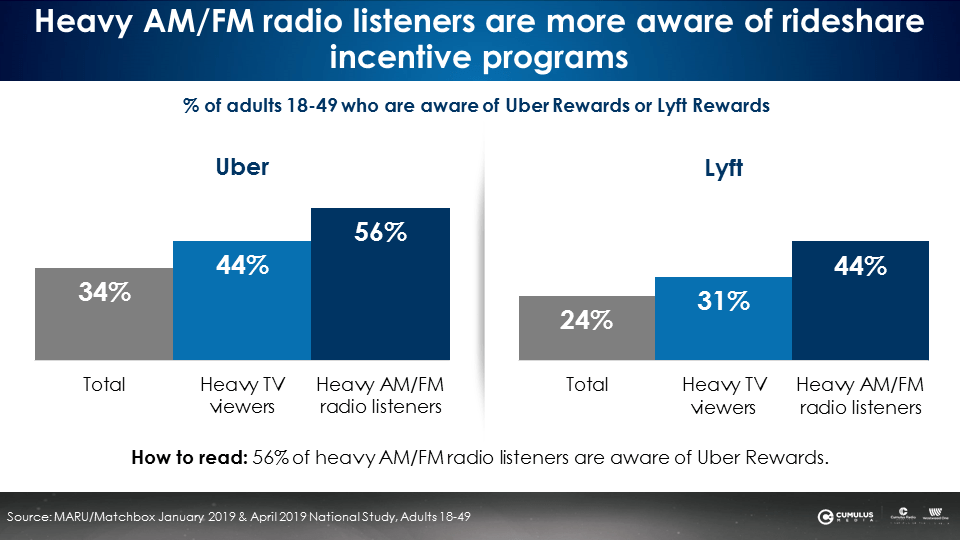

Compared to television audiences, heavy AM/FM radio listeners are more aware of rideshare incentive programs

As rideshare companies like Uber and Lyft use incentive programs to build brand loyalty, it’s important to understand the effectiveness of these programs. The MARU/Matchbox study shows that awareness of Uber’s loyalty program is much higher among heavy AM/FM radio listeners (56%) versus 44% of heavy TV viewers. 44% of heavy AM/FM radio listeners are aware of Lyft’s incentive program compared to only 31% of heavy TV viewers.

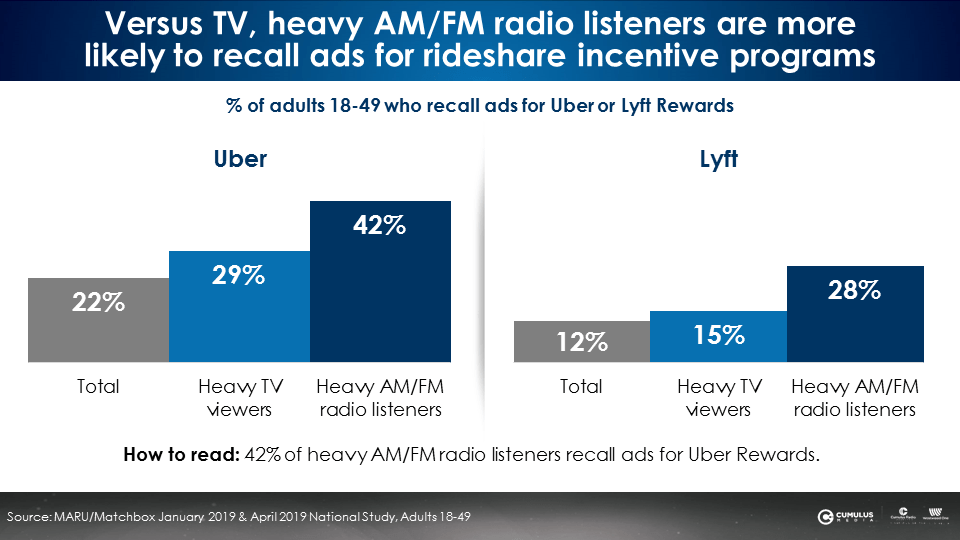

Heavy AM/FM radio listeners recall ads for rideshare incentive programs

In addition to awareness, ad recall is highest for rideshare incentive programs among heavy AM/FM radio listeners. More heavy AM/FM radio listeners could recall ads for both Uber (42%) and Lyft (28%) compared to heavy TV viewers (29% for Uber and 15% for Lyft).

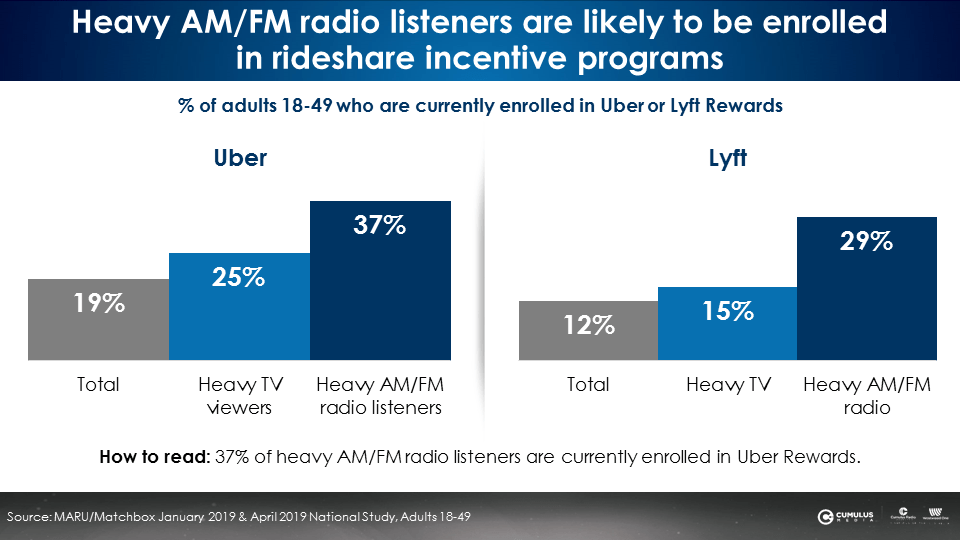

Heavy AM/FM radio listeners are likely to be enrolled in rideshare incentive programs

The pattern continues with actual enrollment in rideshare incentive programs. 37% of heavy AM/FM radio listeners are currently enrolled in Uber Rewards and 29% are enrolled in Lyft Rewards. This is higher than heavy TV viewers enrolled in both programs, Uber at 25% and Lyft at 15%.

The relationship between the auto category and AM/FM radio is well-established. Now, with this analysis of Uber and Lyft users, we see that ridesharing services are a brand new area of the auto-related environment for advertisers to make an impact.

AM/FM radio is the ideal medium for rideshare companies like Uber and Lyft to use in their marketing because the customer base is baked in. Heavy AM/FM radio listeners are similar in profile to their desired consumers, big users of ridesharing, and have strong awareness and usage of incentive programs.

Key takeaways:

- Those aware of rideshare providers have a similar profile to heavy AM/FM radio listeners and heavy audio streamers

- Past year usage: Heavy AM/FM radio listeners are big users of ridesharing

- Used past month: Versus heavy TV viewers, heavy AM/FM radio listeners are nearly 3X more likely to use ridesharing services

- Compared to television audiences, heavy AM/FM radio listeners are more aware of rideshare incentive programs, ads for the programs, and are likely to be enrolled

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.