Marketing Strategies For An Unpredictable Economy: How A Focus On Emotional Campaigns And A Budget Shift To AM/FM Radio Can Keep Brands Afloat During Financial Uncertainty

The state of the economy is in flux. Headlines waver daily from concern, optimism, to relative stability. With a mixed economic outlook, the decisions advertisers make for their marketing plans become more complex.

Economic uncertainty can be daunting but navigating it is not impossible. There is a treasure trove of marketing effectiveness best practices to ensure brands stay relevant and sales are protected.

Where is America economically?

It depends where you look but there are some concrete figures that can give a general idea of the financial status of the country.

- Gross domestic product (GDP) growth rate steadies: According to the U.S. Bureau of Economic Analysis, the U.S. gross domestic product change has moderated in 2019. Q3 2019’s 2.1% increase is slightly less than Q2 2019’s 2.3%.

- Agencies and marketers cool on GDP growth sentiment, yet those with a positive or stable outlook are four times the size of those who foresee decline: According to Advertiser Perceptions data from August 2019, 40% of agencies and marketers believe the U.S. GDP will continue to grow in the next six months. 33% believe it will stabilize. Together, that’s four times greater than the 17% of those who believe the GDP will decline.

- Most agency and marketer media spend intentions are leveling off with a notable exception: Advertiser Perceptions finds that while broadcast and cable TV spend intentions have softened, AM/FM radio spend intention has grown from -9 in 2013 to +19 in 2019.

Here are six best practices for how advertisers can proceed:

- Ensure share of voice exceeds share of market

- Continue to advertise: According to the World Advertising Research Center (WARC)/Millward Brown, it can take up to 5 years for brands to recover from “going dark”

- Optimize creative by testing ads for more memorable brand effects: Superior creative can generate outsized lifts on ROI and sales effect

- Shift more resources to brand building versus sales activation

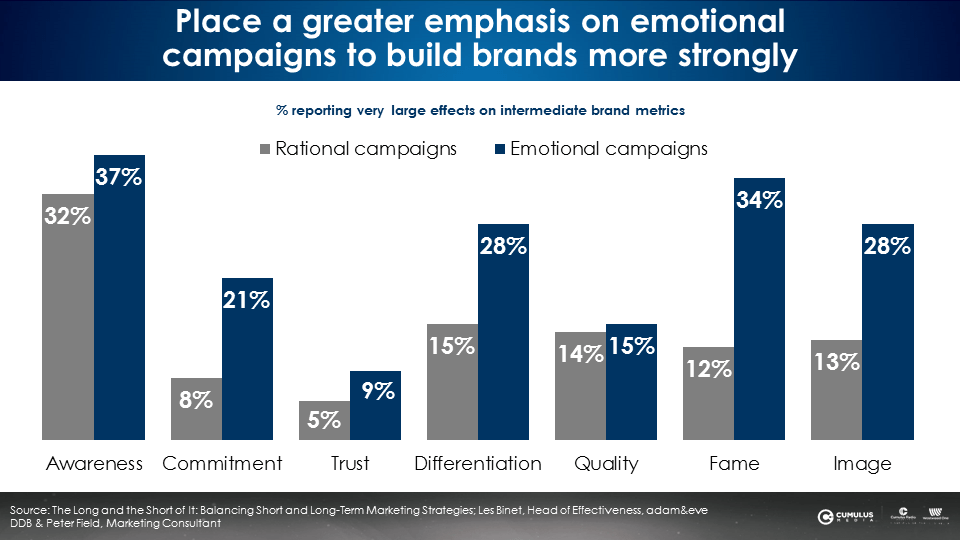

- Place a greater emphasis on emotional campaigns to build your brand more strongly

- Shift budget to AM/FM radio to grow reach even if total budgets are reduced

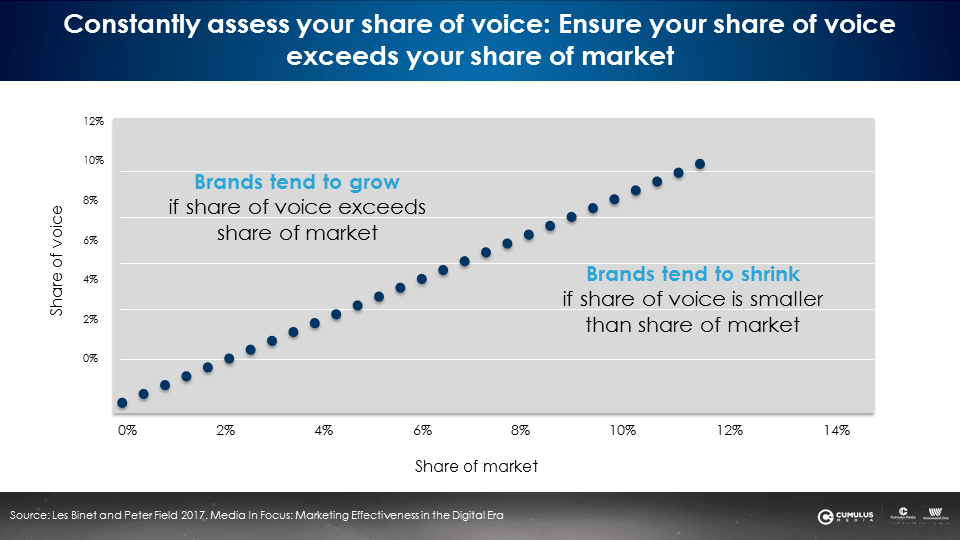

1. Ensure share of voice exceeds share of market

To understand how to budget properly in a recession or periods of uncertainty, brands need to understand the share of voice rule, an equation that can predict if a brand grows, declines, or remains stable. Share of voice is the brand ad spend divided by category ad spend.

Share of voice is compared to share of market. Share of market is a brand or retailer’s revenue divided by category sales.

- If share of voice exceeds share of market, brands tend to grow.

- If share of voice is similar to share of market, brands tend to be stable.

- If share of voice is smaller than share of market, brands tend to shrink.

According to Millward Brown, during times of economic uncertainty, keeping a high share of voice is effective. In “Marketing During Recession: To Spend or Not To Spend,” they state, “If you increase your marketing investment at a time when competitors are reducing theirs, you should substantially increase the saliency of your brand. This could help you establish an advantage that could be maintained for many years.”

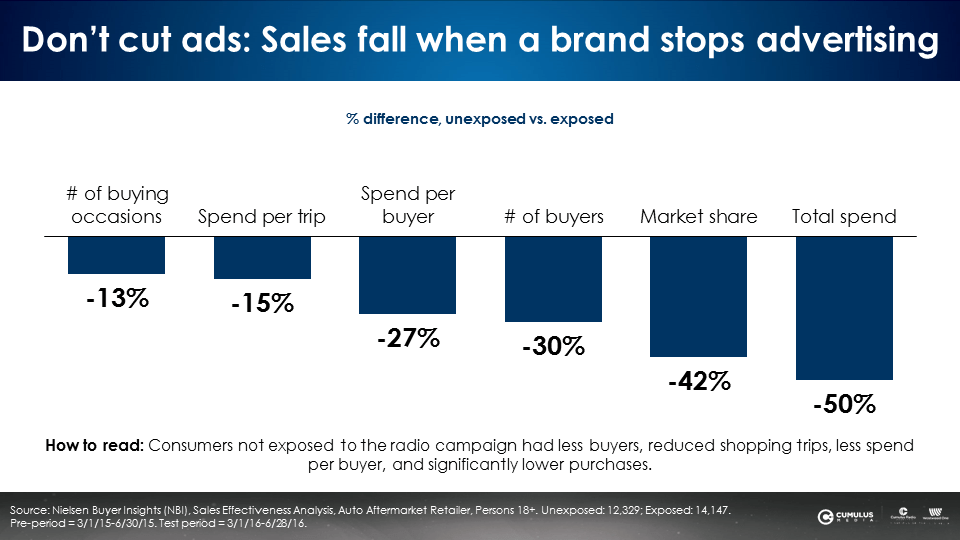

2. Continue to advertise: According to WARC/Millward Brown, it can take up to 5 years for brands to recover from “going dark”

Economic instability can trigger the impulse to pull advertising. If there is less spending by consumers, logic would dictate that there would be less of a need to advertise due to the lower numbers of customers.

The Advertising Research Foundation states otherwise in their “When Brands Go Dark” report: “During recessions, companies must understand customers’ shifting needs and then adjust their communications strategies and offerings. Marketers should segment customers according to their recession psychology (from fearful to carefree) and how they categorize their purchases (from essentials to expendables).”

An economic recession is handled differently depending on consumer. Some save. Some spend. Instead of a blanket decision to go dark, marketers must take the time to understand the different consumer segments.

Going dark is risky. According to a Nielsen ROI study commissioned by Westwood One for an auto aftermarket retailer, cutting ads is detrimental across the board. Among those not exposed to AM/FM radio ads, the retailer saw decreases in the number of buying occasions (-13%), spend per trip (-15%), spend per buyer (-27%), number of buyers (-30%), market share (-42%), and total spend (-50%).

While the Advertising Research Foundation finds that continuing to market during recessions is “strongly associated with positive shareholder value, customer loyalty, and superior long-term profitability,” WARC/Millward Brown warn that “it can take up to five years to recover from budget-cutting during a recession.”

Continuing to advertise endears brands to consumers. Cutting spend can be disastrous to long-term branding efforts.

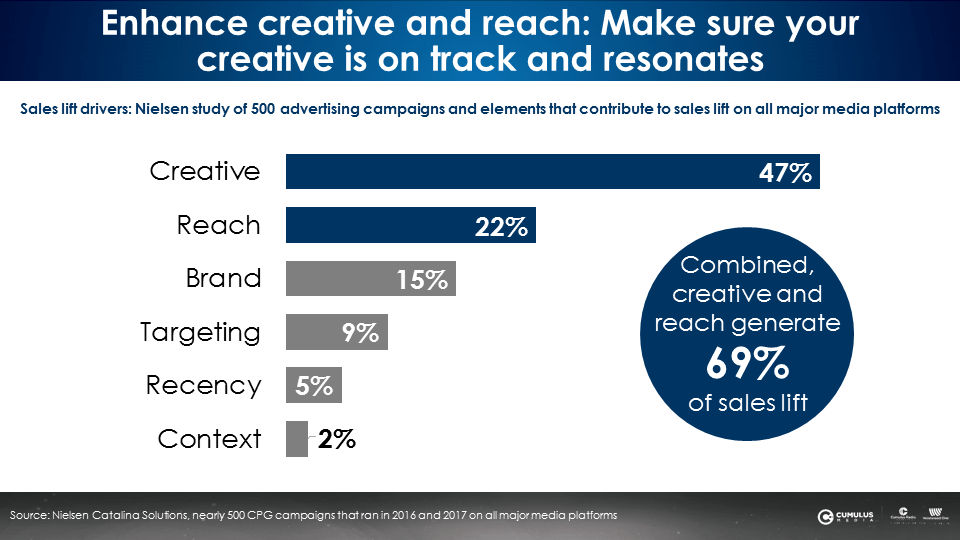

3. Optimize creative by testing ads for more memorable brand effects

Creative is critical to the success of ad campaigns. According to a Nielsen Catalina Solutions study of nearly 500 TV, digital, and audio campaigns, creative is the number one sales driver. Combined, creative and reach represent 69% of total sales lift.

Creative might seem frivolous to focus on during a recession but paying attention to it can pay dividends even when overall spend is decreased.

WARC/Millward Brown find that “more memorable creative can maintain or increase ad awareness levels, even with a lower spend.” Developing creative that resonates with consumers is time well spent for brands during times of economic uncertainty.

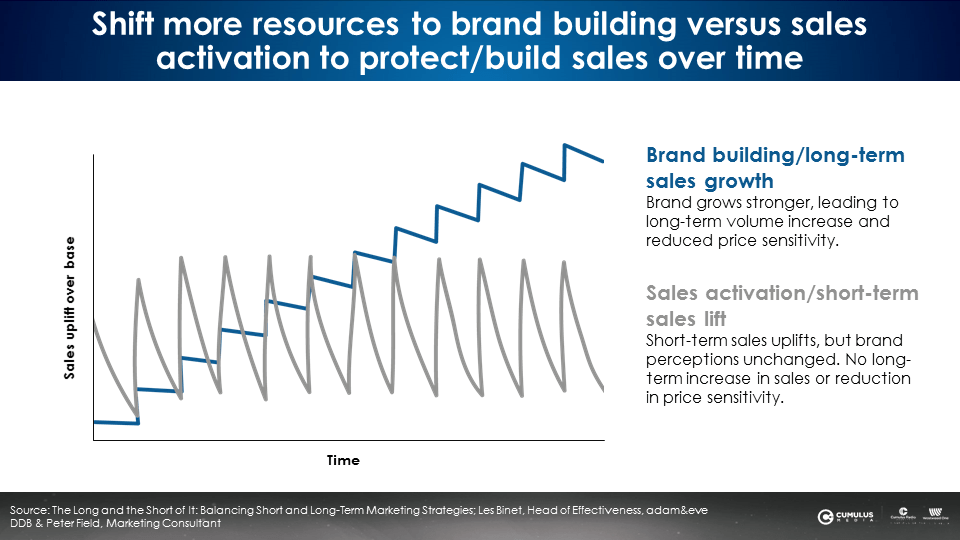

4. Shift more resources to brand building versus sales activation

There are two types of campaigns: brand building and sales activation. The godfathers of marketing effectiveness, Les Binet and Peter Field, find sales activation campaigns (the grey line below) generate sales uplift through a series of short-term sales spikes that quickly collapse. Sales activation campaigns don’t build long-term sales. They are the “carbs of advertising,” a sugar rush of short-term sales uplift and then a crash.

Brand building ads (indicated by the blue line) are the “protein of advertising.” Of the two types of campaigns, brand building is harder to achieve, requires a greater investment, and is more important. According to Binet and Field, “Brand building means creating mental structures (associations, memories, beliefs, etc.) that will pre-dispose potential customers to choose one brand over another. This is a long-term job involving conditioning consumers…so it takes time; talking to people long before they come to buy.”

During an economic recession, brands need to look at their long-term sales strategies. Short-term sales spikes won’t ensure brand longevity.

Binet and Field recommend 60% of marketing weight be allocated towards brand building and 40% against sales activation. In their new book Effectiveness in Context: A Manual for Brand Building, Binet and Field lay out the recommended mix of brand building and sales activation for a variety of industries and brand life cycles.

Focus instead on developing a deeper relationship with consumers through branding campaigns that will take root and make a lasting impact. The economy bounces back. When spending resumes, the results of strong branding campaigns can start to reveal themselves.

5. Place a greater emphasis on emotional campaigns to build your brand more strongly

Across all metrics, Binet and Field find emotional campaigns result in very large effects among consumers, far outweighing the impact of rational campaigns. Awareness, commitment, trust, differentiation, quality, fame, and image are all see stronger performance from emotional campaigns compared to their rational campaign counterparts.

During recessions, touting deals or rational sales information isn’t going to move the needle for consumers. Putting a stronger emphasis on campaigns that will touch consumers on an emotional level builds a brand more strongly. Emotions, feelings, and associations are more important than the message.

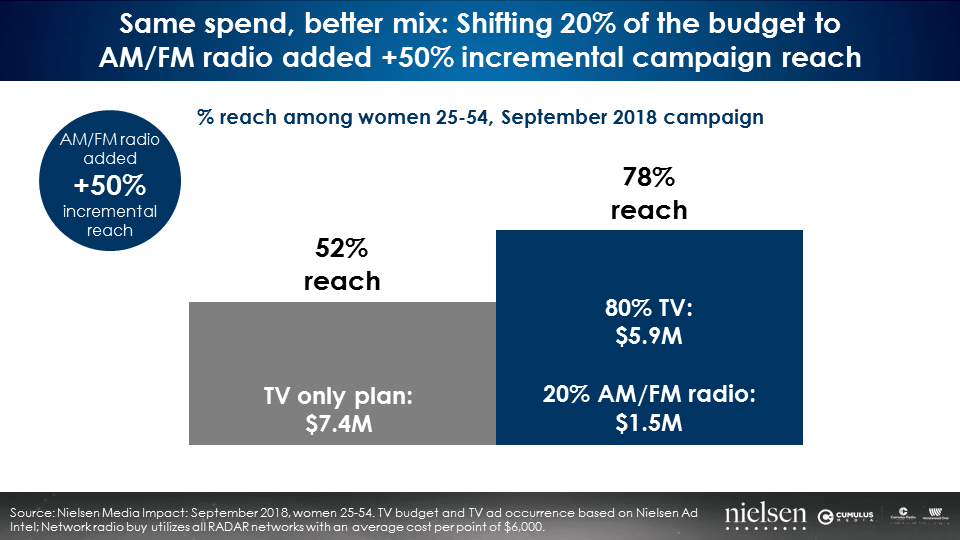

6. Shift budget to AM/FM radio to grow reach even if total budgets are reduced

Using Nielsen Media Impact, a cross-platform media planning and optimization platform, it is possible to definitively prove how shifting a small portion of a budget from TV to AM/FM radio adds incremental reach.

For example, a $7.4 million TV investment for a furnishings retailer generates 52% reach among the target consumer, women 25-54. The same spend with a 20% reallocation to AM/FM radio adds +50% incremental reach to the total campaign.

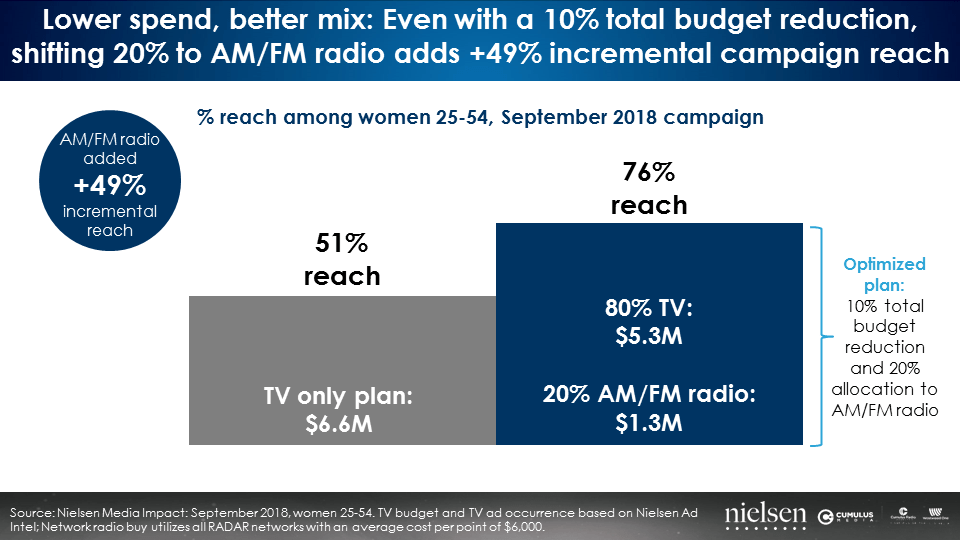

In a recession, overall budgets tend to be reduced. However, even with a lower spend, AM/FM radio’s impact on a TV campaign is significant.

A reduction of the furnishings retailer’s budget by 10% means a $6.6 million TV only plan generates 51% reach. Reallocating 20% of the budget to AM/FM radio, even with a reduced overall spend, still generates +49% incremental reach.

A cut in spend isn’t necessarily detrimental to campaign reach. By using an optimized plan of reallocated dollars, advertisers can utilize AM/FM radio’s power as a mass reach medium to make up for losses elsewhere.

Recessions are complicated. While the impulse to pull back on spending might be strong, the results are more layered than brands might assume. Instead of cutting budgets, do as Andrea Brimmer, Chief Marketing and Public Relations Officer at Ally recommends when she says, “Lean into your brand and don’t cut back on spending. While the economy is strong, push it as far as you possibly can and then make the proper adjustments.”

In their book How Not To Plan: 66 Ways To Screw It Up, Les Binet and Sarah Carter conclude, “Recessions are a particularly dangerous time for brands: they’re one of those periods when ‘mass extinctions’ tend to occur. Remember death is optional for brands. If not, unfortunately, for the rest of us.”

Focus on share of voice, optimized creative, and brand building and emotional campaigns. With stronger branding and a shift in budget to AM/FM radio, advertisers can strategically weather an uncertain economy.

Marketing strategies for an uncertain economic outlook:

- Ensure share of voice exceeds share of market

- Continue to advertise: According to WARC/Millward Brown, it can take up to 5 years for brands to recover from “going dark”

- Optimize creative by testing ads for more memorable brand effects: Superior creative can generate outsized lifts on ROI and sales effect

- Shift more resources to brand building versus sales activation

- Place a greater emphasis on emotional campaigns to build your brand more strongly

- Shift budget to AM/FM radio to grow reach even if total budgets are reduced

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.