Nielsen Diary Market Surprise Dispels The New York City Coronavirus AM/FM Radio Myth

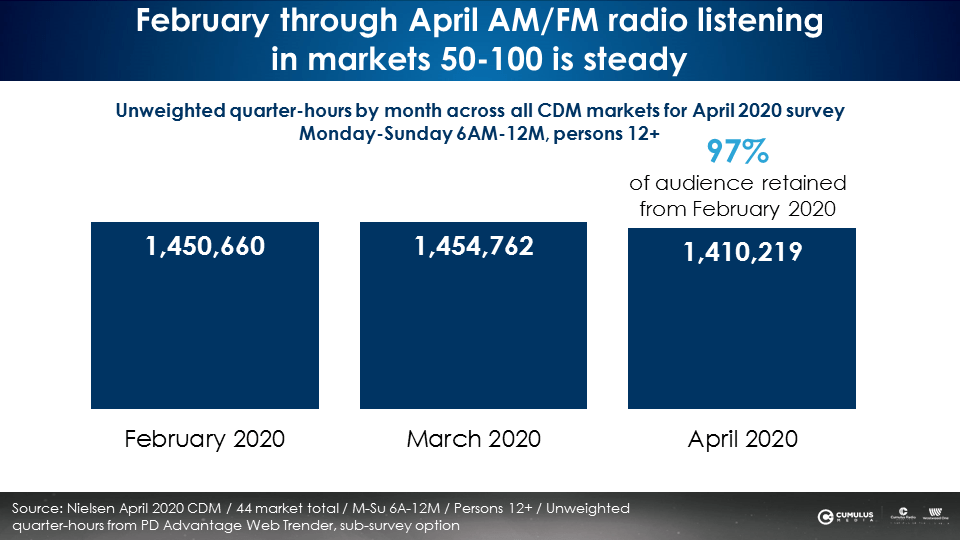

This afternoon, Nielsen held client webinars to present an April 2020 listening analysis of 44 diary markets. This was the first report of listening in markets ranked 50 to 100 reflecting the impact of COVID-19.

For the last two months, the only AM/FM radio listening data issued by Nielsen was from their Portable People Meter data from America’s top 50 cities, the markets most impacted by the Coronavirus.

April 2020 was the month when Americans significantly restricted their movements and sheltered at home. Nielsen compared April listening levels in these 44 diary markets to the pre-COVID-19 February. The key finding?

New Nielsen diary data reveals there was no audience impact from COVID-19

AM/FM radio retained 97% of prior listening volumes in markets 50-100. In short, there was only a -3% reduction in listening from February to April in markets ranked 50-100!

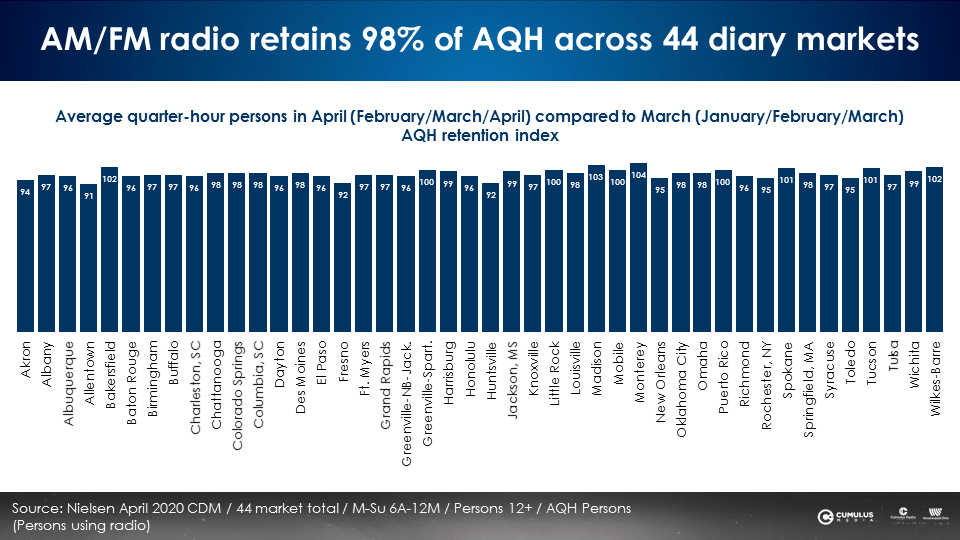

Comparing the January/February/March measurement period to the February/March/April survey releasing this week, Nielsen reports AM/FM radio retains 98% of its average quarter-hour audience (AQH). Across the 44 diary markets, AQH audiences are remarkably consistent. Nielsen also found AM/FM radio retained 99% of its reach between the two surveys periods.

These findings dispel the current myth heard from New York City-based media planners and strategists:

“No one is driving now, so no one is listening to AM/FM radio. That’s why I’m buying Pandora and Spotify.”

Mark Ritson, the legendary marketing professor observes, “There is increasing global evidence that marketers are basing their media choices on their own behavior or that stoked by the digitally obsessed marketing media, rather than actual audience data … The first law of marketing is that you are not the market. You are a urban, professional, well paid media executive. Everything you think and do is from a highly unrepresentative n of 1.”

Are the barren streets of New York City, America’s capital of media planning, representative of America? Let’s examine the facts of actual audience data:

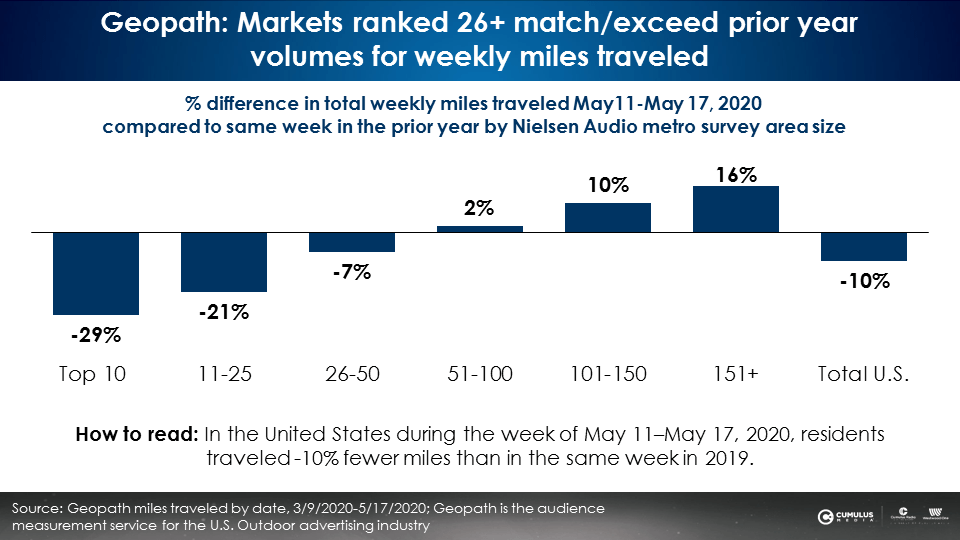

Geopath: Outside of America’s largest cities, miles traveled match or exceed prior year volumes

Geopath is the audience measurement service for the American outdoor advertising industry. They amass consumer movement data from millions of cell phones to produce miles-traveled data for every market in America.

Americans are on the road and clocking miles in their car

Total U.S. miles traveled for the week of May 11-May 17, 2020 are down only -10% versus the prior year. So much for, “No one is driving.”

The relationship between market size and driving volumes

Miles traveled in the top 25 markets is -25% lower than the prior year. Outside the top 26 markets, miles traveled volumes match or exceed the prior year. The top ten markets are not representative of America.

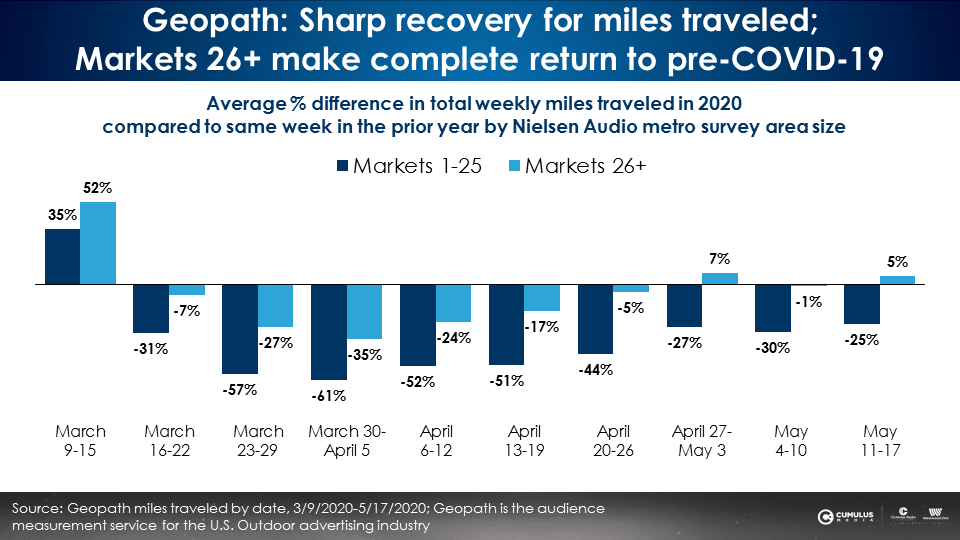

Sharp recovery for miles traveled since early April

Geopath data shows a significant drop in miles traveled in late March and early April. Since then, traffic volumes have recovered significantly.

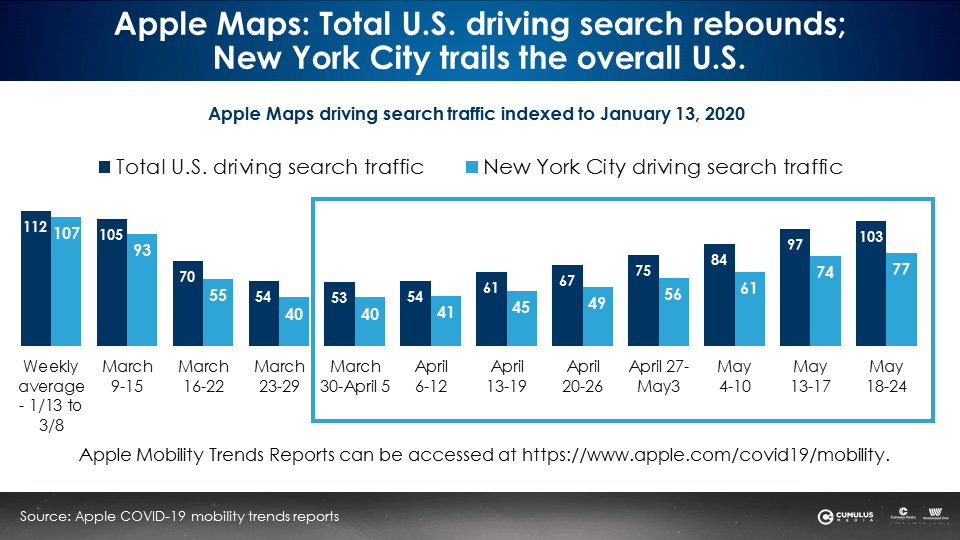

Apple Maps: U.S. driving search requests completely recover to pre-COVID-19 levels

While total U.S. driving volumes have returned to prior levels indexed to January, New York City is at 77% pre-COVID-19 norms. Once again, New York City is not comparable to the total U.S.

American AM/FM radio retains 93% of pre-COVID-19 audience

Combining the just-released April diary data with recent May PPM audiences to form a national perspective, American AM/FM radio has retained 93% of pre-COVID-19 reach levels and 86% of pre-COVID-19 average quarter-hour audiences.

These Nielsen facts upend the myth, “No one is listening to AM/FM radio.” Let’s now turn to assessing the feasibility of shifting budget from AM/FM radio to Pandora and Spotify.

Pandora and Spotify are reach challenged: 91%+ of Americans do not listen

In a typical day in America, 91% are not reached by ad-supported Pandora and 96% of Americans are not reached by ad-supported Spotify.

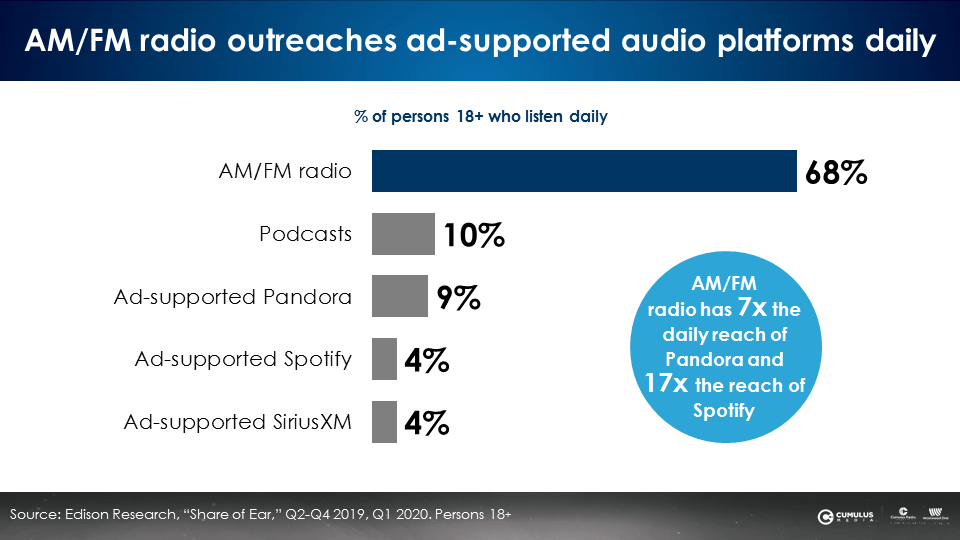

Edison’s recently-released “Share of Ear” report reveals AM/FM radio’s daily reach towers over Pandora and Spotify. AM/FM radio has 7X the reach of ad-supported Pandora and 17X the reach of ad-supported Spotify.

Given that AM/FM radio has retained the vast majority of its reach (93%), it is the only audio option that affords brands the massive reach needed to drive brand equity and sales effect.

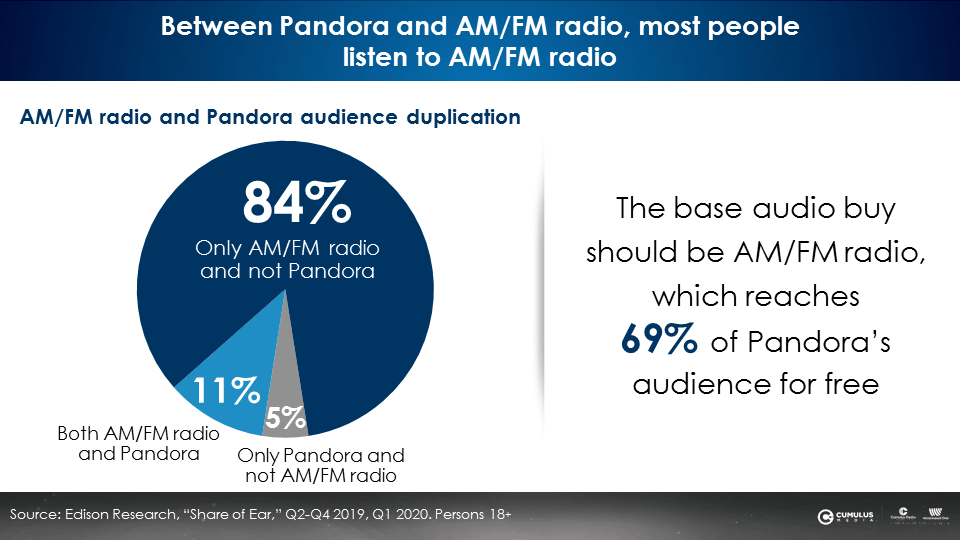

A buy on AM/FM radio reaches 69% of Pandora’s audience for free

According to Edison, a huge number of Americans (84%) only listen to AM/FM radio and do not listen to Pandora. Only 11% of Americans listen to both AM/FM radio and Pandora. A tiny 5% of Americans only listen to Pandora and do not listen to AM/FM radio.

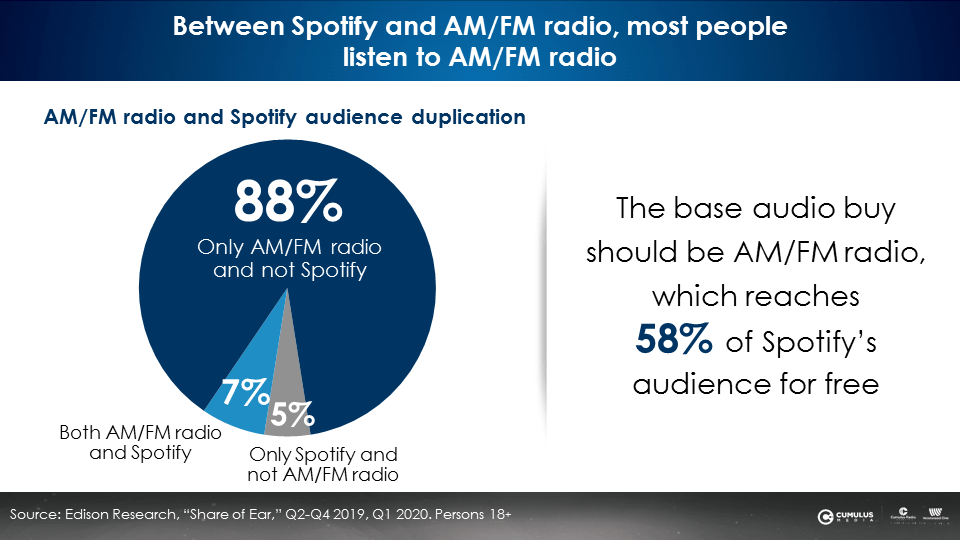

A buy on AM/FM radio reaches 58% of Spotify’s audience for free

Similarly, Edison finds a huge number of Americans (88%) only listen to AM/FM radio and do not listen to Spotify. Only 7% of Americans listen to both AM/FM radio and Spotify. A tiny 5% of Americans only listen to Spotify and do not listen to AM/FM radio.

“Take the me out of media”

In their book How Not To Plan: 66 Ways to Screw It Up, Les Binet and Sarah Carter remind agencies and brands, “We’re marketing and communication people, we’re different from the majority. In the US and UK, we’re less than 1% of the population. We tend to be younger. … And we live in a handful of big cities. So it’s all too easy for us overlook how different our lifestyles and perceptions are from the people we talk to.”

Acknowledging this, Colin Kinsella, the CEO of Havas Media North America, says, “The biggest risk for AM/FM radio is the 26-year-old planner who lives in New York or Chicago and does not commute by car and does not listen to AM/FM radio and thus does not think anyone else listens to AM/FM radio.”

Key takeaways:

- Projecting New York City’s COVID-19 experiences and media habits to the rest of America constitutes marketing malpractice

- There is no evidence to support the myth: “No one is driving and no one is listening to AM/FM radio”

- U.S. driving and miles traveled have experienced a sharp recovery

- Driving in the largest markets has recovered but is still about -25% below pre-COVID-19 norms

- Traffic volumes match or exceed the prior year in markets outside the top 25

- U.S. AM/FM radio has retained 93% of pre-COVID-19 reach levels and 86% of pre-COVID-19 AQH

- Pandora and Spotify are reach challenged as 91%+ of Americans are not reached by the two streaming services

- An AM/FM radio buy reaches large portions of Pandora and Spotify audiences for free

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.