Nielsen: Consumer Recovery Optimism And Purchase Intentions Soar As AM/FM Radio Audiences Recover

This afternoon, Nielsen released the results of a second study tracking U.S. consumer sentiment on COVID-19 recovery and purchase intentions. This new study was based on 1025 nationally representative interviews with persons 18+, conducted May 27-29, and compared to the same study fielded with 1000 people on April 30-May 2.

While only a month separates the two studies, the shift in American attitudes on reopening of the economy and a return to normalcy is remarkable.

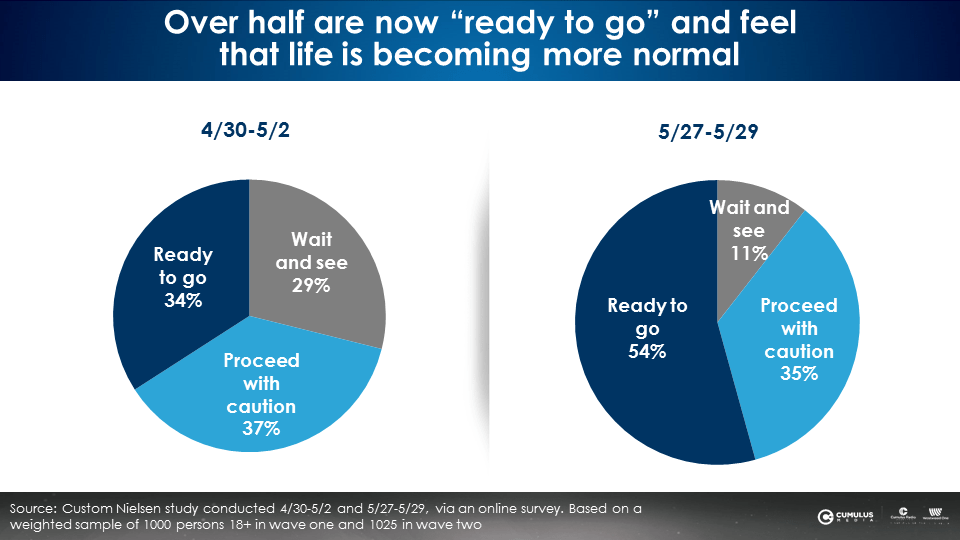

“Ready to go” consumer segment surges from 34% to 54%

In early May, 34% comprised the segment expressing the greatest optimism on a return to normalcy. The “ready to go” segment grew twenty points to 54%. The most pessimistic segment, “wait and see” consumers, dropped from 29% to 11%.

Consumers indicated varying levels of agreement or disagreement for reopening statements. The degree of agreement with these statements determined which of the three optimism segments consumers were assigned to.

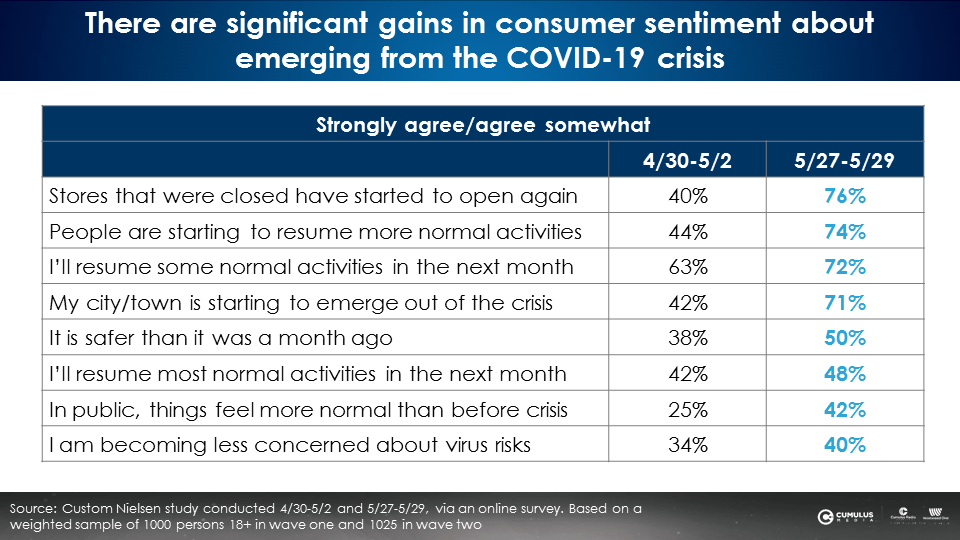

There are massive gains in the number of Americans who say stores are reopening, normal activities are beginning to resume, and their area is starting to emerge out of the crisis. The average agreement with the recovery statements is up 18 points, a +44% increase.

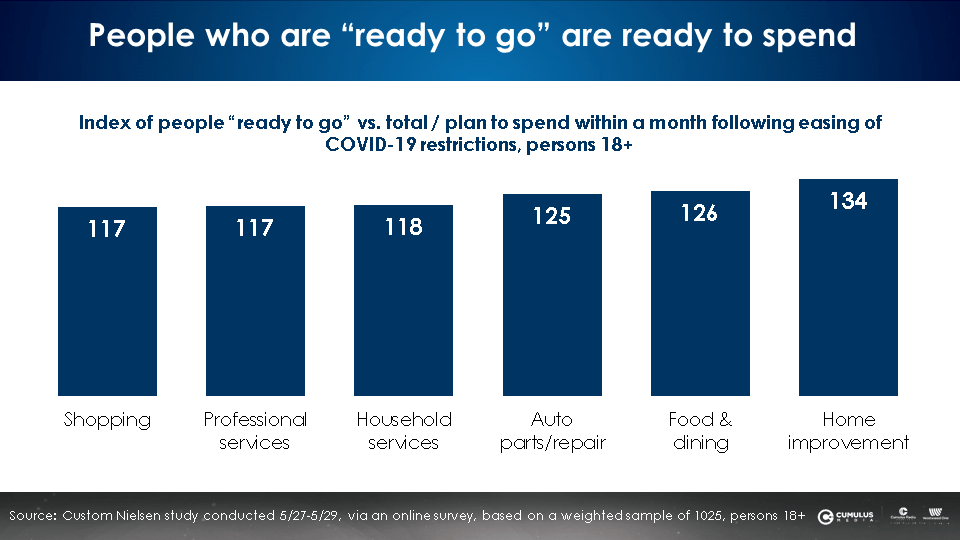

Growth in recovery sentiment translates into economic recovery: “Ready to go” means “ready to spend”

On average, the “ready to go” segment is +23% more likely to make purchases within a month across a broad range of purchase categories.

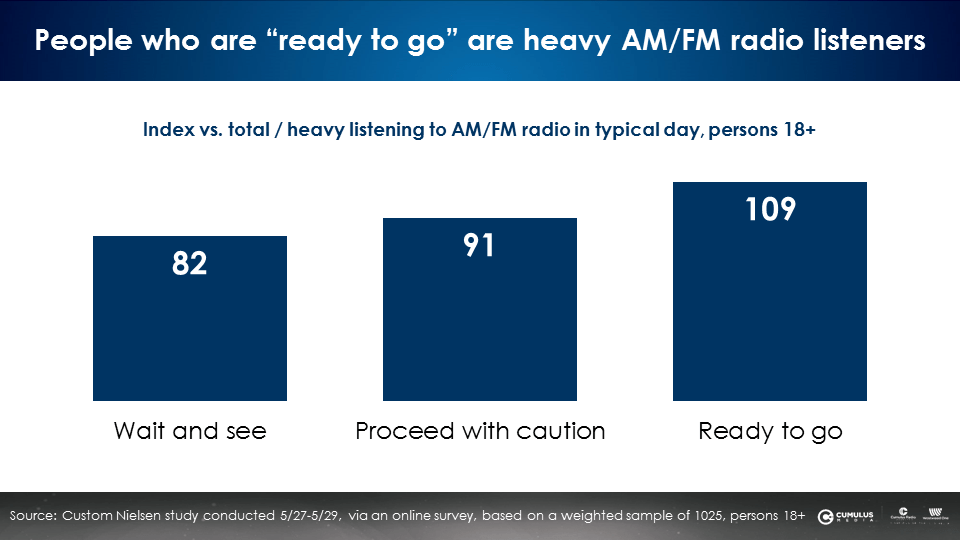

“Ready to go” consumers are heavy AM/FM radio listeners

The greater the consumer optimism about the economic recovery and return to normalcy, the greater the time spent with AM/FM radio. The “ready to go” consumers are +33% more likely to be heavy AM/FM radio listeners compared the most pessimistic “wait and see” consumer segment. No wonder that Nielsen declares AM/FM radio to be “the soundtrack of American recovery and reemergence.”

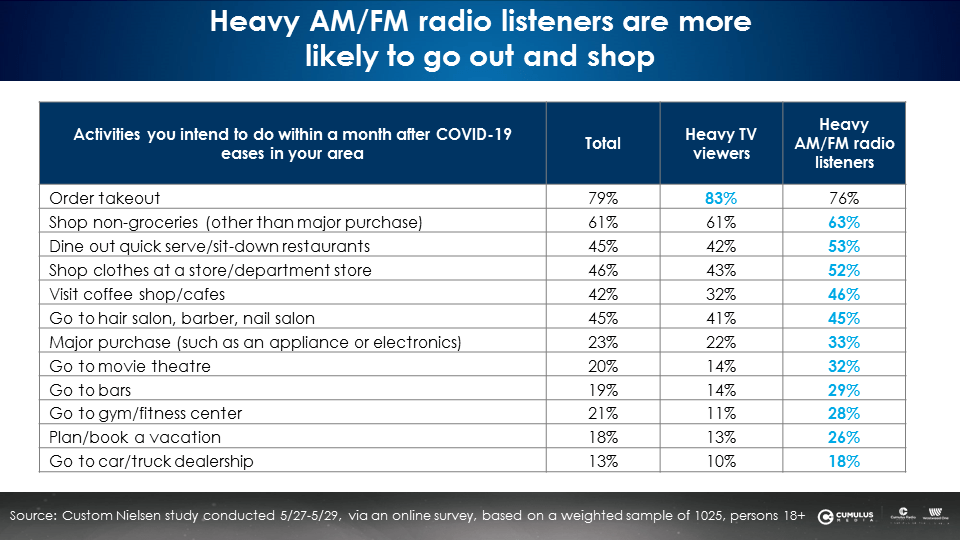

Compared to heavy TV viewers, heavy AM/FM radio listeners are much more likely to purchase within a month after the crisis eases across a vast array of categories

On average, 32% of heavy TV viewers say they will make purchases one month after COVID-19 eases in their area. A far greater proportion of heavy AM/FM radio listeners (42%) say they will make purchases within a month after the crisis eases across these twelve categories.

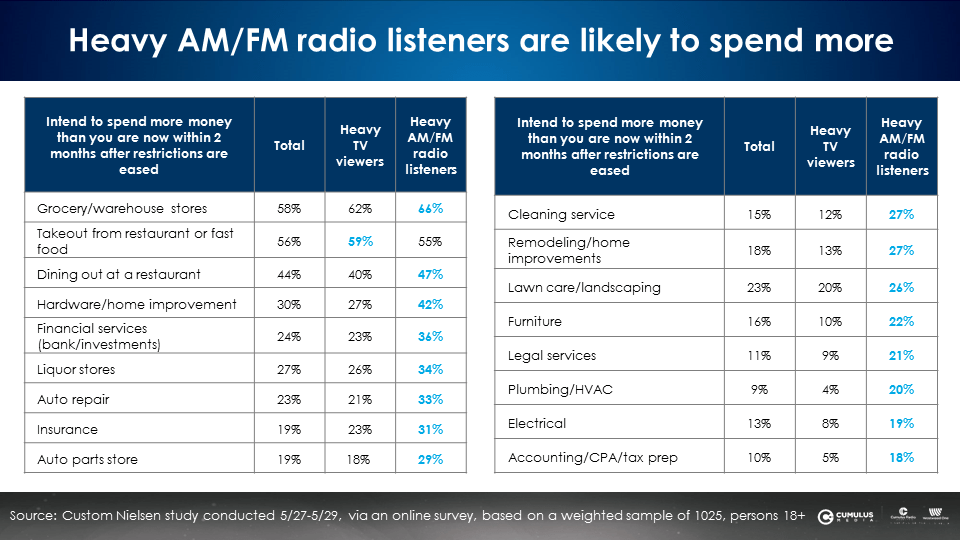

Across these purchase categories, on average, 22% of heavy TV viewers say they will make a purchase within the next two months. Among heavy AM/FM radio listeners, 33% say they will make a purchase within the next month, a +50% difference.

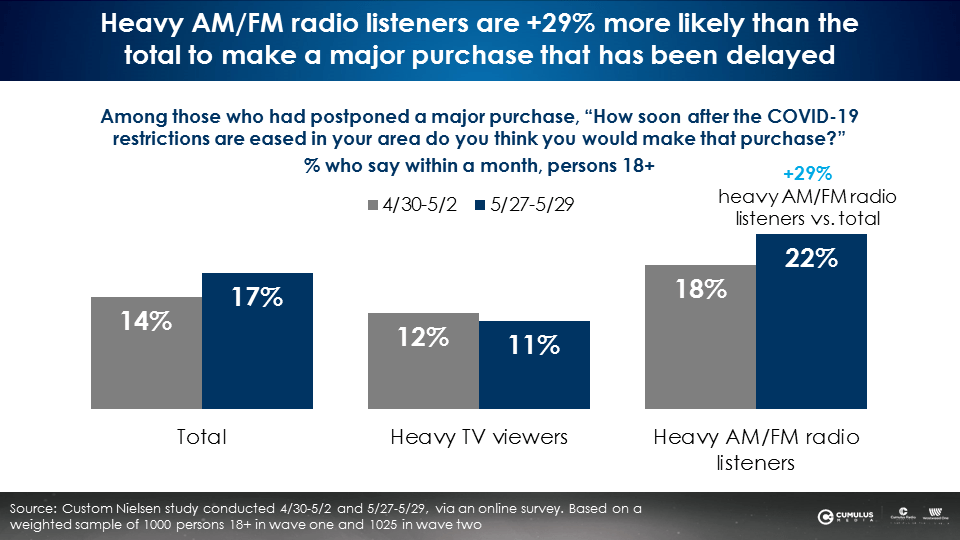

More consumers say they will make delayed purchases, especially AM/FM radio listeners

In another sign of growing consumer confidence, a greater proportion of consumers (17%, up from 14% a month ago) say they will make a major purchase that has been delayed.

Heavy AM/FM radio listeners are even more likely to say they will soon be making a delayed major purchase. Twice as many heavy AM/FM radio listeners (22%) will make a delayed purchase within a month compared to heavy TV viewers (11%).

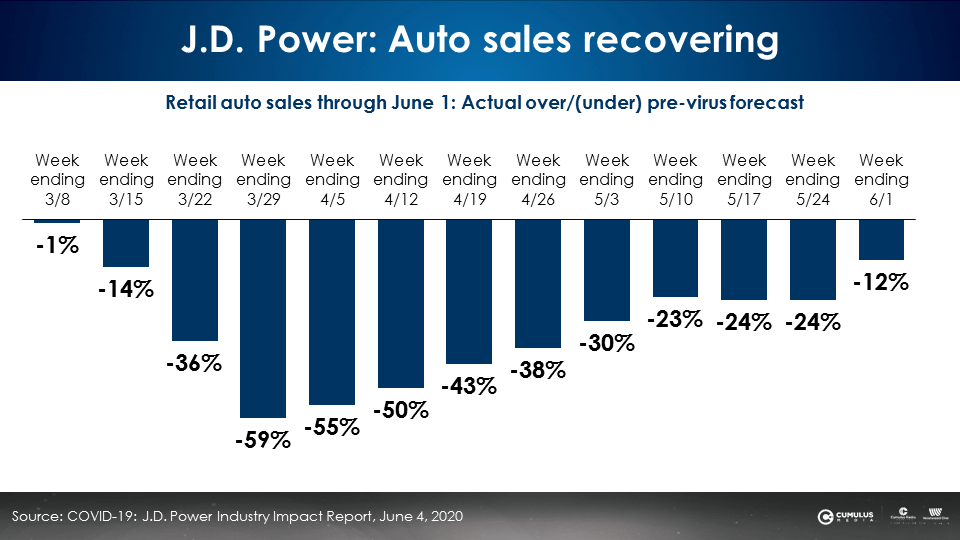

AM/FM radio drives auto purchases as sales roar back

J.D. Power reports that weekly auto sales have recovered sharply since the beginning of April. In the week ending June 1, auto sales were only -12% below pre-virus forecasts.

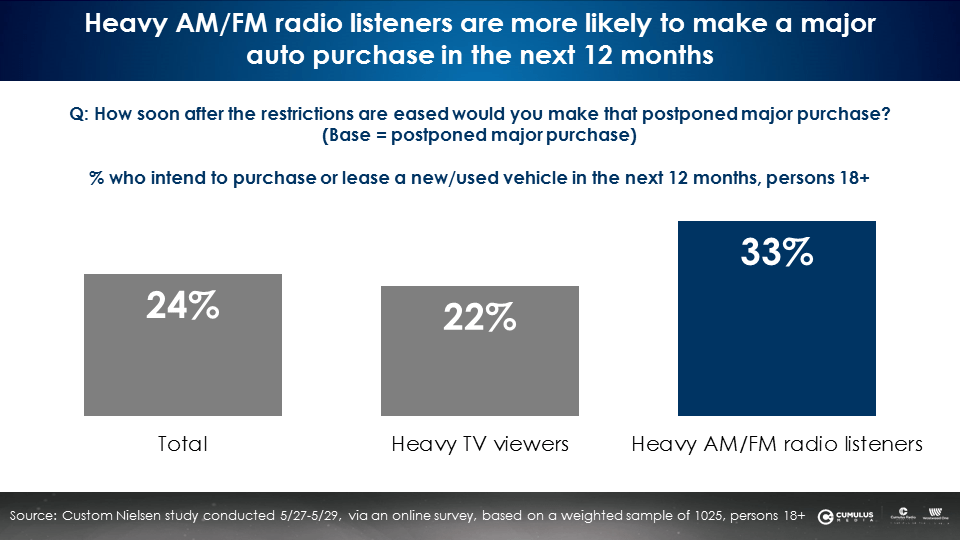

Nielsen reports that heavy AM/FM radio listeners are +50% more likely than heavy TV viewers to make an auto purchase in the next year. 33% of heavy AM/FM radio listeners say they will purchase a vehicle in the next year compared to only 22% of heavy TV viewers.

AM/FM radio listeners are spending more time on the road, increasing listening levels

A variety of data sources reveal Americans are spending more time on the road. Geopath, the outdoor audience measurement service, reports a massive recovery in weekly miles traveled.

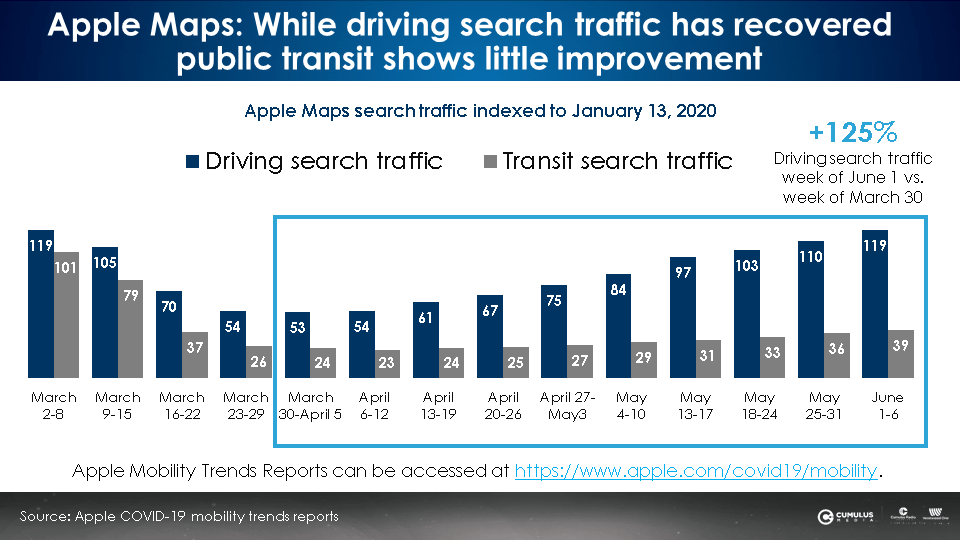

Apple Maps reveals a return to pre-COVID-19 driving search requests while public transit shows little improvement. For the foreseeable future, driving volumes will balloon, a net positive for AM/FM radio as Americans avoid public transportation.

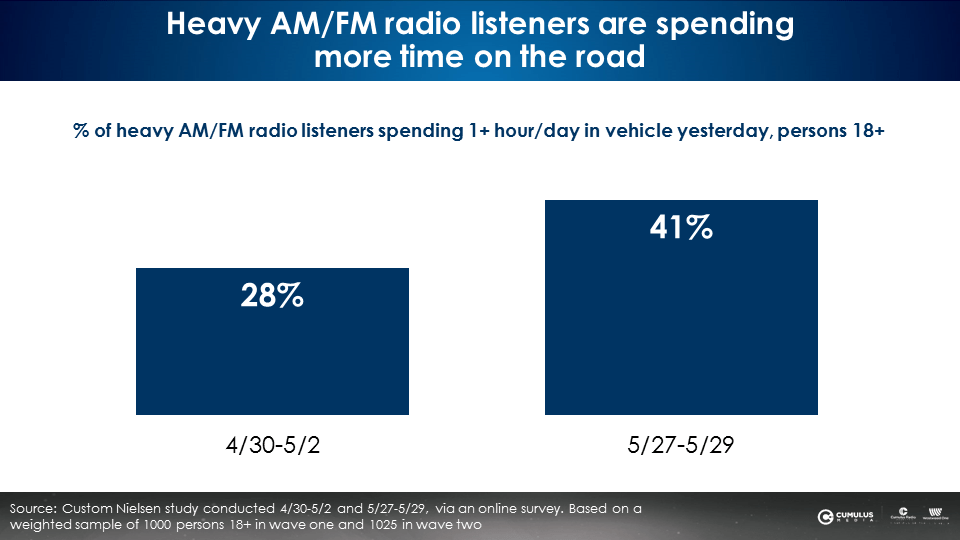

This most recent Nielsen study finds a greater proportion of heavy AM/FM radio listeners spending one or more hours in a car in the last day. This has led AM/FM radio audiences to continue to grow and recover.

American AM/FM radio retains 93% of pre-COVID-19 audience

Combining the just-released April diary data with recent May PPM audiences to form a national perspective, American AM/FM radio has retained 93% of pre-COVID-19 reach levels and 85% of pre-COVID-19 average quarter-hour audiences.

Key findings:

- “Ready to go” optimists perceive less risk, feel safer, and indicate their cities are emerging from the COVID-19 crisis

- “Ready to go” optimists and heavy AM/FM radio listeners are opening up the economy, with strong lifts in spending on both essentials and non-essentials

- Home improvement, home services, professional services, and auto dealers will be the beneficiaries of strong spending from AM/FM radio listeners far greater than from TV viewers

- Driving has increased overall which in turn has caused AM/FM radio listening to recover and grow

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.