Nielsen: AM/FM Radio Audiences Continue Steady Recovery Impacting Network Upfront Survey Selection

Yesterday afternoon Nielsen held a customer webinar to review the results of the just-released July 2020 Portable People Meter data as well as findings from the Spring 2020 diary markets.

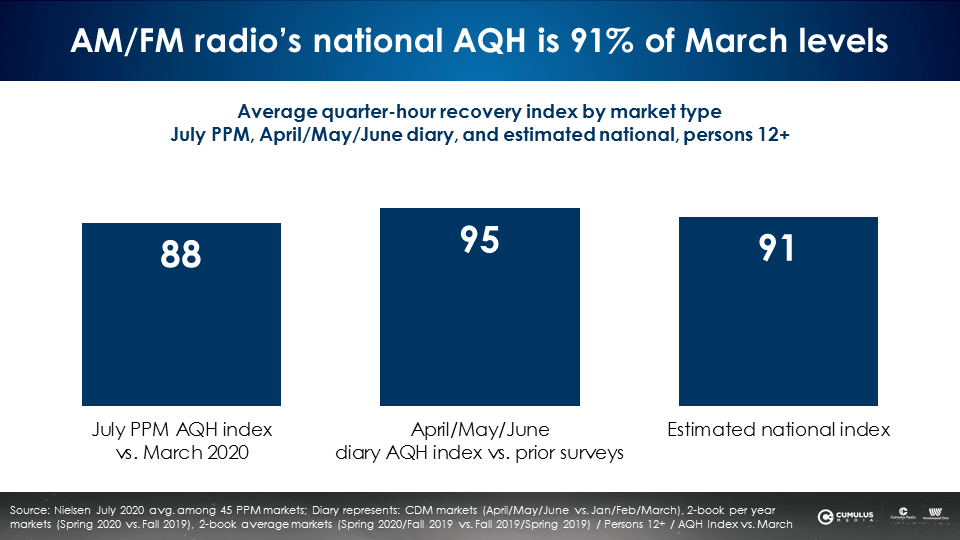

National average quarter-hour AM/FM radio audiences are now 91% of prior levels

In July 2020, PPM market average quarter-hour (AQH) audiences are now 88% of March 2020’s AQH. Spring diary market AQH audiences are 95% of prior audiences. Combined, total national AM/FM radio AQH is 91% of prior levels.

AM/FM radio’s reach is now 97% of prior levels

Across the four different Nielsen markets types (Portable People Meter, continuous diary measurement markets, standard markets, and two-book average markets), U.S. AM/FM radio retained virtually all of its cume audiences from prior periods. It is comforting that AM/FM radio retains its impressive reach given that AM/FM radio is American’s number one mass reach media and many brands use AM/FM radio to generate incremental audiences to TV.

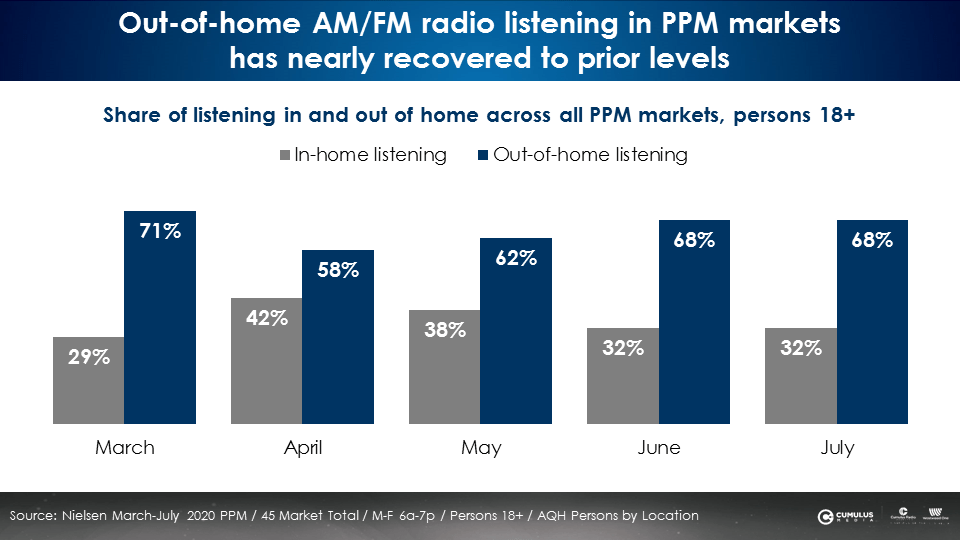

Out-of-home AM/FM radio listening now very similar to previous levels

Currently, 68% of all AM/FM radio listening in PPM markets during 6AM to 7PM is occurring away from home, very close to the 71% in March 2020. Even during April 2020, at the height of “shelter at home” mandates, 58% of all daytime AM/FM radio listening occurred out of home.

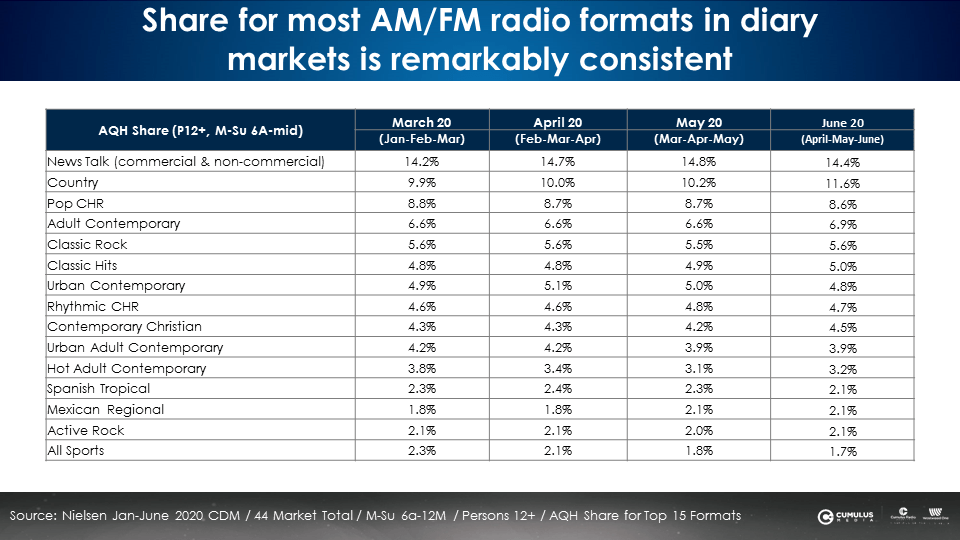

Format share trends are remarkably consistent

Across diary markets (indicated below), and Portable People Meter markets, AM/FM radio format shares are very stable. Americans like their favorite AM/FM radio stations and formats and are sticking with them.

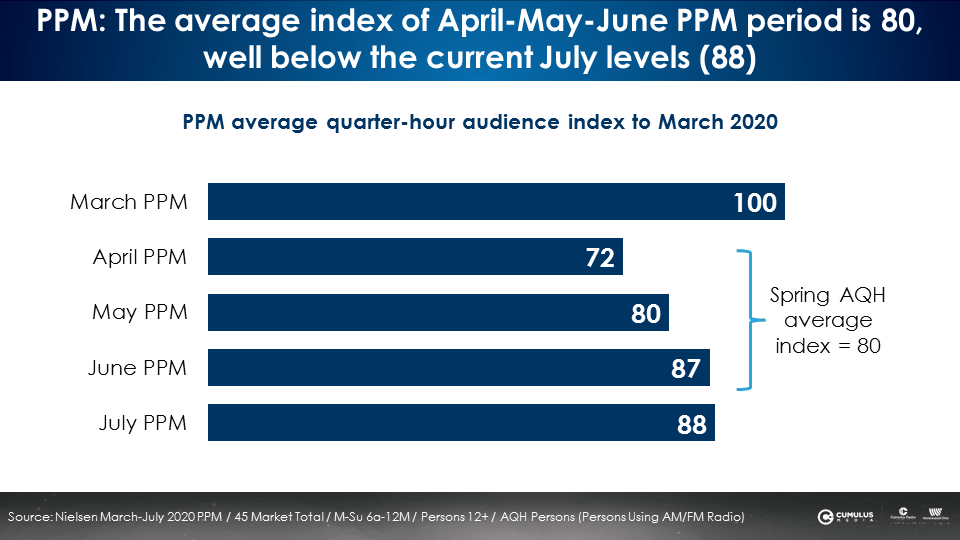

In PPM markets, the April-May-June Spring survey is not representative of current listening patterns

Using March 2020 PPM as the benchmark with a 100 index, we can examine month by month AQH in the PPM markets. AM/FM radio listening has sharply recovered from April. The average index of April-May-June PPM period is 80, well below the current July levels (88).

Nielsen: Spring Nationwide not be utilized for future buys

Nielsen’s “Nationwide” service is their roll up of all radio listening from all markets utilized by AM/FM radio network advertisers. Nielsen released the following product advisory statement about the Spring 2020 Nationwide survey:

“Given the anomalous nature of audience behavior during the COVID-19 public health emergency, it is Nielsen’s position that future buying and planning decisions for periods that fall outside the COVID crisis should not be made with COVID-impacted audience estimates.”

Typically, the Spring Nationwide survey is used as the basis for network upfront negotiations for the coming year as well as Q4 scatter buys. Due to Nielsen’s advisory, a different survey will need to be utilized for the 2021 network radio upfronts and Q4 scatter. The most likely candidate is the Fall 2019 Nationwide survey.

To recap:

- National AQH audiences are now 91% of prior levels.

- AM/FM radio’s reach is 97% of prior levels. This is significant as AM/FM radio is used by many brands for its dominant reach.

- Out-of-home AM/FM radio listening proportions are now very similar to previous levels

- Format share trends are remarkably consistent.

- In PPM markets, the April-May-June Spring survey is not representative of current listening patterns. Versus March 2020, the Spring survey averages at an 80 index versus July (88).

- Nielsen has advised that the Spring Nationwide survey used by network radio advertisers should not be utilized for future buys.

- Fall 2019 Nationwide is the most likely survey to be utilized for the 2021 network radio upfront and Q4 scatter buys.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.