New Nielsen Consumer Study: Workplace Commuting Increases Sharply, Time Spent In The Car Rises, Half Of Kids Go To School In Person, And AM/FM Radio Is The Soundtrack Of The American Economic Recovery

Today on a client webinar Nielsen released the results of a just-completed national consumer study of 1,000 respondents that was conducted October 1-5. This is fourth in a series of studies that have tracked the pandemic’s impact on consumer movement, spending, attitudes, and media usage. The prior studies were conducted in April, May, and June of this year.

Here is what you need to know:

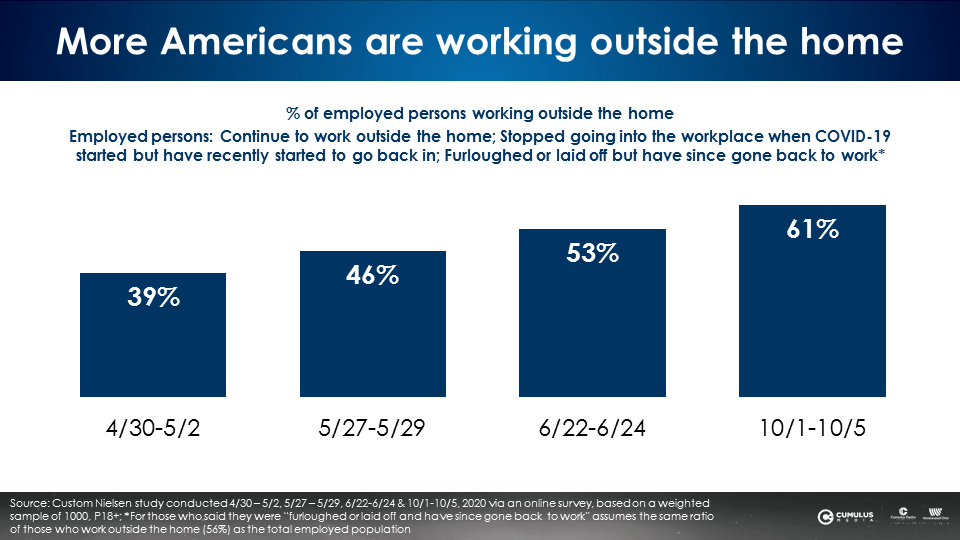

Commuting surge: There is a +56% increase in the number of Americans working outside the home

Nielsen reports 61% of U.S. workers are now commuting to their workplace, up from 39% in early May, a +56% increase. Commuting volume has been steadily increasing over the last five months.

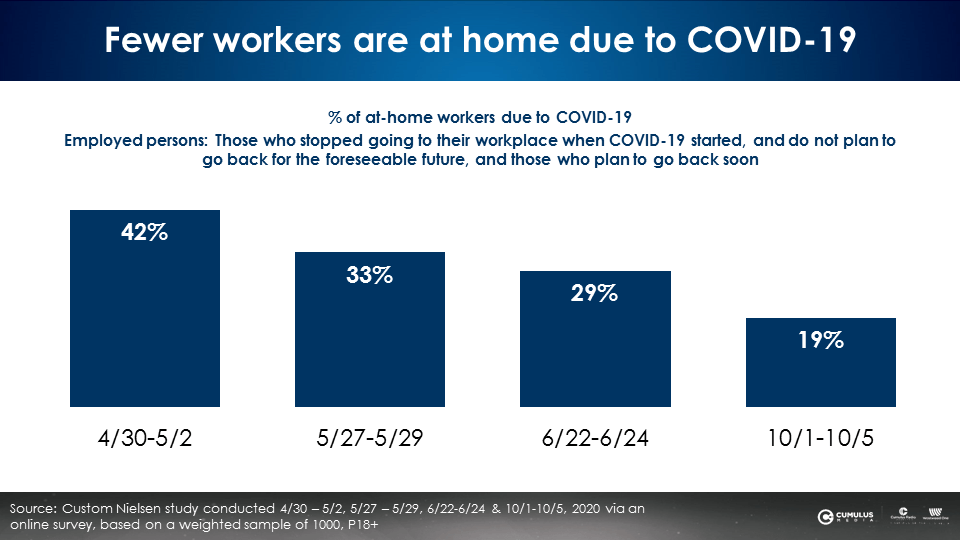

The number of at-home workers is down -55%

As the number of Americans commuting soars, the work-from-home population is shrinking. As of early October, Nielsen finds 19% of those employed are working at home, down from 42% in May. These 19% at-home workers previously worked outside of the home.

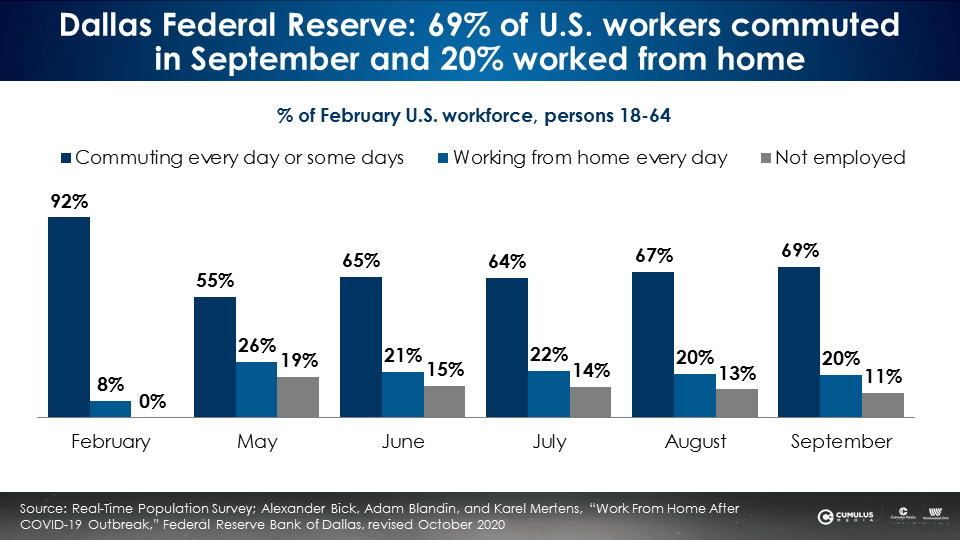

Dallas Federal Reserve: In September, 69% of U.S. workers commuted to work and 20% worked from home

Validating Nielsen’s findings is a just-released national commuting study from the Dallas Federal Reserve. Over the last eight months, the Dallas Federal Reserve studied Americans who were in the workforce prior to COVID-19.

In May during the shelter-at-home lockdown, 55% of pre-COVID-19 workers were still commuting to work, 26% were working at home, and 19% were not employed. Over the course of the spring and summer, commuting increased, those out of the workplace dropped, and the number of those working at home decreased.

As of September 2020, 69% of those who were employed pre-pandemic were commuting to work. 20% were working from home and 11% were not employed.

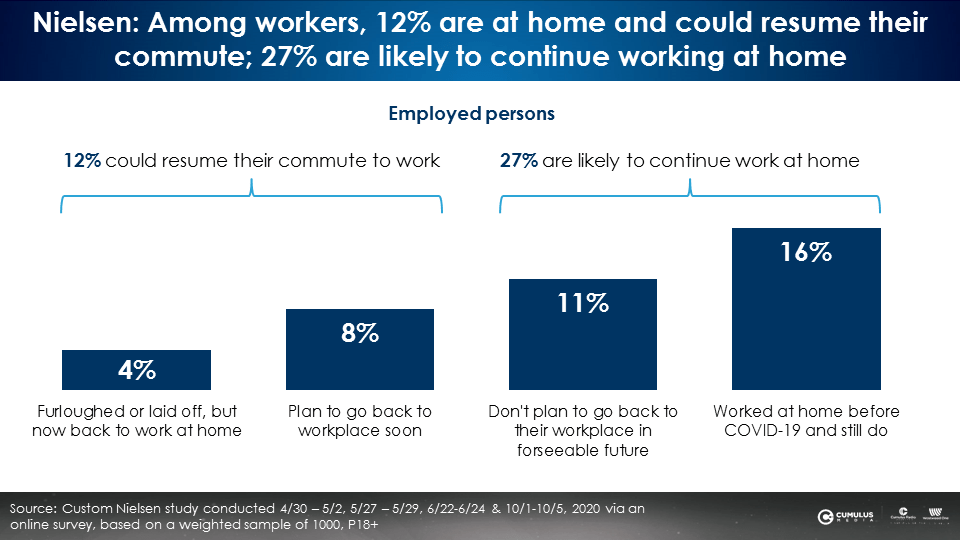

How many more at-home workers could resume their commute?

Both Nielsen and the Dallas Federal Reserve indicate there are additional workers who will resume their commute. The Dallas Federal Reserve found that before the pandemic, 8% of those employed worked out of the home. Thus, there are currently 12% of American workers who are working from home that did not previously do so.

Nielsen’s early October study also concludes there are 12% of workers at home who could resume their commute. 4% report working from home after being furloughed or laid off. 8% say they plan to go back to the workplace soon.

11% indicate they do not plan to go back to their workplace in the near future. There is another 16% who were at-home workers before the pandemic.

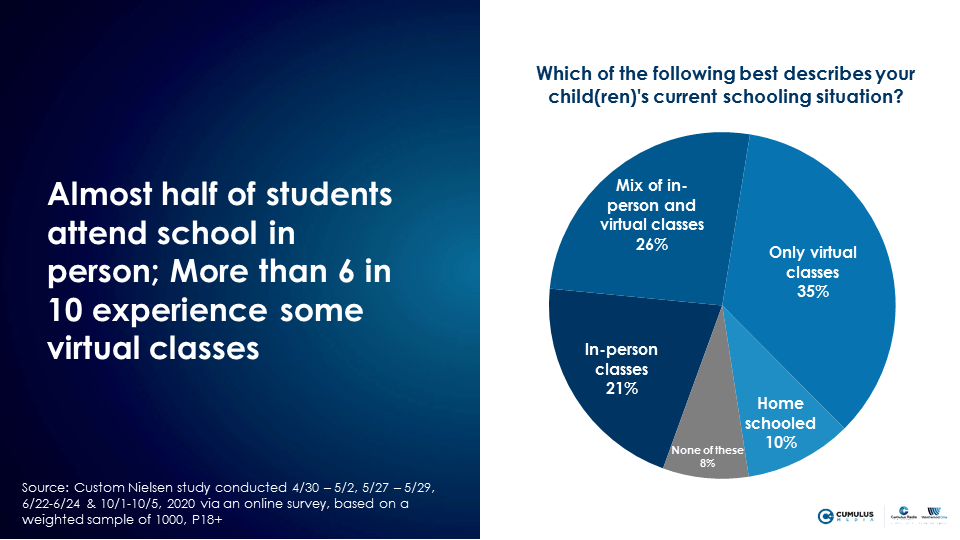

Half of schoolchildren attend school in person to some degree while six in ten experience some form of virtual schooling

In one of the first studies of the location of American schoolchildren, Nielsen finds there is a mix in attendance methods. 35% of parents say their children are only doing virtual schooling, 26% are doing a mix of in-person and virtual learning, and 21% are just doing in-person learning. The remaining children are being home schooled or using some other method.

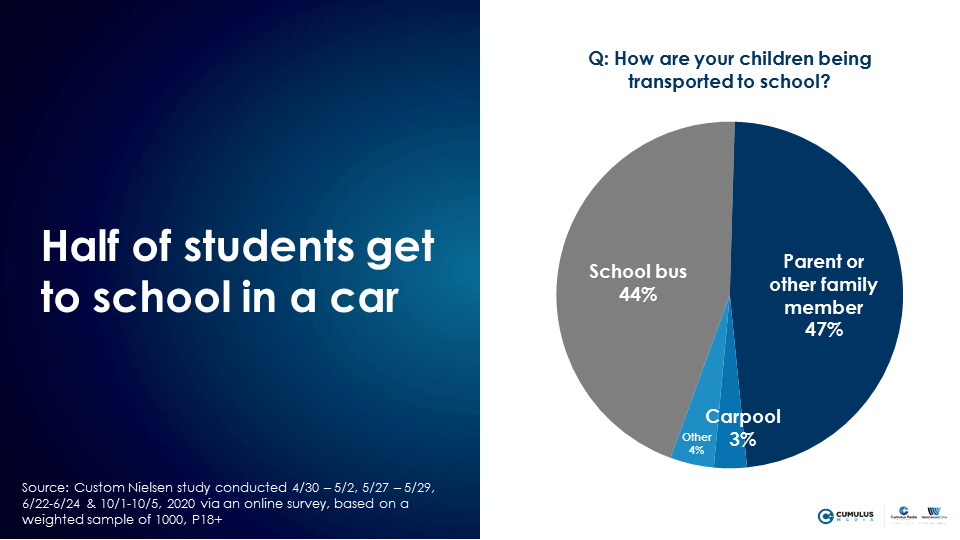

Half of American schoolchildren are driven to school with AM/FM radio playing in the car

50% say their children are driven to school (3% carpool, 47% parent/family member). 44% of American schoolchildren are taking the bus.

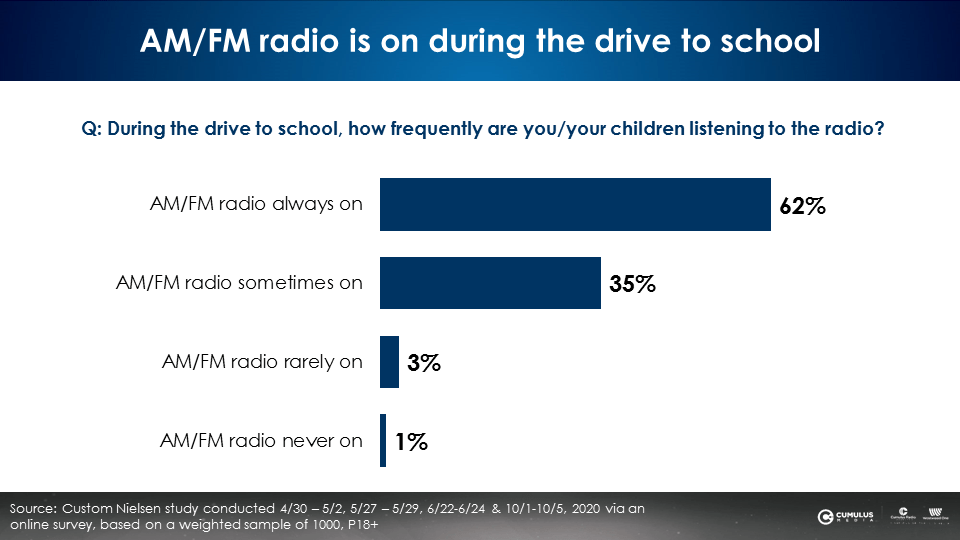

Nielsen reports that AM/FM radio is the soundtrack of the drive to school. 62% indicate that AM/FM radio is always on and 35% say AM/FM radio is sometimes on.

AM/FM radio’s audience recovery and time spent in the car is powered by commuting increases and a return to school

On the webinar Nielsen reported that drive time audience recovery continues in the Portable People Meter markets. In the September PPM survey, reach is now 97% of March and average quarter-hour persons is 90% of March levels. In Nielsen’s diary markets there has been no impact in listening levels versus pre-COVID-19. In fact, 41% of the continuously measured diary markets in the July-August-September survey have greater listening levels than Q1 2020.

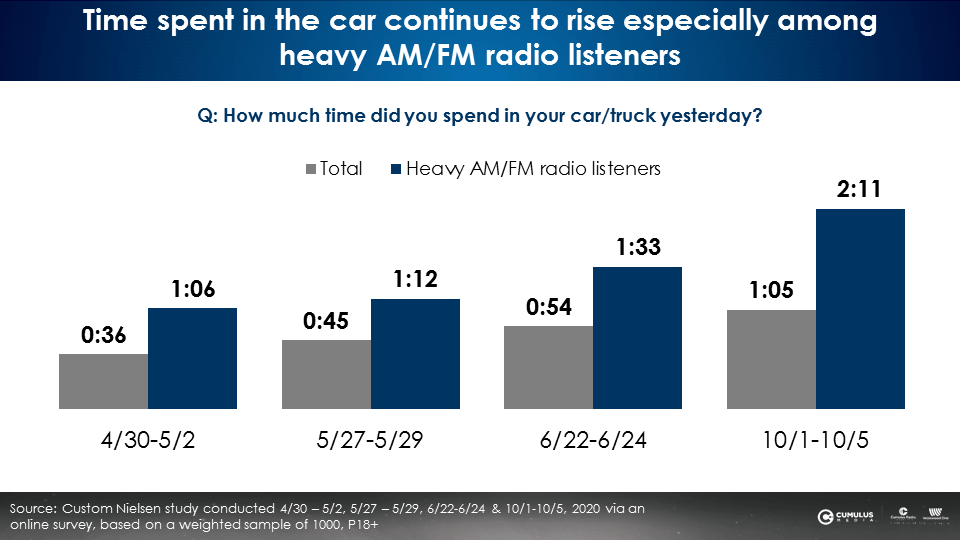

The growth of workplace commuting combined with the return of children to school has caused time spent in the car to surge. This is good news for both the outdoor advertising and U.S. AM/FM radio industries. From May to October, Nielsen finds daily time spent in the car has grown +81% from 36 minutes in May to 65 minutes in October. Among heavy AM/FM radio listeners, daily time spent in the car has doubled from an hour and six minutes a day to two hours and eleven minutes.

AM/FM radio is the soundtrack of the American economic recovery

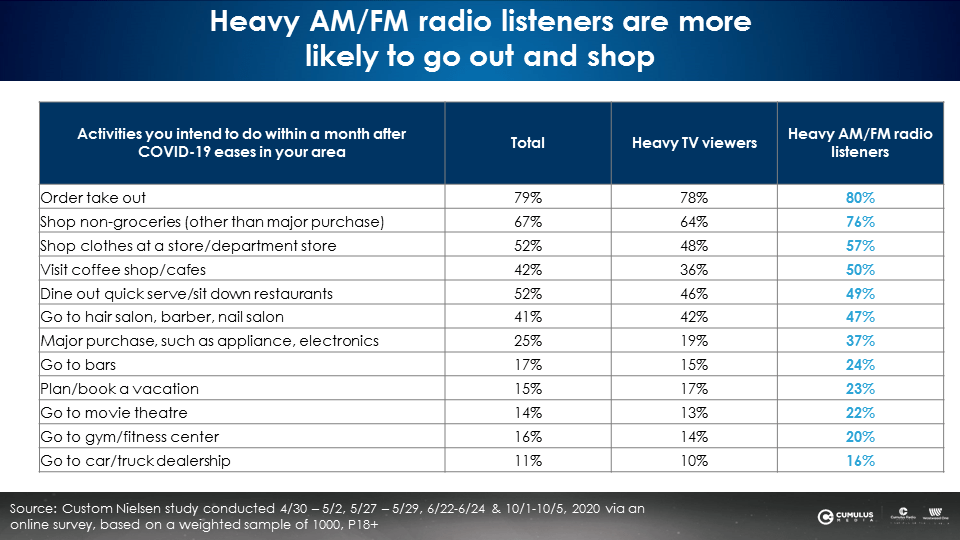

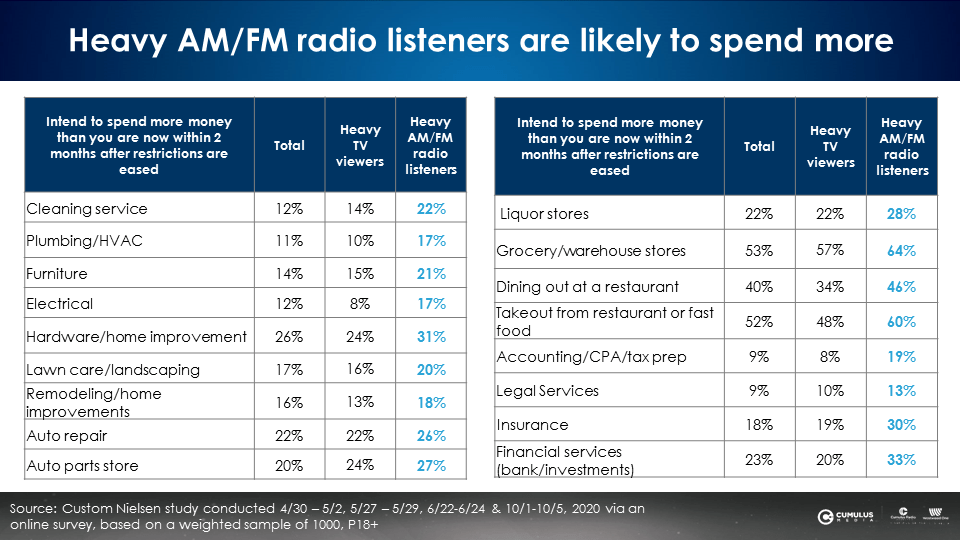

Compared to heavy TV viewers, heavy AM/FM radio listeners will spend more across a wide variety of purchase categories. Over the past four consumer studies, Nielsen has found that heavy AM/FM radio listeners are the engine of America’s economic recovery.

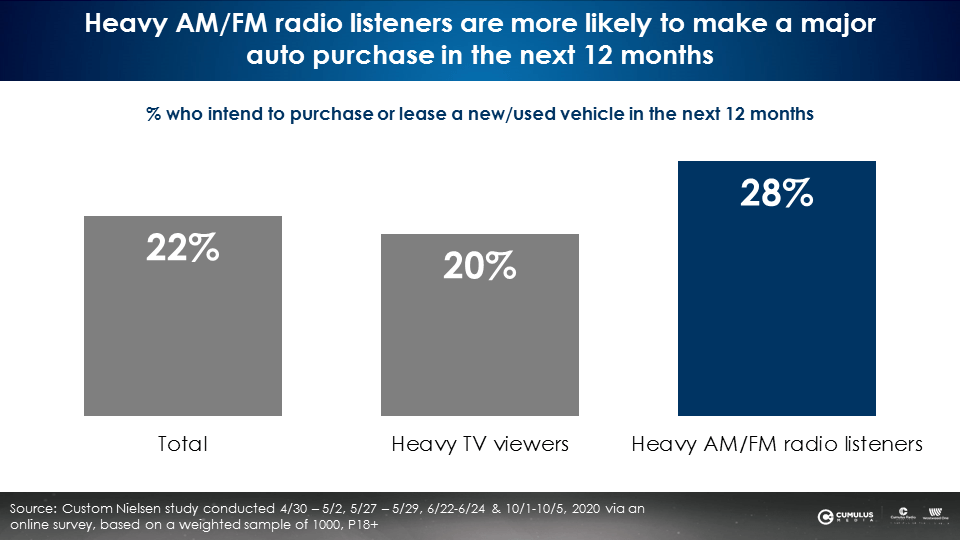

A greater proportion of heavy AM/FM radio listeners (28%) will buy or lease a vehicle in the next year compared to heavy TV viewers (20%).

Across 29 categories, heavy AM/FM radio listeners show stronger purchase intentions compared to heavy TV viewers

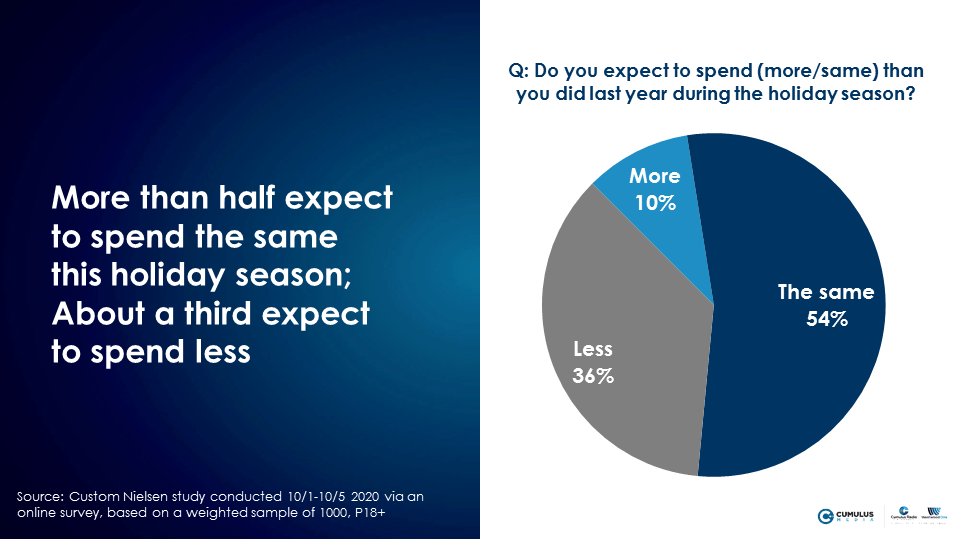

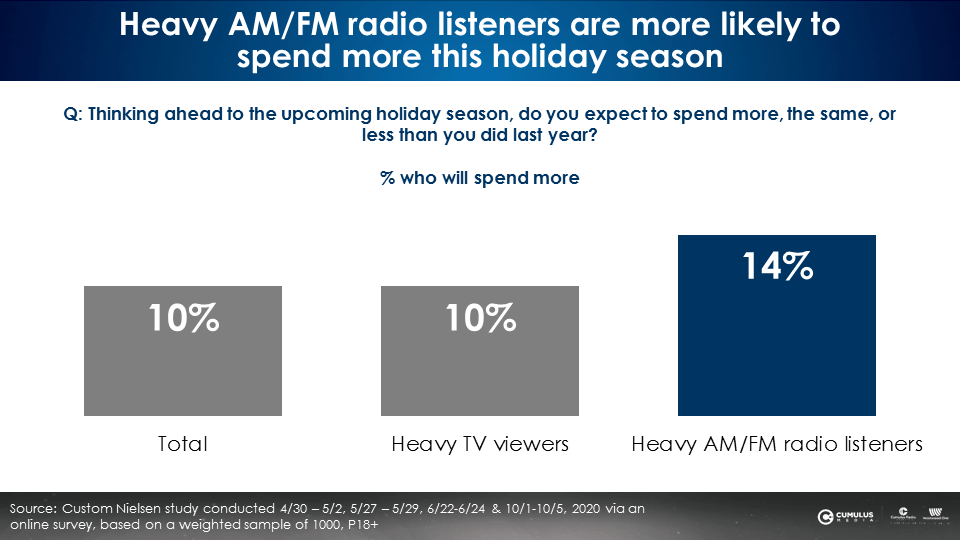

The economy will affect holiday shopping but AM/FM radio listeners will spend more than the average

54% of consumers say their holiday spending will remain unchanged from last year. 36% say it will be less and 10% indicate they will spend more.

A greater proportion of heavy AM/FM radio listeners say they will spend more this holiday (14%) versus heavy TV viewers (10%) and the overall market (10%).

Key takeaways:

- Commuting surge: There is a +56% increase in the number of Americans working outside the home

- The number of at-home workers is down -55%

- Dallas Federal Reserve: In September, 69% of U.S. workers commuted to work and 20% worked from home

- Half of schoolchildren attend school in person to some degree while six in ten experience some form of virtual schooling

- Half of American schoolchildren are driven to school with AM/FM radio playing in the car

- AM/FM radio’s audience recovery and time spent in the car is powered by commuting increases and a return to school

- AM/FM radio is the soundtrack of the American economic recovery

- Across 29 categories, heavy AM/FM radio listeners show stronger purchase intentions compared to heavy TV viewers

- The economy will affect holiday shopping but AM/FM radio listeners will spend more than the average

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.