Historic Nielsen Retailer ROI Study: AM/FM Radio Generates Triple the Sales Lift of TV

At the recent National Association of Broadcasters and Radio Advertising Bureau “Radio Show” conference, CUMULUS MEDIA CEO Mary Berner described AM/FM radio by saying, “We’re big and we work.”

It is acknowledged that AM/FM radio is America’s number one mass reach media. According to Nielsen’s Total Audience Report, AM/FM radio has a greater weekly audience than TV, social media, and online video. AM/FM radio’s ability to drive sales effect is less well documented.

CUMULUS MEDIA | Westwood One is excited to debut a historic new study that examines the sales lift of a retailer’s entire TV and AM/FM radio campaign. Every single TV and AM/FM radio ad run by the retailer was examined. While Nielsen has conducted dozens of sales lift studies for AM/FM radio campaigns, this is only the fourth time that the sales lift of AM/FM radio and a TV schedule was examined in the same study.

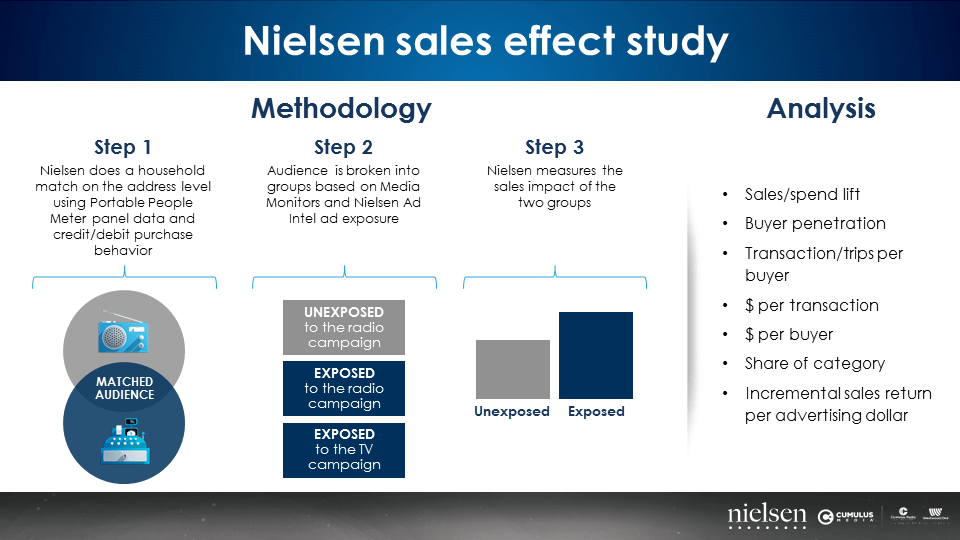

Commissioned by CUMULUS MEDIA | Westwood One, Nielsen’s sales effect study matched Portable People Meter panel data with purchase data to reveal how TV and AM/FM radio impacted sales for a major national retailer. Nielsen’s analysis examined the campaign that ran from April 30, 2018 through May 27, 2018, comparing those who were exposed and unexposed to determine ad effectiveness.

Actual ad exposure and actual customer spend generate actual sales effect and ROI

Using Nielsen’s Portable People Meter panel of 80,000 respondents, campaign exposure was measured at the individual person level, not just at the household level.

Commercial audience exposure was matched to actual spend using credit and debit card spending from the home address associated with PPM advertising exposure.

Imagine 32 Main Street in Eastchester, NY is a Nielsen Portable People Meter home. Debit and credit card spending from that household address is matched to the individual person’s TV and AM/FM radio commercial exposure to the retailer’s ads.

Why “real” ROI studies are better than media mix modeling

It is not uncommon for brands to report that AM/FM radio does not perform well in media mix modeling studies. AM/FM radio is such a small part of many national brand media investments that the media mix model has a hard time generating a stable and reliable read.

Media mix modeling is a self-fulfilling prophecy. It reads well for the largest media investments in the plan. The small elements in the media plan experience “performance bounce” in sale volume and return on marketing investment metrics.

A far more effective and meaningful approach is to conduct “real” sales effect and return on ad spend studies with Nielsen. Actual media exposure is connected to actual consumer spend to generate actual sales effect and ROI.

Here are the key findings from the Nielsen study:

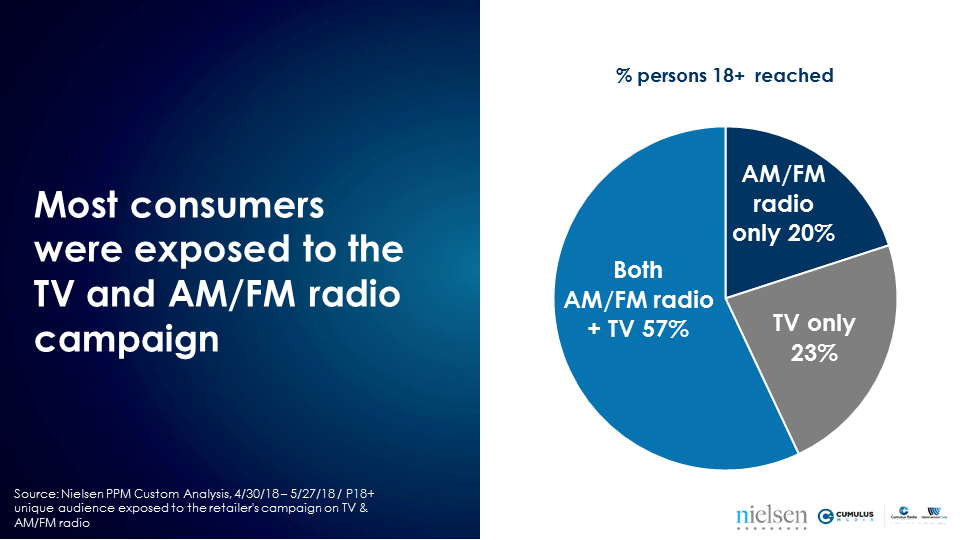

Most consumers were reached by both the TV and the AM/FM radio campaign

During the one-month measurement period, of those exposed to the campaign, 57% of were reached both by the TV and AM/FM radio campaign. 23% only saw the TV ads and 20% only heard the AM/FM radio ads. Nielsen examined sales lift and return on advertising ad spend among each of the three media exposure segments.

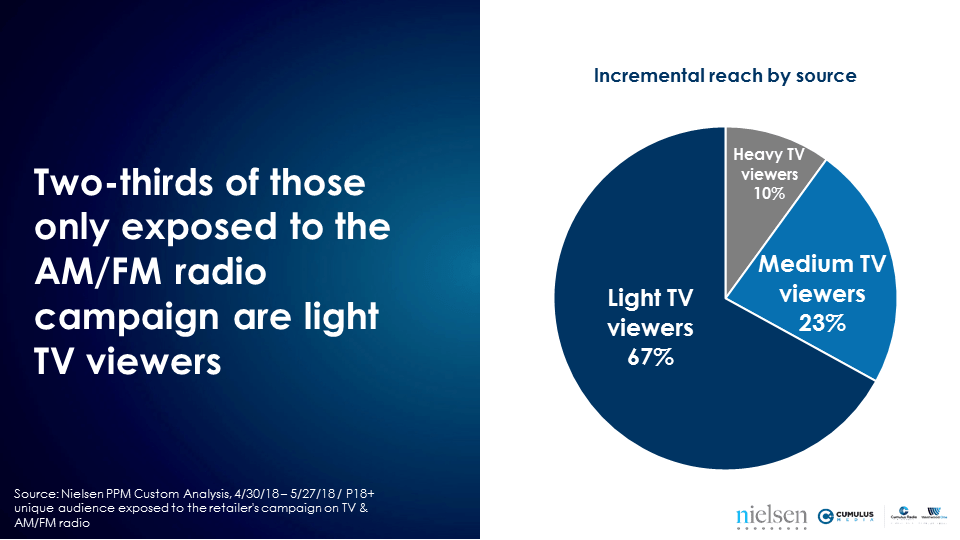

The majority of those only reached by the AM/FM campaign were light TV viewers

Nielsen reported that AM/FM generated a +24% increase in incremental reach to the TV media plan. The younger the demographic, the greater AM/FM radio’s lift in incremental reach. These findings are consistent with multiple incremental reach studies Nielsen has conducted.

The majority of those only reached by the AM/FM radio campaign were light TV viewers. A wise media planner once said, “You cannot solve your light TV viewer problem with more TV.” One of AM/FM radio’s superpowers is the ability to reach light TV viewers. Light TV viewers are rarely, if ever, exposed to TV ads.

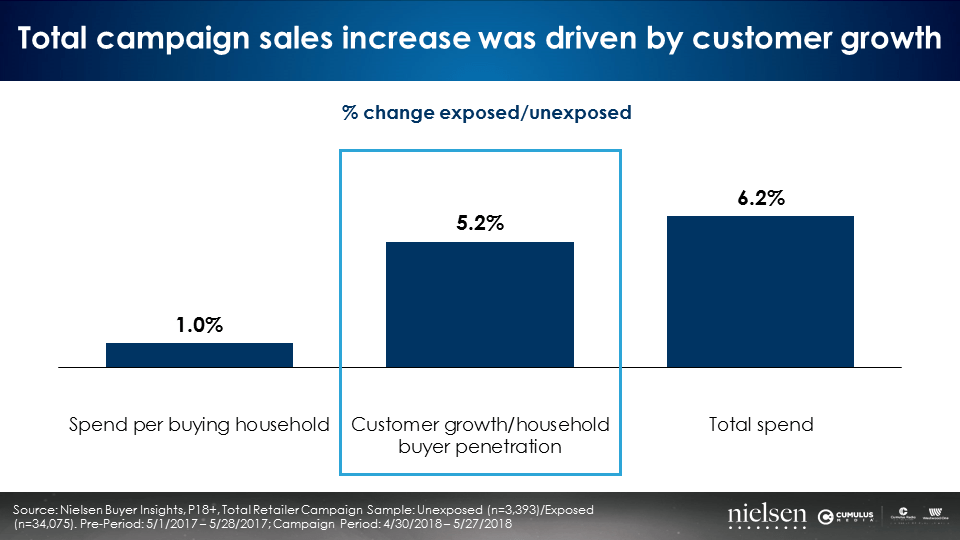

Total campaign sales increase was driven by customer growth

What’s more important – increasing sales from existing customers or growing your customer base? A vast array of marketing effectiveness gurus come down decisively on the side of growing the customer base, also known as household buyer penetration.

Byron Sharp, the author of the marketing bestseller How Brands Grow: What Marketers Don’t Know, says growth “never occurs without the brand increasing the size of its customer base (market penetration), and that requires building mental and physical availability.”

Les Binet, Head of Effectiveness at adam&eveDDB, and Peter Field, Marketing Consultant and one of the foremost experts of advertising effectiveness, wrote the highly respected book, The Long and the Short of It: Balancing Short and Long-Term Marketing Strategies.

Binet and Field studied hundreds of campaigns and sales results. Their conclusions were:

- Targeting existing customers delivers smaller profits and more short-term sales response

- The longer the time frame, the more important new customers are to profitability

- The benefits of broad reach considerably outweigh the benefits of tight targeting

Nielsen found the combined effect of the TV and AM/FM radio campaign was a strong increase in the customer base (+5.2%) and a modest increase in spend per buying household (+1.0%). In total, the campaign generated a +6.2% increase in sales. Most of the sales lift came from customer growth.

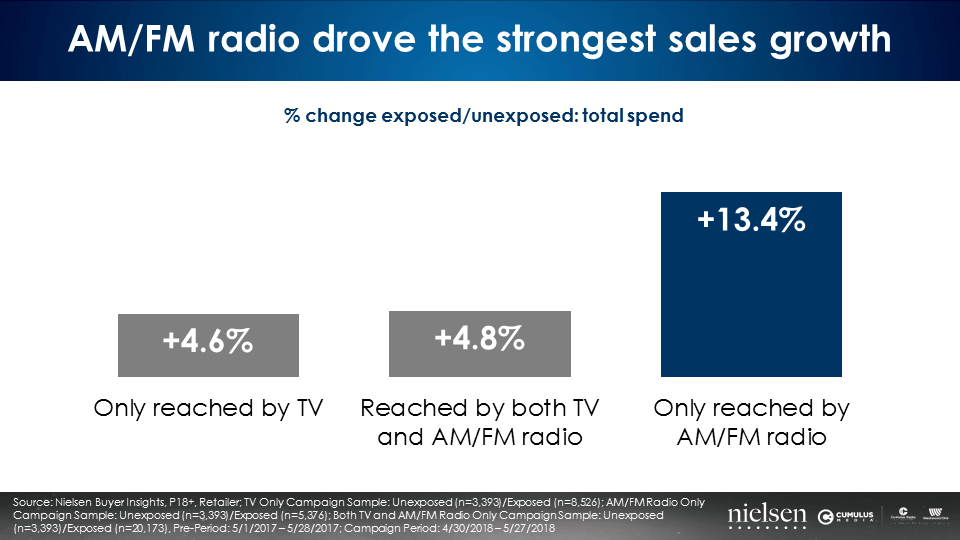

AM/FM radio sales lift is triple that of TV

Examining the sales increase among the three media exposure segments revealed the AM/FM radio-only segment (consumers only reached by the AM/FM radio campaign), had 3X the sales lift of the consumers reached by the TV ads.

- Consumers only exposed to the TV ads generated a +4.6% sales increase

- Those who saw both the TV ads and the AM/FM radio ads had a +4.8% sales lift

- The segment only exposed to the AM/FM radio ads had an outsized +13.4% increase in sales

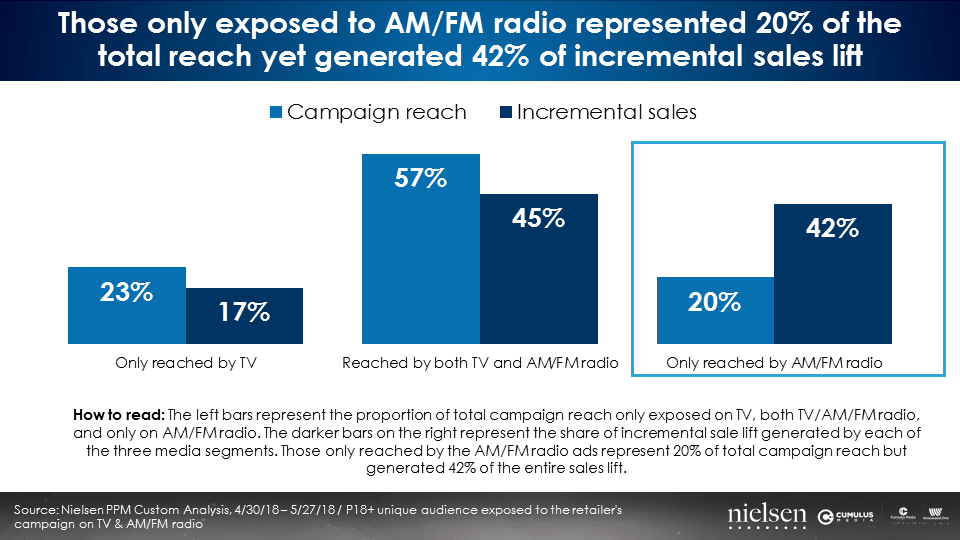

Those only exposed to the AM/FM radio ads represented 20% of campaign reach yet generated 42% of the total sales lift

The consumers who only heard the retailer’s AM/FM radio ads (and were not exposed to the TV ads) had a massive impact on sales. 42% of the entire incremental sales lift came from the 20% of the total campaign reach who were only exposed to the AM/FM radio ads. One point of AM/FM radio-only reach generated two points of incremental sales.

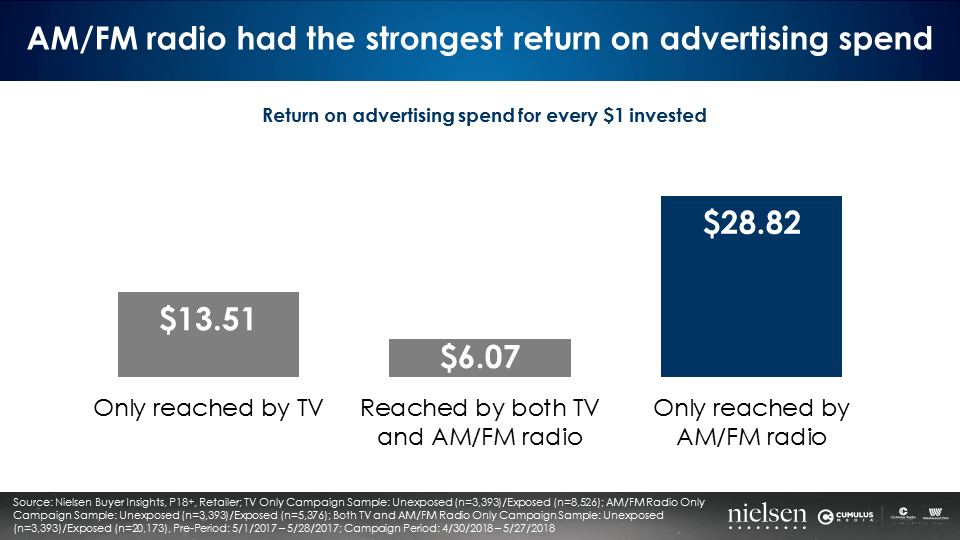

AM/FM radio has double the return on advertising spend as TV

For every dollar invested in AM/FM radio, there were $28.82 of incremental sales generated. This is twice the return on ad spend of TV ($13.51).

Key takeaways:

- Historic study: This is a first-ever TV and AM/FM radio cross-media sales effect study for this retail category and only the fourth such study in Nielsen’s history. The entire TV and AM/FM radio campaign (including all vendors) was studied.

- AM/FM radio’s superpower is building substantial reach among light TV viewers: Among those only reached on AM/FM radio, two-thirds were light TV viewers.

- Customer growth/penetration was the major sales driver: The overall TV + AM/FM radio campaign yielded significant lifts for penetration. Sales per household grew modestly.

- AM/FM radio sales lift is triple that of TV: Sales grew +13.4.% among those only exposed to the AM/FM radio campaign.

- Return on advertising spend was positive and AM/FM radio’s ROI was 2X TV’s: Those only exposed to AM/FM radio ads generated a significant $28.82 return on advertising spend, double that of TV ($13.51).

- Those exposed only to the AM/FM radio campaign had an outsized impact on incremental sales: 42% of the entire incremental sales lift came from the 20% who were only exposed to the AM/FM radio campaign.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.