New CUMULUS MEDIA | Westwood One Study Reveals 12 Million Americans Are Looking For A New Tax Preparation Provider; Reaching These Service Switchers Will Take More Than TV And Digital

Each year, consumer tax preparation services tout their brands to maintain current clients and attract new customers. Kantar estimates between $350 million and $400 million are spent annually marketing personal tax services. About 30%-40% of the all tax preparation advertising is spent in January with 76% spent in the first quarter of the year.

To understand the current state of the consumer tax category, CUMULUS MEDIA | Westwood One fielded a 990-person national study in October of 2020.

Here’s what you need to know:

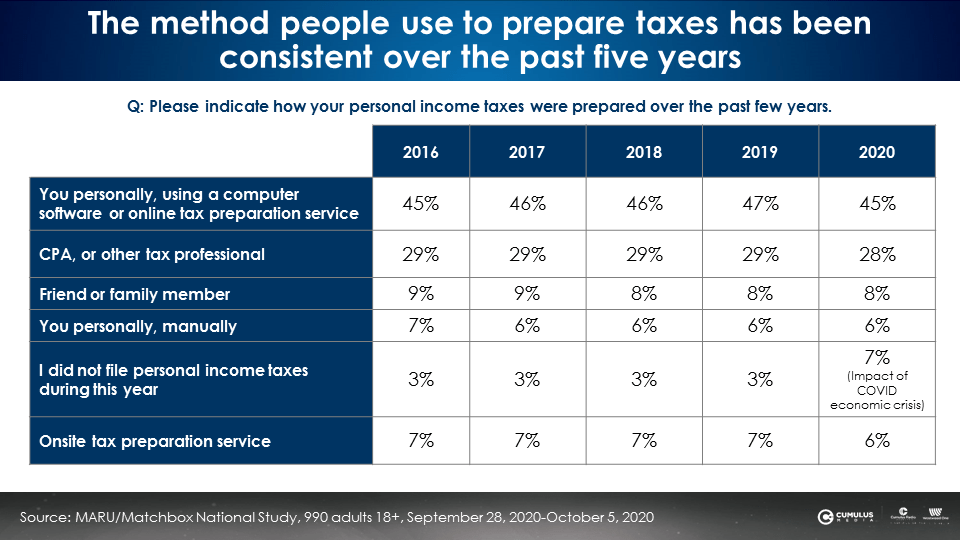

45% use software or an online service while 28% use a CPA or tax professional

This past year, 8% of respondents had a friend or family member prepare their taxes and 6% filed manually. 6% used an onsite service. The way people prepare their taxes has been very consistent over the last five years.

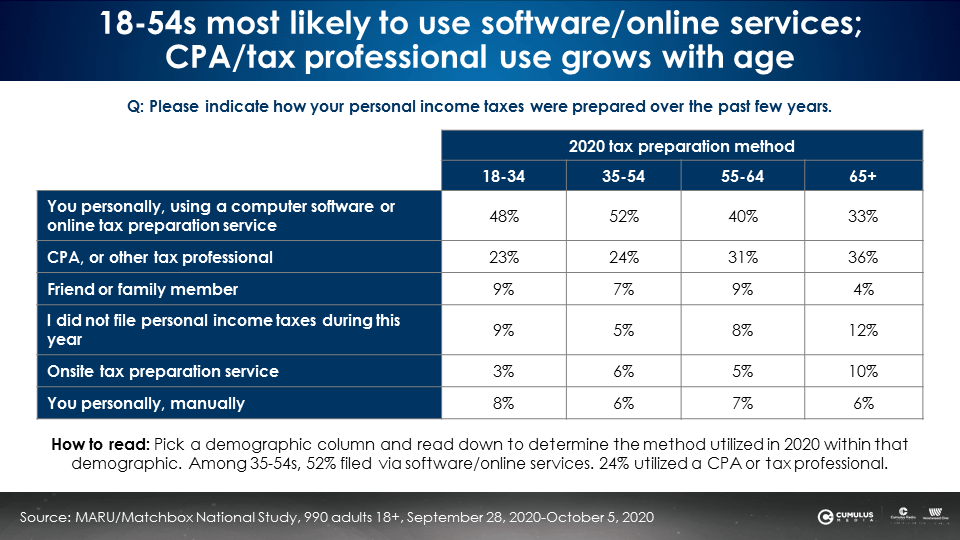

18-54s favor software/online services and 55+ consumers prefer tax professionals

It is not surprising that Boomers want a tax professional rather than software or an online service. Persons 50+ have greater assets and wealth. Forbes reports that according to Oxford Economics findings, “Americans over 50 already account for $7.6 trillion in direct spending … and control more than 80% of household wealth.” Acxiom data reveals Boomers 50+ represent 54% of all disposable income. Robert Passikoff, President of Brand Keys Inc., notes, “While the Millennials are sharing stuff, Boomers are buying stuff.”

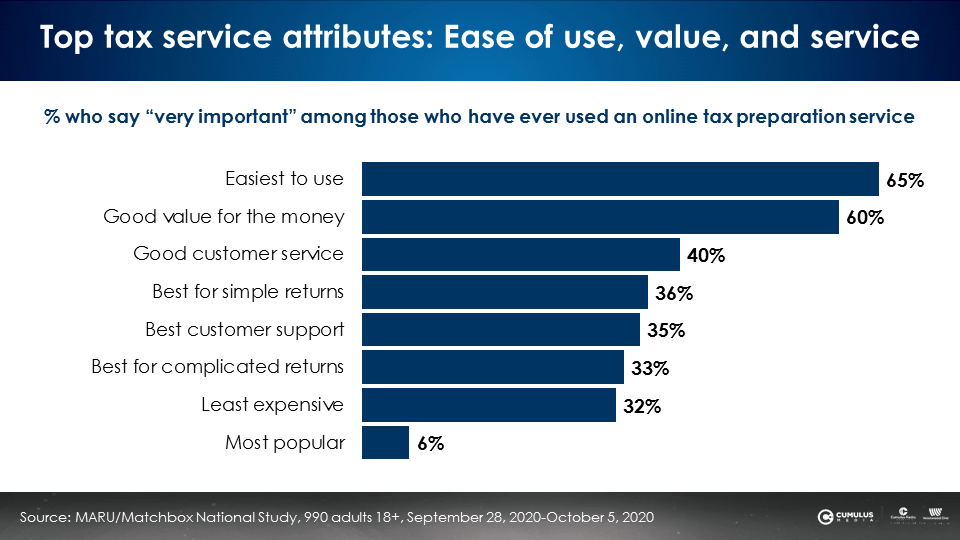

Ease of use and value for the money are top attributes of online tax preparation

While most online tax services tout low prices as their dominant creative message, low prices do not rate as a leading attribute among consumers.

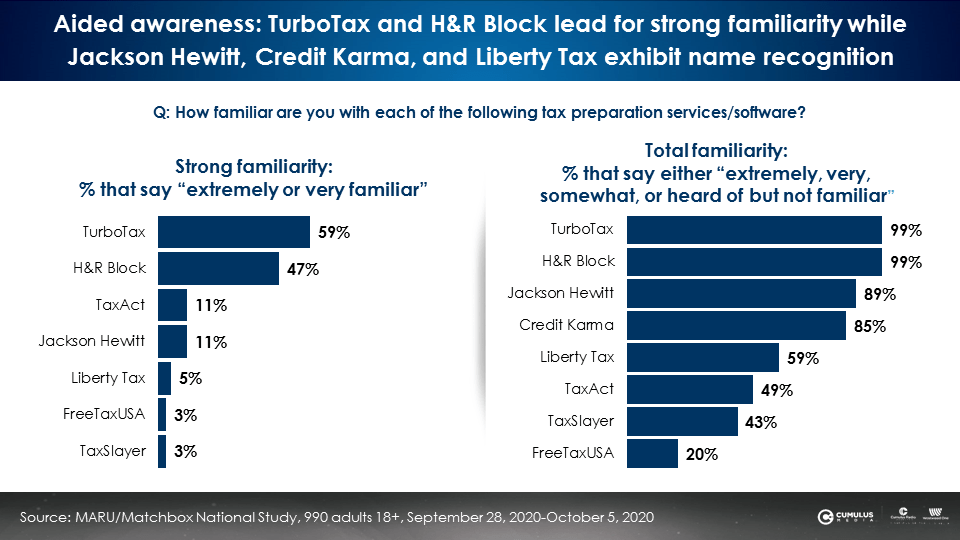

Brand awareness: TurboTax and H&R Block lead; Jackson Hewitt and Credit Karma follow closely

The most generous measure of aided awareness (total familiarity below) places four brands over 85% and three brands between 40% and 60%. TurboTax and H&R Block lead with those saying they are “extremely/very familiar” with tax preparation firms followed by TaxAct and Jackson Hewitt.

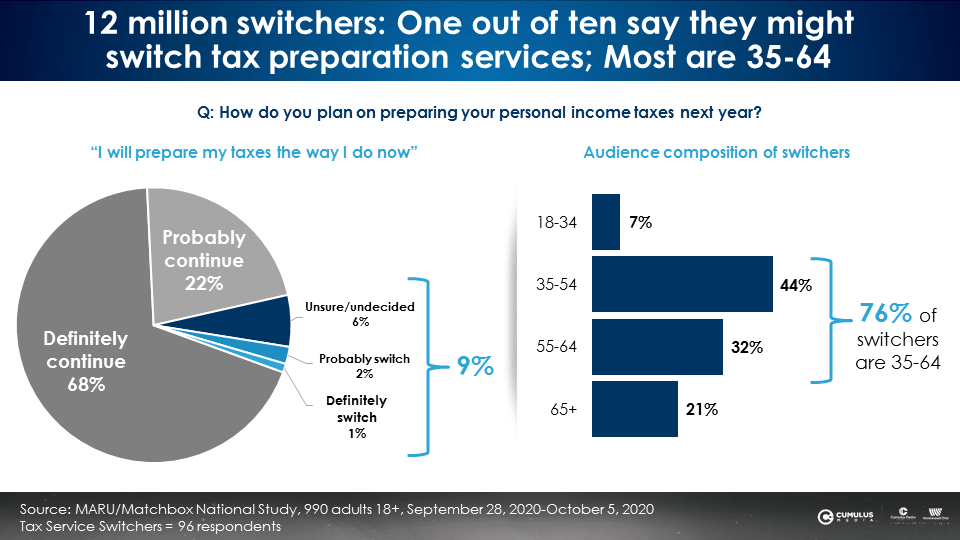

12 million customers are up for grabs; 9% of tax preparation customers say they will switch

Another 22% say they will “probably continue” with their current method, pointing to a less than definitive commitment to their current service. The vast majority of the 9% who say they will switch providers are aged 35-64.

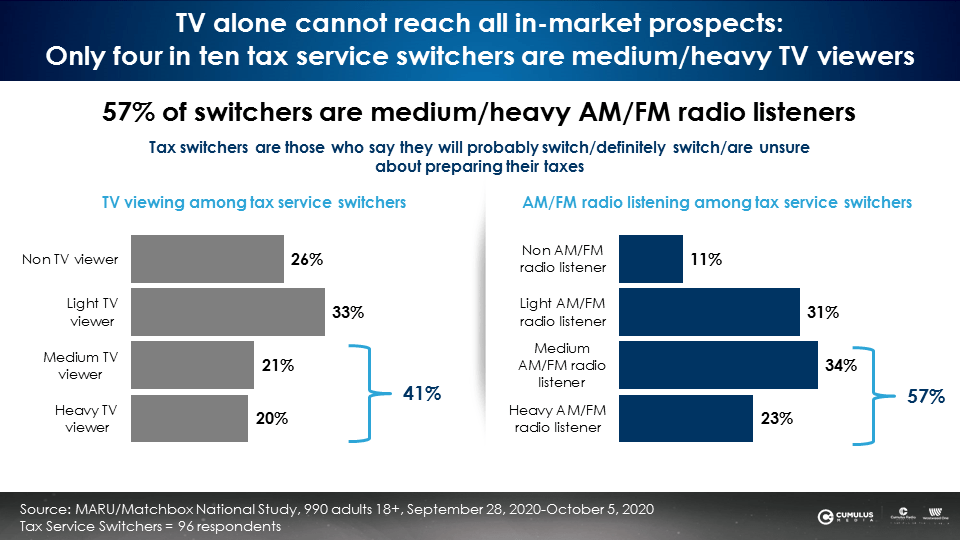

Targeting tax preparation switchers will require more than just TV and digital; AM/FM radio is used more heavily among those looking for a new service

Only 41% of those who say they will be looking for a new tax preparation provider are medium or heavy users of TV. A greater proportion (57%) are medium/heavy AM/FM radio listeners.

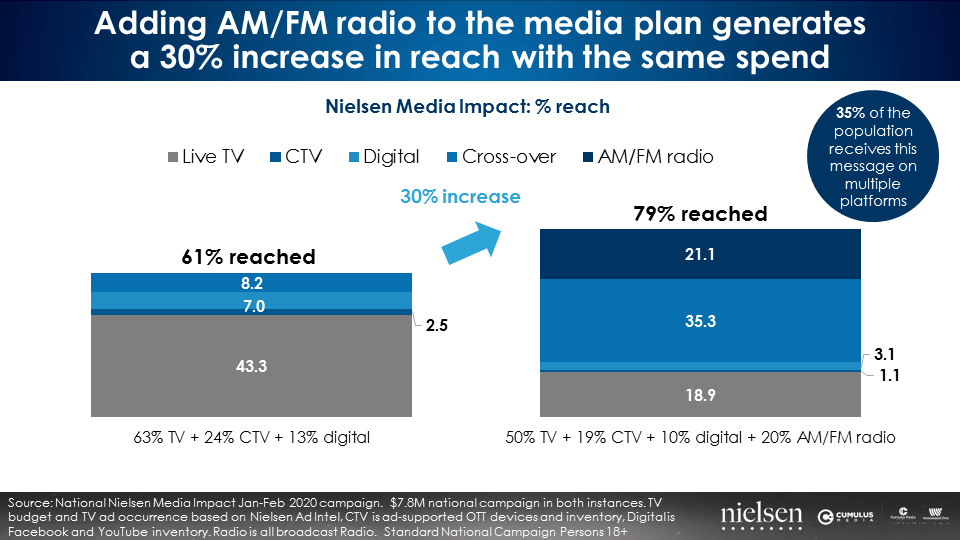

Reach surges when AM/FM radio is added to a media plan with digital, connected TV, and linear TV

There is a mistaken assumption that OTT, connected TV, and digital can make up for all of the audience losses of linear television. While they help somewhat, the addition of AM/FM radio generates a significant increase in reach for the same budget.

An analysis conducted by Nielsen Media Impact, the media optimization platform, found a plan with 63% of the budget allocated to linear TV, 24% connected TV, and 13% digital had a 61% reach. Shifting 20% of the media budget to AM/FM radio with no increase in spend grows reach from 61% to 79%, a +30% increase.

Even more impressive, the addition of AM/FM radio quadruples the proportion of consumers reached by two or more media platforms (8% to 35%). AM/FM radio elevates the media plan, generating a massive increase in reach as well as a lift in cross-media frequency.

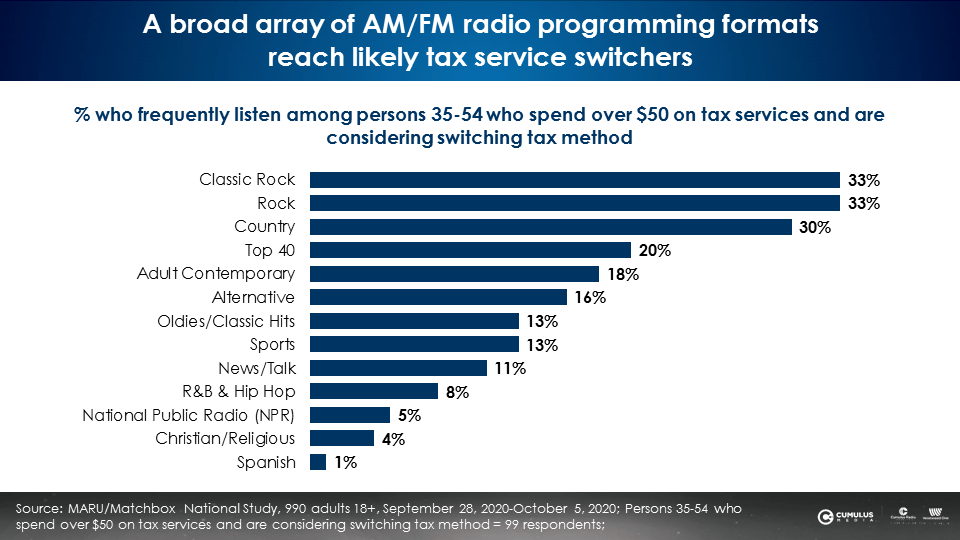

Reach tax service switchers with a broad array of AM/FM radio programming formats

Various flavors of Rock, Country, Top 40, and Adult Contemporary are excellent AM/FM radio programming formats to reach tax switchers.

Key takeaways:

- 45% use software or an online service while 28% use a CPA or tax professional

- 18-54s favor software/online services and 55+ consumers prefer tax professionals

- Ease of use and value for the money are top attributes of online tax preparation

- Brand awareness: TurboTax and H&R Block lead; Jackson Hewitt and Credit Karma follow closely

- 12 million customers are up for grabs; 9% of tax preparation customers say they will switch

- Targeting tax preparation switchers will require more than just digital and TV; AM/FM radio is used more heavily among those looking for a new service

- Reach surges when AM/FM radio is added to a media plan with digital, connected TV, and linear TV

- Tax service switchers can be reached with a broad array of AM/FM radio programming formats

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.