Westwood One | Magellan AI Podcast Advertising Analysis Shows Podcasts Are Pandemic Proof: After Modest Dip In April, Ad Volumes Roar Back In Q3 2020

Despite the global pandemic, podcasting has remained a vibrant media option for advertisers. According to Edison Research’s “Share of Ear,” podcasting’s ad-supported audio shares among persons 25-54 more than tripled from 4% in Q3 2016 to 15% in Q4 2020.

With podcast listening up, are podcast advertisers similarly growing their investments? CUMULUS MEDIA | Westwood One partnered with Magellan AI, the definitive source of podcast advertising analytics, to analyze podcast advertising occurrence data from the top 400 podcasts in the U.S. through Q3 2020.

Here are the key findings:

Podcast advertising is pandemic proof: Ad volumes quickly recover and surge to record levels

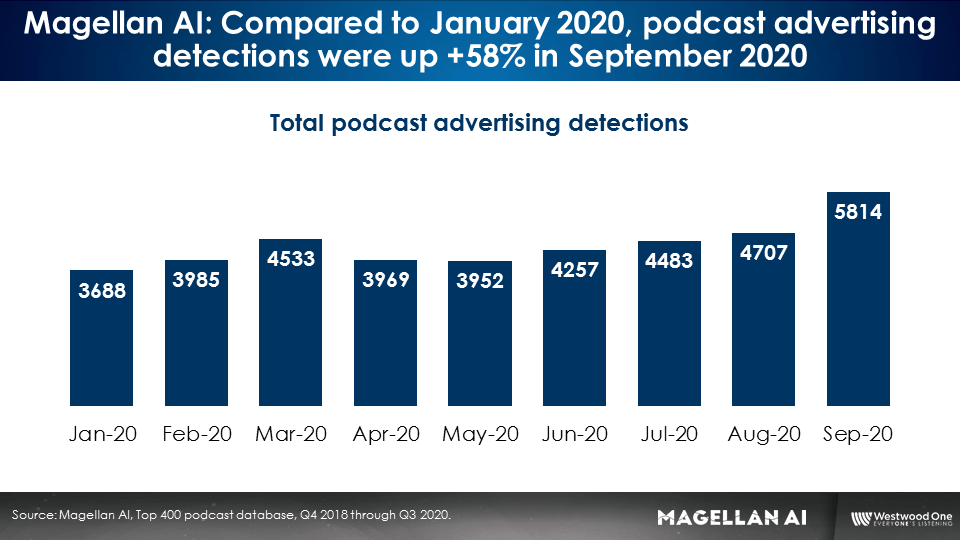

March 2020 was a strong month for podcast advertising with a record number of ad detections. When the pandemic intensified in April, total ad occurrences dropped -12%.

The recovery began immediately. In June, total podcast occurrences grew +7% versus April.

Ad volumes grew month over month throughout the summer and exploded in September. Compared to January 2020, September 2020 total podcast ad occurrences were up an incredible +58%.

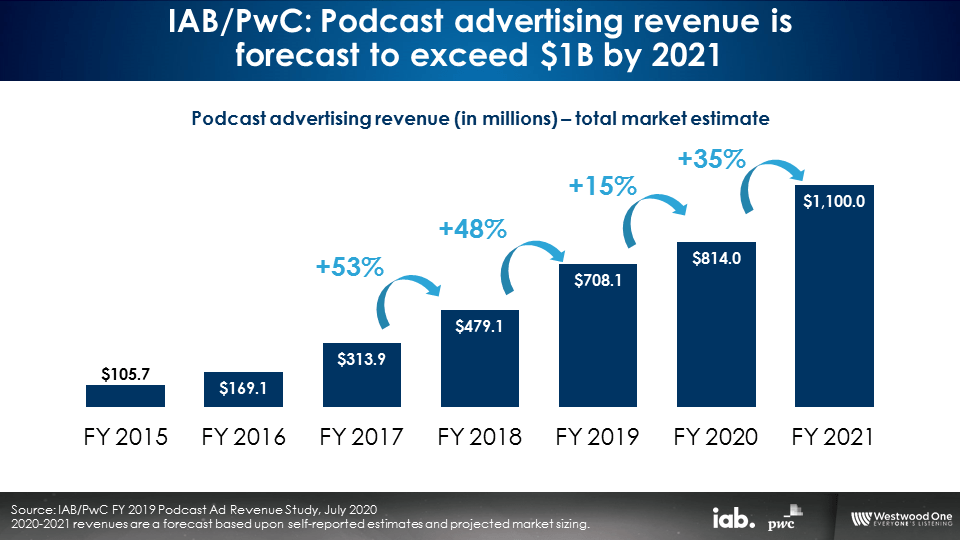

The resilience and strength of podcast advertising from Magellan AI’s occurrence data validates the IAB/PwC podcast revenue growth forecast for 2020 (+15%) and 2021 (+35%).

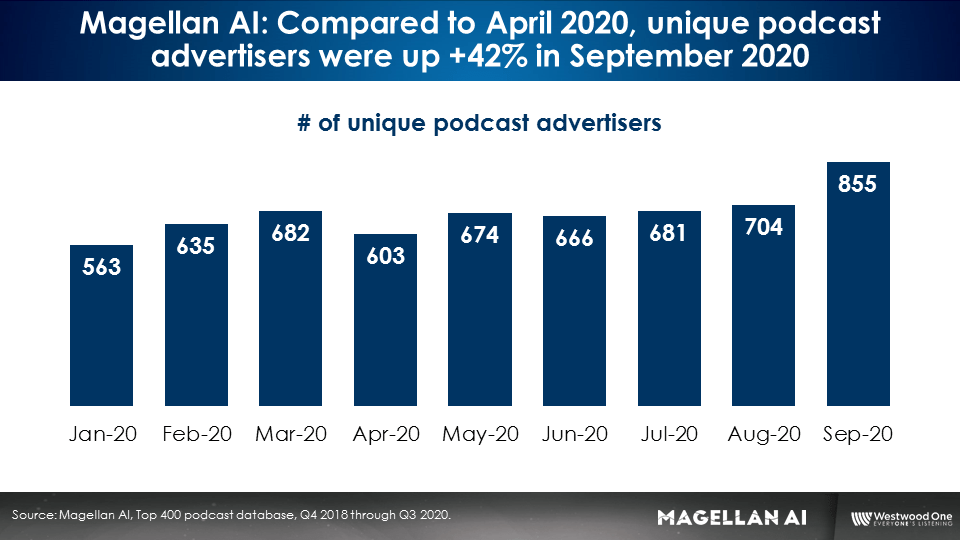

Despite the pandemic, the number of podcast advertisers soared +42% in September off April lows

While the pandemic did depress the number of podcast advertisers in April 2020, by May the number of unique podcast advertisers was nearly back to pre-pandemic levels. September 2020 saw a record 855 advertisers, a stunning +42% increase from April.

Podcast over-commercialism has not arrived

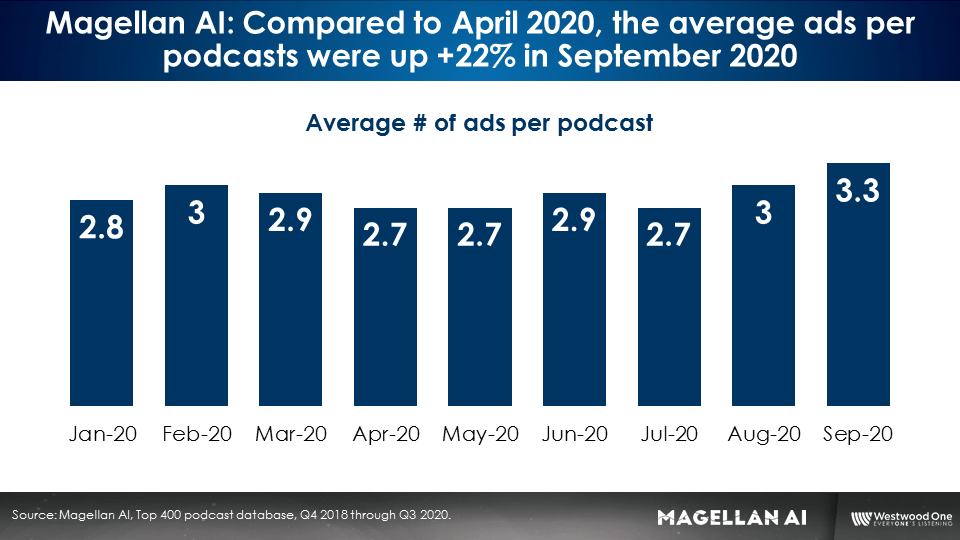

Depending on the TV network, advertising can represent 23% to 27% of programming. According to Magellan AI, advertising represents about 5% of podcast program content. Podcast advertising stands out given the exceptionally low ratio of ads to content.

Throughout 2020, the average number of ads per podcast hovered slightly under three ads. September saw the number of ads per podcast to jump to 3.3, a +22% increase from April.

Financial and insurance categories spotlight: It is hard to maintain podcast’s share of voice when category spend increases over 70%

Magellan AI provides brand and category spend and it is fascinating to see how mass-market brands are pouring into podcasting providing competition to the direct-to-consumer brands that helped build the podcast industry.

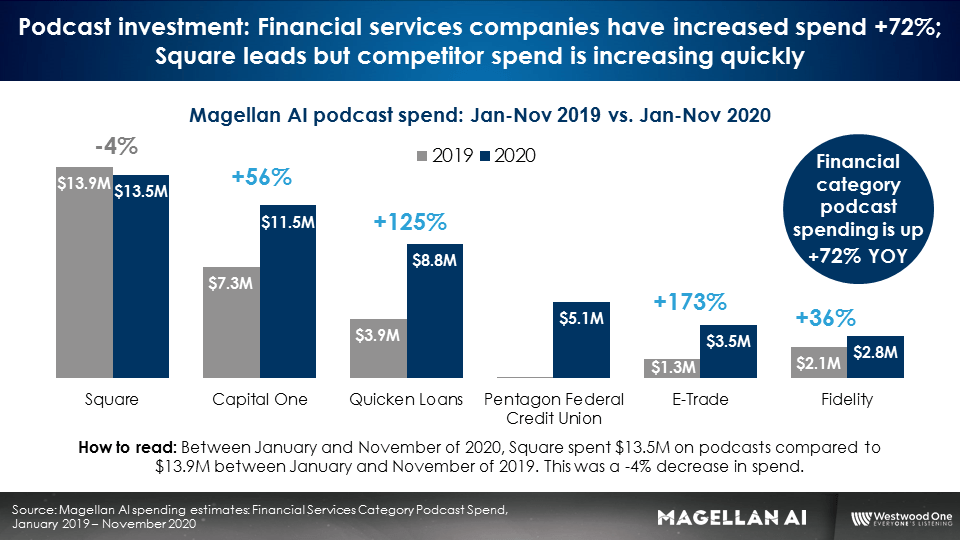

In the financial category, payments provider Square leads in spend, but Capital One, Quicken Loans, and others are aggressively ramping up investment. Year over year, podcast investment in the financial category is up +72%.

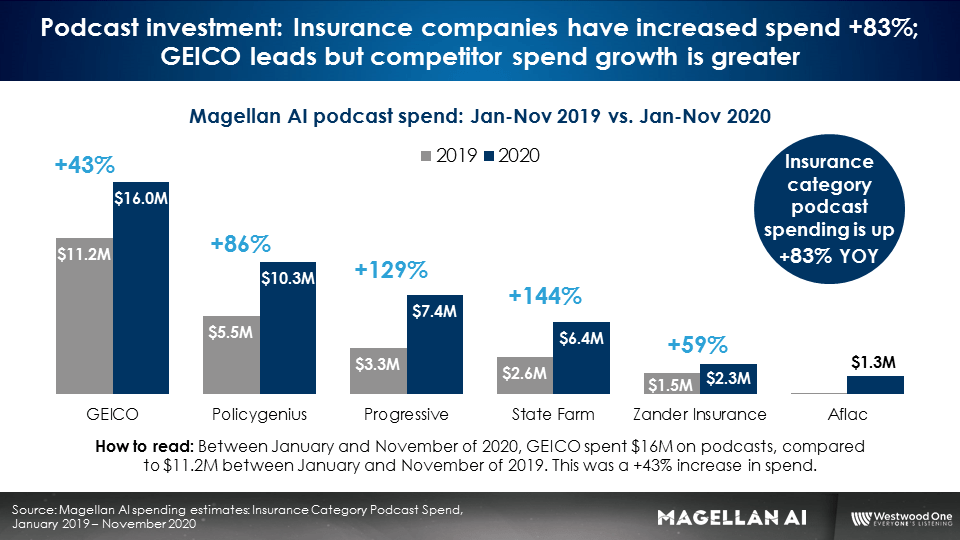

In the insurance category, GEICO is the leader in podcast spend, but Policygenius, Progressive, and State Farm are upping spend at a faster rate. Overall, podcast spend in the insurance category is up +83% year over year.

Key takeaways:

- According to Edison Research’s “Share of Ear,” podcasting’s ad-supported audio shares among persons 25-54 more than tripled from 4% in Q3 2016 to 15% in Q4 2020

- Podcast advertising is pandemic proof: Ad volumes quickly recover and surge to record levels

- Despite the pandemic, the number of podcast advertisers soared +42% in September off April lows

- Podcast over-commercialism has not arrived

- Financial and insurance categories spotlight: It is hard to maintain podcast’s share of voice when category spend increases over 70%

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.