Case Study: AM/FM Radio Plays A Powerful And Unique Role In The Media Plan As Streaming Video Brands Battle For Awareness And Subscribers

Once Netflix, Amazon Prime Video, and Hulu were the primary players in the subscription streaming video space. Now fifteen or more services clamor for consumer attention. Every major media company is pouring resources into their video subscription services at the expense of their broadcast TV and cable networks:

- WarnerMedia is investing heavily in HBO Max at the expense of its cable networks TNT and TBS. The decision to simultaneously release twelve major motion pictures this year in the theaters and on HBO Max rocked Hollywood.

- NBCU is spending heavily on Peacock while reducing investment in their cable networks.

- ViacomCBS launches Paramount+ on March 4, the rebrand of CBS All Access, which will now incorporate Viacom content.

- Disney’s December 2020 announcement of their accelerated content investments in their direct-to-consumer businesses caused Wall Street media analyst Michael Nathanson to declare, “The sheer size and quality of the content tsunami headed to Disney+ was mind-blowing and frightening to any sub-scale company thinking about competing in the scripted entertainment space.”

- Also in December, Discovery Networks debuted their long-awaited streaming video on demand service Discovery+. MoffettNathanson notes Discovery+ could negatively impact their cable networks: “The entirety of its business is built on its traditional cable networks, which given the nature of content could likely be highly cannibalized by a direct-to-consumer offering.”

AM/FM radio can make your TV better

For advertisers that run local or national ads on cable networks, the audience erosion brought on by the rise of Netflix and cord cutting will only continue. The major investments in video streaming services companies will hasten the erosion of cable audiences.

AM/FM radio plays a useful role in helping offset cable audience losses. Reallocating the media plan to include AM/FM radio causes campaign reach to surge.

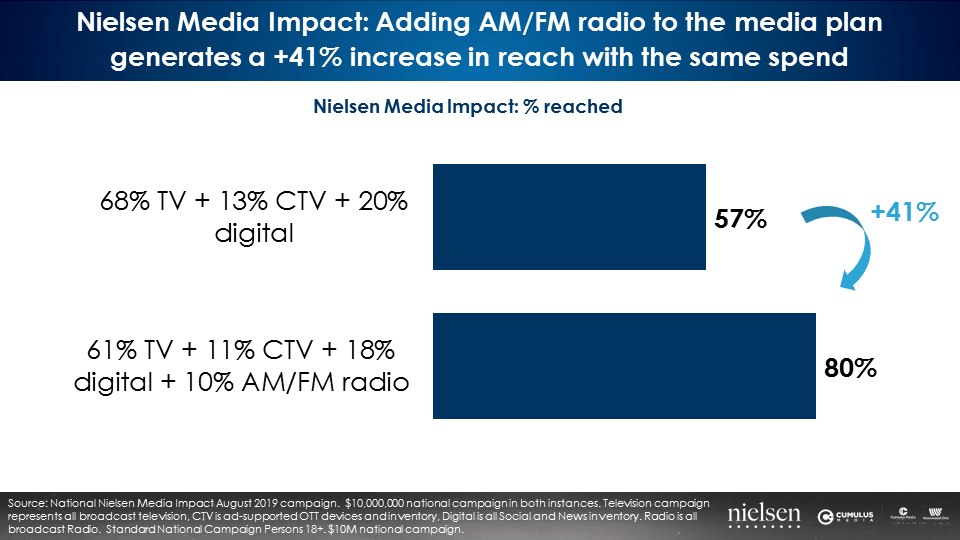

Consider a typical media plan that devotes 68% of the budget to linear TV, 20% to digital, and 13% to connected TV. Total campaign reach is 57%. Maintaining the budget but shifting a modest 10% of the media plan to AM/FM radio results in a stunning +41% increase in campaign reach (57% to 80%), a significant lift in reach for the same spend.

Case study: An AM/FM radio campaign on the NFL on Westwood One lifts brand perceptions and purchase intent for a streaming video brand

The inclusion of AM/FM radio in the plan drives significant growth in incremental reach and impact. Streaming video brands are turning to AM/FM radio like never before. This past fall, a major streaming service used the NFL on Westwood One to tout their service. CUMULUS MEDIA | Westwood One retained Nielsen to measure the impact of the streaming service’s AM/FM radio investment.

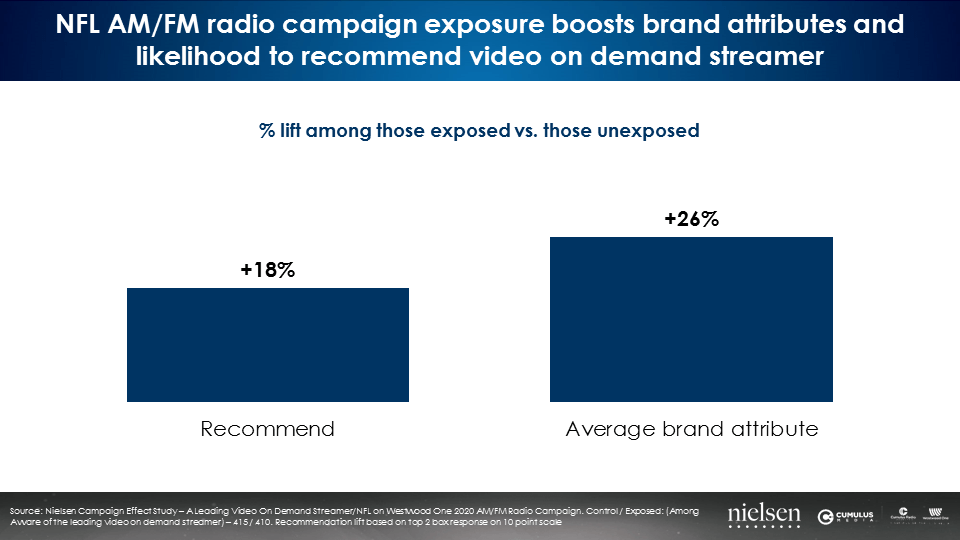

Nielsen conducted a national study and compared consumers who had been exposed to the NFL AM/FM radio campaign to those who were not exposed. Nielsen found the NFL AM/FM radio campaign generated an +18% growth in brand recommendation and an impressive +26% increase in average brand attribute.

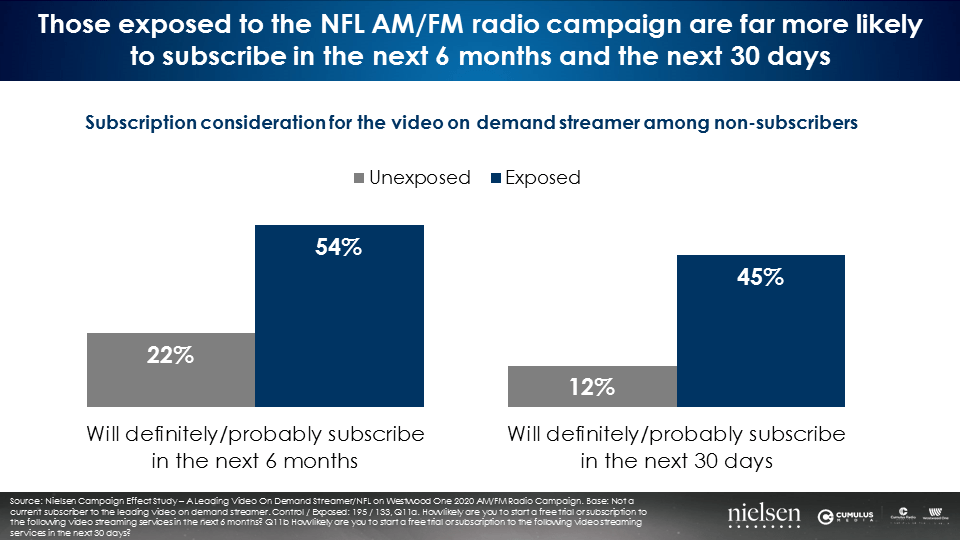

The NFL AM/FM radio campaign generated extraordinary levels of purchase intent. 12% of those unexposed indicated they might subscribe to the video streamer in the next month. Among those exposed to the NFL AM/FM radio campaign, 45% indicated they would probably/definitely subscribe in the coming month.

AM/FM radio is better than TV at promoting streaming video on demand services

This seems counterintuitive. Wouldn’t it be better to promote a video service on TV? According to Nielsen, AM/FM radio audiences are far more engaged with video streaming services than TV viewers.

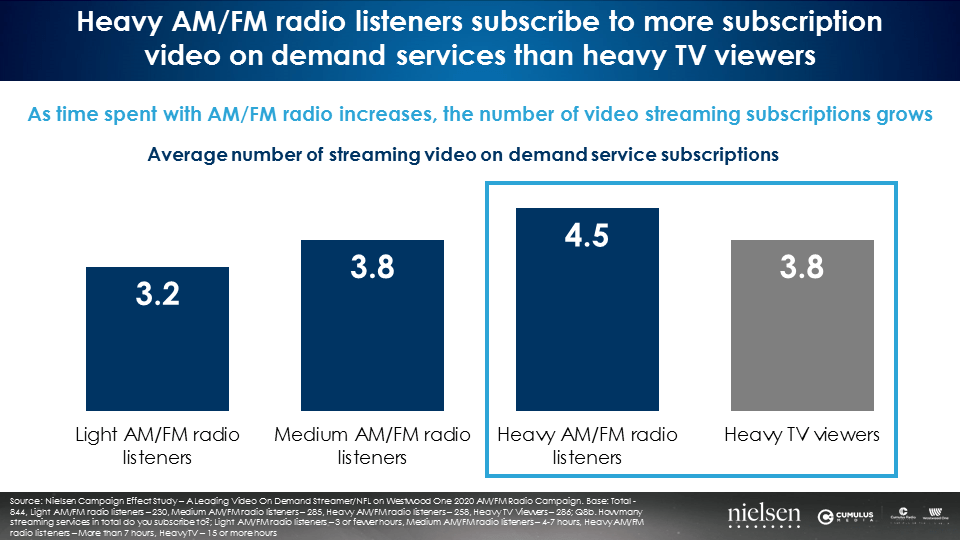

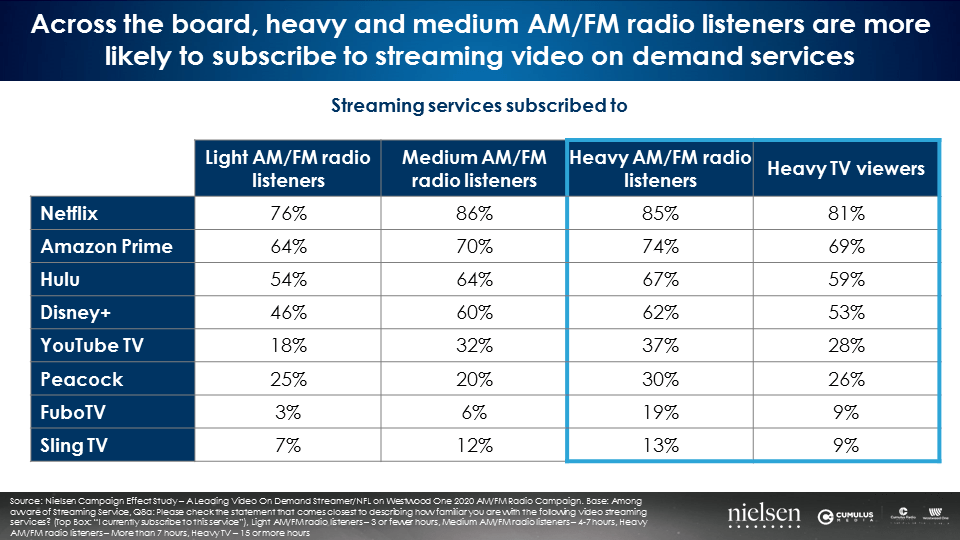

In their fall 2020 study, Nielsen found that heavy AM/FM radio listeners subscribe to more streaming video services than heavy TV viewers. Heavy TV viewers subscribe to 3.8 streaming video services while heavy AM/FM radio listeners subscribe to 4.5 streaming services. In fact, the greater the time spent with AM/FM radio, the greater the number of streaming video subscriptions.

Nielsen found that heavy AM/FM radio listeners are far more likely to subscribe to the major video streaming services compared to heavy TV viewers. Regardless of the service, whether Hulu, Amazon Prime Video, Disney+, or YouTube TV, a greater proportion of AM/FM radio listeners subscribe versus TV viewers.

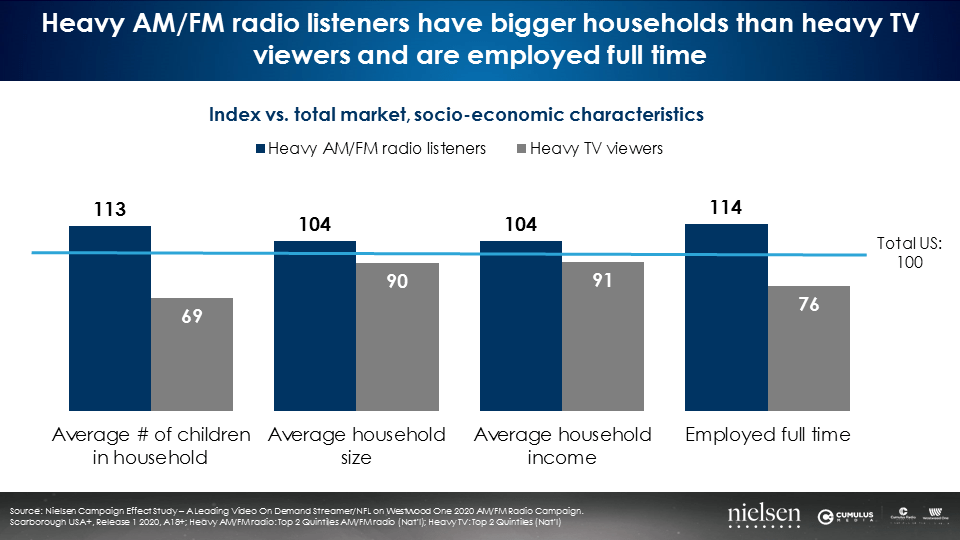

Nielsen: AM/FM radio listeners are bigger users of streaming video because of higher income, employment, and larger households with a greater presence of children

Comparing heavy TV viewers and heavy AM/FM radio listeners, Nielsen reports that AM/FM radio outperforms TV for presence of children, larger households, employment, and income. Larger homes with children have greater demands for certain types of content. Greater incomes and employment provides the means to subscribe to a greater number of video streaming services.

Key takeaways:

- Major investments in streaming services will accelerate the erosion of cable audiences

- Adding AM/FM to the media plan can make TV better by generating incremental reach for the same budget

- NFL AM/FM radio campaign exposure increased brand attributes and the likelihood of recommendation for a leading video on demand streamer

- Those exposed to the NFL AM/FM radio campaign were more likely to subscribe to the video on demand streamer in the next 6 months and the next 30 days

- AM/FM radio is the ideal platform to promote streaming video on demand services: Heavy AM/FM radio listeners subscribe to more subscription video services than heavy TV viewers

- AM/FM radio listeners are bigger users of streaming video services because they have larger households, a greater prevalence of children, are more likely to work full time, and have greater incomes

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.