Perception And Reality: Marketers And Agencies Dramatically Underestimate The State Of U.S. Worker Commutes; Plus The Latest Nielsen Data Shows A Complete Recovery Of AM/FM Radio Listeners In $75K+ Households

In January 2021, Advertiser Perceptions, the leader in researching advertiser and agency sentiment, fielded a study of 300 media decision makers. They asked, “What percentage of American workers are either working from home daily, commuting some days, or commuting every day?”

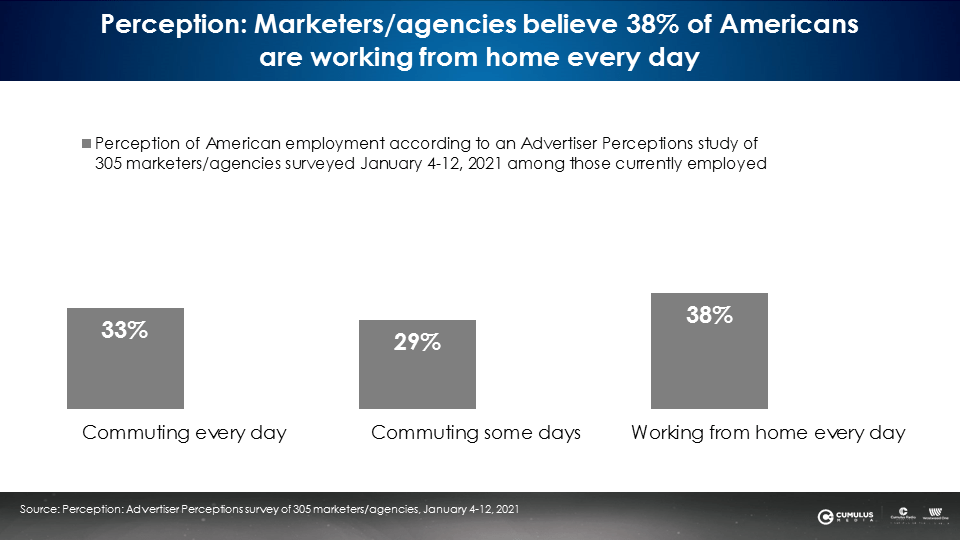

Here are buy side perceptions of the state of the American commute:

Marketers and agencies with media budget responsibilities perceive that 38% of U.S. workers are working from their homes every day. They believe only 33% are commuting every day and 29% are commuting some days.

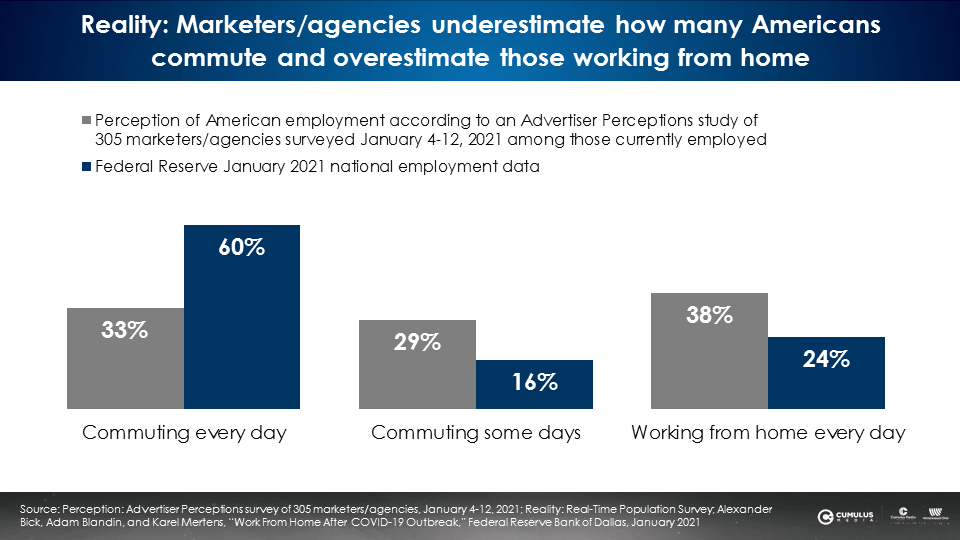

Recently, the U.S. Federal Reserve released the latest results from their ongoing tracking study of American worker commutes. The Federal Reserve’s most recent study was for January 2021, the same month of the Advertiser Perceptions industry survey. How did the reality stack up to what marketers and agencies believe?

- Marketers and agencies dramatically underestimate the number of Americans who are commuting to work each day: Per the U.S. Federal Reserve, 60% of U.S. workers are commuting every day. Marketers and agencies think only 33% are commuting daily. Actual U.S. daily commutes are double the advertiser perception.

- Marketers and agencies overestimate the number of Americans who are working from home: Per the U.S. Federal Reserve, 24% of workers are working from home daily. Marketers and agencies think the percentage of those working from home is 38%.

- Marketers and agencies overestimate the number of Americans who are commuting some days: The Federal Reserve says 16% of workers are commuting some days. Marketers and agencies perceive 29% of workers are commuting some days.

Marketers and agencies need to take the “me out of media”

Marketers and agencies believe that since they are all working from home, so must the rest of the country.

In their book How Not To Plan: 66 Ways to Screw It Up, Les Binet and Sarah Carter remind agencies and brands, “We’re marketing and communication people, we’re different from the majority. In the US and UK, we’re less than 1% of the population. We tend to be younger. … And we live in a handful of big cities. So it’s all too easy for us overlook how different our lifestyles and perceptions are from the people we talk to.”

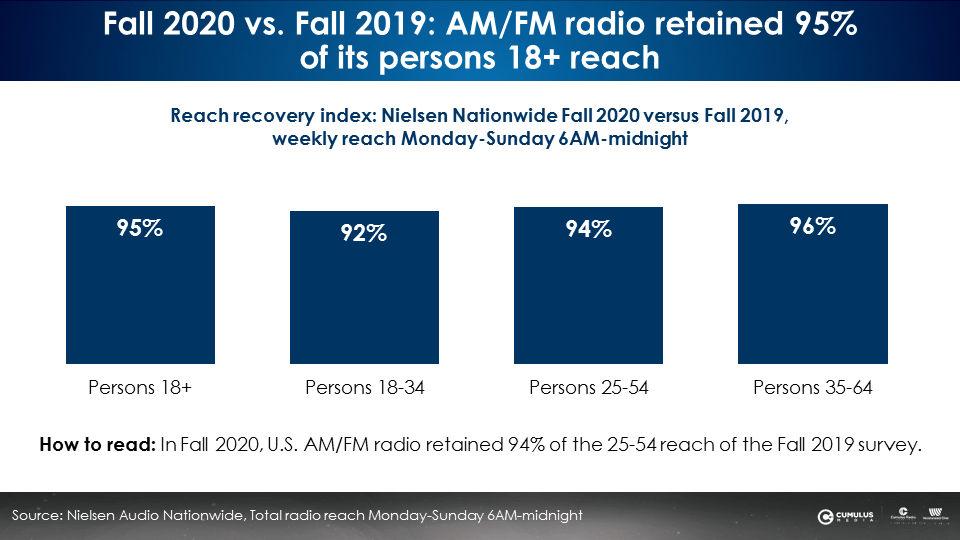

Nielsen: AM/FM radio recovered 95% of its pre-pandemic reach

According to the latest Nielsen Fall 2020 Nationwide Report, AM/FM radio has retained 95% of its persons 18+ reach from the Fall 2019 survey. Nielsen’s Nationwide study aggregates total American AM/FM radio listening from all 253 Nielsen local markets and all U.S. DMA markets.

In Fall 2020, total U.S. AM/FM radio retained 94% of its persons 25-54 weekly reach from the Fall 2019. Among persons 35-64, American AM/FM radio retained 96% of the total weekly reach from Fall 2019.

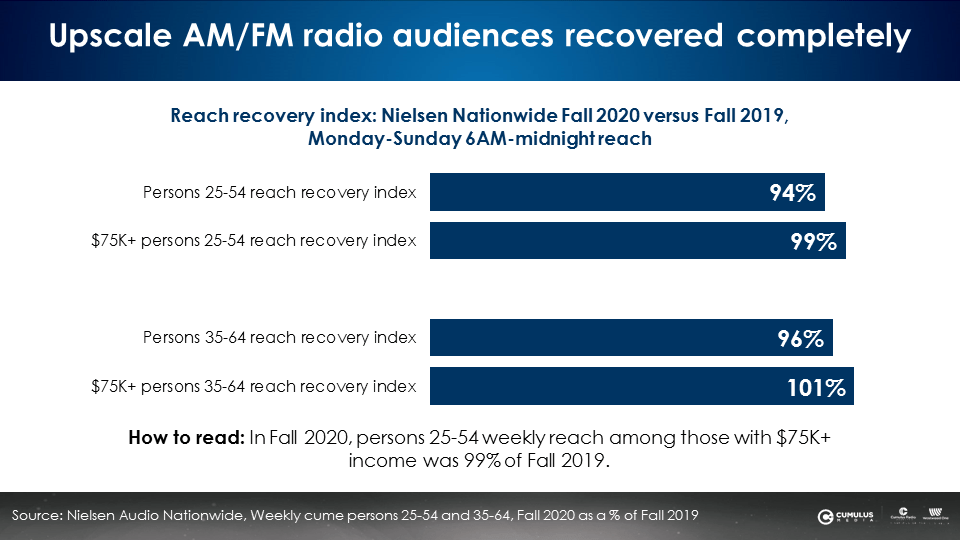

Nielsen: Upscale $75K+ AM/FM radio audiences completely recovered

Approximately half of all AM/FM radio listening comes from households with an income of $75,000 or greater. In Fall 2020, the total U.S. AM/FM radio weekly reach among homes with a $75,000+ income was identical to the prior year among both persons 25-54 and 35-64.

In Fall 2020, persons 25-54 weekly reach among those with a $75,000+ annual income was 99% of what it was in Fall 2019. Persons 35-64 weekly reach among those with a $75,000+ income was 101% what it was in Fall 2019.

Key takeaways:

- Advertiser Perceptions: Marketers and agencies dramatically underestimate the number of Americans commuting to work and overestimate the number working from home and commuting some days. Twice as many workers (60%) are commuting daily versus advertiser/agency perceptions (33%).

- Federal Reserve: Commuters outnumber work-from-home employees by nearly three to one. In January 2021, 76% of U.S. workers commuted to work and 24% worked from home.

- AM/FM radio recovered 95% of its persons 18+ pre-pandemic weekly reach per the Nielsen Fall 2020 Nationwide Audience Study.

- Nielsen: Upscale $75K+ AM/FM radio audiences completely recovered. In Fall 2020, the total U.S. AM/FM radio weekly reach among homes with a $75,000+ income was identical to the prior year among both persons 25-54 and 35-64.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.