May Recovery Strong: AM/FM Radio’s Listening Surge Can Help Businesses Bounce Back As America’s Vehicular Traffic And Commuting Continue To Grow

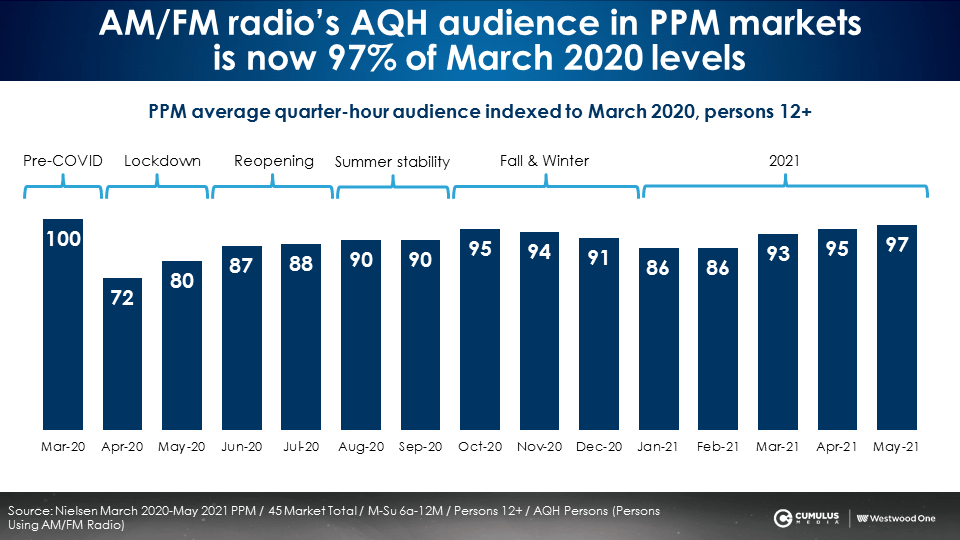

Last week, Nielsen released the May 2021 Portable People Meter data for the top 48 markets in the U.S. It was yet another month of strong AM/FM radio audience growth amidst a surge in worker commutes and auto traffic.

In PPM markets, AM/FM radio’s average quarter-hour audience for May 2021 was the highest since the pandemic started, notching a 97% recovery index versus March 2020. Since the beginning of 2021, AM/FM radio’s AQH is up +13%.

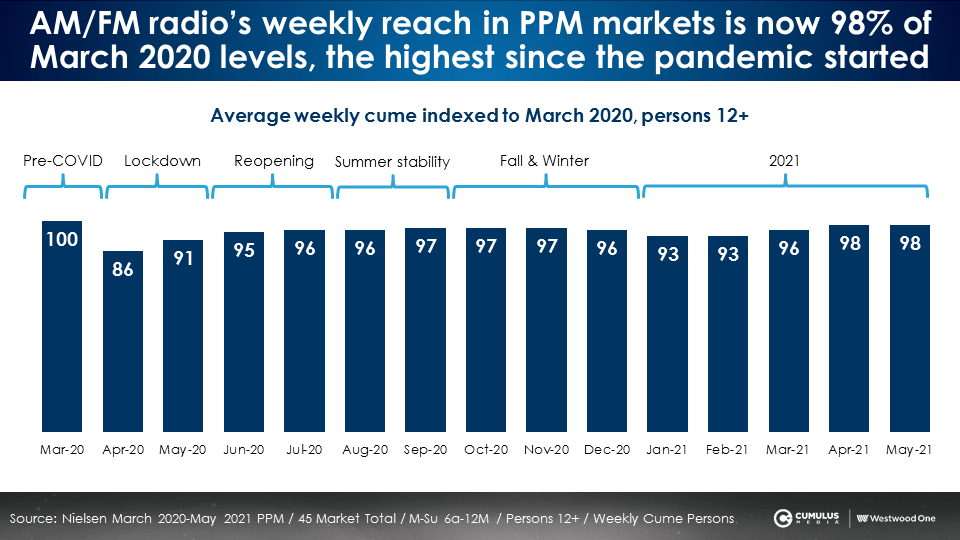

AM/FM radio’s reach recovery index was a 98, a tie for the highest point since the pandemic began.

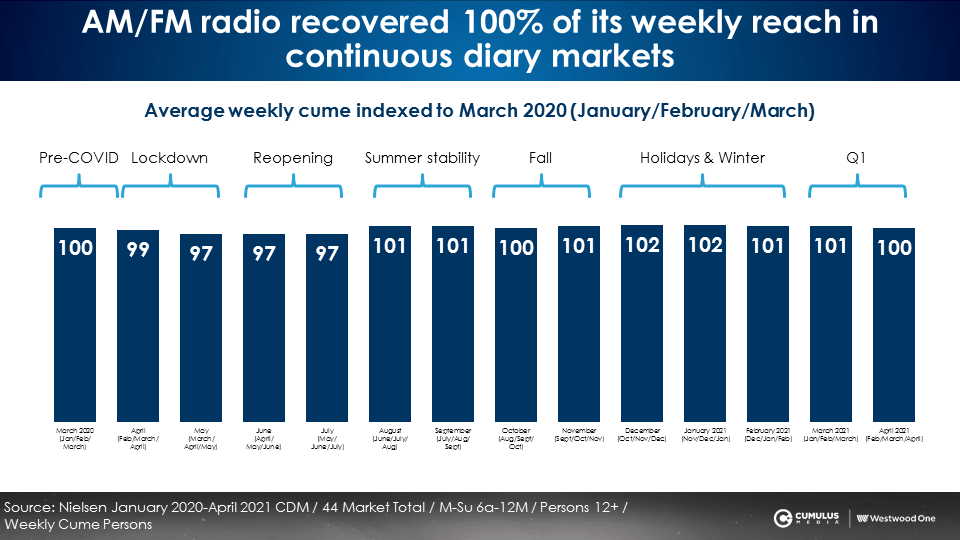

In markets outside of the top 50, AM/FM radio audiences saw little COVID erosion

In markets outside the top 50 measured by the personal diary, Nielsen reports that AM/FM radio audiences are incredibly stable having experienced very slight reach losses in Spring 2020, which immediately recovered. February-March-April 2021 AM/FM radio reach in the diary markets is identical to the same period a year ago.

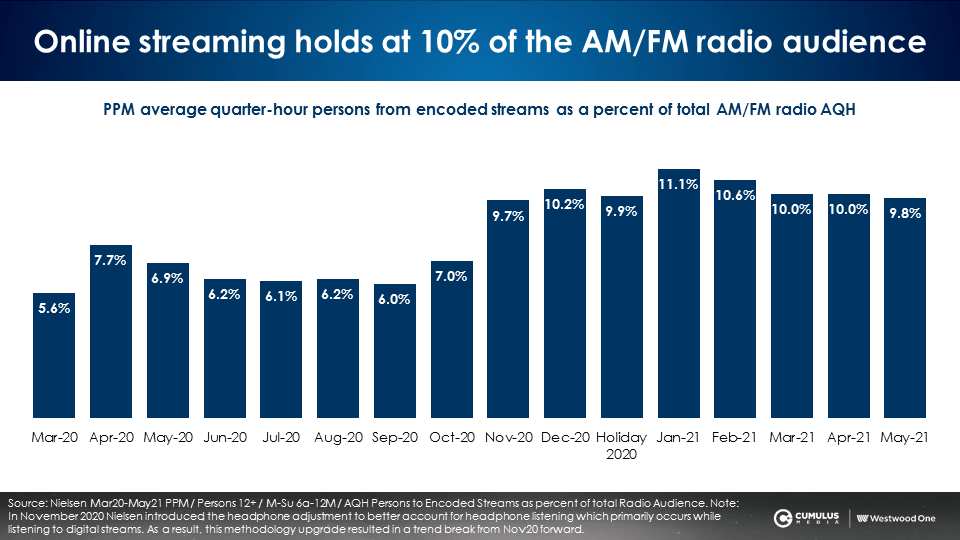

Online streaming holds at 10% of the AM/FM radio audience

Since the introduction of Nielsen’s PPM headphone listening methodology enhancement last October, 10% of AM/FM radio’s average quarter-hour audience occurs via streaming.

What is behind AM/FM radio’s audience growth? Consumer movement is up

Americans are getting out of the house and on the move. A just-released consumer tracking study from GroupM’s Mindshare found 34% of Americans plan to spend more time outside and 21% plan to spend less time online during 2021. “[These findings] bode well for media consumed out-of-home, especially outdoor, place-based media and radio,” according to MediaPost’s Joe Mandese.

Consumers spending time outdoors plus growth in vehicular traffic and miles traveled mean increases in AM/FM radio time spent. With an 87% share of ad-supported audio in the car, AM/FM radio is the queen of the road.

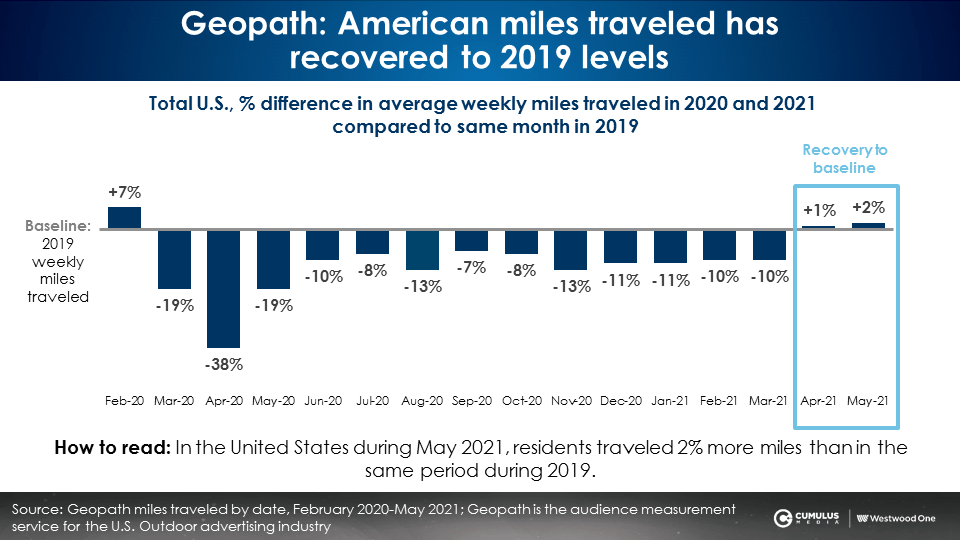

Geopath, the Nielsen of the outdoor advertiser industry, reports May 2021 miles traveled has recovered to the 2019 baseline. Miles traveled over the last six months lagged about -10% below historical norms. April and May 2021 saw a sharp recovery to 2019 levels.

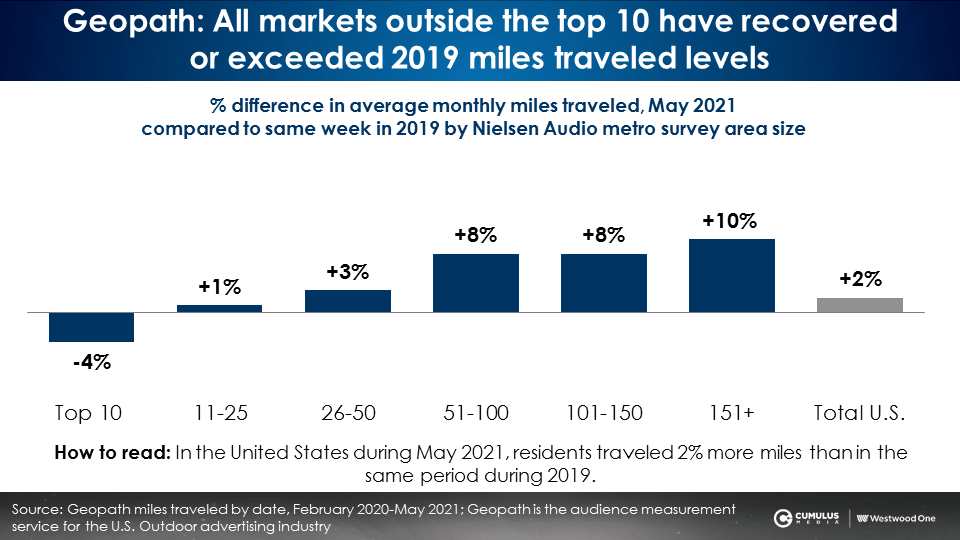

Geopath data reveals miles traveled in markets 50 and smaller are up versus 2019. The smaller the market, the larger the miles traveled increase versus 2019.

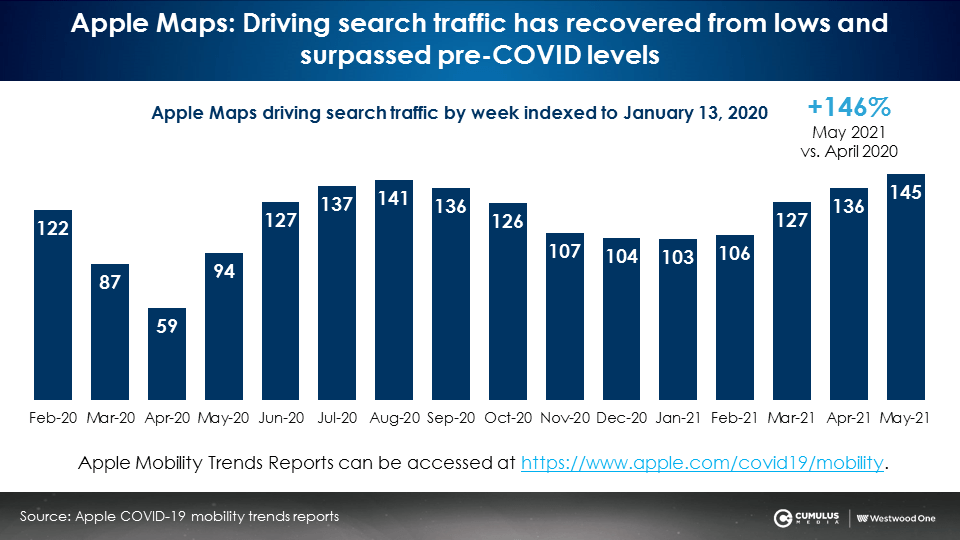

Apple Maps has been tracking automotive trip search requests over the last year. In May 2021, Apple Maps car trip search requests were +45% greater than before the pandemic, marking their highest levels in the last two years.

Back to the office: 66% of workers are now commuting full time and 18% are commuting some days

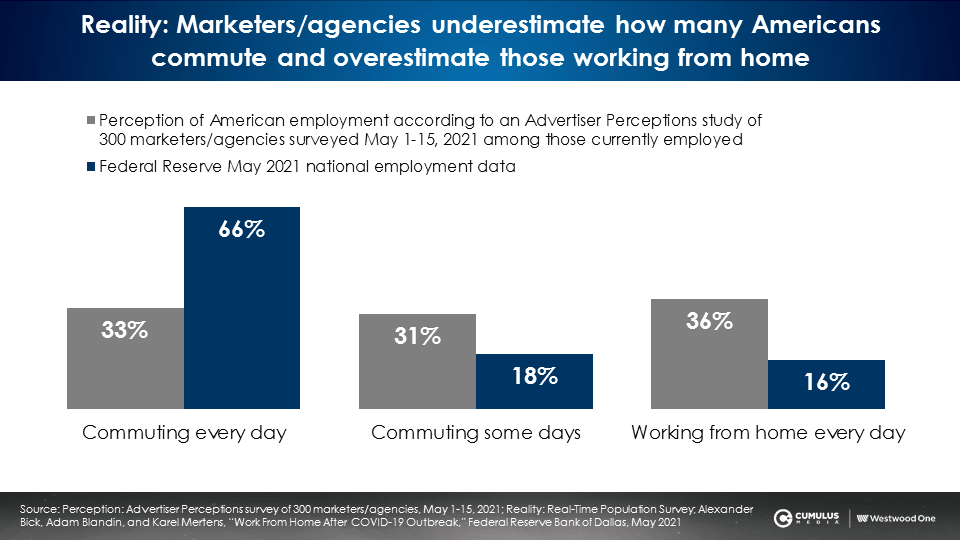

The Federal Reserve reports in May 2021, 66% of workers commuted full time and 18% commuted some days. 16% are working from home every day.

The Federal Reserve data reveals agency and marketer perceptions about the current state of American commuting patterns are off the mark. In May 2021, Advertiser Perceptions, the leader in researching advertiser and agency sentiment, fielded a study of 300 media decision makers. They asked, “What percentage of American workers are either working from home daily, commuting some days, or commuting every day?”

The chart below depicts advertiser/agency perceptions in grey compared to the actual Federal Reserve commuting data in blue.

- Marketers and agencies dramatically underestimate the number of Americans who are commuting to work each day: Per the U.S. Federal Reserve, 66% of U.S. workers are commuting every day. Marketers and agencies think only 33% are commuting daily. Actual U.S. daily commutes are double the advertiser perception.

- Marketers and agencies overestimate the number of Americans who are working from home: Per the U.S. Federal Reserve, 16% of workers are working from home daily. Marketers and agencies think the percentage of those working from home is 36%.

- Marketers and agencies overestimate the number of Americans who are commuting some days: The Federal Reserve says 18% of workers are commuting some days. Marketers and agencies perceive 31% of workers are commuting some days.

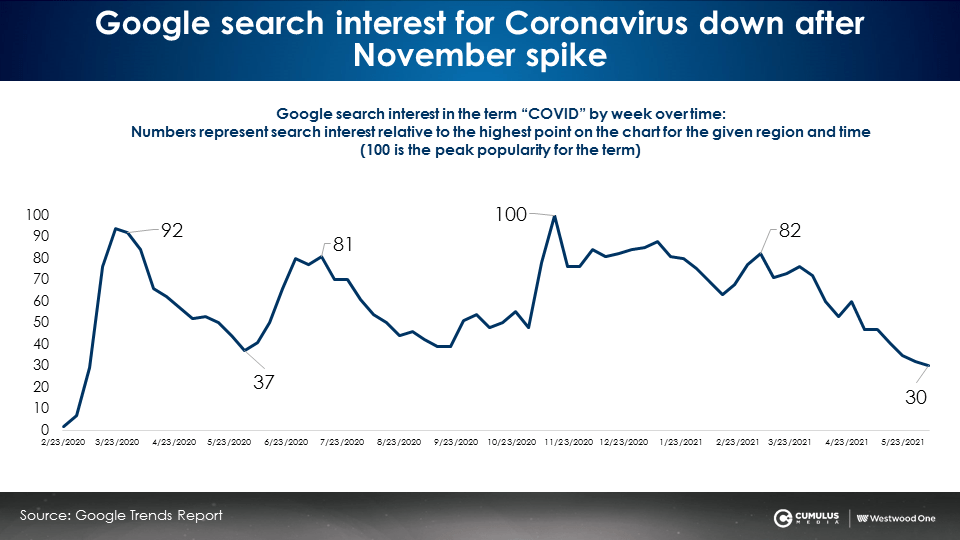

COVID concern is subsiding according to Google search trends

In late May 2021, Google search trends for the term “COVID” neared their lowest level since the pandemic, 70% below the November peak. Google search trends are a powerful source of consumer interest data. We are now at reduced COVID interest levels not seen since last February when the world was just beginning to learn about the COVID virus.

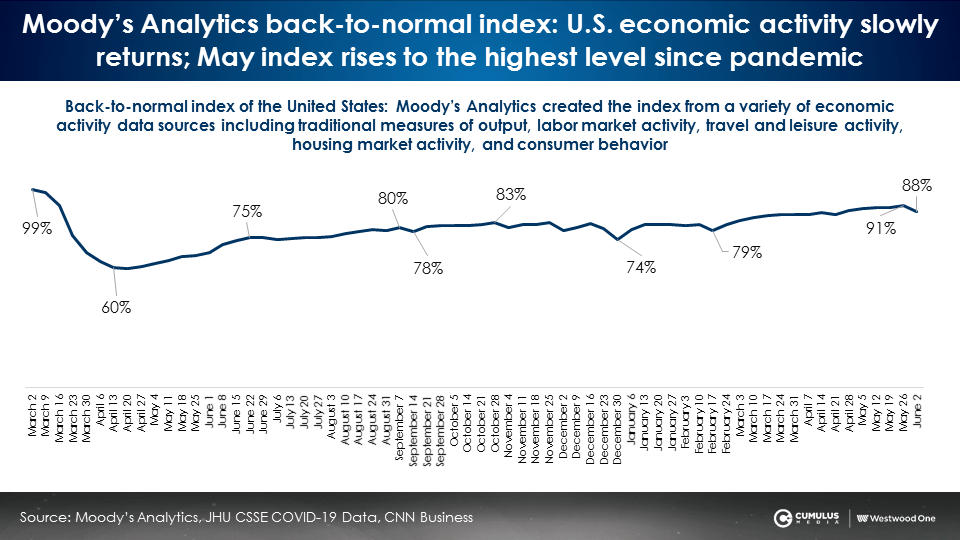

Moody’s Analytics back-to-normal index rises to an 88

Moody’s Analytics created the “back to normal” index from a variety of economic activity data sources including measures of output, labor market activity, travel and leisure activity, housing market activity, and consumer behavior. At the depth of the Spring 2020 lockdown, the index sunk to a low of 60. Throughout 2021, the Moody’s back-to-normal index has been steadily rising and is now at an 88.

AM/FM radio is the soundtrack of America’s recovery

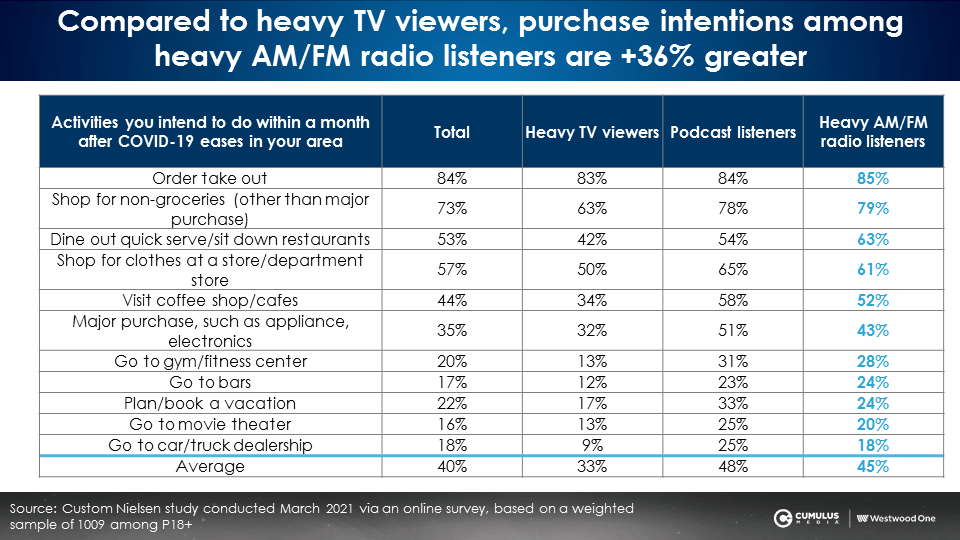

According to Nielsen’s recently released consumer purchase study, purchase intentions among AM/FM radio listeners are +36% greater than TV viewers. Across many different purchase categories, podcast listeners and AM/FM radio listeners show stronger purchase intentions than heavy TV viewers.

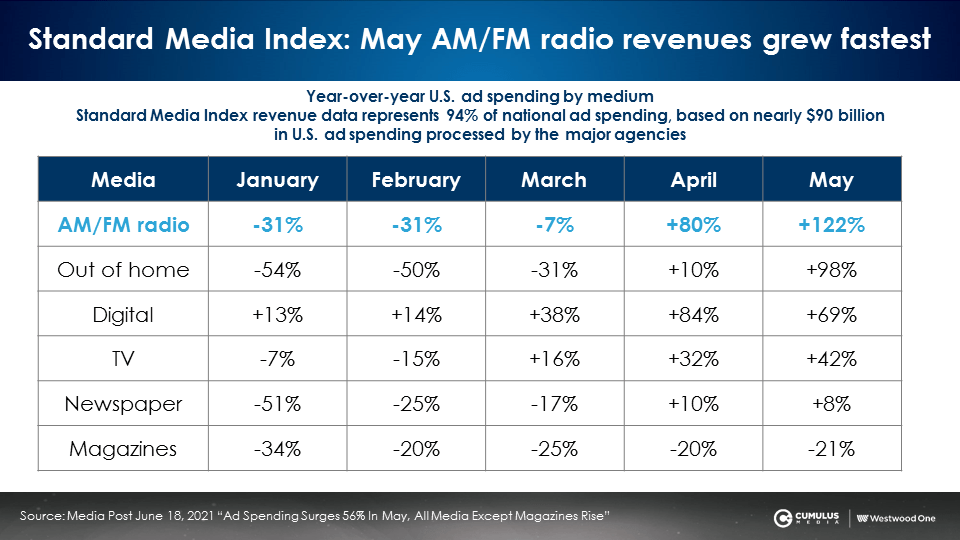

Standard Media Index: May year-over-year media ad spend grew fastest for AM/FM radio

In response to consumer movement and AM/FM radio consumption growing, advertisers are following suit. According to Standard Media Index, the U.S. firm that looks at 94% of national ad spending by major agencies in the U.S., May 2021 saw significant ad spend across media types. AM/FM radio saw the greatest growth, up +122% year-over-year for May.

How advertising can accelerate business recovery

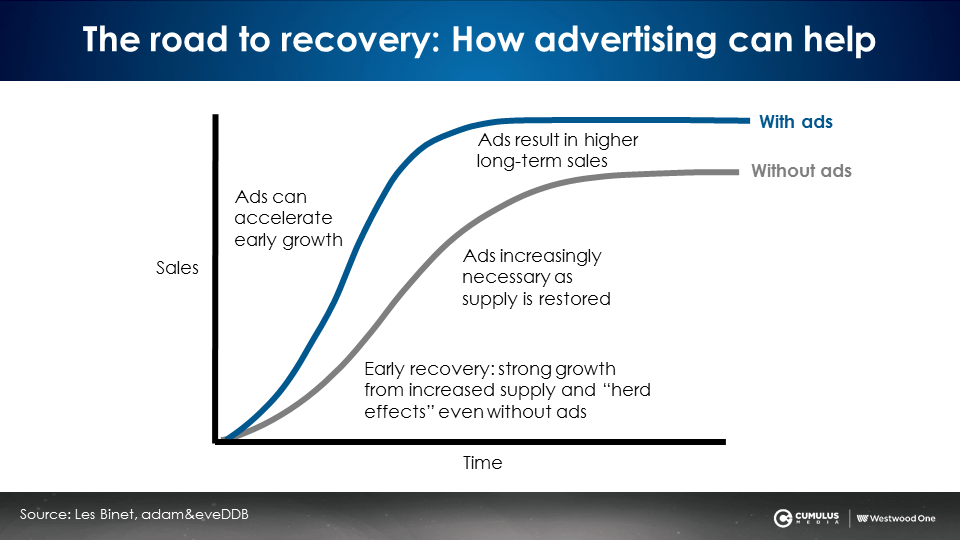

This fantastic visual below, created by adam&eveDDB London’s Les Binet, “the godfather of marketing effectiveness,” demonstrates how advertising can be the “recovery accelerator.”

The vertical axis represents sales and the horizontal axis depicts time. The grey line represents sales growth without advertising. The blue line presents sales growth with advertising.

Coming out of a recovery, business will grow from increased supply and consumer “herd mentality” even without advertising. However, as the economy recovers, businesses that advertise accelerate early growth. Businesses that continue to advertise generate stronger sales growth that converts into higher long-term sales.

Charlie Rudd, Chief Executive Officer, Leo Burnett London, could have been thinking about AM/FM radio when he said:

“We build businesses by creating large customer numbers keen to buy into what a brand offers. We mobilize and persuade large groups of people to act. It will be our contribution to rebuilding businesses and creating new jobs for many. … it will come from large broadly targeted brand marketing campaigns that empathize and inspire a nation yearning for recovery and positivity. It’s what we do best and it’s what [business] needs from us right now.”

Key takeaways:

- AM/FM radio’s average quarter-hour audience in the PPM markets grew to the highest point, a 97% recovery index. This is the strongest AQH performance since the pandemic began.

- AM/FM radio’s audience reach for May 2021 was the highest since the pandemic started, notching a 98% recovery index versus March 2020.

- Geopath reports May 2021 miles traveled have returned to 2019 base line.

- Apple Maps car trip search requests in May 2021 were +45% greater than before the pandemic, marking their highest levels in two years.

- According to the Federal Reserve, 66% of workers are now commuting full time and 18% are commuting some days.

- COVID concern is subsiding to 70% below previous highs according to Google search trends.

- Moody’s Analytics back-to-normal economic index rises to 88%.

- Across many different purchase categories, podcast listeners and AM/FM radio listeners show stronger purchase intentions than heavy TV viewers.

Click here to view a video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.