The Definitive Tool For Answering Top Media Planning Questions: CUMULUS MEDIA | Westwood One Audio Active Group’s Audio Planning Guide

Click here to view a 10-minute video of the key findings.

In our conversations with marketers and agencies, here are the frequently asked questions about audio media strategy:

- What is the ideal media plan allocation of ad-supported audio platforms?

- What are recommended GRP thresholds for light, medium, and heavy AM/FM radio campaigns?

- What is the ideal allocation of AM/FM radio weight by daypart?

- Why is AM/FM radio incorrectly thought of as a “drive time” medium?

- How does listening align by market size?

- What are the age and gender profiles of AM/FM radio programming formats?

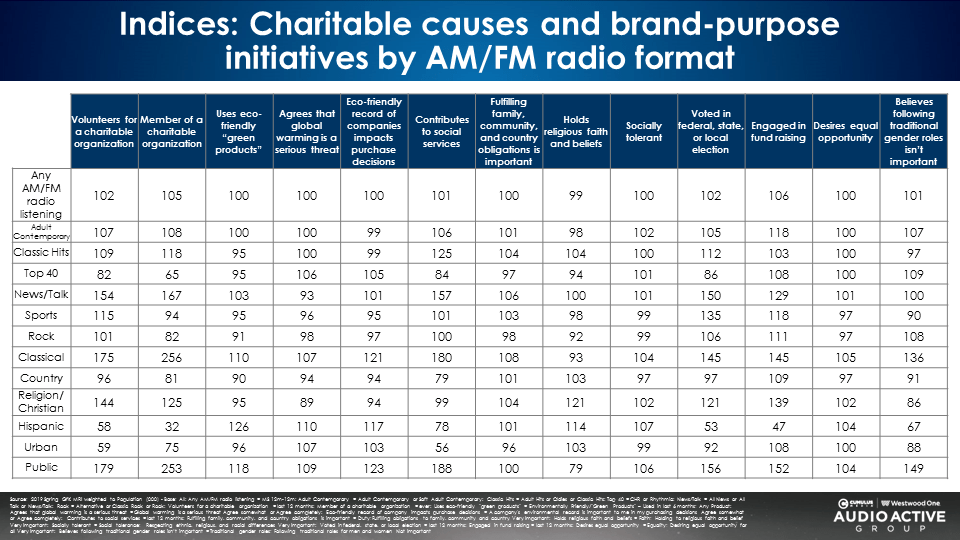

- Which charitable causes and brand-purpose initiatives resonate best with AM/FM radio programming format audiences?

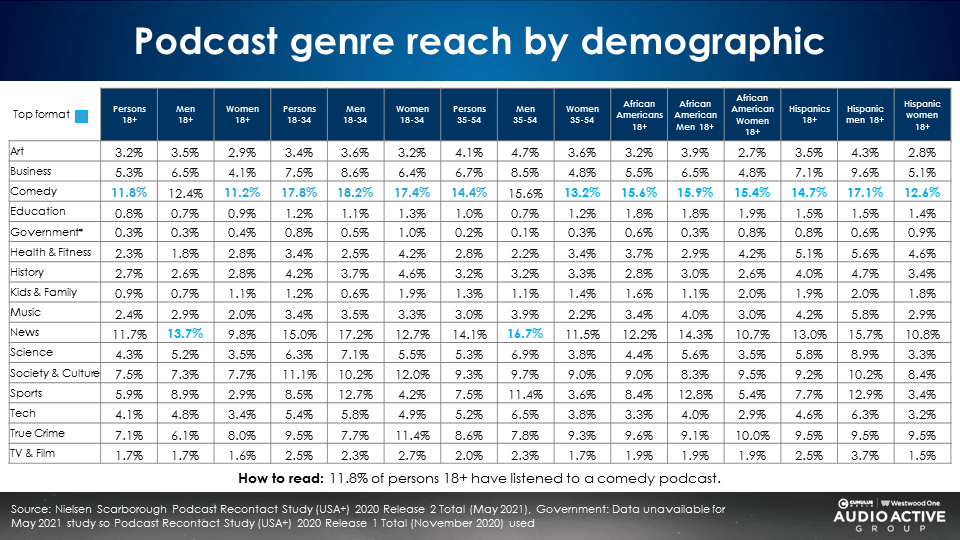

- Which podcast genres have the strongest reach for key age and gender demographics?

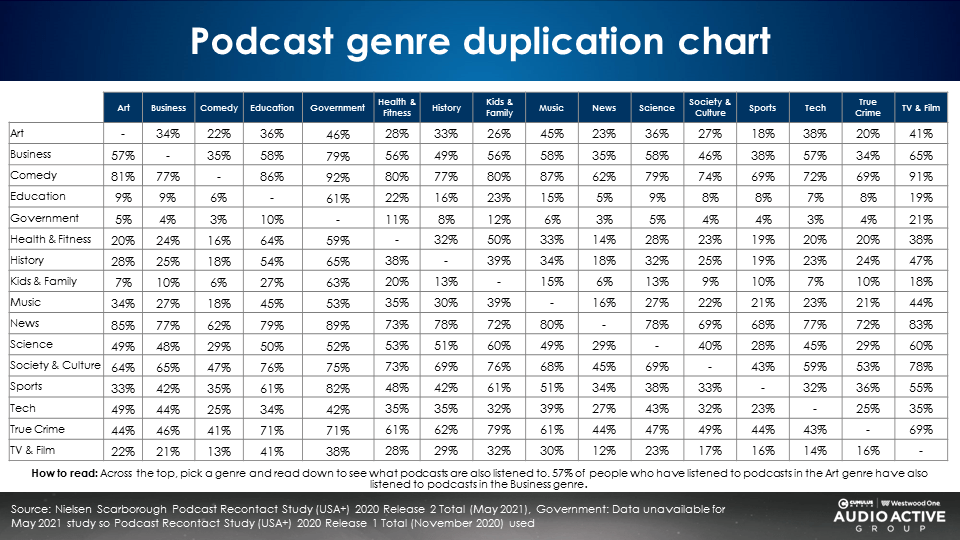

- What are the audience duplication patterns between podcast genres?

In response to these questions, the CUMULUS MEDIA | Westwood One Audio Active Group, media strategy and creative advisory team, has developed the Audio Planning Guide. The data is sourced from Edison Research’s “Share of Ear” Report, Nielsen’s Nationwide, and Nielsen’s Podcast Buying Power study.

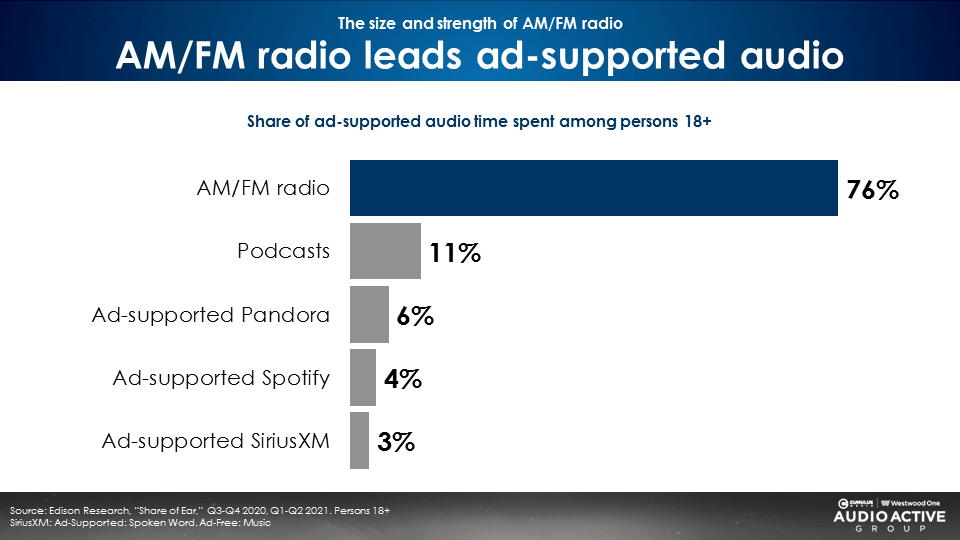

The ideal media plan allocation of ad-supported audio platforms

Many media strategists and planners mistakenly believe Pandora and Spotify have the largest share of ad-supported audio listening. Perception is not reality. At a 76% share, Edison Research’s “Share of Ear” reveals AM/FM radio is the dominant ad-supported audio platform.

From the Q2 2021 “Share of Ear” study, Edison reports the 76 share of AM/FM radio is 13 times larger than Pandora and 19 times larger than Spotify.

Interestingly, podcast audiences are now larger than Pandora and Spotify combined. Podcasts have very strong shares among younger demographics.

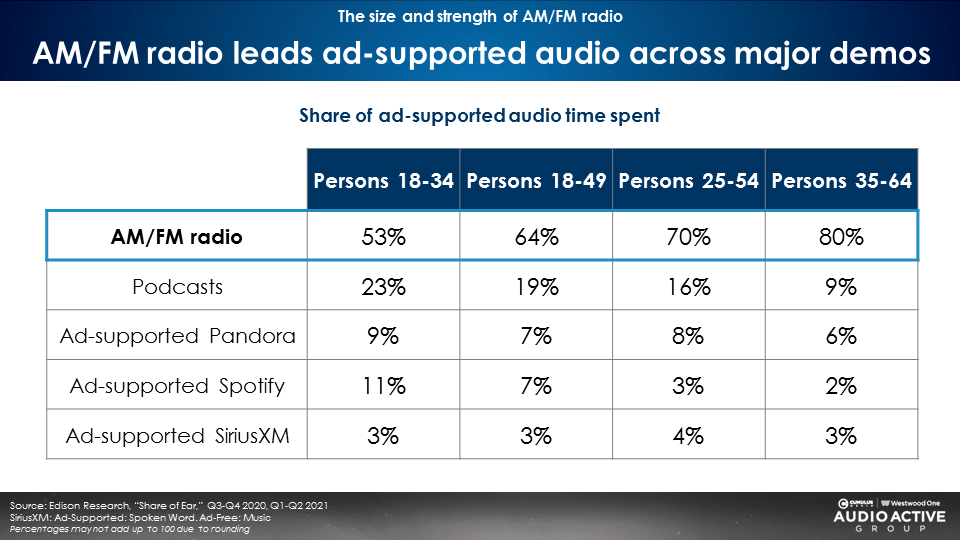

For a series of major buying demographics, here are the shares of ad-supported audio that can be used to allocate audio investments:

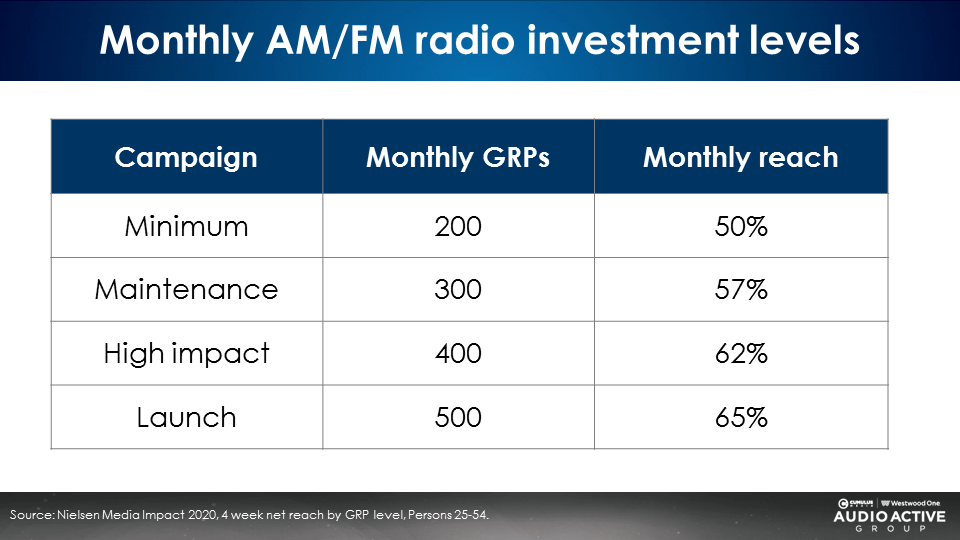

Recommended GRP thresholds for light, medium, and heavy AM/FM radio campaigns

Via Nielsen Media Impact, the media planning and optimization software tool, four monthly campaigns of varying GRP weights and reach can be developed:

To price out these four investment levels, multiply the GRPs by the cost per point of the local market or the total U.S.

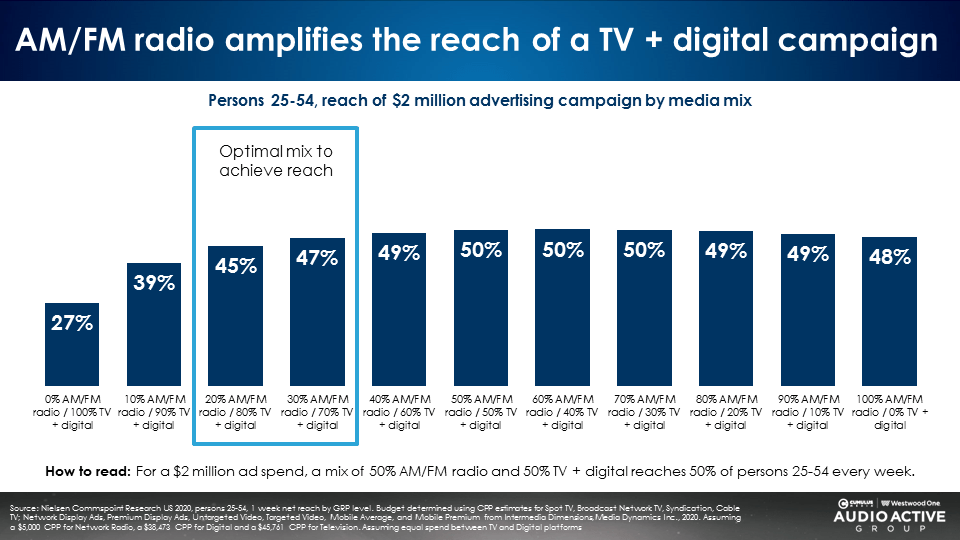

The ideal introduction of AM/FM radio to the TV plan

Major brands find that adding AM/FM radio to media plans can generate a significant lift in campaign reach. According to Nielsen Commspoint, the media planning platform, a reallocation of 20%-30% of the TV budget to AM/FM radio generates significant lifts in incremental reach.

For example, a national investment of two million dollars in network television results in a 27% reach among persons 25-54. Shifting 30% of the TV budget to AM/FM radio results in campaign reach jumping from 27% to 47%. This reallocation of 30% of the TV budget to AM/FM radio generates a stunning +74% increase in reach for the same investment.

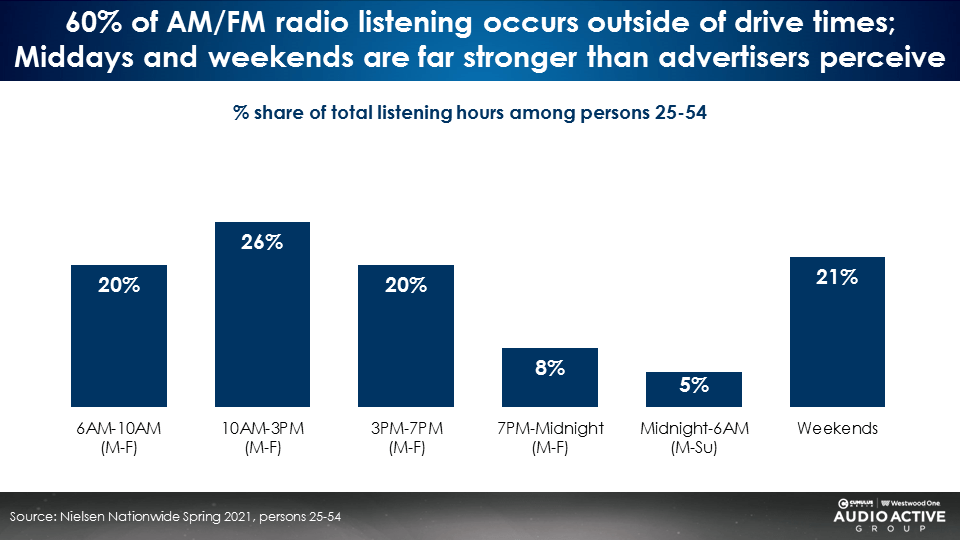

The ideal allocation of AM/FM radio weight by daypart and why AM/FM radio is incorrectly thought of as a “drive time” medium

One of biggest misperceptions of AM/FM radio is that it is a “drive time” medium. Nothing could be further from the truth.

Only 40% of U.S. AM/FM radio listening occurs during mornings and afternoon drive times. 60% of U.S. AM/FM radio listening occurs outside of drive times.

Monday-Friday 10AM-3PM is the most listened to daypart. Weekends are a crucial time period with just as much listening as mornings or afternoon drive.

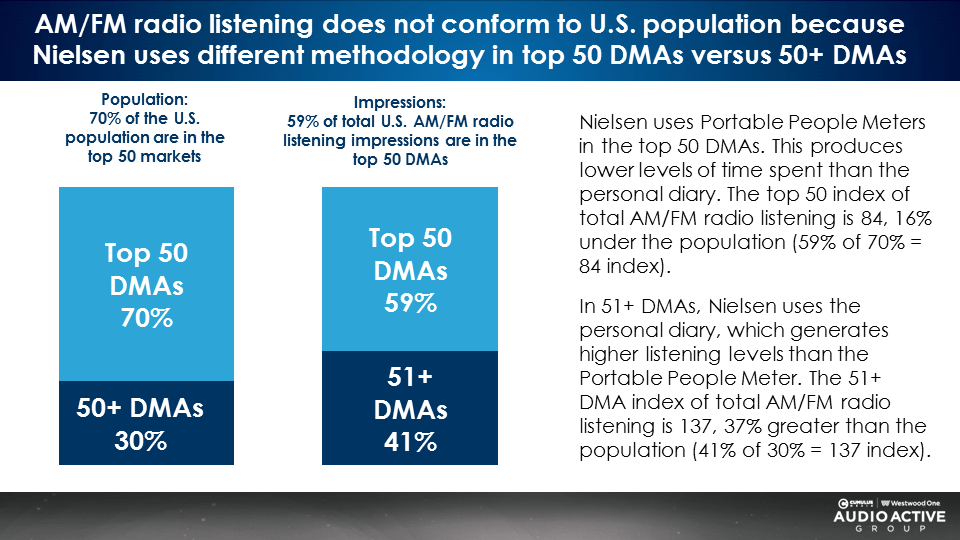

AM/FM radio listening aligns by market size

70% of the U.S. population resides in the top 50 markets. 70% of AM/FM radio’s reach in the U.S. comes from the top 50 DMAs.

A smaller proportion of AM/FM radio time spent (59%) occurs in the top 50 DMA markets. This is because of the two different methodologies Nielsen uses to measure AM/FM radio.

Portable People Meters in the top 50 DMAs show lower total listening than the personal diary utilized in markets beyond the top 50.

If a brand wants to assess their AM/FM radio deliveries by market size, they should peg their index of tuning based on the AM/FM radio reach generated, not time spent.

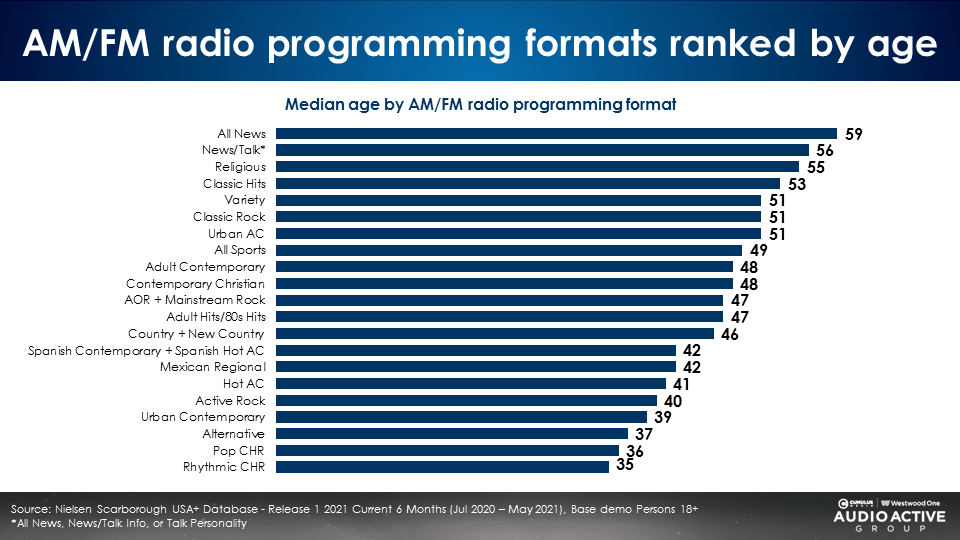

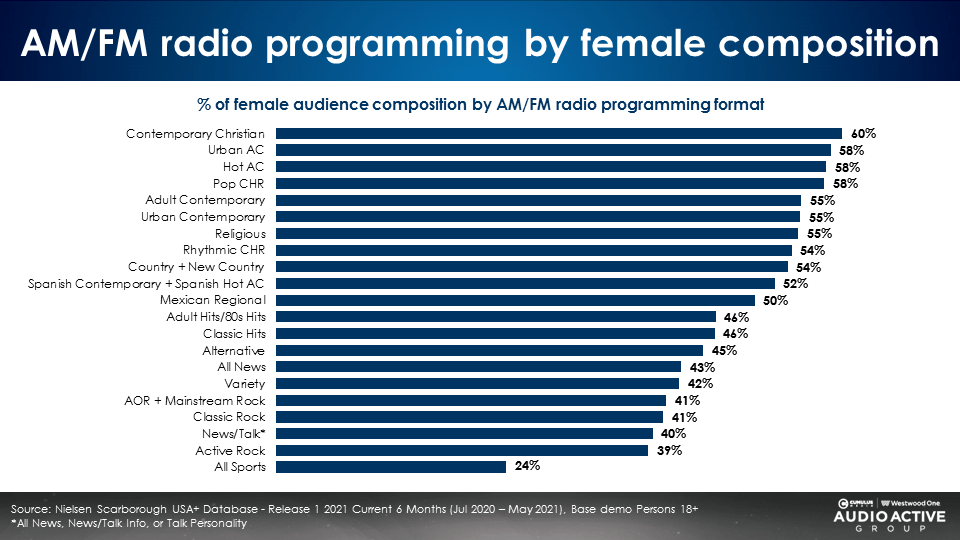

Age and gender profiles of AM/FM radio programming formats

Indicated below are the median age and female composition of U.S. AM/FM radio programming formats.

Overall, AM/FM radio listening skews slightly male (53%) versus female (47%). It is not possible to create a mass reach buy that is 55% female given the profile of AM/FM radio listening. Achieving a 50% female composition on a mass reach buy is more realistic.

Charitable causes and brand-purpose initiatives that resonate best with AM/FM radio programming format audiences

Brands often seek to associate a brand-purpose campaign with audiences who support the cause. The table below from GfK MRI provides indices by AM/FM radio programming format for causes such as the environment, charitable giving, and social tolerance.

Podcast genres with the strongest reach

Given their 41% monthly reach according to Edison Research’s Infinite Dial 2021 study, podcasts can no longer be dismissed as a low reach media platform. From Nielsen’s Podcast Buying Power study, here is monthly reach by podcast genre:

Audience duplication patterns between podcast genres

Scale can be achieved by running ads across podcast genres. This Nielsen Scarborough table provides the audience duplication between podcast genres:

Key findings:

- At a 76% share, AM/FM radio has the largest share of ad-supported audio.

- Podcasts are a fast-growing number two with significant shares among younger demographics.

- Ad-supported Pandora and Spotify have surprisingly small audience shares.

- Most AM/FM radio listening occurs outside “drive times.” Monday-Friday, 10AM-3PM (midday) is the most listened to time period. Weekends, afternoon drive (Monday-Friday 3PM-7PM), and morning drive (Monday-Friday 6AM-10AM) have similar shares.

- While AM/FM radio’s reach aligns well with population by market, impressions are lower in the top 50% due to differing Nielsen measurement methodologies.

- Shifting 20%-30% of TV budgets to AM/FM radio results in extraordinary increases in campaign reach.

Click here to view a 10-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group.

Contact the Insights team at CorpMarketing@westwoodone.com.