Edison’s “Share Of Ear” Q3 2021 Five-Year Report Card: Pandora Collapses, Spotify Stagnates, Podcasts Soar, AM/FM Radio Dominates, And AM/FM Radio Streaming Is Up 2X

Click here to view a 13-minute video of the key findings.

Edison’s quarterly “Share of Ear” study is the authoritative examination of American audio time use. The just-released Q3 2021 report provides an opportunity to look back over five years to understand the shifts in U.S. listening.

Here are the key findings:

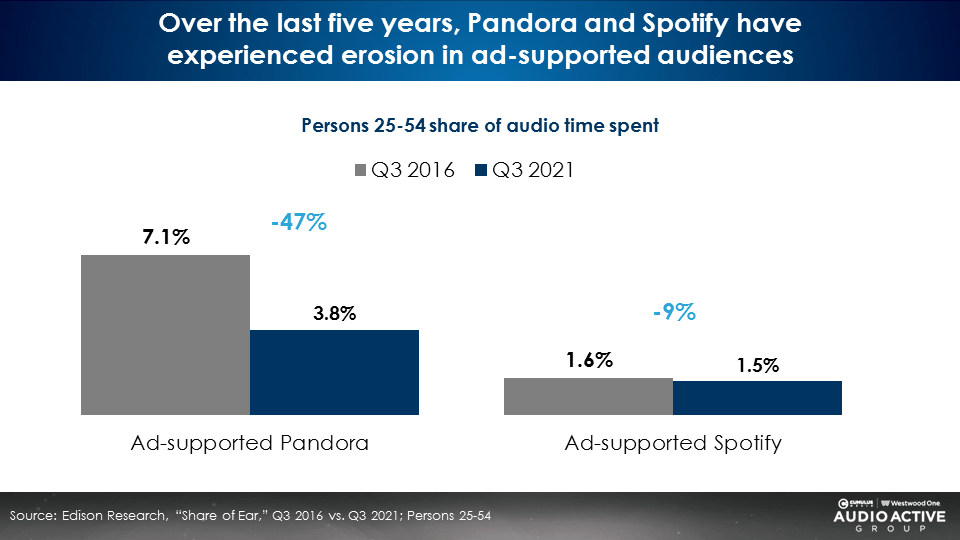

Ad-supported audiences: Pandora collapses and Spotify stagnates

Since 2016, Pandora’s share has been cut in half. Spotify’s exceptionally small ad-supported audiences remain unchanged.

From Q3 2016 to Q3 2021, Pandora’s ad-supported share among persons 25-54 has dropped from 7.1% to 3.8%, a -47% reduction. Spotify’s ad-supported share went from a 1.6% to a 1.5%, a -9% drop.

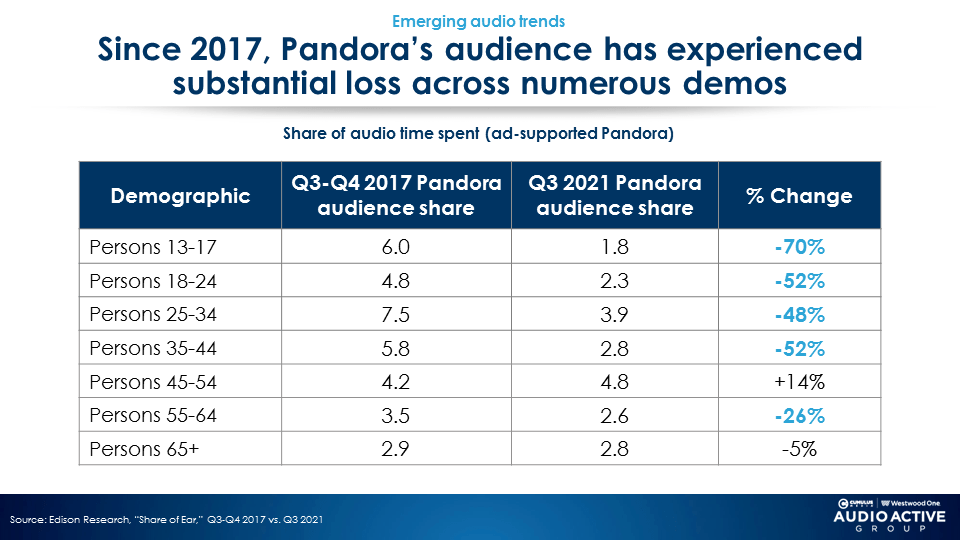

Pandora sees significant losses in most demographics

In the middle part of the last decade, Pandora was a new and interesting audio streaming service. They enjoyed strong shares among persons 13-44. Then came Spotify’s ad-free subscription service.

Over the last four years, Pandora has suffered share losses in the 48% to 70% range among persons 13-44. Pandora’s remaining and small audiences seem to be centered among persons 45-54.

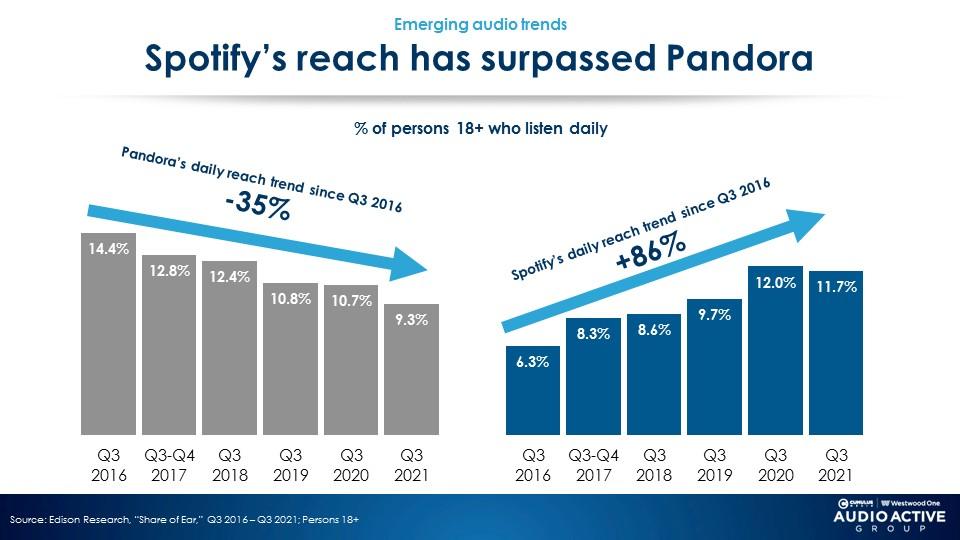

Spotify surpasses Pandora in reach

In the last several years, Pandora has suffered constant reach erosion at the hands of Spotify. Since 2016, Pandora’s daily reach is down -35% while Spotify is up +86%.

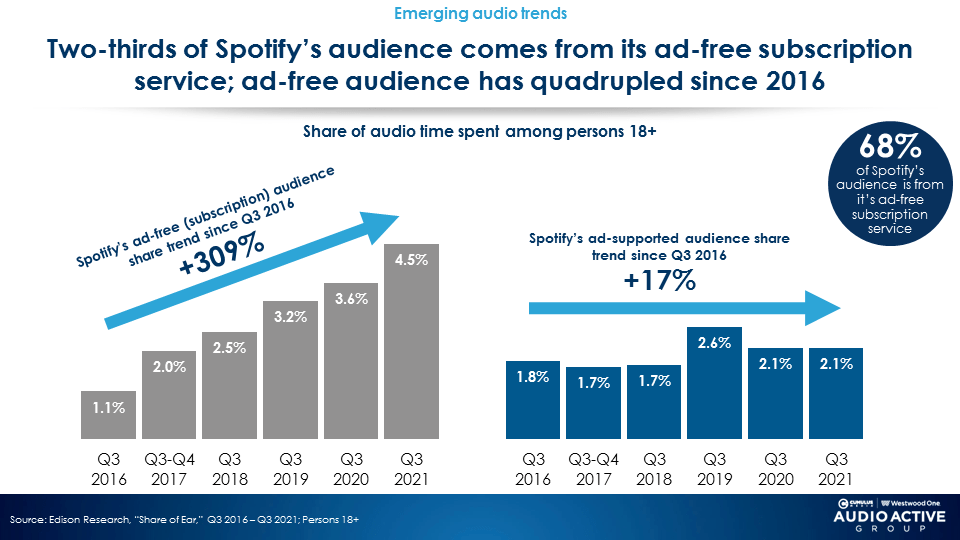

All of Spotify’s growth comes from its advertising-free subscription service

Since 2016, Spotify’s advertising-free subscription service is up +309% while the ad-supported free service grew only by three-tenths of a share point (1.8 to a 2.1).

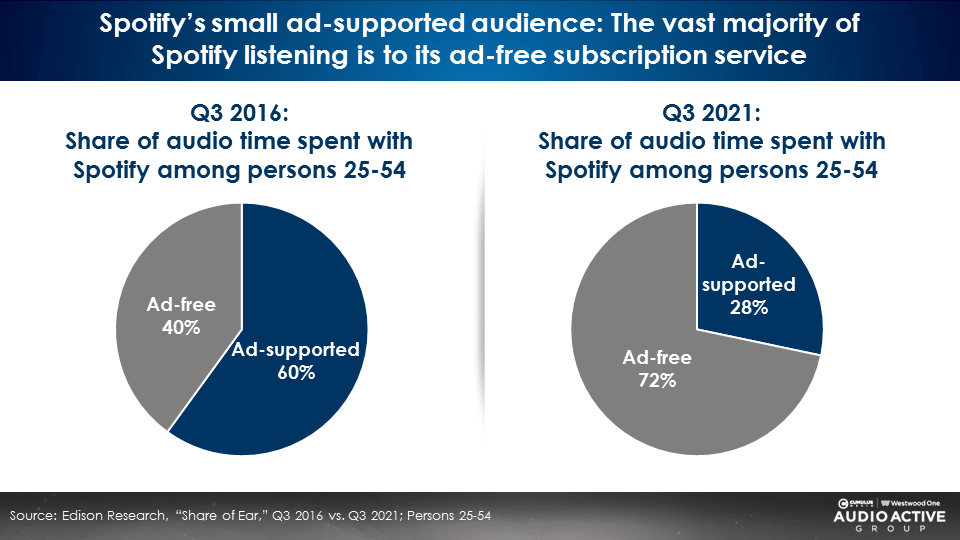

72% of Spotify 25-54 listening is to its ad-free subscription service

Five years ago, 60% of the time spent with Spotify was to the ad-supported service. Now only 28% of time spent with Spotify is to the ad-supported version. While many advertisers and agencies personally enjoy listening to Spotify’s ad-free subscription service, Spotify’s ad-supported audience remains a small and shrinking aspect of the platform.

Podcast audiences soar

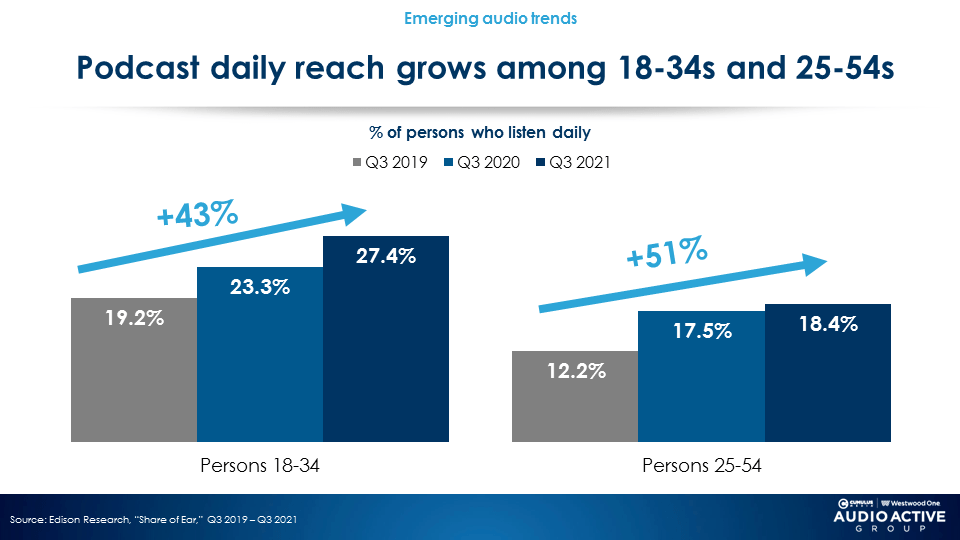

The two audio platforms that are consistently growing are AM/FM radio streaming and podcasts. Over the last several years, podcast reach and audience shares have exploded.

In the last two years, podcast daily reach among persons 18-34 is up +43% and daily reach among persons 25-54 is up an eye popping +51%.

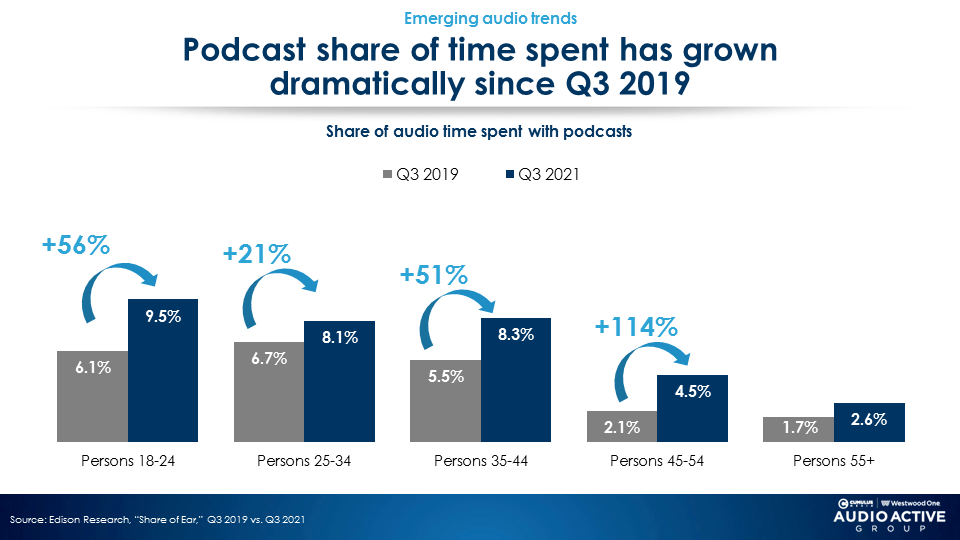

Since 2019, podcast audience shares among persons 18-54 have seen significant growth. Podcasts now have shares in the 8-9 range among persons 18-44. Podcast’s persons 45-54 share, coming off a small base, has doubled to a 4.5% share.

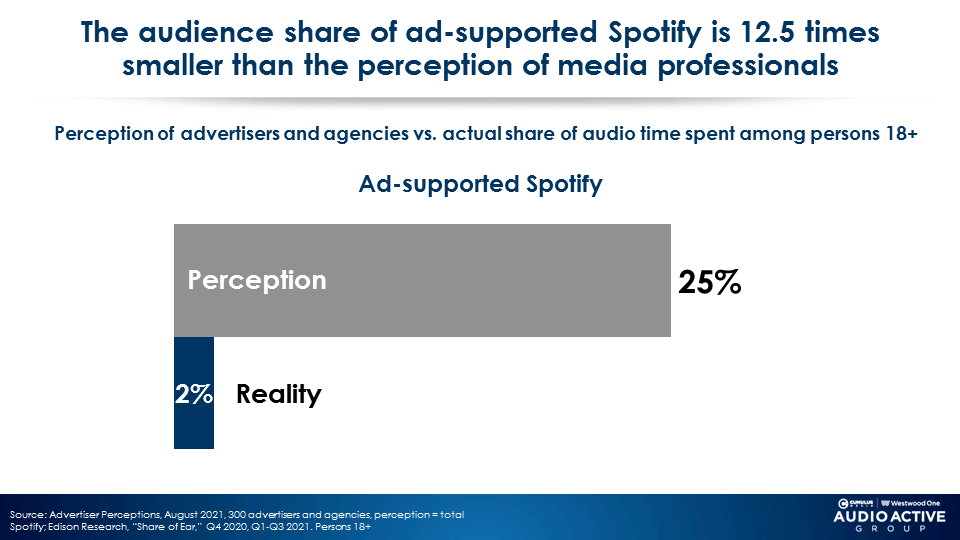

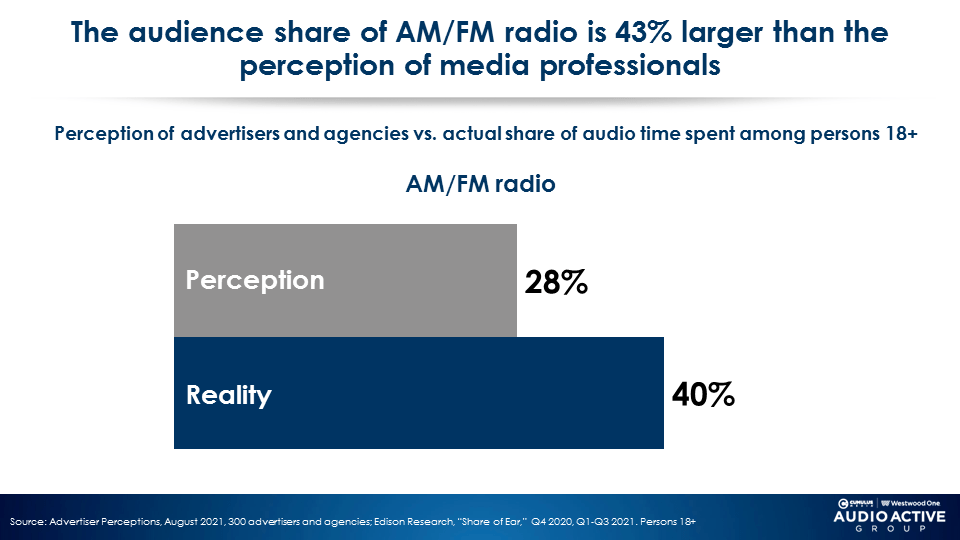

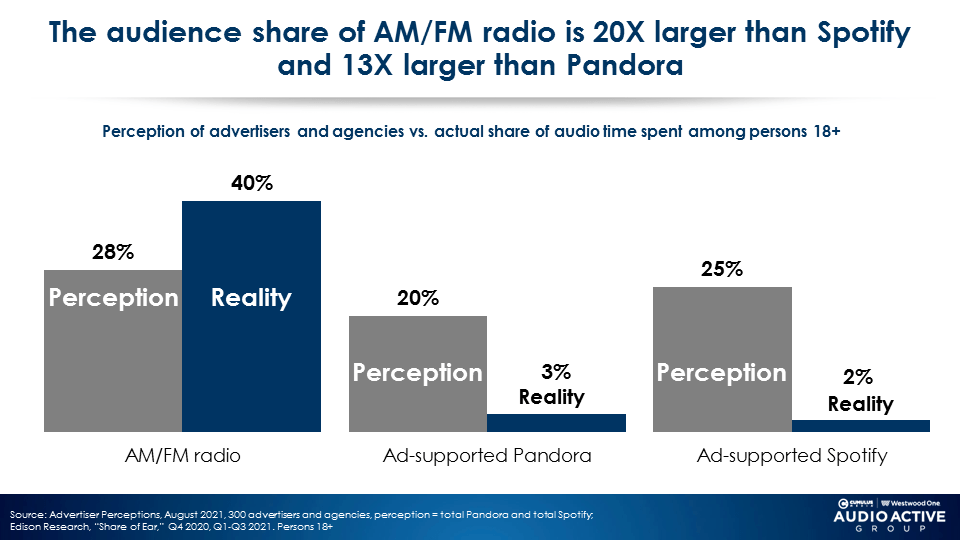

Perception vs. reality: Marketers and agencies overestimate Pandora and Spotify shares and underestimate AM/FM radio listening

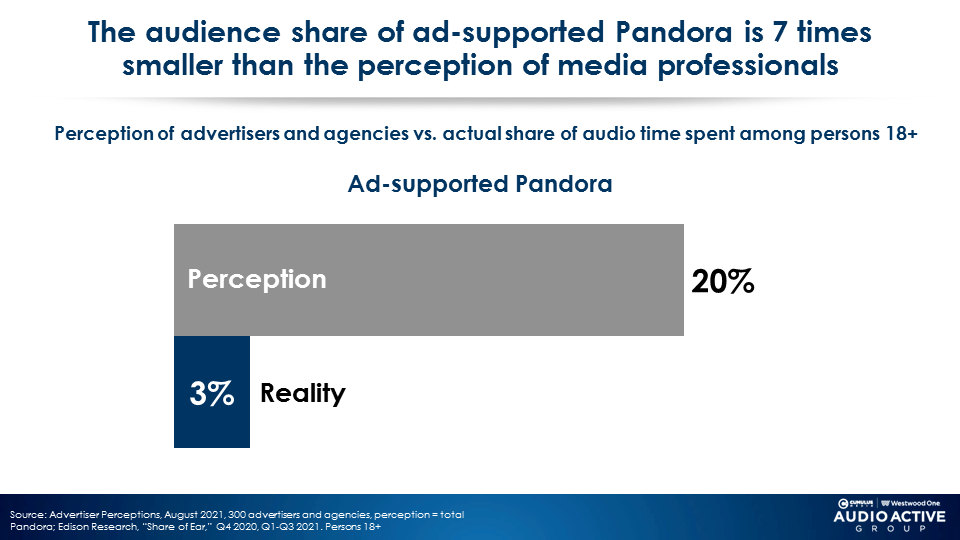

In August 2021, Advertiser Perceptions, the gold standard measurement firm of advertiser and agency sentiment, asked 300 media decision makers at brand and media agencies to estimate the audience shares of Pandora, Spotify, and AM/FM radio.

Agencies and advertisers estimated that Pandora has a 20% share of listening. This is seven times larger than Pandora’s actual 3% audience share in Edison’s “Share of Ear.”

Marketers and media agencies estimate that Spotify has a 25% share of audience. That is over twelve times larger than Spotify’s actual 2% audience share.

Among media agencies and brands, the perceived audience share of AM/FM radio is 28%, far smaller than the 45% share of Spotify and Pandora combined. In reality, AM/FM radio’s actual share (40%) far exceeds the 28% perception.

Massive disconnect: The perception and reality of audio shares

The chart below summarizes the perceived audio listening shares among brands and media agencies. Grey is from the August 2021 Advertiser Perceptions study. In blue are the actual ad-supported shares from Edison’s Q3 2021 “Share of Ear.” What a disconnect.

How can media agencies and their brand clients be so far off in understanding how Americans actually listen to audio?

Marketers and agencies need to take the “me out of media”

Bob Hoffman, a long-time ad agency executive and now an in-demand speaker at industry conferences, asks, “How can professional people who work in an industry that is largely constructed on media behavior be so astoundingly misinformed? The answer is pretty simple. Marketing people are living in a world of their own.”

Renowned marketing professor Mark Ritson explains, “There is increasing global evidence that marketers are basing their media choices on their own behaviour or that stoked by the digitally obsessed marketing media, rather than actual audience data.”

In their book How Not To Plan: 66 Ways to Screw It Up, Les Binet and Sarah Carter remind agencies and brands, “We’re marketing and communication people, we’re different from the majority. In the US and UK, we’re less than 1% of the population. We tend to be younger. … And we live in a handful of big cities. So it’s all too easy for us overlook how different our lifestyles and perceptions are from the people we talk to.”

Acknowledging this, Colin Kinsella, former CEO of Havas Media North America, says, “The biggest risk for AM/FM radio is the 26-year-old planner who lives in New York or Chicago and does not commute by car and does not listen to AM/FM radio and thus does not think anyone else listens to AM/FM radio.”

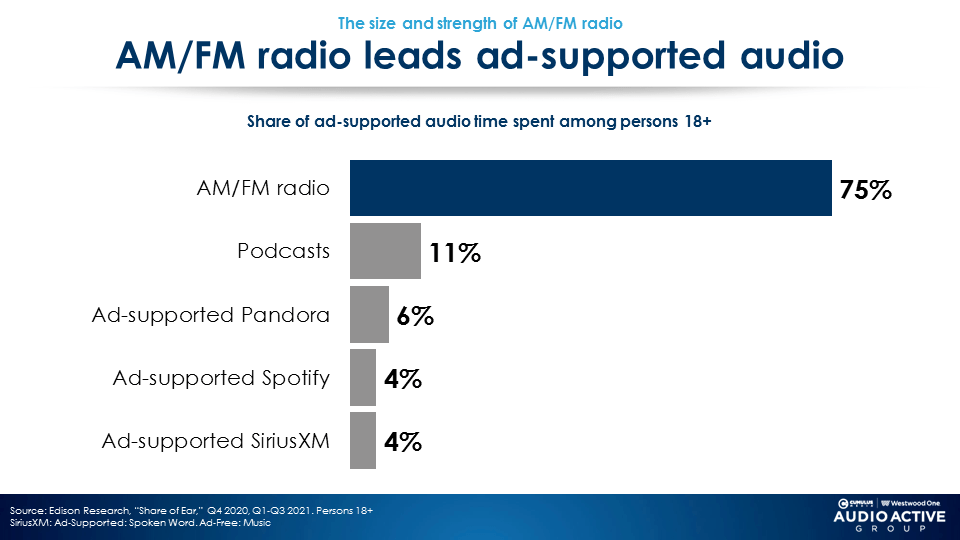

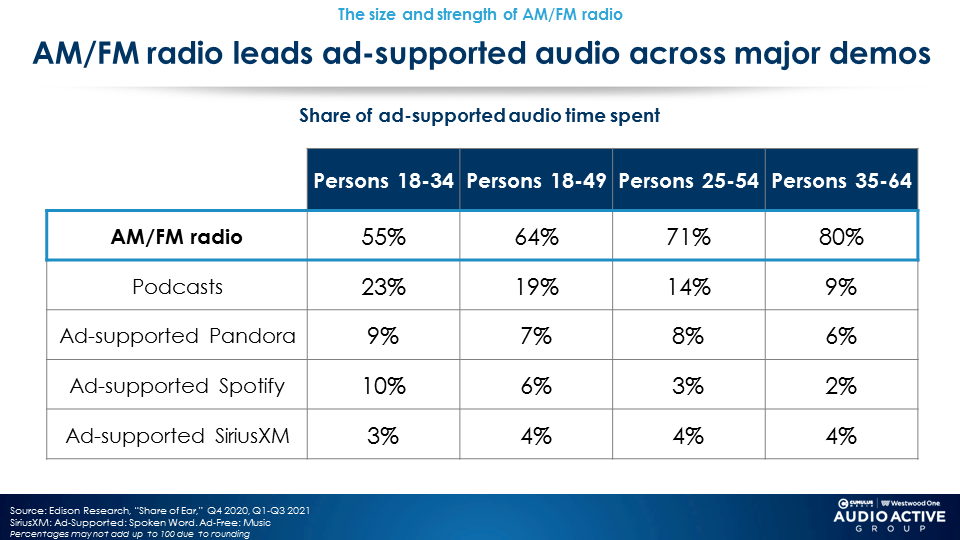

AM/FM radio dominates ad-supported audio with a 75% share of listening

Edison’s Q3 2021 “Share of Ear” study reveals AM/FM radio has a massive share of time spent among ad-supported platforms. Podcast shares (11%) now exceed the combined share of Pandora and Spotify (10%).

Among younger demographics, podcast shares are significant

Regardless of the demographic, podcast shares exceed the combined audiences of Pandora and Spotify.

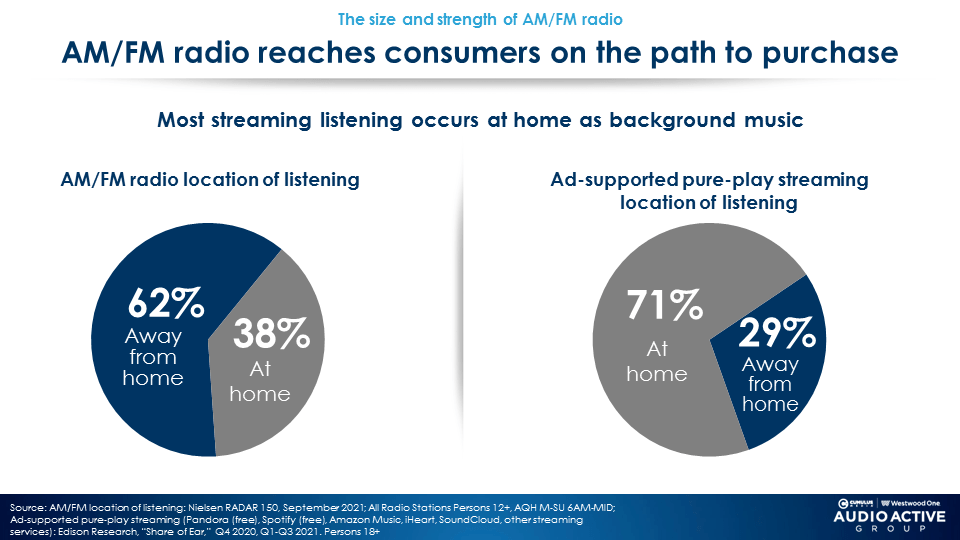

Most Pandora/Spotify listening occurs at home while most AM/FM radio listening occurs away from home

Sales brochures from Pandora and Spotify show listeners in all sorts of situations out of the home. The reality of where Pandora and Spotify is consumed is quite different from the glossy sales materials.

According to “Share of Ear,” the vast majority of Pandora and Spotify listening occurs at home. 71% of all time spent occurs at home. Only 29% occurs away from home. Most music streaming occurs at home, softly playing in the other room.

AM/FM radio is actually the real out-of-home medium with 62% of all time spent occurring away from home.

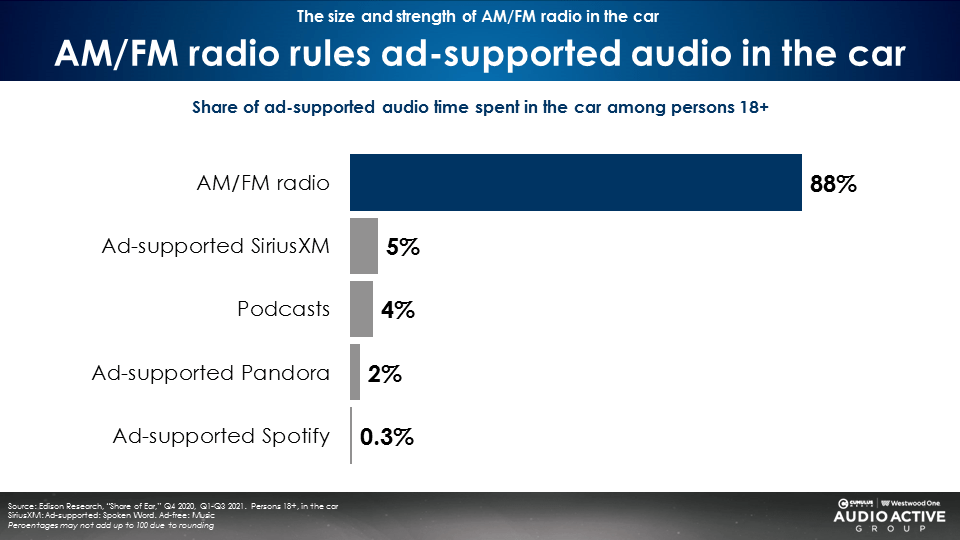

AM/FM radio dominates in-car listening with an 88% share

Over the last six years, Edison reports AM/FM radio’s share of ad-supported audio in the car has hovered around a 90% share. Q3 2021 was no different.

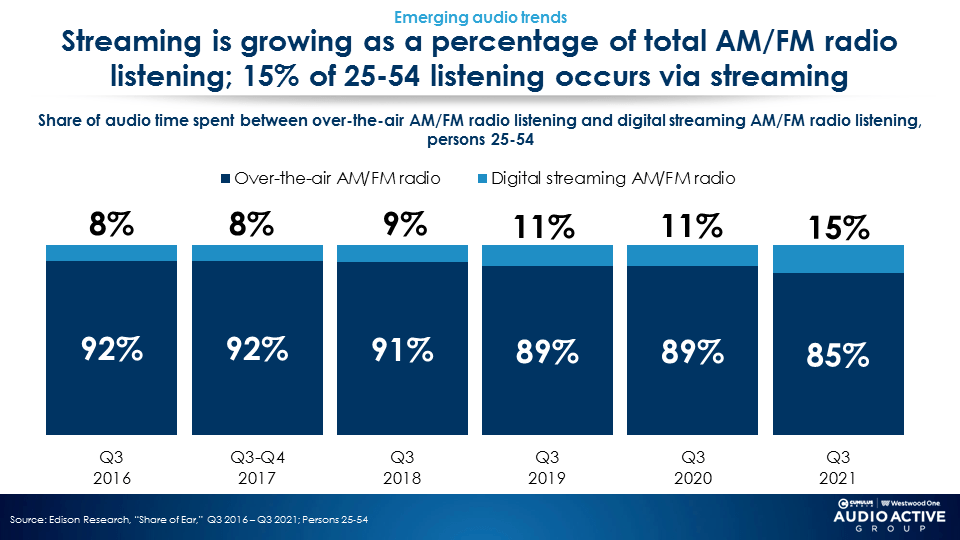

AM/FM radio streaming is now 15% of total AM/FM radio listening among persons 25-54

After podcasts, the fastest growing audio platform is AM/FM radio streaming. Versus five years ago, the proportion of total persons 25-54 AM/FM radio listening occurring via the stream has increased from 8% to 15%.

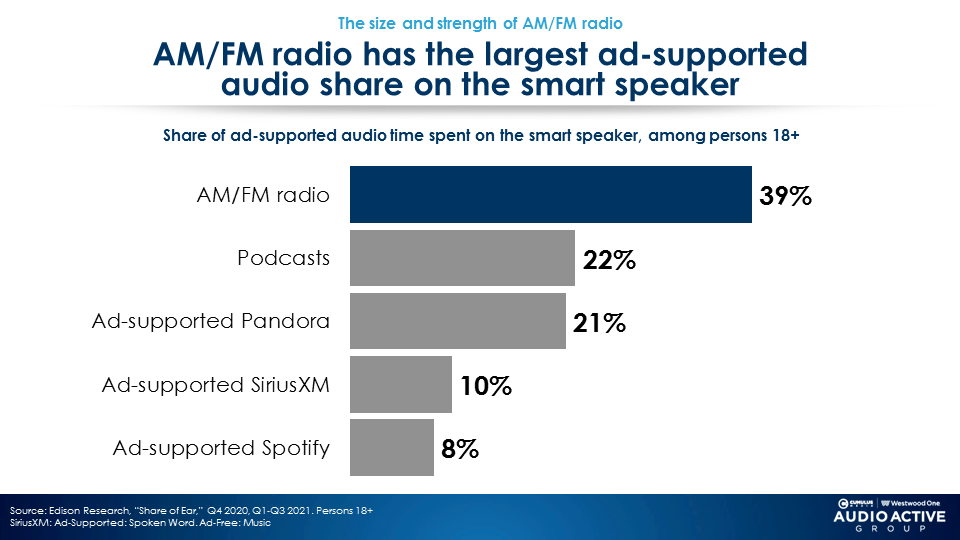

AM/FM radio streaming is #1 on smart speakers

One of the drivers for the growth of AM/FM radio streaming are smart speakers which have brought AM/FM radio back into the home. The latest “Share of Ear” reveals AM/FM radio is the number one ad-supported platform on smart speakers.

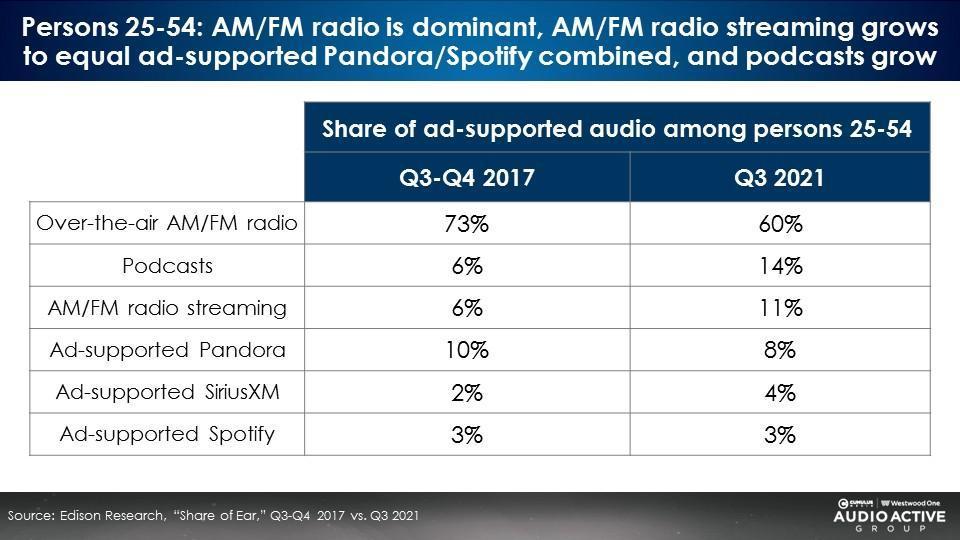

Ad-supported audio: AM/FM radio dominates, podcasts and AM/FM radio streaming represent all the growth, Pandora is down, and Spotify stagnates

This four-year view provides the most comprehensive understanding of the state of American ad-supported audio. AM/FM radio remains the leader while podcasts jump into the number two position. AM/FM radio streaming has nearly doubled.

The three remaining players (Pandora, Spotify, and SiriusXM) represent just 15% of listening, unchanged from 2017, with very small audiences with little or no growth. Notice that AM/FM radio streaming (11%) is now as big as Pandora and Spotify combined.

Key takeaways:

- Ad-supported audiences: Pandora collapses and Spotify stagnates

- Pandora sees significant losses in most demographics

- Spotify surpasses Pandora in reach

- All of Spotify’s growth comes from its advertising-free subscription service which accounts for 72% of all Spotify listening

- Podcast audiences soar

- Perception vs. reality: Marketers and agencies overestimate Pandora and Spotify shares and underestimate AM/FM radio listening

- Marketers and agencies need to take the “me out of media”

- AM/FM radio dominates ad-supported audio with a 75% share of listening

- Among younger demographics, podcast shares are significant

- Most Pandora/Spotify listening occurs at home while most AM/FM radio listening occurs away from home

- AM/FM radio dominates in-car listening with an 88% share

- AM/FM radio streaming is now 15% of total AM/FM radio listening among persons 25-54

- AM/FM radio streaming is #1 on smart speakers

- Ad-supported audio: AM/FM radio dominates, podcasts and AM/FM radio streaming represent all the growth, Pandora is down, and Spotify stagnates

Click here to view a 13-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group.

Contact the Insights team at CorpMarketing@westwoodone.com.