The State Of The Fast-Food Consumer And Why AM/FM Radio And Quick Service Restaurants Are Made For Each Other

Click here to view a 12-minute video of the key findings.

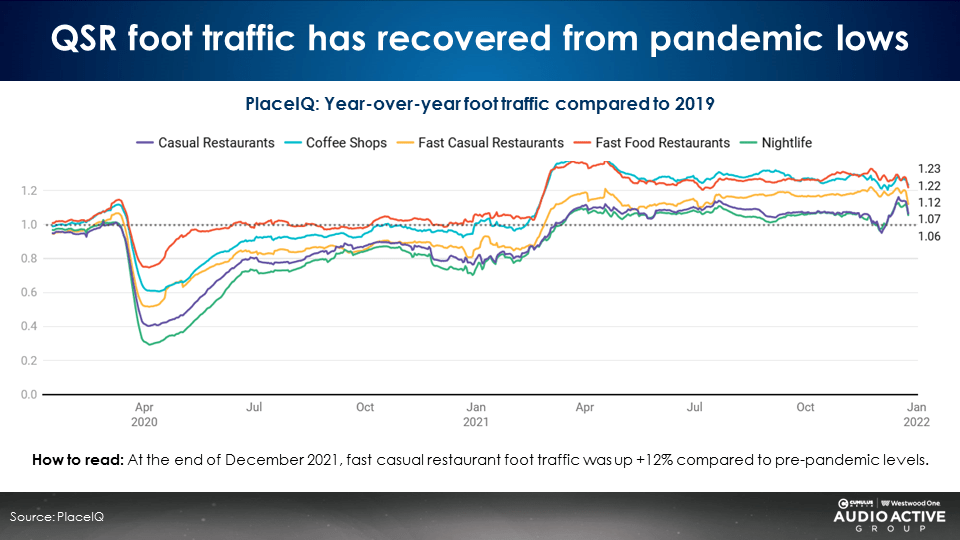

While COVID has altered many shopping and retail habits, visits to quick service restaurants (QSR) have roared back. According to the latest QSR visitation data from PlaceIQ, one of the leading location analytics firms, visits to fast-food restaurants now exceed pre-pandemic levels. As of January 2022, U.S. fast-food foot traffic is up +22% versus 2019 levels.

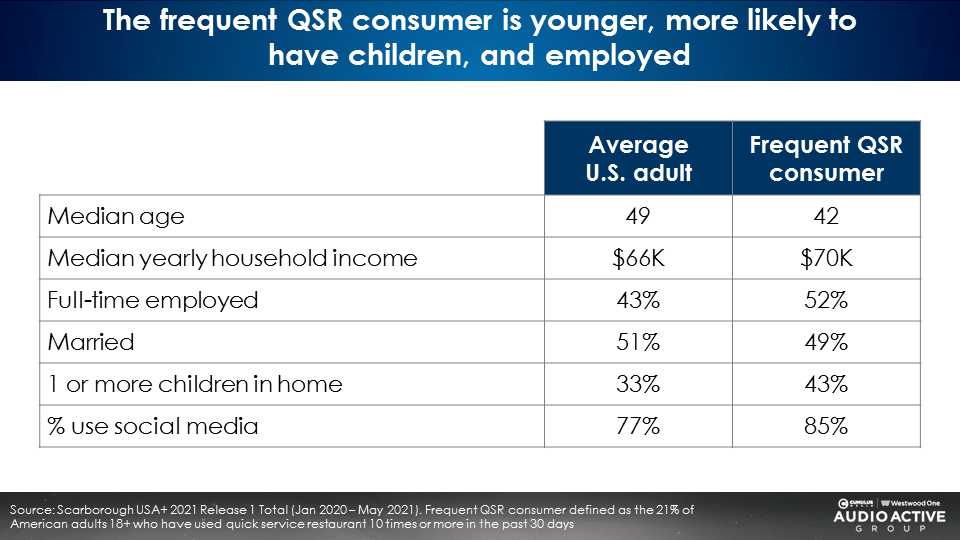

Frequent fast-food consumers are younger, have higher than average incomes, are more likely to be employed, and have kids

Nielsen Scarborough reports that compared to the average person, frequent QSR customers are more likely to have families and be employed, which explains their higher income.

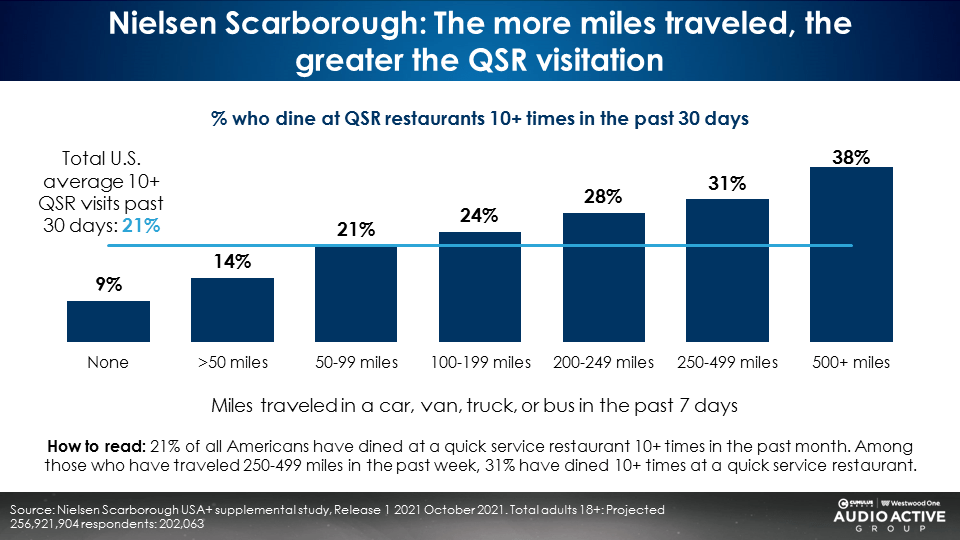

Since frequent fast-food diners are more likely to work and have kids, it is no surprise that they clock a lot of miles in their vehicles

A recent October 2021 Nielsen Scarborough study found that consumers who visit quick service restaurants 10+ times in the past month are high mileage drivers.

21% of Americans who are considered frequent fast-food diners have visited a quick service restaurant 10+ times in the past month. Those who have clocked more miles in the car are far more likely to be frequent fast-food diners. 31% of those who have driven 250 to 499 miles in the last week are 10+ QSR visitors, +50% more than the U.S. average.

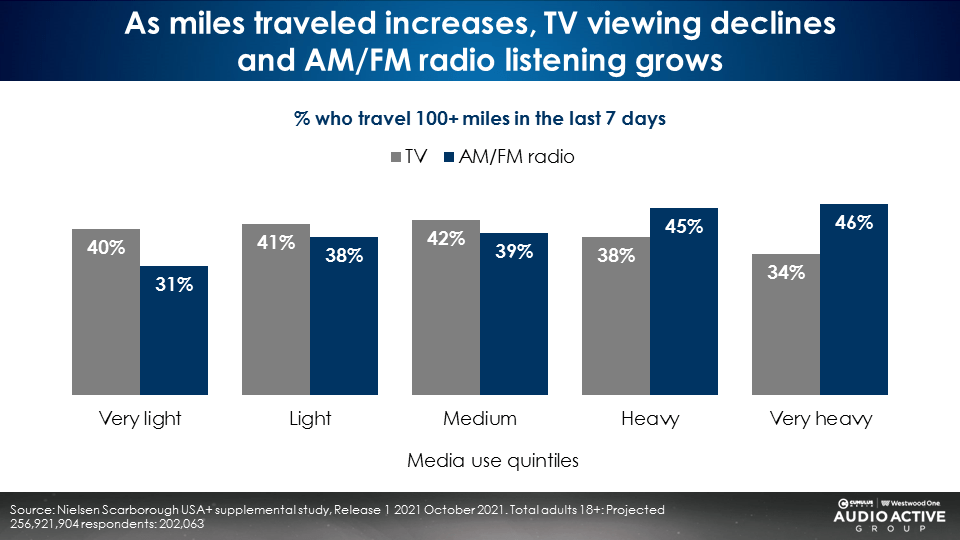

A tale of two cities: Heavy TV viewers are low mileage drivers and heavy AM/FM radio listeners are “mega-milers”

Per Nielsen Scarborough, two out of five Americans (39%) have driven 100+ miles in the past week. When TV and AM/FM radio audiences are divided into five equal groups (called quintiles), based on time spent with each medium, a clear pattern emerges.

As TV time spent increases, miles traveled drops. The heaviest TV viewers who generate the most ad exposures are lower mileage drivers.

Conversely, the heaviest AM/FM radio listeners are much more likely to be high mileage drivers. The heaviest AM/FM radio listeners who generate the most ad exposures are high mileage drivers.

Since heavy TV viewers don’t drive a lot and heavy AM/FM radio listeners clock lots of miles, there is a direct impact on fast-food restaurant visitation.

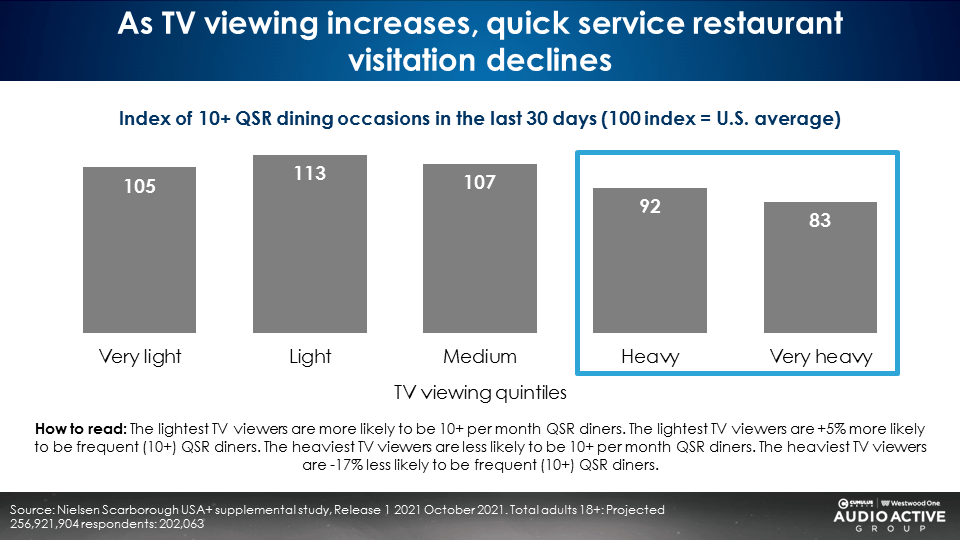

Heavy TV viewers are infrequent fast-food diners: Most TV ad impressions are generated by light QSR category users

When Nielsen Scarborough indexes 10+ monthly QSR visits against the five groups of TV viewers, the data reveals heavy TV viewers are less likely to be frequent QSR visitors. The heaviest U.S. TV viewers are -17% less likely to be 10+ per month fast-food diners.

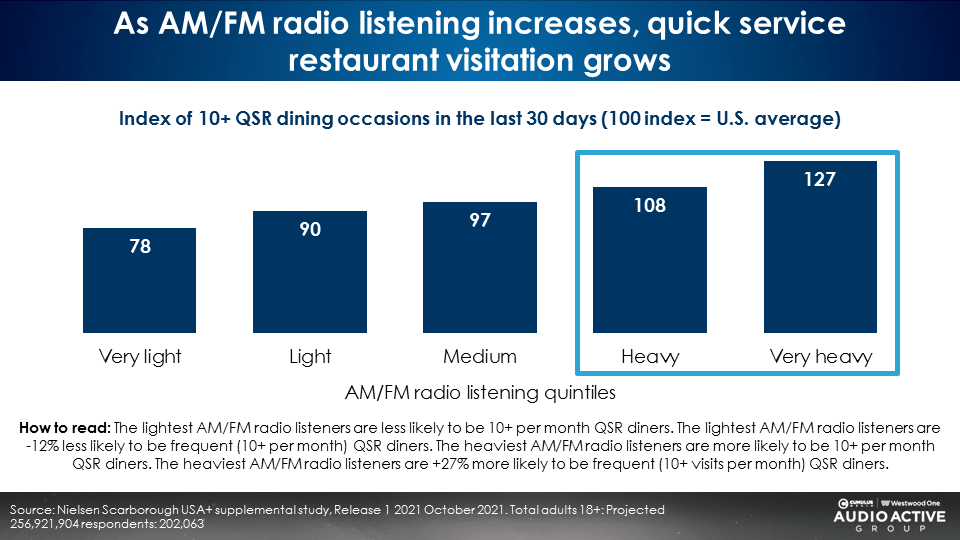

Heavy AM/FM radio listeners are frequent fast-food diners: Most AM/FM radio ad impressions are generated by heavy QSR category users

When Nielsen Scarborough indexes 10+ monthly QSR visits against the five groups of AM/FM radio listeners, the data shows that heavy AM/FM radio listeners are much more likely to be frequent QSR visitors. The heaviest U.S. AM/FM radio viewers are +27% more likely to be 10+ per month fast-food diners.

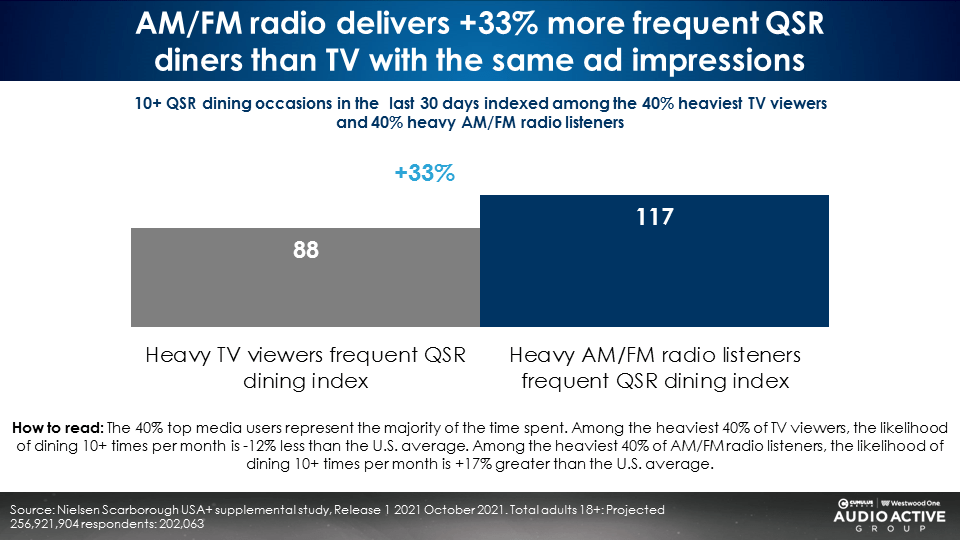

To QSR brands, AM/FM radio impressions are worth +33% more than TV impressions

Most ad impressions are generated by the heaviest users of a medium. There is a “40%/75%” rule. The 40% heaviest media users generate most (~75%) of the ad impressions. The category usage habits of the 40% heavy media users are crucial for media planners.

America’s heavy TV viewers (the top 40% of viewers who watch the most) under-index (88) for 10+ monthly QSR trips. Heavy TV viewers are -12% less likely than the U.S. average to be frequent fast-food diners.

Conversely, America’s heavy AM/FM radio listeners (the top 40% who listen the most) over-index (117) for 10+ monthly QSR trips. Heavy AM/FM radio listeners are +17% more likely than the U.S. average to be frequent fast-food diners.

A QSR campaign on AM/FM radio is +33% more likely than TV (117 vs. 88) to reach frequent fast-food diners.

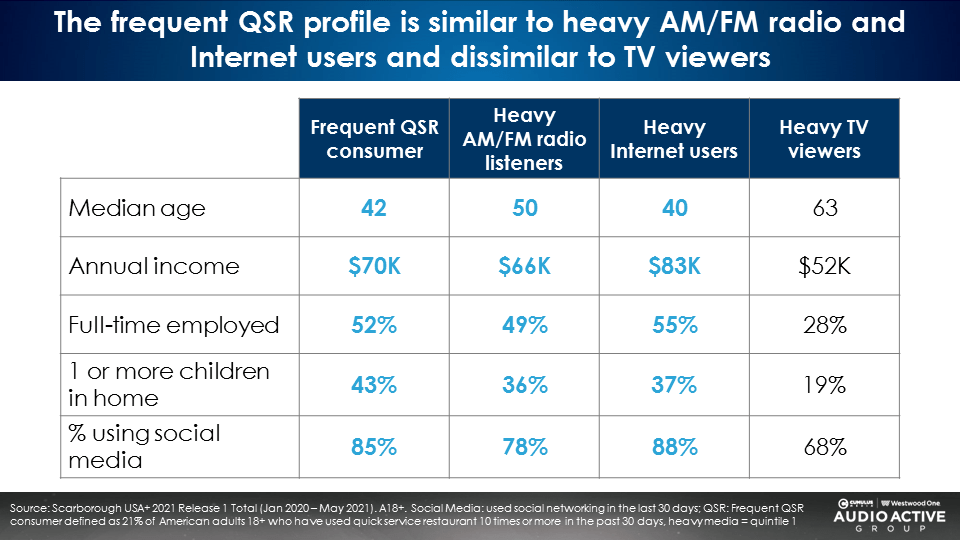

The profile of the frequent fast-food diner is most similar to Internet users and heavy AM/FM radio listeners

Compared to frequent fast-food customers, heavy TV viewers are much older, less employed, and much less likely to have kids.

There is a mismatch in fast-food advertising media budgets: TV is overused and AM/FM radio is underutilized

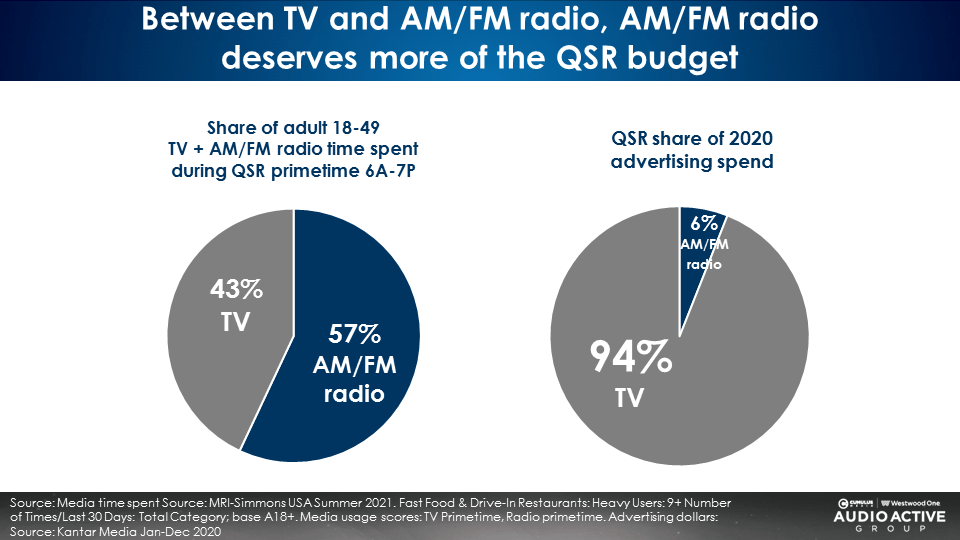

According to PlaceIQ location analytics, 6AM-7PM is “fast-food prime time,” when Americans spend more time with AM/FM radio than TV. Among frequent fast-food customers, 57% of 6AM-7PM media usage goes to AM/FM radio and 43% goes to TV. Yet, between the two media, 94% of the ad dollars goes to TV and only 6% goes to AM/FM radio. A major mismatch.

AM/FM radio makes the QSR TV campaign better by generating significant incremental reach

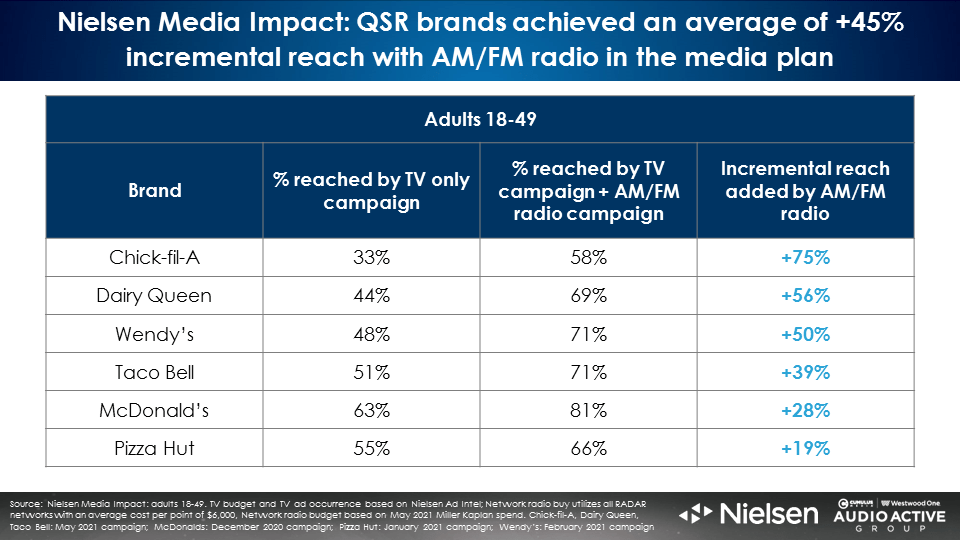

An analysis conducted by Nielsen Media Impact, the optimization and media planning platform, reveals recent QSR TV campaigns saw a massive lift in 18-49 reach due to AM/FM radio campaigns. On average, AM/FM radio generated a massive +45% increase in 18-49 incremental reach for six QSR brands.

A recent Wendy’s linear TV campaign reached 48% of all U.S. 18-49 adults in a month. The Wendy’s AM/FM radio campaign lifted reach by an astonishing +50% to a 71% monthly reach.

How AM/FM radio makes QSR TV better: Massive reach in younger demos

According to Nielsen’s Q2 2021 Total Audience Report, American linear television reaches 66% of the 18-49 demographic in a typical week. The same Nielsen report reveals AM/FM radio weekly reach among adults 18-49 is 85%, a +29% advantage over TV.

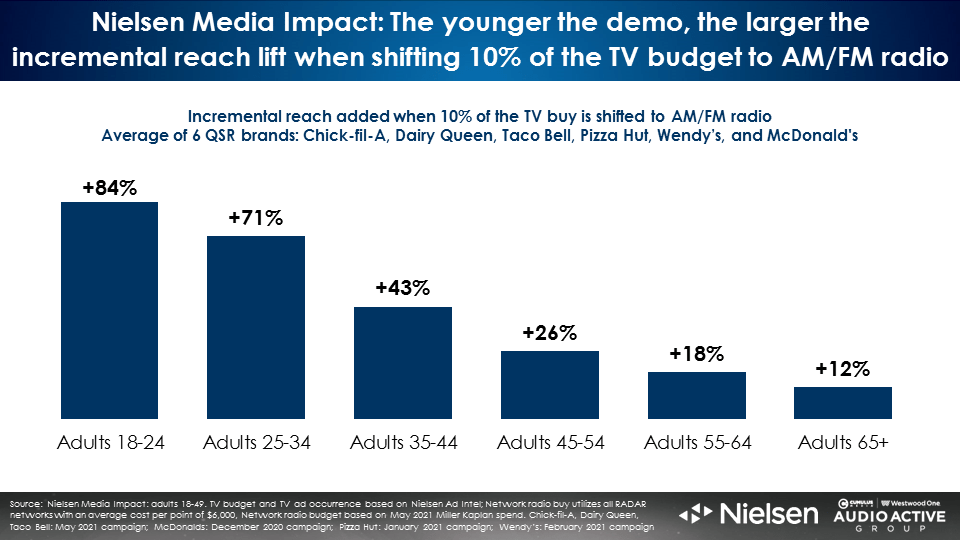

Among adults 18-34, Nielsen reports TV’s weekly reach is 57% to AM/FM radio’s 82%. In a typical week in America, AM/FM radio reaches +44% more adults 18-34. Given AM/FM radio’s significant reach advantage over TV, it is not surprising to find that it is with these younger demographics that AM/FM radio generates a massive lift in incremental reach to QSR TV campaigns.

Aggregating the recent TV campaigns of Wendy’s, Chick-fil-A, Dairy Queen, Taco Bell, McDonald’s, and Pizza Hut, AM/FM radio generated a +71% increase in adult 25-34 reach and an +84% lift in adult 18-24 TV reach. The younger the demographic, the greater the lift incremental reach generated by AM/FM radio.

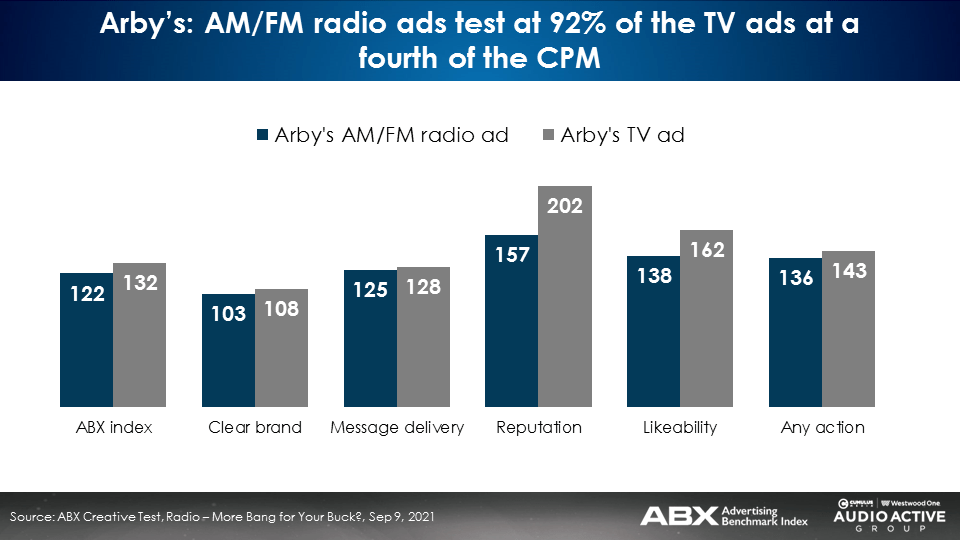

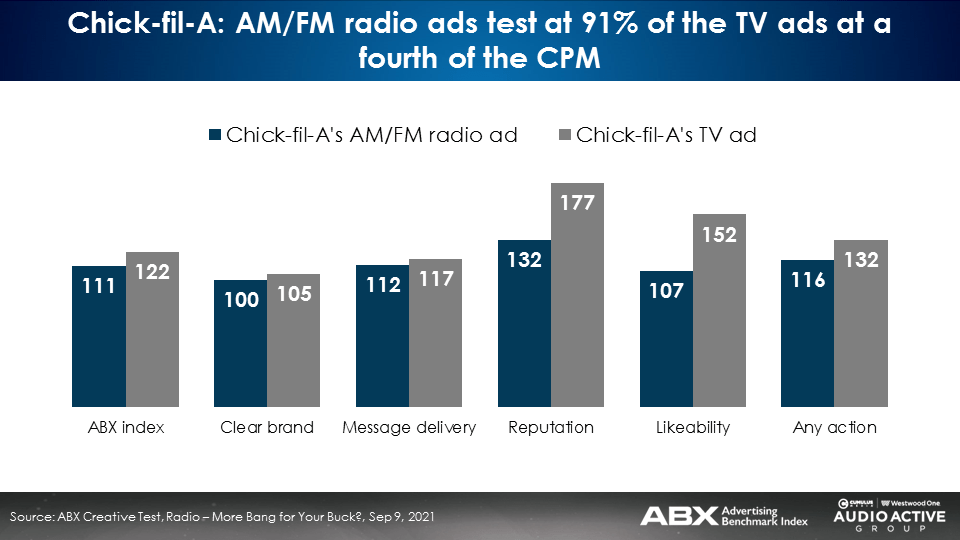

ABX creative testing: QSR AM/FM radio ads test at 90% of the effectiveness of TV at one-fourth the CPM

The old myth is that TV creative is better than AM/FM radio because it has “sight, sound, and motion.” However, eye gaze testing reveals only a minority of TV viewers have “eyes on glass” when ads run.

In fact, the “sound only” audience for TV ads is just as big as “eyes on glass” viewership. For many, the TV advertising experience is an AM/FM radio ad that is heard while gazing at the cell phone.

Recently ABX, a leader in creative testing, measured Arby’s and Chick-fil-A TV and AM/FM radio ads. Across a series of measures (clear brand, message delivery, reputation, likeability, and taking action), the AM/FM radio ads preformed very similarly to the TV ads at a fraction of the CPM.

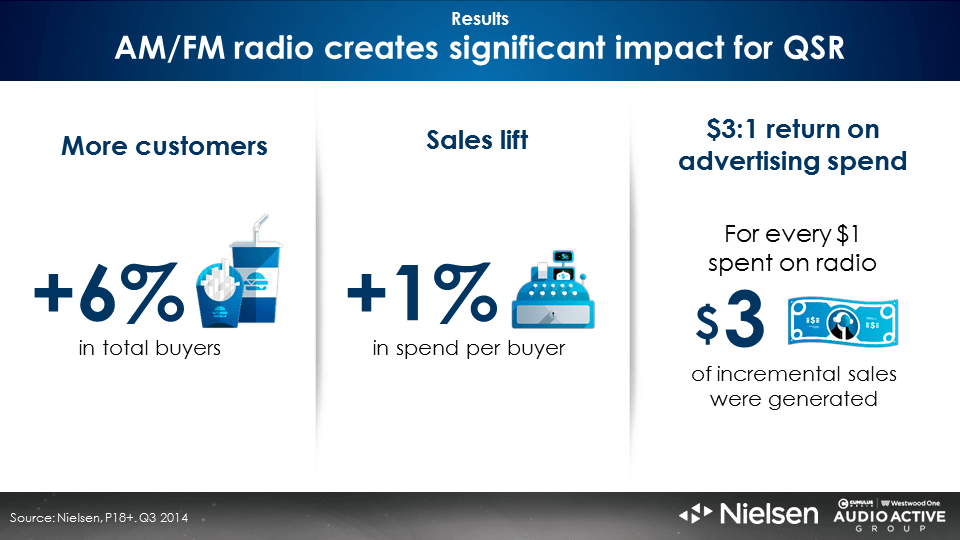

Nielsen sales lift studies reveal AM/FM radio ads generate a +6% increase in total QSR buyers and a $3 to $1 return on investment

Nielsen matched Portable People Meter AM/FM radio commercial exposures to credit and debit card spending. For every dollar of AM/FM radio advertising, $3 dollars of incremental sales were generated.

Key takeaways:

- Frequent fast-food consumers are younger, have higher than average incomes, are more likely to be employed, and have kids

- Since frequent fast-food diners are more likely to work and have kids, it is no surprise that they clock a lot of miles in their vehicles

- A tale of two cities: Heavy TV viewers are low mileage drivers and heavy AM/FM radio listeners are “mega-milers”

- Heavy TV viewers are infrequent fast-food diners: Most TV ad impressions are generated by light QSR category users

- Heavy AM/FM radio listeners are frequent fast-food diners: Most AM/FM radio ad impressions are generated by heavy QSR category users

- To QSR brands, AM/FM radio impressions are worth +33% more than TV impressions

- The profile of the frequent fast-food diner is most similar to Internet users and heavy AM/FM radio listeners

- There is a mismatch in fast-food advertising media budgets: TV is overused and AM/FM radio is underutilized

- AM/FM radio makes the QSR TV campaign better by generating significant incremental reach

- How AM/FM radio makes QSR TV better: Massive reach in younger demos

- ABX creative testing: QSR AM/FM radio ads test at 90% of the effectiveness of TV at one-fourth the CPM

- Nielsen sales lift studies reveal AM/FM radio ads generate a +6% increase in total QSR buyers and a $3 to $1 return on investment

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group.

Contact the Insights team at CorpMarketing@westwoodone.com.