Does Your AM/FM Radio Buy Include Streaming? It Should. New Audience Data Reveals AM/FM Radio Streaming Represents A Significant Amount Of Total AM/FM Radio Listening That Rivals Pandora And Spotify

For many years, the perception was that online streaming audiences to AM/FM radio were small and not worth including in the media plan. No longer.

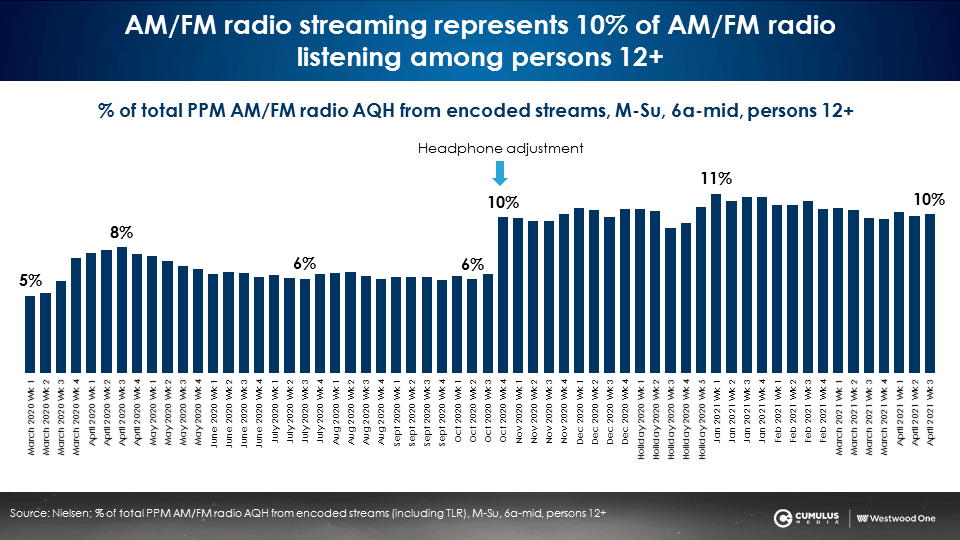

Nielsen Portable People Meter (PPM): AM/FM radio streaming represents 10% of 12+ radio listening

The chart below depicts the weekly share of listening from encoded streams as a proportion of total AM/FM radio listening captured by Nielsen’s PPM. The time horizon spans the first week of March 2020 through the first week of April 2021.

Before the pandemic, streaming represented 5% of AM/FM radio listening. Streaming quickly soared to 8% of listening during the pandemic lockdown period of April and May 2020. When Nielsen introduced the new headphone adjustment methodology enhancement in October 2020, the share of listening to encoded streams jumped to 10% and has held ever since.

Edison Research: Among adults 25-54, AM/FM radio streaming represents 14.6% of listening

14.6%. Surprised? For every seven minutes of AM/FM radio listening among adults 25-54, one minute occurs via the online stream. This is according to Edison Research’s Q1 2021 “Share of Ear” study, the gold standard quarterly tracking report of how Americans consume all forms of audio.

Per “Share of Ear,” 11.3% of total listening among persons 13+ occurs via stream, very similar to Nielsen’s 10%. Since most streaming occurs while listeners are at work, it is not surprising that Edison Research’s adult 25-54 share of streaming is +29% greater than persons 13+. We can surmise that Nielsen’s adult 25-54 PPM share of encoded streams is likely to be in the 13% range.

According to “Share of Ear,” 13% of AM/FM radio listening among adults 18-34 occurs via stream. 11.5% of AM/FM radio listening among adults 35-64 occurs online.

For advertisers, the implication is clear. AM/FM radio streaming needs to be a part of every AM/FM radio buy. With nearly 15% of all adult 25-54 AM/FM radio listening occurring online, AM/FM radio streaming can no longer be ignored.

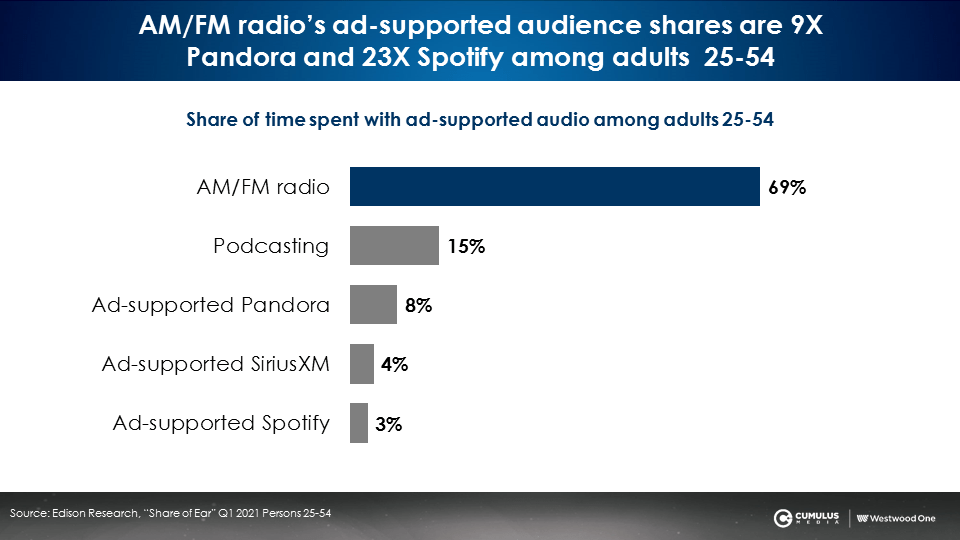

AM/FM radio is nine times bigger than ad-supported Pandora and 23 times bigger than ad-supported Spotify

Edison Research’s “Share of Ear” distinguishes between audiences for subscription audio streaming services that are commercial free and listening to ad-supported streaming services. What advertisers focus on is the audience where they can actually run their ads.

Some advertisers run on Pandora and Spotify and think they’re done with their audio buy. That is like buying two cable networks, one ranked 39 and the other ranked 87, and declaring your TV buy is complete! Per “Share of Ear,” Pandora and Spotify represent only a tiny part of ad-supported audio.

Overall, AM/FM radio (over the air plus streams), dominates the world of ad-supported audio with a 69% share. Podcasts are a fast-growing number two, whose ad-supported shares are larger than Pandora and Spotify combined.

Who has the largest ad-supported audience among adults 25-54: AM/FM radio streams, Pandora, or Spotify? AM/FM radio streaming!

When examining just the streaming portion of AM/FM radio’s audience, AM/FM radio streaming beats both Pandora and Spotify. Per “Share of Ear,” the ad-supported audio shares among adults 25-54 are:

- AM/FM radio streaming: 8.1%

- Ad-supported Pandora: 6.6%

- Ad-supported Spotify: 2.5%

The main takeaway? AM/FM radio should be the major component of any audio plan and AM/FM radio streaming should always be included.

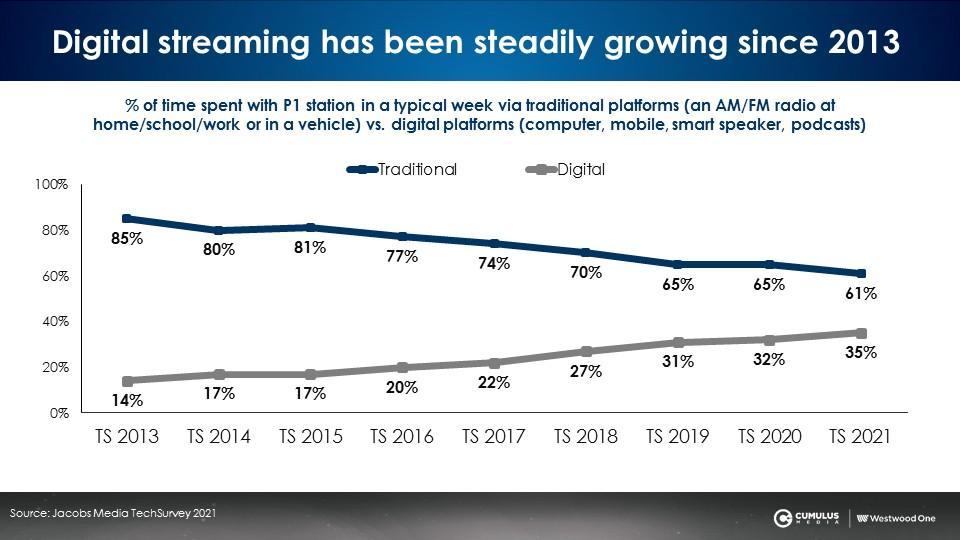

Years in the making: Jacobs Media TechSurvey predicted the rise of AM/FM radio steaming

Followers of the Jacobs Media TechSurvey, the massive, decade-long tracking study of American AM/FM radio listening and device use, foresaw the rise of streaming.

For nine years, Jacobs Media asked AM/FM radio listeners how much time they spent listening to their most preferred station via traditional platforms (AM/FM radios at home, at school, at work, or in a vehicle) versus digital platforms (via computer, mobile, smart speaker, or podcast).

Back in 2013, 85% of the listening occurred via traditional means and 14% occurred on digital platforms. In the just-released 2021 TechSurvey, the share of listening on digital platforms surged to 35% while AM/FM radio time spent via traditional platforms has dropped from 85% to 61%.

If the shift from traditional to digital platforms continues at the historical pace, by 2026, in just five years, an equal share of AM/FM radio listening will come from digital and traditional devices.

If the shift from traditional to digital platforms continues at the historical pace, by 2026, in just five years, an equal share of AM/FM radio listening will come from digital and traditional devices.

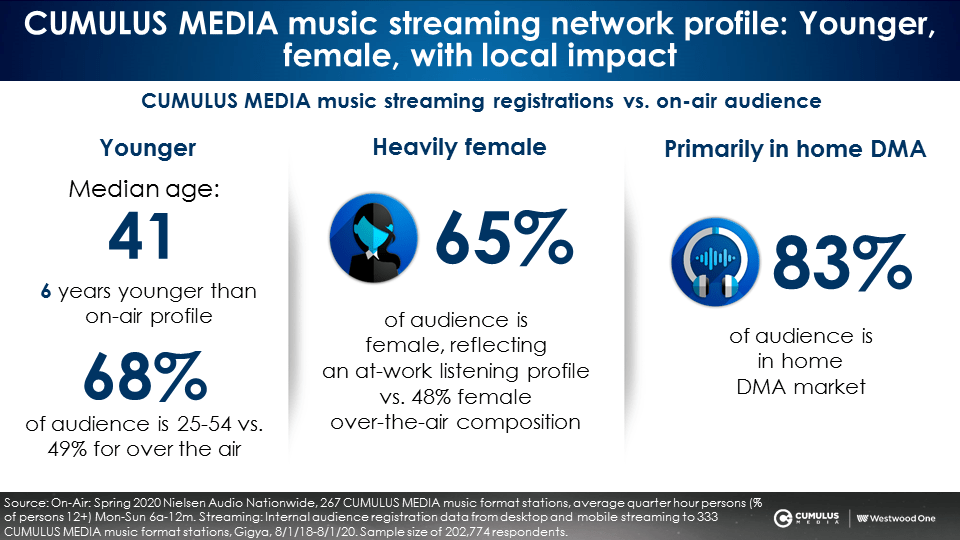

Profile of AM/FM radio streams: Younger, female, and the majority are from the home market

To learn more about the AM/FM radio streaming audience, we studied 202,774 people who had registered their profile (age, gender, and home zip) in order to listen to the streams of CUMULUS MEDIA AM/FM radio stations from around the country.

Here is what we learned about the AM/FM radio streaming audience of music stations:

- Younger: The median age of AM/FM radio streams (41) is six years younger than the total audience (47). 68% of the streaming audience is 25-54 versus 49% for the over-the-air audience. Since AM/FM radio streaming is the “soundtrack of the American worker,” online audiences collapse towards the middle. Younger stations get older. Older stations get younger.

- Female: 65% of the streaming audience is female versus 48% of the total audience. The female skew is no doubt due to the large amount of AM/FM radio listening done at work.

- From the home market: 83% of people listening to a stream live in their home DMA. Advertisers can have confidence that streaming ads will reach listeners in their local market.

MARU/Matchbox: Streaming provides people with the ability to listen to their favorite stations

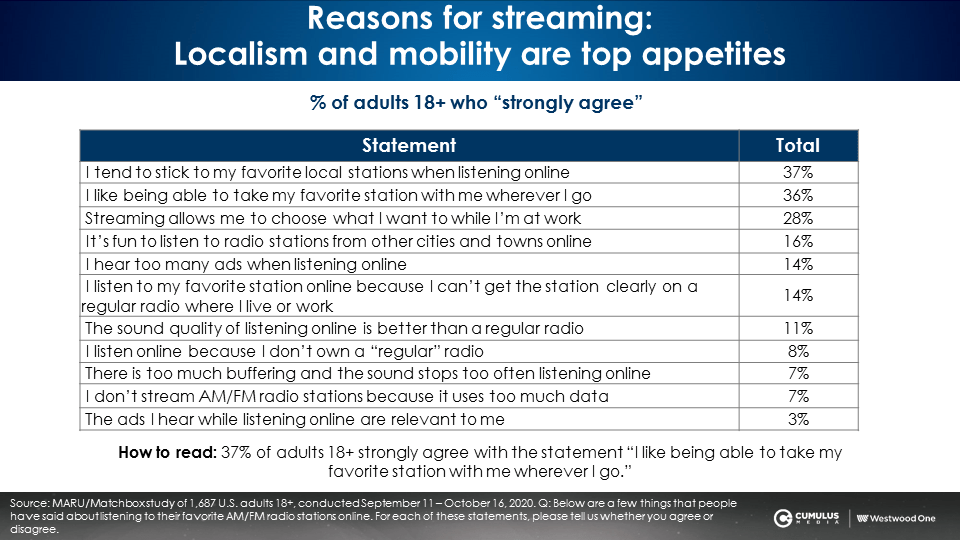

To further understand the nature of the AM/FM radio streaming audience, CUMULUS MEDIA | Westwood One fielded a study of 1,687 AM/FM radio listeners in October of 2020.

When asked about their reasons for streaming AM/FM radio stations, consumers report it is a convenient way to listen to their favorite stations, especially at work.

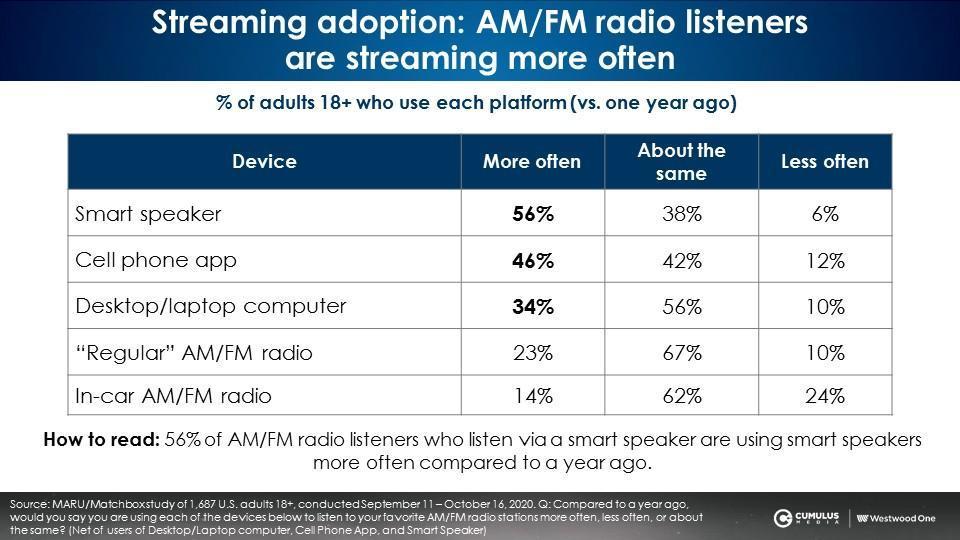

When asked to indicate which devices they are using to access AM/FM radio, steaming devices (smart speakers, cell phones, PCs) are used more frequently. 56% say they are using smart speakers more frequently to listen to AM/FM radio. 46% say they are using their cell phones more often.

AM/FM radio streaming grows as people spend more time listening to AM/FM radio

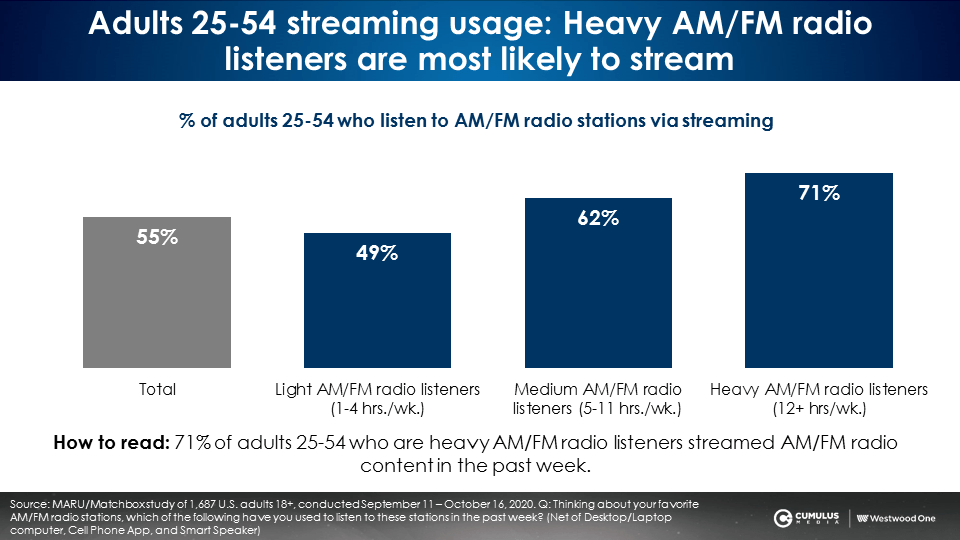

MARU/Matchbox found 55% of all adults 25-54 say they have listened to an AM/FM radio stream in the past week. Among heavy AM/FM radio listeners, that jumps to 71%.

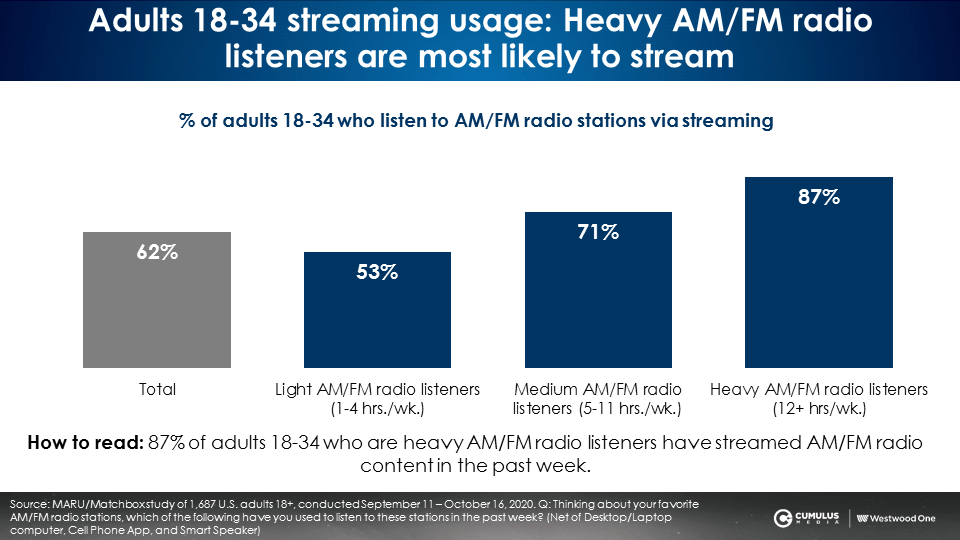

62% of adults 18-34 say they have listened to an AM/FM radio stream in the past week. Among adult 18-34 heavy AM/FM radio listeners, virtually all (87%) say they have listened to an AM/FM radio stream in the past week.

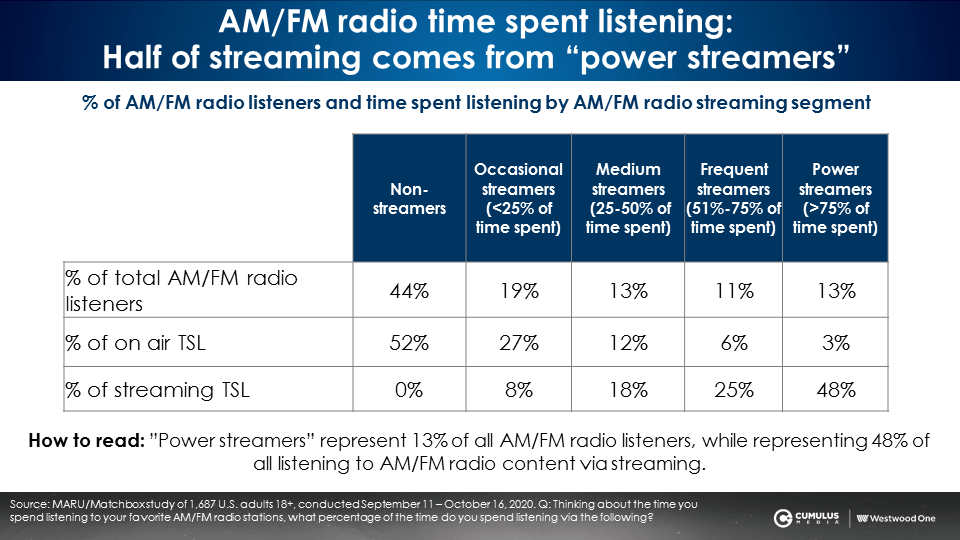

Half of AM/FM radio streaming time spent comes from “power streamers”

According MARU/Matchbox, 13% of AM/FM radio listeners devote more than 75% of their total AM/FM radio time spent to the stream. These “power streamers” represent half of all time spent with AM/FM radio streaming.

The “frequent/power streamers” represent 73% of all streaming time spent to an AM/FM radio station but only 9% of the over-the-air time spent. The “frequent/power” streaming segments are about a quarter of the listeners (24%) who are difficult to reach over the air but very easy to reach via the stream, another reason AM/FM streaming should be in every media plan.

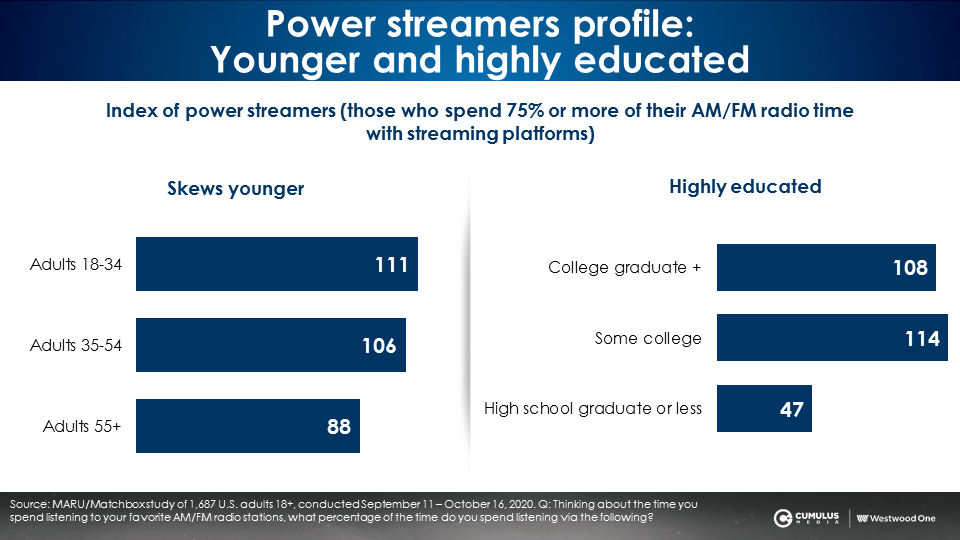

Ideal target: “Power streamers” are highly educated and skew young

Listeners who spent over 75% of their AM/FM radio time listening to the stream over index on education and younger adult 18-34 and adult 35-54 demos.

AM/FM radio streaming is no longer a niche audio option

AM/FM radio streaming is bigger than Pandora and Spotify with significant audience growth over the past year and a desirable consumer profile. AM/FM radio streaming gives advertisers an exciting extension to media plans that engages consumers locally and is engrained in their lives as the soundtrack of the American worker.

Key takeaways:

- Nielsen PPM: AM/FM radio streaming represents 10% of AM/FM radio listening among persons 12+

- Edison Research: Among adults 25-54, AM/FM radio streaming represents 14.6% of listening

- AM/FM radio is nine times bigger than ad-supported Pandora and 23 times bigger than ad-supported Spotify

- AM/FM radio streaming has the largest ad-supported audience among adults 25-54, beating Pandora and Spotify

- Jacobs Media TechSurvey: The share of AM/FM radio listening via digital platforms has been steadily growing for nine years

- Profile of AM/FM radio streams: Younger, female, and the majority are from the home market

- MARU/Matchbox: Streaming provides people with the ability to listen to their favorite stations

- AM/FM radio streaming grows as people spend more time listening to AM/FM radio

- Half of AM/FM radio streaming time spent comes from “power streamers” who are highly educated and skew young

Doug Hyde is the Senior Director, National & Local Insights at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.