7 Key Insights From Edison Research’s “Share Of Ear” Q2 2021: AM/FM Radio, Spotify, Pandora, And Podcast Audiences

The recently released Q2 2021 edition of Edison Research’s “Share of Ear,” the gold standard audio time use study, contains seven key audio insights:

- Over the last five years, Pandora and Spotify have experienced erosion in ad-supported audiences

- Spotify’s audience trends are a tale of two cities: Ad-free subscription audiences soar while ad-supported shares drop

- Perception vs. reality: Brands and agencies significantly overestimate Pandora and Spotify’s audiences

- Podcast audiences have tripled since 2017

- Audio is pandemic proof as AM/FM radio represents three-fourths of all ad-supported audio

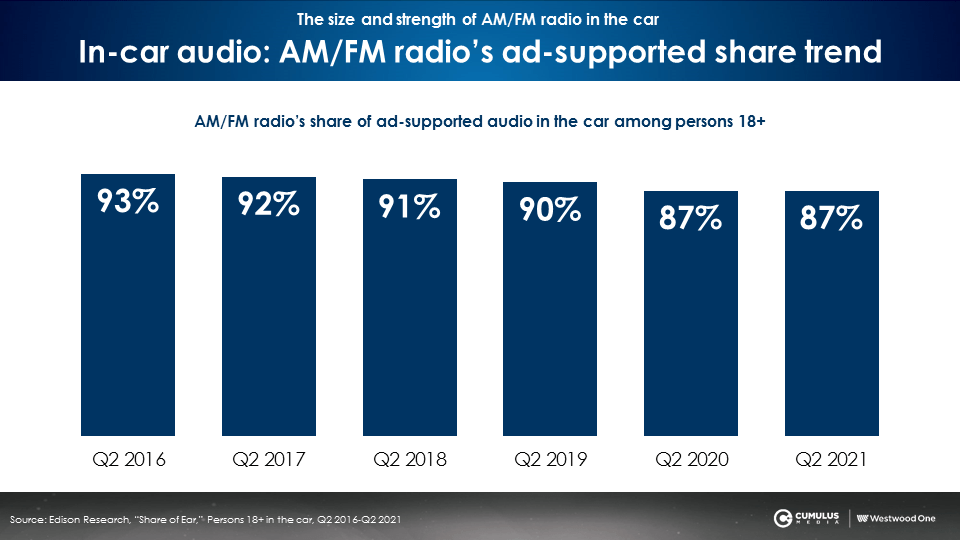

- AM/FM radio owns the car with a 90% share of ad-supported audio six years in a row

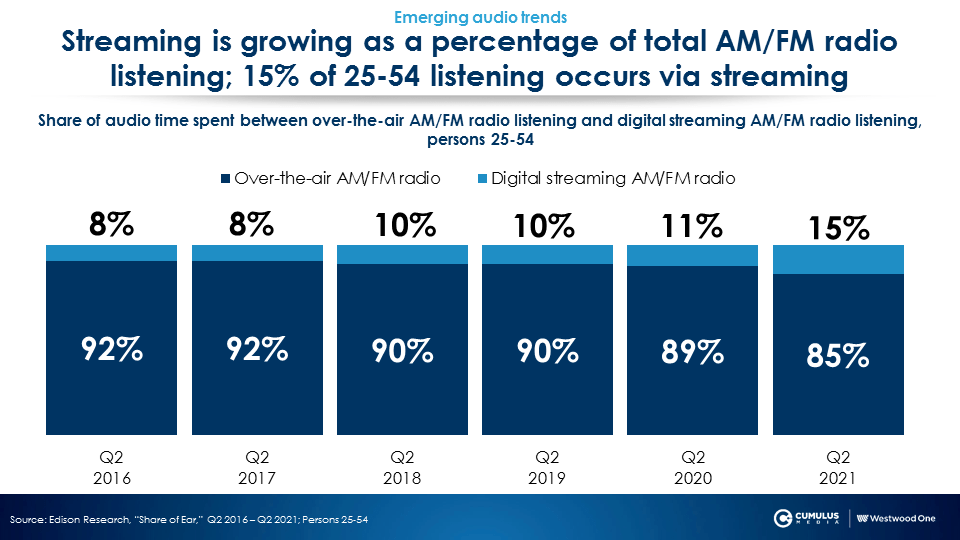

- 15 cents out of every AM/FM radio ad dollar can go to the stream as streaming now represents 15% of persons 25-54 AM/FM radio listening

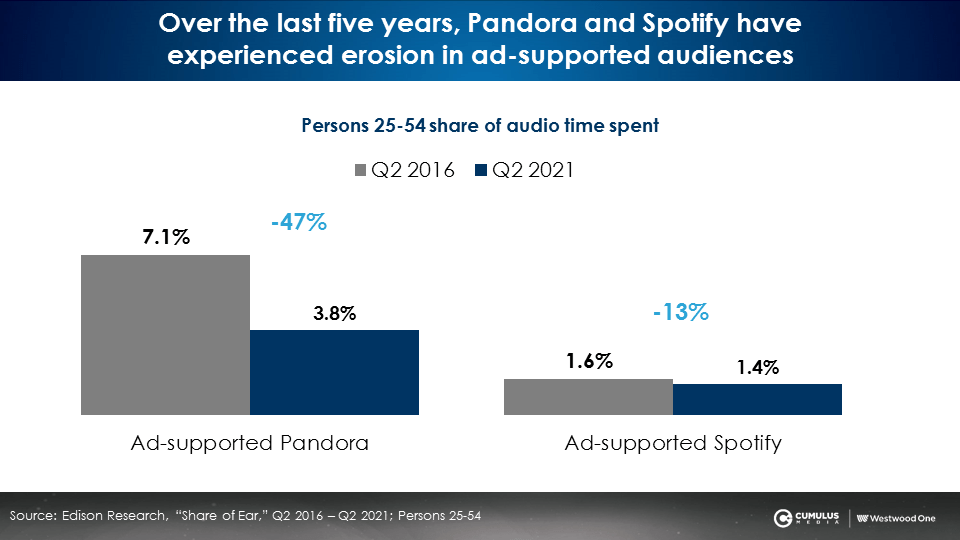

1. Over the last five years, Pandora and Spotify have experienced erosion in ad-supported audiences

Compared to Q2 2016, Spotify’s Q2 2021 ad-supported audience shares have dropped from 1.6% to 1.4%. Pandora’s ad-supported audience share has been cut in half (7.1% to 3.8%).

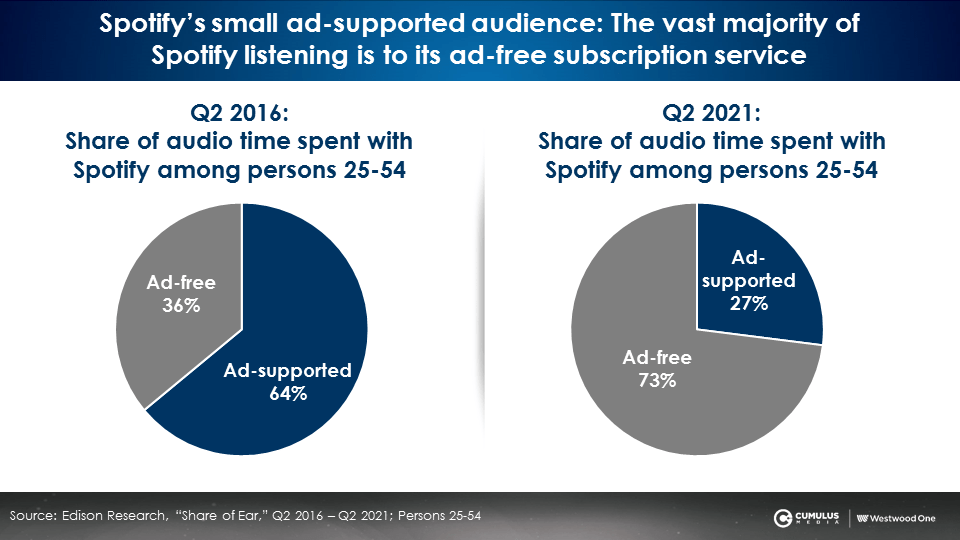

2. Spotify’s audience trends are a tale of two cities: Ad-free subscription audiences soar while ad-supported shares drop

Since 2016, Spotify’s ad-free subscription service audience shares have jumped from 0.9% to 3.7%. Meanwhile, Spotify’s ad-supported free service audiences are small and stagnant (1.6% to 1.4%).

Nearly three-quarters of Spotify listening is to its advertising-free subscription service. Unfortunately for advertisers, Spotify’s available advertising impressions are small and have never grown.

Despite the major effort and investments Spotify has made into podcasts, Edison reports only 5% of all time spent with Spotify goes to podcasts.

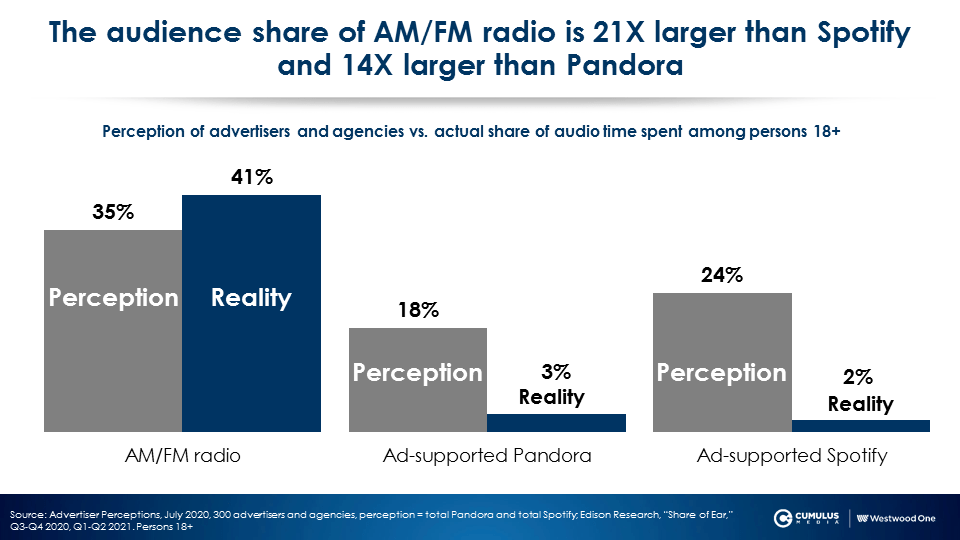

3. Perception vs. reality: Brands and agencies significantly overestimate Pandora and Spotify’s audiences

In July 2020, Advertiser Perceptions surveyed 300 marketers and media agencies on the audience shares of AM/FM radio, Pandora, and Spotify. Examining the Q2 2021 “Share of Ear” study, it is evident that there is a massive disconnect between perceptions and actual audience shares.

Brands and agencies perceive that Spotify’s share (24%) is twelve times larger than its actual 2% share. Pandora’s perceived 18% audience share is over six times larger than reality (3%).

AM/FM radio’s perceived share (35%) is 17% smaller than its actual 41% share. Per Edison, AM/FM radio’s audience is 21X larger than Spotify and 14X larger than Pandora.

“Share of Ear” data proves that advertisers are not taking the “me” out of media

Mark Ritson, the renowned Marketing Professor, describes this phenomenon: “There is increasing global evidence that marketers are basing their media choices on their own behavior or that stoked by the digitally obsessed marketing media, rather than actual audience data.”

Perception is shaded by personal experience. For marketers and agencies, this creates a major disconnect with reality. Media decision makers need to take the “me” out of media.

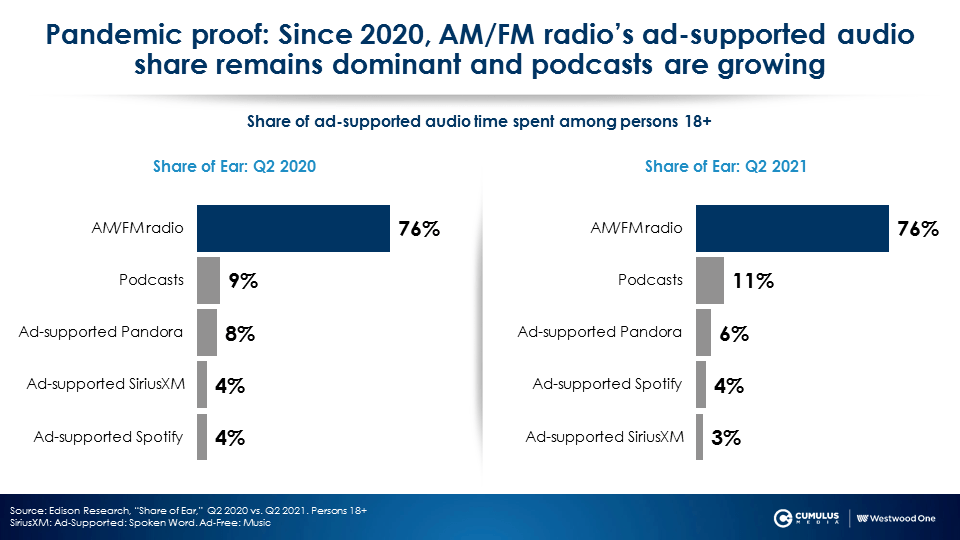

4. Podcast audiences have tripled since 2017

The persons 18+ ad-supported share for podcasts in Q2 2021 (11%) is three times the share from Q2 2017 (4%). All of the growth in ad-supported audio is coming from podcasting.

5. Audio is pandemic proof as AM/FM radio represents three-fourths of all ad-supported audio

The pandemic did not cause major disruption in audio use. Comparing shares of ad-supported audio from Q2 2020 to Q2 2021 reveals little change. At a 76% share, AM/FM radio continues to dominate ad-supported audio.

6. AM/FM radio owns the car with a 90% share of ad-supported audio six years in a row

Since Edison began the “Share of Ear” study, AM/FM radio’s in-car share of ad-supported audio has hovered around a 90% share. AM/FM radio owns the “last mile” of shopping trips before purchases are made.

7. 15 cents out of every AM/FM radio ad dollar can go to the stream as streaming now represents 15% of persons 25-54 AM/FM radio listening

Since 2016, the share of AM/FM radio time spent occurring via the stream has grown from 8% to 15%. Streaming is now bigger than AM radio, which represents 10% of listening.

Key findings:

- Over the last five years, Pandora and Spotify have experienced erosion in ad-supported audiences

- Spotify’s audience trends are a tale of two cities: Ad-free subscription audiences soar while ad-supported shares drop

- Perception vs. reality: Brands and agencies significantly overestimate Pandora and Spotify’s audiences

- Podcast audiences have tripled since 2017

- Audio is pandemic proof as AM/FM radio represents three-fourths of all ad-supported audio

- AM/FM radio owns the car with a 90% share of ad-supported audio six years in a row

- 15 cents out of every AM/FM radio ad dollar can go to the stream as streaming now represents 15% of persons 25-54 AM/FM radio listening

Brittany Faison is the Insights Manager at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.