Edison’s “Share Of Ear” Q3 2022: AM/FM Radio Streaming Listening Surges, Now 20% Bigger Than Ad-Supported Spotify And Pandora Combined, And Podcast Audiences Explode

Click here to view a 13-minute video of the key findings.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. Edison Research surveys 4,000 Americans to measure daily reach and time spent for all forms of audio.

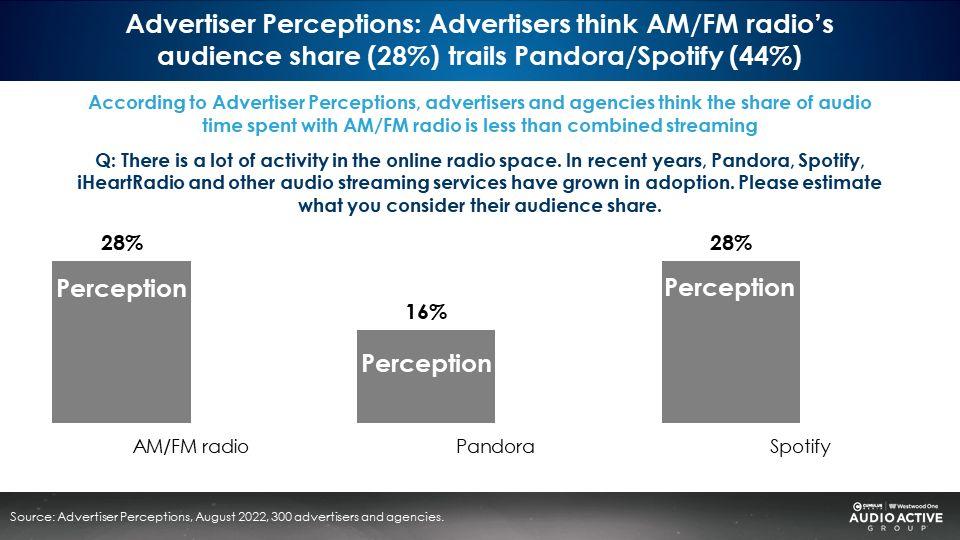

Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and overestimate Pandora and Spotify audiences

The just released Q3 2022 report reveals a yawning gap in agency/marketer perceptions of audio audiences. A study of 300 media agencies and marketers conducted in August 2022 by Advertiser Perceptions, the gold standard measurement firm of advertiser sentiment, found the perceived combined share of Pandora/Spotify is 44%, much greater than the perceived share of AM/FM radio (28%).

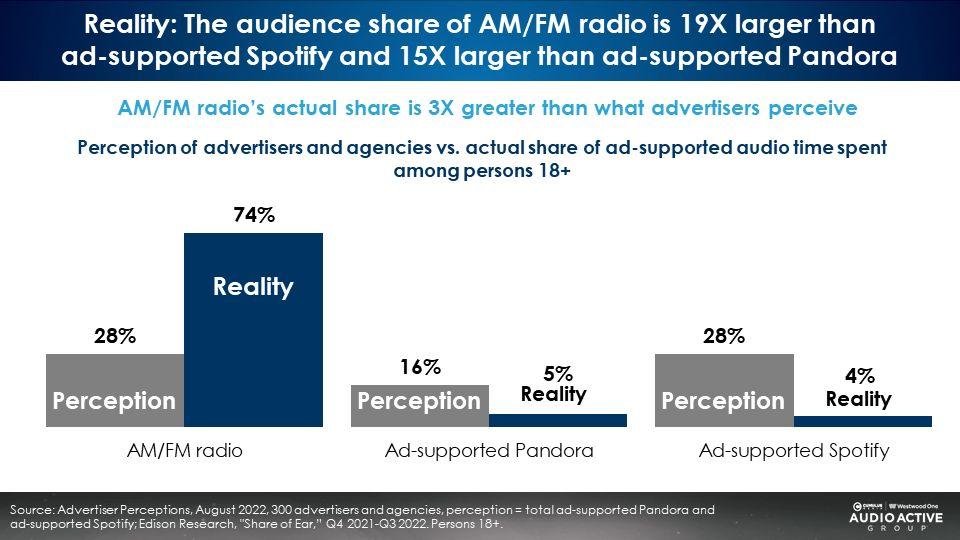

What are the actual shares? The “Share of Ear” reality is quite different!

AM/FM radio’s actual share is three times larger than what advertisers perceive. According to the Q3 2022 “Share of Ear,” AM/FM radio’s persons 18+ share of ad-supported audio (74%) is 15 times larger than Pandora (5%) and 19 times greater than Spotify (4%).

“Share of Ear” data proves that advertisers are not taking the “me” out of media

Mark Ritson, the renowned Marketing Professor, describes this phenomenon: “There is increasing global evidence that marketers are basing their media choices on their own behavior or that stoked by the digitally obsessed marketing media, rather than actual audience data.”

Perception is shaded by personal experience. For marketers and agencies, this creates a major disconnect with reality. Media decision makers need to take the “me” out of media.

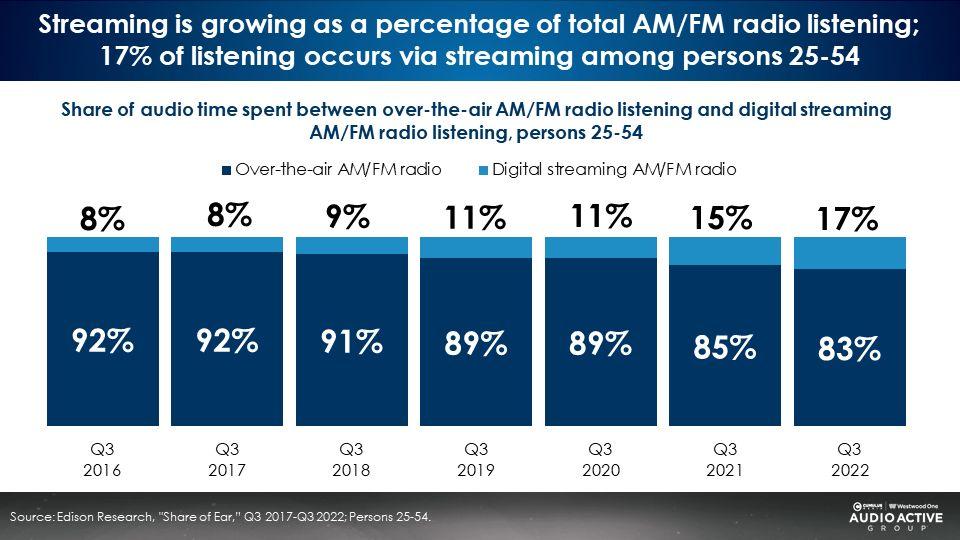

AM/FM radio streaming hits a record high, representing 17% of persons 25-54 AM/FM radio listening

Among 25-54s, AM/FM radio streaming now accounts for 17% of total AM/FM radio listening. The share of total AM/FM radio listening occurring via the stream has doubled over the last five years (8% to 17%).

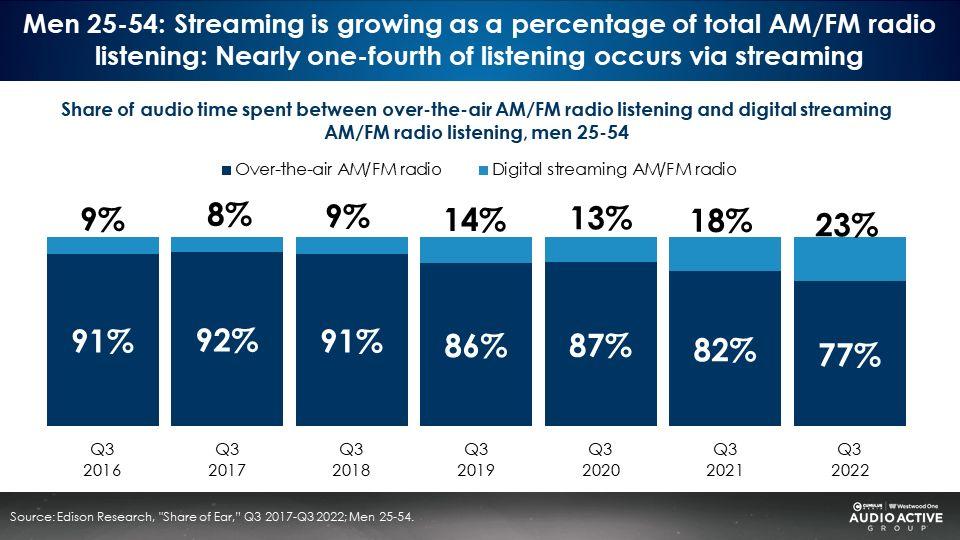

All AM/FM radio streaming growth is coming from men; Among men 25-54, AM/FM radio streaming represents an astonishing 23% of all AM/FM radio listening, up 3X from 2016 (8%)

Nearly a quarter of all men 25-54 AM/FM radio time spent listening occurs via the stream.

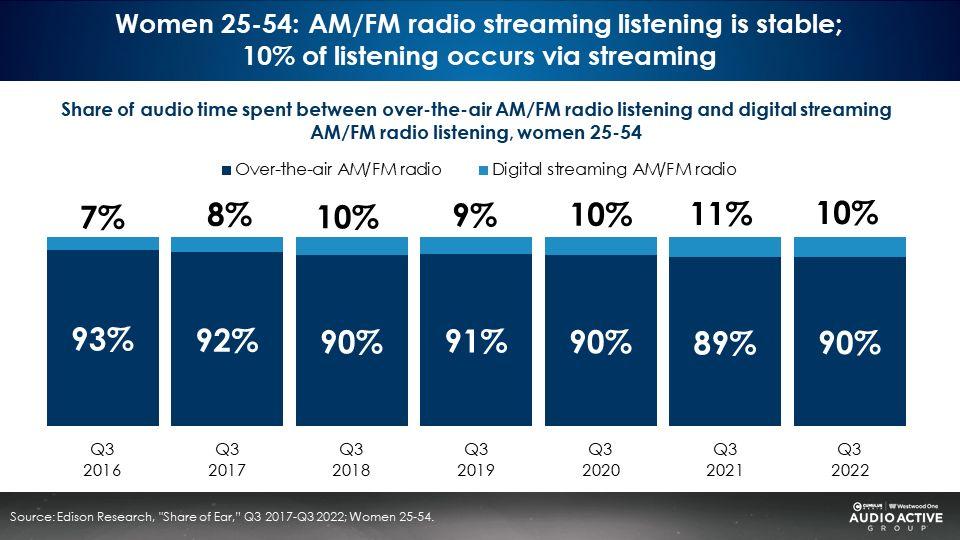

Among women 25-54, AM/FM radio streaming has been flat since 2018

In contrast to men, women are spending less time with AM/FM radio streaming. In Q3 2022, 10% of all AM/FM radio time was from the stream among women 25-54 with the majority of their AM/FM radio consumption occurring over the air (90%). There has been little change in the proportion of AM/FM radio listening occurring via the stream among women 25-54.

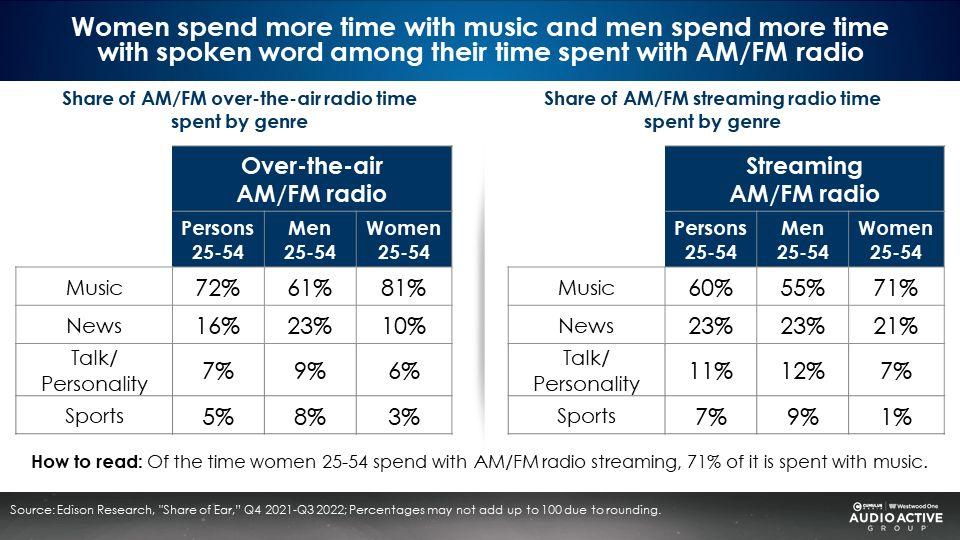

Spoken word represents a far greater share of AM/FM radio streaming time spent (41%) compared to over-the-air AM/FM radio (28%); Among men, nearly half of AM/FM radio streaming time spent goes to spoken word

Among men 25-54, spoken word comprises 44% of streaming time spent. Among women 25-54, spoken word comprises 29% of AM/FM radio streaming time spent.

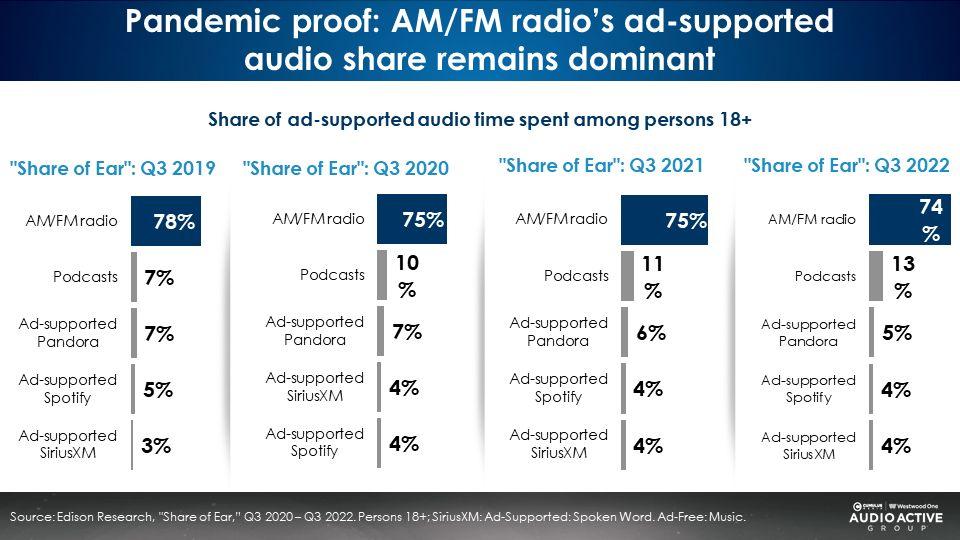

Audio shares are pandemic proof revealing little change before, during, and after the pandemic

Many have wondered if the pandemic shifted audio usage patterns. Overall, ad-supported shares are remarkably consistent from Q3 2019 to Q3 2022. AM/FM radio is stable and dominant.

Podcasts are up. Pandora is down. Spotify and SiriusXM remain small. For the most part, a very stable trend.

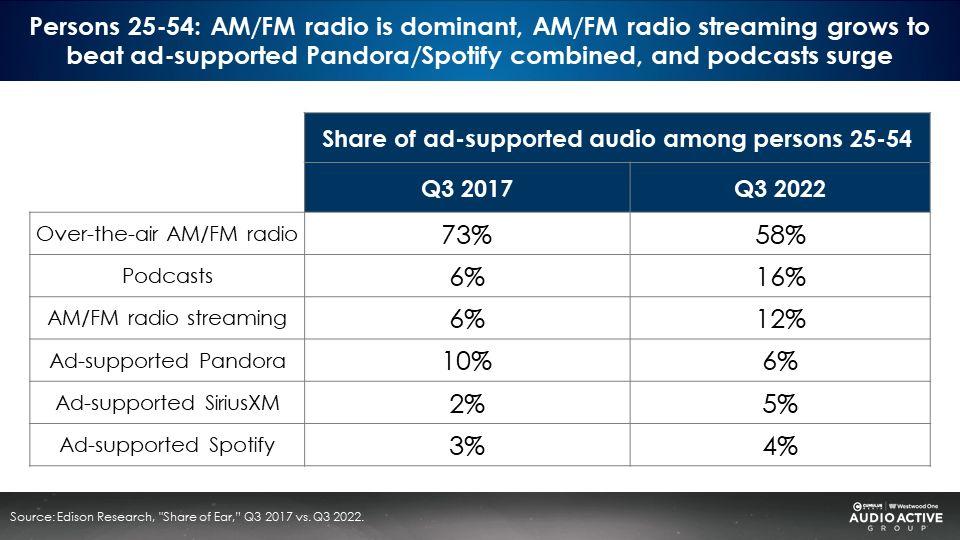

2022 versus 2017: AM/FM radio is dominant, AM/FM radio streaming doubles, podcasts are up 2.5X, Pandora is down, and Spotify up slightly

Looking back over the last five years, the same trends have occurred. Among persons 25-54, AM/FM radio streaming has doubled in five years (6% to 12%). Podcasts have surged from 6% to 16%. Pandora is down significantly (10% to 6%). Spotify is small and up slightly (3% to 4%).

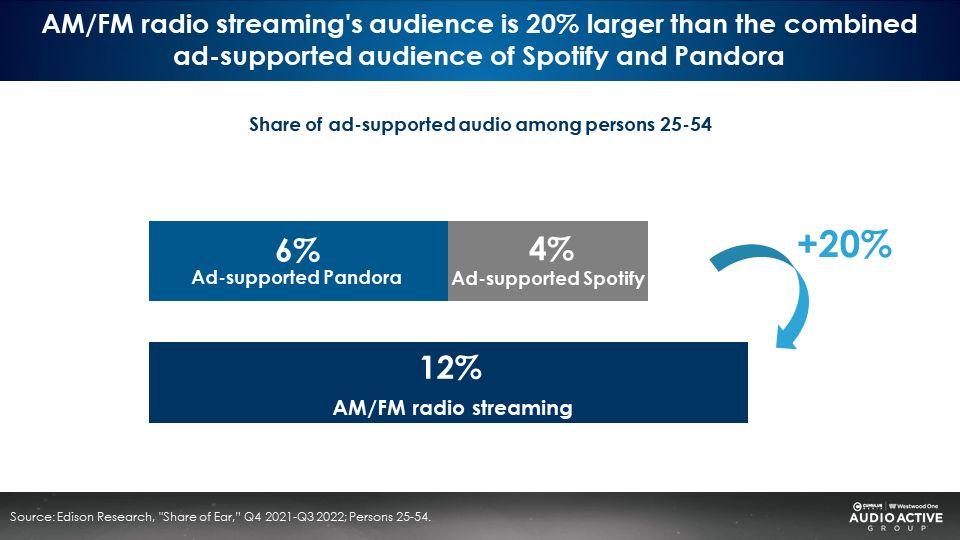

Head snapper: AM/FM radio’s 25-54 streaming audiences are 20% larger than ad-supported Spotify and Pandora combined

Among 25-54s, the ad-supported audiences of Pandora (6%) and Spotify (4%) are quite small. AM/FM radio’s streaming share of 12% is 20% larger than Pandora and Spotify combined.

Podcast audiences are on fire: Reach and share surge

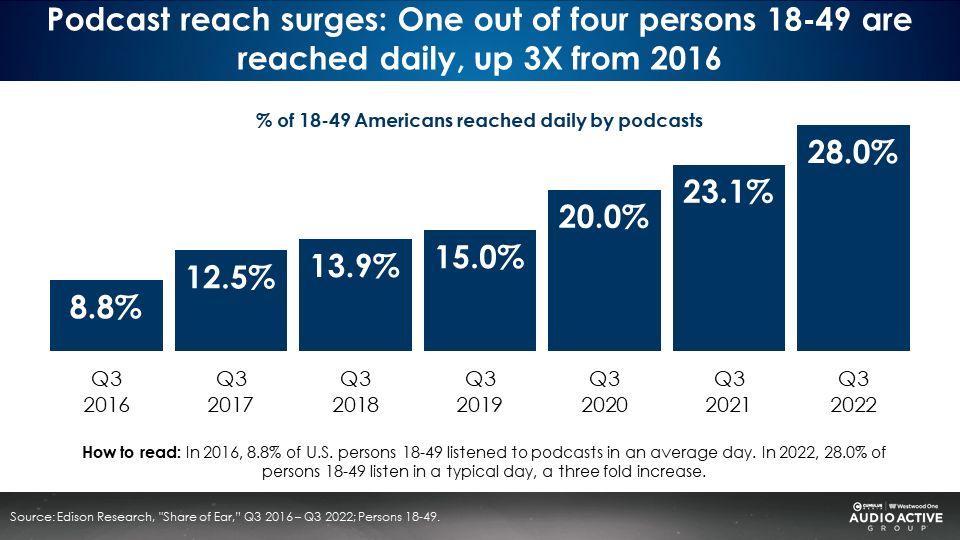

Since the pandemic, daily podcast audiences have been on a tear. From 2016 to 2019, podcast weekly reach grew modestly and consistently by 6 points over four years (8.8% to 15%).

From 2019 to 2023, podcast daily reach has grown dramatically, up 13 points (15% to 28%), far more growth in the most recent four-year period. The pandemic has put podcast audiences into overdrive and growth continues unabated.

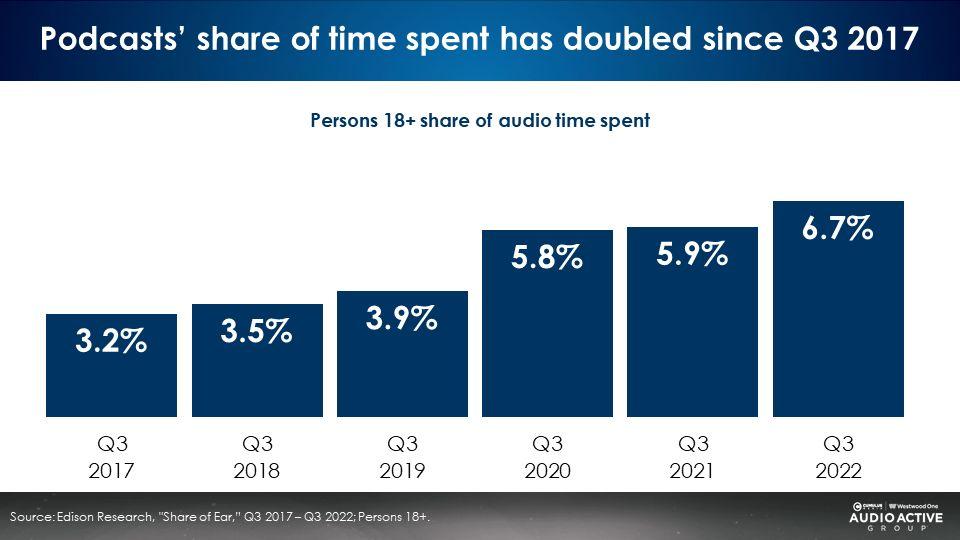

Post pandemic, podcast shares among persons 18+ have soared from a 3.9% in 2019 to a 6.7% in Q3 2022.

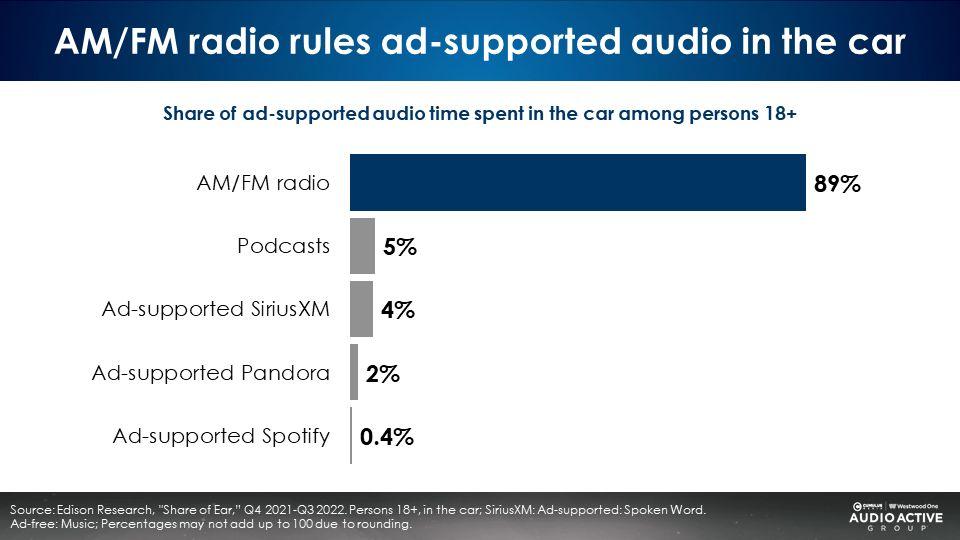

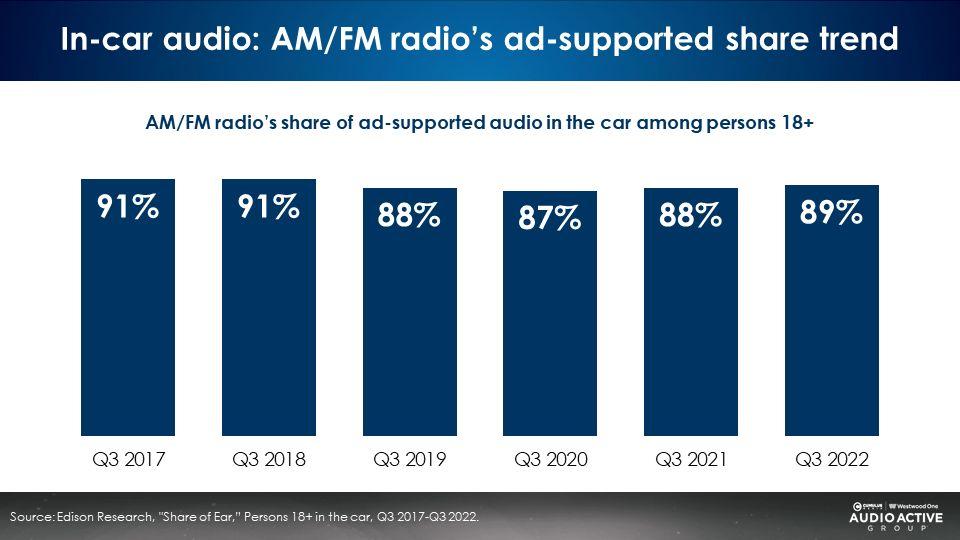

AM/FM radio is the “queen of the road” with a stunning 89% share of ad-supported audio in the car

AM/FM radio’s dominant in-car ad-supported shares have been rock steady over the past six years

Key takeaways:

- Perception vs. reality: Agencies and advertisers underestimate AM/FM radio shares and overestimate Pandora and Spotify audiences

- “Share of Ear” data proves that advertisers are not taking the “me” out of media

- AM/FM radio streaming hits a record high, representing 17% of all 25-54 AM/FM radio listening and 23% of male listening; The proportion of AM/FM radio listening among women 25-54 has remained consistent

- AM/FM radio streaming audiences are 20% larger than ad-supported Spotify and Pandora combined

- Audio shares are pandemic proof, revealing little change before, during, and after the pandemic

- AM/FM radio is the “queen of the road” with a stunning 89% share of ad-supported audio in the car

- AM/FM radio’s dominant in-car ad-supported shares have been rock steady over the past six years

- Podcast audiences continue to surge with reach and share growth

Click here to view a 13-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.