First-Ever Auto Brand “Share Of Ear” Reveals Listening Among Car Owners: AM/FM Radio Represents 60% All In-Car Tuning And 85% Of In-Car Ad-Supported Audio

Click here to download a PDF of the slides.

Click here to view a 10-minute video of the key findings.

As automakers contemplate audio entertainment options and designs for their vehicles, they acknowledge that AM/FM radio is the most listened to in-vehicle audio platform. However, important questions are raised: “What do the drivers of my vehicles listen to in the car? How do the audio habits of my brand’s drivers differ from the total U.S. average?”

Introducing the first-ever analysis of Edison’s “Share of Ear” among auto brand drivers

The Cumulus Media | Westwood One Audio Active Group® conducted a special analysis of Edison’s “Share of Ear,” the long running audio time use tracking study.

Edison Research’s quarterly “Share of Ear” study is the authoritative examination of time spent with audio in America. Edison Research surveys 4,000 Americans annually to measure daily reach and time spent for all forms of audio.

“Share of Ear” can report audio time use among auto brands’ drivers. Since the inception of the study in 2014, Edison has asked, “What is the model year and brand of your primary car or truck – that is, the one vehicle you spend the most time driving or riding as a passenger?”

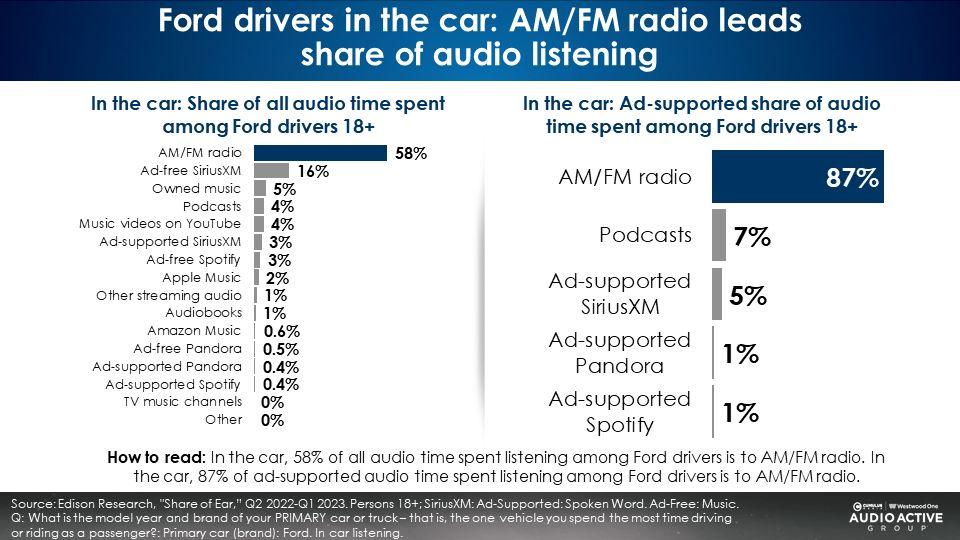

Ford drivers in the car: AM/FM radio has a 58% share of all audio time spent and an 87% share of ad-supported audio

First, we examine listening to all forms of audio in Ford vehicles. This includes subscription services like Spotify and SiriusXM whose music channels do not accept ads.

Among Ford drivers, AM/FM radio has a 58% of all in-car tuning minutes. AM/FM radio’s share is three times greater than the next source, the ad-free music channels of SiriusXM. Number three is owned music, or music people have purchased like iTunes downloads, CDs, etc.

On the right of the above chart are in-car ad-supported audio shares among Ford drivers. AM/FM radio has a whopping 87% share, distantly followed by podcasts (7%) and ad-supported SiriusXM (the spoken word channels which accept ads) at a 5%. Ad-supported Pandora and Spotify only have a one share each.

If Ford wanted to run ads targeting their owners and prospective customers in their vehicles, AM/FM radio would seem to be a good choice with an 87% share among Ford drivers

This new Edison “Share of Ear” data among auto brand drivers serves two purposes. First, it helps product design and operations teams at auto manufacturers understand the massive use of AM/FM radio among their customers. For the brand marketing teams, it shows how AM/FM radio is such a powerful marketing platform to reach American drivers to build auto brands.

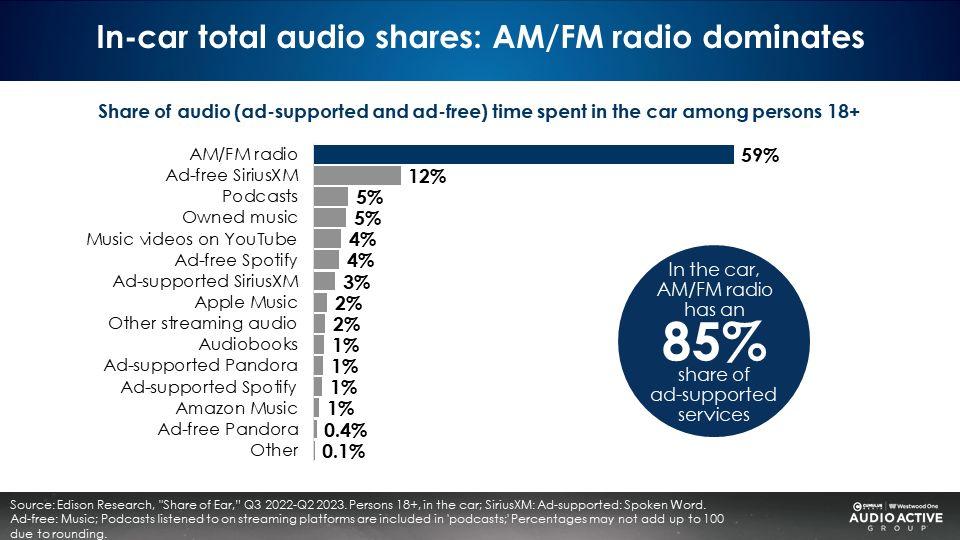

Among all U.S. drivers, AM/FM radio has a 59% share of all audio time spent in the car

Examining listening among all drivers to all forms of audio in the car, 59% of all minutes spent with audio in the car go to AM/FM radio. A distant number two at a 12% are the ad-free music channels of SiriusXM.

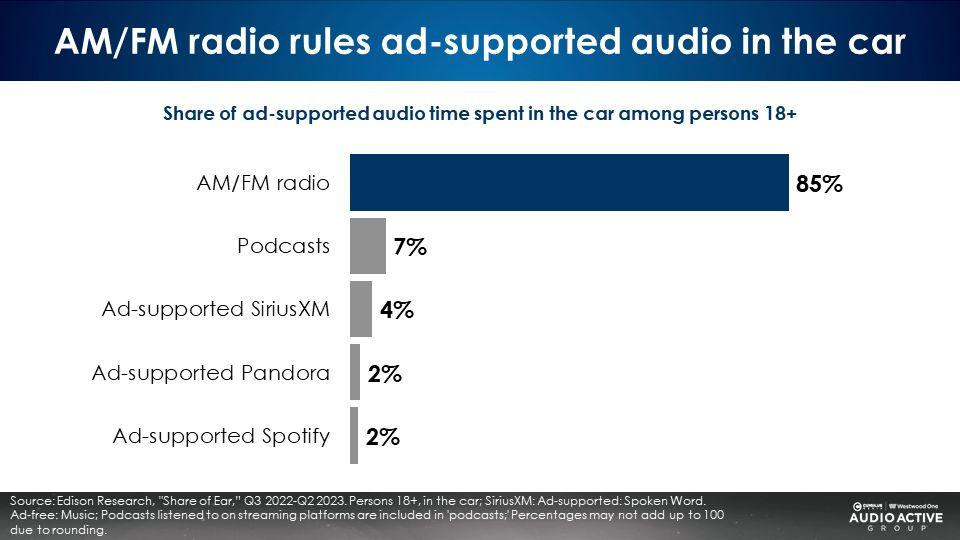

Among all U.S. drivers, AM/FM radio is the ad-supported queen of the road with an 85% share of in-car ad-supported audio

Looking at all ad-supported listening taking place in the car among all drivers, AM/FM radio has a massive 85% share. What better place to build an auto brand among the ideal auto intenders than among in-car consumers daydreaming about their next vehicle?

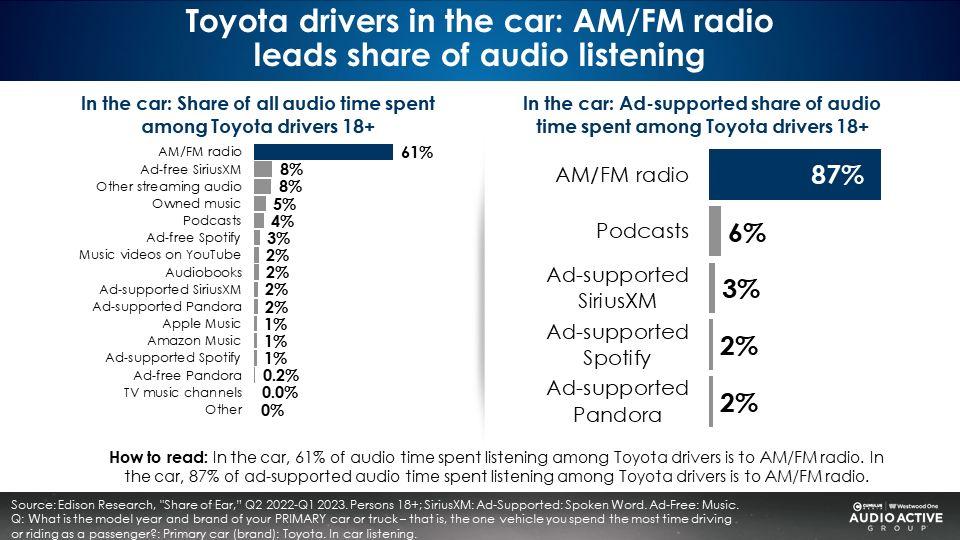

Toyota drivers: AM/FM radio has a 61% share of all audio and an 87% share of ad-supported listening

Similar to Ford, AM/FM radio leads share of all audio time spent and dominates ad-supported audio listening among Toyota drivers.

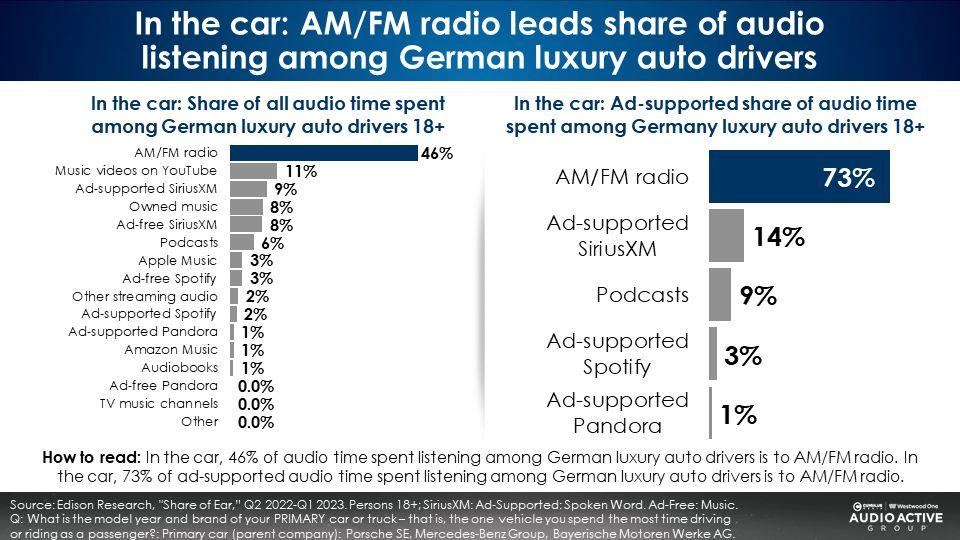

Luxury German brand drivers (Mercedes, BMW, Porsche): AM/FM radio leads total audio time spent with greater tuning to SiriusXM spoken word channels

Among upscale German brand drivers, the spoken word channels of SiriusXM (which accept ads) have a higher in-car ad-supported share (14%) versus the U.S. average (4%). This makes sense as luxury car owners are more likely to opt for the SiriusXM subscription service. Still, AM/FM radio has dominant 73% share of ad-supported audio among drivers of German luxury brands.

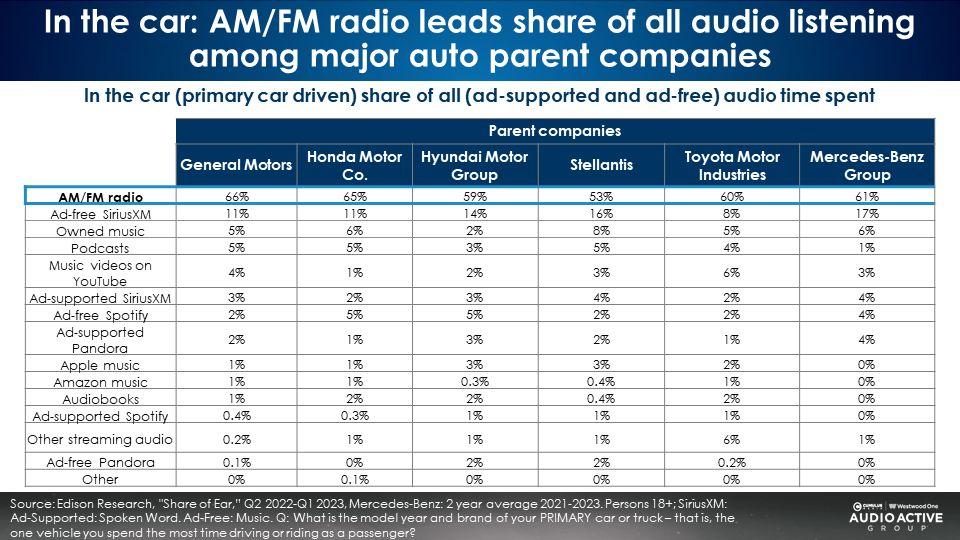

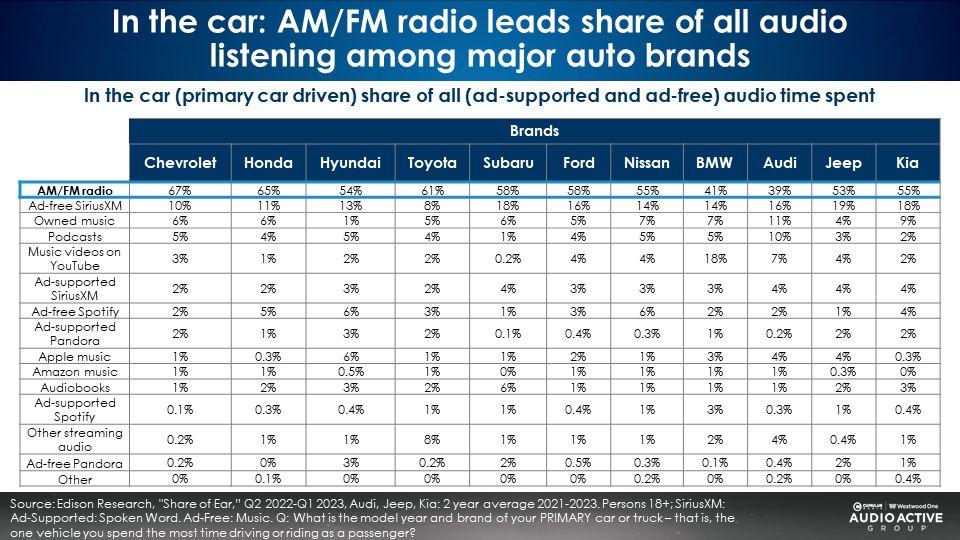

Auto brand in-car listening: Consistent shares to all audio by OEM parent and auto brand

The charts below depict in-car audio shares for all forms of audio among auto brand drivers. The first table includes in-car shares rolled up to the OEM parent company. Below that are in-car shares among auto brand drivers.

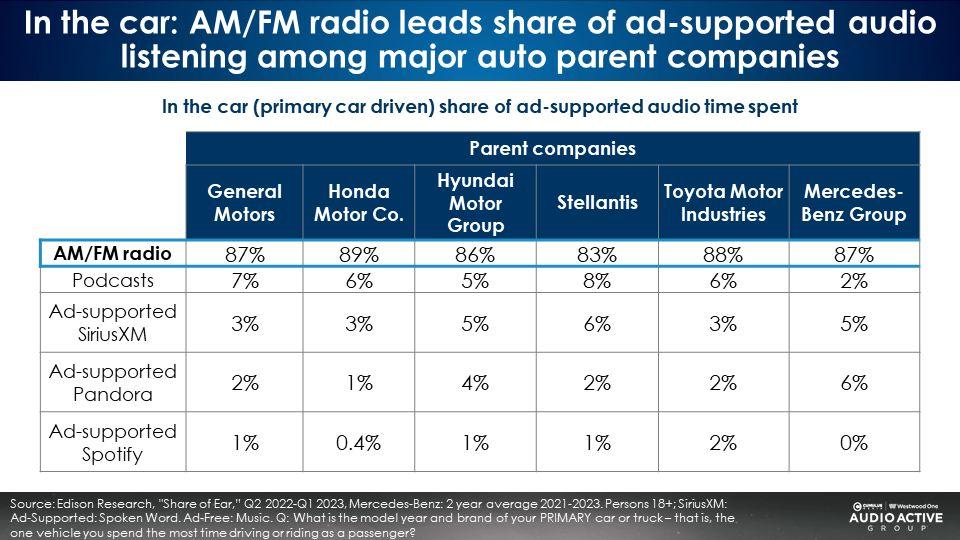

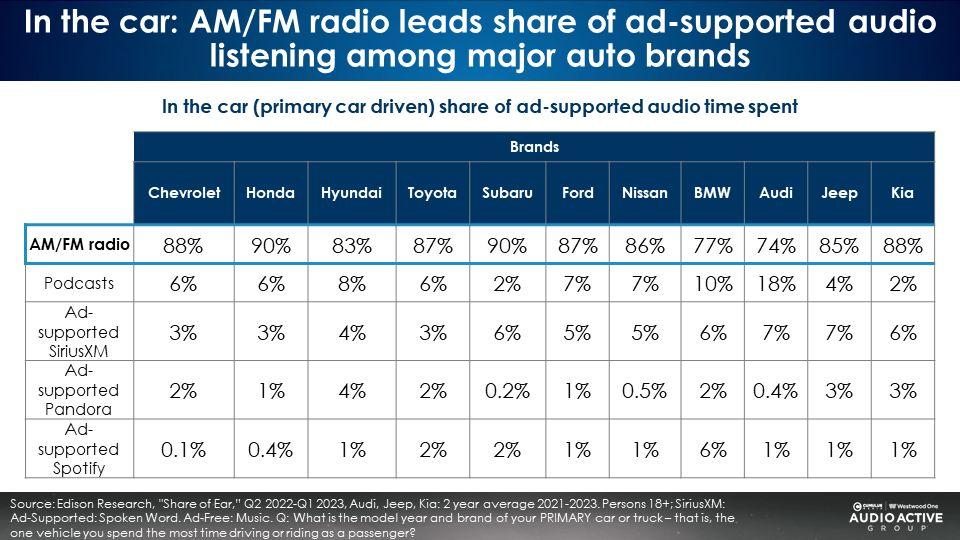

Auto brand in-car listening: Consistent ad-supported shares by OEM parent and auto brand

Below depicts in-car shares to ad-supported audio among brand drivers. First are in-car shares rolled up to the OEM parent company. Next are in-car shares among auto brand drivers. With an average ad-supported in-car share of 85%, these charts depict the huge opportunity that AM/FM radio affords auto OEM marketing teams.

Key takeaways:

- For product design and operations teams at auto manufacturers, it is important to understand the massive use of AM/FM radio among their customers

- For auto brand marketing teams, AM/FM radio is a powerful platform to reach American drivers to build auto brands

- Ford drivers in the car: AM/FM radio has a 58% share of all audio time spent and an 87% share of ad-supported audio

- If Ford wanted to run ads targeting their owners and prospective customers in their vehicles, AM/FM radio would seem to be a good choice with its 87% share among Ford drivers and an 85% share of all drivers

- Among all U.S. drivers, AM/FM radio is the ad-supported queen of the road with an 85% share of in-car ad-supported audio

- Toyota drivers: AM/FM radio has a 61% share of all audio and an 87% share of ad-supported listening

- Luxury German brand drivers (Mercedes, BMW, Porsche): AM/FM radio leads total audio time spent with greater tuning to SiriusXM spoken word channels

Click here to view a 10-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.