Nielsen: AM/FM Radio Expands Its Ratings Lead Over TV And Smashing AM/FM Radio’s Drive Time Myth

Click here to view a 14-minute video of the key findings.

Click here to download a PDF of the slides.

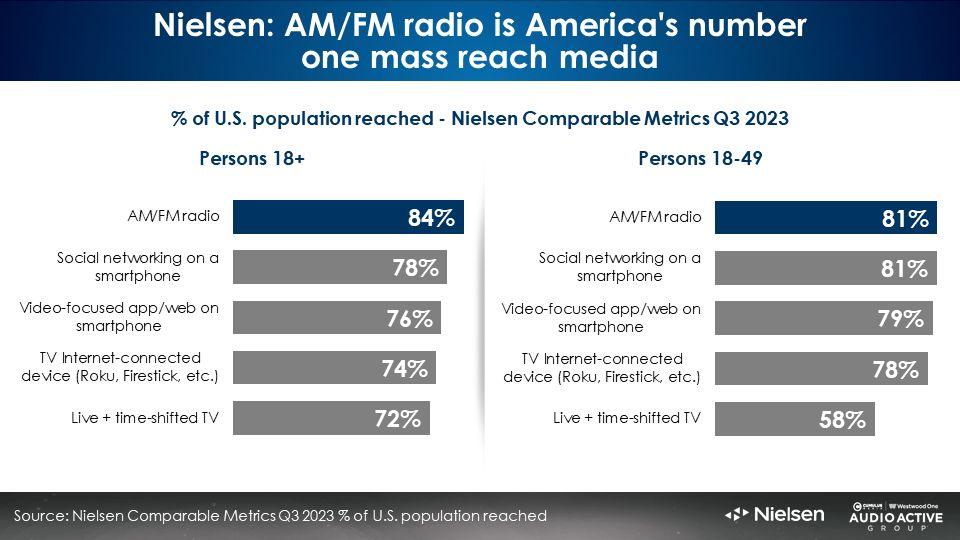

Nielsen’s just released Comparable Metrics from Q3 2023 reveals AM/FM radio continues to be America’s number one mass reach media. Among persons 18+, AM/FM radio out reaches social media, online video, TV/internet-connected devices, and TV.

Among persons 18-49, AM/FM radio’s weekly reach ties social media for first and slightly beats online video and connected TV devices. TV places a distant fifth in 18-49 weekly reach.

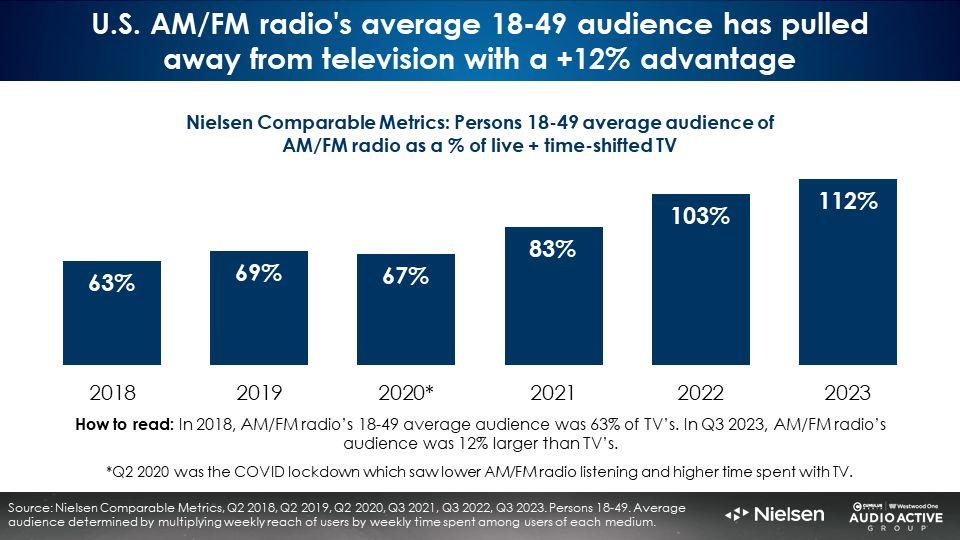

Among persons 18-49, AM/FM radio has pulled away from TV with a +12% average audience advantage

In 2018, AM/FM radio’s 18-49 average audience was 63% the size of live and time-shifted TV. Things have changed quickly.

A year ago, AM/FM radio beat TV by 3% in average audience. Now, Nielsen’s Q3 2023 Comparable Metrics reveals AM/FM radio’s persons 18-49 average audience is +12% greater than television. AM/FM radio’s ratings advantage over TV keeps growing.

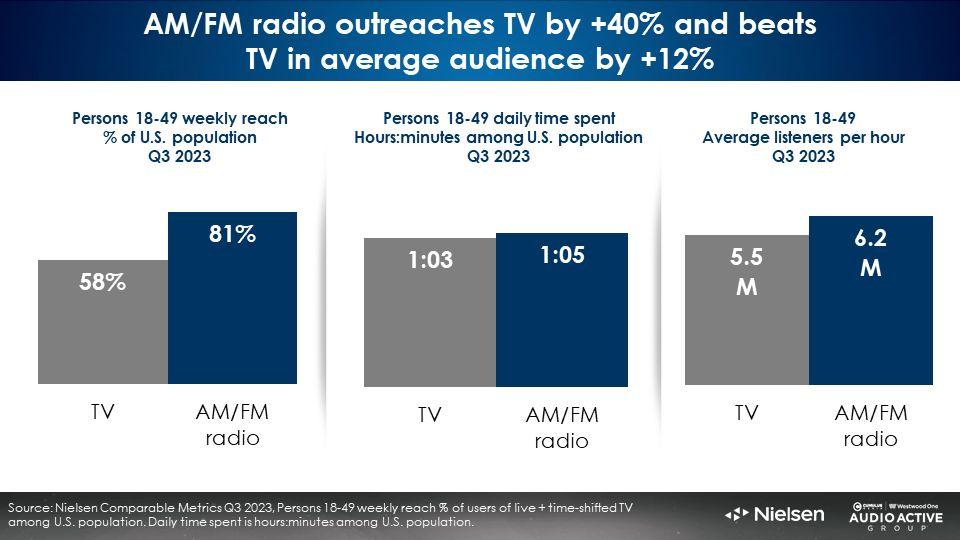

AM/FM radio reaches +40% more persons 18-49 than TV; Daily time spent with TV and AM/FM radio are now virtually tied

AM/FM radio’s weekly persons 18-49 reach of 81% is significantly larger than television’s 58%. Each week, 42% of U.S. persons 18-49 are not reached by live and time-shifted TV.

U.S. AM/FM radio reaches +40% more persons 18-49 than television. 18-49 daily time spent with TV and AM/FM radio are now virtually tied at a little over an hour.

WARC: Reach is the foundation of media effectiveness

According to Erwin Ephron, the father of modern media planning, reach is how advertising works. Ephron stated, “Most advertising usually works by reminding people about brands they know, when they happen to need that product. Ads work best when the consumer is ready to buy. Remind the many. Don’t lecture the few.”

The World Advertising Research Center (WARC) finds, “The reason reach remains so important is that growth tends to come from the large mass of light or infrequent buyers – so reaching as broad a group of category buyers as possible is an important objective when planning media. The primacy of reach to media effectiveness remains undimmed.”

In their book How Not To Plan: 66 Ways to Screw It Up, Les Binet and Sarah Carter advise, “Don’t target too narrowly. It may be efficient, but it’s rarely effective. Tight targeting means low sales and profits.” Using a mass reach media like AM/FM radio means the largest group of category buyers are hearing the advertising message.

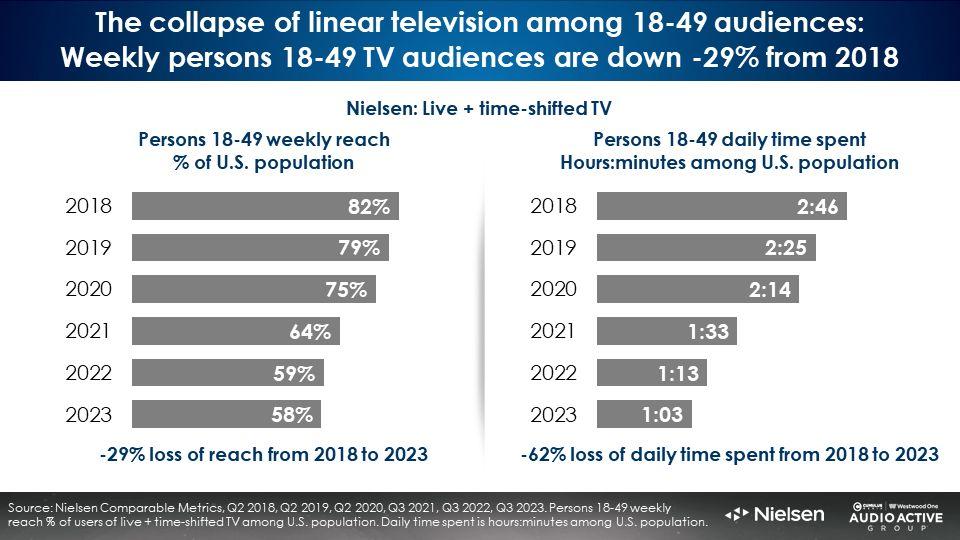

TV reach among persons 18-49 has dropped -29% and time spent viewing has eroded -62%

Since 2018, Nielsen’s Comparable Metrics reveals the 18-49 weekly reach of live and time-shifted TV has dropped -29%. Over the same period, TV’s daily time spent is down -62% from almost three hours a day to an hour a day.

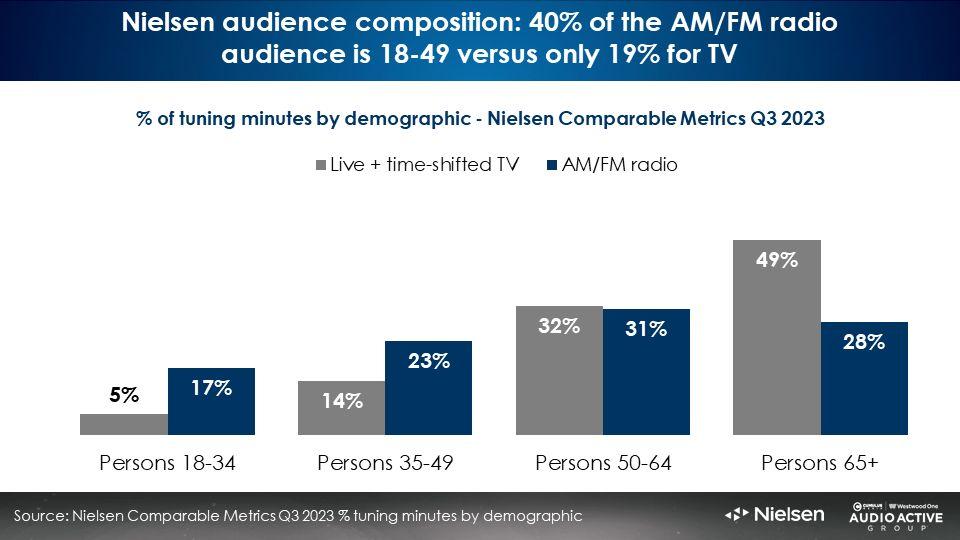

TV is what is playing in God’s waiting room: Half of the linear TV audience is 65+

Half of TV ad campaign impressions will consist of persons 65+, according to Nielsen’s Q3 Comparable Metrics. If a store or brand is using TV to reach 18-49s, only 19 cents out of every TV dollar will go to that target.

Only one-fifth of TV’s average audience is 18-49. The remaining 80% are over the age of 50. Conversely, Nielsen finds AM/FM radio is more evenly distributed with 40% aged 18-49 and 31% 50-64.

Perception vs. reality: Drive time Isn’t the only time for AM/FM radio

There is a common misperception among advertisers about when AM/FM radio listening actually happens. Many believe that most AM/FM radio listening occurs weekdays between 6AM and 10AM and 3PM and 7PM, a.k.a. “drive times.”

Some advertisers only buy drive times thinking they are getting most of AM/FM radio’s audience. That is a mistake.

The drive time perception could be based on AM/FM radio’s strength in vehicles. After all, AM/FM radio dominates in-car listening. According to Edison Research “Share of Ear” study from Q3 2023, AM/FM radio has an 85% share of ad-supported audio in the car.

It would stand to reason most AM/FM radio listening occurs when Americans are commuting to and from the workplace. But is that actually the case?

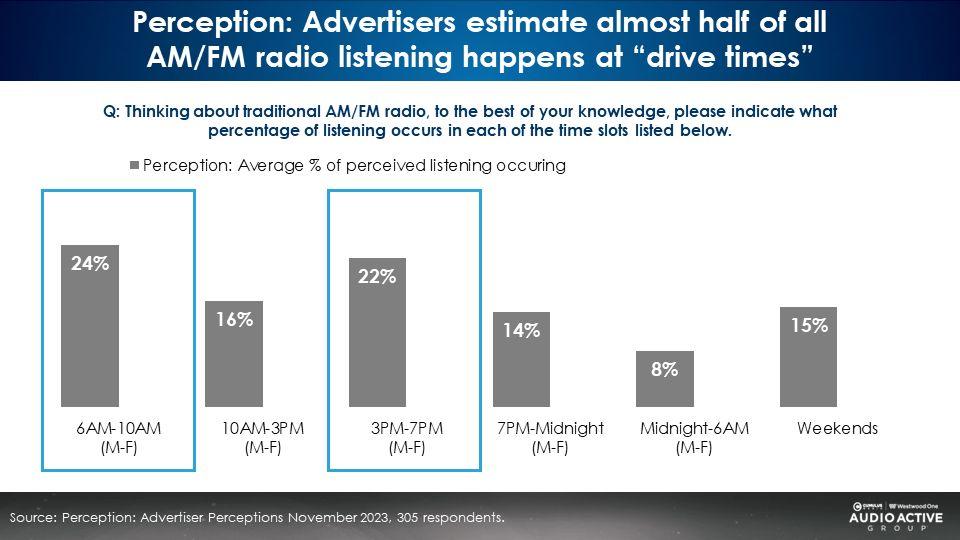

In November 2023, Advertiser Perceptions, the gold standard of advertiser and agency sentiment, surveyed 305 marketers and agency professionals to see when they think AM/FM radio listening happens.

Perception: Advertisers estimate almost half of all AM/FM radio listening happens during “drive times”

When thinking about traditional AM/FM radio, advertisers and agencies believe 24% of listening occurs during weekday morning drive, 6AM-10AM, followed by Monday-Friday afternoon drive, 3PM-7PM, at 22%. Agencies and advertisers think Middays, 10AM-3PM, is a distant third at 16%, narrowly inching out nighttime and weekends.

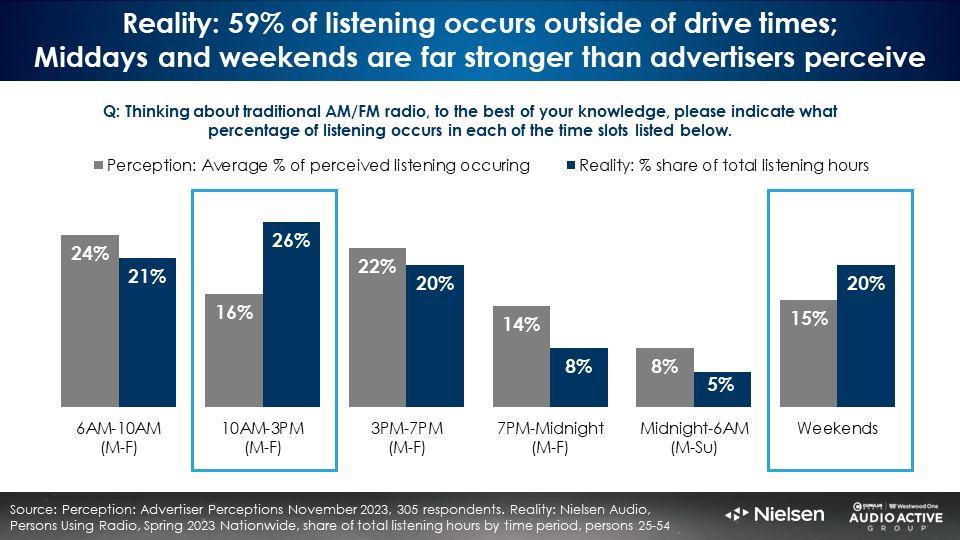

Nielsen reality: 59% of U.S. AM/FM radio listening occurs outside of drive times; Middays are the most listened to time period and weekend listening is far greater than suspected

While the perception is over half of AM/FM radio time spent occurs during morning and afternoon drive (Monday-Friday, 6AM-10AM and Monday-Friday, 3PM-7PM), Nielsen reports only 41% of AM/FM radio listening occurs during drive times. This is based on the Spring 2023 Portable People Meter and Diary data from Nielsen’s Nationwide Study.

Nielsen Audio shows there is a stark difference in perceived and actual AM/FM radio listening. The highest share of time spent among adults 25-54 is middays, 10AM-3PM (26%). Morning (21%) and afternoon (20%) drive times follow.

Why does Monday-Friday, 10AM-3PM have more listening than either morning drive or afternoon drive? Monday-Friday, 10AM-3PM is a five-hour daily daypart. AM and PM drives are only four hours per day each.

There is also a major disconnect about weekend listening. Advertisers perceive only 15% of all listening occurs during the weekend. The Nielsen reality is 20% – as big as morning or afternoon drive!

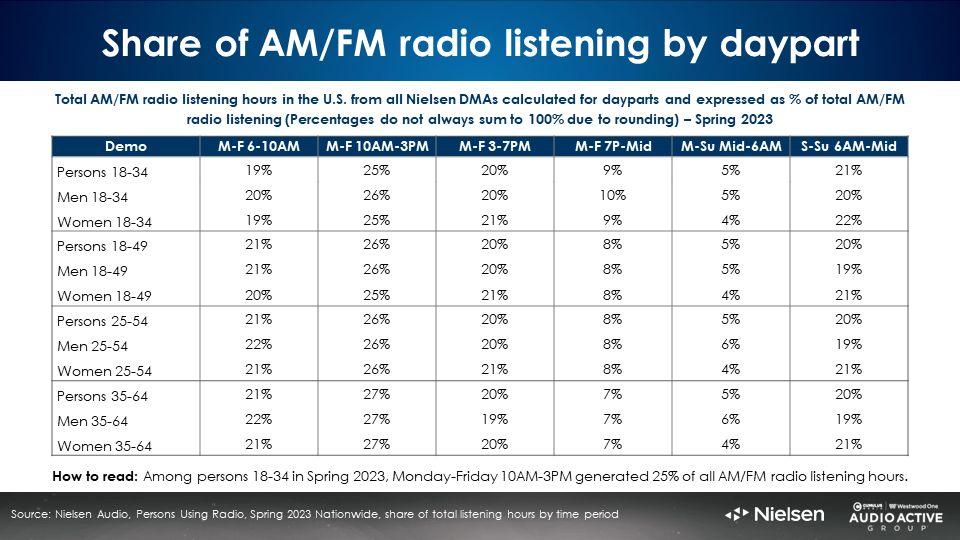

AM/FM radio’s share of listening by time period is very consistent by demographic

The table below depicts the daypart share of time spent for twelve major buying and selling demographics. The time period composition of listening to AM/FM radio is very similar across the diverse demographics.

The “only buy drive times” myth is dangerous and harmful to advertiser campaign reach and sales growth

Countless sales lift and ROI studies conclude that the number one media factor that drives sales is reach. The more people a campaign reaches, the greater the sales lift. Increasing reach is the bigger media lever that ensures a campaign can impact sales.

Restricting AM/FM radio buys to drive times misses 59% of the AM/FM radio audience. It reduces reach and harms advertiser sales effect.

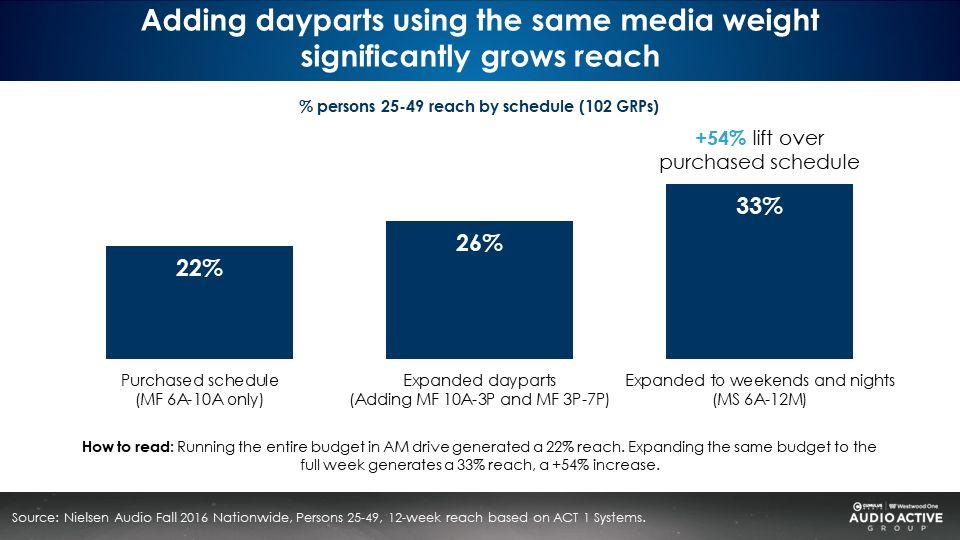

In the example below, an advertiser put all their money into morning drive and reached 22% of the market. As dayparts are added using the same budget, reach grows and grows.

Adding PM drive, middays, nights, and weekends grows reach from 22% to 33%. Spending the same budget on a broader daypart mix causes reach to soar +54%.

AM/FM radio is the soundtrack of the American worker

AM/FM radio does not just dominate in-car listening during drive time. It also has massive shares during the day when Americans are working. Tune in occurs when listeners are commuting and are at their place of employment.

Drive time is an important time for AM/FM radio advertisers. Middays and weekends are just as effective for advertisers to reach consumers. A media planning best practice is to spread investment over all days and dayparts.

Key takeaways:

- Among persons 18-49, AM/FM radio has pulled away from TV with a +12% average audience advantage, according to Nielsen’s Q3 2023 Comparable Metrics.

- AM/FM radio reaches +40% more persons 18-49 than TV. Daily time spent with TV and AM/FM radio are now virtually tied.

- TV is what is playing in God’s waiting room: Half of the linear TV audience is 65+.

- Perception: Advertisers estimate more than half of all AM/FM radio listening happens at “drive times.” The reality is only 41% of AM/FM radio time spent occurs during drive times.

- Nielsen reality: Middays are number one at 26% of total AM/FM radio time spent. Weekend listening is greater than suspected and has as much listening (20%) as morning and afternoon drive.

- Media planning best practice: Allocate weight across all days and time periods to grow reach.

Click here to view a 14-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.