Podcast Consumption Is Undercounted Due To Co-Listening, According To The Latest Cumulus Media And Signal Hill Insights’ Podcast Download – Spring 2024 Report

For the twelfth edition of the Podcast Download series, Cumulus Media and Signal Hill Insights retained MARU/Matchbox to conduct an in-depth study of 603 weekly podcast consumers from April 19-24, 2024. Two studies are conducted annually. The Spring 2024 Report highlights trends from prior studies and examines topics such as co-listening, platform preference, content trends, perceptions of brand safety and content appropriateness, and more.

Liz Mayer, Insights Manager of the Cumulus Media | Westwood One Audio Active Group®, and Paul Riismandel, Chief Insights Officer and Partner of Signal Hill Insights, conducted an extensive analysis of the Podcast Download consumer study.

Here are the key findings:

Podcast consumption is undercounted due to co-listening with friends, family, and children which is not included in selling audience estimates

Since the dawn of podcast advertising, audience measurement has long assumed only one person is being exposed to the ad. Imagine the TV industry always assuming only one person per TV set.

TVision, a leading TV analytics firm, reports TV audiences typically involve 1.3 viewers. Certain family apps like Disney+ have much higher joint tuning with 1.8 viewers. Hulu and Amazon Prime Video each have 1.5 viewers watching on their apps.

Podcast selling estimates never contemplated ad exposures by multiple people to the same show. The podcast industry is leaving “ears on the table.”

While the vast majority of podcasts are consumed via mobile (69%), Edison’s “Share of Ear” reports 11% of podcast time spent occurs on smart speakers and 6% occurs via connected TVs, both in-room devices. Seventeen percent of podcast time spent occurs in-car when others could be listening along.

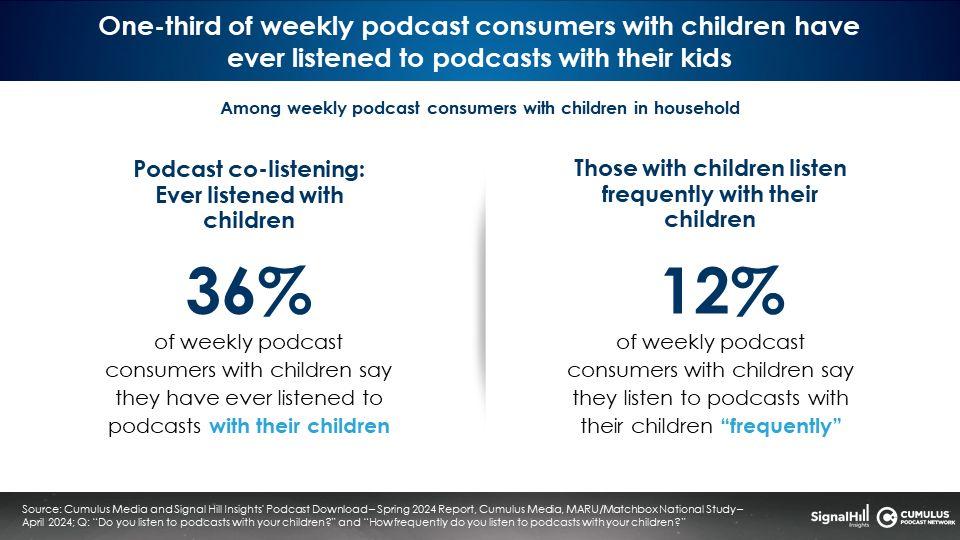

Our new research reveals podcast consumption is not always a solo act. Among weekly consumers with children in the household, 36% say they have ever listened to a podcast with their children. 12% say they frequently listen to podcasts with their children.

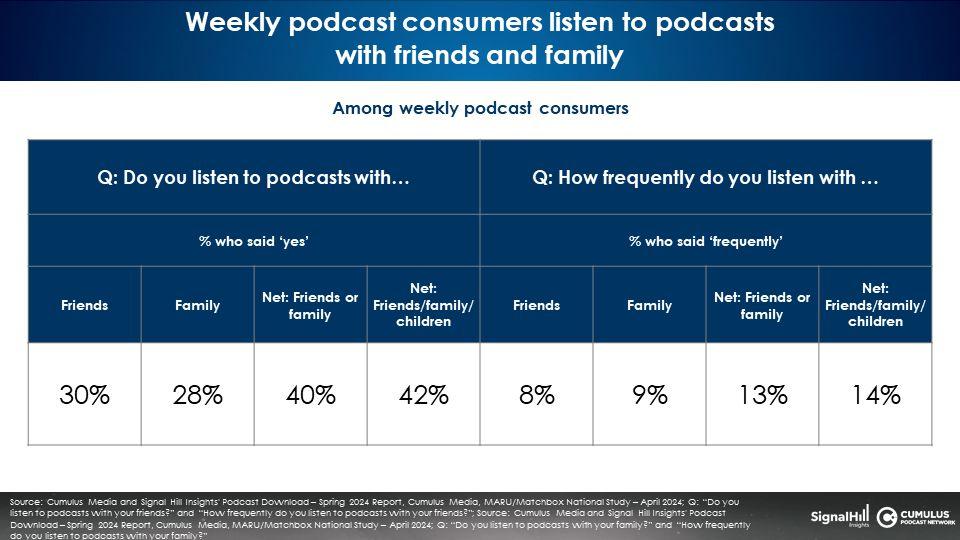

Overall, 14% of weekly podcast consumers say they frequently co-listen

When frequent co-listening with friends, family, and kids is netted out, 14% of weekly podcast consumers say they frequently listen/watch with others. 42% say they’ve listened at some point with others.

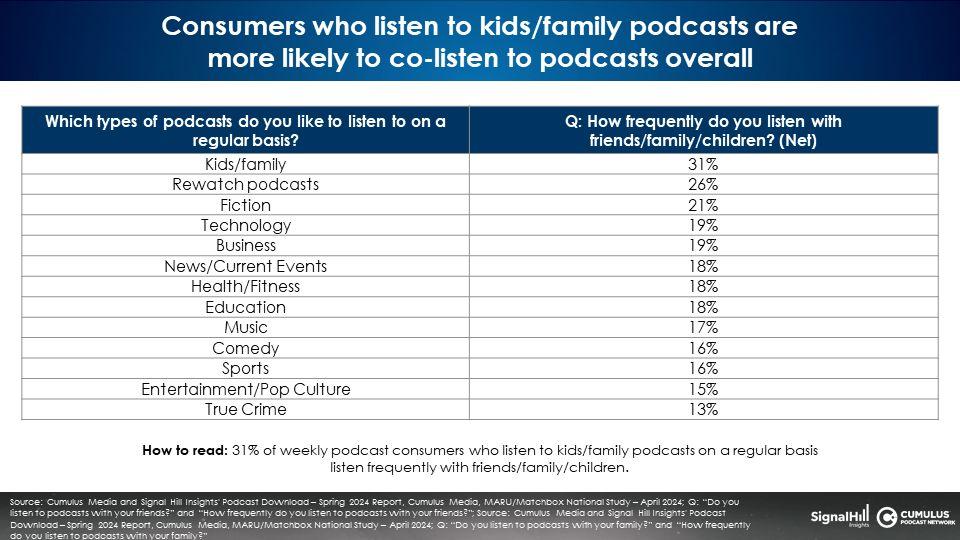

The podcast genre profile of co-listeners varies: Consumers who frequently co-listen make up a large proportion of the kids/family genre (31%) and rewatch podcasts (26%)

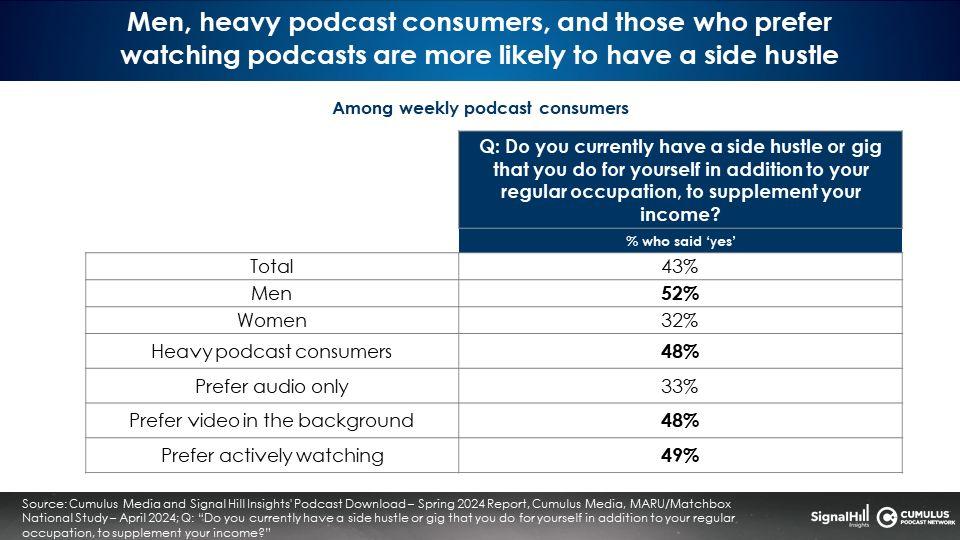

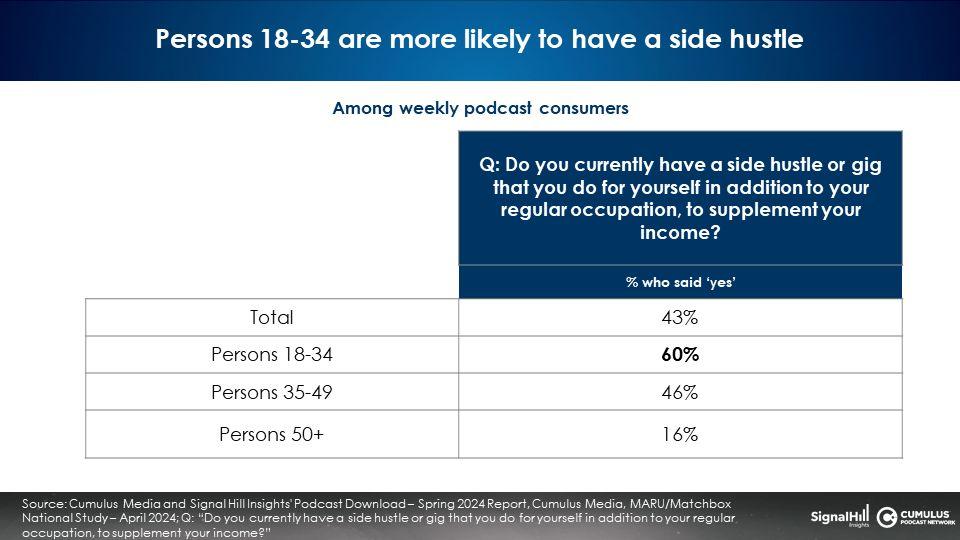

Podcasts are an ideal media platform to target entrepreneurs and those with multiple jobs: Half of heavy podcast consumers say they have a side hustle

Men, heavy podcast consumers, and those who prefer watching podcasts are more likely to have a side hustle. Those who prefer video either in the background or actively watching are also more likely to have side hustles than those who prefer audio only.

60% of 18-34 podcast consumers have a side hustle

The younger the podcast consumer, the more likely they are to have a side hustle with nearly two-thirds of 18-34 podcast consumers working a second gig.

For advertisers targeting those who are working in the gig economy, podcasts offer a rich audience of those with second jobs.

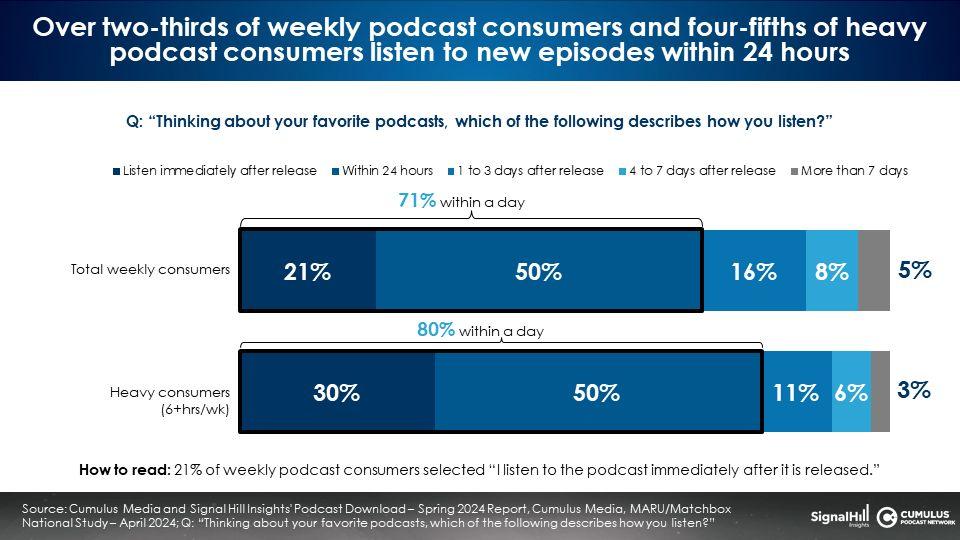

A substantial amount of podcast consumption happens within 24 hours of release

Among weekly consumers, 71% listen within a day. Among heavy consumers (those who consume six or more hours in a week), 80% listen within a day. For many, there is an immediacy to podcast consumption.

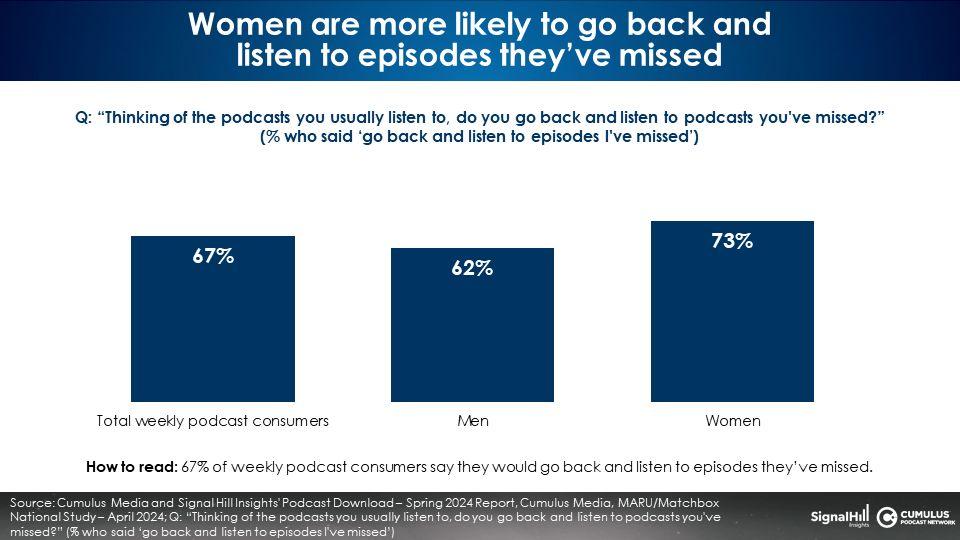

Podcast Pioneers and women like to listen to back episodes

Earlier in the year, the new iOS 17 software update changed how automatic downloads occurred. While the improvement was a positive step for podcast advertisers and content creators, there was still fear surrounding lower download numbers.

For new podcasts, 64% of women go back and listen to back episodes, higher than men (55%) and weekly podcast consumers (59%).

For podcasts they typically listen to, 73% of women go back and listen to episodes they have missed, greater than men (62%) and weekly podcast consumers (67%).

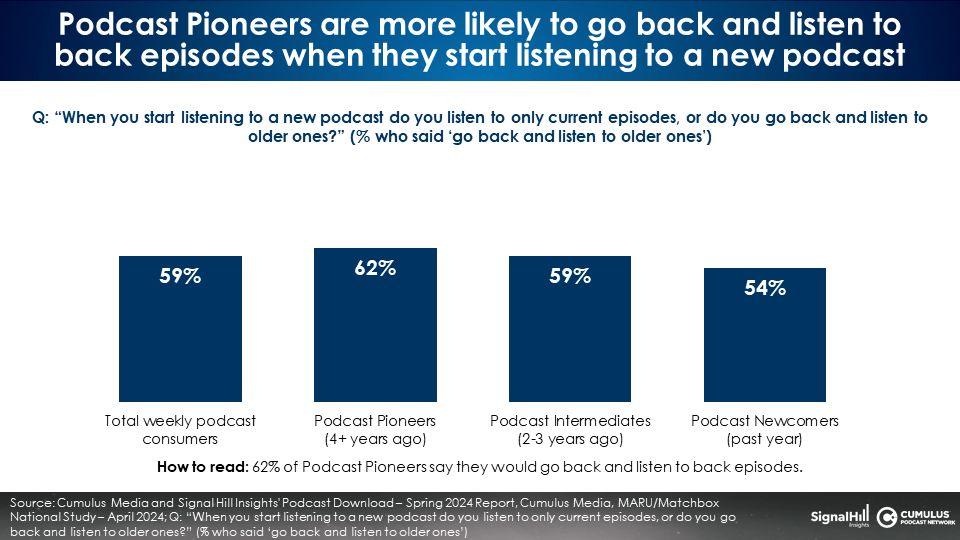

Podcast Newcomers (those who have started listening to podcasts in the past year) are less likely to listen to back episodes of a new podcast. Podcast Intermediates (those who started listening 2-3 years ago) and Podcast Pioneers (those who started listening to podcasts 4+ years ago) are more likely to go back and listen to back episodes when they start listening to a new podcast.

The same pattern exists with podcasts regularly consumed. 72% of Podcast Pioneers go back and listen to back episodes of their favorite podcasts versus 61% of Podcast Newcomers and 62% of Podcast Intermediates.

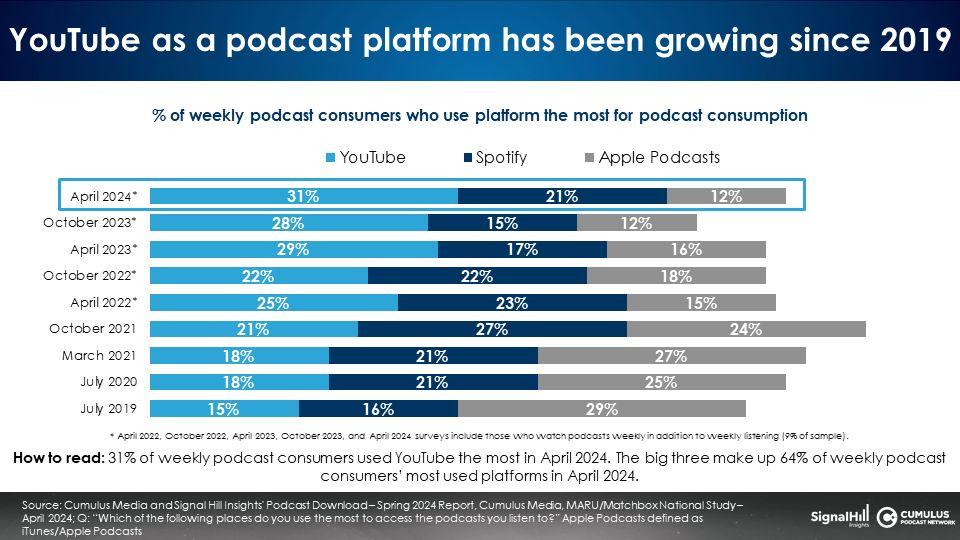

YouTube is the most utilized podcast listening platform in the U.S. for the last year and half: 31% say it is the platform they use the most, followed by Spotify (21%) and Apple (12%)

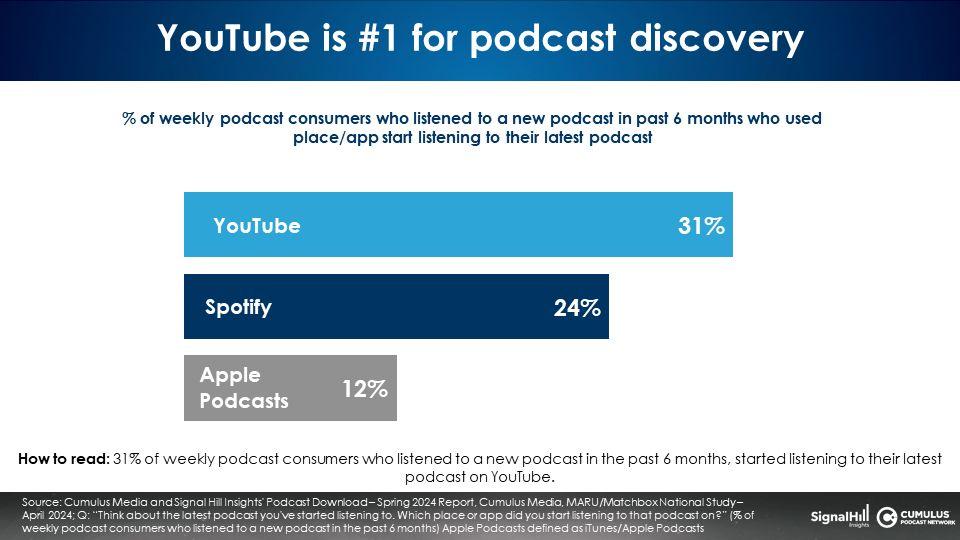

As the world’s entertainment search engine, YouTube is the dominant podcast discovery platform where audiences are more likely to find podcasts

Of the top three podcast platforms (YouTube, Spotify, and Apple Podcasts), YouTube dominates for podcast discovery. Of weekly podcast consumers who have listened to a new podcast in the past six months, a third have used YouTube to discover the podcast. Spotify is number two (24%) followed by Apple Podcasts (12%).

Podcast content creators need to be on YouTube in order to be present in the feeds of podcast consumers.

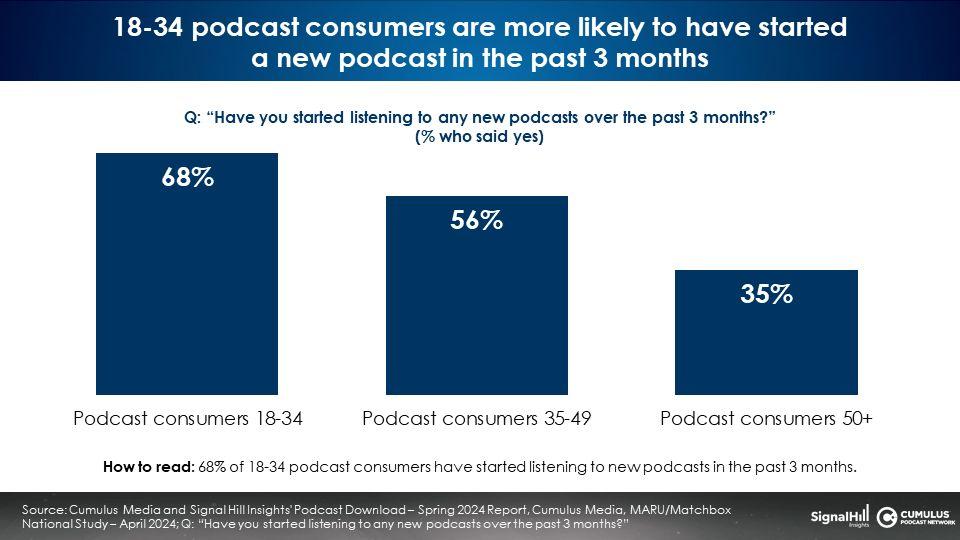

Younger podcast consumers are more likely to listen to new podcasts

18-34 podcast consumers are the most leaned in to new podcasts with 68% having started to listen to a new podcast in the past 3 months. As podcast consumers age, they listen to new podcasts less.

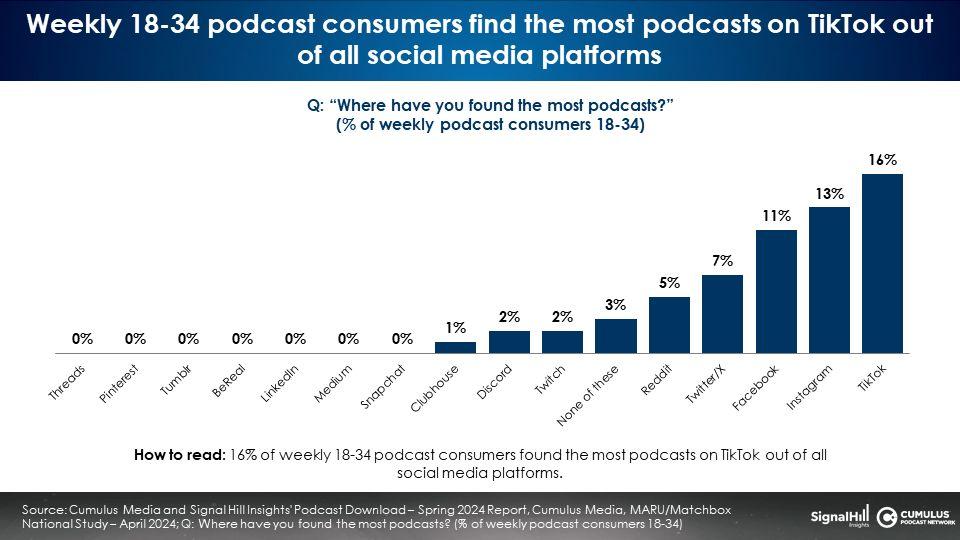

Across social media platforms, TikTok leads for podcast discovery among 18-34 podcast consumers

Examining just social media platforms, 16% of 18-34 weekly podcast consumers have found the most podcasts on TikTok. Instagram, Facebook, and Twitter/X follow.

Key takeaways:

- Podcast consumption is undercounted due to co-listening with friends, family, and children; 14% of the weekly podcast audience say they “frequently” listen with others

- The co-listening profile varies by genre: Consumers who frequently co-listen make up a large proportion of the kids/family genre (31%) and rewatch podcasts (26%)

- Half of heavy podcast consumers have a side hustle, which means podcasts are an ideal ad platform for brands to reach entrepreneurs and those with several roles

- Podcast Pioneers and women like to listen to back episodes

- YouTube is the most utilized podcast listening platform in the U.S. for the last year and half: 31% say it is the platform they use the most, followed by Spotify (21%) and Apple (12%)

- As the world’s entertainment search engine, YouTube is the dominant podcast discovery platform

- Across social media platforms, TikTok leads for podcast discovery among 18-34 podcast consumers

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.