Has Your Media Plan Fully Saturated Podcasts? To Grow Sales, Shift Weight From Cable To AM/FM Radio

Click here to view a 12-minute video of the key findings.

Click here to download a PDF of the full deck.

How does a brand generate incremental reach to grow sales without increasing the budget? Two brands, a meal kit firm and a subscription management app, were measured by the Harris Poll Brand Tracker and analyzed using media plan optimizations via Nielsen Media Impact to determine how to resume growth without increasing media budgets.

Key findings:

- A brand needs to create future demand by advertising to that much larger group of consumers who are not in the market and are not ready to buy now but will be in the future to grow.

- To enhance the impact of your media plan, select media audiences who have interest and usage in your category.

- The Harris Poll Brand Tracker reports a meal kit service and a subscription management app generate extraordinary results with podcast ads. TV’s impact is non-existent while AM/FM radio audiences are highly engaged with the brands despite no AM/FM radio ads running.

- To optimize the media plan, maintain podcast allocation and shift TV investment to AM/FM radio.

- Shifting media weight from TV to AM/FM radio increases campaign reach by +16% to +17% at the same budget, according to Nielsen Media Impact.

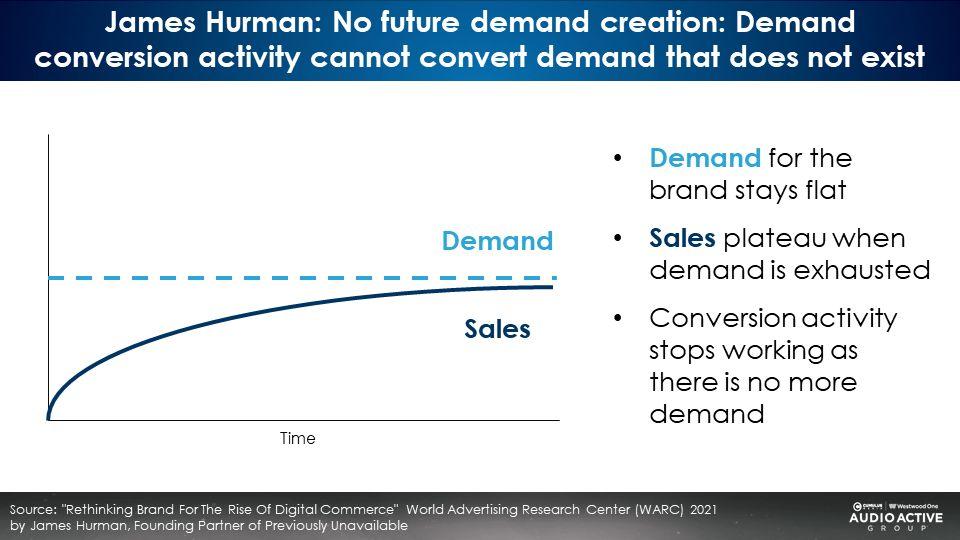

The performance marketing “valley of death”

Sales plateau when a brand fails to create future demand, says James Hurman, a globally recognized expert on brand building and marketing effectiveness. Hurman and the World Advertising Research Center have partnered on a major study, Rethinking Brand for the Rise of Digital Commerce. The World Advertising Research Center (WARC) is the major global organization that devotes itself to the study of marketing effectiveness.

Hurman explains that in order to grow, brands have to be “known before you’re needed.” A brand creates future demand by advertising to that much larger group of consumers who are not in the market and are not ready to buy now but will be in the future. The goal is making them feel familiar with and positively toward your brand in order to get them to gravitate to you when they enter the category.

How to create future demand? Shift to media that are already inclined to your brand and optimize for reach

WARC reports, “Reach is the foundation of media effectiveness.”

Growing reach increases a brand’s “mental availability,” or the propensity of a brand to be noticed and thought of in buying situation. In their book 66 Ways To Screw It Up: How Not to Plan, Les Binet and Sarah Carter explain:

“The single most important factor driving brand preference is ‘mental availability’: how well known a brand is, and how easily it comes to mind. Brands with low mental availability tend to struggle, rejected in favour of more familiar rivals. Or not considered in the first place. Brands with high mental availability don’t have to push so hard to sell, so tend to have higher market shares and better margins.”

Two case studies: A meal kit delivery service and a subscription management app

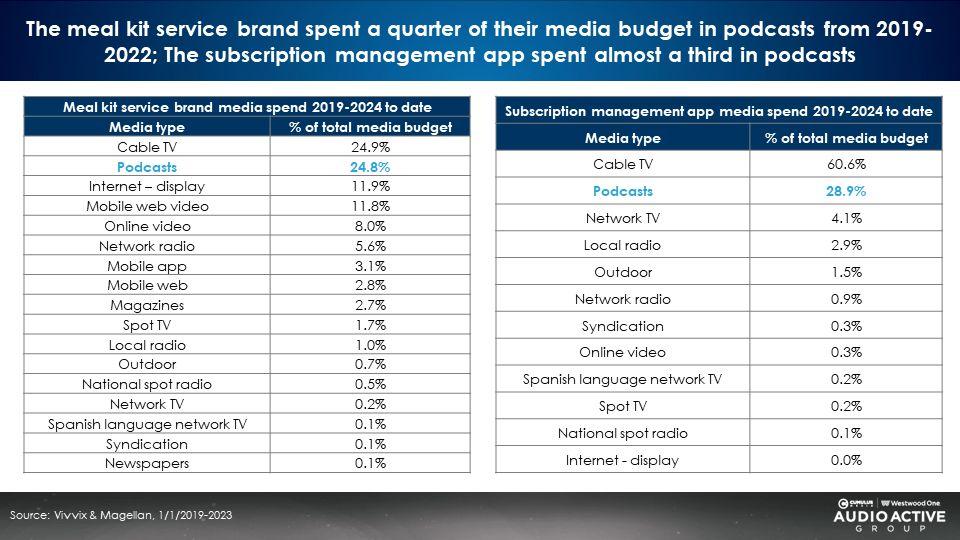

According to Vivvix and Magellan, the advertising expenditure measurement firms, the two brands devote most of their media plan to TV and podcasts. Each brand spends very little on AM/FM radio.

How strong is the brand equity for the two brands among podcast listeners and TV viewers where most of the media weight is running?

Meal kit brand: Podcasts generate stunning results, TV’s impact is non-existent, and AM/FM radio audiences are highly engaged with the brand despite no AM/FM radio ads running

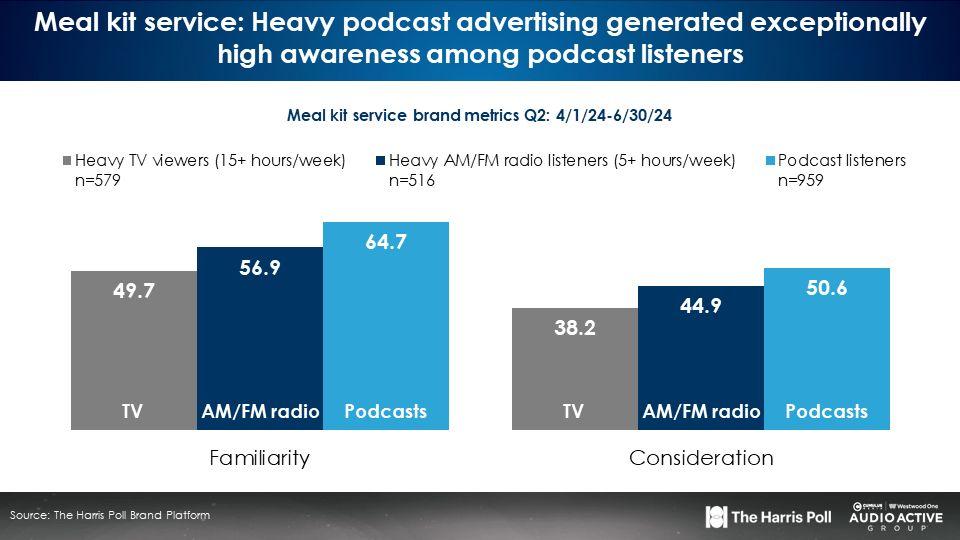

According to the Harris Poll Brand Tracker, podcasts dramatically outperform the impact of TV. The meal kit service is much better known among podcast listeners compared to the TV audience, despite devoting the same proportion of its budget to each media.

Amazingly, AM/FM radio listeners have much stronger familiarity and interest in the media kit brand even though AM/FM radio is not in the media plan!

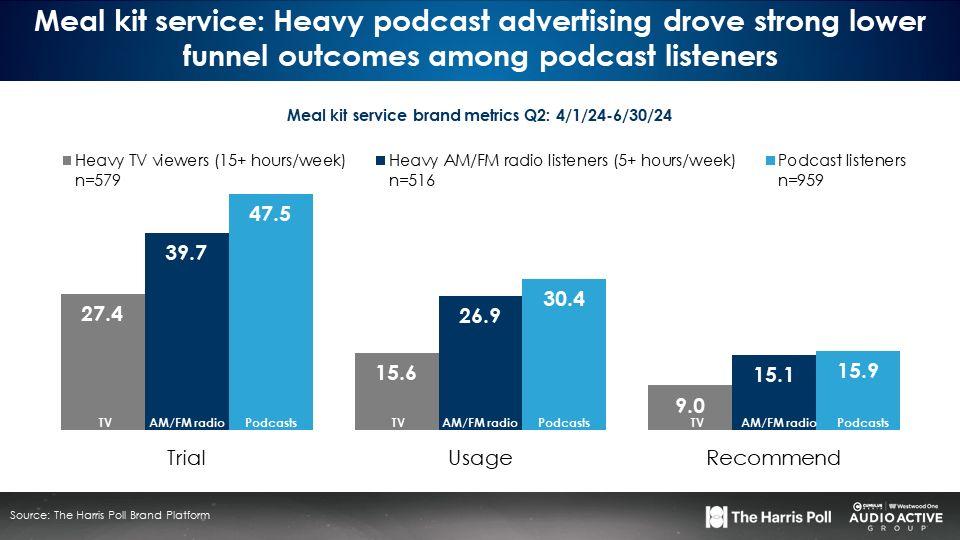

Now let’s move further down the purchase funnel of the meal kit brand and examine usage and recommendation. Again, podcasts are blowing the doors out, TV is failing, and AM/FM radio, while not in the media plan, shows very strong affinity and usage.

It is stunning that the brand does much better among the AM/FM radio audience versus the TV audiences. Despite the massive spend on TV, the meal kit brands suffers from low awareness, interest, and usage among TV viewers.

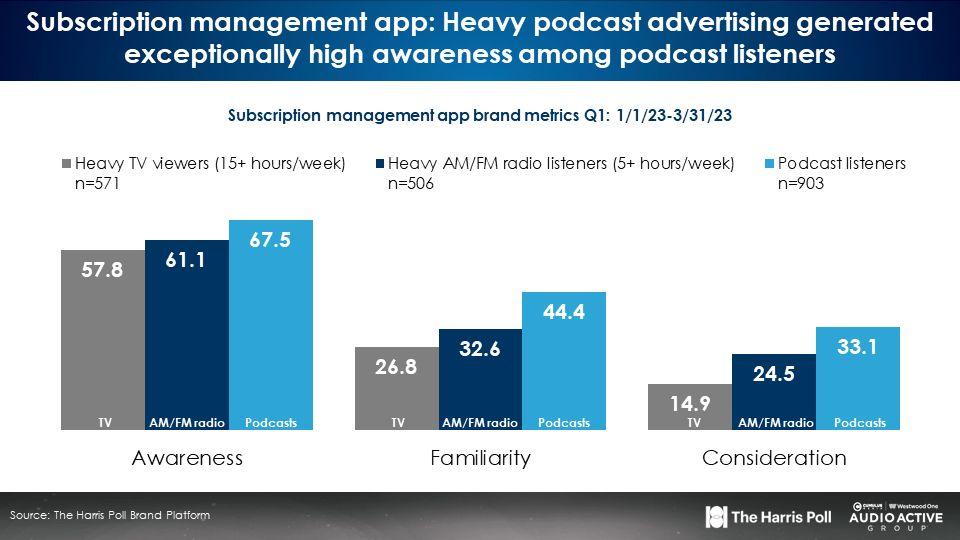

Subscription management service: Podcasts generate extraordinary results, TV impact is non-existent, and AM/FM radio audiences are highly engaged with the brand despite no AM/FM radio ads running

This subscription management app brand spends heavily on TV. 60% of the media plan is on TV. Is all this TV spend growing awareness, familiarly, and interest? In short, no.

The Harris Poll Brand Tracker reveals top funnel measures for the brand are exceptionally weak among TV viewers, super strong among podcast listeners, and impressive among AM/FM radio listeners. The strong performance among AM/FM radio listeners occurs despite the brand not spending on AM/FM radio!

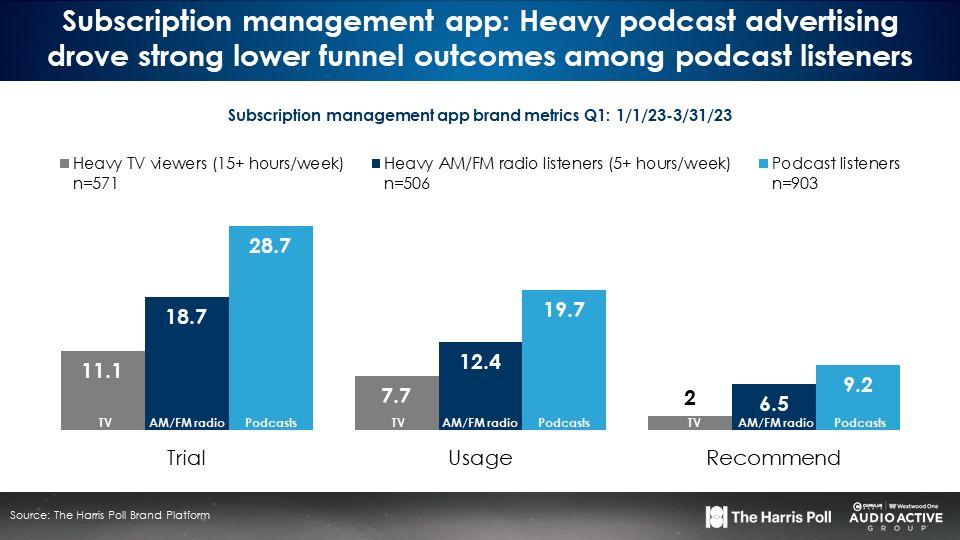

Let’s look at the bottom of the funnel for trial, usage, and recommendation among media audiences. Again, TV is a total flop even though 60% of the spend is on TV!

Lower funnel performance among podcast listeners is exceptional. Considering they are not on AM/FM radio, lower funnel performance among AM/FM radio listeners is strong. AM/FM radio outperforms TV by two to one for trial, usage, and recommendation.

Why do the subscription service and meal kit TV campaigns fail to drive impact among TV viewers? TV audiences are not interested in the categories

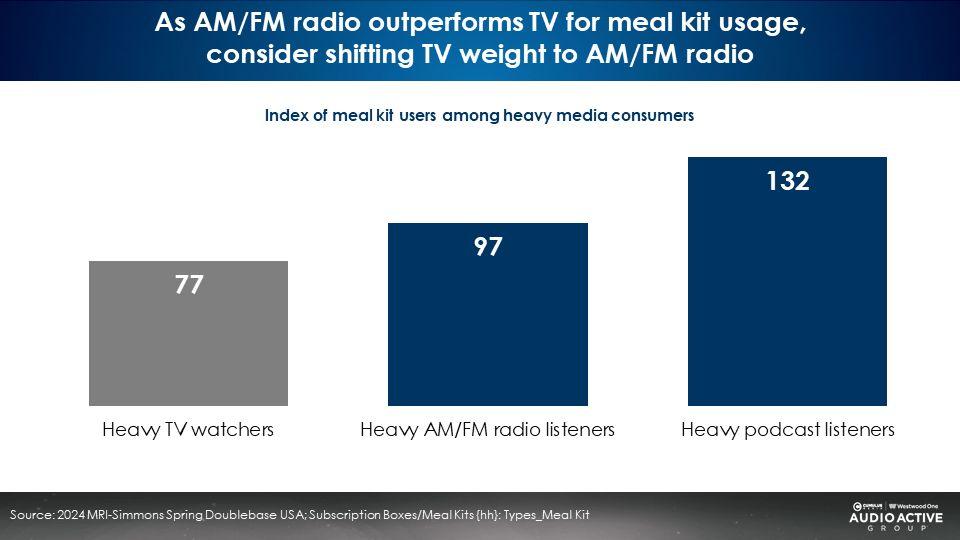

According to MRI-Simmons, TV viewers significantly under index on meal kit usage. Audio listeners are much more likely to be meal kit category users.

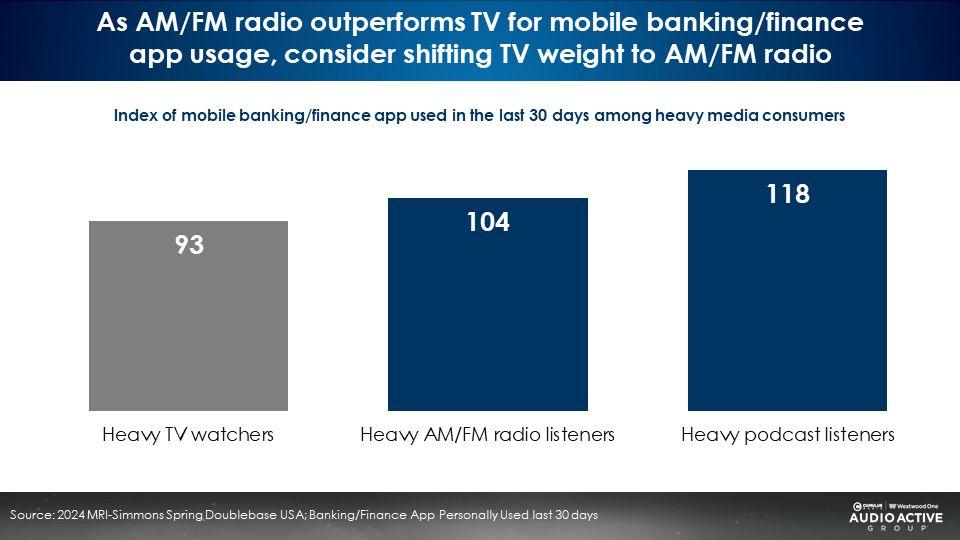

Similarly, MRI-Simmons reports TV viewers under index for financial apps while audio listeners over index.

Why do TV viewers show such little interest in meal kits and subscription management? The aging demographic of TV is also at play here

80% of TV viewing occurs over the age of 50, according to Nielsen. Audio listeners are much younger. The median age of the AM/FM radio audience is 47 and among podcast listeners the median age is only 34.

To optimize the media plan, maintain podcast allocation and shift TV investment to AM/FM radio

- Maintain podcast spending levels: The Harris Poll Brand Tracker data reveals both podcast campaigns have performed spectacularly. Up and down the purchase funnel podcast listeners exhibit strong awareness, interest, and usage. The smart decision is to maintain podcast spend.

- Cut TV spend: TV did not work for these brands. Despite significant TV investment, the Harris Poll Brand Tracker reveals very weak awareness, interest, and usage among TV viewers.

- Add AM/FM radio to the media plan: Despite not spending on AM/FM radio, the two brands have very strong equity among AM/FM radio listeners. AM/FM radio listeners are far more likely to know the brands and use them. The smart move is to shift money from TV to AM/FM radio.

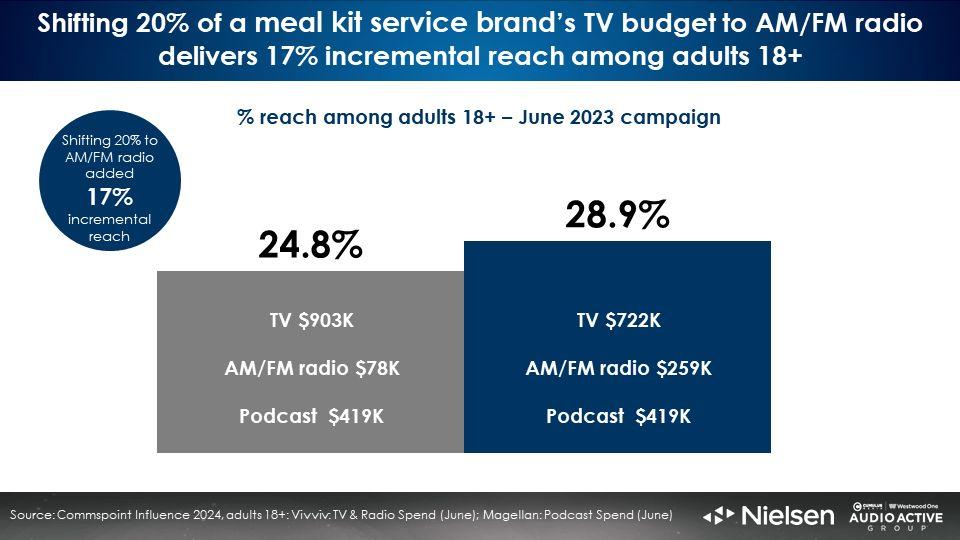

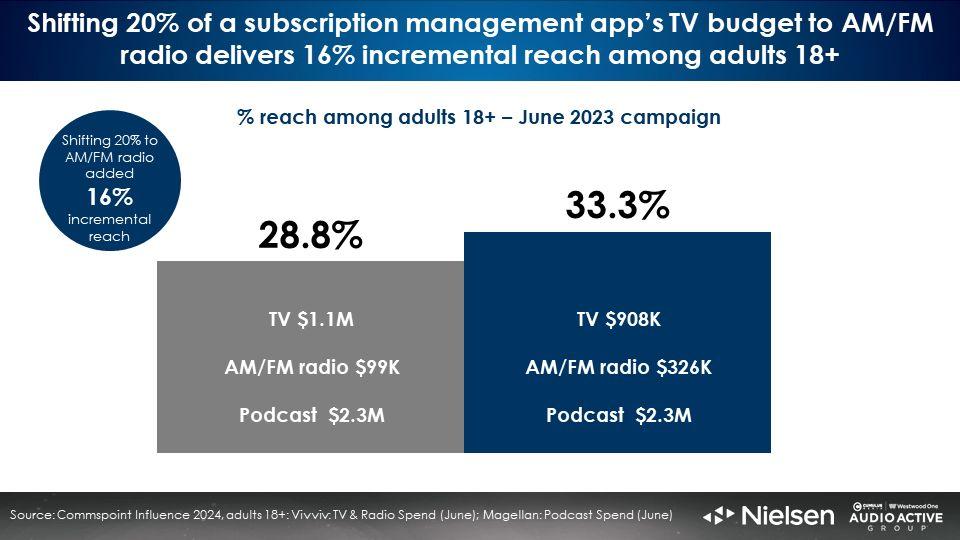

Shifting media weight from TV to AM/FM radio increases campaign reach by +16% to +17% at the same budget

Nielsen Media Impact, the media planning and optimization platform, reveals if the meal kit brand shifts $181K each month from TV to AM/FM radio, reach will grow +17%.

Similarly, if the subscription management app shifts $192K a month from TV to AM/FM radio, Nielsen Media Impact reports campaign reach will increase by +16%.

Key findings:

- A brand needs to create future demand by advertising to that much larger group of consumers who are not in the market and are not ready to buy now but will be in the future to grow.

- To enhance the impact of your media plan, select media audiences who have interest and usage in your category.

- The Harris Poll Brand Tracker reports a meal kit service and a subscription management app generate extraordinary results with podcast ads. TV’s impact is non-existent while AM/FM radio audiences are highly engaged with the brands despite no AM/FM radio ads running.

- To optimize the media plan, maintain podcast allocation and shift TV investment to AM/FM radio.

- Shifting media weight from TV to AM/FM radio increases campaign reach by +16% to +17% at the same budget, according to Nielsen Media Impact.

Click here to view a 12-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.