Advertiser Perceptions: National Marketers Are Bullish On The Economy; New Product Launches Are At Record Highs And Ad Spend Will Increase

Click here to view an 11-minute video of the key findings.

Click here to download a PDF of the slides.

A series of new studies from Advertiser Perceptions reveals national marketers are increasingly confident in the economy, will advertise more, and anticipate new product launches at record levels. The most recent studies were fielded in December 2024 and January 2025.

Each month, Advertiser Perceptions, the leader in providing research-based strategic market intelligence for the advertising and ad tech industries, surveys 300 executives involved in media brand selection decisions who will spend a minimum of 1 million dollars in ad spend over the next 12 months.

Here are the key findings:

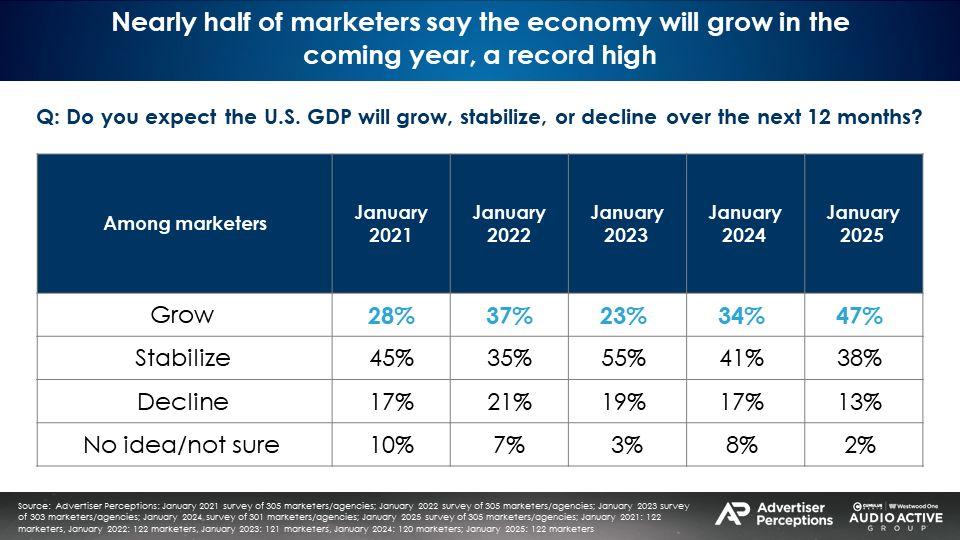

Nearly half of marketers say the economy will grow in the coming year, a record high

The proportion of national marketers who expect the U.S. GDP to grow over the next 12 months doubled from 23% in January 2023 to 47% in January 2025. Advertiser Perceptions’ most recent survey was conducted January 2-10, 2025.

“While increased tariffs on imported goods and regulatory uncertainty remain potential headwinds to the economy, advertisers are feeling bullish about the economy. Barring those issues, expect advertisers to increase budgets this year,” said Eric Haggstrom, VP of Business Intelligence and head of forecasting at Advertiser Perceptions.

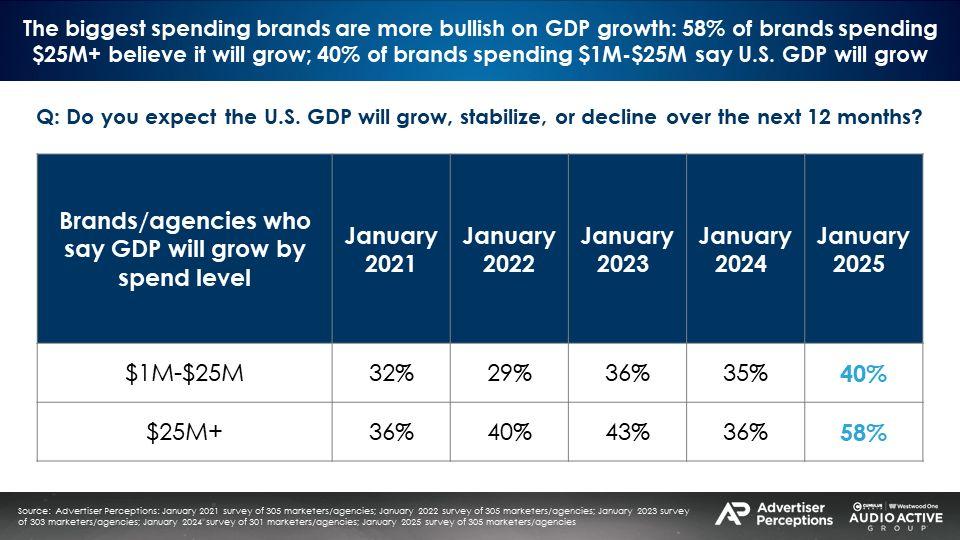

The biggest spending brands are more bullish on GDP growth

58% of brands spending in excess of $25M+ expect the U.S. GDP to grow versus 40% for brands spending $1M to $25M.

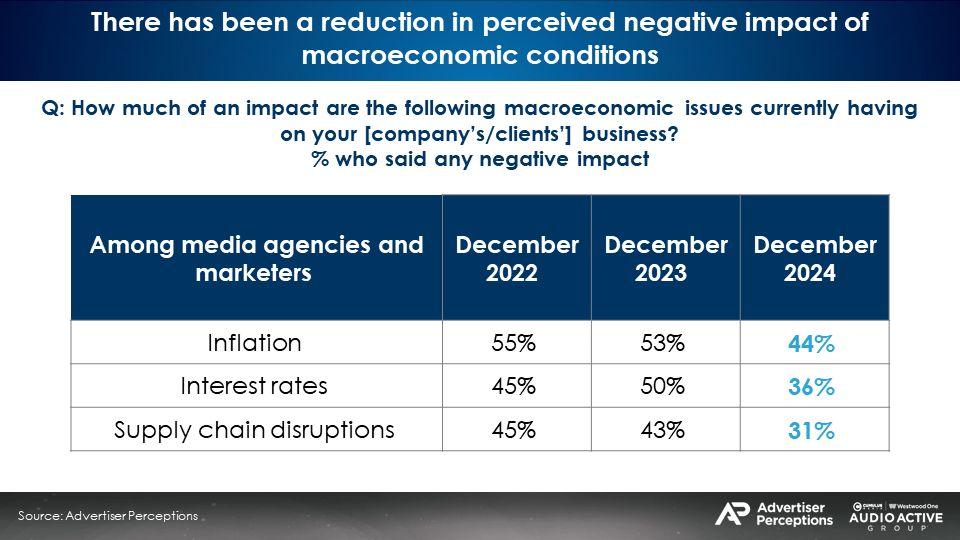

There has been a reduction in perceived negative impact of macroeconomic conditions

Concerns over inflation are down but still elevated. Worries over supply chain disruptions and interest rates have come down significantly versus 2022 and 2023.

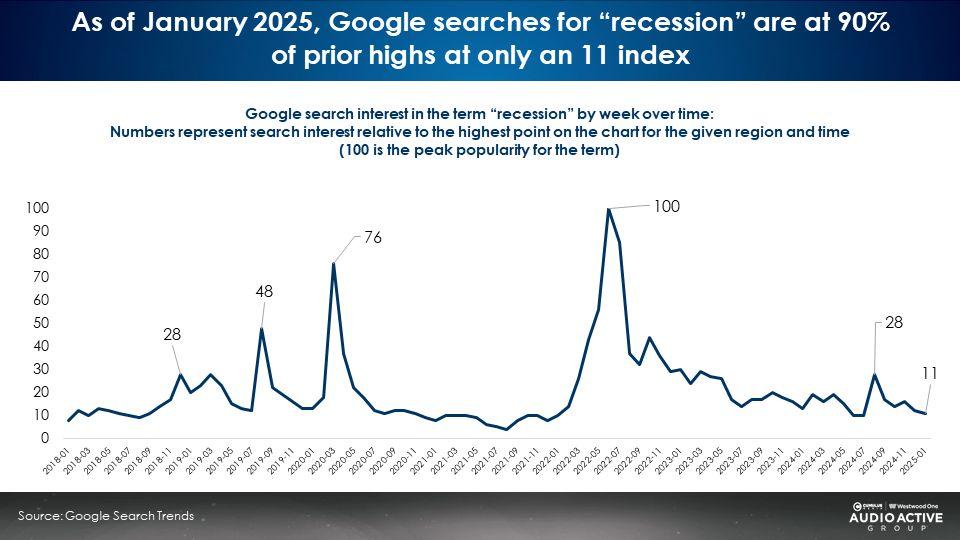

The recession that never came; Marketers shake off the dire predictions of 2022 and 2023

In 2022, the vast majority of economists and businesses expected a recession. These fears carried over into 2023 and 2024. For two years, CNBC anchors sternly forecast the recession to begin in the next month. These alarming forecasts caused national marketers to reduce and hold back ad budgets.

A seven-year trend of Google searches on the term “recession” reveals a peak of a 100 index in June 2022. As of January 2025, Google searches for “recession” are down 90% off prior highs at only an 11 index.

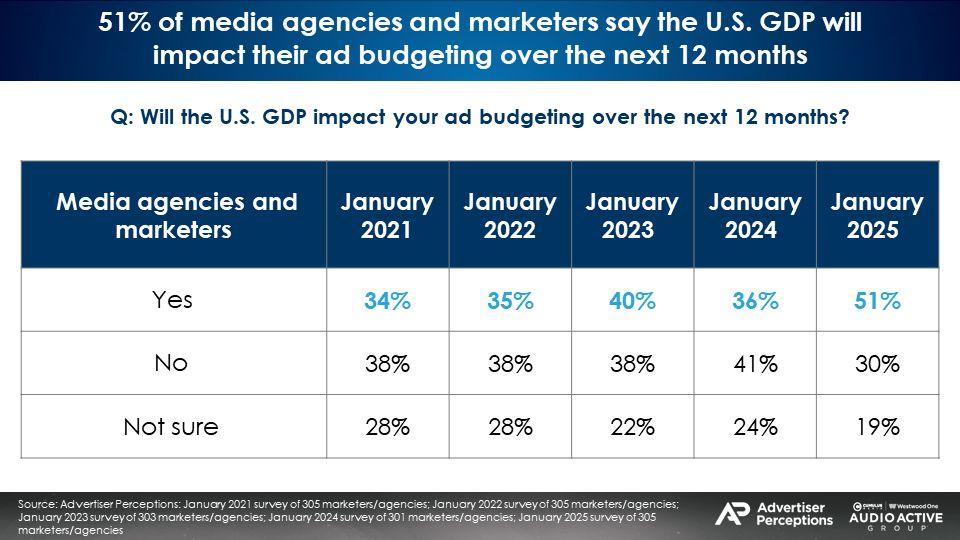

Increasingly, brands and media agencies report the U.S. GDP will impact ad budgets

51% of media agencies and marketers say the U.S. GDP will impact their ad budgeting over the next 12 months. This is a sharp increase from the prior years. Given this, a bullish outlook on the economy portends growth in ad budgets.

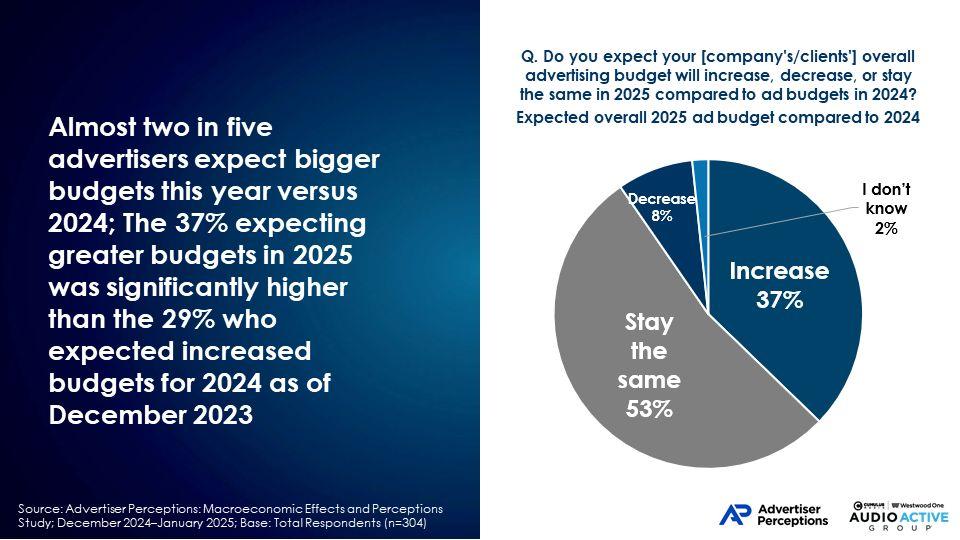

37% of buy-side 2025 ad budgets will be bigger, an increase over the prior year (29%)

Almost two in five U.S. advertisers surveyed in December expected an increase in their ad budget for 2025 compared to 2024, significantly higher than the 29% who expected increased budgets for 2024 as of December 2023. At that time, advertisers were also significantly less likely to expect an improving business climate in the new year.

Advertisers are focused on increasing revenue and acquiring new customers as they head into 2025

They’ll be doing so in a business environment that 44% expect to improve in Q1. Many were already seeing improvements in Q4.

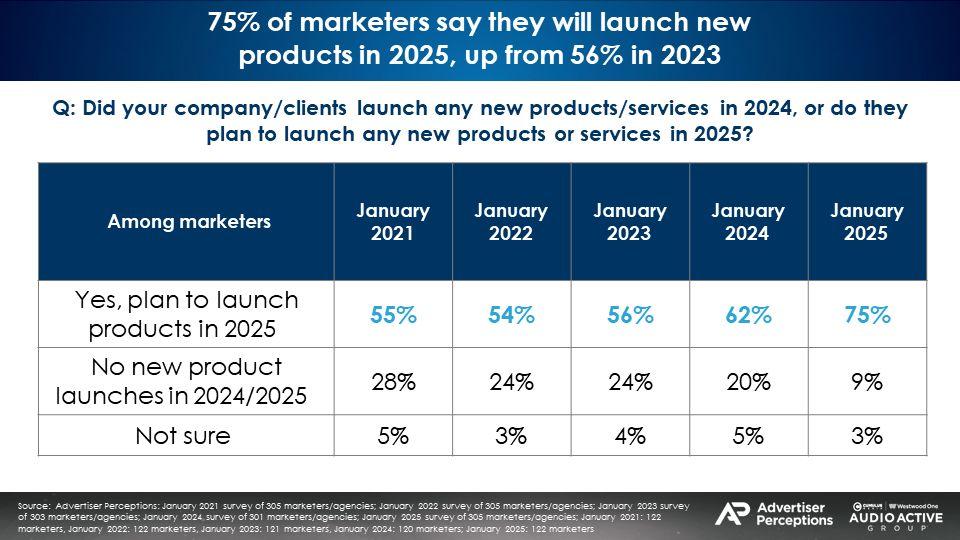

2025 new product launches will hit all time high

Confidence in the economic outlook has pushed 2025 new product launches to record levels. 75% of marketers say they will launch new products in 2025, up from 55% in 2021.

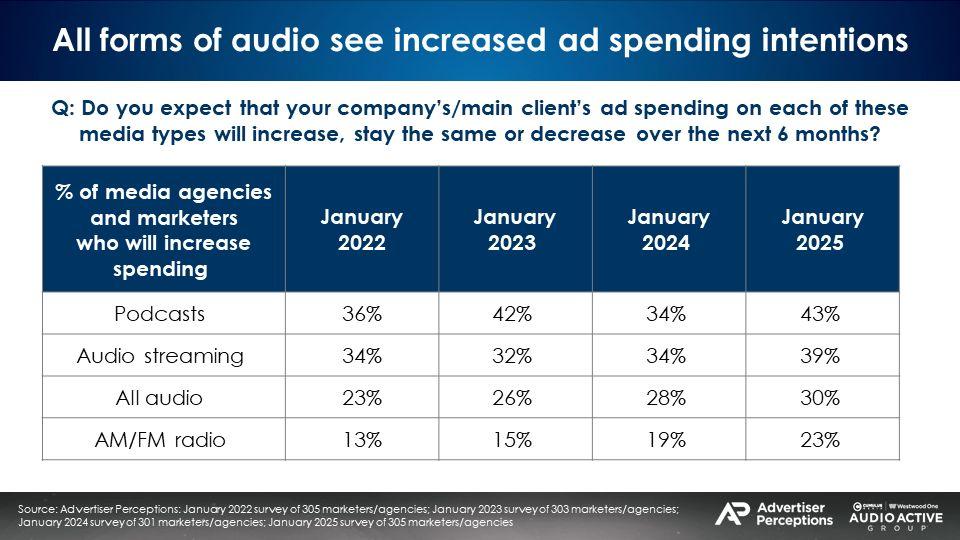

All forms of audio see increased ad spending intentions

Marketers and media agencies indicate they will increase ad spend across all forms of audio.

“The growing cultural importance of podcasts has the potential to lift advertiser investment in all forms of audio advertising. Audio investment has been held back by budgetary constraints and an over emphasis on lower funnel formats. These pressures should ease in 2025,” said Advertiser Perceptions’ Eric Haggstrom.

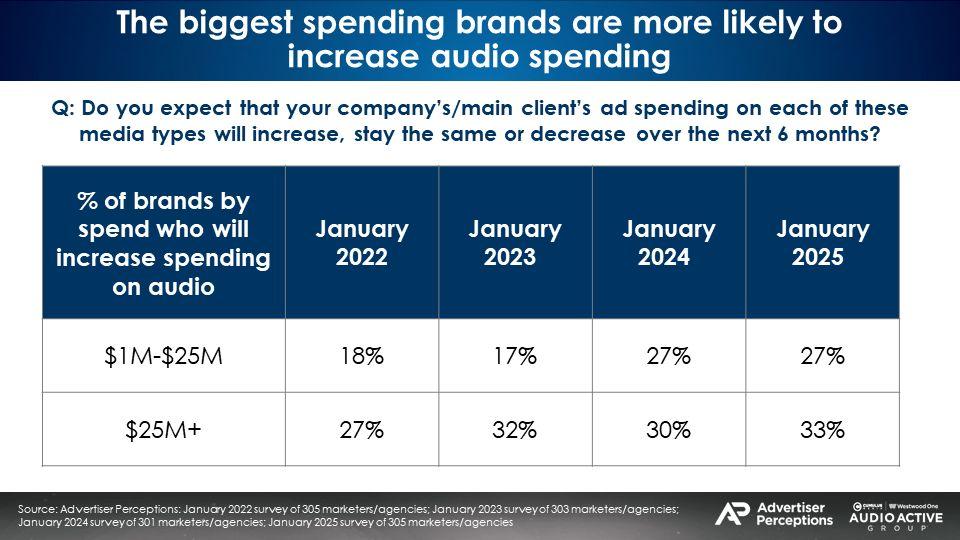

Bigger spending brands indicate a greater inclination to spend more on audio

Compared to marketers who spend $1M to $25M, brands spending $25M+ are more likely to indicate increased spending on podcasts, audio streaming, and AM/FM radio in 2025.

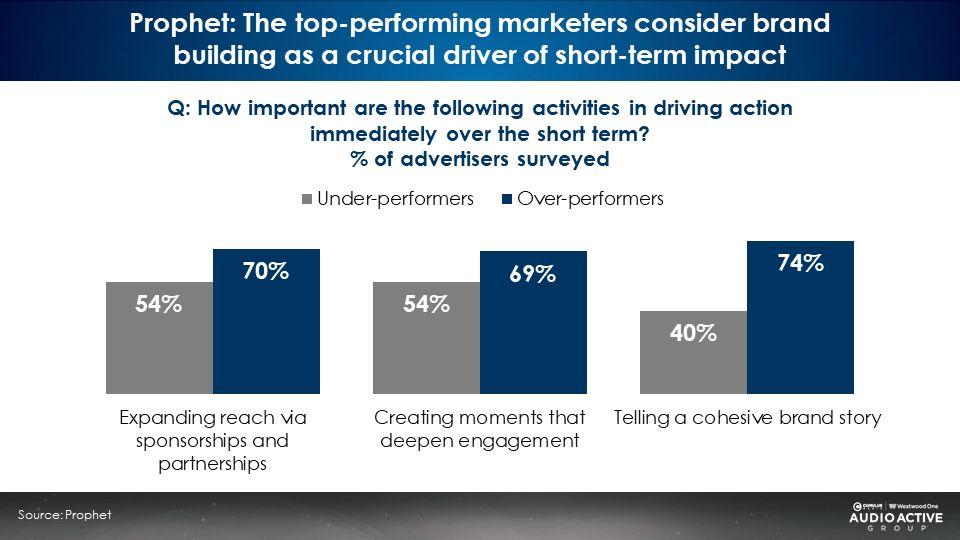

Prophet survey of advertisers reveals top-performing marketers consider brand building as a crucial driver of short-term impact

Seven in ten over-performing brands report telling a cohesive brand story and creating “moments that deepen engagement” were responsible for driving short-term actions among their target audience.

Brand building is significantly less important among underperforming brands. The over reliance on performance marketing leads to reduced revenue and profit growth.

WARC, the World Advertising Research Center, just published a new report: The Multiplier Effect: A CMO’s Guide to Brand Building in the Performance Era. In the study, WARC reveals a new syndrome, “the performance penalty, where overinvesting in performance advertising reduces revenue returns in the range of 20% to 50%.”

Key findings:

- Nearly half of marketers say the economy will grow in the coming year, a record high

- There has been a reduction in perceived negative impact of macroeconomic conditions

- The recession that never came; Marketers shake off the dire predictions of 2022 and 2023

- Increasingly, brands and media agencies report the U.S. GDP will impact ad budgets

- 37% of buy-side 2025 ad budgets will be bigger, an increase over the prior year

- 2025 new product launches will hit all time high

- All forms of audio see increased ad spending intentions in 2025

- Prophet survey of advertisers reveals top-performing marketers consider brand building as a crucial driver of short-term impact

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.