Radio Can Help Reach Online Consumers Who Are Rapidly Adopting Ad-Blocking

You could not escape the blaring headlines of the last few weeks:

Let the iOS 9 ad block wars begin! (Fortune)

Apple Propels an Ad-Blocking Cottage Industry (Wall Street Journal)

Yes, There Is a War on Advertising. Now What? (Advertising Age)

IOS 9 Signals Mobile Display Is A Dead Man Walking — Long Live Native And Social (MediaPost)

Advertisers are concerned over the growing number of consumers who are installing software that blocks out Internet ads. Publishers are concerned over the loss of advertising, their primary revenue stream.

On Wednesday, September 16, Apple released its latest operating system, iOS9, for the iPhone. The new release allows extensions for ad-blocking in the Safari browser. Ad-blocking software apps soared to the top of the iTunes app store.

Ad Age reports advertisers are “fighting back against blocking software with rival technology that ‘blocks the blockers and gets around the blockers.’” But there could be a downside if advertisers adopt this tactic. “We don’t want to anger consumers,” says Dan Jaffe of the Association of National Advertisers. “Everybody needs to move carefully.”

The real issue? Online ads need to get better

James Avery, CEO of Adzerk, writes in AdExchanger: “to slow the adoption of ad blocking and make the Internet a better place, we need to make advertising better…Users install ad blockers because ads are crappy, there are too many of them, they impact computer performance and consumers feel like their privacy has been violated.”

Who is to blame? Advertisers/publishers or the consumer? Casper von Wrede from Kittysplit, wryly observes, “If you milk the cow so hard, it kicks you in the face; don’t blame the cow.”

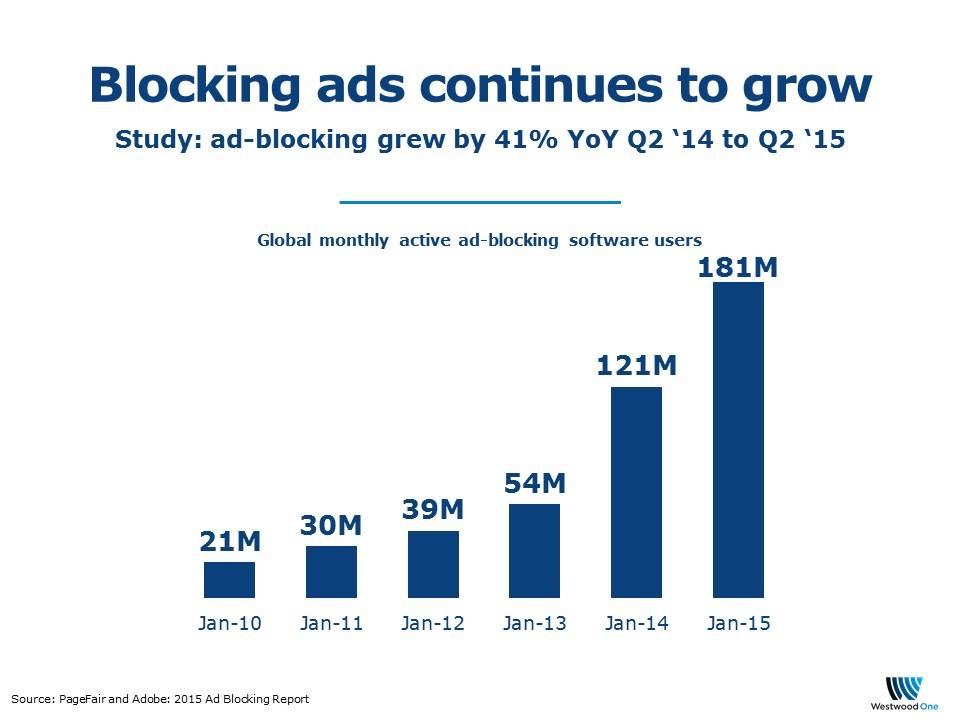

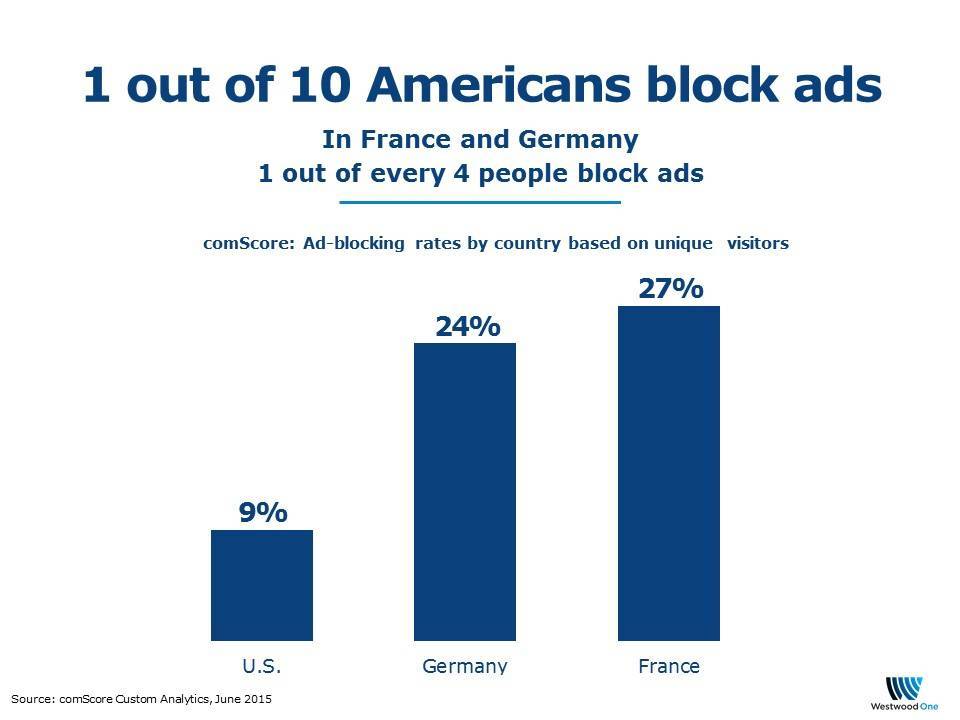

To understand the real magnitude of ad-blocking, we turned to comScore, the leader in digital media measurement, and the technology company PageFair, who partnered with Adobe to release the 2015 Ad Blocking Report. Here are three headlines from studies both firms have released:

1. Globally, ad-blocking is soaring; in the U.S. comScore estimates 9% block ads; PageFair reports 16% block ads. In countries like France and Germany, comScore reports one out of four use ad-blocking. Could the U.S. expect to see ad-blocking levels of that magnitude?

PageFair reports ad-blocking in the United States grew 48% during the past year, increasing to 45 million monthly active users during Q2 2015. PageFair calculates ad-block usage in the United States resulted in an estimated $5.8B in blocked revenue during 2014. It is expected to cost $10.7B in 2015 and $20.3B in 2016.

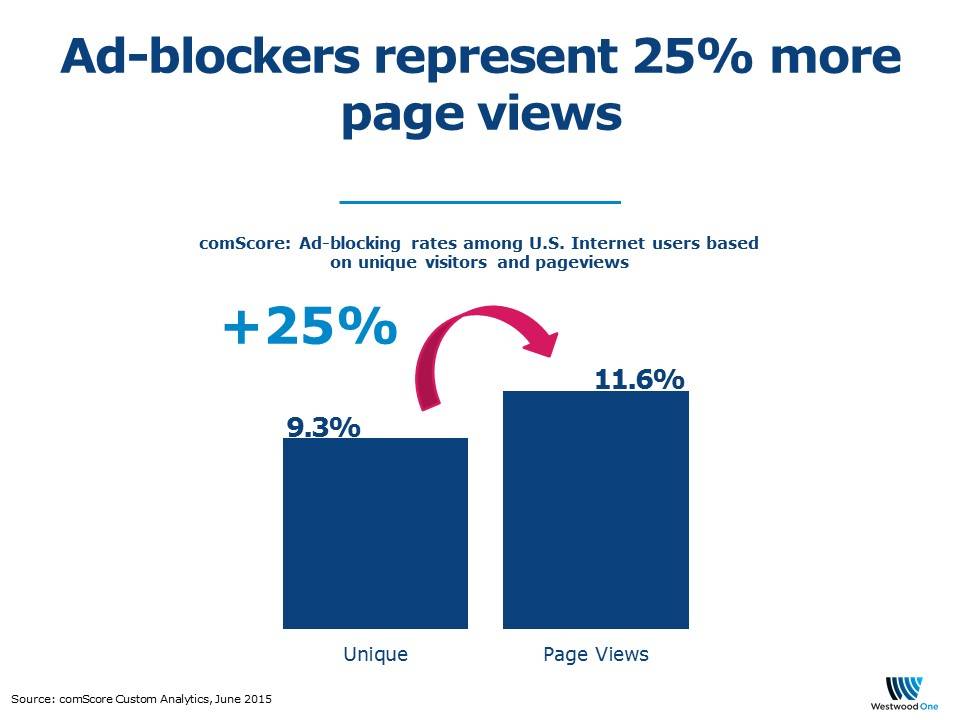

2. Heavy online users are more likely to ad-block: ad-blockers consume 25% more online content. comScore reports U.S. consumers who block ads are 9.3% of online users but represents 11.6% of page views.

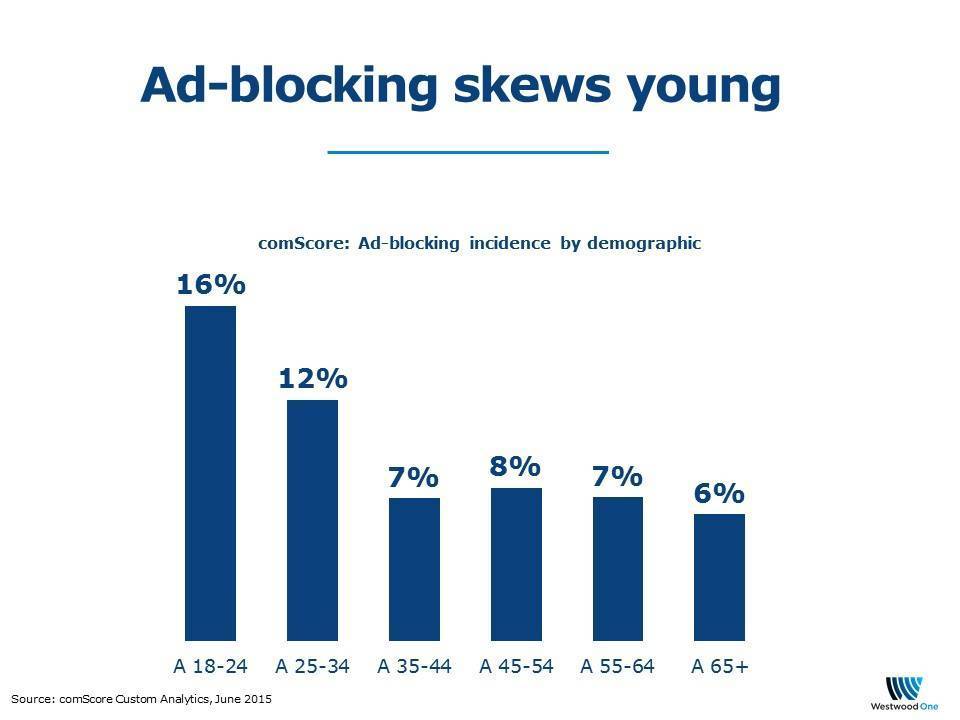

3 U.S. ad-blockers are younger and upscale. comScore indicates ad-blocking is much higher among 18- to 24-year-olds (16%) and 25- to 34-year-olds (12%). Those with the highest income block ads more (12%) than the U.S. average (9%).

Advertisers can reach online ad-blockers with mass reach media like AM/FM. With 9% to 16% of online Americans ad-blocking, and those rate are expected to grow, media plans need help to “plug the hole” of missed consumers.

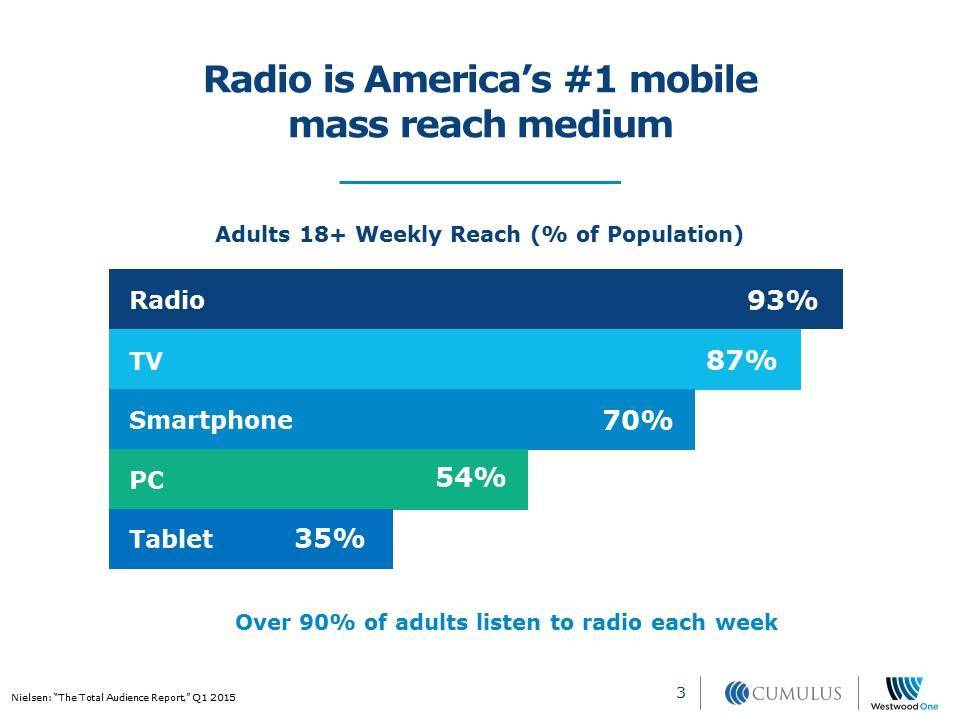

Reach data from Nielsen indicates radio is America’s number one mobile mass reach medium, dominating television, smartphones, tablets, and PCs.

AM/FM is the “last media standing” when it comes to mobile mass reach and can help marketers reach consumers who ad-block online advertising.

Randall Rothenberg, president and CEO of the Internet Advertising Bureau, tells Advertising Age: “We are mistreating our most valuable asset — our consumers…until we commit to the cause of ever-improving user experiences, advertisers and media will be at risk.”

Dave Milner, Cumulus Media’s SVP, Western Division, concludes: “Advertisers cannot put all their eggs in the digital basket; they need AM/FM, America’s number one reach medium, as part of the mix!”

Pierre Bouvard is CMO of Cumulus Media | Westwood One