Why It’s Harder To Reach Consumers With TV Ads And How Radio Can Make Your TV Better

While still a powerful medium for advertisers, it’s getting harder to find the eyeballs on TV these days. Below are six reasons why:

1. Total TV audiences are down 7%. In a recent research note, media analysts MoffettNathanson said 18-49 primetime ratings were down 7% January 2015 versus January 2016. Tuning to the broadcast networks (ABC, CBS, NBC, Fox, etc.) was down even more – 11%. Interestingly, during the same period, Nielsen reports radio listening levels are up 8% among 25-54s and up 10% among Millennials.

2. Millennial TV viewing is falling like a rock. While overall TV viewing is down, erosion among Millennials is much more severe. As this chart from Wall Street analysts MoffettNathanson reveals, TV usage among young viewers has been in negative territory since early in 2014.

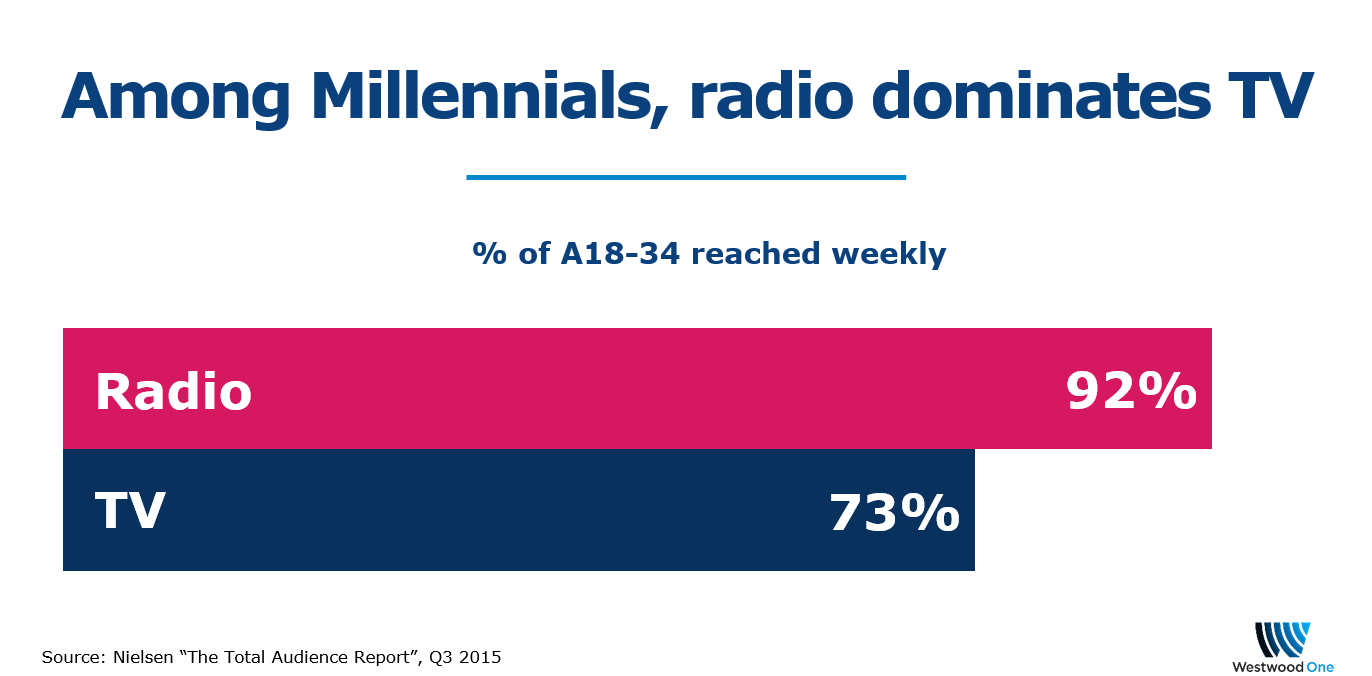

What’s even more challenging is getting 18-34s to even watch ad-supported television. According to Nielsen, only 73% of 18-34s are reached by TV in a week. In contrast, 92% of 18-34s are reached by AM/FM radio.

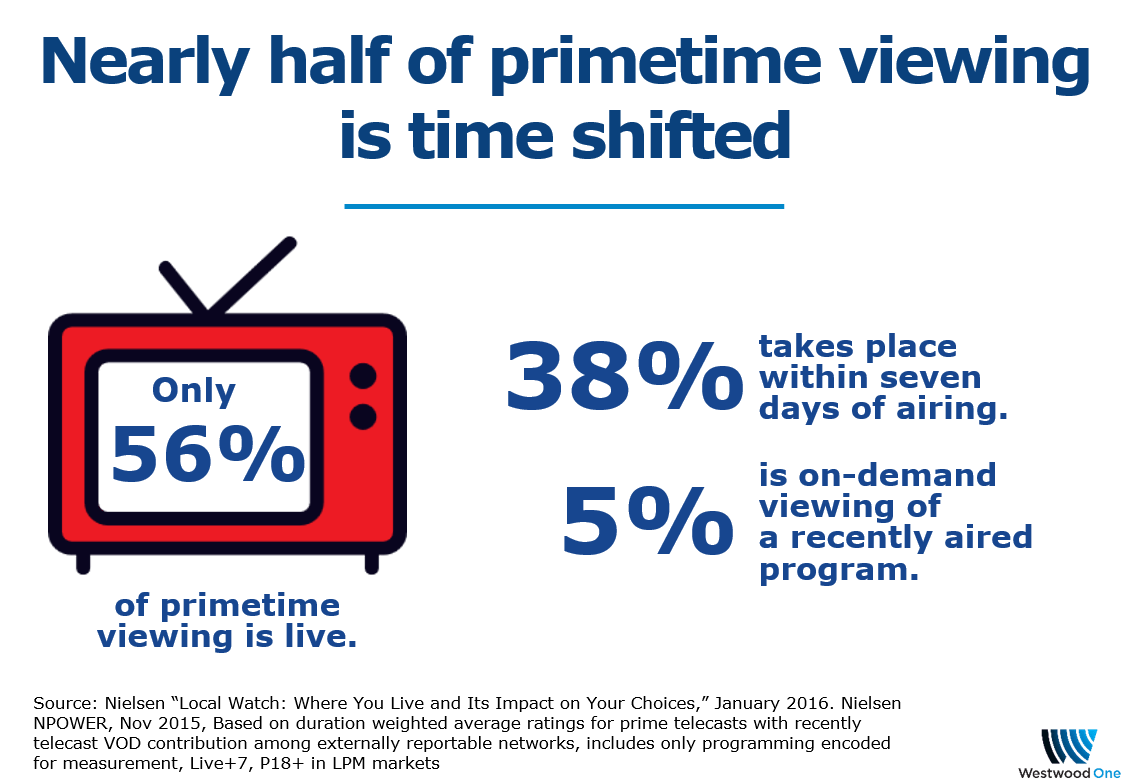

3. Nearly half of primetime viewing is time shifted. Nielsen reports only 56% of primetime viewing is live. The rest is watched later in the week or via on-demand platforms. Those TV ads for the retail sale are being seen long after the foot traffic is needed.

4. Netflix is responsible for 50% of TV viewing erosion. Just last week, MoffettNathanson crunched Netflix’s reported tuning hours and concluded that half of U.S. TV’s viewing drop is due to Netflix.

MoffettNathanson reports:

“We calculate that domestic Netflix usage represented just under 6% of total traditional TV viewing in 2015 … Netflix sourced 50% of the measured decline…As a result, we forecast that Netflix’s U.S. total streaming hours relative to traditional TV will steadily rise to the low double-digit range over the next four years, and will continue to represent half of the declines in traditional TV viewing.”

5. Heavy streaming usage among young demographics explains the sharp drop in TV viewing. Half of U.S. homes have Netflix, Hulu, or Amazon Instant Video, according to Nielsen. Among upscale homes with $75,000+ incomes, streaming subscriptions soar to nearly two-thirds. The younger the consumer, the more likely the home has Netflix, Amazon, or Hulu. Seventy-four percent of homes headed by Millennials 35 and younger subscribe to one of the video streaming services.

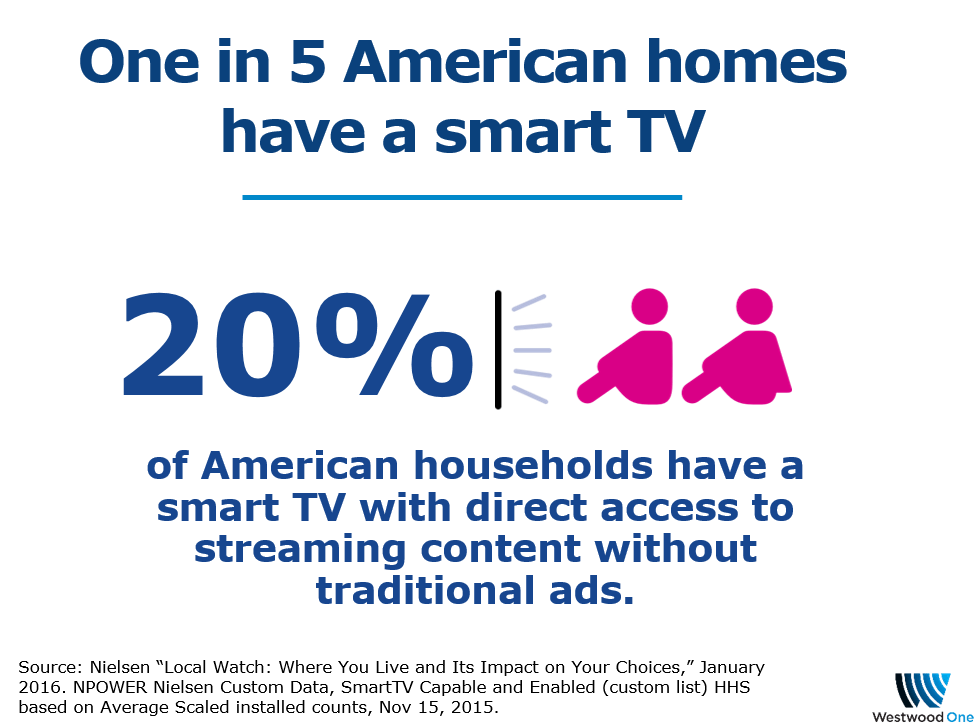

6. One of 5 American homes have a smart TV that connects directly to the Internet, bypassing traditional TV ads. Smart TV prevalence is even higher in upscale homes, Nielsen reports.

How radio can make your TV better

Despite these six challenges, TV is still an excellent ad medium. There is a way to improve TV impact: adding radio to the media plan boosts exposure among consumers who are only lightly exposed to a TV campaign.

In this actual Nielsen case study below, radio doubles campaign frequency among the 40% of Americans who were lightly exposed to the TV campaign. Campaign frequency grows by nearly a third among medium TV viewers. Radio amplifies frequency among the very consumers who need the boost – the 80% of Americans who were lightly reached by television.

In summary, TV time spent and reach are down. Younger and upscale consumers are spending more time with streaming services like Netflix, Amazon Prime, and Hulu. Radio can compensate for the loss of TV tuning and reach by amplifying impact among light and medium TV viewers.

Pierre Bouvard is CMO of Cumulus Media | Westwood One. Follow him on Twitter and LinkedIn.

Contact activate@westwoodone.com today to find out how radio can elevate your marketing campaign.