Better Together: T-Mobile And Sprint Merger Represents Significant Growth Opportunities For Both Brands

In major wireless news, T-Mobile and Sprint recently announced plans to merge into one company. According to Axios, this move will “reduce the number of national competitors from four to three.”

The size of the combined company will be significantly bigger. Telecom analyst Roger Entner reports that as a result of the merger, T-Mobile and Sprint will “have just under 30% of those who get service from one of the major carriers, compared to 38% for Verizon and 33% for AT&T.”

The T-Mobile and Sprint merger represents a big change for the companies and telecom landscape. The potential for growth is huge not just in size and sales but also in brand images and awareness. What are the implications?

Partnering with researcher MARU/Vision Critical, Westwood One conducted a survey of 608 respondents who own a cellphone to determine the state of four largest wireless brands as they stand and what it could mean in the future. Here’s what we found:

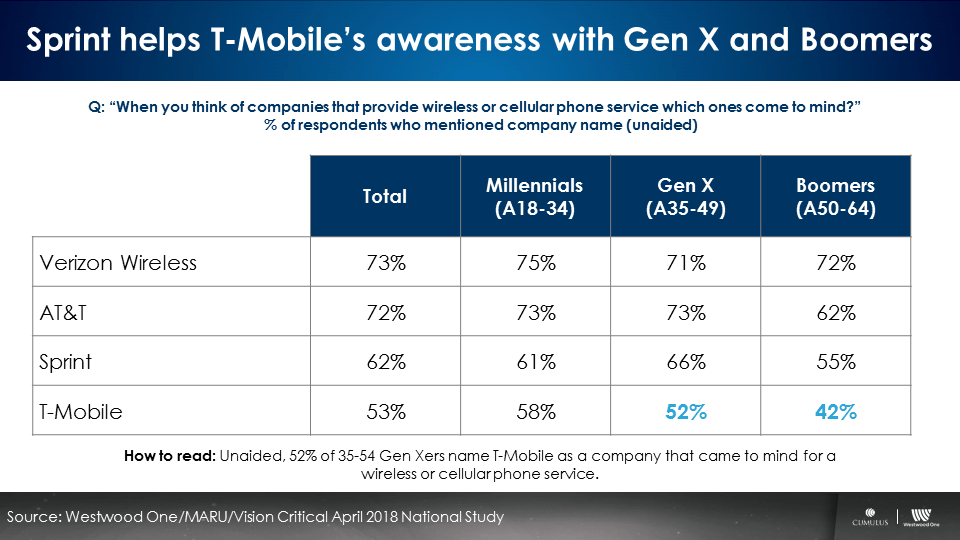

While T-Mobile sees a slight deficit in awareness among Gen X and Boomers, Sprint can make up for the gap

When asked about which wireless company came to mind, T-Mobile saw the strongest unaided awareness among 18-34 Millennials. Awareness drops off, however, among 35-49 Gen Xers at 52% and 50-64 Boomers at 42%, the lowest of the four carriers.

The merger will help fill the gap. Unaided awareness for Sprint was stronger at 66% among 35-49 Gen Xers and 50-64 Boomers at 55%.

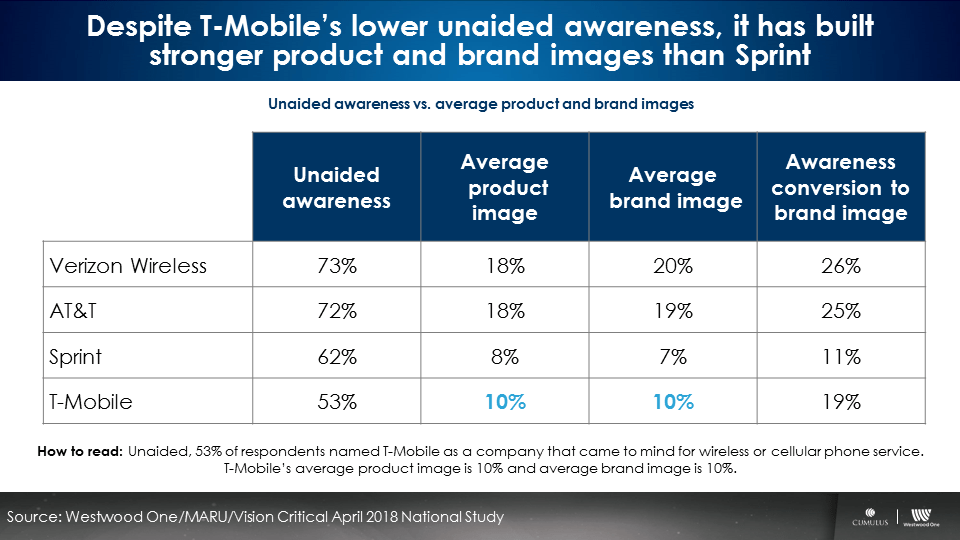

T-Mobile’s strength is in nurturing positive brand images

Overall, T-Mobile has stronger product and brand images than Sprint. The average brand image for T-Mobile is 10% while Sprint is slightly lower at 7%. This represents an area for growth. Together, the two companies can build a unified brand voice to foster more positive images.

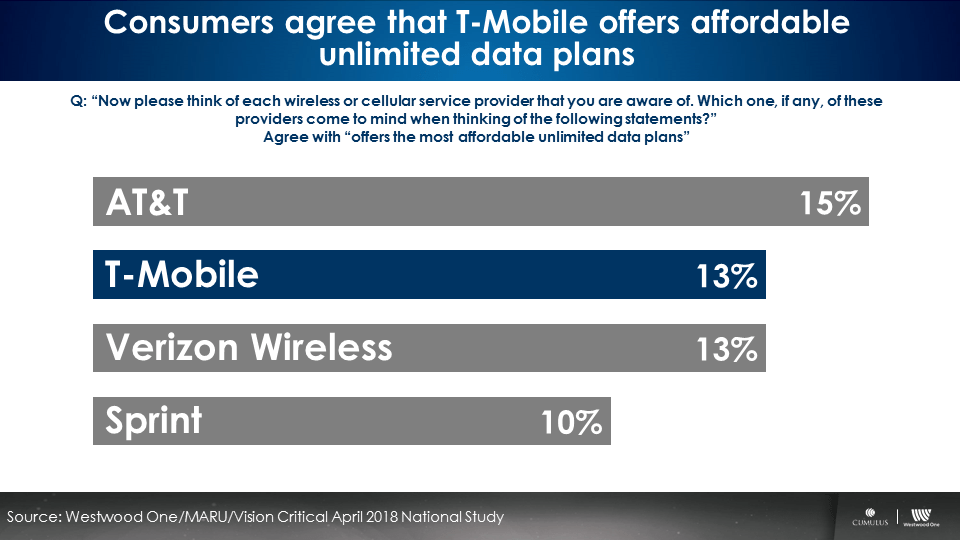

Consumers associate T-Mobile with being an affordable unlimited data plan

In 2013, T-Mobile rolled out the Un-carrier initiative which resulted in customer growth and boosts in the brand’s image. This revolutionary offer did away with long-term plans that locked in customers and made plans more flexible based on individual need.

At the time, CEO John Legere said the plan would “fix a stupid, broken and arrogant industry.” It changed the way customers thought about buying phone service.

Through powerful consumer offerings like the Un-carrier initiative and compelling marketing, T-Mobile secured a leading spot as a carrier that offers affordable unlimited data plans. As telecom technology evolves to 5G, can the combined T-Mobile and Sprint keep strong leadership for this image? Continuing with T-Mobile’s revolutionary spirit with Legere at the helm, there’s a strong possibility.

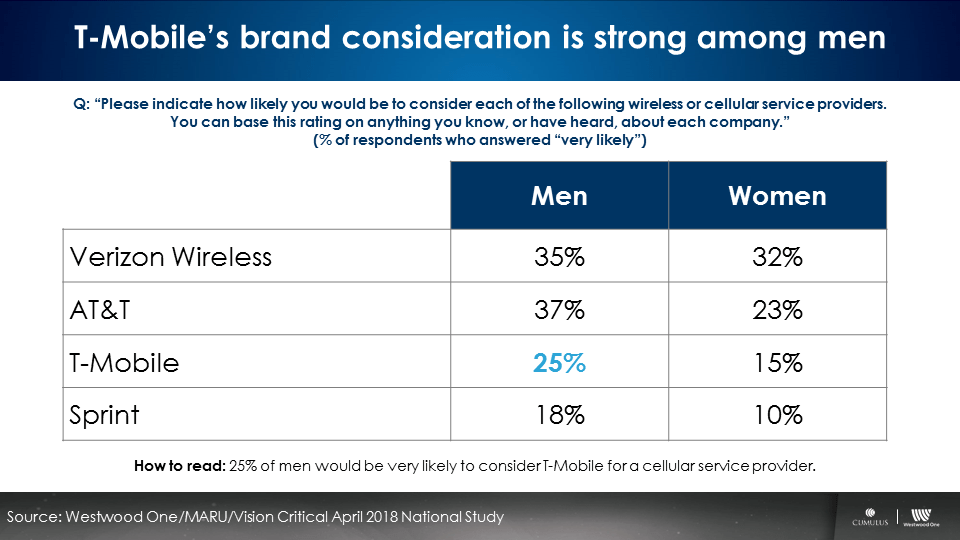

Sprint can help grow T-Mobile’s brand consideration among women

Consideration represents the company consumers would consider if they were looking to make a wireless change. T-Mobile performed strongly among men, with 25% of respondents saying they would be very likely to consider T-Mobile for a cellular service provider.

What about women? Only 15% of women would consider the T-Mobile brand. Fortunately, an additional 10% of women would consider Sprint for a wireless change. By combining the two, T-Mobile gains a significant foothold in the female demographic of potential consumers.

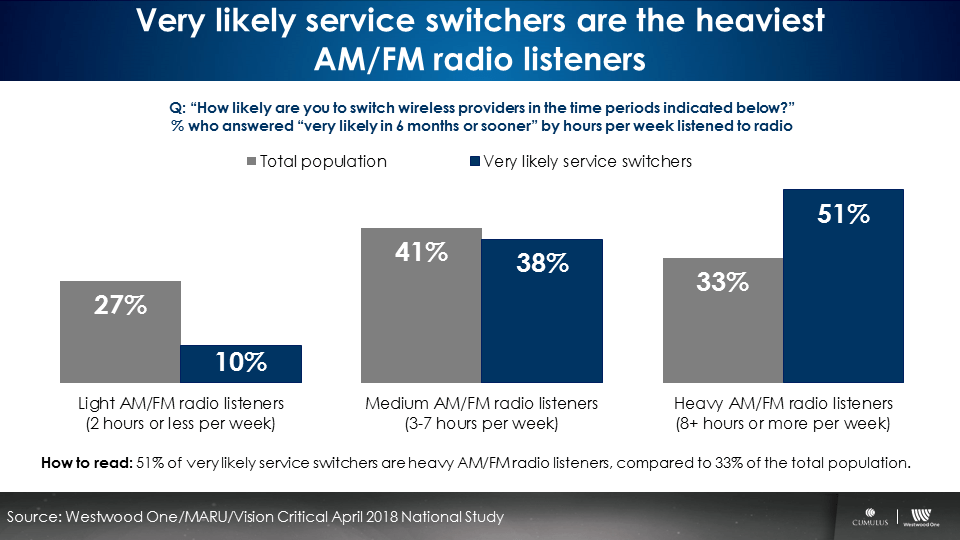

AM/FM radio is the ideal medium to reach consumers ready to switch carriers

T-Mobile and Sprint can capitalize on strong consideration and attract new customers by targeting consumers very likely to switch their wireless service. The richest concentration of “in the market” service switchers is among heavy AM/FM radio listeners. 51% of very likely service switchers are heavy AM/FM radio listeners, compared to 33% of the general population.

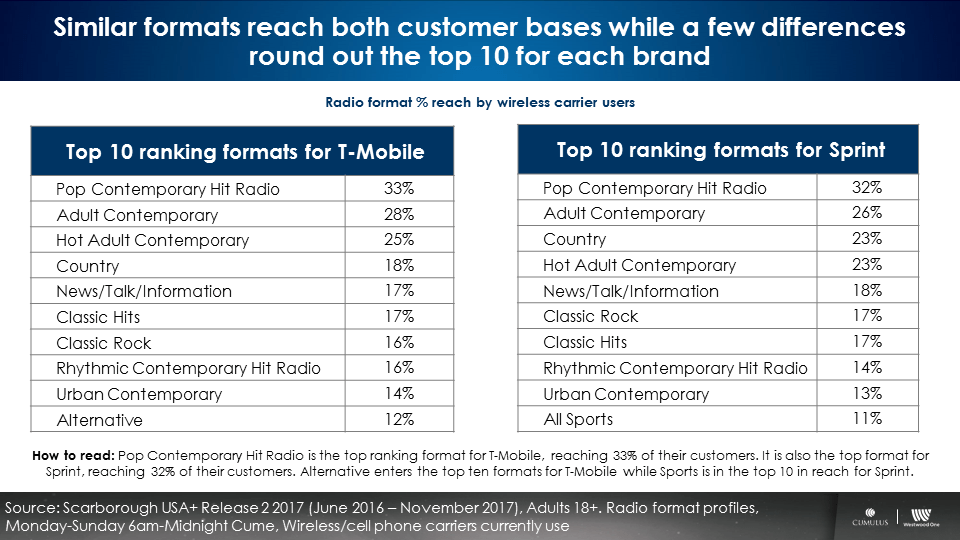

Similar formats reach both T-Mobile and Sprint customer bases while a few differences round out the top 10 for each brand

AM/FM radio works the telecom industry and there’s a format for every kind of wireless customer. T-Mobile and Sprint see similar formats appearing in the top 10 ranked radio formats. For both, Pop Contemporary Hit Radio, Adult Contemporary, Country, and Hot Adult Contemporary appear in the top four highest reaching formats.

Rounding out the top 10, Alternative format stations reach 12% of T-Mobile customers while Sports format stations reach 11% of Sprint users. With a variety of formats reaching significant percentages of customers, the combined company will have options when it comes to AM/FM radio hitting their desired audience.

The T-Mobile and Sprint merger is an exciting convergence of two companies into one major player in the wireless industry. Together they make each other stronger in awareness, brand images, and consideration. With AM/FM radio, the number one mass reach medium, they can start off their unified charge reinforcing existing customers and converting the right consumer likely to change their plan.

Key takeaways:

- While T-Mobile sees a slight deficit in awareness among Gen X and Boomers, Sprint can make up for the gap

- T-Mobile’s strength is in nurturing positive brand images

- Consumers associate T-Mobile with being an affordable unlimited data plan thanks to the Un-carrier initiative

- Sprint can help grow T-Mobile’s brand consideration among women

- AM/FM radio is the ideal medium to reach consumers ready to switch carriers

- Similar formats reach both T-Mobile and Sprint customer bases while a few differences round out the top 10 for each brand

Pierre Bouvard is Chief Insights Officer at Cumulus | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.