Share Of Ear Q2 2018 Review: From Consumers To Voters, AM/FM Radio Has It Covered

Edison Research, leaders in studying American audio use, just published their Q2 2018 Share of Ear report. The quarterly tracking study provides an in-depth view into U.S. audio usage.

Share of Ear Q2 2018 upheld many of the trends we’ve seen in previous quarters such as the dominance of AM/FM radio, Pandora’s freefall, and Spotify’s growth. Plus, a new insight emerged this quarter just in time for election season.

Here’s what we found:

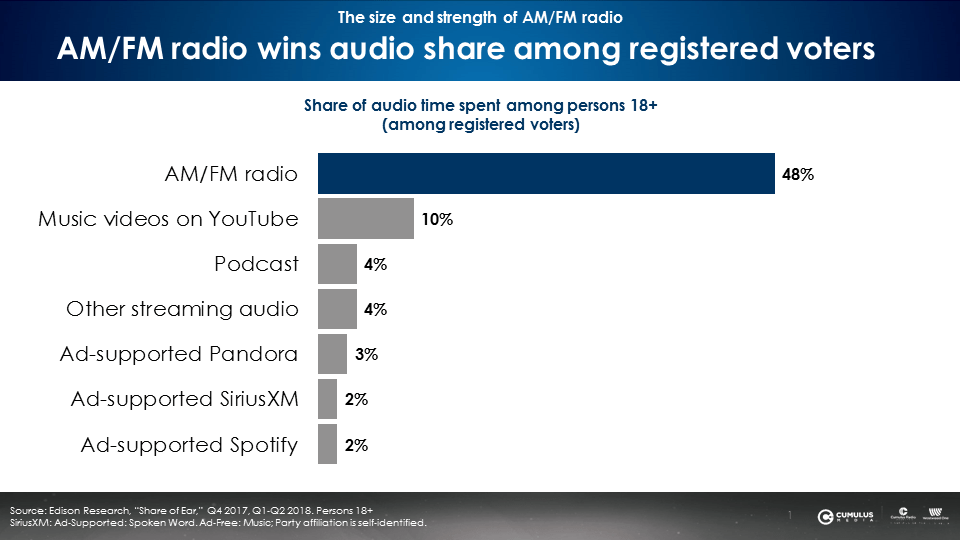

1. AM/FM radio is the ideal ad-supported medium to target American voters. The 2018 midterm elections are around the corner, and for political advertisers, AM/FM radio is the place to be. Among political targets like registered voters, AM/FM radio share of audio beats ad-supported Pandora 16 to 1 and ad-supported Spotify 24 to 1. Among overall Americans 18+, AM/FM radio’s audience dominance remains, crushing ad-supported Pandora by 12x and Spotify by 47x.

According to the Nielsen Comparable Metrics Report, AM/FM radio is America’s #1 mass reach medium. When trying to target key groups, political advertisers and candidates alike should take advantage of AM/FM radio’s powerful share of audio to find registered voters.

2. A major pop hit gets more listens in just one AM/FM radio market than nationwide on Spotify. We compared daily plays of top pop hit “No Tears Left to Cry” by Ariana Grande between AM/FM radio and Spotify and found a stark difference. On July 24, 2018, the daily listens to “No Tears Left to Cry” on all of nationwide Spotify was less than AM/FM radio listens in the Chicago market. Spotify doesn’t hold a candle to AM/FM radio’s massive size.

Share of Ear reports that in a typical day 9 out of 10 Americans are not reached by ad-supported Pandora or Spotify. Advertisers should expand their audio use beyond streaming to include AM/FM radio as they are missing out on the majority of their target audience.

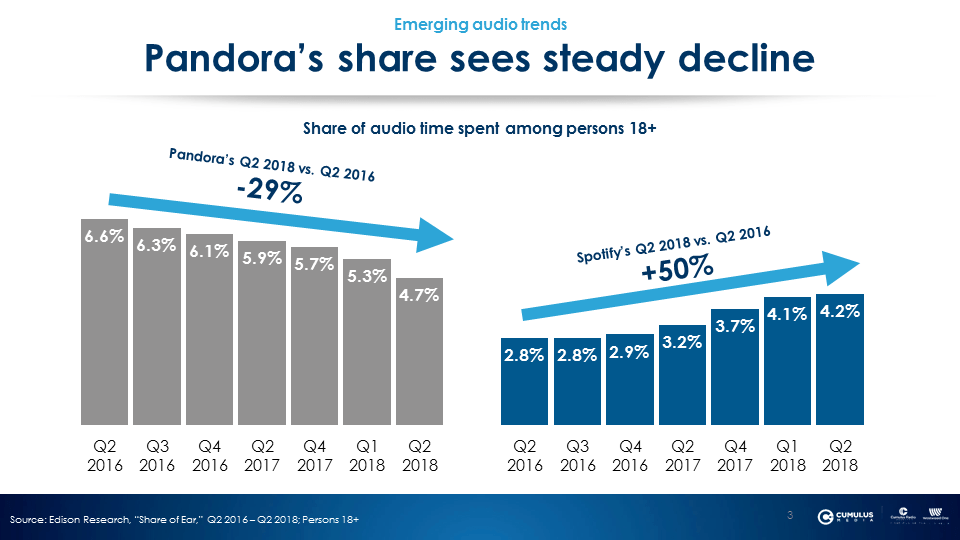

3. Pandora’s audience erodes for the 9th consecutive quarter. Stemming back to Q2 2016, Pandora been experiencing relentless erosion in share of time spent among Americans 18+. In Q2 2018, Pandora’s share has dropped -29% versus Q2 2016. Analysts indicate Pandora’s audience losses come at the hands of Spotify and the increasing consumer desire for on-demand functionality.

4. Spotify is still on the rise, though YouTube is the leading audio streamer. Among total persons 18+, Spotify has grown its share of audio time spent +50% since Q2 2016. Each quarter, Spotify has been able to grow at the expense of Pandora while developing itself as the new leader in the industry. However, Spotify shouldn’t get too comfortable, as YouTube has become the number one audio streaming platform.

To recap:

- AM/FM radio is the ideal ad-supported medium to target American voters.

- A major pop hit gets more listens in just one AM/FM radio market than nationwide on Spotify.

- Pandora’s audience erodes for the 9th consecutive quarter.

- Spotify is still on the rise, though YouTube is the leading audio streamer.

Brittany Faison is the Insights Manager at Cumulus | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.