Brand Building AM/FM Radio Campaigns Are Key As Auto Parts Shoppers Shift To Direct-To-Consumer Retailers

These days it seems like there are all sorts of online retailers: cosmetics outlets, clothing retailers, food delivery, and now, auto parts.

As online shopping for auto parts picks up steam, CUMULUS MEDIA | Westwood One has commissioned MARU/Matchbox to conduct consumer studies to better understand the buying habits of the American auto parts consumer.

Here are the results from studies conducted in 2017 and this year:

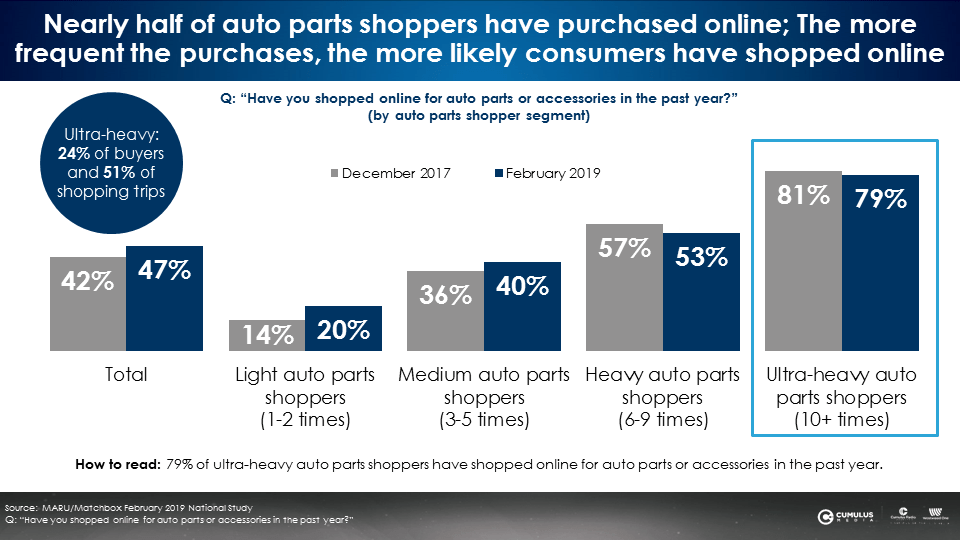

Nearly half of auto parts shoppers have shopped online

From 2017 to 2019, the proportion of auto parts buyers who have shopped online has grown from 42% to 47%.

The more you buy, the more you shop online

Among ultra-heavy auto parts shoppers, those who have made 10+ shopping trips in the last two years, 80% have shopped online. An equally high proportion of do-it-yourselfers (83%) have shopped online in the past year.

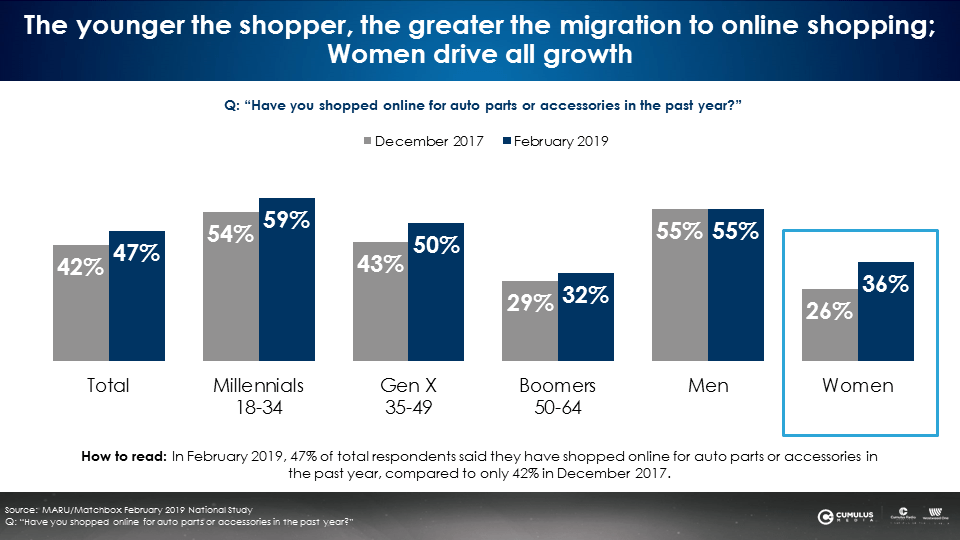

Women are responsible for all the growth in online shopping for auto parts

From 2017 to 2019, the proportion of women who have shopped online for auto parts has grown 26% to 36% while the number of male online shoppers has held steady at 55%.

Younger consumers shop online more

Unsurprisingly, more Millennials 18-34 (59%) have shopped online in the past year for auto parts compared to 2017. 35-49s (50%) are not too far behind. Online shopping falls off with 50-64s (32%).

Online auto parts shoppers are shifting away from retail to more online shopping

Overall, 17% of auto parts shoppers say they “shop more online than at a retail store location.” The “shop online more than retail” proportion is higher among do-it-yourselfers (40%), heavy AM/FM radio listeners (25%), and Millennials (26%).

The rise of direct-to-consumer auto parts retailers: RockAuto and PartsGeek experience growth in awareness and usage, especially among do-it-yourselfers

Both RockAuto and PartsGeek have grown awareness and usage over the past year. Among do-it-yourselfers, awareness has doubled. Far more do-it-yourselfers have shopped at RockAuto and PartsGeek versus the overall auto parts market.

| Among those who have purchased auto parts in the last two years | RockAuto | |

| 2017 | 2019 | |

| Aided awareness | 26% | 30% |

| Aided awareness among do-it-yourselfers | 41% | 55% |

| Shopped last year | 8% | 11% |

| Shopped last year among do-it-yourselfers | 22% | 33% |

| Among those who have purchased auto parts in the last two years | PartsGeek | |

| 2017 | 2019 | |

| Aided awareness | 13% | 17% |

| Aided awareness among do-it-yourselfers | 29% | 40% |

| Shopped last year | 5% | 8% |

| Shopped last year among do-it-yourselfers | 15% | 26% |

Established auto parts retailers devote little focus to marketing online shopping capabilities

While Walmart has aggressively promoted, “Shop online, pick up in store!” to thwart Amazon, brick and mortar auto parts retailers have been quiet about online shopping. This has benefited the two direct-to-consumer auto parts retailers as they are the only ones touting online shopping.

Customers of brick and mortar retailers are shopping at online auto parts specialists. One out of five customers of Pep Boys, NAPA, Costco, and Walmart have shopped at RockAuto and PartsGeek in the past year.

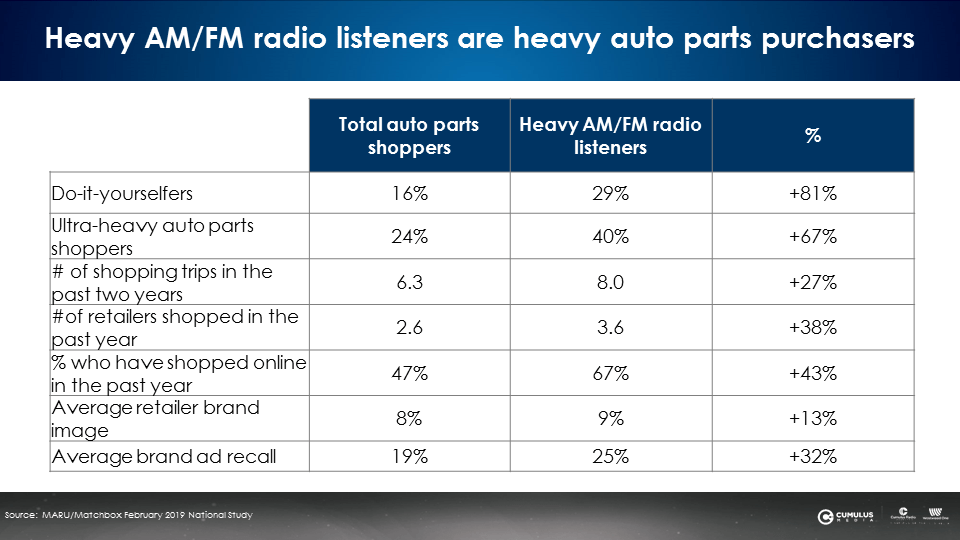

AM/FM radio is the engine of American auto parts shopping

Across every measure of auto parts shopping, heavy AM/FM radio listeners spend more, shop more often, and purchase at more retailers. It makes sense that AM/FM radio is heavily utilized by auto parts retailers.

- 40% of heavy AM/FM radio listeners are ultra-heavy shoppers (10+ shopping trips in the last two years) versus 24% of all auto parts shoppers

- Heavy AM/FM listeners have made 8 shopping trips in the past two years versus 6.3 for the category average

- Heavy AM/FM radio listeners shop at an average of 3.6 retailers, far more than the 2.6 average

- 29% of heavy AM/FM radio listeners are do-it-yourselfers versus 16% on average

- Far more heavy AM/FM listeners have shopped online (67%) compared to the category average (47%)

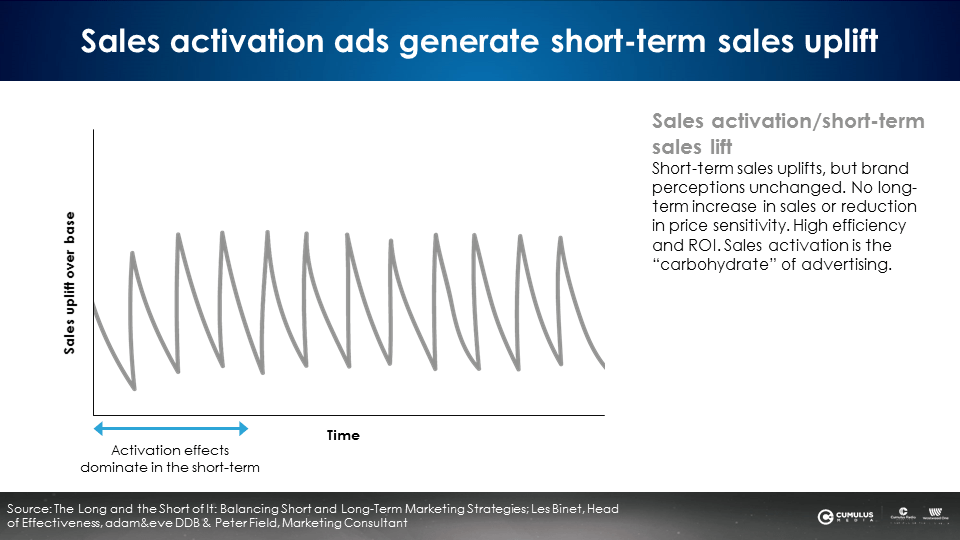

Auto parts retailers are addicted to sales activation campaigns: the “carbs of advertising”

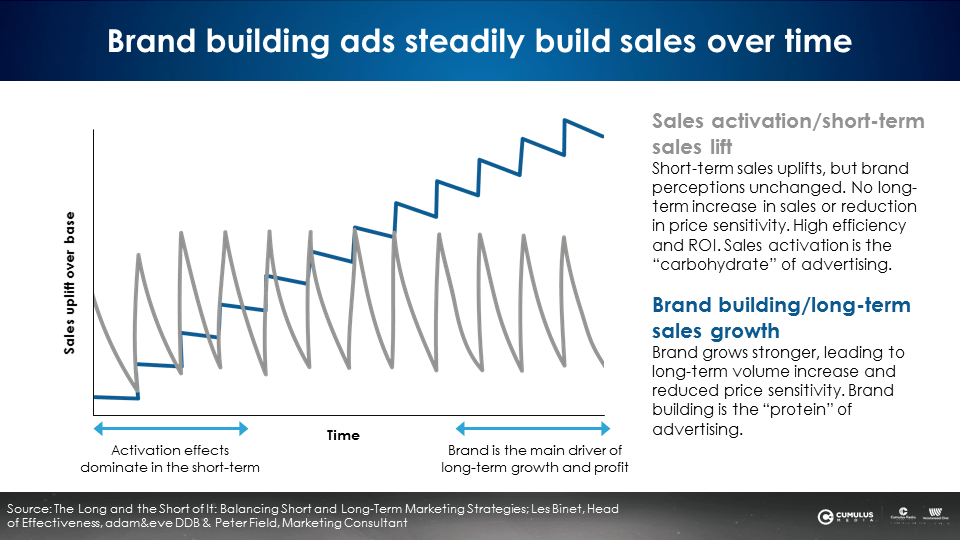

Les Binet and Peter Field, the godfathers of marketing effectiveness, explain that the goal of sales activation “is to focus on people who are likely to buy in the very near future. That means exploiting existing brand equity to generate sales right now.” Sales activation campaigns advertise a special offer and limited time deal.

Sales activation features rational copy and tight targeting. In their book Media in Focus: Marketing Effectiveness in the Digital Era, Binet and Field report, “Activation effects are relatively easy to measure, because they tend to be big, immediate and direct. In the short term (six months or less) they tend to produce the biggest sales responses.”

Sales activation campaigns generate sales uplift through a series of short-term sales spikes that quickly collapse. They decay fast and don’t build long-term sales. Sales activation campaigns (the grey line below) are the “carbs of advertising:” a sugar rush of short-term sales and then a crash.

Most ads for auto aftermarket retailers tout a never-ending series of promotions, product specials, and offers for oil and batteries. Ads for auto parts retailers do a far better job of branding oil companies than the actual retailer.

Few auto parts retailers utilize brand building campaigns: the “protein of advertising”

Of the two types of campaigns, brand building is harder to achieve, requires greater investment, and is more important. According to Binet and Field, “Brand building means creating mental structures (associations, memories, beliefs, etc.) that will pre-dispose potential customers to choose one brand over another. This is a long-term job involving conditioning consumers…so it takes time; talking to people long before they come to buy.”

Brand building requires mass reach media like AM/FM radio. That’s because the goal is to target everyone in the category, even if they are not in the market right now.

Brand building campaigns depend on emotional creative that makes people feel something. Emotional messaging has more impact than rational creative with facts and details that are mostly ignored.

While short-term sales uplifts are smaller, brand building sales effects (the blue line below) grow and grow over time, becoming the main driver of long-term growth and profit.

The massive number of marketing effectiveness studies analyzed by Binet and Field reveal the sales effects of brand building “decay away more slowly…in the long run, brand effects are the main driver of growth.” They find that the ideal mix of marketing investments should be 60% brand building and 40% sales activation.

As online auto parts shopping becomes a bigger part of the consumer process, auto parts retailers should look to AM/FM radio to deliver their message to the masses. Through a focus on brand building campaigns to generate steady sales over time, AM/FM radio is an ideal medium to reach the younger, online shopping audience.

Key takeaways:

- Nearly half of auto parts shoppers have shopped online

- The more you buy, the more you shop online

- Women are responsible for all the growth in online shopping for auto parts in 2019

- Shoppers are shifting away from retail to more online shopping

- Direct-to-consumer auto parts retailers RockAuto and PartsGeek experience growth in awareness and usage, especially among do-it-yourselfers

- Established auto parts retailers devote little focus to marketing online shopping capabilities

- AM/FM radio is the engine of American auto parts shopping

- Auto parts retailers are addicted to sales activation campaigns: the “carbs of advertising”

- Few auto parts retailers utilize brand building campaigns: the “protein of advertising”

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.