AM/FM Radio, Streaming, Pandora, Spotify, Podcasts, And Television: How Usage Has Changed Less Than Expected During The Coronavirus Outbreak

Has the Coronavirus outbreak dramatically shifted American media behaviors? The perception is that every aspect of society has experienced drastic shifts due to “shelter at home.” When it comes to ad-supported media, the differences are not as stark as many assume.

Here is the reality using a variety of just-released sources:

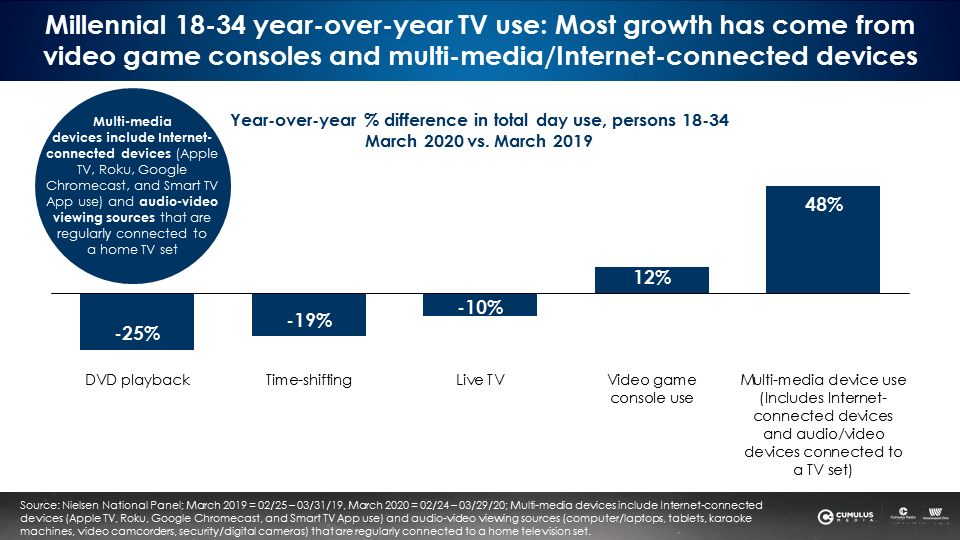

TV: Millennials 18-34 down -10% and persons 25-54 dips -3%

Many assume that with so much more time being spent at home, ad-supported TV viewing must be through the roof. Nielsen data reveals otherwise when comparing March 2020 versus March 2019.

Nielsen national live TV total day viewing levels among 18-34s for March 2020 finds a -10% decrease versus the prior year. Time-shifted TV viewing among 18-34s is down -19% year-over-year.

The major growth for Millennials is among video game console use, up +12% from March of the prior year, and multi-media device use, up +48%, most likely from Netflix and Amazon Prime. Multi-media device use includes Internet-connected devices (Apple TV, Roku, Google Chromecast, and Smart TV App use) and audio-video viewing sources (computer/laptops, tablets, karaoke machines, video camcorders, security/digital cameras) that are regularly connected to a home television set.

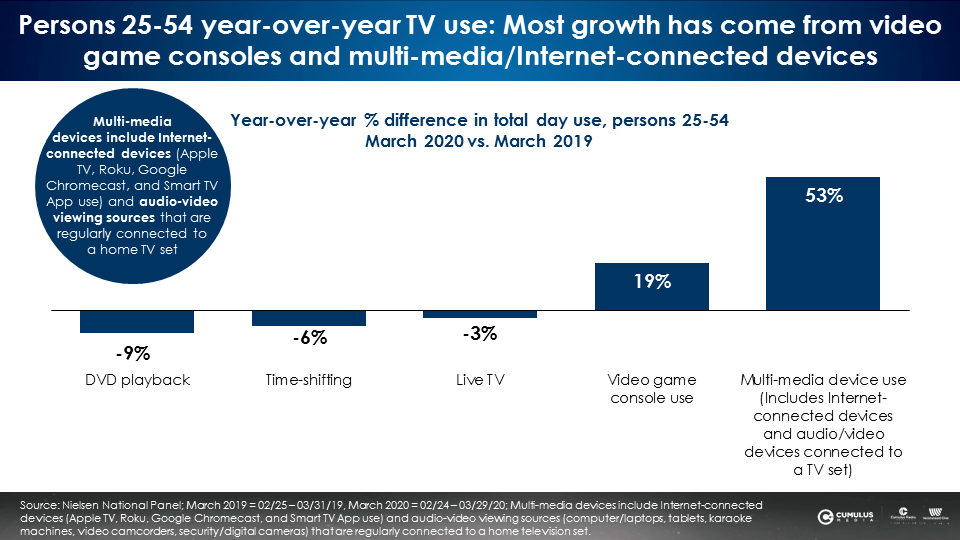

Among persons 25-54, Nielsen shows a similar pattern for total day viewing in March 2020 versus March 2019. The platforms advertisers can buy ads in, live and time-shifted linear TV, are down -3%. The major viewing increases were for video game console use (+19%) and multi-media devices (+53%).

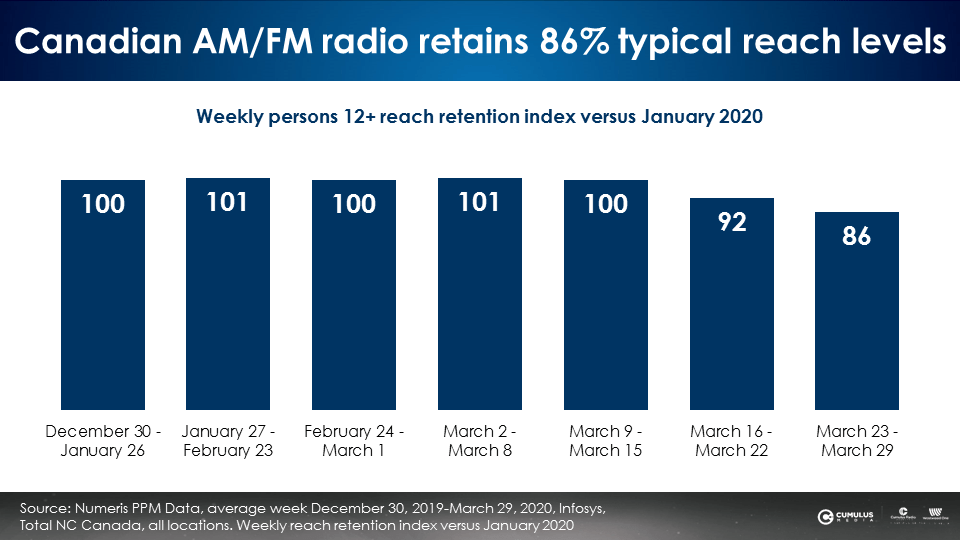

AM/FM radio: Using Canadian Portable People Meter data as a preview of what is to come for America, AM/FM radio has retained 86% of typical weekly reach levels

While the U.S. awaits this week’s publication of the March Nielsen Portable People Meter data, Canada’s just-released AM/FM radio audience data provides insight on how “sheltering at home” impacts listening.

The data reveals that just like the U.S., Canada’s AM/FM radio has massive weekly reach. Despite an early March “shelter at home” mandate, AM/FM radio reach levels for the most recent week of March 23-29 were at 86% of January 2020 levels.

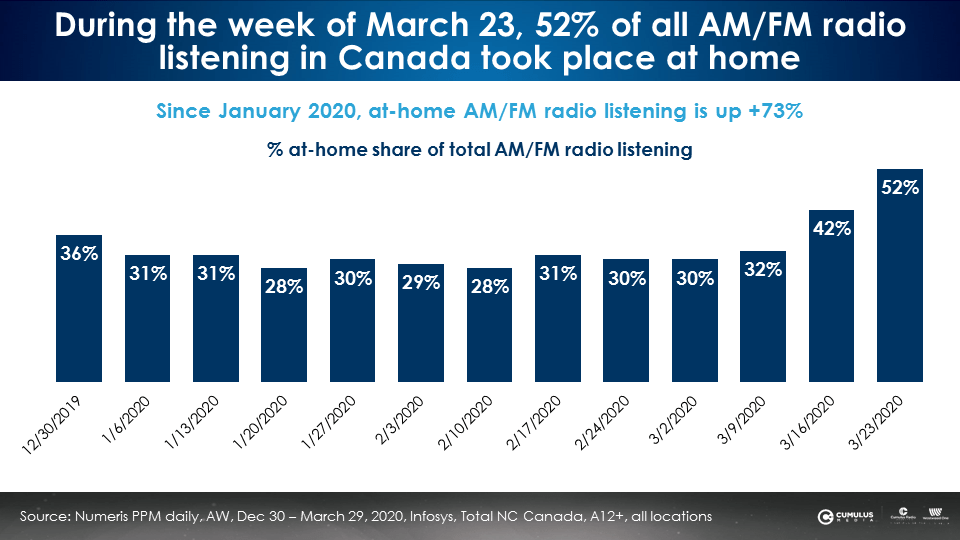

AM/FM radio: The at-home share of total Canadian AM/FM radio listening has increased +73%

As is the case in the U.S., typically 30% of Canadian AM/FM radio listening occurs at home. By the last week of March, Canada’s at-home share of total AM/FM radio listening grew to 52%.

Why is AM/FM radio such an important medium during this time?

- AM/FM radio connects: A recent Nielsen study found AM/FM radio is crucial to listeners during a crisis. Americans say AM/FM radio makes them feel less alone and more connected to their community.

- AM/FM radio informs: Listeners also find that AM/FM radio gives them timely and accurate information that makes them feel informed about the things they need to know.

- Americans have access to AM/FM radio: According to Edison Research and Triton Digital’s Infinite Dial 2020 report, 68% of American homes own a radio. Another 8% own a smart speaker but no radio. Lastly, 20% of Americans own a smartphone device but no radio or smart speaker.

Pandora/Spotify: Streaming audiences are down modestly

- Pandora down -9%: According to Rolling Stone Magazine, during the week of March 13-19, “Programmed streams on services like Pandora dropped 9% to just under 3.5 billion, while on-demand streams (audio and video) dropped 7.3 percent to 16.6 billion.”

- Spotify U.S. streams of the top 200 songs is down -16%: For Spotify, Investor’s Business Daily reports a -16% decrease for Spotify’s U.S. top 200 songs streams. Despite the major life disruption, usage of these streaming platforms is only seeing minor decreases.

Streaming: Triton Digital finds +3% increase in streaming driven by mobile and smart speaker listening

According to an analysis by Triton Digital of more than 3,200 AM/FM radio streams for the week ending March 21, overall streaming of U.S. radio stations increased by +3% compared to the average of the prior four weeks.

Triton data also finds streaming on mobile devices was up +6% and streaming on smart speakers was up +4% the week ending March 21 compared to the average of the prior four weeks.

Streaming: The Cumulus Streaming Network is only off -5% during March 30-April 3 compared to early March

Compared to March 2-March 6, the Cumulus Streaming Network has seen a decrease of only -5% in average active sessions for the week of March 30-April 3. Americans are still streaming their favorite AM/FM radio stations.

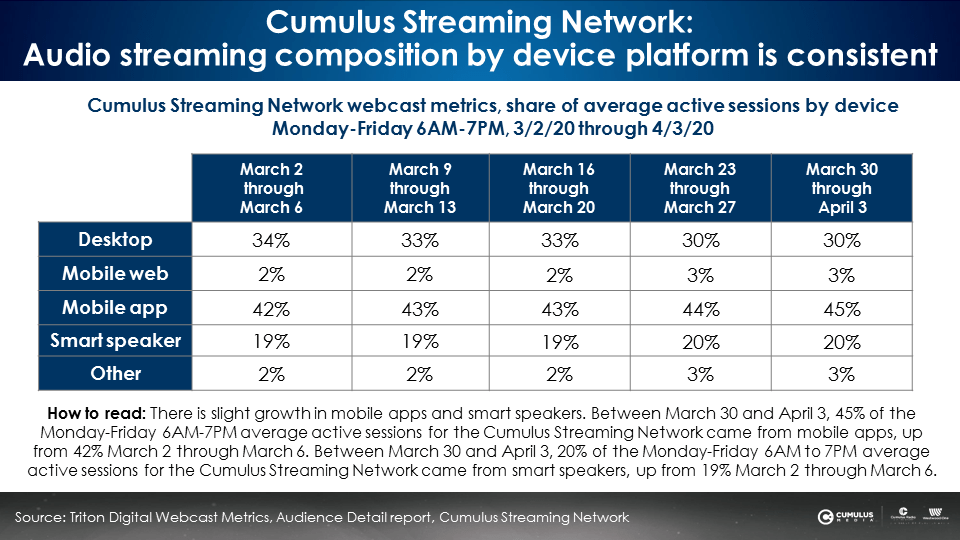

Streaming: Device use is consistent with slight increases in mobile apps and smart speakers for the Cumulus Streaming Network

Between March 30-April 3, 45% of the Cumulus Streaming Network’s average active sessions took place on a mobile app, up slightly from 42% from March 2-6. Streaming on smart speakers went from 19% to 20% over four weeks. Streaming on a desktop dipped from 34% in the beginning of March to 30% in the beginning of April.

Podcasts: Slight reduction in downloads and audiences

According to Podtrac data, podcast listening levels are down slightly overall. Their data reveals, “U.S. weekly podcast downloads decreased 1% the week of March 30- April 5, 4% the week of March 23-29, 2% the week of March 16-22, and 1% during the week of March 9 -15, across all Podtrac measured podcasts.”

Ad-supported media behaviors have not changed overnight

In the absence of media facts, imaginations run wild. A change in scenery for many Americans has not resulted in a dramatic shift in ad-supported media behavior.

Media that most ads run on (TV, AM/FM radio, audio streaming, and podcasts), have experienced modest audience changes. The media platforms with the largest audience gains generally don’t accept advertising. These platforms include video games and Internet-connected devices, gateways to advertising free video subscription services like Netflix and Amazon Prime.

While a location disruption might cause consumers to explore new technologies and platforms for their media consumption, meaningful behavior change occurs over an extended period of time. As it currently stands, Americans are still looking to AM/FM radio, streaming, podcasts, and television with remarkable consistency given changing circumstances.

Key takeaways:

- TV: Millennial 18-34 down -10% and persons 25-54 dips -3% versus the prior year

- AM/FM radio: Using Canadian Portable People Meter data as a preview of what is to come for America, AM/FM radio has retained 86% of typical weekly reach levels

- AM/FM radio: The at-home share of total Canadian AM/FM radio listening has increased +73%

- Pandora/Spotify: Streaming audiences are down modestly

- Streaming: Triton Digital finds +3% increase in streaming driven by mobile and smart speaker listening

- Streaming: The Cumulus Streaming Network only off -5% during March 30-April 3 compared to early March

- Streaming device usage: Consistent with slight increases in mobile apps and smart speakers for the Cumulus Streaming Network

- Podcasts: Slight reduction in downloads and audiences

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.