Westwood One And LeadsRx Release Second Annual Direct-To-Consumer Media Attribution And Awareness Report

Even before the Coronavirus, e-commerce was on a tear. In Q1 2020, the U.S. government indicated e-commerce represented 11.8% of total U.S. retail sales, up from 6.9% in Q1 2015 and 4.8% in Q1 2010. eMarketer forecasts e-commerce will represent 14.5% of full year 2020 total retail sales.

A key aspect of e-commerce are direct-to-consumer brands who sell straight to consumers online. Examples of direct-to-consumer companies include Wayfair, the home goods retailer, Stitch Fix clothing, and Casper mattresses.

LeadsRx and MARU/Matchbox: Second annual direct-to-consumer media attribution and awareness study

To understand the marketing effectiveness of direct-to-consumer firms and the state of their brand equity, Westwood One, America’s largest radio network, partnered with LeadsRx and MARU/Matchbox to issue our second annual Direct-to-Consumer Media Attribution and Awareness Report.

LeadsRx, one of the leading multi-touch attribution firms, conducted a major attribution study. They measured advertising campaigns of 207 different direct-to-consumer retailers that ran during 2019 covering the categories of home, auto, events, entertainment, food, pet, apparel, and marketplace/online auction sites. The LeadsRx study consisted of 137 Google/Facebook advertisers, 50 AM/FM radio advertisers, and 20 TV advertisers.

Across the 207 direct-to-consumer brands, LeadsRx measured the site traffic lift generated by advertising on Google/Facebook, AM/FM radio, and television throughout 2019. These findings were compared to the first LeadsRx direct-to-consumer study conducted of 62 brands in 2018 and released in April of 2019.

Westwood One commissioned MARU/Matchbox to field a national awareness study in February 2020 of 400 direct-to-consumer brands selected across a variety of categories. 1,456 consumers were surveyed. The direct-to-consumer firms measured included nearly all of IAB’s “250 Brands To Watch.” Awareness data for 86 brands measured in the 2019 MARU/Matchbox study were trended to the 2020 study.

In addition, an analysis of GfK MRI consumer shopping data profiled e-commerce consumers’ spending and media habits. Nielsen Media Impact, the media optimization platform, was utilized to quantify the incremental reach of adding AM/FM radio to direct-to-consumer TV campaigns.

Reinforcing Westwood One’s commitment to understanding the impact of audio and using its power to drive sales results, the report is being released by the Westwood One ROI Guarantee Audio Insights platform.

Here are key findings:

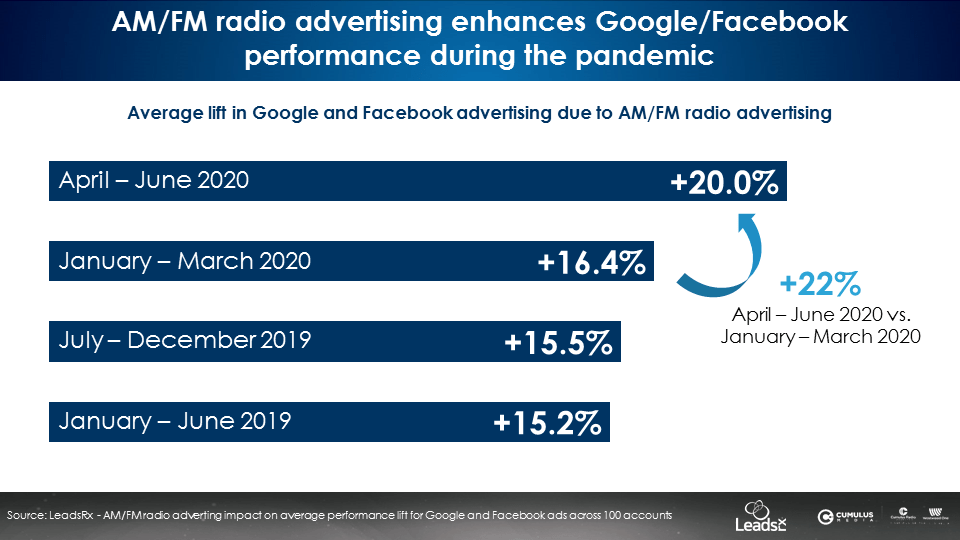

AM/FM radio advertising enhances Google/Facebook performance during the pandemic

LeadsRx studied 100 direct-to-consumer brands who advertise with Google, Facebook and AM/FM radio. They determined the average lift for Google and Facebook ads generated by AM/FM radio advertising over the course of 2019 and 2020.

During 2019, Facebook and Google ads saw a +15% increase in performance due to AM/FM radio advertising. Q1 2020 showed an uptick in the average lift (+16.4%). Then in Q2 2020, average lift surged to +20.0%, a +22% increase from Q1 2020.

During the COVID-19 crisis, AM/FM radio generated even more performance for Facebook and Google advertising.

LeadsRx founder and CEO AJ Brown observes, “This data shows how radio contributes to the success of Google and Facebook. Why is radio driving even more Google and Facebook impact during the pandemic? I believe it’s because radio listeners at home are responding MORE to radio ads now than they “normally” did last year. The increase in Q1 performance was probably from March, right as many started staying home. Then, the Google/Facebook performance up-tick continued into Q2.”

Brown concludes, “Radio has this ‘halo’ effect and sub-conscious impact. Even while listening in the background while checking email or performing other work activities, it’s likely consumers recall an advertiser when getting on the internet.”

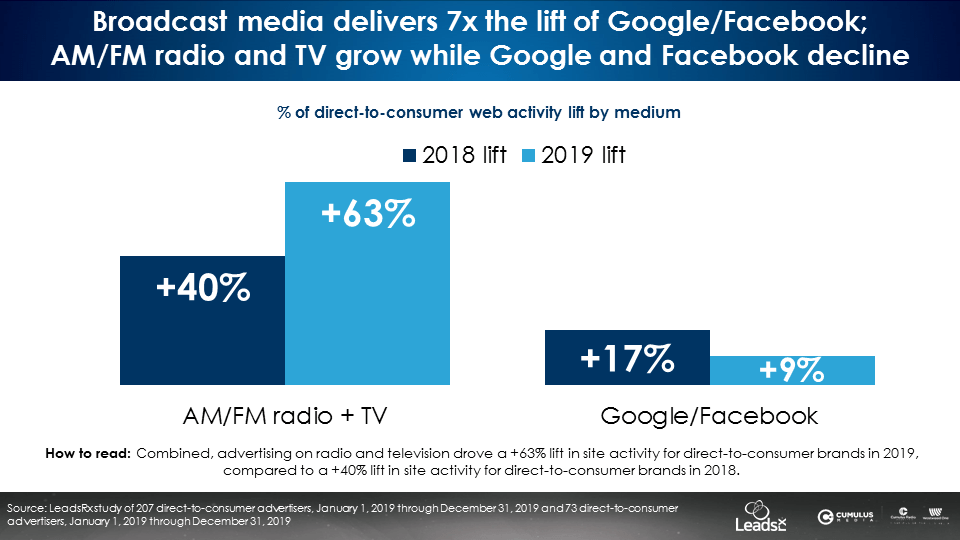

Site traffic lift: Broadcast TV and AM/FM radio surge while Google/Facebook drop

The combined site traffic lift of TV and AM/FM radio grew from +40% in 2018 to +63% in 2019. The lift of Google and Facebook fell from +17% to +9% during the same period.

Broadcast TV and AM/FM radio have 7X the lift of Google/Facebook. Why has broadcast media become such major drivers of direct-to-consumer site traffic? Campaign weight. Direct-to-consumer brands have been pouring into TV and AM/FM radio. As the AM/FM radio/TV spend has grown, so has consumer response and the attributed lift.

Marketing maturity: The second act of direct-to-consumer brands features a greater focus on brand building via mass reach media

Direct-to-consumer’s evolution away from “performance media” to a greater emphasis on brand building campaigns on broad reach media has been anticipated by great marketing minds. Shane O’Leary, an agency strategy executive based in Ireland, predicted last year that the direct-to-consumer space was evolving from its “first act” to “second act.”

O’Leary explains where direct-to-consumer brands once looked to target and attract early adopters, in the second act, they “attempt to grow through market penetration (growing their customer base) and attracting the masses.” Other shifts will include a business model attracting light category buyers, favoring traditional media and brand building over digital direct response options and creating relationships with consumers, and developing physical retail experiences.

O’Leary asserts, “The reality is that it’s still incredibly hard to create a profitable, mass market business if you try to do it without mass media, physical retail and distribution. VC money, hype and early adopters will only get you so far. To build a business you need a mix of old and new. Traditional and digital. Direct and through retail.”

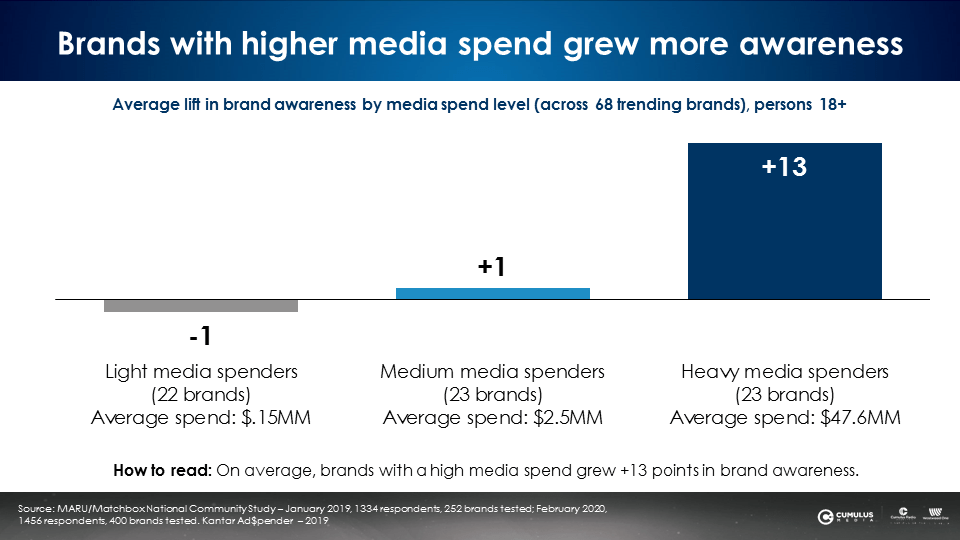

Brands with higher media spend grew awareness

There is a logical correlation between increased awareness for direct-to-consumer brands and the magnitude of the ad budget. Comparing the MARU/Matchbox brand awareness studies from 2019 and 2020, direct-to-consumer firms that had the highest media investment achieved the greatest increase in awareness.

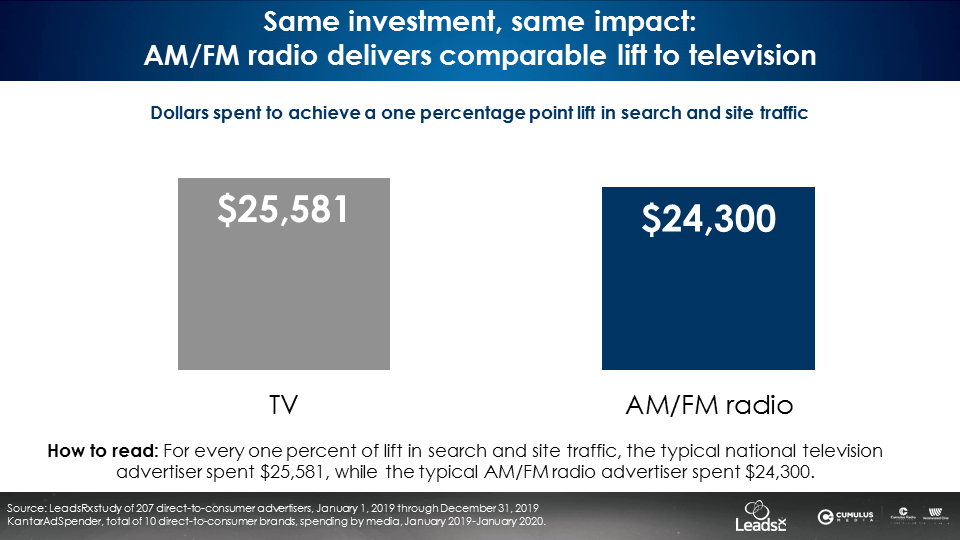

TV and AM/FM radio generate similar cost per lift point

Surprisingly, LeadsRx found that TV and AM/FM radio require almost the same investment to generate similar search and site traffic lift. Across all the attribution studies performed, LeadsRx found a $24,300 investment in AM/FM radio generated one point of search and site traffic lift. To attain a point of lift via TV advertising, a $25,581 investment is needed.

The fact that AM/FM radio and TV have the same “cost per lift point” flies in the face of the TV’s supposed superiority of “sight, sound, and motion.” It appears that TV’s visuals do not translate into more site traffic lift than AM/FM radio.

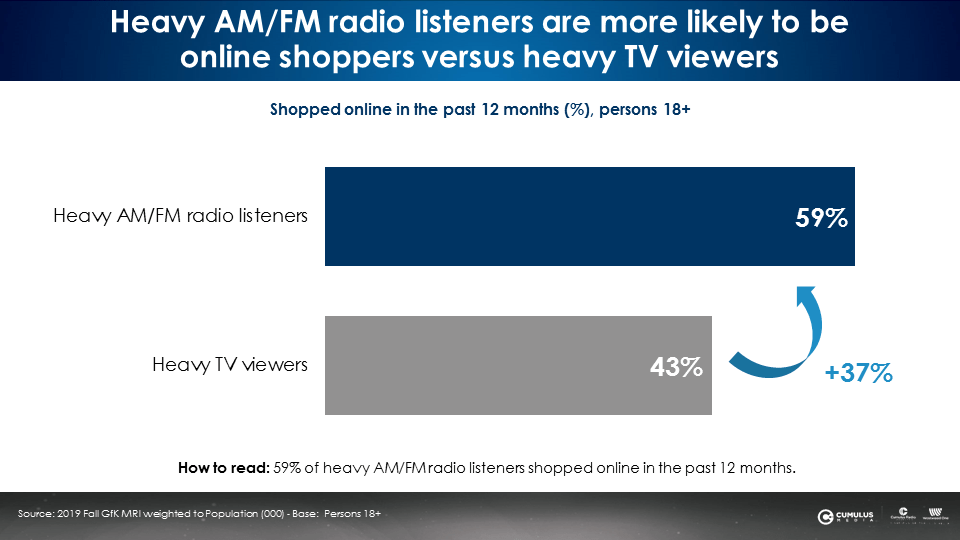

Heavy AM/FM radio listeners are +37% more likely to buy online than heavy TV viewers

According to GfK MRI, 59% of heavy AM/FM listeners have shopped online in the last year versus only 43% for heavy TV viewers. For every dollar a direct-to-consumer brand spends on AM/FM radio, 59 cents reach online shoppers. For every dollar spent on TV, only 43 cents reach consumers who shop online.

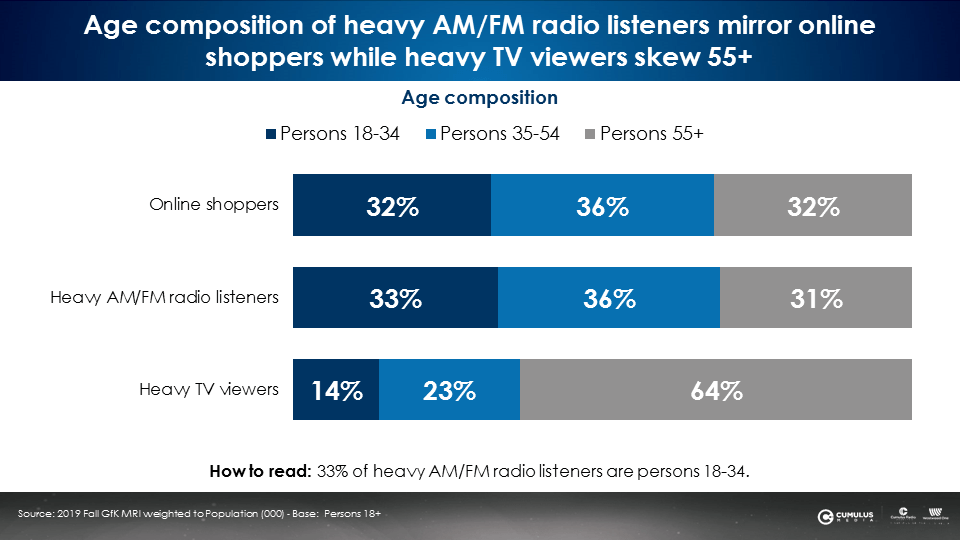

The profile of the online shopper aligns more with AM/FM radio listeners than the TV audience

One of the reasons the AM/FM radio audience has more online shoppers than TV is due to the similar audience profile of AM/FM radio listeners and online shoppers. GfK MRI reveals online shoppers are nearly equally segmented into three age groups: 18-34 (32%), 35-54 (36%) and 55+ (32%).

Heavy AM/FM radio listeners mirror the online shopper profile: 18-34 (33%), 35-54 (36%), and 55+ (31%). The heavy TV viewer skews older: 18-34 (14%), 35-54 (23%) and 55+ (64%).

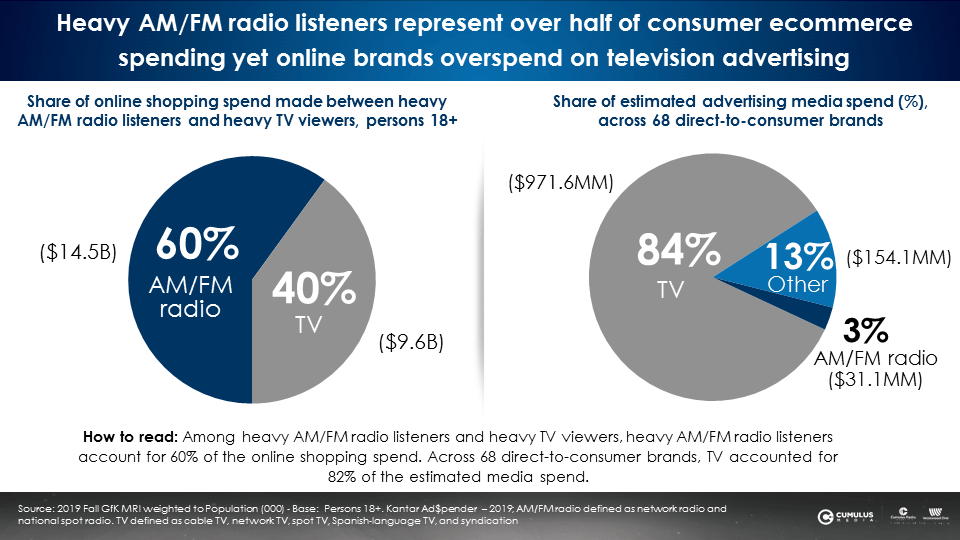

Massive disconnect: AM/FM radio listeners generate 60% of consumer e-commerce spend but AM/FM radio attracts only 3% of e-commerce advertising

GfK MRI reports AM/FM radio represents 60% of the consumer e-commerce spend. Yet, according to Kantar Media, only 3% of e-commerce ad dollars are spent on AM/FM radio. There is a strong opportunity for online brands to upweight AM/FM radio in their media plans.

Nielsen Media Impact: Adding AM/FM radio to the direct-to-consumer media plan dramatically increases 18-54 reach

The challenge for direct-to-consumer brands who use a lot of TV is that most online shoppers are under the age of 55 while most TV viewing is generated by 55+ viewers. Per Gfk MRI, 68% of online shoppers are 18-54. Only 36% of heavy TV viewers are 18-54. Nearly two-thirds of TV deliveries (64%) skew 55+, a demo that only represents 32% of online shoppers. AM/FM radio to the rescue.

Adding AM/FM radio into the direct-to-consumer TV plan generates significant incremental reach under the age of 55. Via the Nielsen Media Impact optimization platform, here are three direct-to-consumer brands advertising on TV with small, medium, and large budgets. In each case, the inclusion of AM/FM radio into the plan dramatically increases campaign reach.

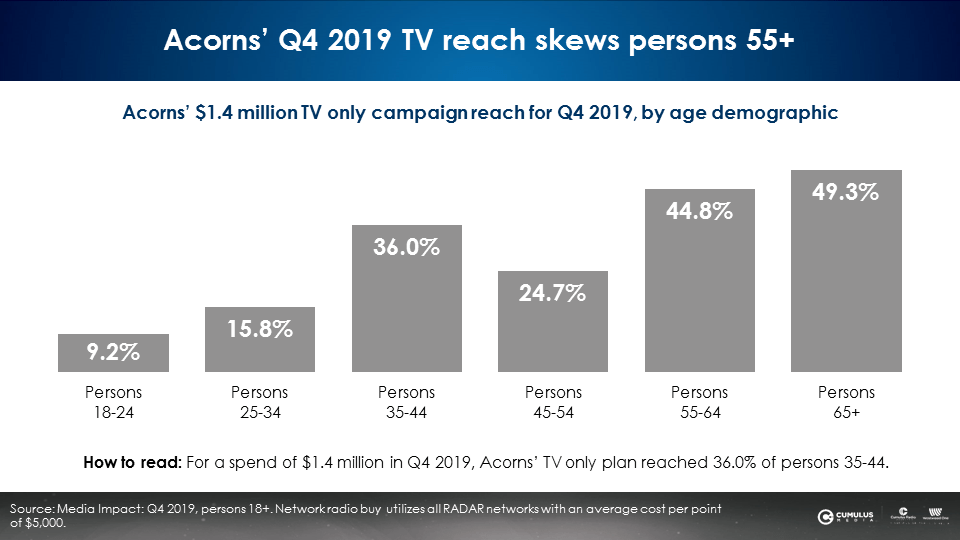

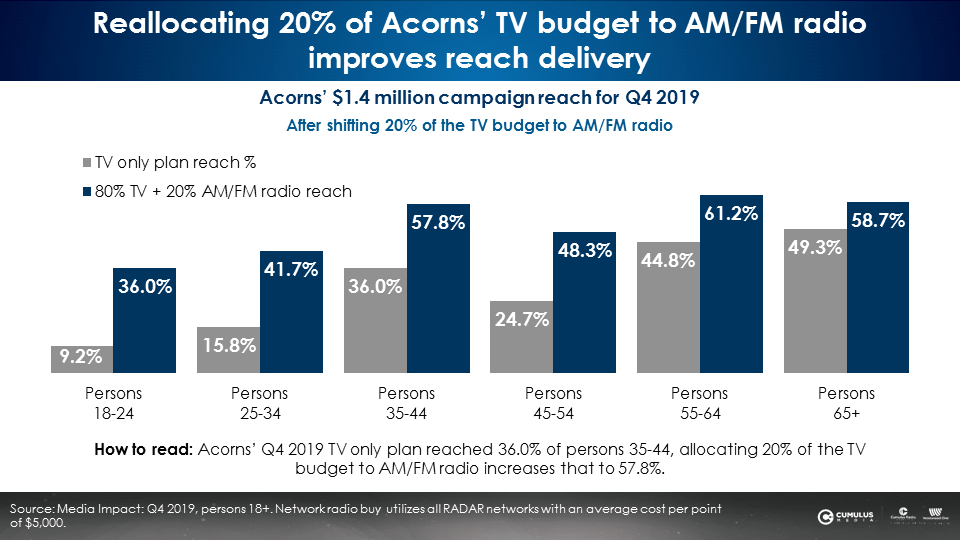

Acorns: Direct-to-consumer brand is a light TV spender

Direct-to-consumer brand Acorns is a savings and investment platform. According to Nielsen, Acorns spent $1.4 million on TV in Q4 2019.

The grey bars above are Acorns’ reach of each age cell from their TV plan. Nielsen Media Impact reveals Acorn’s TV buy reached nearly 50% of the 55+ demographic, but about a third of 35-54s and only 13% of 18-34s. Nielsen Media Impact determined the impact of shifting 20% of the Acorns TV budget ($280,000) to AM/FM radio.

The blue bars above represent the 80% TV/20% AM/FM radio media plan. The reallocation of 20% of Acorns’ TV media plan to AM/FM radio has a significant impact in lifting reach across every age demographic. Among 35-54s, reach doubles. Among 18-34s reach surges by 3X. Even among persons 55+, the addition of radio lifts reach by over 25%.

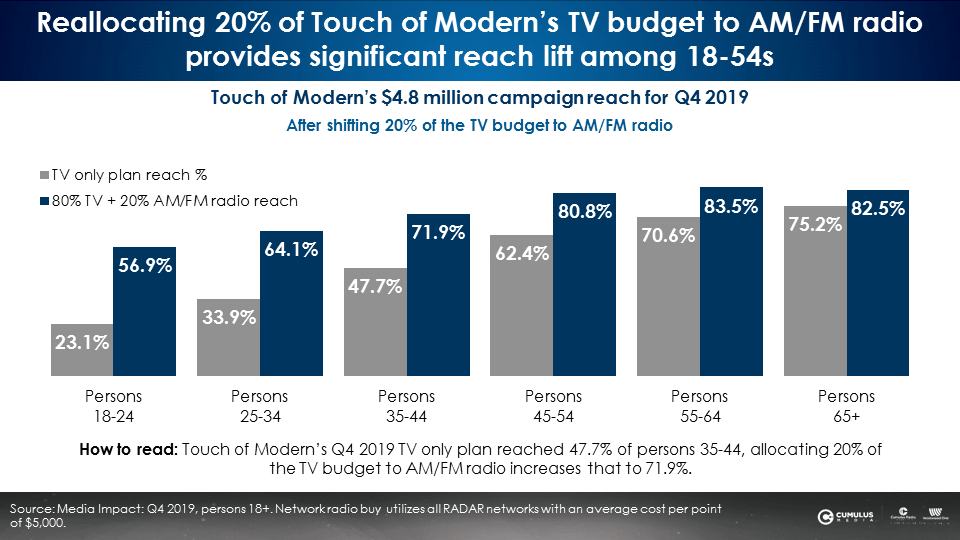

Touch of Modern: Adding AM/FM radio to the TV plan generates a massive increase in 18-54 reach

According to Nielsen, the direct-to-consumer brand Touch of Modern spent $4.8M on television in Q4 2019. The grey bars below reflect the reach of the TV plan. The blue bars present the reach of the 80% TV/20% AM/FM radio plan. Using the same budget and shifting 20% of the TV plan to radio ($960,000) generates added lift in every age cell.

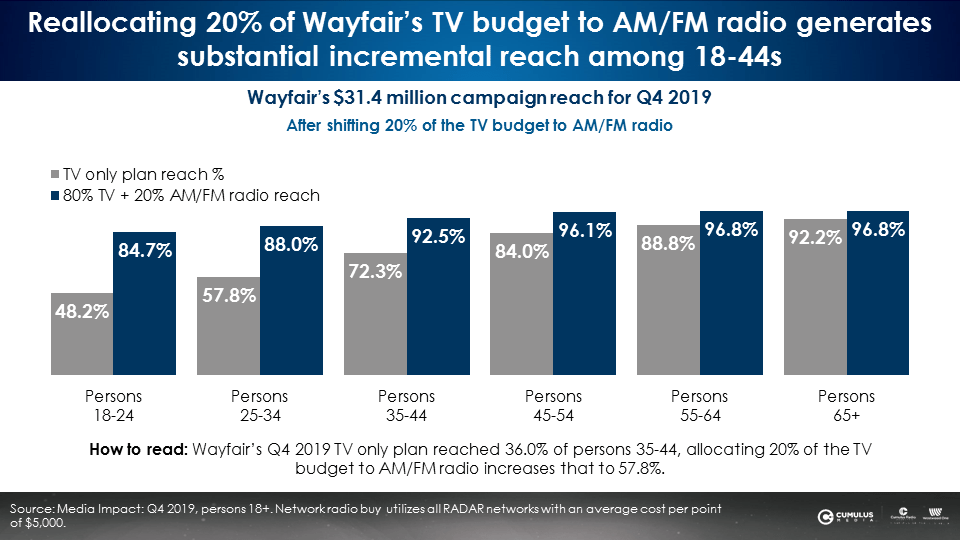

Wayfair: Despite aggressive TV budgets, Wayfair misses 40% of persons 18-44s

Nielsen Media Impact reveals Wayfair’s $31.4 million Q4 2019 TV budget reached 90% of persons 55+, but missed over 20% of 35-54s and half of 18-34s. AM/FM radio to the rescue.

Shifting 20% of Wayfair’s TV spend to AM/FM radio, causes reach to soar to nearly 90% of every age demographic.

Best practices to power direct-to-consumer marketing effectiveness

Some of the world’s leading experts on marketing effectiveness and measurement offer these strategies to boost sales and profit for direct-to-consumer marketers:

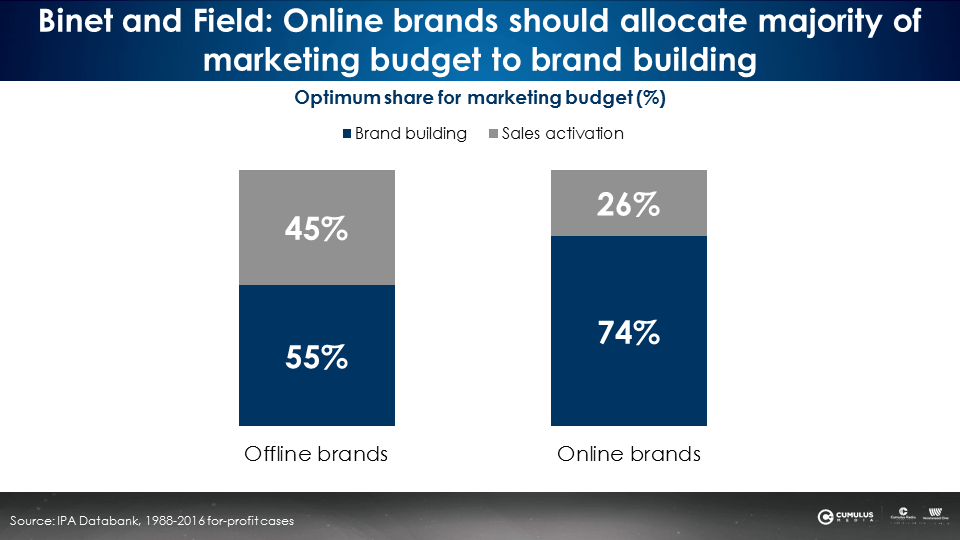

1. Allocate 74% of marketing budgets to brand building and 26% to sales activation

Brand building ads create memories that influence future behavior. Sales activation ads produce an immediate behavioral response. In their book Effectiveness in Context: A Manual for Brand Building, the godfathers of marketing effectiveness, Les Binet and Peter Field, recommend the majority of budgets for firms who sell online be devoted to brand building. Binet and Field’s massive studies reveal “brand building is such a dominant force in effectiveness; it is not only essential for long-term effects, but also boosts short term effects.”

2. Target broadly to expand the customer base

According to Binet and Field, “Compared to offline brands, growth for online brands is even more dependent on broad targeting beyond existing customers … in the crowded online world, reaching out to new customers is vital.”

In their marketing account strategy book How Not To Plan: 66 Ways to Screw It Up, Les Binet and Sarah Carter offer these recommendations to grow sales:

- “Always aim to get more customers from all segments of the market. It’s the main way brands grow.

- Talk to everyone who buys your category. Talk to them regularly. Advertising memories fade.

- Go for reach, rather than frequency. Reach as many category buyers as possible.

- Don’t target too narrowly. It may be efficient, but it’s rarely effective. Tight targeting means low sales and profits.”

3. Employ emotional advertising to build direct-to-consumer brands and drive sales and profit

Binet and Field’s analysis reveals, “The more crowded the category is with choice, the more vital it is that we harness the priming effects of emotional advertising. Rational advertising in online categories appears to be so inefficient that we cannot reliably measure it.”

4. Be known before you are needed: Brand marketing generates better lower funnel performance

Aidan Mark, Group Planning Director & Head Of Effectiveness, VCCP London

Aidan Mark, Group Planning Director & Head Of Effectiveness, VCCP London

Mark reveals there are 10 performance measures that are positively impacted by brand building. These include brand/product search uplift, direct site traffic, attention and advertising recall, click-through rate uplift, quality score improvements, SEO visibility, loyalty and repeat customers, conversion rate to sales, word of mouth effects and price sensitivity.

“Direct-to-consumer brands often over-emphasize the ROI power of bottom-funnel tactics like social and display, remarketing, and brand SEM. Scaling efficient channels with the mass reach of television and AM/FM radio feeds the funnel from the top and amplifies awareness and brand impact,” observed John Leeman, former President & CMO of Brand Value Growth LLC, an owner of a diversified portfolio of direct-to-consumer brands, and former Head of B2B Mobile Marketing, Samsung Electronics America.

5. Media best practices: As campaign weight is important, buy lots of ads in all days and dayparts

A LeadsRx attribution study commissioned by Westwood One on behalf of a nutrition retailer found that markets with light GRP exposure saw a +7% lift in site traffic. Markets with the heaviest GRP weight from the AM/FM radio campaign saw a massive +16% increase in visitation to the retailer’s web site.

The largest AM/FM radio attribution study ever conducted was this study of auto dealer website traffic by iHeartMedia and LeadsRx. LeadsRx studied 310 dealers who ran 1.8M AM/FM radio ads in 100 markets over 17 months. The major findings:

- Run every day: There is very little difference in web traffic by day.

- Run full week campaigns: Lift doubles when the number of days in a schedule grow from 3-4 days a week to 7 days a week.

- Run lots of ads each day: The more ads run per day, the greater the site traffic. 10 ads per day has twice the site traffic of 1-9 ads per day. 40+ ads per day has 5X the lift of 10 ads per day.

Key takeaways:

- AM/FM radio advertising enhances Google/Facebook performance, even more so during the pandemic

- Broadcast TV and AM/FM radio deliver 7X the site traffic lift as Google and Facebook

- Surprisingly, AM/FM radio is just as good as TV in driving site traffic

- Heavy AM/FM audio listeners are +37% more likely to shop online versus heavy TV viewers

- Despite representing 60% of consumer e-commerce sales, AM/FM radio only receives only 3% of e-commerce ad spend

- Per Nielsen’s Media Impact optimization platform, a reallocation of 20% of a direct-to-consumer TV buy to AM/FM radio generates stunning growth in incremental campaign reach

- Best practices: Allocate 74% of marketing budgets to brand building and target broadly with emotional advertising that runs in all days and dayparts

Click here to download the full report

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.