Nielsen: Adding Spanish AM/FM Radio To The Media Plan Generates Significant Impact

Recently while reviewing an audio media plan with a major client we noted that while they were using a vast array of AM/FM radio programming content, they were not buying Spanish radio. The response was, “We get the audience with a general market buy.”

Was that really true? Can a general market buy with only English language stations do an effective job of reaching Hispanics and Spanish speakers? We turned to Oliver Marquis, VP Media Analytics at Nielsen, for assistance.

Oliver Marquis, VP Media Analytics, Nielsen

Hispanics will represent two-thirds of American population growth over the next forty years

First, Oliver shared findings from Nielsen’s significant research on the U.S. Latinx market. Here are key highlights:

- Hispanics are the main engine of American population growth: From 2000 to 2018, the U.S. Hispanic population grew +67% compared to only +9% for U.S. non-Hispanics. Over the next forty years, the Hispanic population will grow +82% versus only +9% for U.S. non-Hispanics. By 2058, the non-Hispanic population will increase by 24.3 million people. Over the same period, the U.S. Hispanic population will grow by 49.1 million people. Hispanics will generate two-thirds of all U.S. population growth.

- Language is important: Language is a cultural connector by choice with 71% of all Hispanics speaking at least some Spanish at home.

- Hispanic households are younger, bigger, and have more kids: Nielsen reports that half of Hispanic households have kids under the age of 18 compared to 28% of non-Hispanic homes. The average household size of Hispanics (3.26 people per home) has 35% more people that than the average non-Hispanic household (2.42 people per home).

- Hispanic buying power has grown 7X since 2000: In 1990, Hispanics spent $213 billion in the U.S. By 2018, U.S. Hispanic buying power grew by seven times to $1.5 trillion. In 2023, Hispanic buying power will be $1.9 trillion. Brands must step up and realize that Latinx consumers represent a strong strategy for future growth.

Determining if a general market AM/FM radio campaign can reach Hispanics and Spanish-dominant Hispanics

To test out this theory, Oliver created a series of English-language-only AM/FM radio buys. He selected five top Hispanic markets and examined the reach of a 100-GRP media plan using the top 10 English language stations in each market.

Then Oliver created a 90%/10%-English/Spanish AM/FM radio media plan. He reduced the GRPs on the English language stations to 90 and allocated 10 GRPs to three Spanish AM/FM radio stations in each market.

Reach and frequency reports were run to examine impact in the total market and among Hispanics and Spanish-dominant Hispanics. Here are the major takeaways:

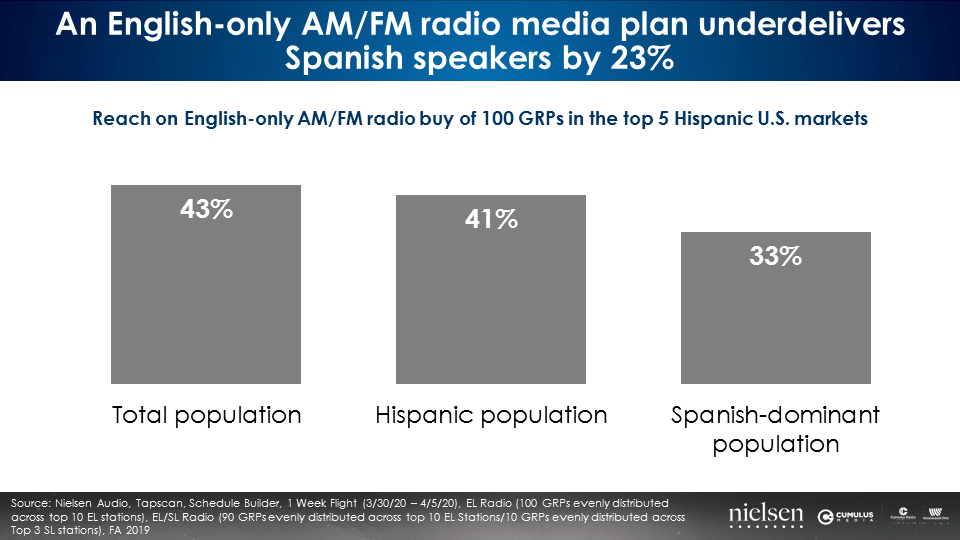

An English-only buy underdelivers Spanish speakers by 23%

Across the five markets, a 100-GRP AM/FM radio buy of the top ten English language AM/FM radio stations reaches 43% of the total market but only 33% of Spanish-dominant Hispanics. That’s a 23% reach shortfall among Spanish speakers.

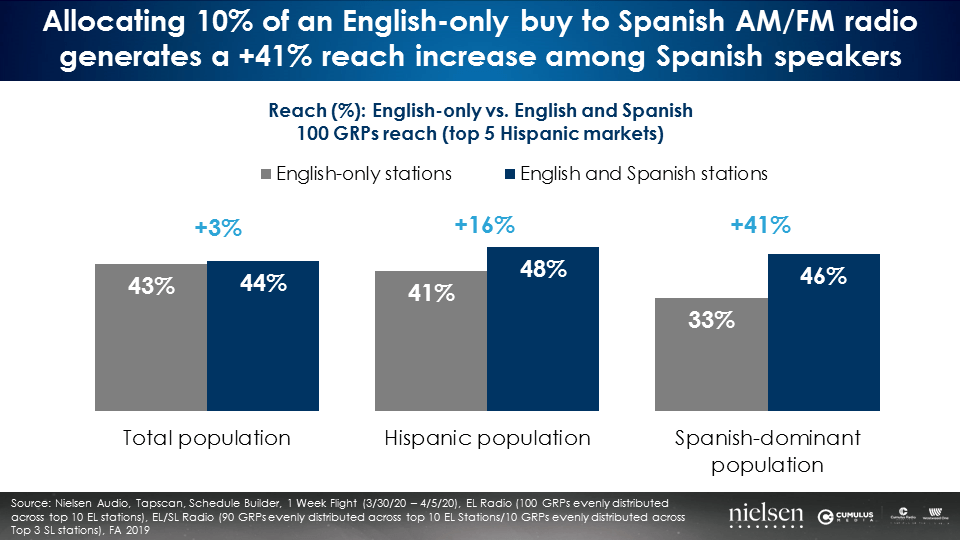

Allocating 10% of an English-only buy to Spanish AM/FM radio generates a +41% reach increase among Spanish speakers as well as a lift in Hispanics (+16%) and the entire media plan (+3%)

By shifting 10% of the media plan to include Spanish AM/FM radio, reach among Hispanics increases +16%, from 41% to 48%. Among Spanish-dominant Hispanics, reach soars +41%, from 33% to 46%. Interestingly, the total reach of the buy also increases by +3%.

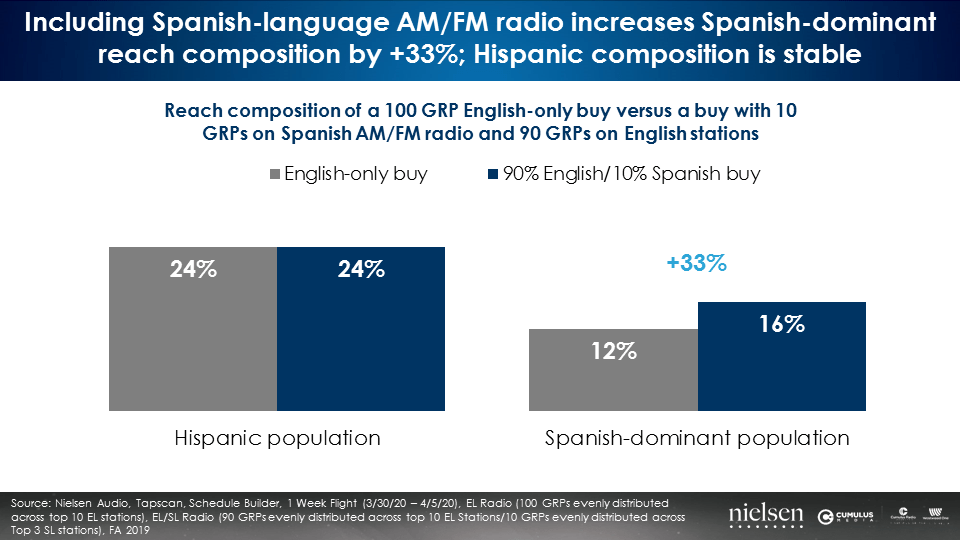

Including Spanish AM/FM radio into an AM/FM radio buy increases Spanish-dominant reach composition by +33% and maintains Hispanic composition

A 90/10 mix of English/Spanish AM/FM radio increases the reach composition of Spanish-dominant Hispanics from 12% of total campaign reach to 16%, a +33% increase.

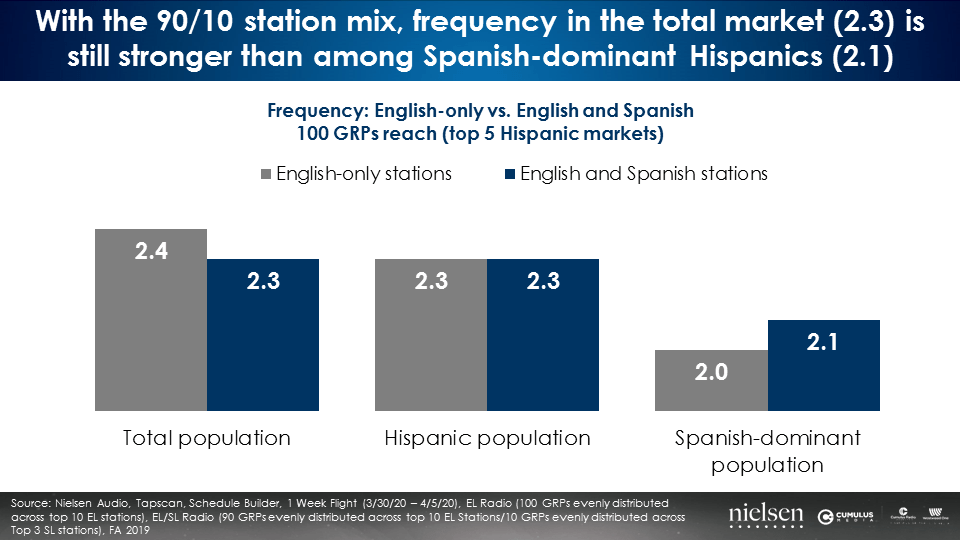

A 10% reallocation to Spanish AM/FM radio might be on the light side as campaign frequency still underdelivers among Spanish speakers

A 90% English station and 10% Spanish AM/FM radio mix generates slight increases in frequency that still underdeliver the overall market. The all-English AM/FM radio buy resulted in a 2.4 schedule frequency in the overall market and only a 2.0 frequency among Spanish speakers. The shift of 10% of the weight to Spanish AM/FM radio helped some, but does not appear to be sufficient.

With the 90/10 mix, frequency in the total market (2.3) is still stronger than among Spanish-dominant Hispanics (2.1). Given that these five markets are about 40% Hispanic, the mix of GRPs on Spanish AM/FM radio needs to be increased to generate consistent frequency.

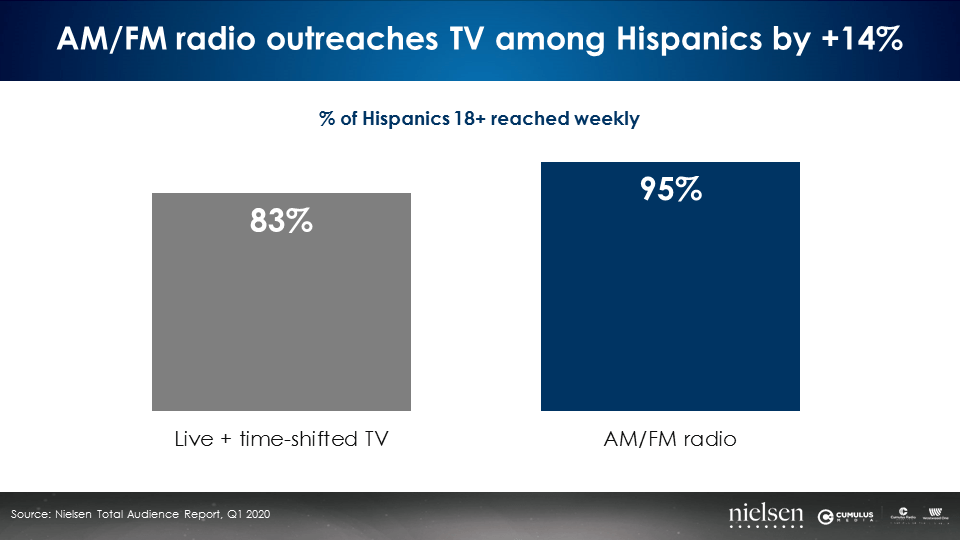

AM/FM radio outreaches TV among Hispanics

The just-released Q1 2020 Nielsen Total Audience Report shows AM/FM radio has mass reach among Hispanics. AM/FM radio’s 95% weekly reach among Hispanics 18+ outreaches live and time-shifted TV’s 83% weekly reach by +14%.

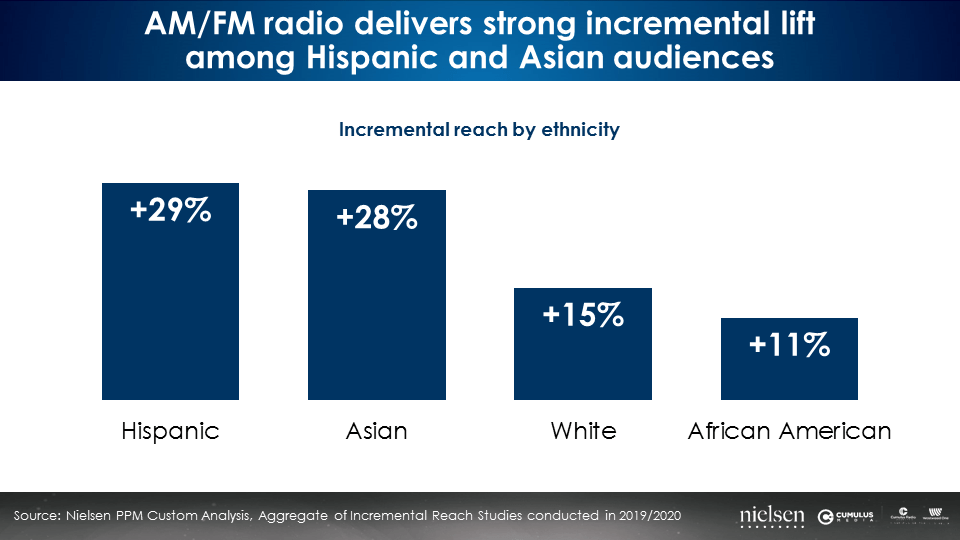

AM/FM radio makes your TV better for Hispanic reach

Nielsen incremental reach studies of five TV campaigns across a variety of categories reveals when 20% of a TV buy is allocated to AM/FM radio, Hispanic reach soars by an average of +29%.

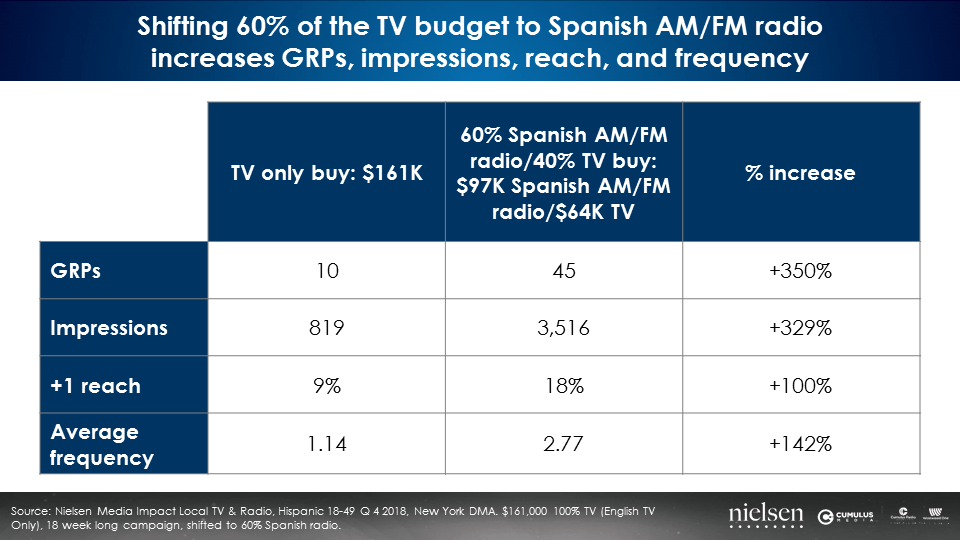

Another cross-media study conducted by Nielsen in a local market examined a $161K TV buy targeting 18-49 Hispanics. The TV buy generated very weak levels of reach, frequency, and impressions. Reallocating 60% of the TV media plan to Spanish AM/FM radio generated astonishing increases in 18-49 Hispanic delivery.

There is a significantly better outcome with the same budget by shifting 60% of the TV money to Spanish AM/FM radio. GRPs and impressions triple. Reach and frequency double.

The moral of the story: You cannot do an adequate job of reaching Hispanics and Spanish-dominant Hispanics unless Spanish AM/FM radio is in the media plan.

Key takeaways:

- Hispanics are the engine of American population and economic growth. Brands must step up and realize that reaching Latinx consumers represents a strong strategy for future growth.

- An English-only buy underdelivers Spanish speakers by 23%.

- Allocating 10% of an English-only buy to Spanish AM/FM radio generates a +41% reach increase among Spanish speakers.

- AM/FM radio outreaches TV among Hispanics by +14%.

- AM/FM radio makes your TV better: On average, allocating 20% of TV buy to AM/FM radio causes a massive +29% increase in Hispanic reach.

- In a local market, 18-49 Hispanic audience deliveries soar when a TV-only buy is remixed with 60% of the budget moved to Spanish AM/FM radio.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.