Nielsen: Latest AM/FM Radio Audience Data Shows Continued Recovery In PPM Markets As Morning Drive Grows, Sports Radio Soars, And Diary Markets Are Pandemic Proof

Nielsen just released high-level findings from the August Portable People Meter markets and the May-June-July diary surveys. For those expecting stability, there were surprising increases across the board.

Audience recovery in the Portable People Meter markets continues

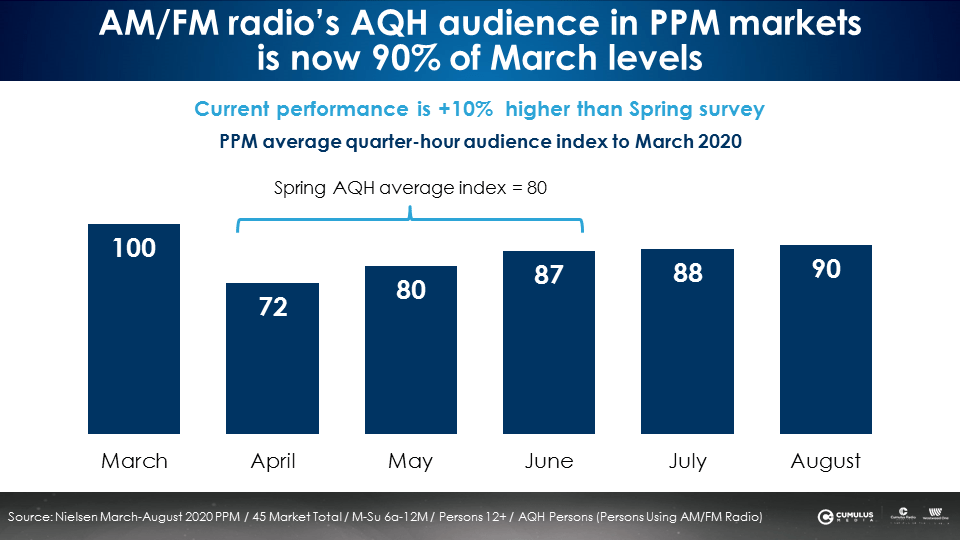

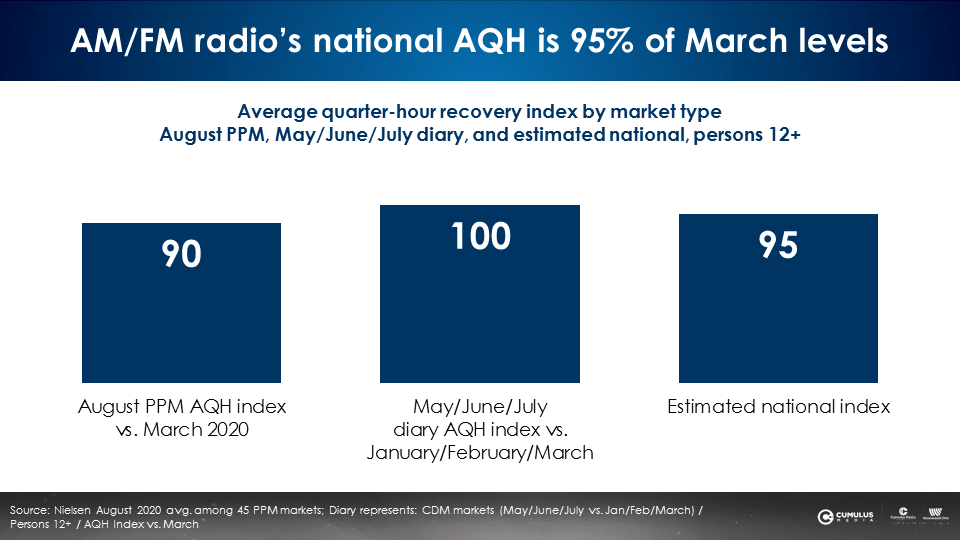

Benchmarking against the March PPM survey, August average quarter-hour audiences increased again, now generating 90% of the prior audiences. Total PPM AQH listening is now +10% higher than the Spring 2020 (April-May-June) period.

In terms of weekly reach, AM/FM radio in the PPM markets has recaptured 96% of March cume listening. In diary markets, AM/FM radio has retained 97% of prior weekly cume.

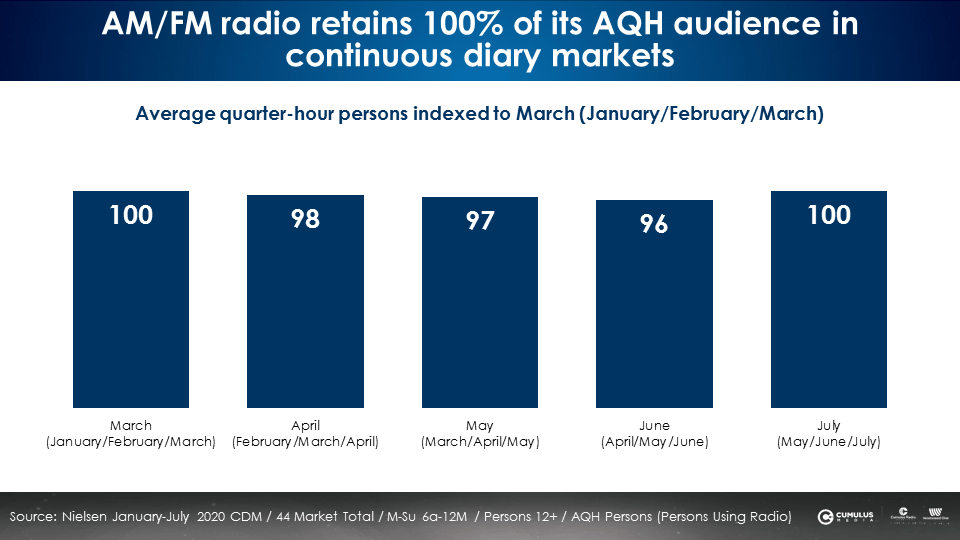

In medium and smaller diary markets, AM/FM radio is “pandemic proof”

Miles traveled data reveals the COVID-19 crisis caused the biggest impact in the largest U.S. markets. In markets beyond the top 50, measured by Nielsen’s diary, there was no impact in miles traveled and thus no impact to AM/FM radio listening.

AQH listening in the just-released May-June-July survey is virtually identical to the January-February-March period as AM/FM radio retains 100% of prior listening.

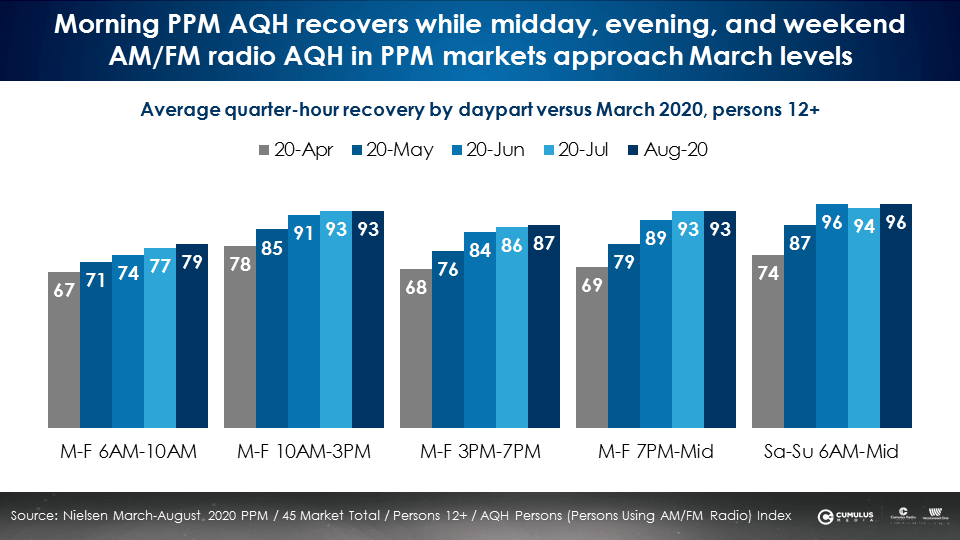

Mornings represent virtually all of the AQH growth in August PPM

As the recovery from April began, middays, weekends, and nights quickly recovered. Middays followed. AQH recovery in mornings has been slower but consistent. In the just-released August PPM data, most of the growth occurred Monday-Friday 6AM-10AM and on weekends.

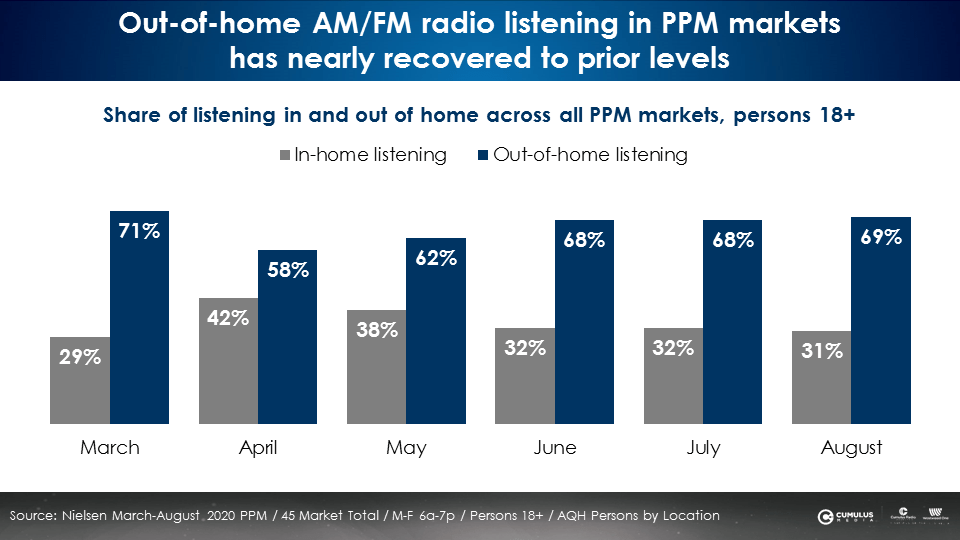

Out-of-home PPM listening continues steady recovery and nearly matches prior levels

In April, the month with the most “shelter at home” mandates and reduced time spent in the car, the share of AM/FM radio time spent out of home dropped to 58% in April from 71% in March. As of August, 69% of AM/FM radio time spent occurs away from home, nearly matching pre-COVID levels.

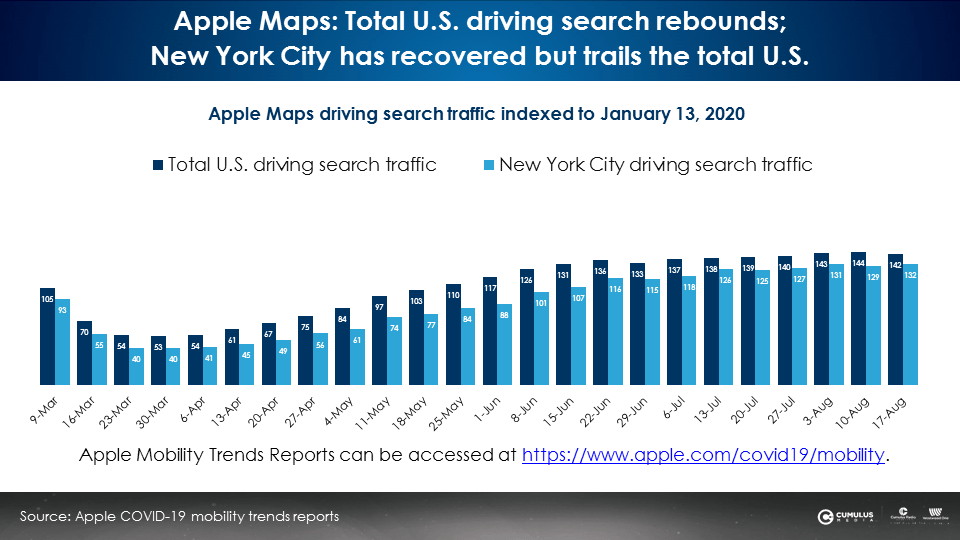

Apple Maps: U.S. driving volumes rebound and surpass pre-COVID, even in New York City, the capital of media planning and buying

The current myth heard from New York City-based media planners and strategists is:

“I’m working from home. Everyone I know is working from home. So no one is driving in America, and no one is listening to AM/FM radio.”

Mark Ritson, the legendary marketing professor observes, “There is increasing global evidence that marketers are basing their media choices on their own behavior or that stoked by the digitally obsessed marketing media, rather than actual audience data … The first law of marketing is that you are not the market. You are a urban, professional, well paid media executive. Everything you think and do is from a highly unrepresentative n of 1.”

Are media habits of media and marketing execs in New York City, America’s capital of media planning, representative of America? Let’s examine the facts of actual audience data:

In late March and early April, Apple Maps showed a significant reduction in American mobility (dark blue in the chart), even more so in New York City (bright blue in the chart). By late April, U.S. driving volumes began to recover.

By mid-May, U.S. mobility had surpassed pre-COVID volumes. It took another month for New York City driving volumes to fully recover and exceed pre-COVID traffic volumes in early June. By the week of June 22, New York City driving search volumes exceeded pre-COVID levels by 16%.

“Take the me out of media”

In their book How Not To Plan: 66 Ways to Screw It Up, Les Binet and Sarah Carter remind agencies and brands, “We’re marketing and communication people, we’re different from the majority. In the US and UK, we’re less than 1% of the population. We tend to be younger. … And we live in a handful of big cities. So it’s all too easy for us overlook how different our lifestyles and perceptions are from the people we talk to.”

Acknowledging this, Colin Kinsella, the CEO of Havas Media North America, says, “The biggest risk for AM/FM radio is the 26-year-old planner who lives in New York or Chicago and does not commute by car and does not listen to AM/FM radio and thus does not think anyone else listens to AM/FM radio.”

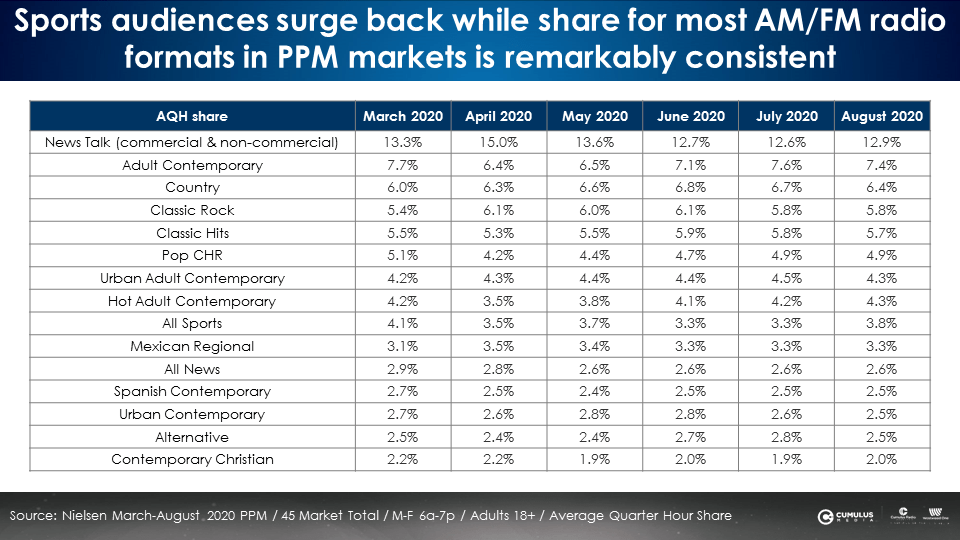

PPM: Sports radio storms back while most format shares remain very stable

The lack of live sports caused audience shares for sports formatted radio stations to drop from a 4.1 share in March to a 3.3 by June. In August, the return of many sports and the looming reemergence of the NFL generated a +15% increase in all sports PPM shares (3.3 to 3.8).

Total U.S. AM/FM radio listening is now at 95% of March levels

In August 2020, PPM market average quarter-hour (AQH) audiences are now 90% of March 2020’s AQH. May-June-July diary market AQH audiences are 100% of prior audiences. Combined, total national AM/FM radio AQH is 95% of prior levels.

To recap:

- National AQH audiences are now 95% of prior levels.

- AM/FM radio’s reach is 97% of prior levels. This is significant as AM/FM radio is used by many brands for its dominant reach.

- Mornings represent virtually all of the AQH growth in August PPM.

- Out-of-home AM/FM radio listening proportions are now very similar to previous levels.

- Sports radio has surged back while most format share trends are remarkably consistent.

- In PPM markets, current AQH performance is +10% stronger than the April-May-June Spring survey (August = 90% of March versus Spring 80% of March).

- Projecting New York City’s media planner work from home COVID-19 experiences and media habits to the rest of America constitutes marketing malpractice.

- There is no evidence to support the myth: “No one is driving and no one is listening to AM/FM radio.”

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.