Advertiser Perceptions: Brand/Agency Podcast Advertising Consideration And Intention Soar To Record Levels

What a difference five years makes. On September 10, 2015, the Interactive Advertising Bureau (IAB) held its first ever “Podcast Upfront Showcase.”

The objective was to provide “advertisers and media buyers with a preview of the latest in innovative podcast programming from some of the biggest names in the digital audio arena. The event aims to educate and raise awareness around the power of podcasts as a valuable platform to reach consumers.”

In advance of the first IAB Podcast Upfront, CUMULUS MEDIA | Westwood One commissioned Advertiser Perceptions to study brand and agency sentiment on podcast advertising. Each year since, we have reprised the study to track buy-side podcast advertising consideration and intention. Here is what Advertiser Perceptions found in In September 2015:

| Advertiser Perceptions | Sept 2015

% among agencies and marketers |

| Have you and your colleagues discussed podcast advertising for potential media investment? | 41% have discussed |

| How likely are you to consider advertising in podcasts in the next six months? |

18% definitely would consider |

| How likely are you to actually advertise in podcasts in the coming six months? | 10% definitely would advertise |

| Do you currently advertise in podcasts? | 15% currently advertise |

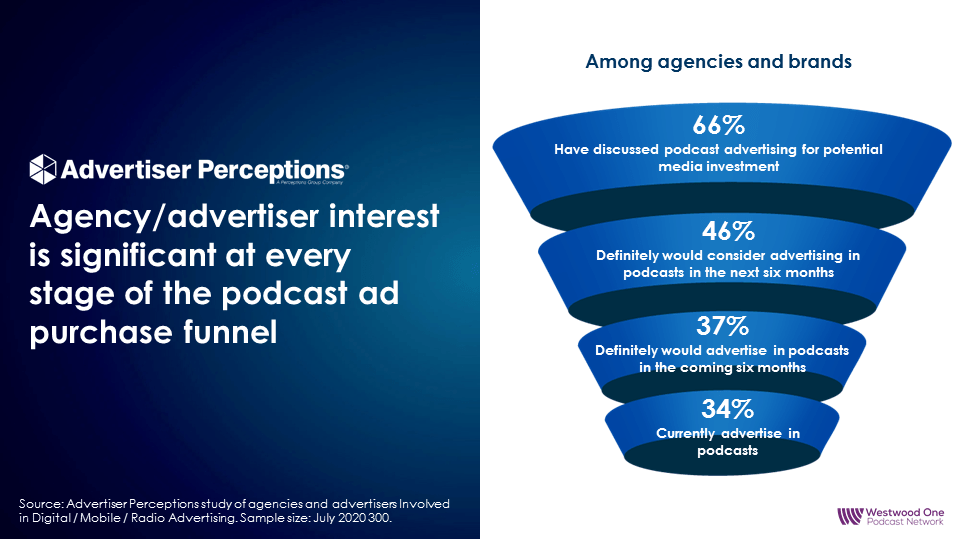

In 2015, only 10% of brands and media agencies indicated they intended to advertise in podcasts in the next six months. Flash forward to 2020. Here is the current marketer/agency podcast advertising purchase funnel:

Currently, two-thirds of brands and media agencies have discussed podcast advertising for media investment. 46% are considering advertising and 37% say they intend to advertise in the next six months. One-third say they are currently advertising in podcasts.

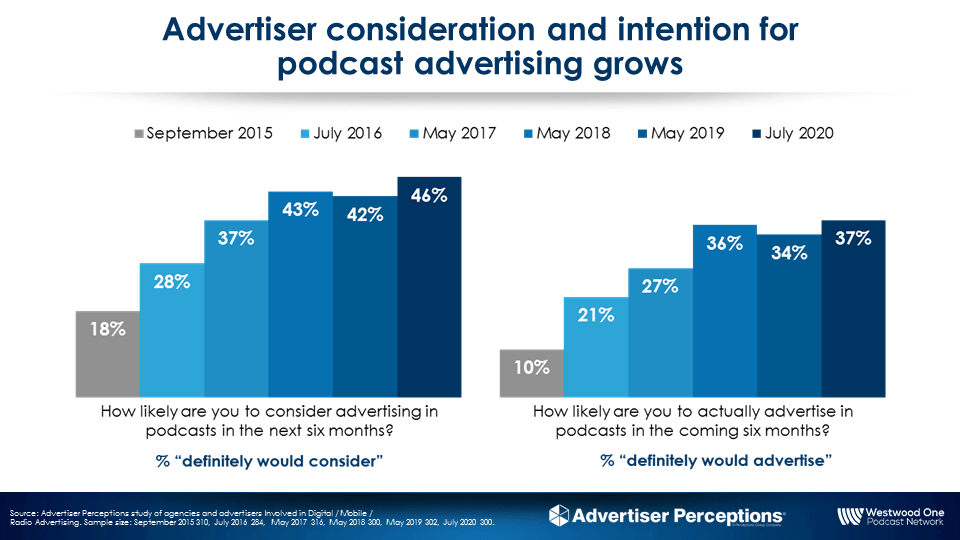

Since 2015, podcast advertising consideration has grown 2.5X and spend intention has grown nearly 4X

Podcast advertising consideration has soared from 18% in 2015 to 46% this year. Podcast advertising intention has nearly quadrupled from 10% in 2015 to 37% in 2020.

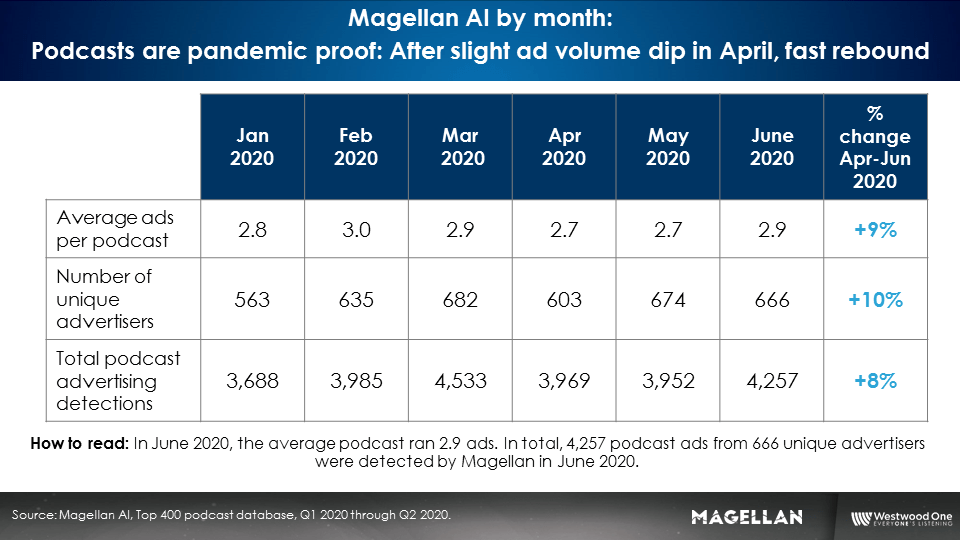

Despite the pandemic, advertiser commitment to podcast advertising has been significant and resolute. CUMULUS MEDIA | Westwood One partnered with Magellan AI, the definitive source of podcast advertising analytics, to analyze podcast advertising occurrence data from the top 400 podcasts in the U.S. through Q2 2020.

Podcast advertising is pandemic proof: Ad volumes quickly recover and surpass prior levels

March 2020 was a strong month for podcast advertising with a record number of advertisers and ad detections. When the pandemic intensified in April, the number of unique advertisers dipped -12% from March while total ad occurrences also dropped -12%.

The recovery began immediately.

In May, the number of unique advertisers in podcasting jumped back to March levels. In June, total podcast occurrences grew +8% versus April and the average number of ads per podcast (2.9) reverted to pre-pandemic volumes.

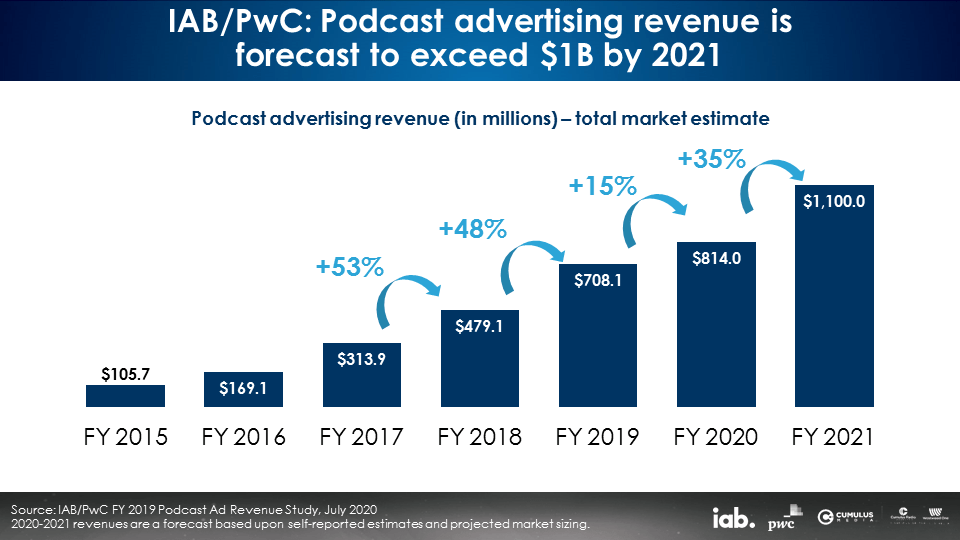

Comparing June to January 2020, the number of U.S. podcast advertisers surged +18% and total podcast ad occurrences are up +15%. The resilience and strength of podcast advertising from Magellan AI’s occurrence data validates the IAB/PwC recent podcast revenue growth forecast for 2020 (+15%) and 2021 (+35%).

Brands rush in: The proportion of brand ads continues to grow

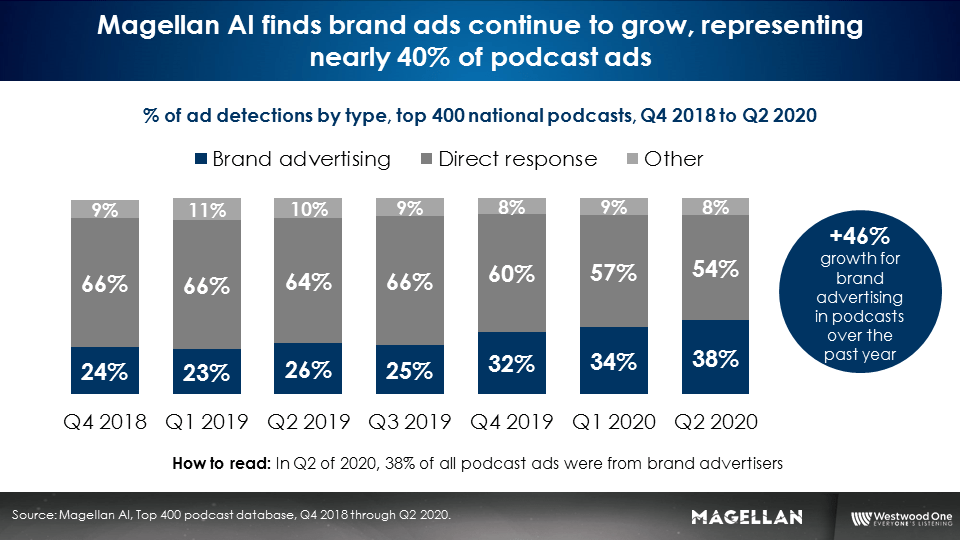

Magellan AI determined the campaign objective (direct response, brand awareness, or tune-in) at the brand or product level based on whether ads for that brand or product included a promotional code or unique vanity URL.

The proportion of brand advertising in podcasting has been steadily rising over the past year. In Q2 2020, 38% of ad occurrences were from brands, up +46% from Q2 2019 (26%).

Brands and their agencies are following consumer exuberance over podcasts. A review of Edison’s “Share of Ear,” the gold standard consumer audio time use study, reveals podcasting is the fastest growing American audio platform.

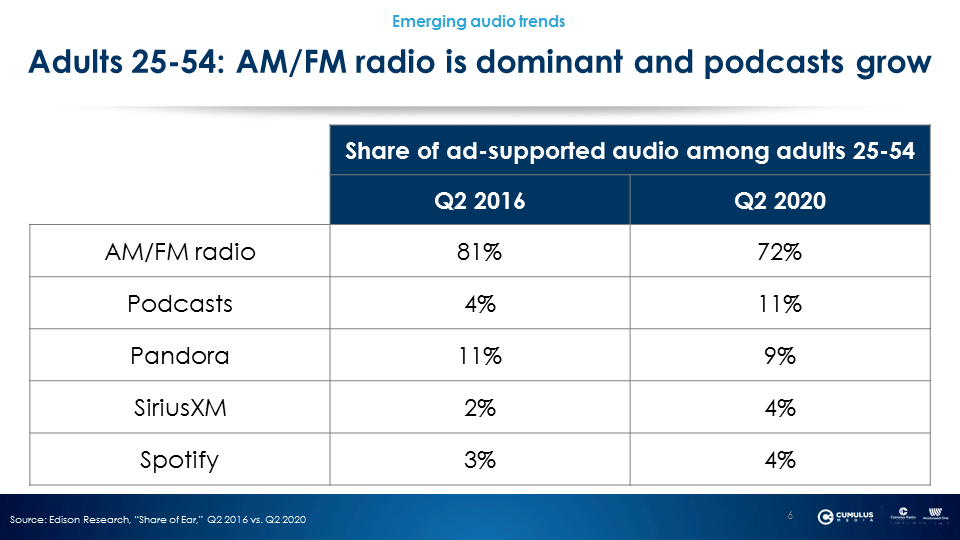

Each quarter, “Share of Ear” quantifies the reach and share of time spent with all audio platforms. Q2 2020 marks the first “Share of Ear” release since the pandemic began. A comparison of Q2 2016 to Q2 2020 chronicles the stunning growth of the podcast audience.

Edison’s “Share of Ear” 2016 versus 2020: Podcasts soar, music streaming down, AM/FM continues to dominate

Over the last four years, an examination of ad-supported audio audience shares among persons 25-54 reveals the combined shares of music streamers Spotify and Pandora slightly dropped from 14% in Q2 2016 to 13% in Q2 2020.

Meanwhile, from Q2 2016 to Q2 2020, podcasts surpassed both streaming giants and nearly tripled in share (4% to 11%). AM/FM radio remains the dominant player.

The 2015 IAB Podcast Upfront featured six publishers during a four-hour event. This year’s event occurring September 9-11 has expanded to three days and dozens of presenting publishers. Despite the current tumult in the economy and the marketing world, this is podcasting’s finest hour.

Key takeaways:

- Since 2015, podcast advertising consideration among brands and agencies has grown 2.5X and spend intention has grown nearly 4X, according to Advertiser Perceptions.

- Two-thirds of buy-side decision makers are discussing podcast advertising and one-third are actively spending.

- Podcast advertising is pandemic proof: After a brief April dip, ad volumes and advertisers have surged back and now exceed pre-pandemic levels, according to Magellan AI.

- Brand advertising shows strong growth in podcasts: Magellan AI finds major brand advertisers are tripling down on their ad commitments.

- Podcasting’s audience share of ad-supported audio has nearly tripled since 2016, according to Edison’s “Share of Ear.”

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.