Westwood One’s Podcast Download – Fall 2020 Report: Platform Wars Are Heating Up, Audiences Are Pandemic Proof, Women Represent the Majority of Newly Arrived Listeners, And Audiences Embrace Advertising

Click here to download Westwood One’s Podcast Download – Fall 2020 Report

This week, a sea of advertisers, agencies, entertainment companies, and content providers, including our own Westwood One Podcast Network, have been glued to their video screens for the sixth annual Interactive Advertising Bureau (IAB) Podcast Upfront. Record-breaking attendance and an impressive union of great minds is a testament to the power and strength of podcast advertising.

This major event in the podcast industry also marks the publication of Westwood One’s Podcast Download – Fall 2020 Report, now in its fourth annual release.

CUMULUS MEDIA | Westwood One retained MARU/Matchbox to conduct a study in July 2020 of weekly podcast listeners. This fourth chapter in Westwood One’s Podcast Download Fall series highlights trends from prior studies as well as new ones.

Here are the key findings:

Podcasts power through the pandemic: This year, perhaps due to COVID-19, newly arrived audiences quickly form strong listening habits

According to a recent and robust analysis by Westwood One and Magellan AI of podcast advertising trends, from January to June 2020, the number of U.S. podcast advertisers surged +18% and total podcast ad occurrences were up +15%. By any measure in this study, podcast audiences have steadily grown and strengthened over the last four years despite the recent COVID-19 crisis:

- Heavy podcast listening is steadily growing: The proportion of weekly podcast audiences who are considered heavy consumers (6+ hours/week) has grown +22% since 2017. Despite the pandemic, those spending 6+ plus hours listening each week has grown from 32% in 2017 to 39% in 2020.

- Weekly time spent has grown, especially among women and persons 18-34: Since 2017, weekly podcast listening has added a full hour of time spent. Total weekly time spent increased +16%, from 5.5 hours in 2017 to 6.4 hours in 2020. Since 2017, female listening is up significantly (+27%) compared to male listening (+14%). 18-34 Millennial time spent has also grown (+22%) and time spent among 35-49s is up (+18%) over the course of four years.

- The COVID-19 crisis has increased listening: When asked about the impact of the pandemic on their podcast habits, 41% of weekly podcast listeners say they are listening more. 52% are listening about the same and only 7% say they are listening less. Comparing 2019 versus 2020, time spent and heavy listening all grew.

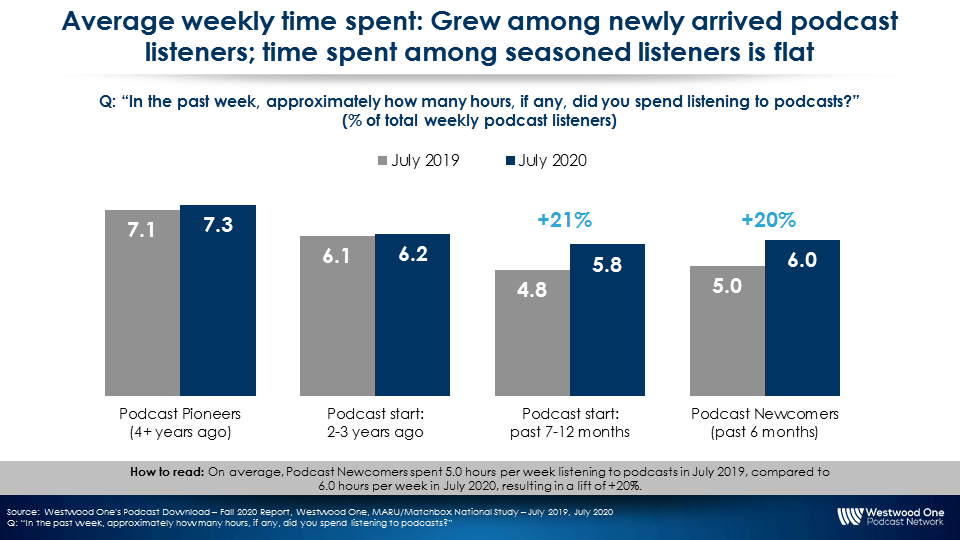

- Consumers who recently began listening to podcasts are forming much stronger audience habits in 2020: Versus 2019, weekly time spent is +20% stronger among those who began listening to podcasts in the last year. Is it possible shelter-at-home mandates and COVID-19-induced isolation ignited much deeper connections with podcast content among those who are new to the medium? Last year, heavy listening was much greater among those who had been listening to podcasts the longest (4+ years). This year, time spent among those new to the podcast medium is much stronger.

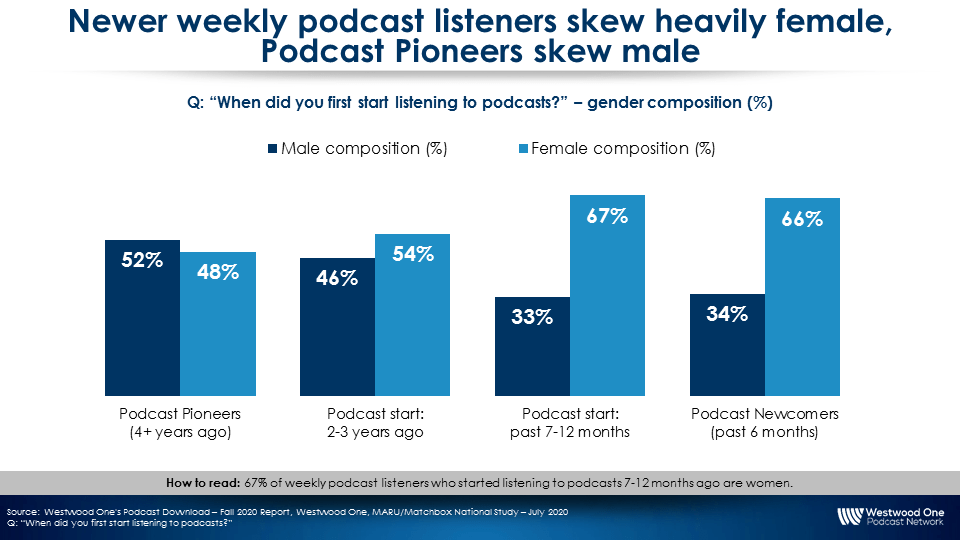

Women represent a significant proportion of newly arrived podcast listeners

Among those who began their podcast listening habit in the last year, two-thirds are women.

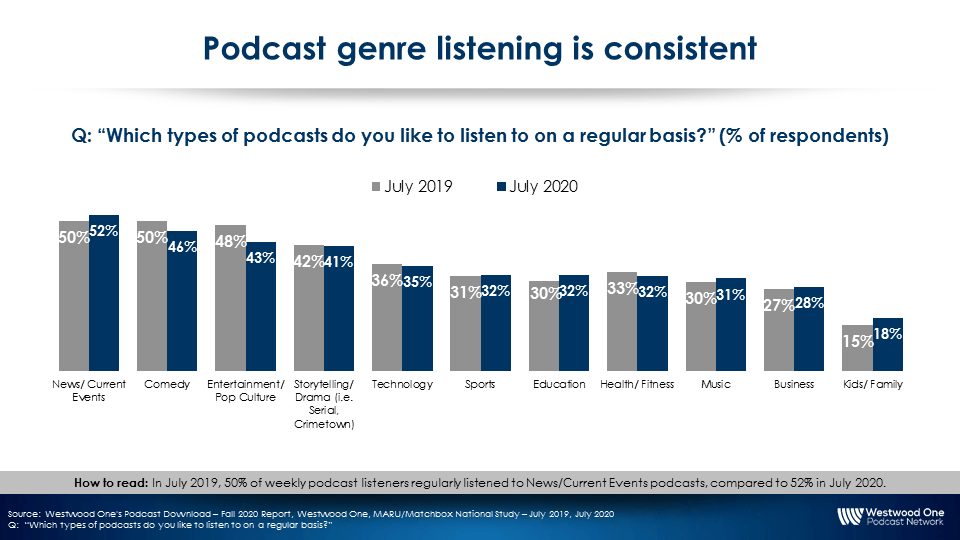

Podcast genre listening: More interest in News/Current Events podcasts and slightly less in Entertainment/Comedy/Pop Culture podcasts

This is not surprising given the news cycle and a reduced amount of pop culture being produced. Overall, regular listening to podcast genres is very consistent.

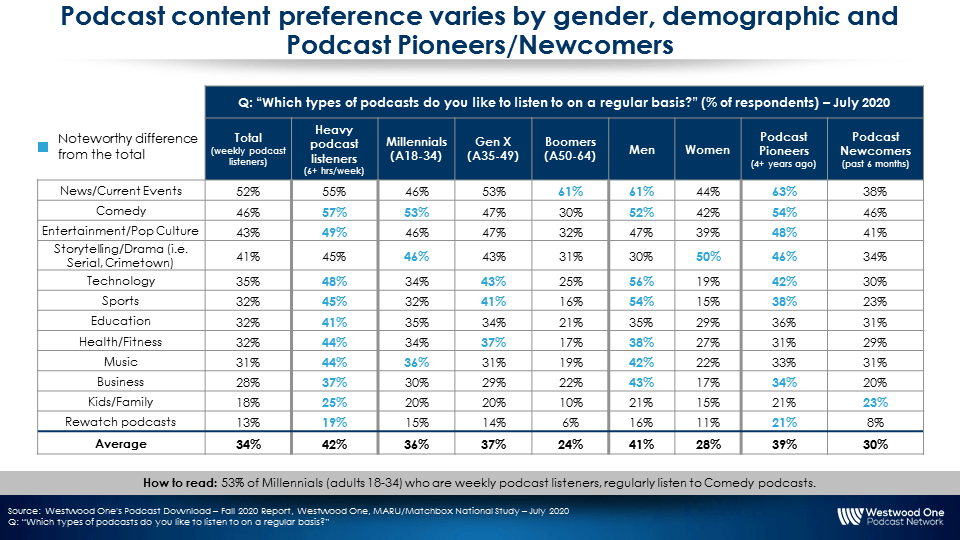

Podcast content preference varies by gender, demographic, and when consumers began their podcasting habit

- Gender: Men are twice as likely to regularly listen to News/Current Events (61%) versus Storytelling/Drama (30%). Among women, the Storytelling/Drama genre (50%) is the leading content form.

- Age: The younger the listener, the greater the number of podcasts genres regularly listened to.

- Length of podcasting habit: Podcast Pioneers, those who began listening to podcasts over four years ago, are a serious bunch, listening most to News and Current Events. Among Podcast Newcomers, those who began listening in the last 6 months, Comedy is the most popular genre.

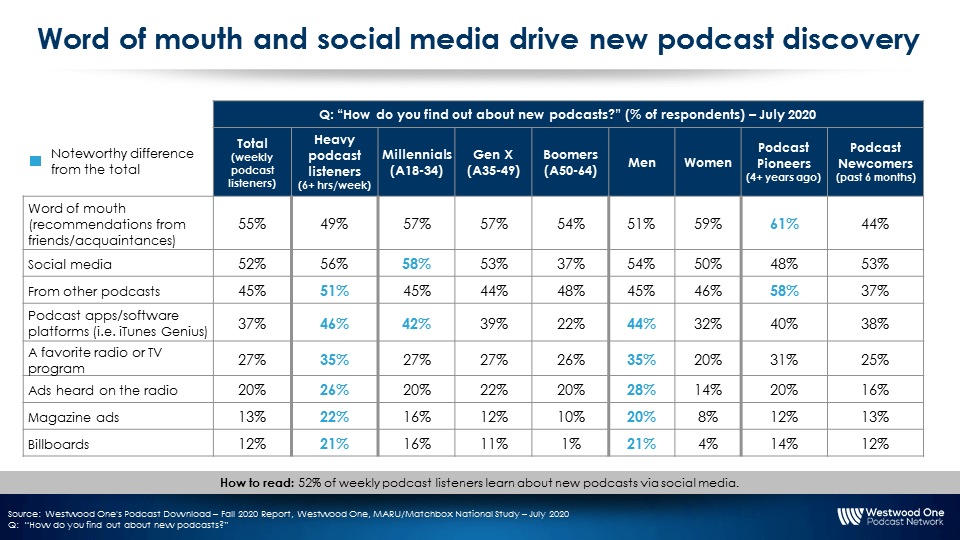

Content discovery: For Podcast Pioneers, word of mouth leads while Podcast Newcomers rely on social media

61% of Podcast Pioneers, those who began listening to podcasts 4+ years ago, say word of mouth and recommendations from friends are how they find out about new podcasts. Among the newly arrived Podcast Newcomers, those who began listening to podcasts in the last six months, 53% first say social media followed by word of mouth (44%).

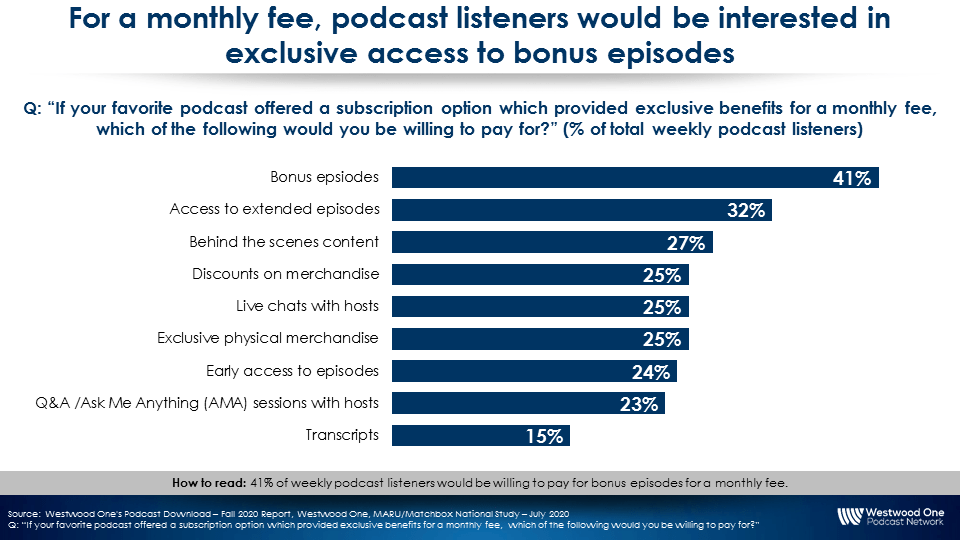

Subscription model: People love their favorite podcasts and want more content

Consumers indicate that if they were to pay a subscription fee for their favorite podcasts, getting bonus episodes and extended episodes would be the exclusive benefits they would be most willing to pay for.

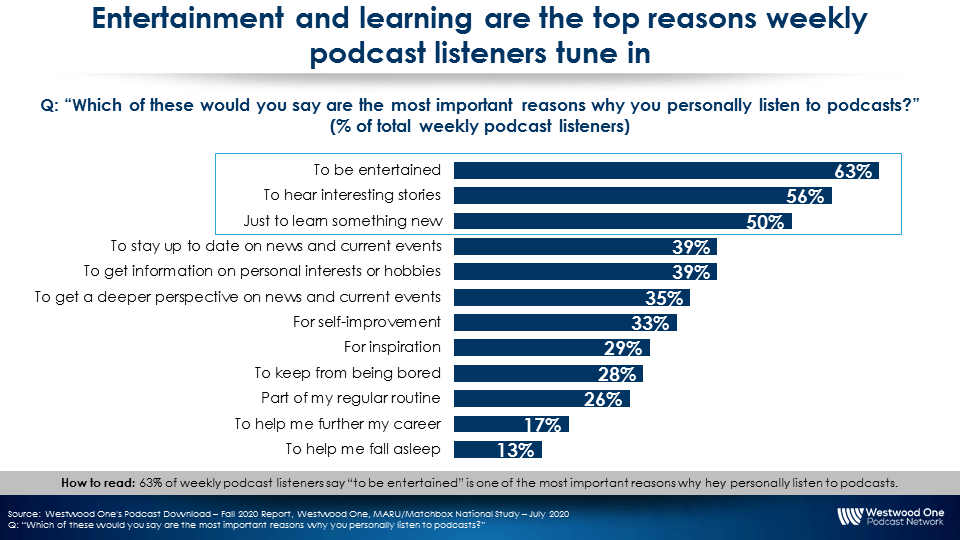

Podcast need states: Listeners are looking to podcasts for entertainment and education

Among weekly podcast listeners, the most important reason for listening to podcasts is to be entertained (63%). Closely following, 56% of weekly listeners want to hear interesting stories and half want to learn something new.

Podcasting is a content source where entertainment and education coexist. The need to learn implies strong concentration and attentiveness. This provides advertisers with intensely engaged audiences.

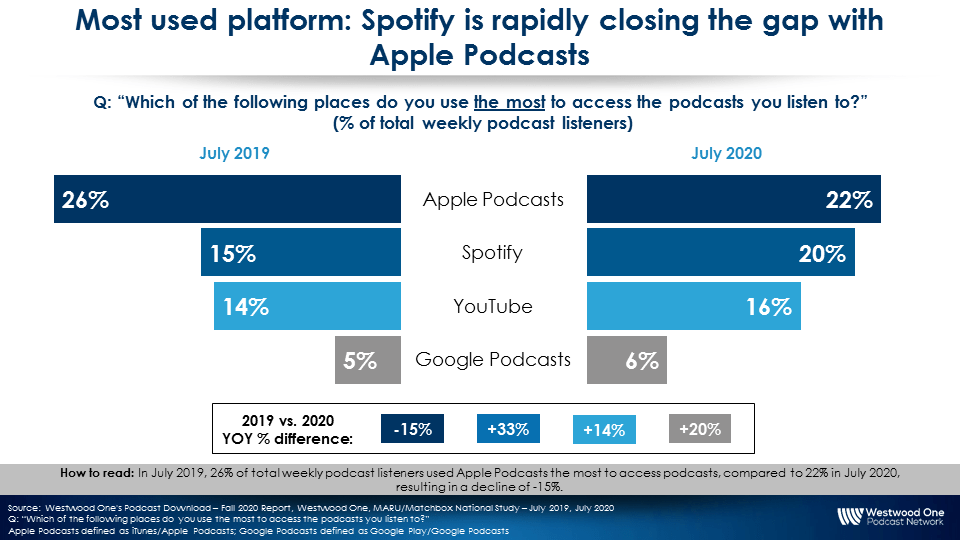

Platform used most: Apple still leads but Spotify and YouTube are closing in

When asked to indicate the platform they use the most to access podcasts, Apple leads at 22%, a reduction from 26% in 2019. Spotify grew the most (15% to 20%) and YouTube increased 14% to 16%.

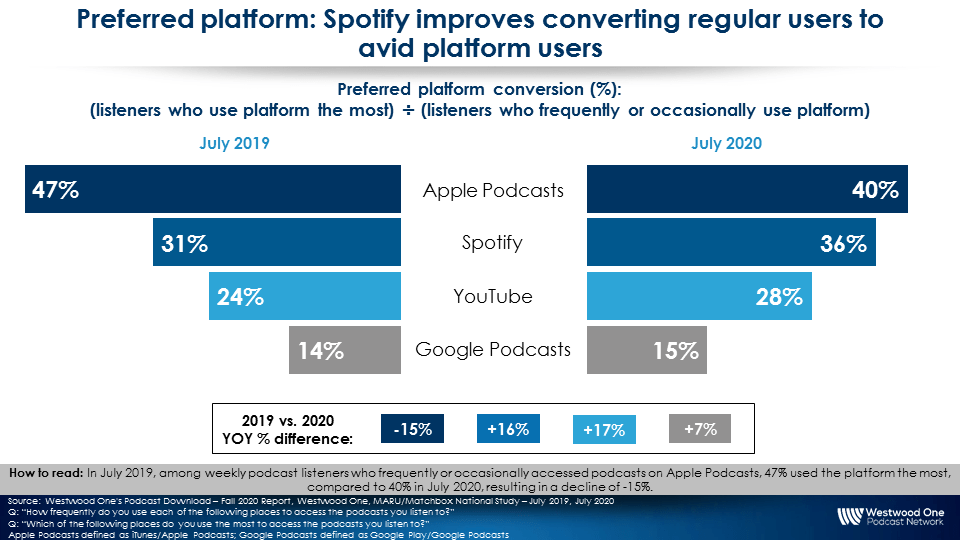

Podcast platform loyalty: Apple dropped while the others grew

Podcast platform loyalty is determined by dividing those who use a platform the most over those who use the platform frequently/occasionally. The higher the ratio, the more a platform is converting users into loyalists.

Apple is still the leader in podcast platform loyalty conversion. The others are growing. Last year, nearly half of those who used Apple for listening to podcasts considered it their most preferred platform. This year, Apple’s platform loyalty conversion dropped from 47% to 40%. Spotify (31% to 36%) and YouTube (24% to 28%) both increased.

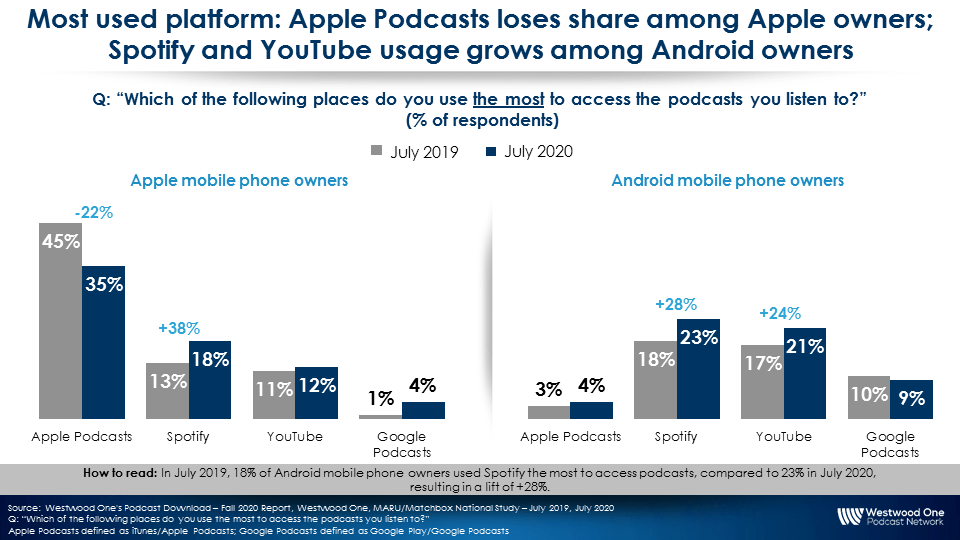

Among iPhone owners, Apple’s share of podcast usage leads, but Spotify is gaining

35% of iPhone owners say Apple is the leading place they use most to access their podcasts. This is down from 45% in the prior year. iPhone owners who use Spotify most to access podcasts have increased from 13% in 2019 to 18% in 2020. 12% of iPhone owners use YouTube. 4% use Google Podcasts.

Among Android phone owners, Spotify and YouTube are the leading podcast listening platforms

Among Android phone owners, 23% use Spotify most, closely followed by YouTube (21%). 9% say they use Google Podcasts (Google Play/Google Podcasts app).

Podcast listeners embrace advertising and recognize that ads support their favorite podcast

In the rest of the media world, advertising is something to be avoided or blocked. Consumers impatiently skip YouTube ads at the earliest possible moment. TV audiences embrace ad-free subscription video streaming services. Ad-blocking software is heavily utilized.

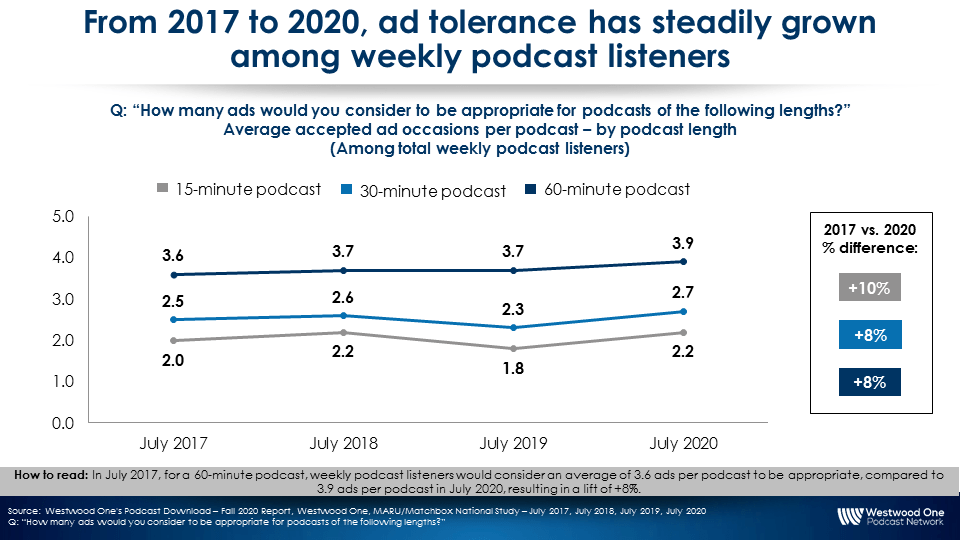

Podcast advertising is another story. Podcast ad tolerance is very strong. Perhaps because many ads are read by the host, consumers feel the ads are what keep their favorite podcast in business.

Since 2017, podcast ad tolerance has steadily grown. When asked how many ads listeners would consider to be appropriate in podcasts of various lengths, there has been an +8% to +10% increase over the past four years. It would be inconceivable that consumers would be as accepting of seeing more ads on TV, online video, or on the internet.

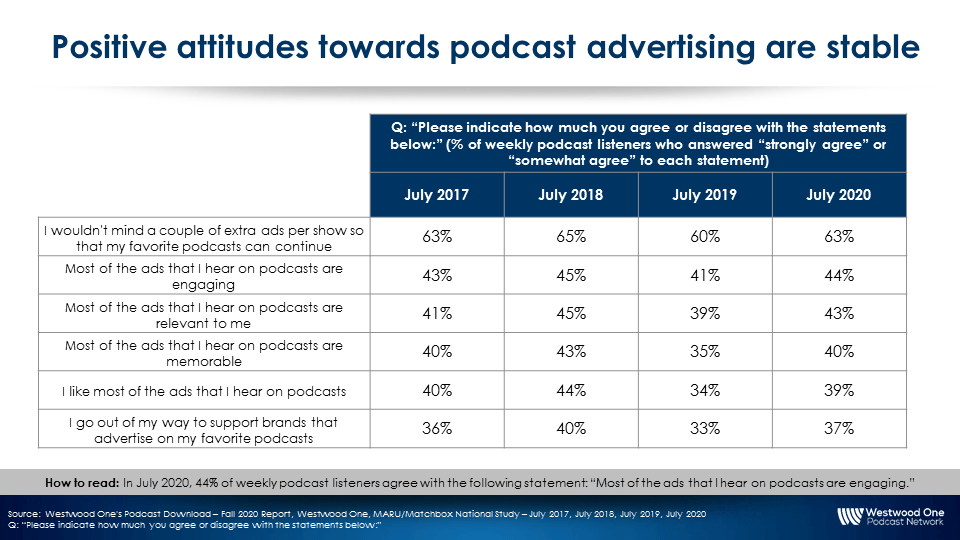

Since 2017, positive attitudes towards podcast advertising have been stable

- 63% agree they wouldn’t mind a couple of extra ads per show so their favorite podcast can continue

- Four out ten say podcast ads are engaging, relevant, likable, and memorable

- 37% agree they go out of their way to support brands that advertise on their favorite podcasts

- 51% prefer host-read ads, 29% prefer ads that are pre-recorded, and 19% have no opinion

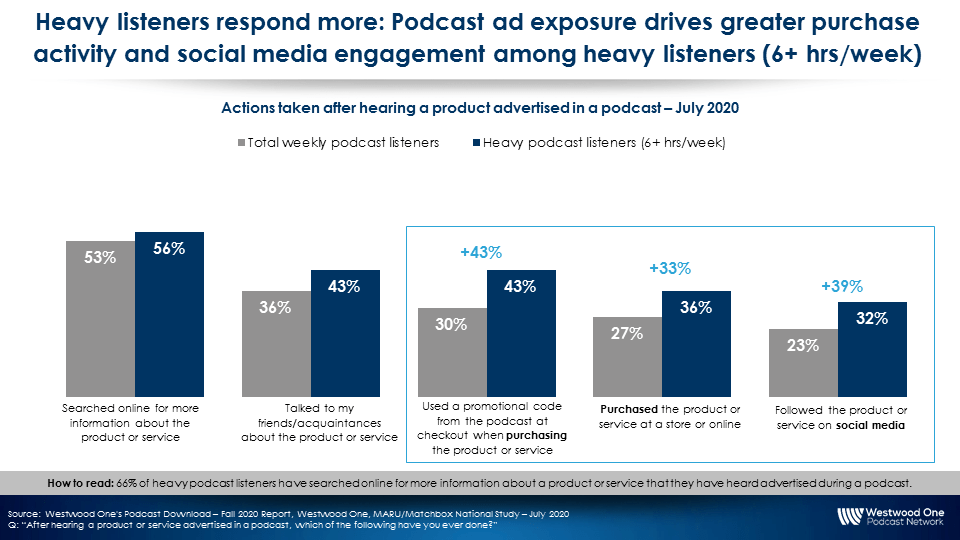

Four out of five podcast listeners have taken an action based on podcast advertising while heavy listeners are much more likely to take action

Across every measure of podcast advertising response, heavy listeners, those who spend over six or more hours a week with podcasts, are much more responsive.

Compared to total weekly listeners, the heavy listening segment is +33% more likely to have made a purchase, +39% more likely to follow an advertised product on social media, and +43% more likely to use a promo code from a podcast when purchasing an advertised item.

Key takeaways:

- Podcasts power through the pandemic: Heavy podcast listening is steadily growing, weekly time spent has grown, and consumers who recently began listening to podcasts are forming much stronger audience habits in 2020

- Women represent a significant proportion of newly arrived podcast listeners

- Podcast genre listening: More interest in News/Current Events podcasts and slightly less in Entertainment/Comedy/Pop Culture podcasts

- Content discovery: For Podcast Pioneers, word of mouth leads while Podcast Newcomers rely on social media

- Subscription model: People love their favorite podcasts and want more content

- Podcast need states: Listeners are looking to podcasts for entertainment and education, leading to extraordinary levels of concentration and attentiveness and strong results for advertisers

- Platform used most: Apple still leads but Spotify and YouTube are closing in

- Podcast listeners embrace advertising and recognize that ads support their favorite podcast

- Four out of five podcast listeners have taken an action based on podcast advertising while heavy listeners are much more likely to take action

Click here to download Westwood One’s Podcast Download – Fall 2020 Report

Brittany Faison is the Insights Manager at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.