Auto Aftermarket Retailers: The Impact Of Amazon And Online Shopping And Why AM/FM Radio Is The Ideal Marketing Platform

CUMULUS MEDIA | Westwood One completed the third annual study of the auto aftermarket category conducted by MARU/Matchbox to determine the current state of America’s auto parts retailers.

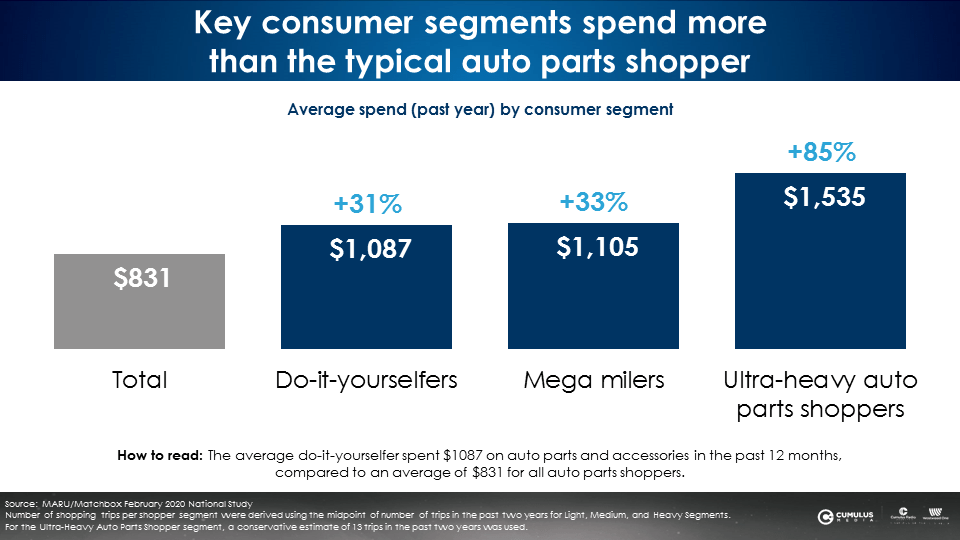

Key segments: Do-it-yourselfers and ultra-heavy auto parts shoppers

12% of auto parts category shoppers are do-it-yourselfers, spending +31% more than the average. Mega milers clock 200+ miles in their vehicles a week and spend +33% more on auto parts than the average.

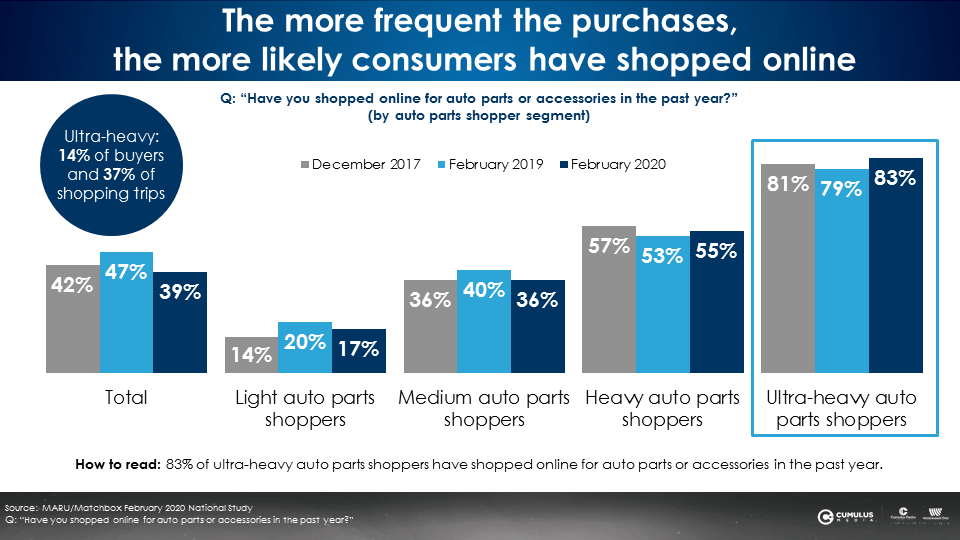

Ultra-heavy auto parts shoppers have made 10+ shopping trips in the past two years. They comprise 14% of category shoppers and represent 37% of all category shopping trips. They also spend almost twice as much as the average. A little less than a third of ultra-heavy auto parts shoppers say they repair and maintain cars for a living.

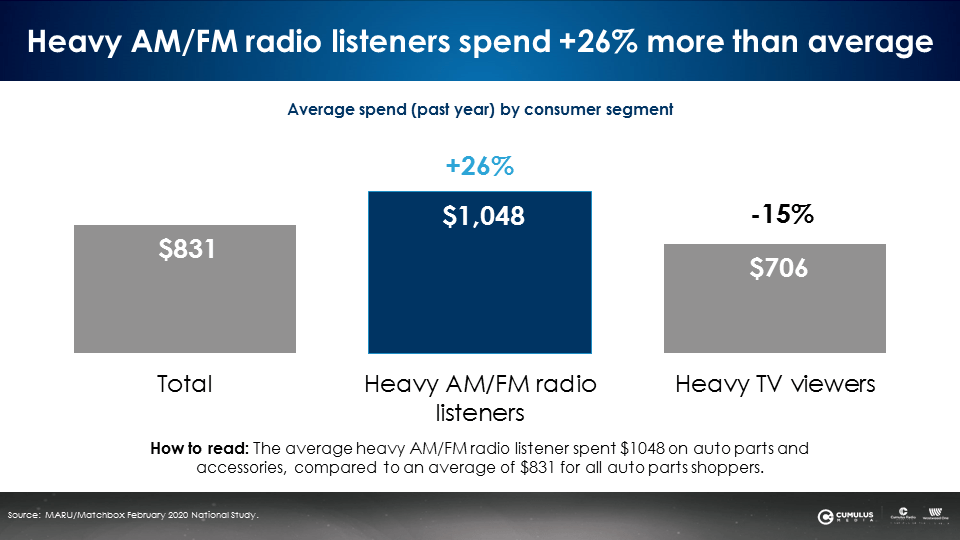

AM/FM radio is the ideal platform to advertise auto aftermarket

Heavy AM/FM radio listeners visit more retailers in the category, make more shopping trips, and spend +26% more than the average.

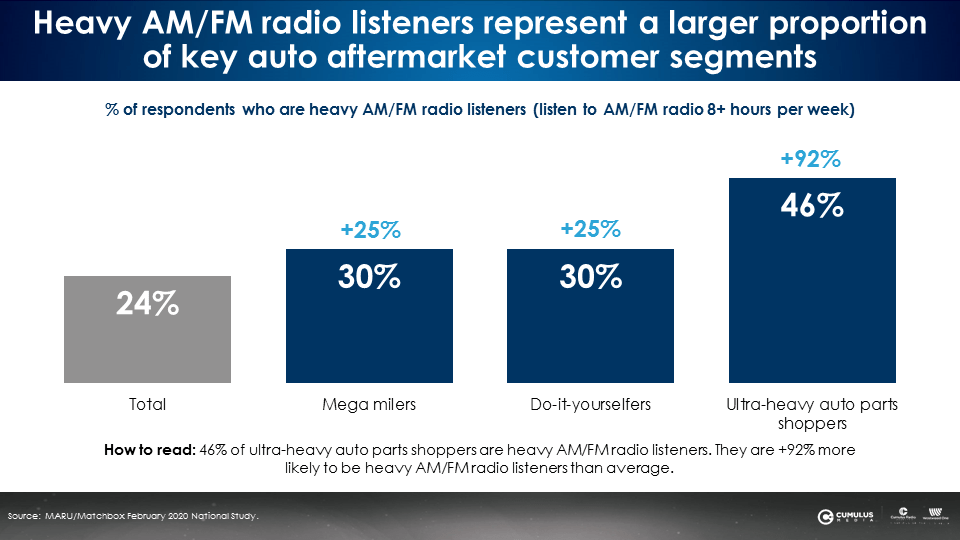

Two key consumer segments, do-it-yourselfers and ultra-heavy auto parts shoppers, are far more likely to be heavy AM/FM radio listeners. Twice as many ultra-heavy auto parts shoppers are heavy AM/FM radio listeners. The do-it-yourselfers segment is +25% more likely to be heavy AM/FM radio listeners.

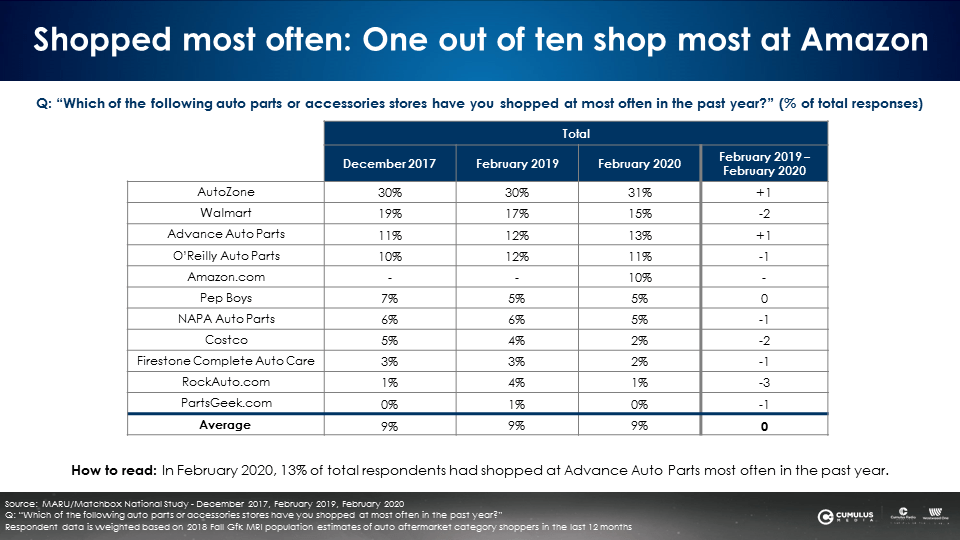

Consistent brand equity and shopping patterns: AutoZone leads but Amazon is a factor

Across the last three years, brand equity and shopping patterns have been generally consistent. Amazon, measured for the first time, earns a 10% share for “shopped most often in the past year.” AutoZone, one of the first major national auto parts retailers, has nearly one-third who say they shop most at the retailer.

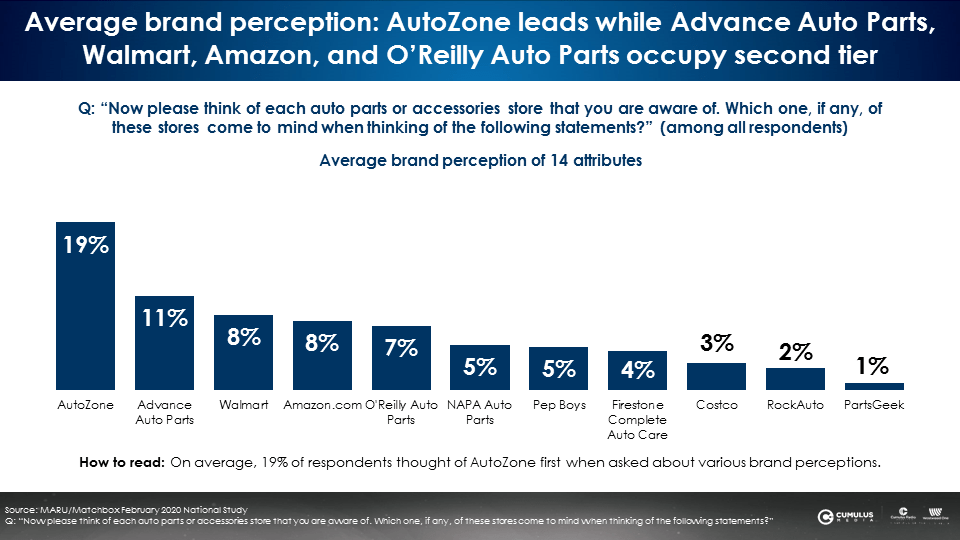

Brand equity: AutoZone leads, followed by Advance Auto Parts, Walmart, Amazon, O’Reilly Auto Parts, and NAPA Auto Parts

Fourteen different brand attributes were measured such as ‘has the most convenient locations,’ ‘has the most knowledgeable and helpful staff,’ etc. Consumers were asked to name the retailer that first came to mind for the attribute. The average of these fourteen retailer associations creates the average brand perception. In the overall shopper category, AutoZone’s average brand perception is nearly twice the nearest brand.

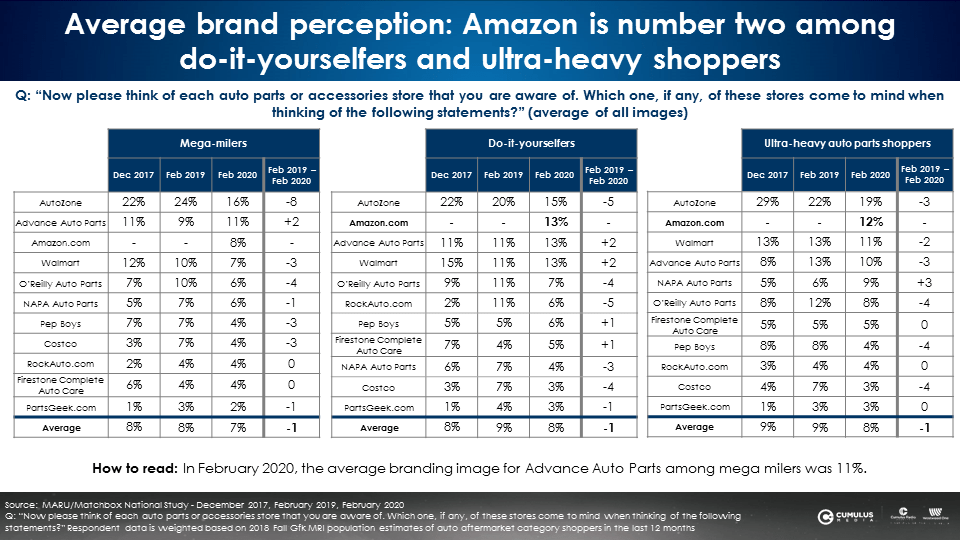

Brand perceptions: Amazon ranks second among do-it-yourselfers and the ultra-heavy auto parts shopper segment

Averaging a series of 14 different category perceptions, Amazon places second among do-it-yourselfers and the ultra-heavy auto part shopper segments.

Online retailers are making inroads. Three online auto parts retailers (PartsGeek.com, RockAuto.com, and Amazon) have a combined 19% average brand image among the ultra-heavy auto parts shoppers.

Brand opportunity: 27% of category shoppers cannot attribute perceptions to any retailer

Over a quarter of auto parts shoppers are unable to name a retailer for an average of the fourteen brand attributes. Historically, the auto aftermarket sector heavily marketed vendor oil special offers. It is hard to tell one retailer from the other when so much of the creative is dedicated to touting specials and the latest deal.

There is a significant body of marketing research from Les Binet and Peter Field, the godfathers of marketing effectiveness, that indicates “a succession of short-term response-focused (offer) campaigns will not succeed as strongly over the longer term as a single brand-building campaign designed to achieve year-on-year improvement to business success.”

Sales activation campaigns: The “carbs of advertising”

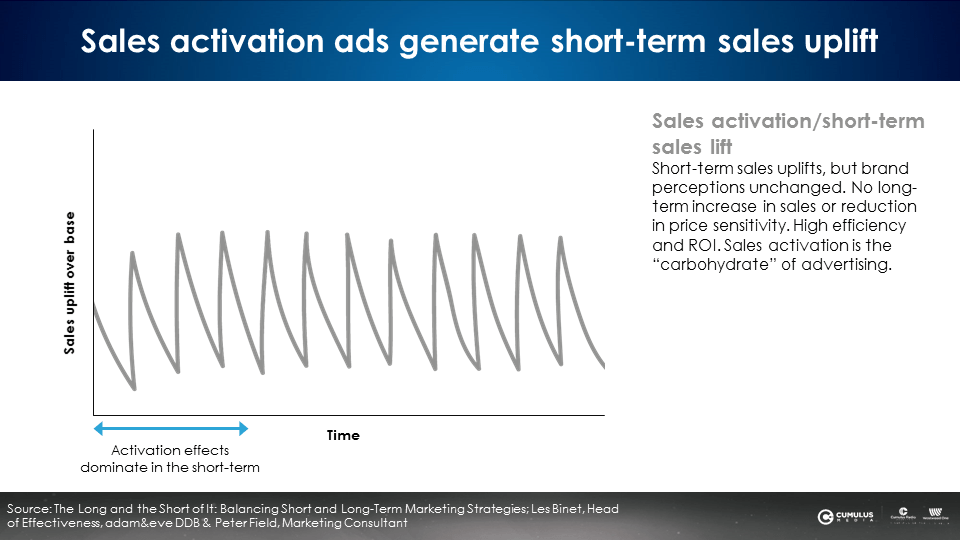

Les Binet and Peter Field explain that the goal of sales activation “is to focus on people who are likely to buy in the very near future. That means exploiting existing brand equity to generate sales right now.”

Sales activation features rational copy and tight targeting. In their book Media in Focus: Marketing Effectiveness in the Digital Era, Binet and Field report that “activation effects are relatively easy to measure, because they tend to be big, immediate and direct. In the short term (six months or less) they tend to produce the biggest sales responses.”

Binet and Field show how sales activation campaigns generate sales uplift through a series of short-term sales spikes that quickly collapse.

Sales activation campaigns decay fast and don’t build long-term sales. They are the carbs of advertising: a sugar rush of short-term sales and then a crash.

Brand building campaigns: The “protein of advertising”

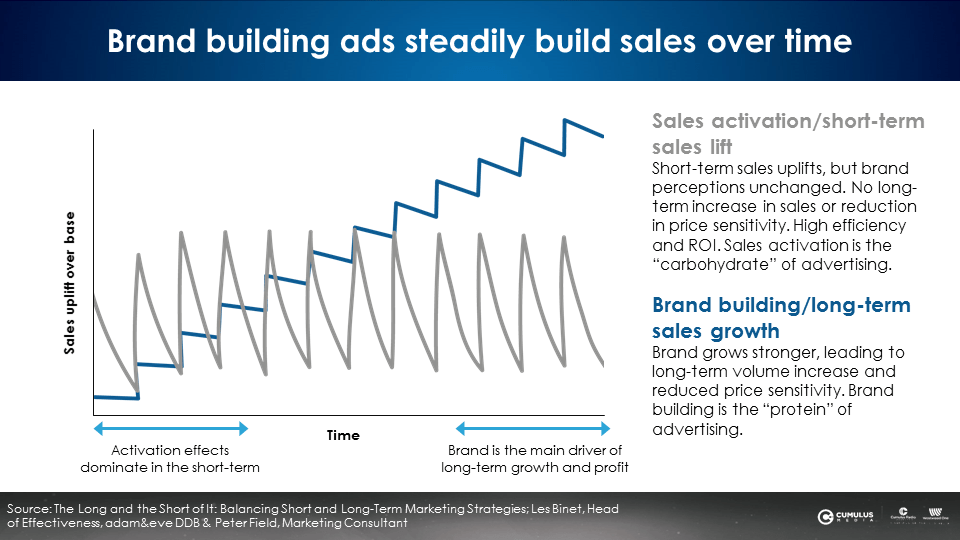

Of the two types of campaigns, brand building is harder to achieve, requires greater investment, and is more important. According to Binet and Field, “Brand building means creating mental structures (associations, memories, beliefs, etc.) that will pre-dispose potential customers to choose one brand over another. This is a long-term job involving conditioning consumers…so it takes time; talking to people long before they come to buy.”

Brand building requires mass reach media like television and AM/FM radio because the goal is to target everyone in the category, even if they are not in the market right now.

Brand building campaigns depend on emotional creative that makes people feel something. Emotional messaging has more impact than rational creative with facts and details that are mostly ignored.

While short-term sales uplifts are smaller, brand building sales effects (the blue line below) grow and grow over time, becoming the main driver of long-term growth and profit.

The massive number of marketing effectiveness studies analyzed by Binet and Field reveal the sales effects of brand building “decay away more slowly…in the long run, brand effects are the main driver of growth.” Binet and Field find that the ideal mix of marketing investments should be 60% brand building and 40% sales activation.

Heavy auto parts shoppers are more likely to purchase online

Over the last three years, eight out of ten ultra-heavy auto parts shoppers have purchased online in the last year. Infrequent shoppers are far less likely to have purchased online.

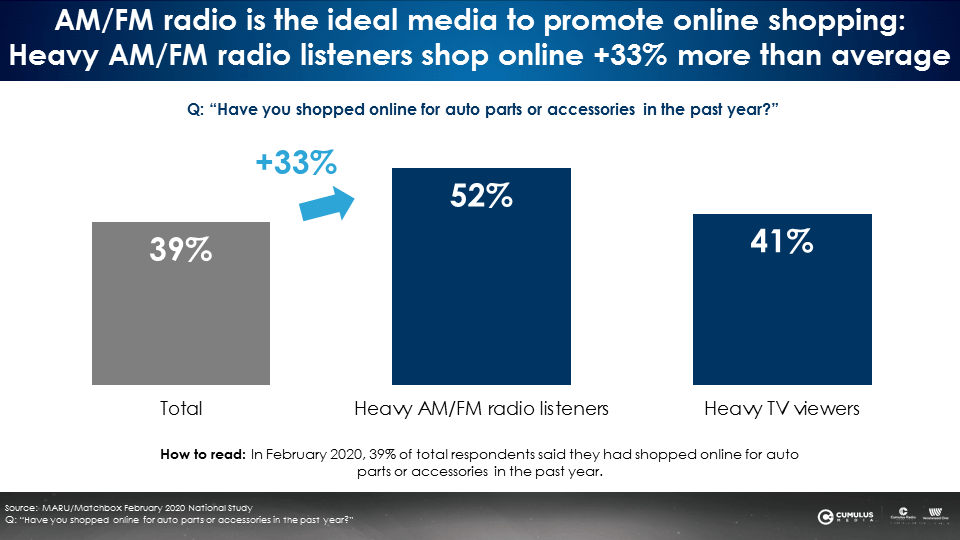

AM/FM radio works as a platform for auto parts retailers to tout their online sales channel

Heavy AM/FM radio listeners are +33% more likely to have shopped online.

Key takeaways:

- AM/FM radio is the ideal platform to advertise auto aftermarket products and services

- Consistent brand equity and shopping patterns: AutoZone leads but Amazon is a factor

- Brand equity: AutoZone leads, followed by Advance Auto Parts, Walmart, Amazon, O’Reilly Auto Parts, and NAPA Auto Parts

- Brand perceptions: Amazon ranks second among do-it-yourselfers and the ultra-heavy auto parts shopper segment

- Brand opportunity: 27% of category shoppers cannot attribute perceptions to any retailer.

- Sales activation campaigns are the “carbs of advertising” and brand building campaigns are the “protein”

- Heavy auto parts shoppers are more likely to purchase online

- AM/FM radio works as a platform for auto parts retailers to tout their online sales channel

Justin Thomas is a Research Analyst at Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.