Nielsen: Latest AM/FM Radio Audience Data Reveals Continued Drive Time Recovery In PPM Markets As More Americans Commute To Work

Nielsen just released high-level findings from the September Portable People Meter markets and the June-July-August diary surveys. Most of the September PPM survey period falls into August, from August 13 through September 9. This included the Labor Day holiday, which depresses listening levels.

For those expecting stability, there were surprising increases across the board.

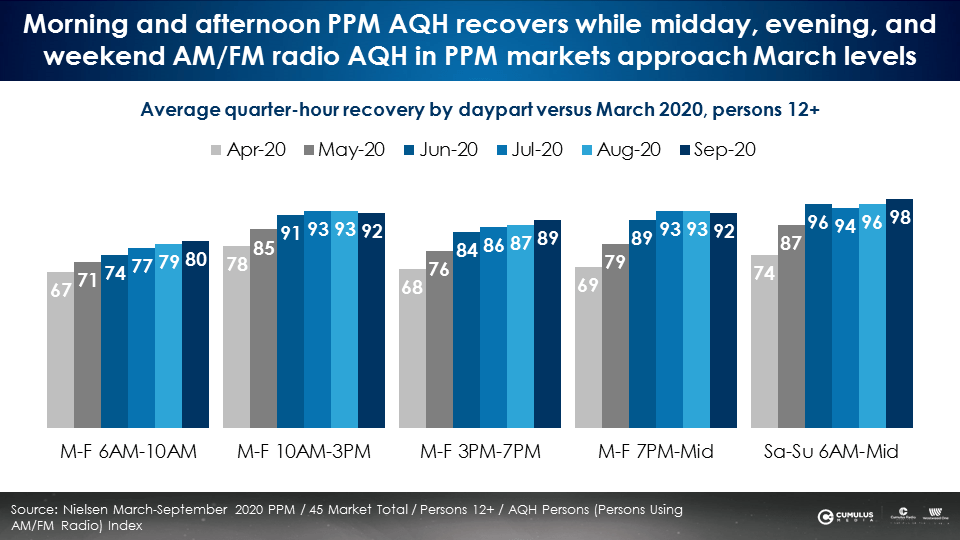

Drive time audience recovery continues in the Portable People Meter markets

Benchmarking against the March PPM survey, overall total week September average quarter-hour listening is at 90% of March audiences. Total PPM AQH listening is now +10% higher than the Spring 2020 (April-May-June) period.

For the fifth month in a row, morning drive listening and afternoon drive listening have grown. Middays are at 92% and afternoon drive is at 89% of prior levels. Weekend audiences fully recovered in June.

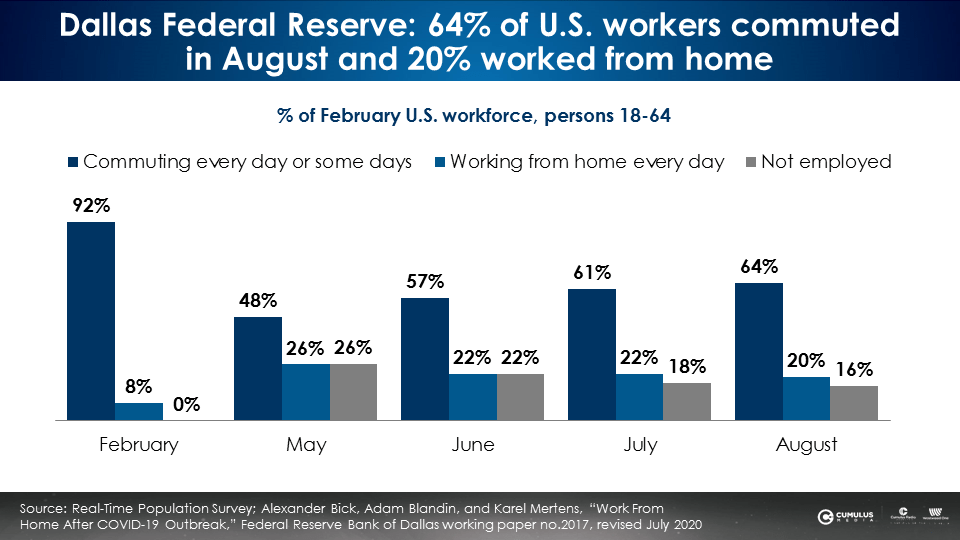

In August, three times as many Americans commuted to work versus those who worked from home, according to the Dallas Federal Reserve

A national study of those who worked in February conducted by the Dallas Federal Reserve reveals a steady increase in the proportion of workers who are commuting to jobs away from their homes.

64% of the February workforce commuted to work in August, three times as many as those who worked from home (20%). Those commuting to a job are indicated by the dark blue bar below. The consistent increase in commuting workers is responsible for the continued growth in drive time AM/FM radio audiences.

Since May, the proportion of those working from home (the light blue bar below) has ticked down. Also dropping is the proportion of February workers who are not employed (the grey bar).

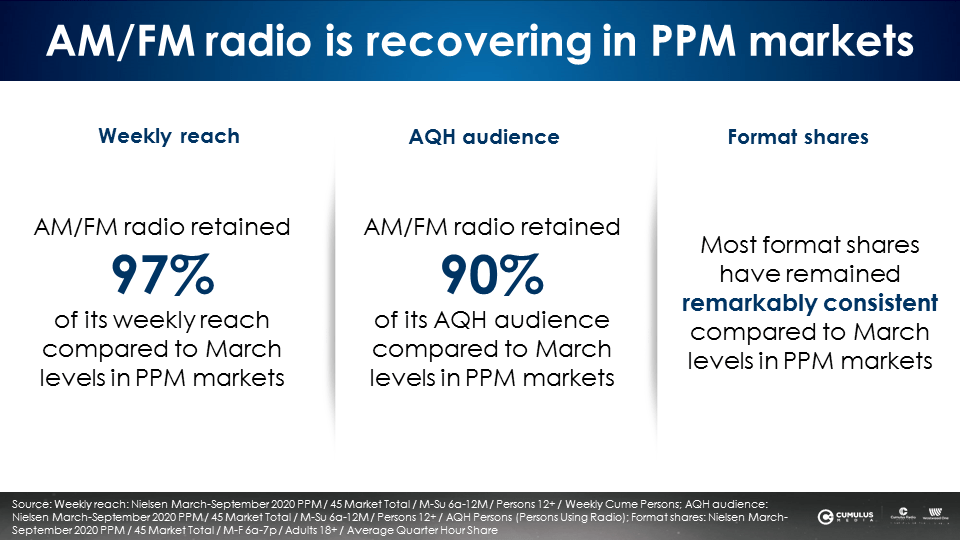

PPM recovery scorecard: Reach is now 97% of March and format shares are rock steady

Compared to March, AM/FM radio has retained 97% of its weekly reach. Format shares are exceptionally stable. The sports format held onto its 3.8 share in September, which grew sharply from July to August.

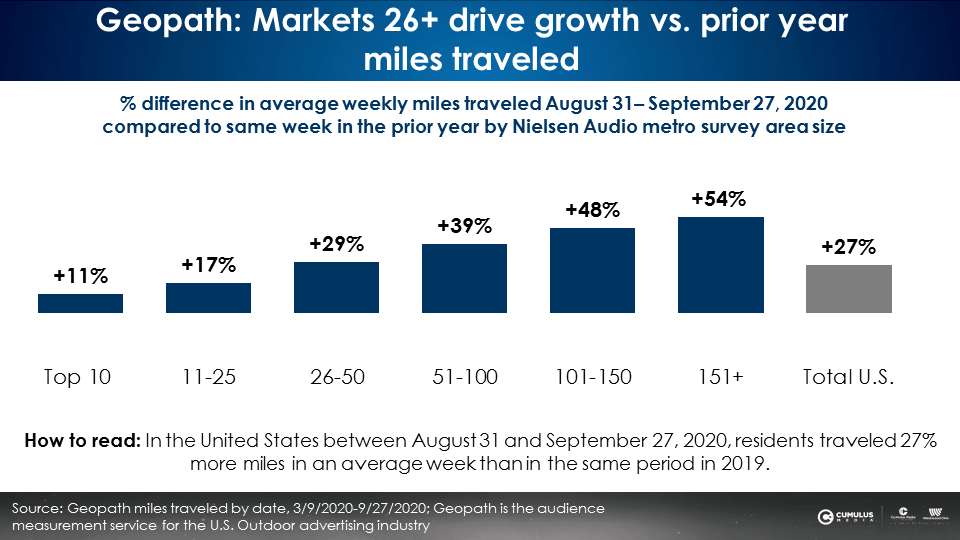

Geopath: American average miles traveled recovers strongly, especially in markets outside of the top 25

Geopath, the Nielsen of the outdoor advertising industry, reports U.S. weekly average miles traveled recovered in June. Over the last six months, one of the consistent findings of the Geopath data has been that medium and smaller markets saw little, if any, decreases in vehicle miles traveled due to the pandemic.

During September, the smaller the market, the greater the mileage increase over the same week in the prior year. Compared to the prior year, mileage traveled in the past week in the top 25 markets was +11% to +17% greater than in the prior year.

In markets 26-100, average miles traveled was 29% to 39% greater than 2019. Markets outside the top 100 experienced significant growth in miles traveled, +48% to +54%.

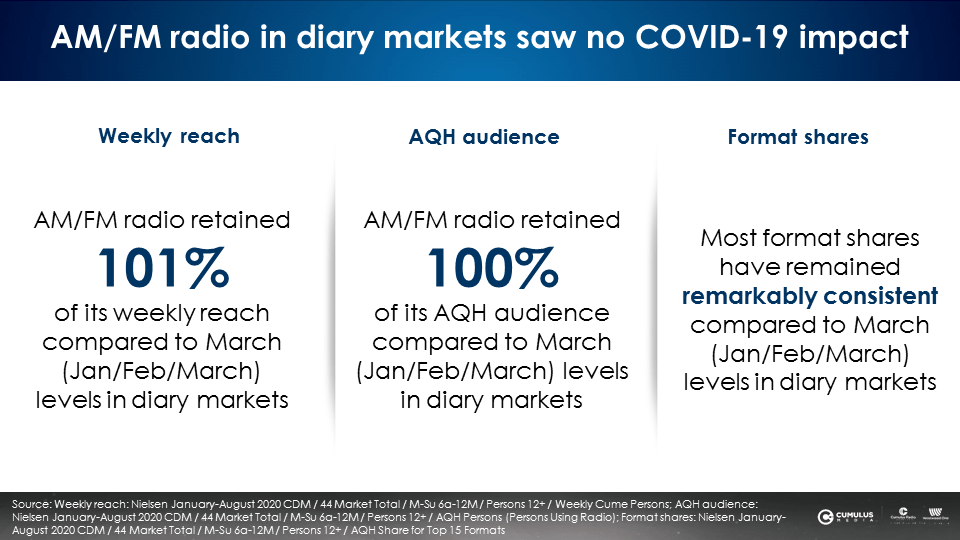

Diary market scorecard: No impact in listening levels versus pre-COVID

Geopath reports significant year-over-year mileage increases for Nielsen’s diary markets. Total listening during the June-July-August survey in the continuously measured diary markets is virtually identical to the pre-COVID January-February-March period. The just-released total week reach is 101% of the prior period and AQH is 100% of the prior survey.

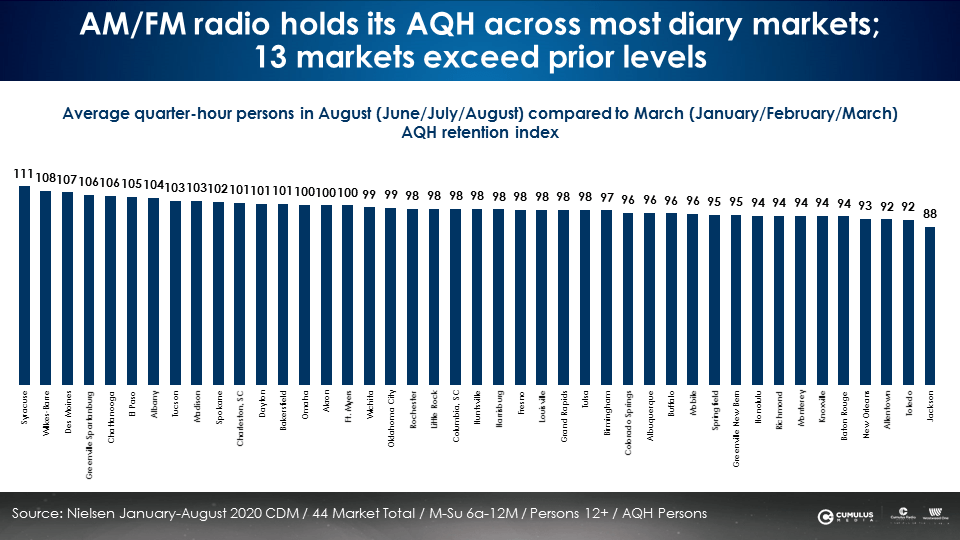

One-third of the continuously measured diary markets now have greater listening levels than Q1 2020

Comparing the June-July-August diary surveys to the January-February-March period finds that thirteen markets currently have listening levels that exceed pre-COVID levels. Listening in Syracuse is now +11% greater than in the winter. Wilkes-Barre, Des Moines, Greenville, Chattanooga, El Paso, Albany (New York), Tucson, Madison, Spokane, Charleston, SC, Dayton, and Bakersfield all have greater listening today than in the pre-COVID period.

Q4 2020: Three factors will lead to continued AM/FM radio listening growth

- In October 2020, Nielsen will implement a headphone listening adjustment to PPM AM/FM radio streaming audiences. The impact to total U.S. listening is projected to be +1% to +2.5% (+2% to +5% in PPM markets).

- With school resuming in the fall and into 2021 for some proportion of students, morning AM/FM radio audiences will continue to recover.

- The number of Americans going to work continues to increase.

Key takeaways:

- Drive time audience recovery continues in the Portable People Meter markets

- In August, three times as many Americans commuted to work versus those who worked from home, according to the Dallas Federal Reserve

- PPM recovery scorecard: Reach is now 97% of March and format shares are rock steady

- Geopath: American average miles traveled recovers strongly, especially in markets outside of the top 25

- Diary market scorecard: No impact in listening levels versus pre-COVID

- One-third of the continuously measured diary markets now have greater listening levels than Q1 2020

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.