Edison Research’s “Share Of Ear” Q3 2020: In-Car Audiences Rebound, Brands And Agencies Overestimate Pandora/Spotify Audiences, AM/FM Radio Dominates Ad-Supported Media, And Podcast Audiences Surge

Edison Research recently released the Q3 2020 “Share of Ear” report, the media industry’s go-to for understanding how Americans consume audio each day. Released each quarter, “Share of Ear” quantifies the reach and time spent with all forms of audio.

Here are key findings:

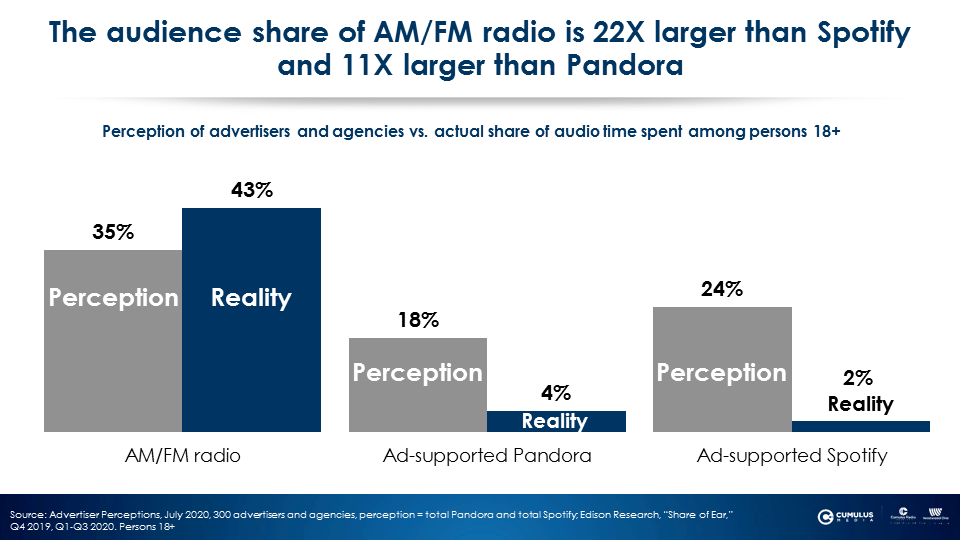

Perception vs. reality: Brands and agencies significantly overestimate Pandora and Spotify’s audiences

In July 2020, Advertiser Perceptions surveyed 300 marketers and media agencies on the audience shares of AM/FM radio, Pandora, and Spotify. Examining the Q3 2020 “Share of Ear” study, it is evident that there is a massive disconnect between perceptions and actual audience shares.

Brands and agencies perceive that Spotify’s share (24%) is twelve times larger than its actual 2% share. Pandora’s perceived 18% audience share is over four times larger than reality (4%).

AM/FM radio’s perceived share (35%) is 23% smaller than its actual 43% share. Per Edison, AM/FM radio’s audience is 22X larger than Spotify and eleven times larger than Pandora.

“Share of Ear” data proves that advertisers are not taking the “me” out of media

Mark Ritson, the renowned Marketing Professor, describes this phenomenon: “There is increasing global evidence that marketers are basing their media choices on their own behavior or that stoked by the digitally obsessed marketing media, rather than actual audience data.” Perception is shaded by personal experience and for marketers and agencies, this creates a major disconnect with reality.

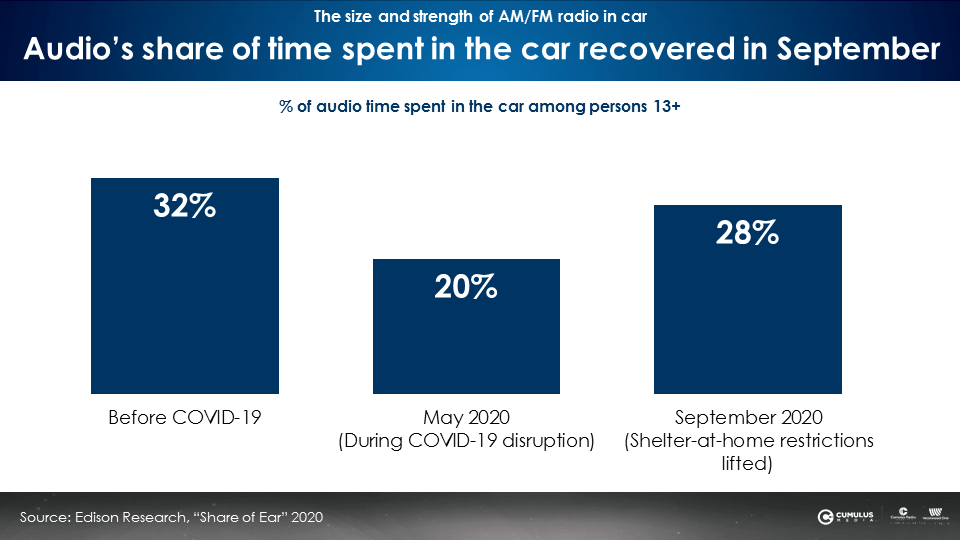

Listening shifts from the home back to the car as COVID-19 restrictions lift in Q3

Before the pandemic, 32% of all audio time spent occurred in the car. During May’s COVID-19 shelter-at-home period, the in-car share of audio time spent dropped to 20%. In September, it recovered to 28%.

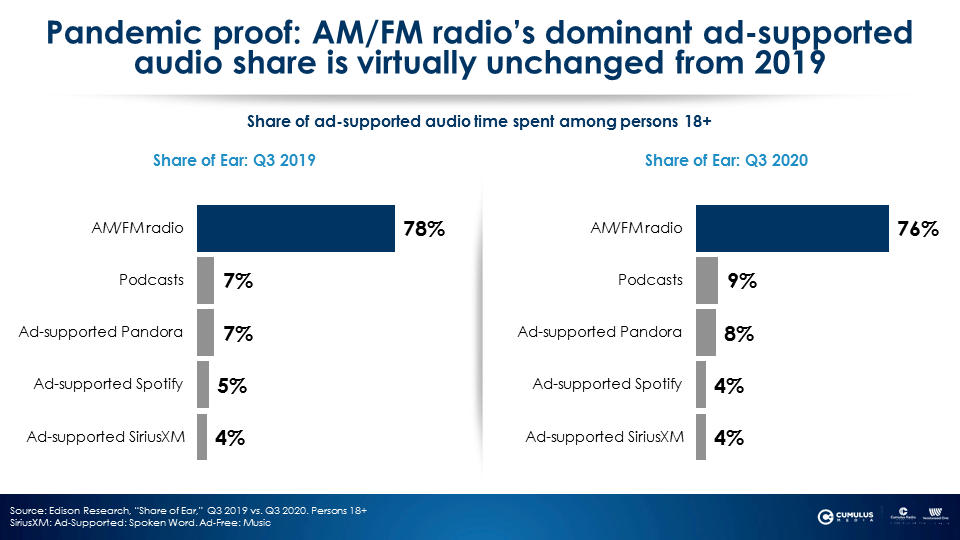

Audio is pandemic proof as AM/FM radio continues to represent three-fourths of all ad-supported audio

Some predicted that the pandemic would cause major changes in media use. Comparing shares of ad-supported audio from Q3 2019 to Q3 2020 reveals little change. At a 76% share, AM/FM radio continues to dominate ad-supported audio.

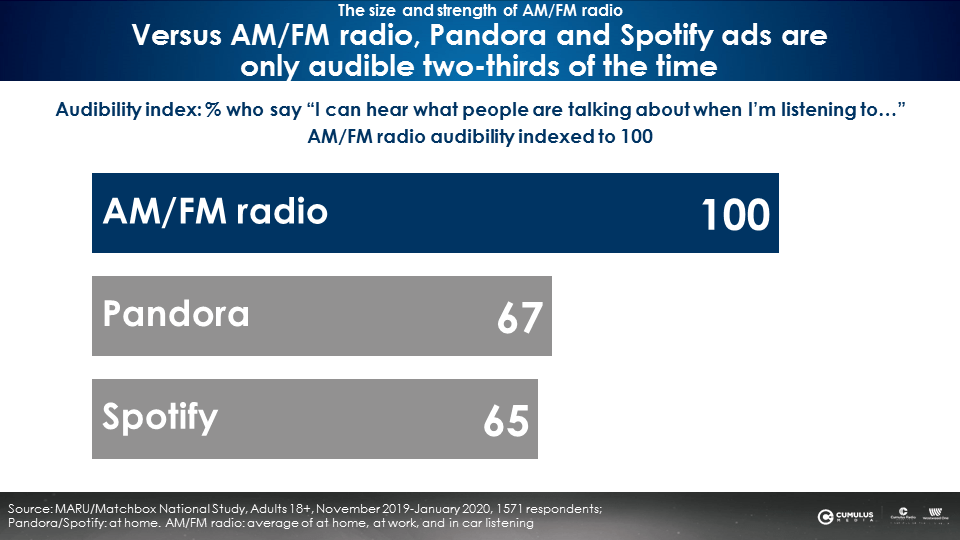

Versus AM/FM radio, Pandora and Spotify ads are only audible two-thirds of the time

A January 2020 study of 1,571 respondents conducted by MARU/Matchbox revealed ads on Pandora and Spotify are not always audible since consumers use these streaming services to play softly as background music.

MARU/Matchbox asked consumers if they could hear what people were talking about on Pandora, Spotify, and AM/FM radio. The study found that Pandora and Spotify have 65% to 67% of the audibility of AM/FM radio.

This is not surprising given that AM/FM radio is a more foreground medium with engaging on-air personalities, information, interaction with listeners, and service elements like news, weather, and traffic. Pandora and Spotify are like a “box of music” playing in the background in the other room.

Media buyers, planners, and strategists who seek to quantify if their ads are actually heard can apply a simple factor to Pandora and Spotify impressions. Reduce Pandora and Spotify impressions by 35% to 33% to estimate the amount of people who actually heard the ads.

35% of the Pandora/Spotify impressions are wasted as the ads are not audible or can be heard. This “audible impressions” approach will drive up Pandora/Spotify CPMs by 50%.

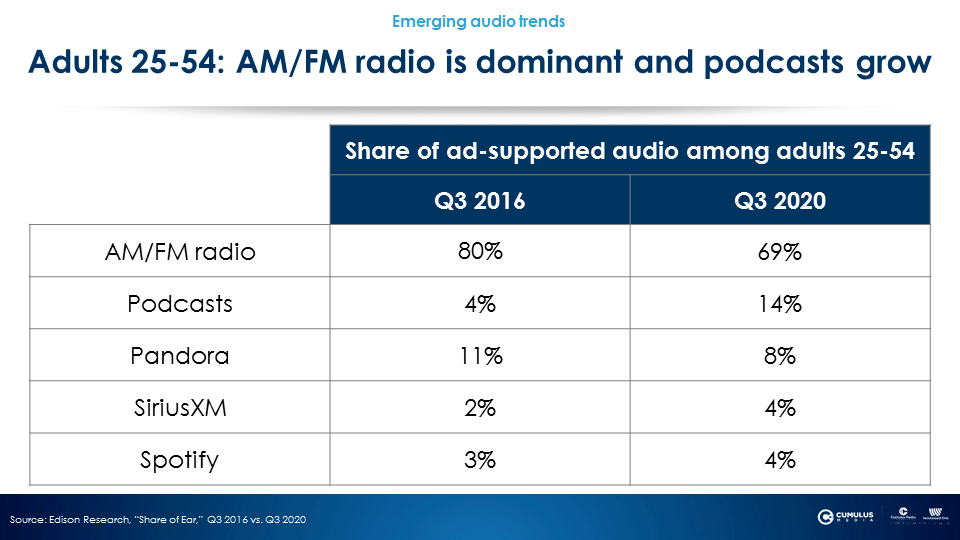

2016 vs. 2020: Podcasts soar, Pandora and Spotify stagnate, and AM/FM radio remains dominant

It is useful to examine long-term trends in audio. The findings are surprising.

From 2016 to 2020, ad-supported audio shares among persons 25-54 for Pandora are down, podcasts have more than tripled, and AM/FM radio has remained strong. Over the last four years, the combined share of Pandora and Spotify dropped from 14% to 12%. Podcasting’s 14% share among persons 25-54 in Q3 2020 now beats ad-supported Pandora and Spotify combined (12%).

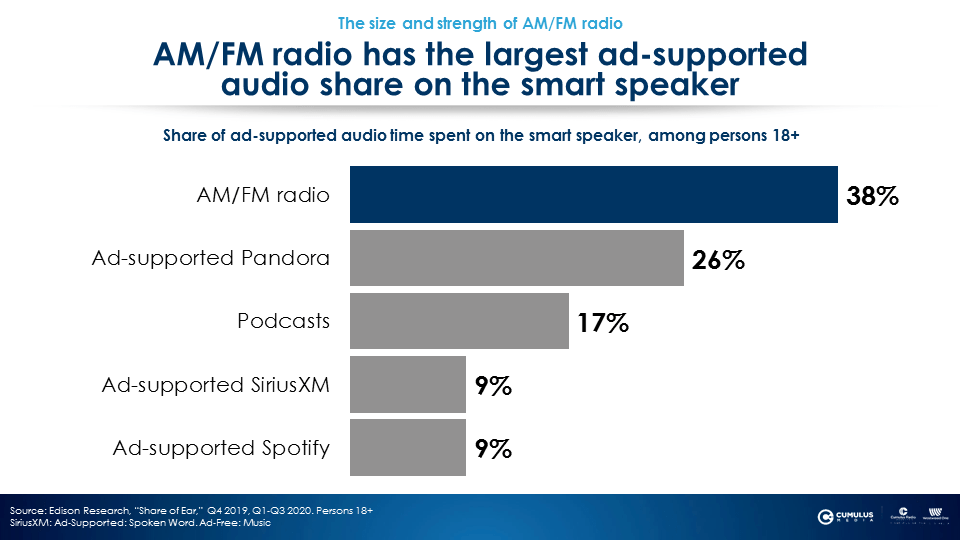

AM/FM radio is the #1 ad-supported platform on smart speakers

AM/FM radio has a 38% share of ad-supported audio on the smart speaker followed by ad-supported Pandora (26%) and podcasts (17%).

Key takeaways:

- Perception vs. reality: Brands and agencies significantly overestimate Pandora and Spotify’s audiences

- “Share of Ear” data proves that advertisers are not taking the “me” out of media

- Listening shifts from the home back to the car as COVID-19 restrictions lift in Q3

- Audio is pandemic proof as AM/FM radio continues to represent three-fourths of all ad-supported audio

- Versus AM/FM radio, Pandora and Spotify ads are only audible two-thirds of the time

- 2016 vs. 2020: Podcasts soar, Pandora and Spotify stagnate, and AM/FM radio remains dominant

- AM/FM radio is the #1 ad-supported platform on smart speakers

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.