Edison Research’s “Share Of Ear” Q4 2020: Podcasting Eats Spotify/Pandora And AM/FM Radio Remains The Dominant Ad-Supported Audio Platform

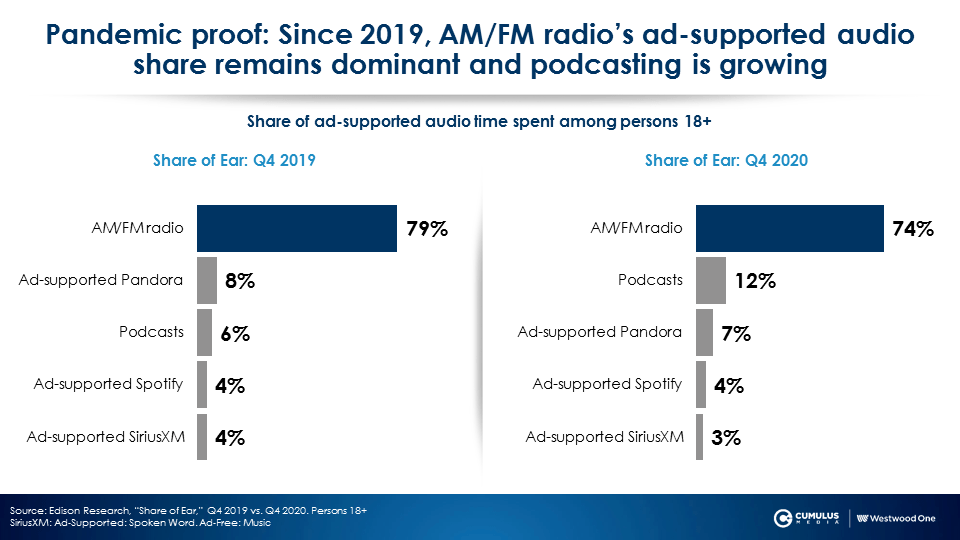

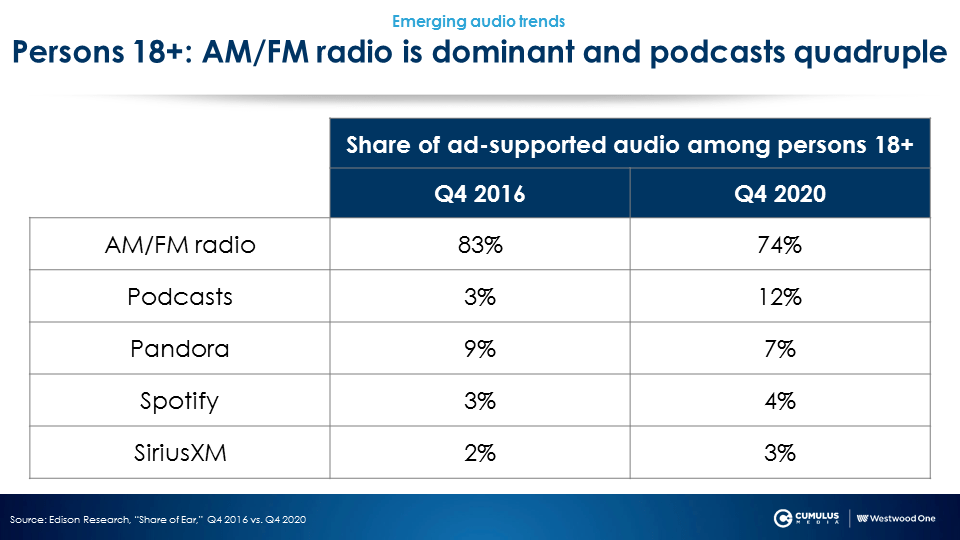

The Q4 2020 edition of Edison Research’s “Share of Ear,” the gold standard audio time use study, contains stunning news. For the first time, audience shares for podcasting surpassed the combined audiences of ad-supported Pandora and ad-supported Spotify.

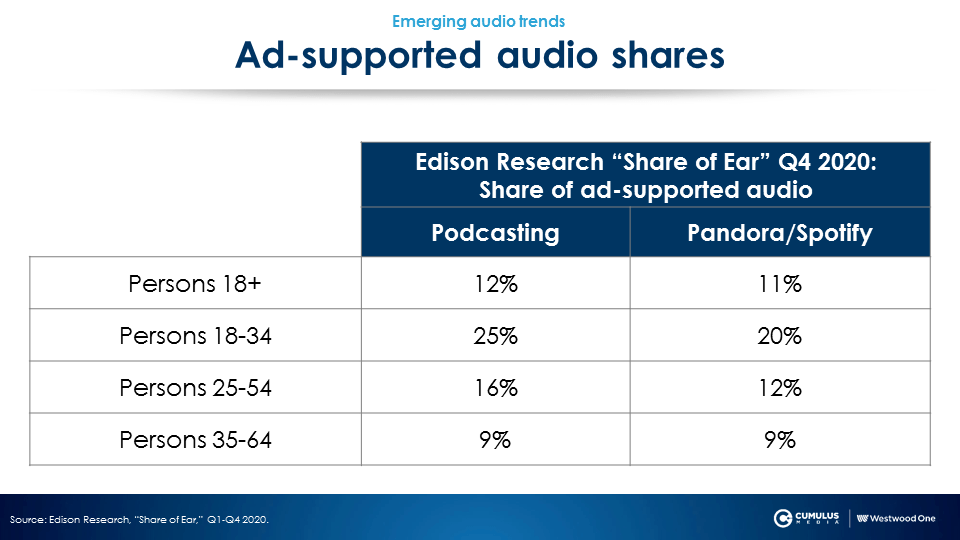

Podcasting achieved a 12% share compared to Pandora and Spotify’s combined 11% share of ad-supported audio among persons 18+. This is notable as ad-supported audio audiences are of great importance to brands and their media agencies. Podcasting also beat Pandora and Spotify handily among the persons 18-34 and persons 25-54 ad-supported audiences.

Some other key audio insights:

AM/FM radio remains the dominant ad-supported audio platform

AM/FM radio’s 74% share of ad-supported audio is 11 times bigger than Pandora and 19 times larger than Spotify. Advertisers cannot check the box on audio without AM/FM radio. The pandemic did not alter AM/FM radio’s dominant position as there was little change between Q4 2019 and Q4 2020.

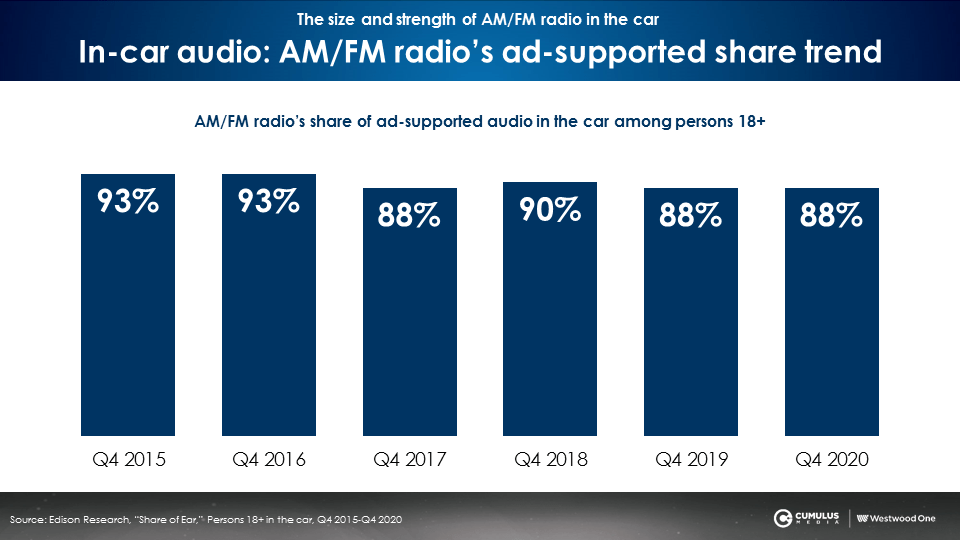

AM/FM radio owns the car with a 90% share of ad-supported audio six years running

Since Edison began the “Share of Ear” study, AM/FM radio’s in-car share of ad-supported audio has hovered around a 90% share. AM/FM radio owns the “last mile” of shopping trips before purchases are made.

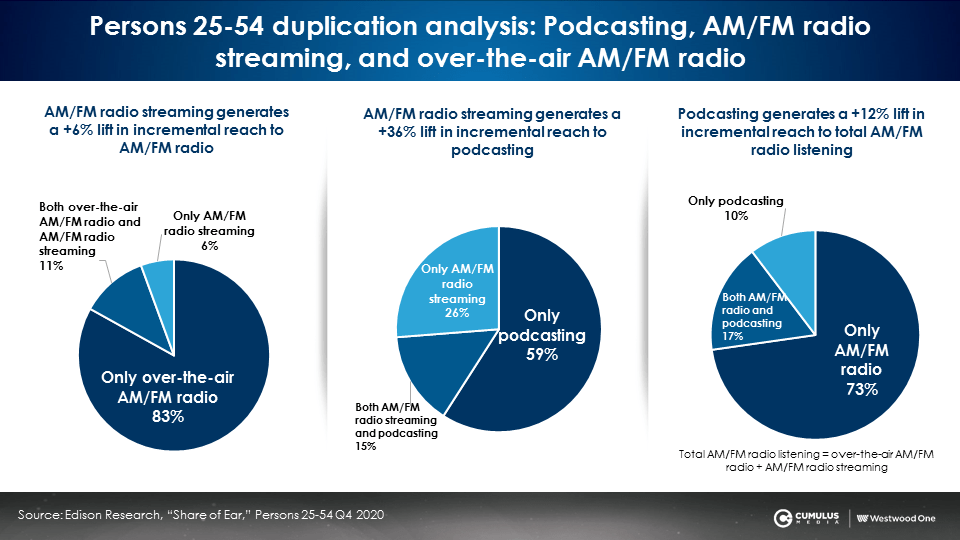

Adding podcasts and AM/FM radio streaming generates incremental reach to over-the-air AM/FM radio media plans

Using the “Share of Ear” data, CUMULUS MEDIA | Westwood One examined the duplication between over-the-air AM/FM radio and the AM/FM radio audio stream, podcasting and AM/FM radio, and AM/FM radio streaming and podcasting.

- Adding AM/FM radio streaming to over-the-air AM/FM radio generates a +6% lift in incremental reach. Among those that are listening to AM/FM radio streaming, two-thirds also listen to over-the-air AM/FM radio.

- Adding AM/FM radio streaming to podcasts generates a +36% lift in incremental reach. 36% of AM/FM radio streaming audiences also listen to podcasting.

- Adding podcasting to AM/FM radio generates a +12% increase in incremental reach. About 62% of podcast listeners also listen to AM/FM radio.

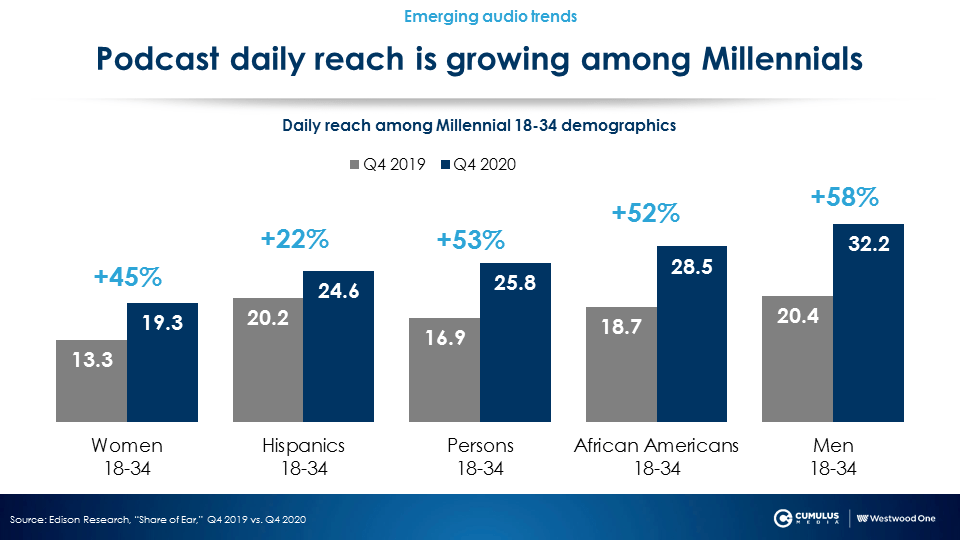

Podcasts have scale, especially among persons 18-34

In the last year, Edison reports significant podcast daily reach growth among persons 18-34. As of Q4 2020, podcasting’s daily reach is now 25% to 32% of persons 18-34. The weekly reach is even greater.

According to Edison Research’s 2021 Infinite Dial study, 56% of persons 12-34 are reached weekly by podcasts. The Nielsen Scarborough Podcast Buying Power Study reports podcasting’s median age is 38, making it one of the youngest media platforms.

Multi-cultural podcast daily reach has also grown sharply over the last year. African American 18-34 reach is up +52% and Hispanic 18-34 reach is up +22%.

Ad-supported Pandora and Spotify music streaming peaked in 2016; Podcasting now accounts for all the growth in audio

A four-year comparison of “Share of Ear” data reveals ad-supported Pandora and Spotify shares have dropped from a 12% share in 2016 to a 11% share in 2020. Over the same period, podcast shares increased 4 times, 3% to 12%.

During the four-year period, Spotify’s ad-supported shares have grown only slightly 3% to 4%. The vast majority of Spotify’s growth has occurred with its ad-free subscription service. Currently, about two-thirds of time spent with Spotify is devoted to its advertising-free subscription service.

AM/FM radio is still the dominant ad-supported audio platform with a 74% share. Duncan Stewart, Director of Research, Technology, Media & Telecommunications at Deloitte, observes, “Why do people think that nobody listens to AM/FM radio anymore? Because there is a narrative that new media kills old media, so nobody bothers to look at evidence that doesn’t fit the narrative.”

At the dawn of the streaming video era, major TV companies did not focus much on building out direct-to-consumer content. Now, all media firms are very focused on their streaming video content.

In contrast, at the dawn of the podcast era, AM/FM radio companies are investing big in podcasting. Audacy, iHeartRadio, and CUMULUS MEDIA | Westwood One are all very engaged with producing rich podcast content with strong distribution and promotion.

Once upon a time, digital audio just meant music streaming. In 2021, digital audio increasingly means immersive spoken word via podcasting.

Key takeaways:

- AM/FM radio remains the dominant ad-supported audio platform

- AM/FM radio owns the car with a 90% share of ad-supported audio six years running

- Adding podcasts and AM/FM radio streaming generates incremental reach to over-the-air AM/FM radio media plans

- Podcasts have scale, especially among persons 18-34

- Ad-supported Pandora and Spotify music streaming peaked in 2016; Podcasting now accounts for all the growth in audio

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One.

Contact the Insights team at CorpMarketing@westwoodone.com.