Nielsen Nationwide Spring 2021: AM/FM Radio Audience Recovery Continues As Audiences Surge +7% Versus Spring 2020 And Remain Steady From Fall 2020; Plus Female, Black, And Hispanic Growth

Last week, Nielsen released the Spring 2021 Nationwide report. In addition, Nielsen is releasing the August 2021 Portable People Meter data from the top 50 markets. Both reports show strong recovery in AM/FM radio audiences.

Nationwide is Nielsen’s roll up of all AM/FM radio listening from all U.S. markets and counties produced twice a year in Spring and Fall. The Spring Nationwide survey is used as the basis for AM/FM radio network upfront negotiations for the coming year as well as Q4 scatter buys.

The big picture: Since the Spring 2020 lockdown, AM/FM radio audiences have recovered. Just-released Nielsen listening data reveals the audience rebound continues.

Here are the key takeaways:

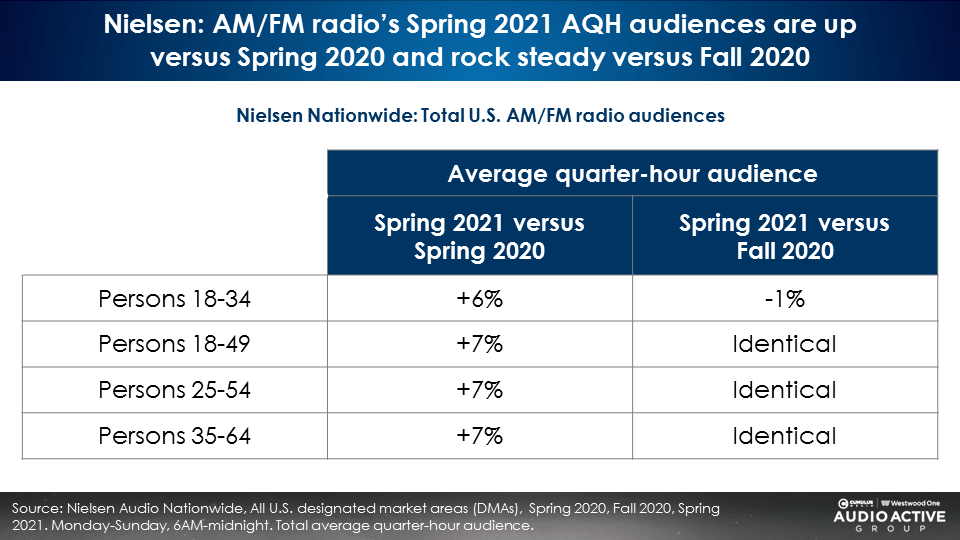

Nielsen Nationwide: AM/FM radio’s Spring 2021 AQH audiences are up +7% versus Spring 2020 and rock steady versus Fall 2020

All of the major buying demographics see AQH listening gains of +7% versus Spring 2020. Versus the Fall 2020 Nationwide survey, AQH listening among all major buying demographics is virtually identical. Only persons 18-34 saw a small -1% drop from Fall 2020 to Spring 2021.

The exceptionally steady listening levels from Fall 2020 to Spring 2021 are especially good news for advertisers and agencies. Typically, there are modest -1% to -2% AQH listening losses from one survey to the next. The fact that listening is so stable from Fall 2020 to Spring 2021 is a testament to the resilience and vitality of American AM/FM radio. This is in stark contrast to the freefall in U.S. linear television viewing.

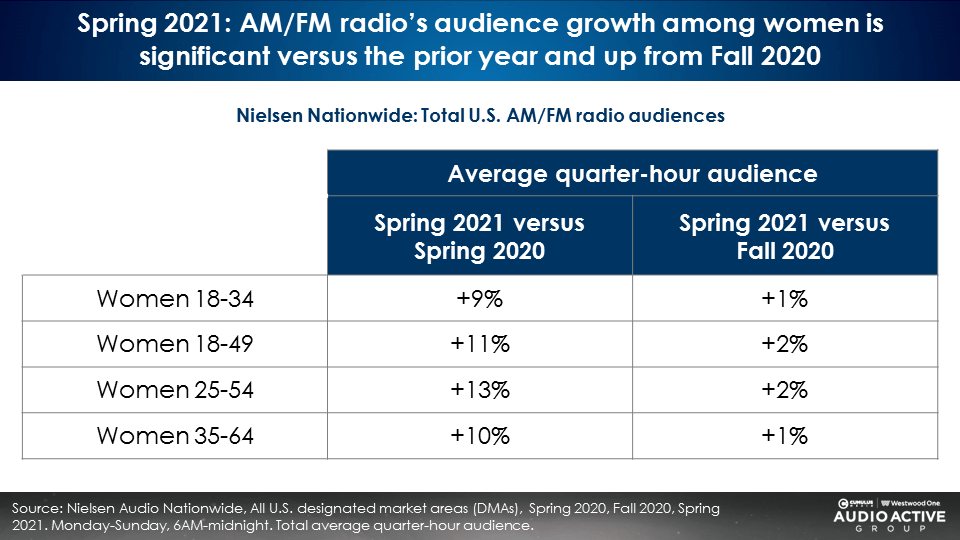

Extraordinary female audience recovery: +13% versus Spring 2020 and +2% versus Fall 2020

During the lockdown of Spring 2020, AM/FM radio listening among women dropped more than men. During the pandemic, the burden of childcare fell disproportionally to women. The question was: Would female AM/FM radio listening recover as kids returned to school in Spring 2021 and the country opened back up?

The answer is a resounding yes. Compared to Spring 2020, the just-released Spring 2021 Nationwide survey reveals AQH listening surged +11% among women 18-49 and grew an eye-popping +13% among women 25-54.

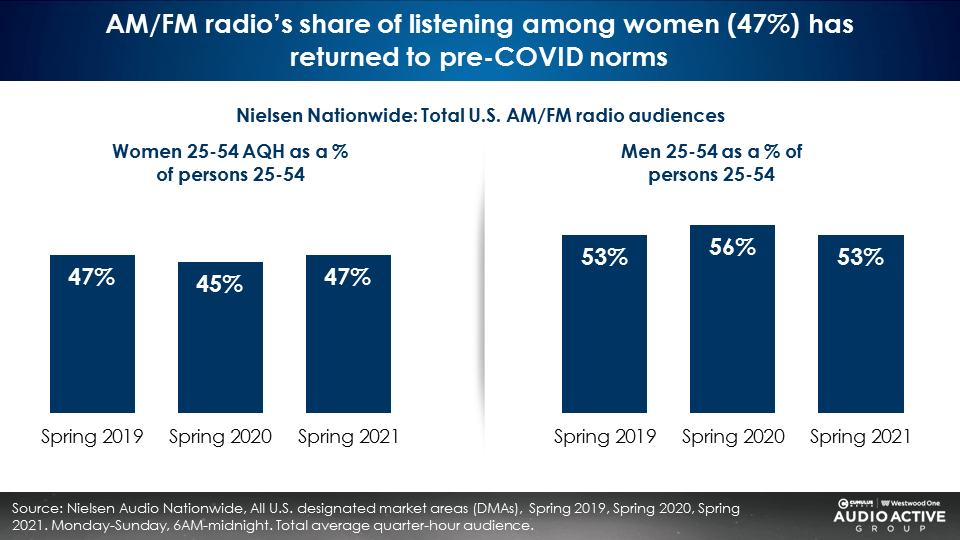

AM/FM radio’s share of listening among women (47%) has returned to pre-COVID norms

Historically, AM/FM radio’s share of time spent leans a few points towards men. In Spring 2019, persons 25-54 listening was 53% men and 47% women.

During the Spring 2020 lockdown, female listening dropped to 45% of persons 25-54 time spent. In the just-released Spring 2021 Nationwide, the share of female listening has returned back to its typical 47%.

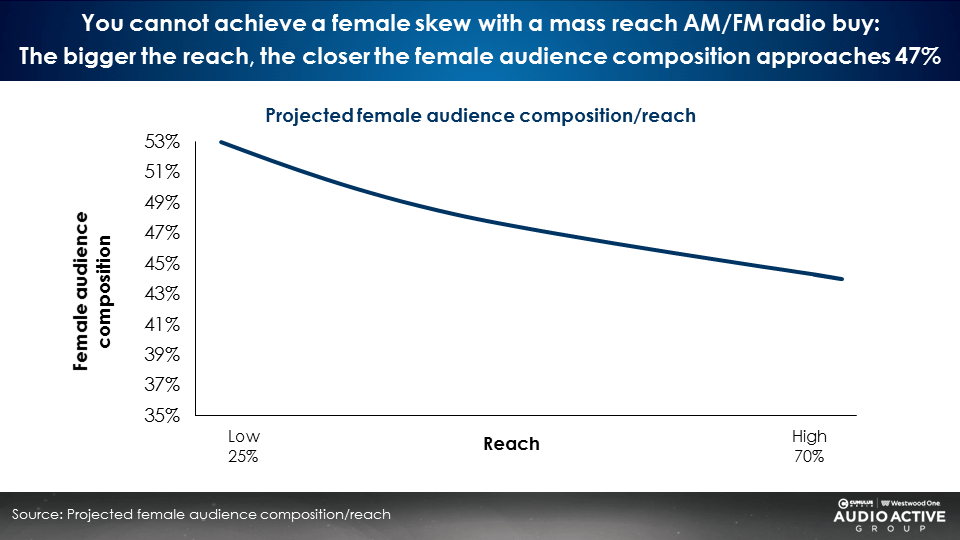

Be smart: Attempting an AM/FM radio buy with a 55% female audience composition is impractical

Marketers who target women with a mass reach national AM/FM radio media plan mistakenly seek a 55% female audience composition. Given that women represent 47% of all American AM/FM radio listening, a mass reach buy with a 55% female audience composition is simply unattainable. Achieving a 50/50 male/female ratio is a more realistic objective.

The vast majority of AM/FM radio listening occurs on stations with similar amounts of men and women listening. There are some AM/FM radio programming formats that lean more male or a little more female. The only way to have a buy with a 55% female skew is to have a small buy with low reach.

As the visual below reveals, it is possible to attain a female skew with small, low reach buys. As the reach of the campaign grows, the female gender composition drops and approaches 47%, the overall profile of American AM/FM radio.

Should I worry about a female skew or go for reach? Reach trumps targeting 2.5 to one

What is more important – targeting or reach? A massive Nielsen NCSolutions study of the sales effect of 500 brands reveals 22% of sales lift is generated by reach while targeting only represents 9% of sales. Reach has two and half times the sales lift of targeting. Ditch the gender skew dictate and go for reach!

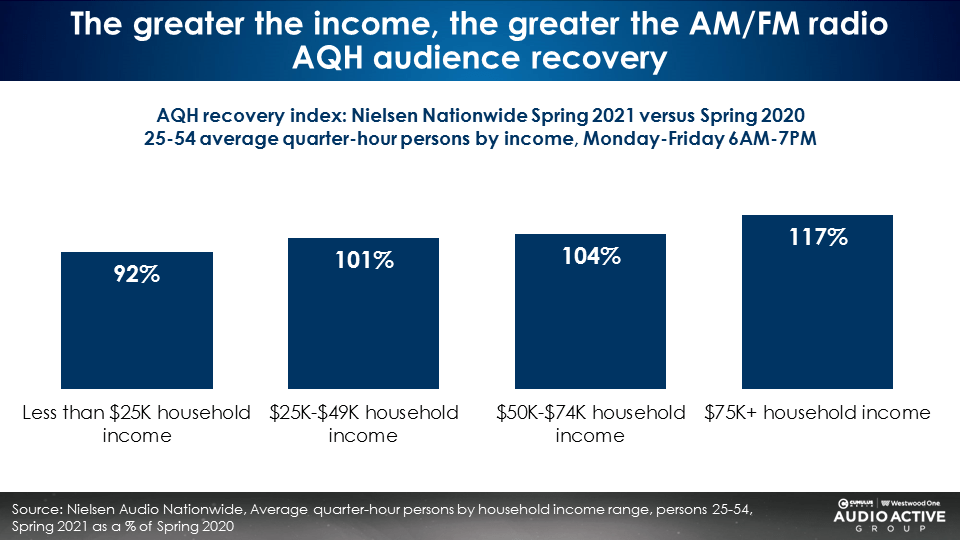

Upper income audience recovers strongly: $75K+ income listening soars +17%

Comparing Nationwide Spring 2020 to Spring 2021, the greater the income, the greater the listening recovery. Among those with a $75K+ income, AM/FM radio listening is up +17%. Listening among those with a $50K-$74K income is up +4%.

Post-pandemic, the profile of American AM/FM radio listening is more upscale. Prior to COVID, 47% of total AM/FM radio listening came from those with an income of $75K+. In Spring 2021, the $75K+ income audience composition has grown from 47% to 52% of total U.S. listening.

From a reach perspective, there are actually more AM/FM radio listeners with a $75K+ income today than before the pandemic. AM/FM radio’s reach among persons 25-54 with a $75K+ income is +3% greater versus pre-pandemic.

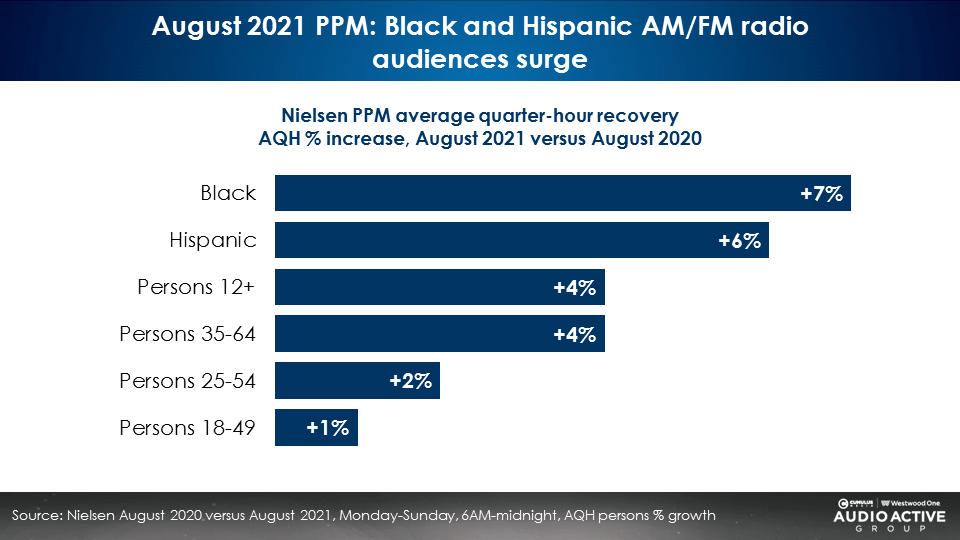

August 2021 Portable People Meter: Black and Hispanic audiences surge

Comparing the 48 just-released PPM markets to the prior year August 2020 survey, there are significant increases in Black (+7%) and Hispanic (+6%) AQH listening. August 2020 to August 2021 saw total growth among persons 25-54 at +2% and growth among persons 35-64 at +4%.

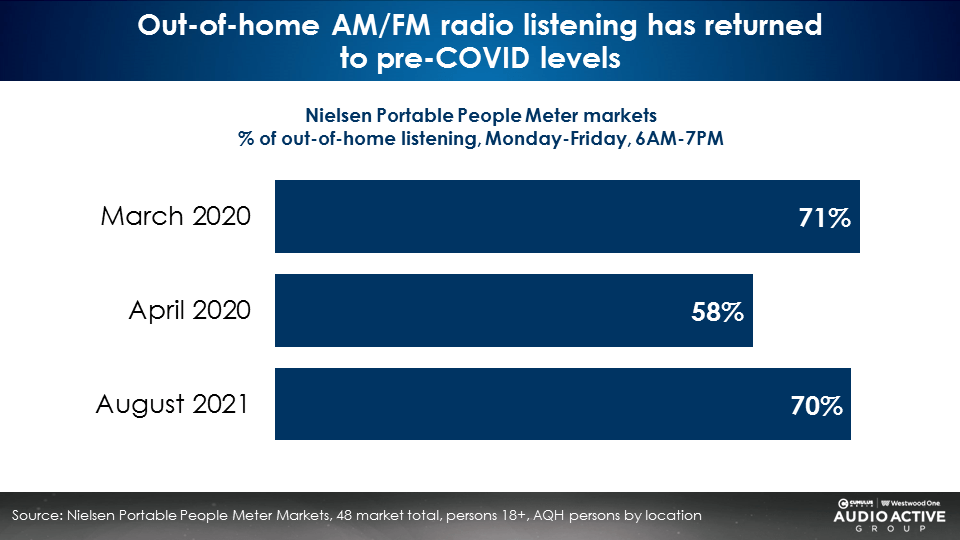

August 2021 PPM: Out-of-home AM/FM radio listening has returned to pre-COVID levels

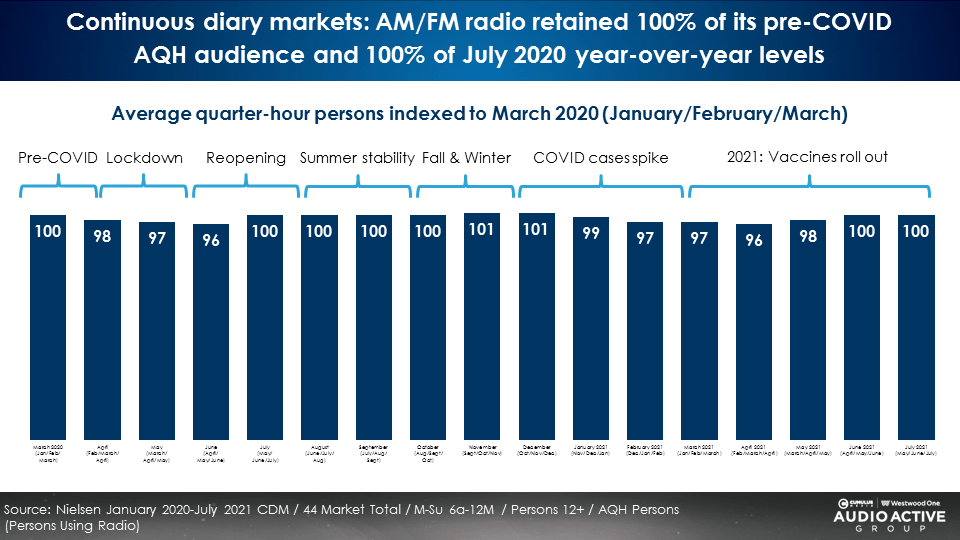

Diary markets never experienced COVID audience erosion as AM/FM radio listening is remarkably steady

AQH listening in the 44 continuous diary markets has been incredibly stable over the last 20 months. Benchmarking AQH listening to the pre-COVID January-February-March 2020 survey reveals AM/FM radio listening levels are unchanged in the most recent May-June-July 2021 survey.

Key takeaways:

- Nielsen Nationwide: AM/FM radio’s Spring 2021 AQH audiences are up +7% versus Spring 2020 and rock steady versus Fall 2020

- Extraordinary female audience recovery: +13% versus Spring 2020 and +2% versus Fall 2020

- AM/FM radio’s share of listening among women (47%) has returned to pre-COVID norms

- Upper income audience recovers strongly: $75K+ income listening soars +17%

- August 2021 Portable People Meter: Black and Hispanic audiences surge

- August 2021 PPM: Out-of-home AM/FM radio listening has returned to pre-COVID levels

- Diary markets never experienced COVID audience erosion as AM/FM radio listening is remarkably steady

Doug Hyde is the Senior Director, National & Local Insights of the CUMULUS MEDIA | Westwood One Audio Active Group.

Contact the CUMULUS MEDIA | Westwood One Audio Active Group at CorpMarketing@westwoodone.com.