New Study: Caesars Sportsbook, WynnBET, And BetMGM Experience Awareness Surge As More Americans Engage With Online Sports Betting

Click here to view an 11-minute video of the key findings.

The CUMULUS MEDIA | Westwood One Audio Active Group commissioned MARU/Matchbox to conduct a national brand awareness study of 21 online sports betting brands. 1,343 persons 21+ were surveyed in October 2021. 387 respondents were from states that have legalized sports betting and 956 respondents were from states that have not. The findings were compared to a prior study that was conducted in April 2021.

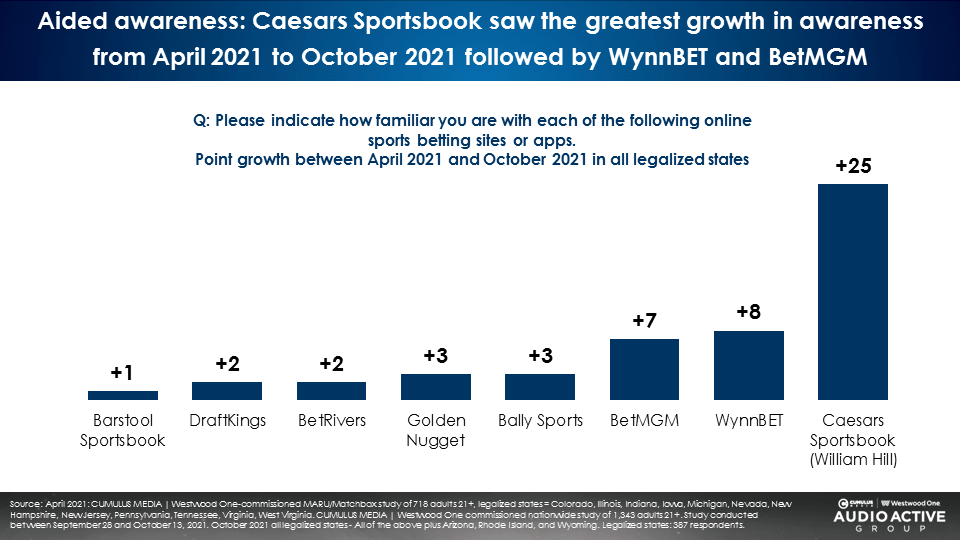

Here come the big brands: Caesars Sportsbook, WynnBET, and BetMGM see the greatest awareness growth

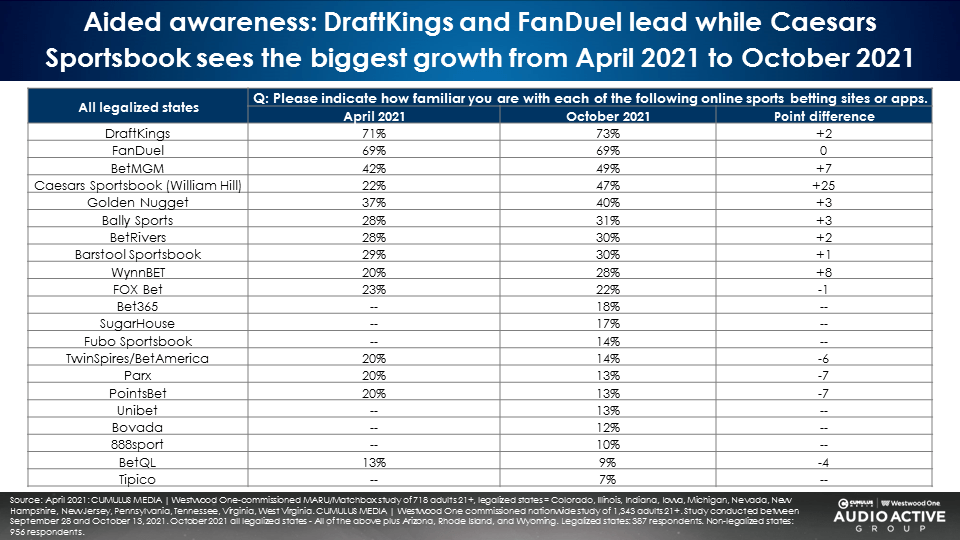

Consumers were provided with the names of the 21 online sport betting brands and asked if they were aware of each service. Seven new brands were added in this survey.

The online sports betting brands that saw the largest awareness growth in states with legalized betting were well-established Las Vegas gaming leaders. Fueled by a major promotional push, Caesars Sportsbook, rebranded from William Hill, grew dramatically with a 25-point increase in awareness from April 2021 to October 2021.

WynnBET’s awareness increased by eight points and BetMGM grew by seven points. Golden Nugget and Bally Sports grew three points each. BetRivers’ awareness improved by two points and Barstool Sportsbook increased by one point.

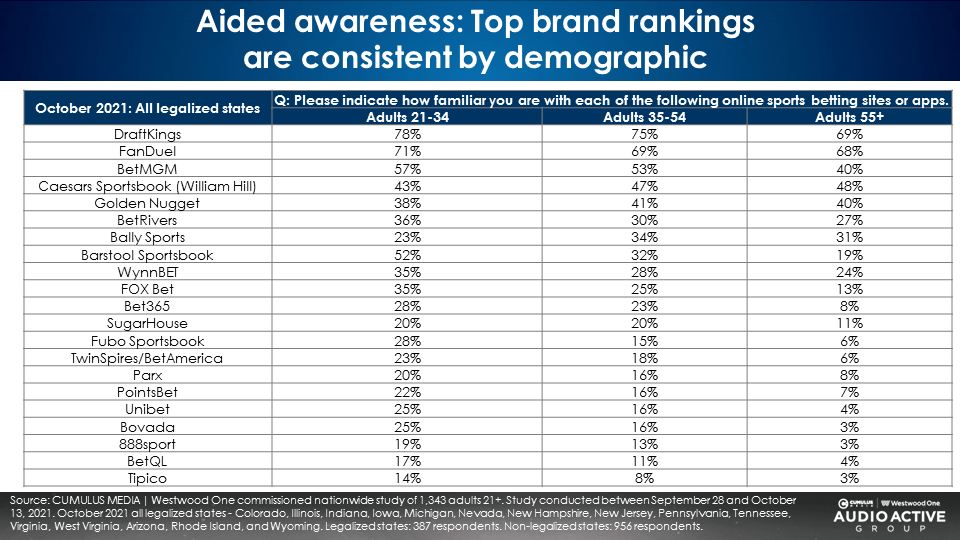

In states with legalized sports betting, the top two brands in aided awareness are DraftKings and FanDuel. The second tier of brand awareness includes BetMGM, Caesars Sportsbook, and Golden Nugget.

The next tier of brands hover around 30% aided awareness: Bally Sports, BetRivers, Barstool Sportsbook, and WynnBET.

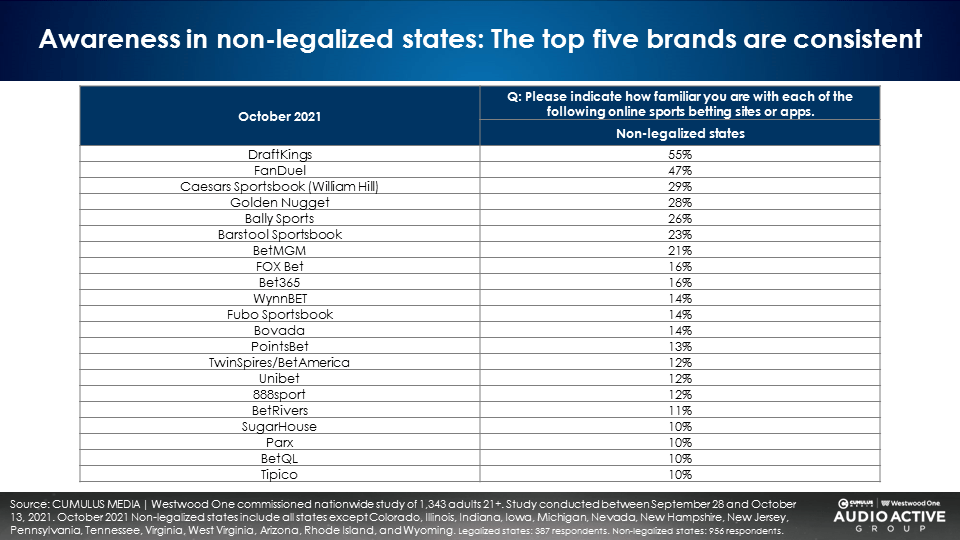

In non-legalized states, the same five online sports betting brands top the awareness rankings

Each year, new states begin online sports betting operations. Since the April 2021 study, three states (Arizona, Rhode Island, and Wyoming) came online. Since awareness and brand perceptions are like glaciers, slow to form and slow to melt, it is important to study brand equity in the rest of the country where sports betting has yet to legalize.

In the two-thirds of the country where online sports betting has not yet been legalized, total brand awareness levels are weaker by as much as 25% to 50%. The aided awareness rank position is very similar.

DraftKings and FanDuel are in the top tier of aided brand awareness. In the second tier are Caesars Sportsbook, Golden Nugget, and Bally Sports. The third tier consists of Barstool Sportsbook and BetMGM.

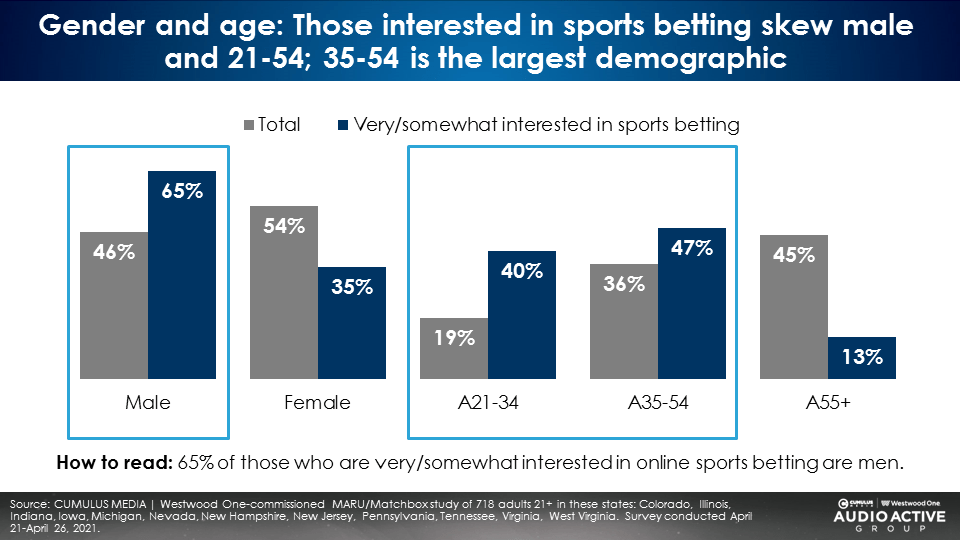

The most important online sports betting target demographic is persons 35-54 followed by persons 21-34

Nearly half of those most interested in online sports betting are persons 35-54 (47%) followed by persons 21-34 (40%). Nearly 90% of the online sports betting category are persons 21-54 and few are over the age of 55.

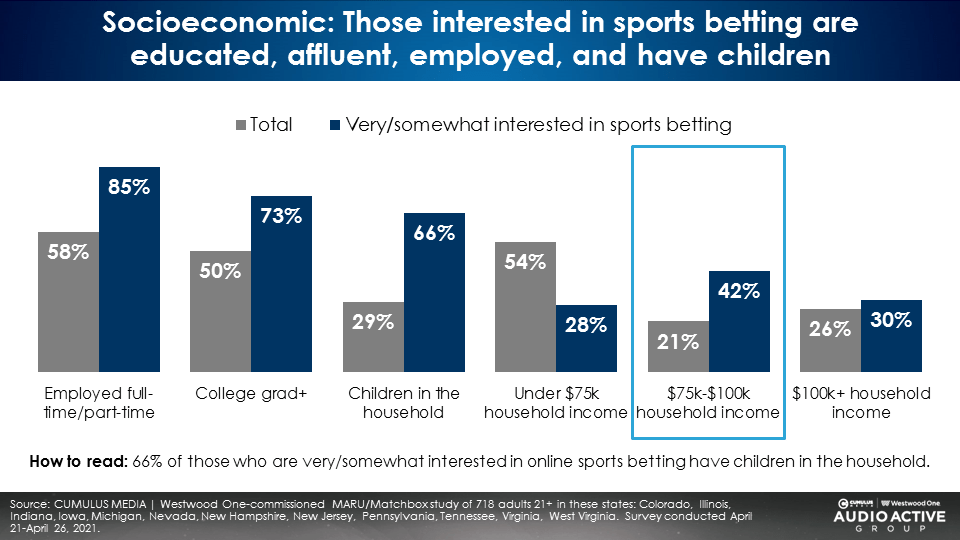

Those interested in online sports betting are married, educated, employed, upscale, and have children

This is not the stereotype of single “dudes.” These are family men.

Aided brand awareness by demographic mirrors total rankings

The ranking below is sorted on persons 35-54, the largest sports betting demographic.

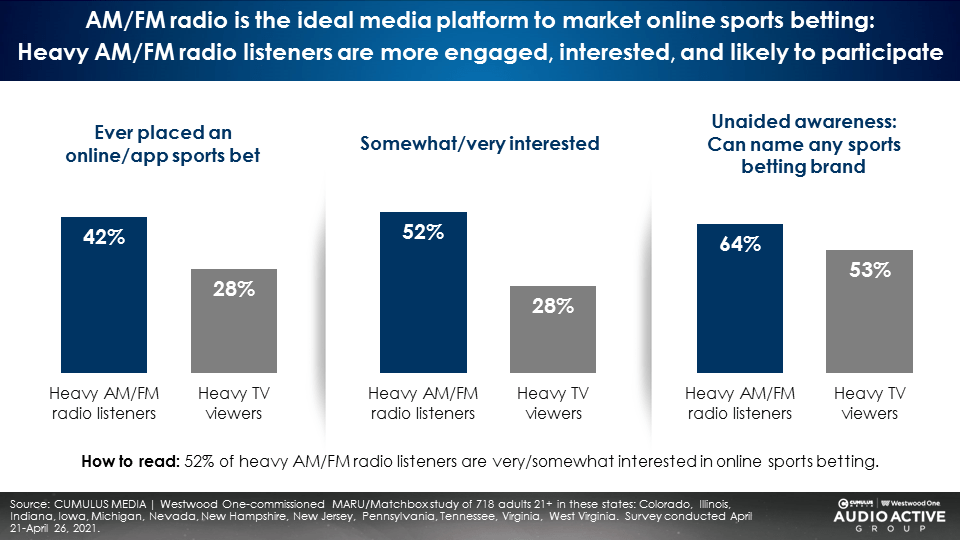

Compared to TV viewers, AM/FM radio listeners have far more experience with sports betting, greater interest, and greater awareness of online sports betting brands

Across states with legalized sports betting, MARU/Matchbox finds more online sports betting engagement among AM/FM radio listeners:

- More AM/FM radio listeners (42%) have ever placed an online sports bet versus TV viewers (28%).

- Nearly twice as many AM/FM radio listeners (52%) say they are very/somewhat interested in online sports betting versus TV viewers (28%).

- More AM/FM radio listeners can name an online sports betting brand compared to TV viewers. This is shocking considering that the vast majority of online sports brand advertising runs on TV. For every dollar spent on AM/FM radio, sixteen dollars are spent on TV, according to Kantar.

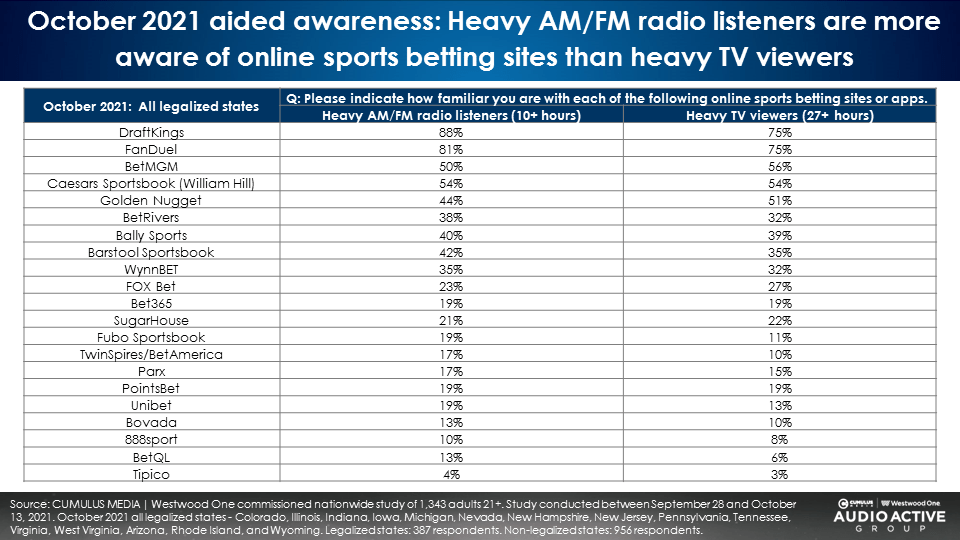

Compared to TV viewers, AM/FM radio listeners are more aware of online sports brands

Despite the fact that most advertising for online sports betting runs on TV, in legalized states AM/FM radio listeners are more aware of sports betting brands. Why? Compared to older TV viewers, AM/FM radio listeners are more engaged, interested, and more likely to participate in online sports betting.

TV is not an ideal platform to market online sports betting as the vast majority of those interested in sports betting are under the age of 50; Most TV viewers are 50+

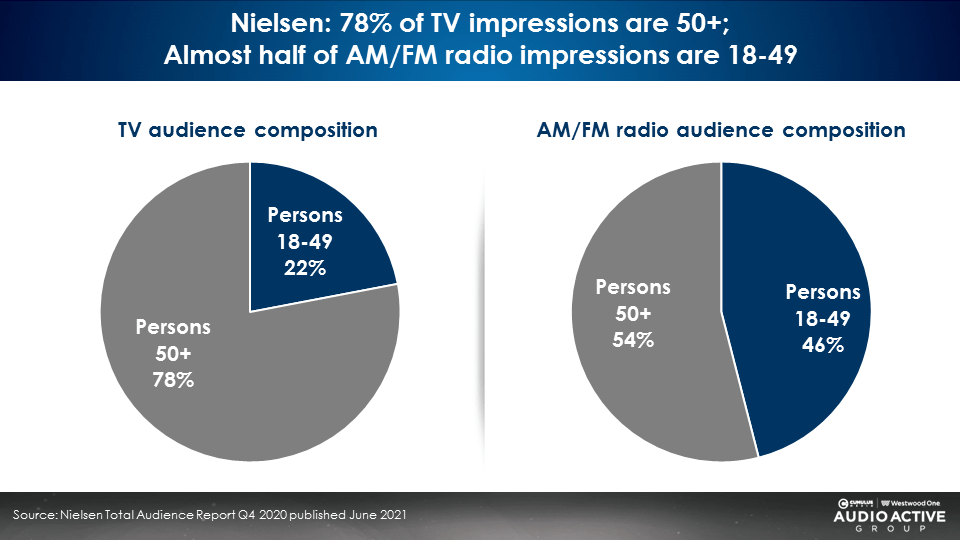

87% of those most interested in online sports betting are persons 21-54. Per Nielsen, only 22% of linear TV audiences are under the age of 50. In contrast, nearly half of AM/FM radio listeners are under the age of 50.

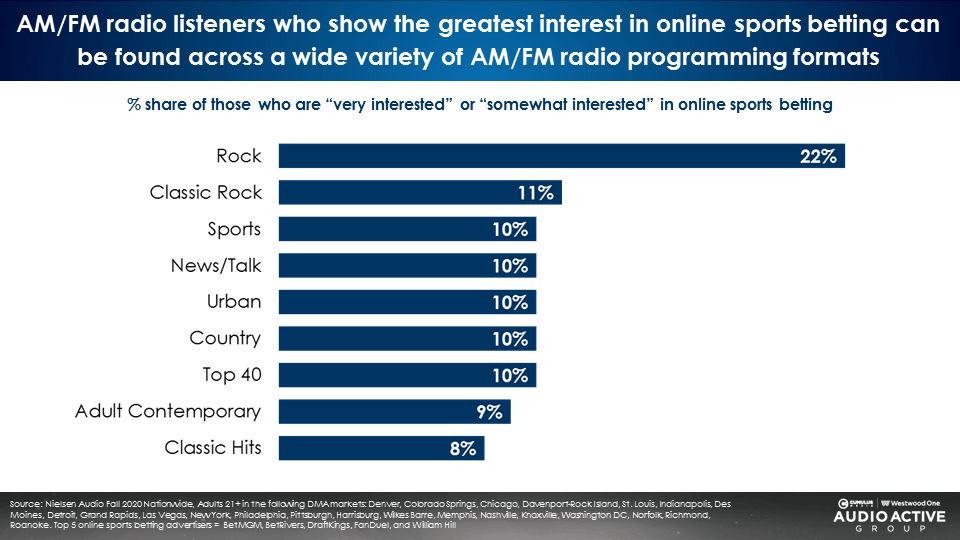

AM/FM radio listeners who show the greatest interest in online sports betting can be found across a wide variety of AM/FM radio programming formats

The Rock programming format has a 22% share of those most engaged with online sports betting. After that, each format has about 10% of the in-market consumers.

Key takeaways and recommendations:

- The big Las Vegas gaming brands have grown online sports betting awareness: Caesars Sportsbook, WynnBET, BetMGM, Golden Nugget, and Bally Sports saw the greatest increase in aided advertising recall from April to October 2021. These brands are top brands in states that have legalized online sports betting and in the rest of the country as well.

- AM/FM radio should be the centerpiece of the online sports betting media plan: Compared to TV viewers, AM/FM radio listeners have far more experience with online sports betting, greater interest, greater awareness of, and greater engagement with online sports betting brands.

- The audio sports betting media plan should contain a wide array of AM/FM radio programming formats: Those interested in online sports betting listen to a broad array of podcast genres and AM/FM radio programming formats beyond just Sports programming. Audio media plans that focus mostly on spoken word (News/Talk and Sports) will miss a large number of those who are engaged with online sports betting. Based on AM/FM radio programming format preferences among those interested in online sports betting, the ideal allocation is 20% of impressions to Rock and then 10% each to the rest of the formats (Classic Rock, News/Talk, Sports, Classic Hits/Oldies, Country, Top 40, Urban, and Adult Contemporary).

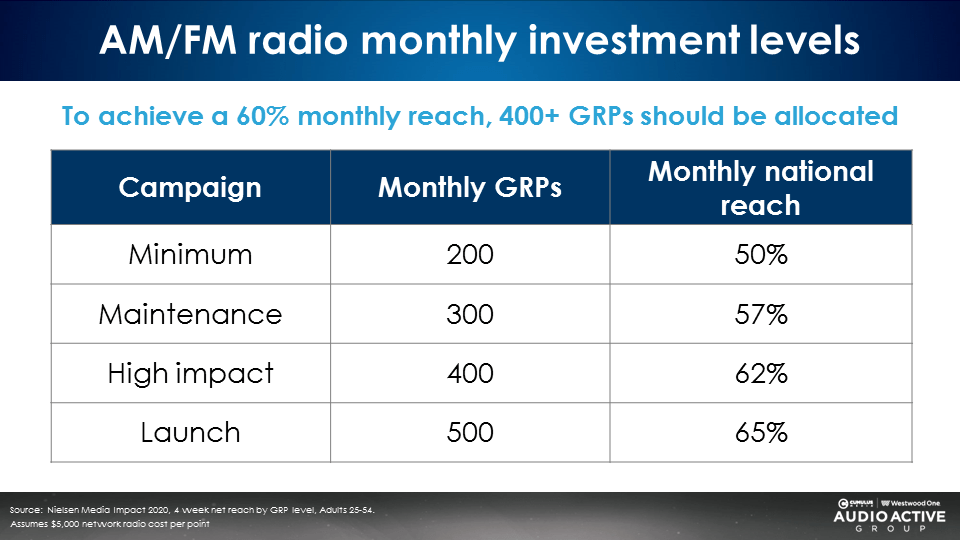

- Audio media plans should emphasize reach over frequency and increase weight to reach 60% of the market: Recent monthly AM/FM radio plans are only reaching 28% of the market. Brands should seek to reach at least 60% of the market each month. Here are the monthly AM/FM radio GRP investment levels and the market reach achieved:

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group.

Contact the Insights team at CorpMarketing@westwoodone.com.