Home Improvement: Eight Studies Reveal Audio Is Sales Engine Of The Category

Click here to view a 15-minute video of the key findings.

Eight consumer studies commissioned by the CUMULUS MEDIA | Westwood One Audio Active Group over a six-year period find audio listeners are the engine of home improvement sales and reveal creative and media strategies that can optimize impact.

Eight things to know:

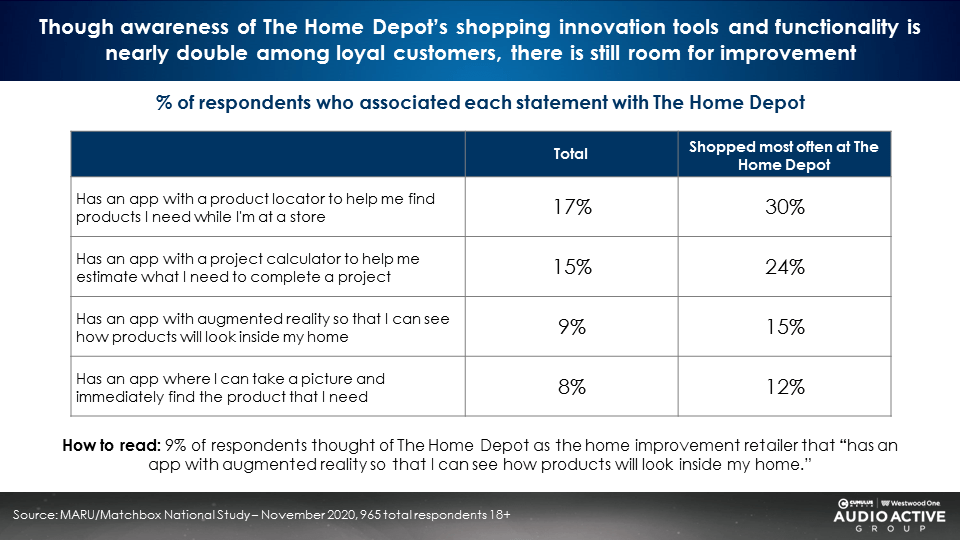

- The Home Depot has a branding opportunity as few loyal shoppers are aware of their innovative shopping apps and home improvement tech tools.

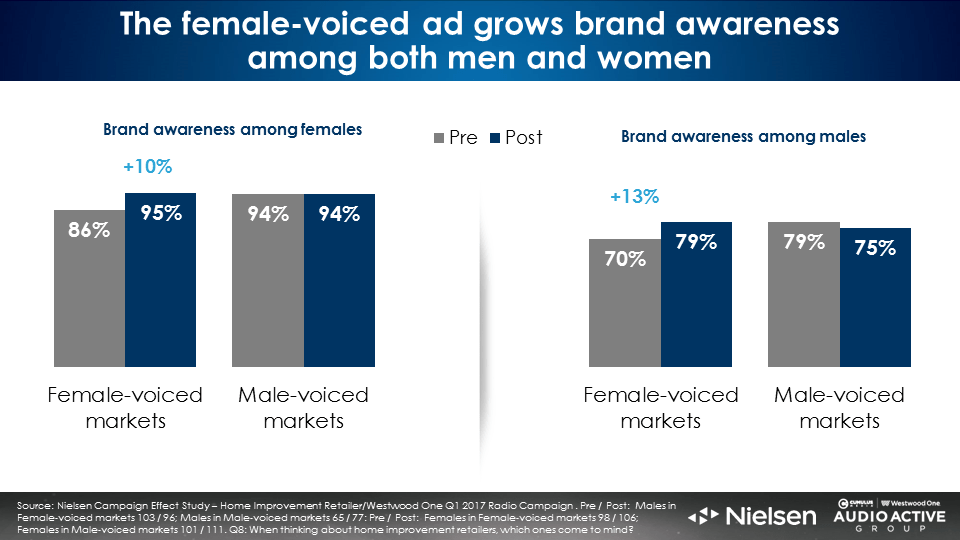

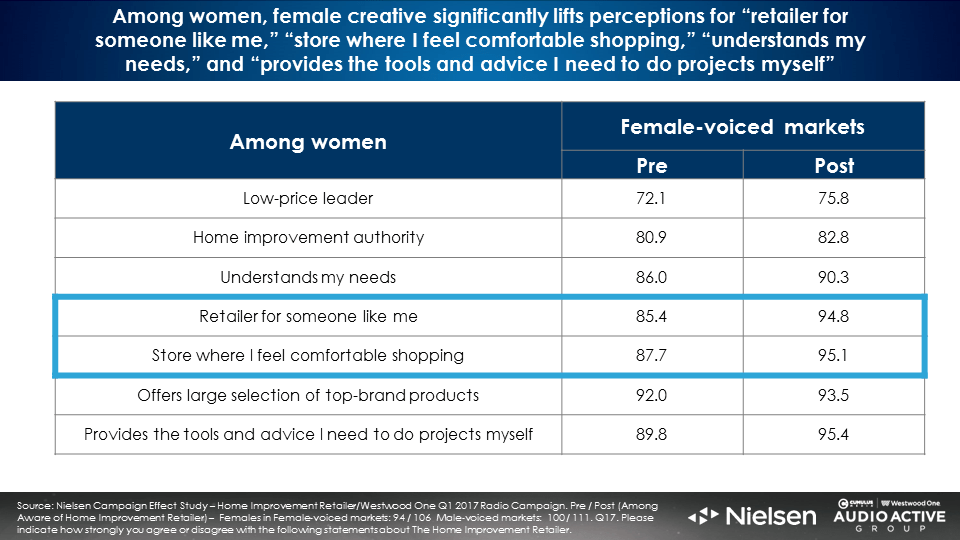

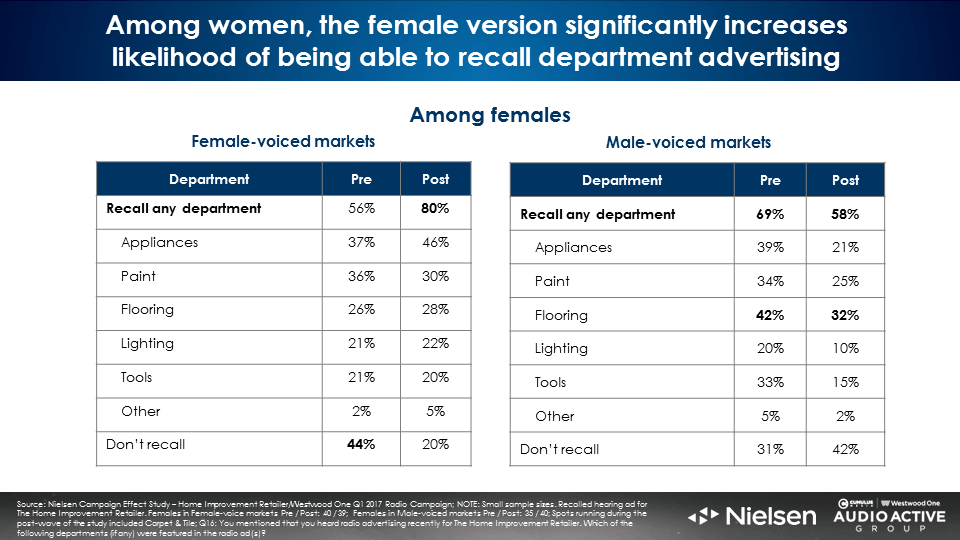

- Women prefer female voiceovers: A major study found ads with a female voiceover drove stronger brand awareness and brand perceptions among both men and women.

- Big audio users are massive home improvement shoppers: Podcast listeners and heavy AM/FM radio listeners are much bigger home improvement shoppers than heavy TV viewers. Heavy audio listeners spend more (4X) and shop more frequently (+43%).

- Heavy up spending works: A home improvement retailer that increased AM/FM radio spend 2.3X in 21 local markets experienced a significant surge in store traffic and sales.

- Audio is an ideal media platform to tout home improvement e-commerce as heavy AM/FM radio and podcast listeners are more likely to shop online.

- AM/FM radio ads that focus on sales events for different home improvement departments create a “halo effect” that results in increased online shopping and store visits.

- AM/FM radio generates significant incremental reach for home improvement TV campaigns: Recent TV campaigns for The Home Depot and a home improvement retailer saw significant lift in reach with the addition of AM/FM radio. The younger the demographic, the greater the reach lift generated by AM/FM radio.

- AM/FM radio generates three times the sales lift of TV in a historic Nielsen TV and AM/FM radio sales effect study for a home improvement retailer.

The Home Depot has a branding opportunity as few loyal shoppers are aware of their innovative shopping apps and home improvement tech tools

The Home Depot has innovative shopping tools that help shoppers navigate the stores to find items. Their app offers item finders, store navigation, and augmented reality to help homeowners visualize what new colors, designs, and improvements would look like.

Few frequent shoppers of The Home Depot are aware of these innovative shopping tools and apps, according to a MARU/Matchbox study commissioned by the CUMULUS MEDIA | Westwood One Audio Active Group in November 2020.

Virtually all of The Home Depot’s marketing efforts are focused on department special sales events. Very little marketing resources are devoted to brand building or touting useful shopping innovations. Campaigns touting these innovative shopping apps and tools could build greater shopper loyalty, brand perceptions, and sales.

Women prefer female voiceovers

A home improvement retailer that only used male voiceovers in their AM/FM radio ads wanted to study the impact of using female voiceover talent. Certain home improvement departments, like paint for example, report that the majority of purchase decisions are made by women.

The CUMULUS MEDIA | Westwood One Audio Active Group retained Nielsen to test consumer reaction to AM/FM radio ads voiced by women versus the traditional male narration. Certain DMAs were only exposed to AM/FM radio campaigns with a female voiceover. Other DMA markets heard the same ad with the usual male voiceover.

Markets with the female-voiced ads saw much stronger increases in brand awareness. Both men and women saw greater lifts in brand awareness as a result of the female-voiced ads.

Brand perceptions for “a retailer for someone like me” and “a store where I feel comfortable shopping” were much stronger among women who were exposed to the female-voiced AM/FM radio ads.

Of greatest significance, women exposed to female-voiced ads were better able to recall departmental ads from the home improvement retailer. After the female-voiced campaign, 80% of women could recall at least one of the retailer’s departmental ads compared to only 58% for the male-voiced campaign.

Big audio users are massive home improvement shoppers

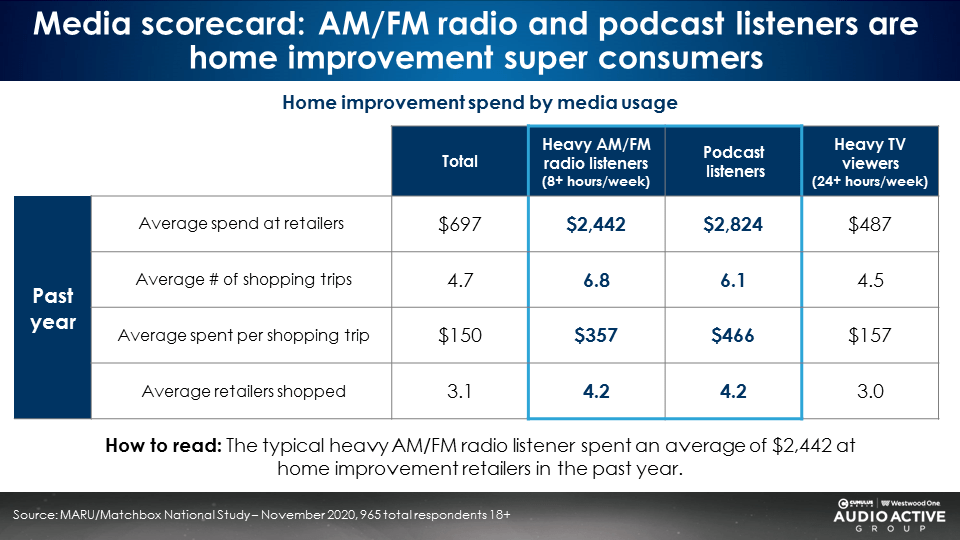

A recent study conducted by MARU/Matchbox examined home improvement shopping behavior among heavy AM/FM radio listeners, podcast listeners, and heavy TV viewers. Audio listeners purchase from more retailers, shop more often, and spend far more than average.

Versus heavy TV viewers, heavy AM/FM radio listeners spend five times as much ($2,442 versus $487), shop more retailers (4.2 versus 3), and make more shopping trips (6.8 versus 4.5). Podcast listeners also outperform TV viewers by sizable margins.

Heavy up spending works: Sales grow +9%, customers increase +3%, and store foot traffic up +5%

A home improvement retailer wanted to measure the store traffic and sales effect in markets where AM/FM radio spend more than doubled. Nielsen was retained to measure sales generated by AM/FM radio ads in the heavy up markets where spend was increased by 2.3X versus markets with typical spend levels.

Nielsen matched credit card spending in Portable People Meter homes of consumers who were exposed and not exposed to the AM/FM radio campaign. In the heavy up markets, sales grew +9% more than the typical weight markets and customer growth increased +3%.

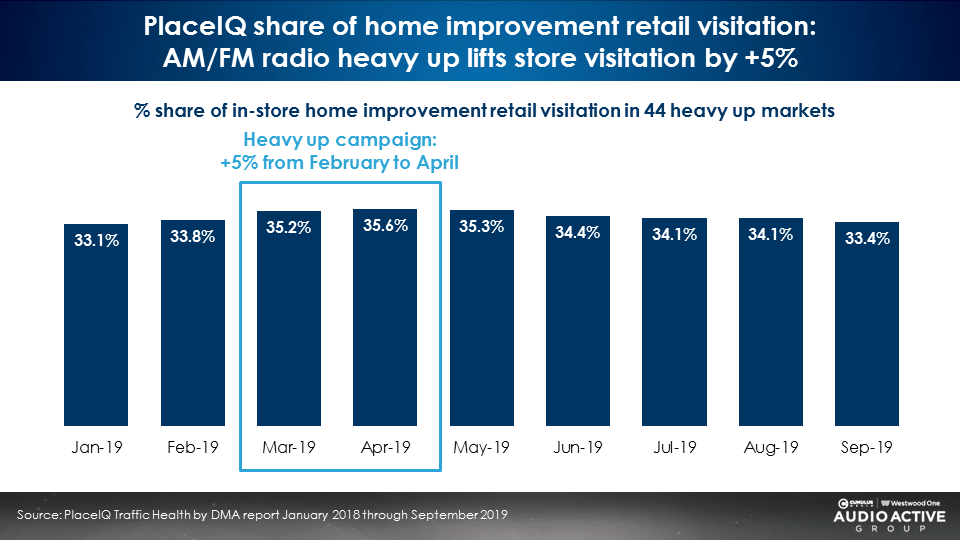

PlaceIQ, the firm that measures consumer foot traffic, was commissioned to study monthly foot traffic to the retailer before and after the heavy up campaign. PlaceIQ reported the retailer’s share of home improvement in-store traffic grew +5% from February 2019, the month before the heavy up campaign, to April 2019.

Audio is an ideal media platform to tout home improvement e-commerce as heavy AM/FM radio and podcast listeners are more likely to shop online

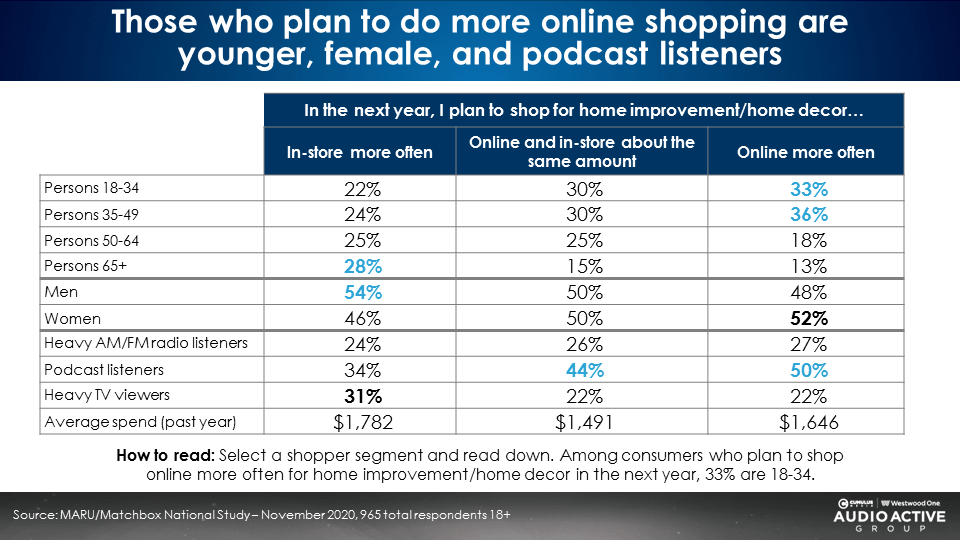

In the MARU/Matchbox study, home improvement customers were asked if in the coming year they would shop more in-store, online, or in-store and online about the same amount. When looking at the profile of future online shoppers, they tended to lean 18-49, female, and were big podcast fans. Home improvement customers who planned to shop more in-store skewed male and older.

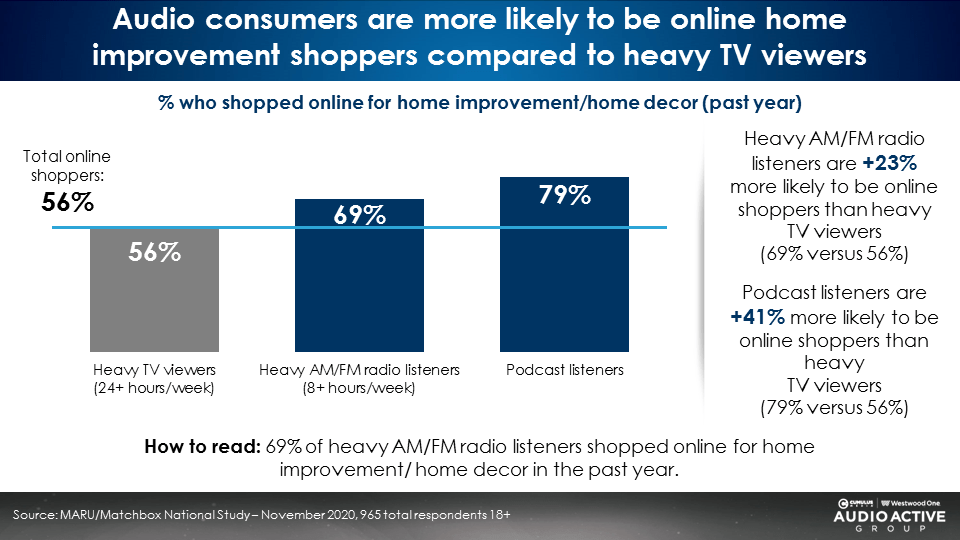

Home improvement shoppers were asked if they had shopped online in the last year. Overall, 56% said they had shopped online in the past year.

Heavy AM/FM radio listeners (69%) and the podcast audience (79%) are far more likely to be online home improvement shoppers. Podcast listeners are +41% more likely to have shopped online. Heavy AM/FM radio listeners are +23% more likely to shop online.

Versus linear TV viewers, audio listeners are more likely to shop online for home improvement. Audio is a much stronger sales channel for direct-to-consumer brands and firms seeking online transactions.

AM/FM radio ads that focus on sales events for different home improvement departments create a “halo effect” that results in increased online shopping and store visits

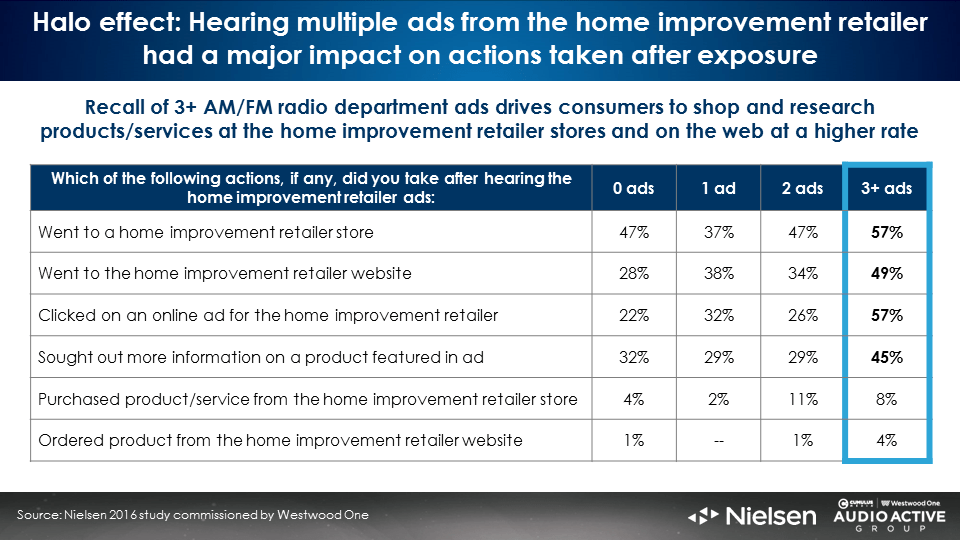

A home improvement retailer wondered if a series of simultaneous AM/FM radio campaigns for different departments created a synergistic campaign effect for the brand. Nielsen surveyed consumers on the number of AM/FM radio campaigns they could recall from the retailer.

The greater the number of AM/FM radio campaigns recalled, the more likely consumers took an action such as going to the store and shopping on the retailer’s website. Nielsen found those who recalled 3+ AM/FM radio ads shopped in-store and online and researched products/services at a higher rate.

AM/FM radio generates significant incremental reach for home improvement TV campaigns

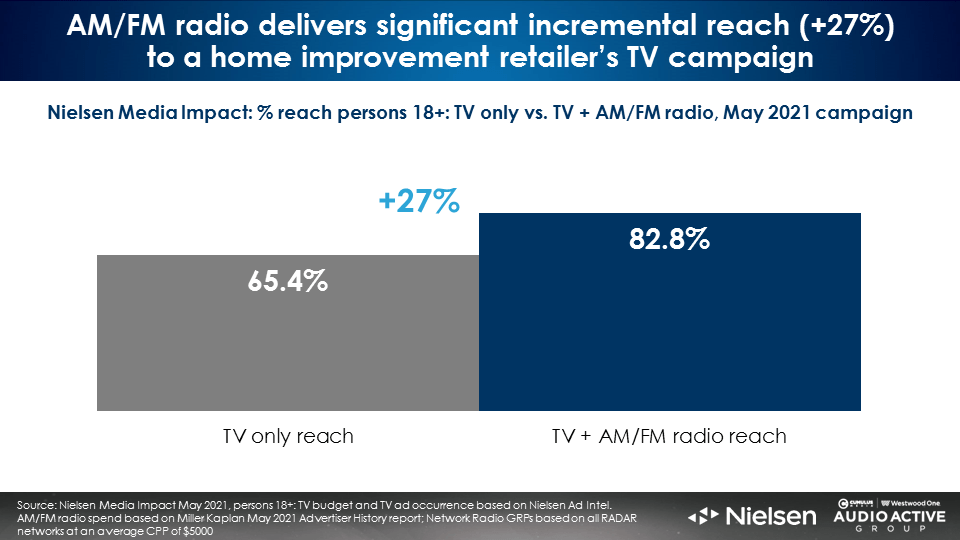

A Nielsen Media Impact analysis of recent home improvement retailer TV campaigns reveals significant lift in reach with the overlay of AM/FM radio. In May 2021, a home improvement retailer’s TV campaign reached 65% of persons 18+. The AM/FM radio campaign generated an additional +27% of reach, lifting campaign reach to 83%.

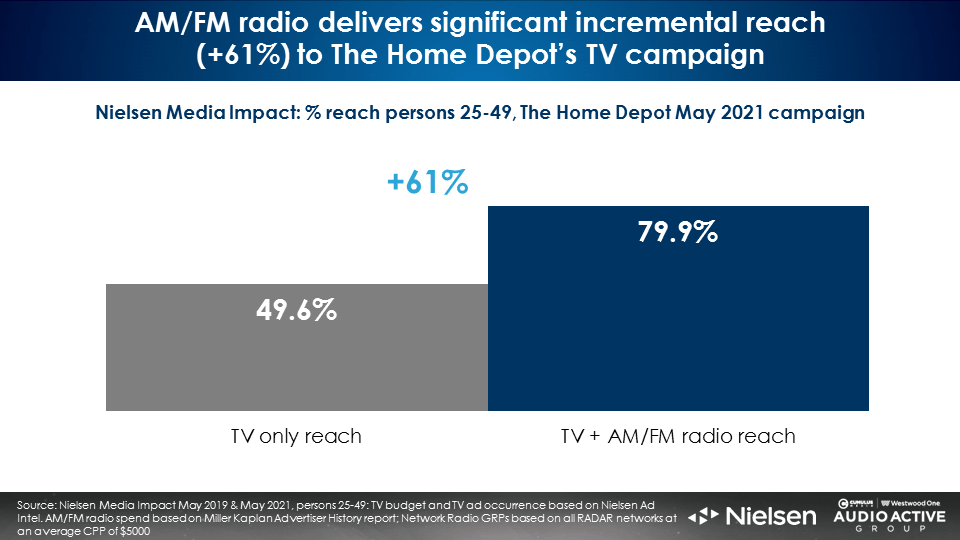

Nielsen Media Impact reports The Home Depot’s May 2021 TV campaign reached only half of American persons 25-49. The Home Depot’s AM/FM radio campaign caused their TV reach to soar by +61% for a total net reach of 80%.

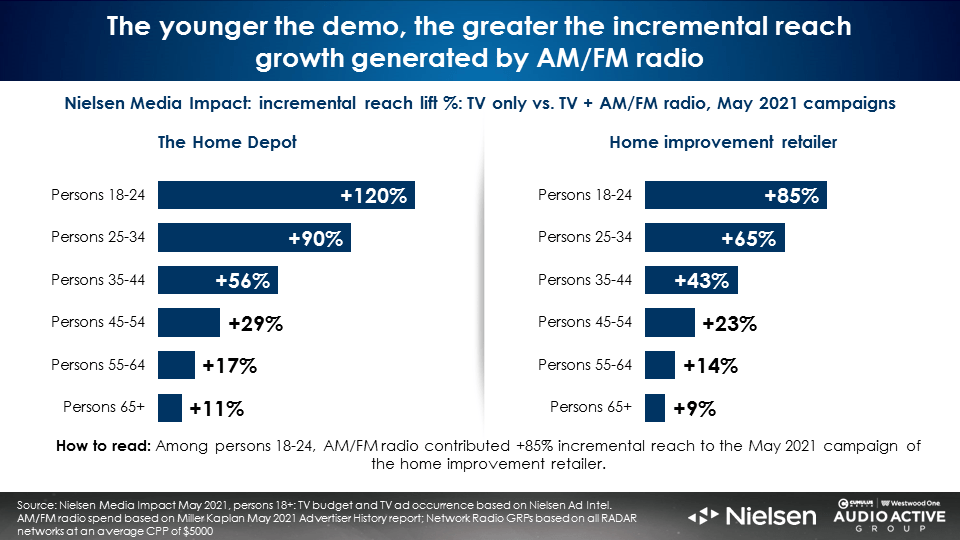

Nielsen Media Impact found the younger the demographic, the greater the lift in reach generated by AM/FM radio. The home improvement retailer’s AM/FM radio campaign generated an incremental reach lift of +43% among persons 35-44. The Home Depot’s AM/FM radio campaign increased reach by +90% among persons 25-34.

AM/FM radio generates three times the sales lift of TV in a historic Nielsen TV and AM/FM radio sales effect study for a home improvement retailer

A home improvement retailer sought to understand the sales effect of their AM/FM radio spend in the context of their television campaigns. In a first for the category, Nielsen was commissioned to undertake a study of the entire TV and AM/FM radio investment for a given month.

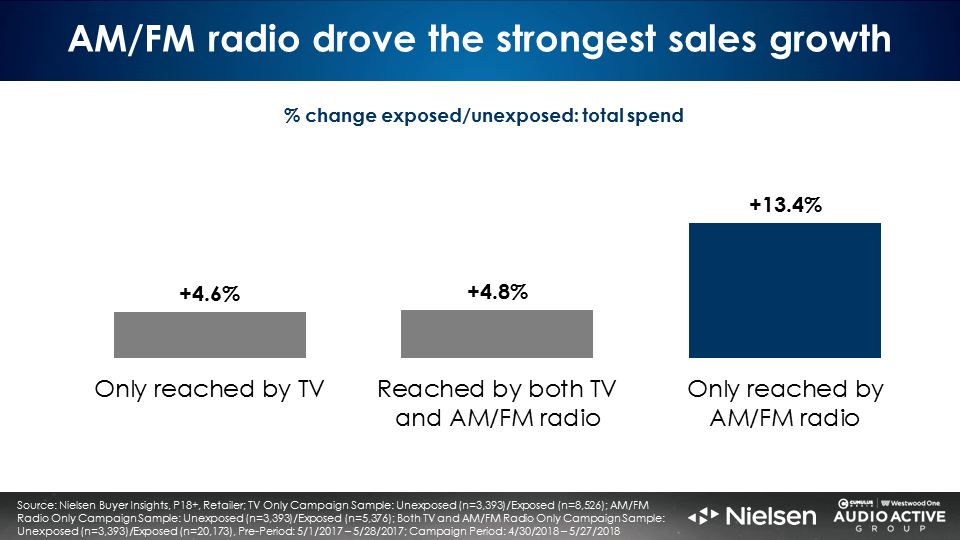

Nielsen matched TV and AM/FM radio advertising exposures from the Portable People Meter to credit and debit card purchases from the same homes. Purchases among those not exposed to the campaign were compared to those exposed.

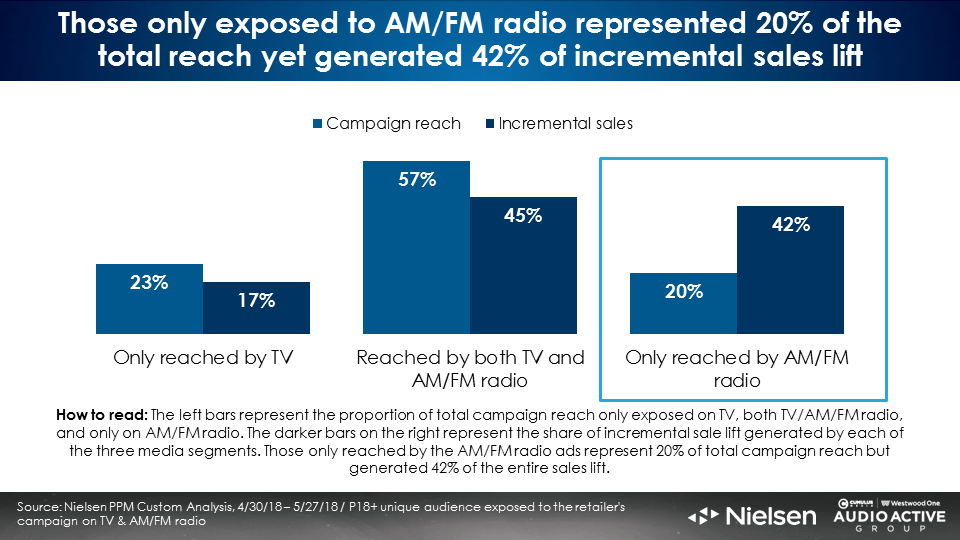

Consumers exposed to just the AM/FM radio campaign generated a +13.4% increase in sales, three times that of those who were only exposed to the TV campaign.

AM/FM radio advertising exposure drove the vast majority of the home improvement retailer’s sales. Those only reached by the AM/FM radio campaign represented 20% of total campaign reach but generated 42% of the incremental sales lift.

Consumers reached both by the TV and AM/FM radio campaign were responsible for 45% of the sales lift. Those just exposed to the TV campaign represented only 17% of incremental sales.

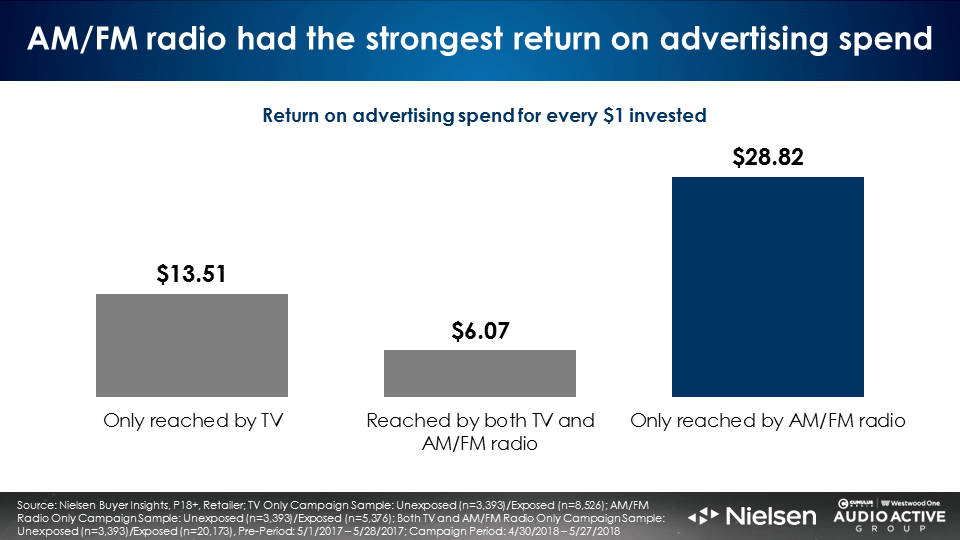

Not only was AM/FM radio the most effective media platform for the retailer, it was also the most efficient. AM/FM radio’s return on advertising spend was twice that of television.

A dollar of AM/FM radio advertising generated $28.82 in incremental sales. A dollar of TV advertising resulted in $13.51 of sales for the home improvement retailer.

Key takeaways:

- The Home Depot has a branding opportunity as few loyal shoppers are aware of their innovative shopping apps and home improvement tech tools.

- Women prefer female voiceovers: A major study found ads with a female voiceover drove stronger brand awareness and brand perceptions among both men and women.

- Big audio users are massive home improvement shoppers: Podcast listeners and heavy AM/FM radio listeners are much bigger home improvement shoppers than heavy TV viewers. Heavy audio listeners spend more (4X) and shop more frequently (+43%).

- Heavy up spending works: A home improvement retailer that increased AM/FM radio spend 2.3X in 21 local markets experienced a significant surge in store traffic and sales.

- Audio is an ideal media platform to tout home improvement e-commerce as heavy AM/FM radio and podcast listeners are more likely to shop online.

- AM/FM radio ads that focus on sales events for different home improvement departments create a “halo effect” that results in increased online shopping and store visits.

- AM/FM radio generates significant incremental reach for home improvement TV campaigns: Recent TV campaigns for The Home Depot and a home improvement retailer saw significant lift in reach with the addition of AM/FM radio. The younger the demographic, the greater the reach lift generated by AM/FM radio.

- AM/FM radio generates three times the sales lift of TV in a historic Nielsen TV and AM/FM radio sales effect study for a home improvement retailer.

Click here to view a 15-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group.

Contact the Insights team at CorpMarketing@westwoodone.com.