As TV Viewers Flock To Ad-Free Video Streaming, Advertisers Can Find Lost Audiences With Podcasts

Click here to view an 11-minute video of the key findings.

Click here to download CUMULUS MEDIA and Signal Hill Insights’ Podcast Download – Fall 2021 Report.

In December of last year, CUMULUS MEDIA | Westwood One and Signal Hill Insights released the seventh installment of the Podcast Download series. MARU/Matchbox was retained to conduct an in-depth study of 600 weekly podcast listeners in October 2021. The Fall 2021 report highlighted trends from prior studies and examined new topics such as the emerging array of social audio platforms.

Today’s focus is how advertisers can use podcasts to reach consumers who are difficult to reach with TV or advertising-free streaming platforms.

Nielsen Total Audience Report: Persons 18-49 linear TV audiences are collapsing

Throughout the past year, the television landscape has underwent massive changes as audience viewing habits shifted from linear TV to ad-free streaming options. Major players like WarnerMedia, NBCU, ViacomCBS, and Disney are pouring resources into their video subscription services at the expense of their broadcast TV and cable networks.

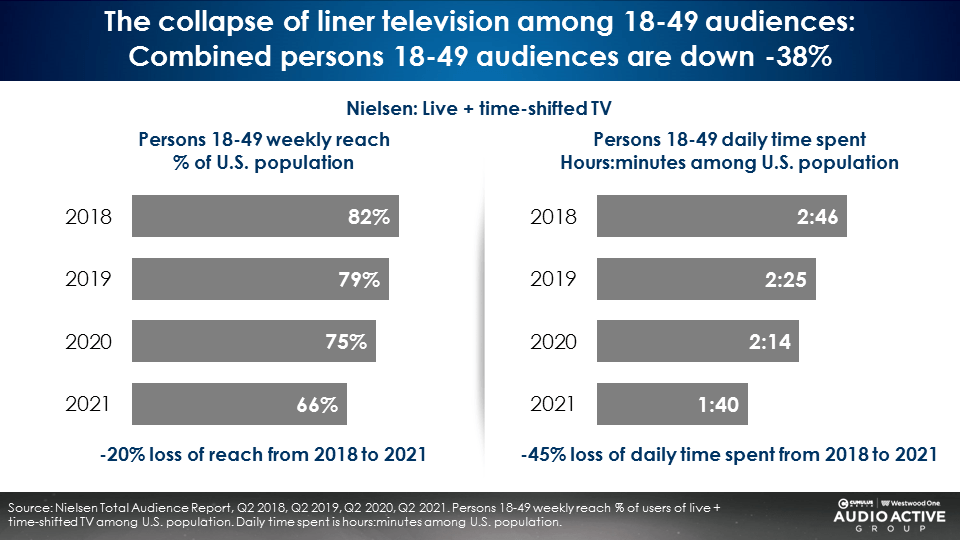

For advertisers, that means their historically TV-heavy media plans are reaching less people. According to Nielsen’s Q2 2021 Total Audience Report, TV audiences among persons 18-49 are down -38% from 2018, in part caused by a -20% loss of reach.

Americans are also spending less time with linear TV. Nielsen finds persons 18-49 spend an average of one hour and 40 minutes with TV daily, down -45% from an average of two hours and 46 minutes in 2018.

Podcast listeners are avid users of video streaming services

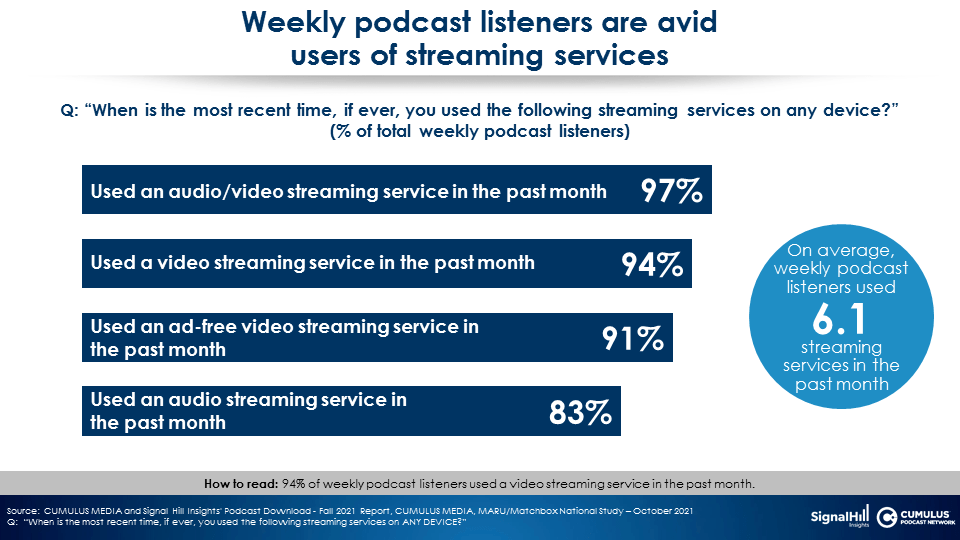

Advertisers can find displaced TV viewers with podcasts. According to the Podcast Download, weekly podcast listeners are flocking to streaming services. 94% have used a video streaming service in the past month. The vast majority (91%) have used an ad-free video streaming service.

Weekly podcast listeners watch ad-free streaming services (Netflix and Amazon Prime Video) the most

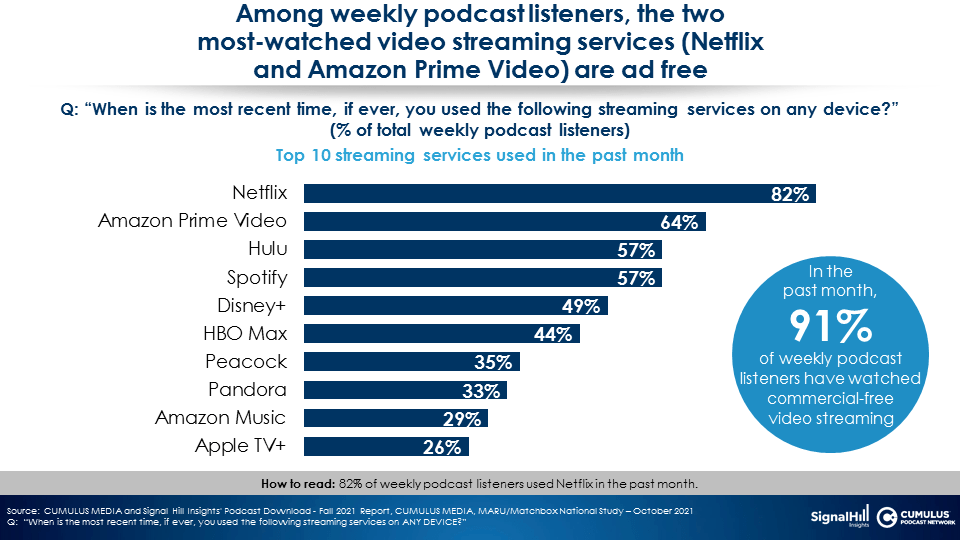

82% of weekly podcast listeners have used Netflix in the past month. Number two is Amazon Prime Video at 64%. While these podcast listeners are streaming ad-free video content, they can be reached by podcast ads.

Podcast listeners are cord cutters with four out of ten weekly listeners not subscribing to pay TV

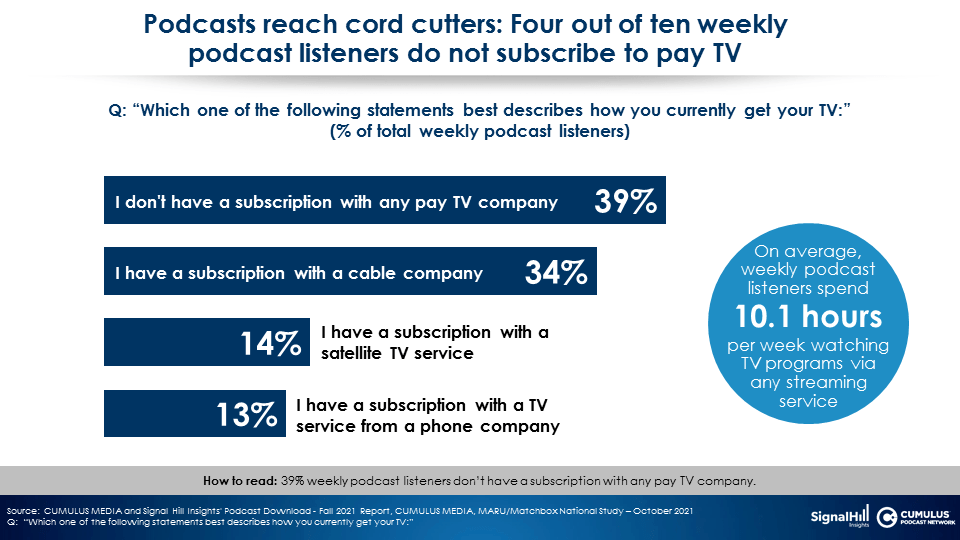

When asked how they currently get their TV, 39% of weekly podcast listeners reveal they do not have a subscription with any pay TV company. On average, weekly podcast listeners are spending 10.1 hours a week with streaming TV.

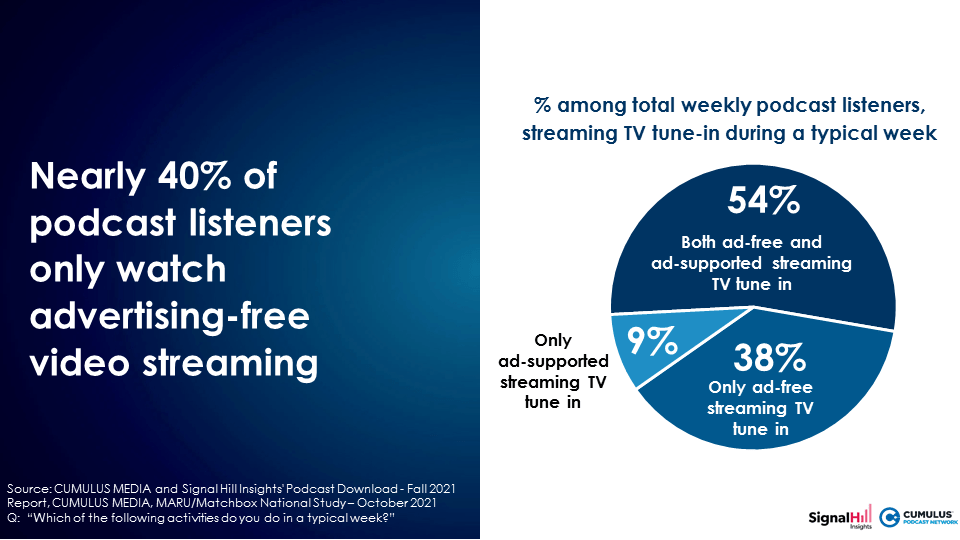

38% of weekly podcast listeners only watch ad-free video streaming

Among weekly podcast listeners, 54% watch both ad-free and ad-supported streaming TV. 9% are only viewing ad-supported TV. A remarkable 38% of weekly podcast listeners only consume ad-free TV streaming, making them unreachable to TV advertisers.

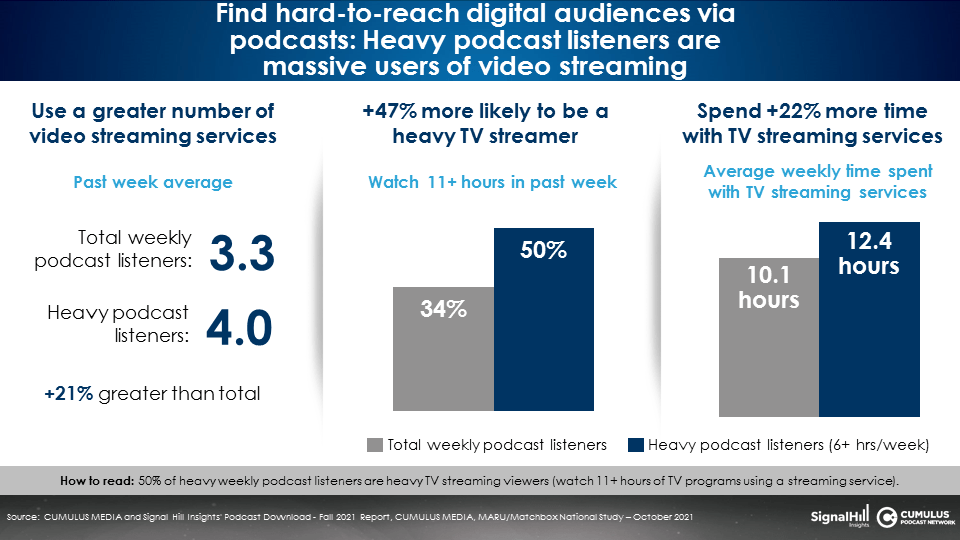

The heavier the podcast listener, the more TV streaming content consumed

Heavy podcast listeners, those who have listened to 6+ hours in the past week, are even more inclined to be heavy TV streamers who are difficult to reach with traditional TV advertising.

Compared to weekly podcast listeners, heavy podcast listeners are +47% more likely to be heavy video streamers. On average, heavy podcast listeners spend 12.4 hours with TV streaming services, +22% more time than the weekly podcast listener.

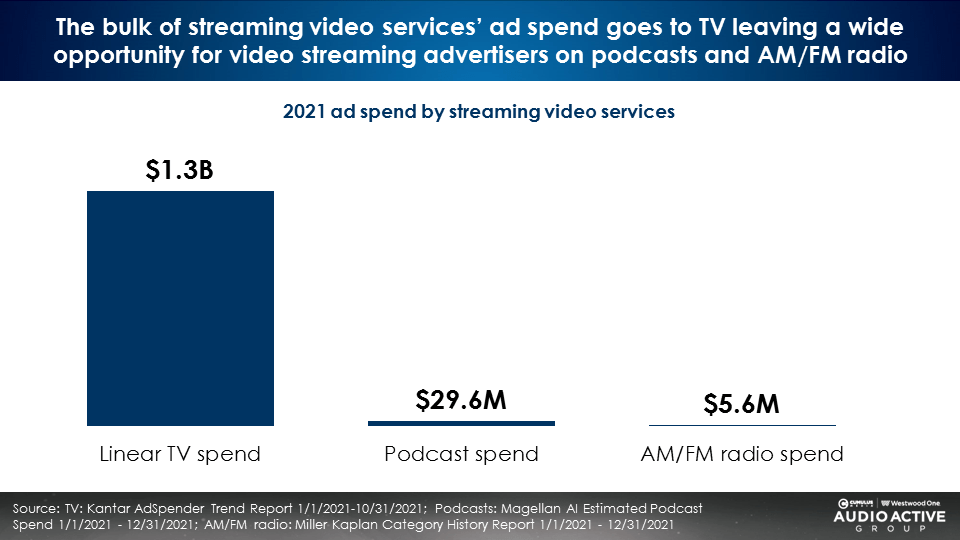

TV tune-in: Despite declining TV viewership, the bulk of video streaming ad budgets is spent on linear TV

According to Kantar, video streaming platforms spent $1.3 billion from January to October 2021 on linear TV to market their subscription services and promote show launches. Podcasts and AM/FM radio received significantly less investment.

According to Millward Brown, a high share of voice is important for brands: “If you increase your marketing investment at a time when competitors are reducing theirs, you … substantially increase the saliency of your brand. This could help you establish an advantage that could be maintained for many years.” Increasing spend on these audio platforms while others are not can benefit video streaming platforms.

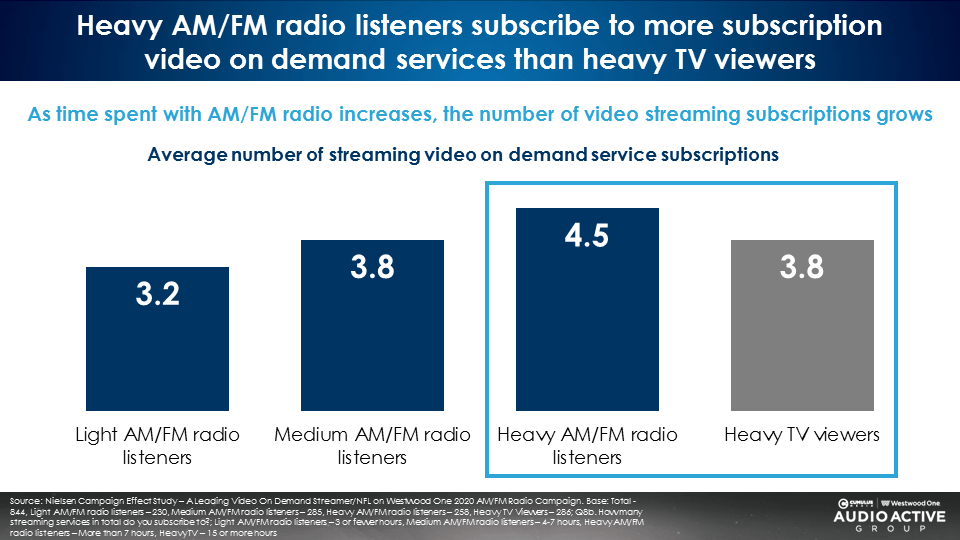

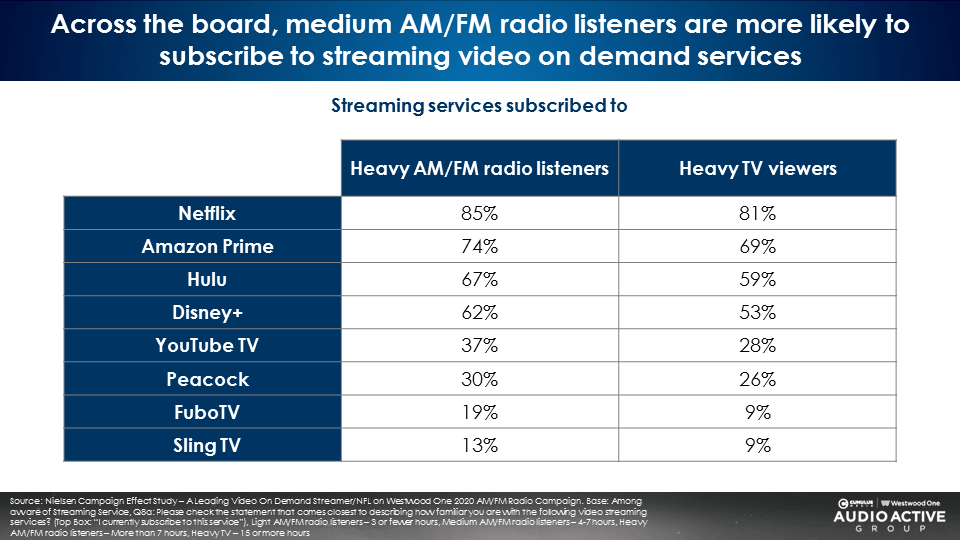

Video streaming subscriptions are greater among heavy AM/FM radio listeners compared to heavy TV viewers

According to Nielsen, as time spent with AM/FM radio increases, the number of video streaming subscriptions surges. Heavy AM/FM radio listeners subscribe to 4.5 services, more than heavy TV viewers (3.8).

Compared to heavy TV viewers, heavy AM/FM radio listeners are more likely to subscribe to subscription video services.

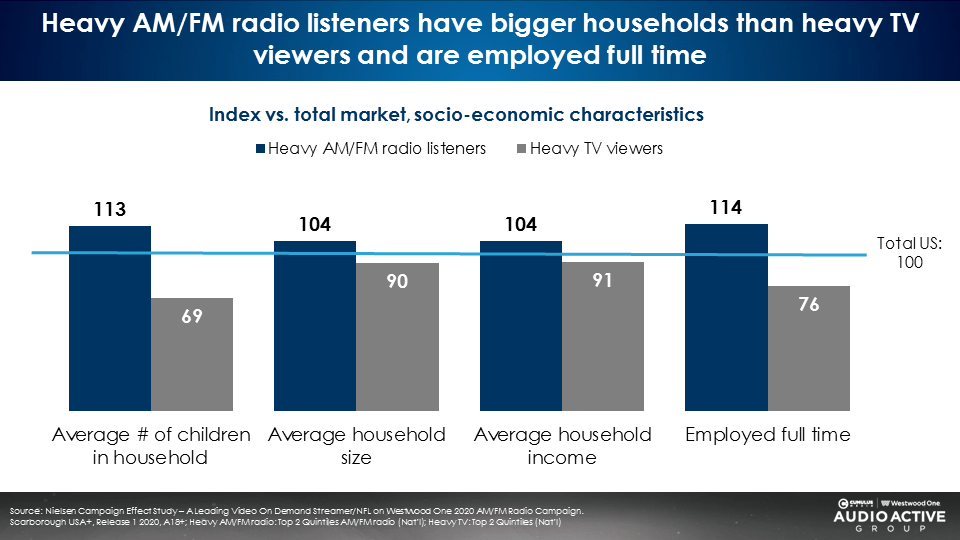

Why AM/FM radio is a better platform to promote video streaming: Bigger households, more full-time employment, and higher incomes

Versus heavy TV viewers, Nielsen finds heavy AM/FM radio listeners have higher incomes, more kids, larger households, and much higher levels of employment. AM/FM radio offers a far more receptive audience for video streaming services.

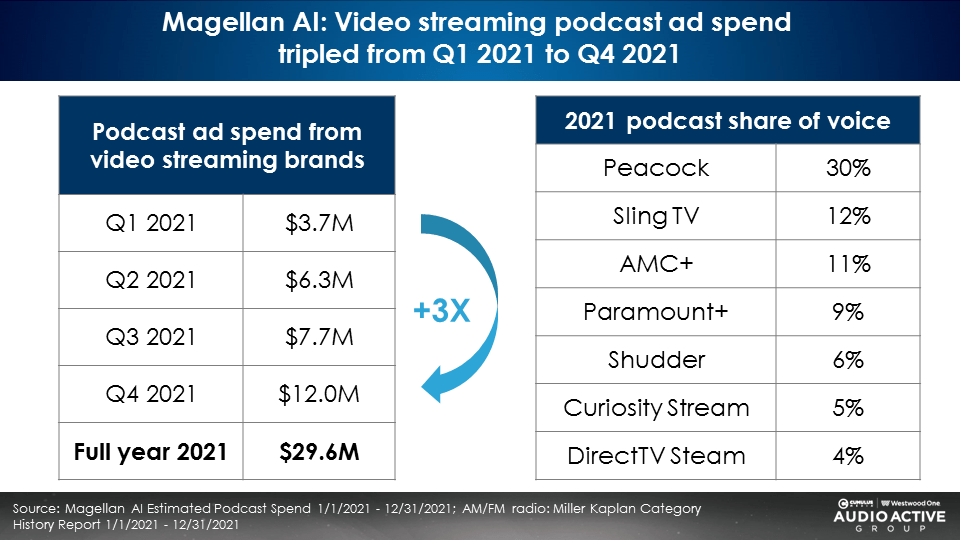

In 2021, podcast advertising spend from video streaming services tripled, according to Magellan AI

In Q1 2021, video streaming services spent $3.7 million in podcast advertising. By Q4 2021, video streaming service podcast spend tripled to $12 million.

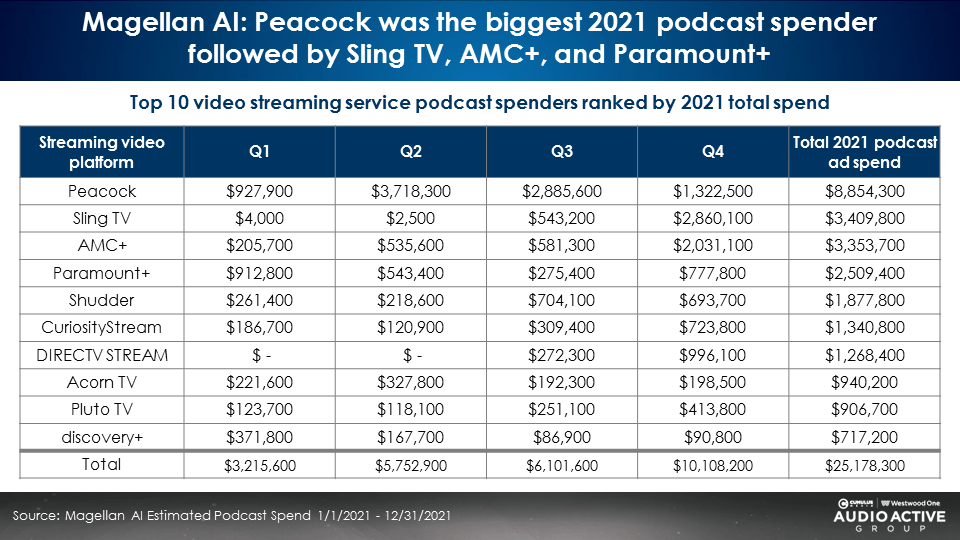

In 2021, the biggest podcast spender was Peacock, followed by Sling TV, AMC+, and Paramount+

According to Magellan AI, by a large margin, Peacock was the highest spender on podcasts among video streamers in 2021 with $8.9 million. Following Peacock were Sling TV, AMC+, and Paramount+.

Absent from the top 10 list were major streaming platforms: Hulu, Disney+, Netflix, Roku, and Amazon Prime Video. For video streaming companies looking to advertise their shows and subscriptions, podcasts offer a massive untapped opportunity.

Key takeaways:

- Nielsen Total Audience Report: Persons 18-49 linear TV audiences are collapsing due to lower reach and daily time spent.

- Podcast listeners are avid users of advertising-free video streaming services. Many only watch ad-free video streaming.

- Advertisers can find lost TV audiences with podcast advertising.

- The bulk of video streaming ad dollars promoting their services went to linear TV despite eroding audiences.

- AM/FM radio and podcasts are an ideal way for video streaming services to promote subscriptions and show launches.

- Versus heavy TV viewers, heavy AM/FM radio listeners subscribe to far more video streaming services since AM/FM radio audiences have bigger households and greater incomes.

- During 2021, podcast spending by video streamers tripled from Q1 to Q4.

Click here to view an 11-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.