3 Ways To Destroy Reach In Your Network Radio Campaign

Click here to view a 15-minute video of the key findings.

Click here to download your copy of the Audio Planning Guide.

Key takeaways:

- Index-based dictates drive up CPMs and restrict access to inventory causing brands to compete for the same small impression pool

- Index is destructive as it is blind to audience volume

- Buying dictates for a 110+ female index fail to appreciate that total AM/FM radio listening skews male (53%) and most AM/FM radio programming delivers fairly equal amounts of men and women

- Buying dictates for a 110+ top market impressions index fail to appreciate that total AM/FM radio listening in the top 50 markets under delivers by 16% because Nielsen uses Portable People Meters in top markets and diaries elsewhere

- Buying dictates for networks and content with mostly drive time audiences (Monday-Friday, 6-10AM and Monday-Friday, 3-7PM), fail to appreciate that 60% of all American AM/FM radio listening occurs outside “drive times”

- Eliminating dictates for female skew and top market index causes reach to soar

- Top market and female reach increased over +50% on a network buy that was optimized by eliminating index dictates

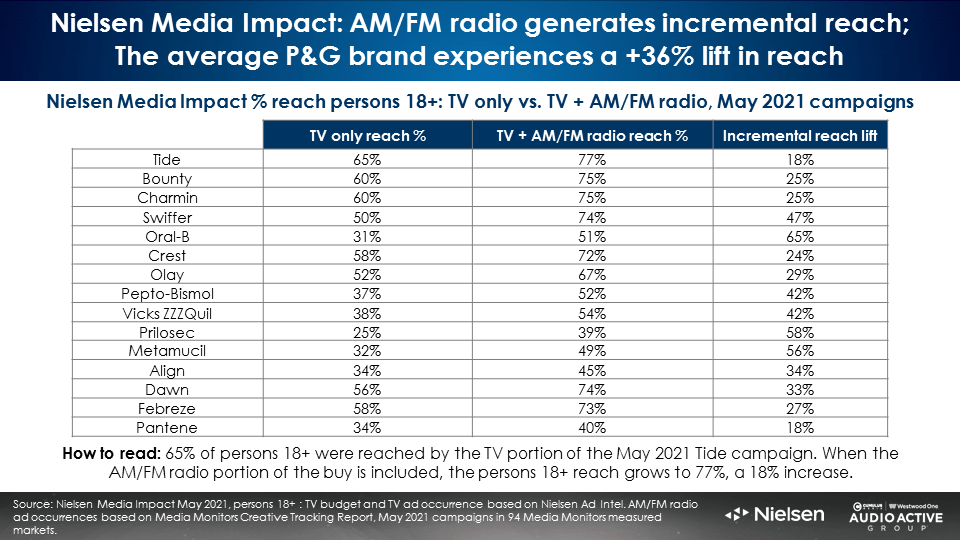

Brands are flocking to AM/FM radio to make their TV better via lifts in incremental reach. According to Nielsen Media Impact, the average P&G brand experiences a +36% lift in TV reach due to the addition of AM/FM radio.

World Advertising Research Center: Reach is the foundation of media effectiveness

WARC is the global leader in marketing effectiveness measurement. They proclaim reach is foundation of media effectiveness: “The work of Professor Byron Sharp and the Ehrenberg-Bass Institute put the focus of media strategy squarely on reach. Les Binet and Peter Field, in their analysis of the IPA database, have also argued for the benefits of media that can reach as many people in a brand’s category as possible as often. This, in turn, suggests that scale is likely to be an important influence on media effectiveness. They found that campaigns that used TV, outdoor, radio and press were far more likely to report very large business effects than those which did not. The results showed a strong correlation with reach.”

Binet and Carter: Reach trumps frequency

The most useful marketing strategy book ever written, How Not To Plan: 66 Ways to Screw It Up from Les Binet and Sarah Carter, offers these recommendations:

- “Always aim to get more customers from all segments of the market. It’s the main way brands grow.

- Talk to everyone who buys your category. Talk to them regularly. Advertising memories fade.

- Go for reach, rather than frequency. Reach as many category buyers as possible.

- Don’t target too narrowly. It may be efficient, but it’s rarely effective. Tight targeting means low sales and profits.”

Given that reach is the most significant media factor that drives sales effect, smart media planners need to identify and eliminate practices that reduce reach.

Three buying dictates that destroy reach: Top market index, female index, and drive time concentration

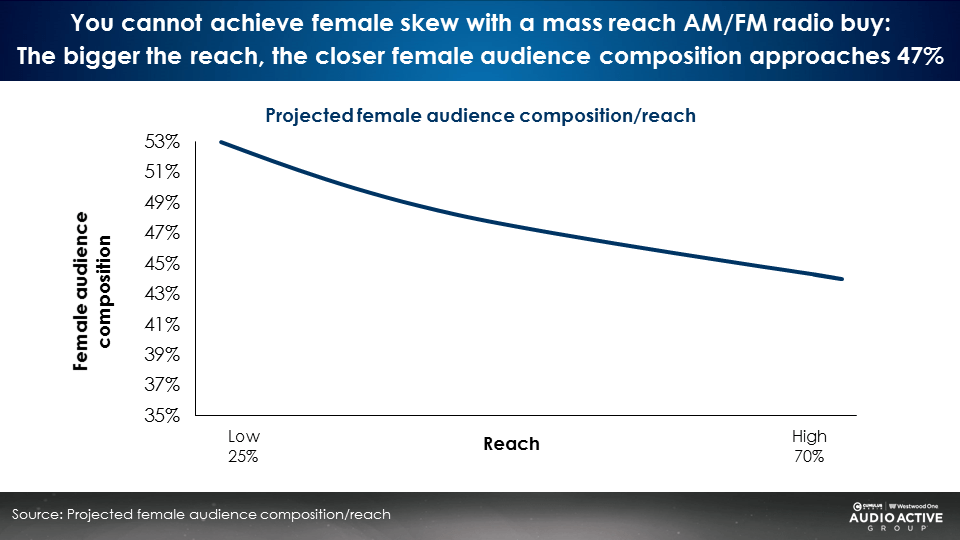

A number of decades old network radio buying practices have now been found to harm reach. The first is the desire for a 55%+ female skew. It turns out that all U.S. AM/FM radio listening skews 53% male. Trying to plan a mass reach buy with 55% female skew is unattainable.

As the visual above reveals, you can plan a low reach buy with a female skew. As overall campaign reach grows, the proportion of female impressions will revert to the 47% norm.

The reality is that most AM/FM radio formats have a fairly equal proportion of men and women listening.

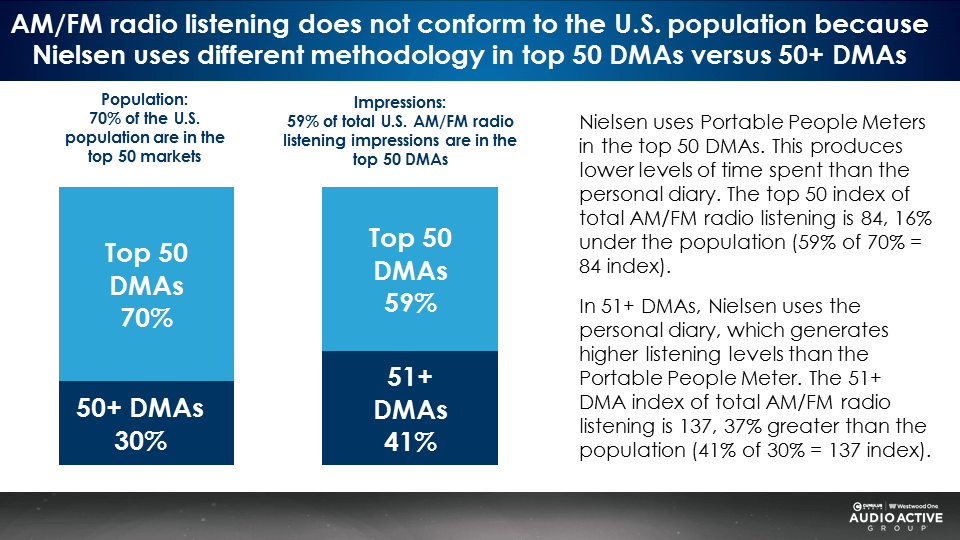

AM/FM radio listening under indexes in the top 50 markets by 16% because top markets have the Nielsen Portable People Meters and the rest of the markets have diaries

A media plan with a “top market index” dictate does make sense for a small number of advertisers. For example, retailers who have store locations primarily in top markets should have media plans that favor larger markets.

However, the vast majority of brands are sold in all size markets. As the brand manager of the oral care division of P&G recently said, “Why would I want to over index in large markets? My target is, ‘Do you have teeth?’” Or as the CMO of Subway once famously said, “If you have a mouth and a wallet, you’re a potential customer!”

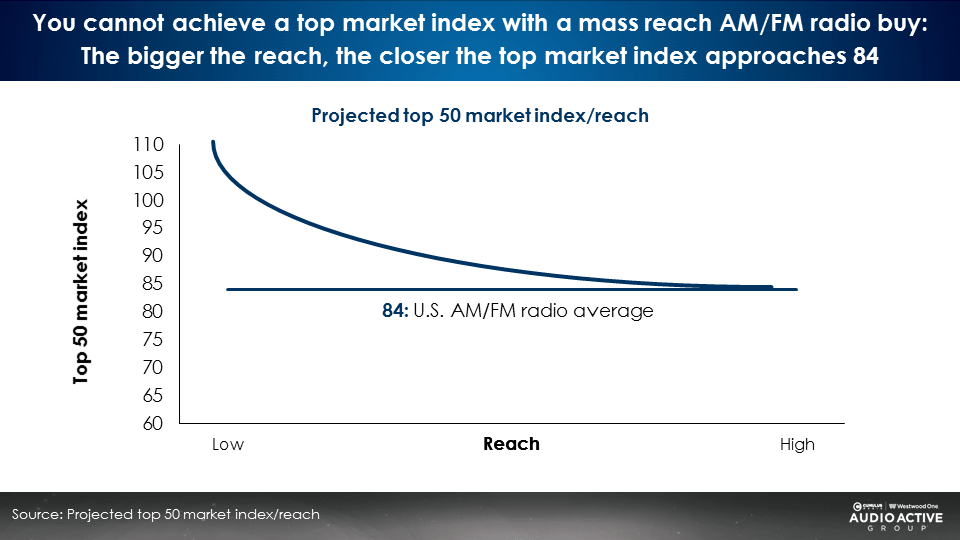

In 2010, Nielsen rolled out Portable People Meters in the top 50 markets. The meters are accurate and report less listening than the diary method. All U.S. AM/FM radio listening indexes at an 84 in the top 50 markets.

Does that mean people in the top 50 markets listen to less AM/FM radio? Of course not. Different methodologies report varying levels of AM/FM radio usage.

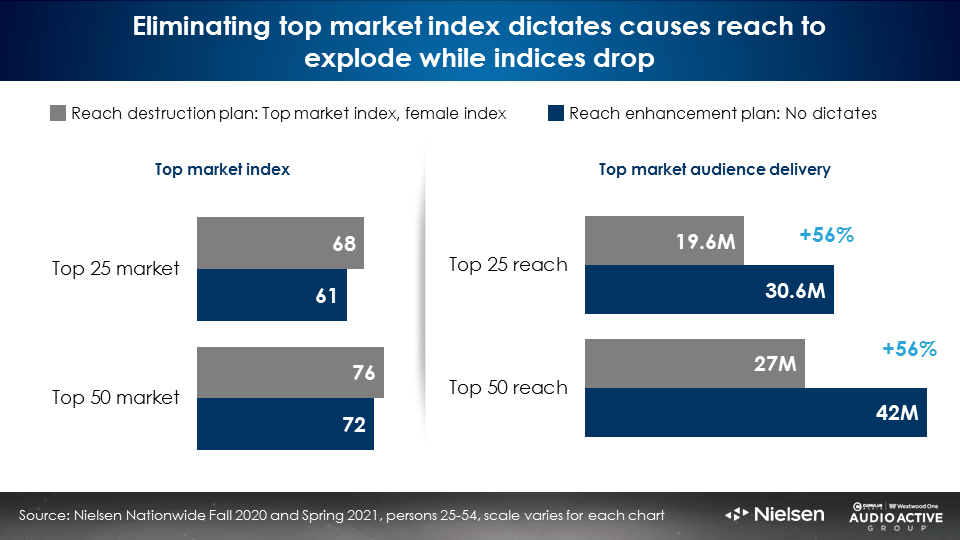

Per the graph below, you can plan a low reach buy with a top market index. As overall campaign reach grows, the top market impressions will revert to the 84 index norm.

Myth: AM/FM radio is a drive time medium

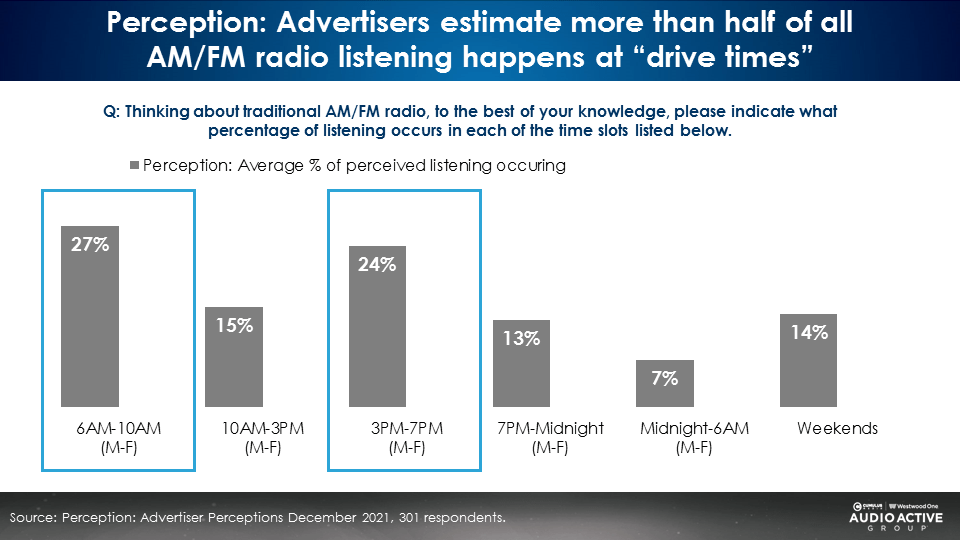

Advertiser Perceptions, the company that surveys thousands of advertisers and agencies, asked a simple question. “What % of AM/FM radio listening occurs by time period?” Here is what they found:

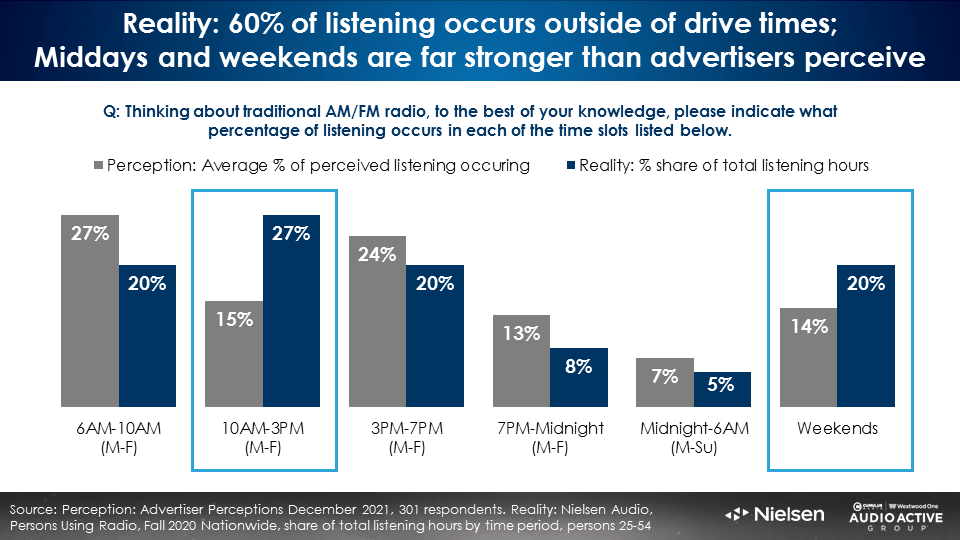

Marketers and agencies perceive that half of all AM/FM radio listening occurs in the morning and during afternoon drive. What is the reality?

60% of all AM/FM radio listening occurs outside of drive times! A buying dictate for just drive times misses 60% of American AM/FM radio listening.

Combining buying dictates reduces reach, drives up CPMs, and restricts access to inventory causing brands to compete for the same limited inventory

Imagine opening a dating app looking for people that are six foot seven, scored 1600 on their SATs, and are doctors. Talk about limiting your options! That is what it is like looking for top market inventory with a female skew in drive times.

Each criteria seems vaguely appealing. Combining all three dictates sharply reduces your options.

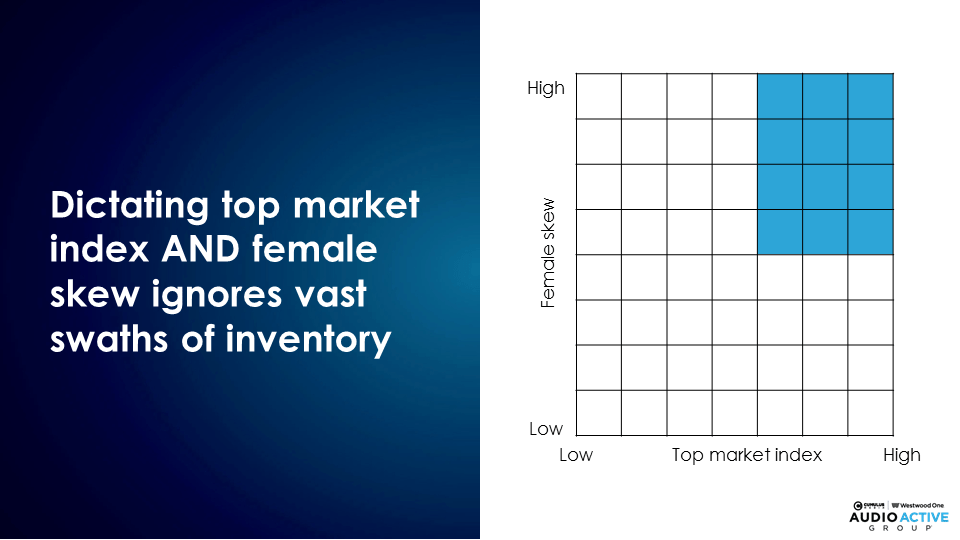

This visual below represents network radio inventory. One axis is top market index and the other is female skew. Asking for both a top market index AND a female skew ignores vast swaths of inventory.

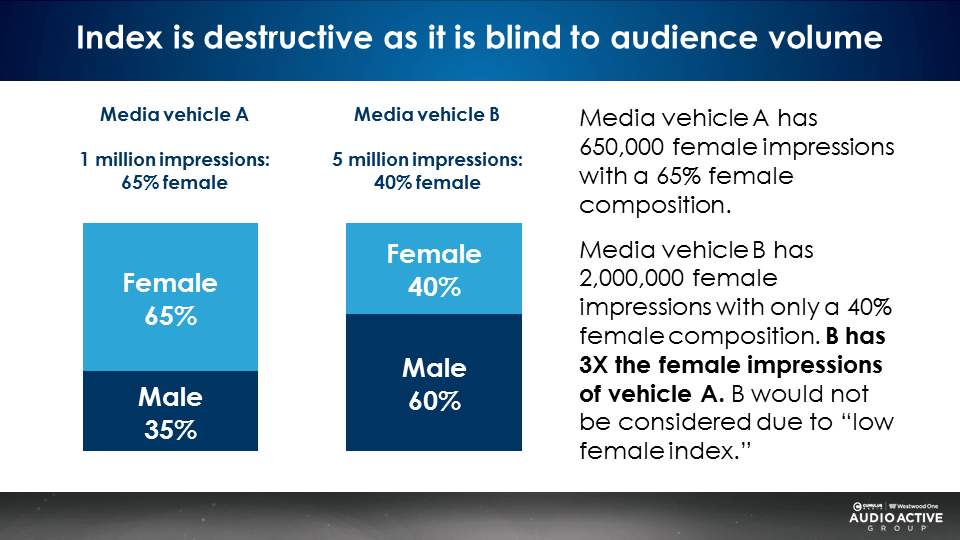

Index is destructive as it is blind to audience volume

An index doesn’t buy products and services. People do. An index has no relationship to audience size.

Consider these two media vehicles:

- Media vehicle A has 1 million impressions and is 65% female.

- Media vehicle B has 5 million impressions and is 40% female.

- Media vehicle A has 650,000 female impressions with a 65% female composition.

- Media vehicle B has 2,000,000 female impressions with only a 40% female composition.

- Media vehicle B has three times the female impressions of vehicle A. Yet, media vehicle B would not be considered due to “low female index.”

At the end of the day, what is more important – a “good index” or the greater audience volume? Time after time, marketers say, “I want the reach please.” The World Advertising Research Council says reach is the foundation of marketing effectiveness, not a “good index.”

With and without for a real buy: Eliminating index dictates for top market and female skew causes reach to soar

Here is an actual network radio buy and what happens when the buy is optimized for reach by eliminating top market and female skews.

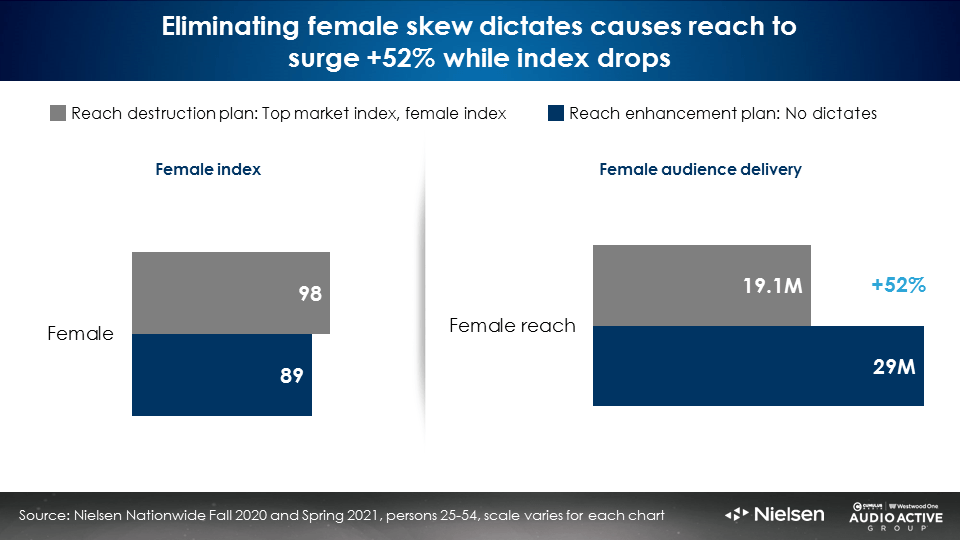

The buy in grey below (“reach destruction”) is an actual $1.9 million dollar network radio buy with top market and female skew dictates. The buy in blue (“reach enhancement”) represents the same investment without index dictates. In both scenarios, 75% of the impressions ran during Monday-Friday, 6AM-7PM. The differences are stunning.

For the same investment:

- Persons 25-54 reach soars from 39.8M to 61.7M, a +55% increase

- Expressed as a % of population, reach grows from 31% to 48%

- Frequency drops -31%

Elimination of the top market index dictate causes top market reach to explode +56%, from 19.6 million to 30.6 million. Top market index drops, a meaningless outcome given that reach grows by ten million persons.

Elimination of the female index dictate causes female reach to explode +52%, from 19.1 million to 29 million. Female index drops, a meaningless outcome given that female reach grows by ten million persons.

Here’s the kicker. The same investment secures a +7% increase in GRPs and impressions. This “no dictate” media plan results in a -5% reduction in CPM and cost per point. Stunning reach growth that’s more efficient.

Key takeaways:

- Total U.S. AM/FM radio listening skews male. 47% of listening is female.

- Small, low reach buys can achieve a slight female skew. Mass reach buys will conform to 47% female impressions composition.

- Total U.S. AM/FM radio listening achieves an 84 top 50 market impressions index due to a different Nielsen methodology used in major markets versus DMAs 51+.

- Small, low reach buys can achieve top 50 market indices in the 90s to 100s. Mass reach buys will conform to the 84 top 50 market impression index.

- AM/FM radio is miscast as a “drive time medium.” 60% of American AM/FM radio listening occurs outside of morning and afternoon drive.

- Top market and female reach increased over +50% on a network buy that was optimized by eliminating index dictates.

Recommendations:

- To capture the value of AM/FM radio’s mass reach, eliminate dictates for female skew, top market index, and drive times. These dictates drive up CPMs and restrict access to inventory causing brands to compete for the same small impression pool.

- Implementing “no dictate” media plans generates massive increases in top market reach and female reach.

- Analysis ideas: Index total deliveries to actual listening, not population. The 100 index on female skew would be set to 47% female, not the 50% female population. A 100 index for a top 50 market would tie to 59% of listening, not the 70% population.

- Shift to index analysis based on reach delivery, not impressions, as reach is the leading media sales driver and the foundation of media effectiveness.

Click here to view a 15-minute video of the key findings.

Download your copy of the Audio Planning Guide

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.