Surprise: AM/FM Radio Ratings Overtake TV Among Persons 18-34 And Hispanics; In Three Years, AM/FM Radio Will Surpass TV Among Persons 18-49 And 25-54

Click here to view a 13-minute video of the key findings.

Click here to download your copy of the Audio Planning Guide.

Three years ago, Duncan Stewart, Director of Research with Deloitte’s Technology, Media, and Telecommunications Practice, made a surprising forecast. By 2025, he predicted that AM/FM radio audiences would overtake TV among Millennials. Stewart’s prediction occurred four years early.

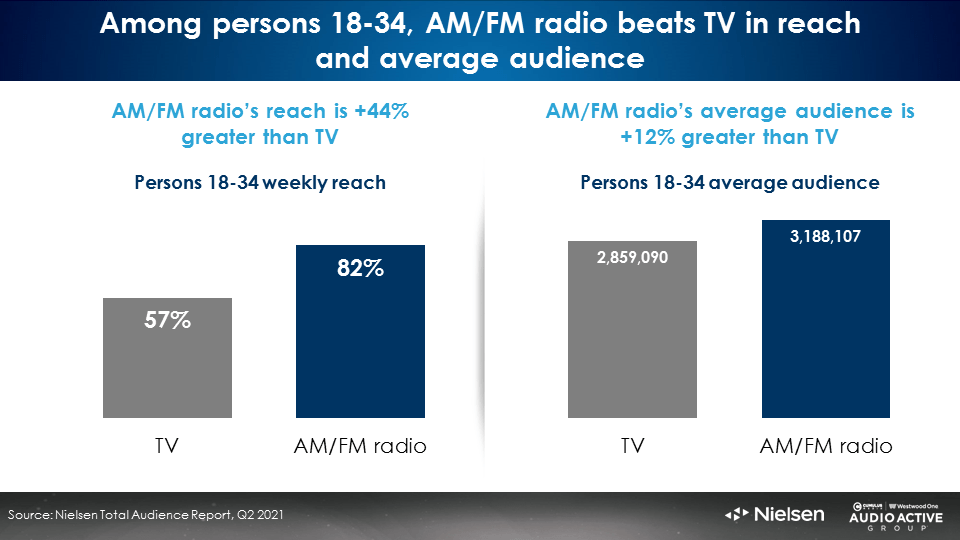

Among persons 18-34, AM/FM radio now beats TV in average audience and weekly reach

In 2018, TV’s persons 18-34 average audience was +25% bigger than AM/FM radio. Things have changed quickly. According to Nielsen’s Q2 2021 Total Audience Report, AM/FM radio’s persons 18-34 average audience is now +12% greater than television.

AM/FM radio’s weekly persons 18-34 reach of 82% is significantly larger than television’s 57%. Each week, almost half of U.S. persons 18-34 are not reached by live and time-shifted TV. U.S. AM/FM radio reaches +44% more persons 18-34 than live and time-shifted television.

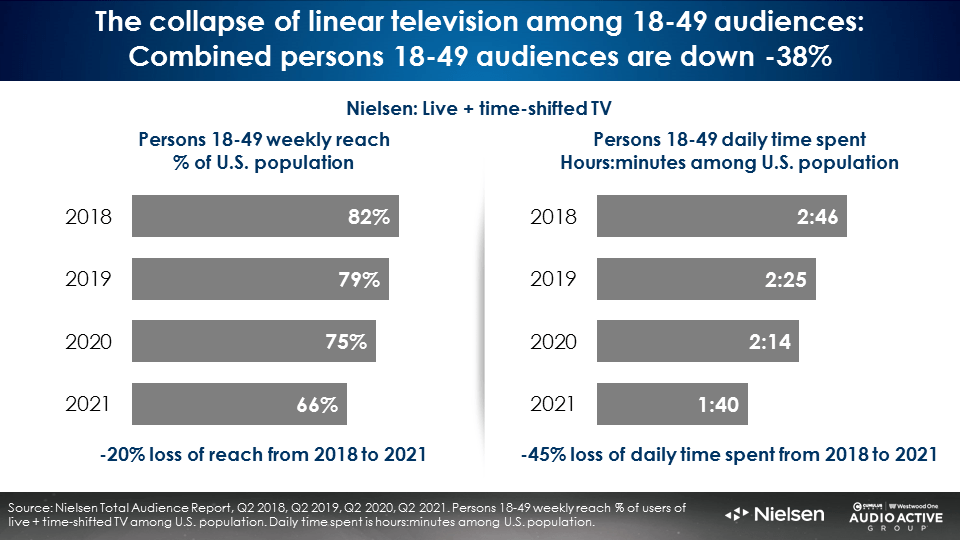

Persons 18-49 TV audiences are down -38% since 2018

Nielsen’s Total Audience Report reveals the weekly reach of live and time-shifted TV has dropped from 82% in 2018 to 66%. Today, one out of three American persons 18–49 never watch linear TV in a typical week.

Persons 18-49 weekly time spent to live and time-shifted TV is down -45% over the last four years. Combined with a -20% loss in reach, Nielsen reports TV’s persons 18-49 average audiences are off by -38%.

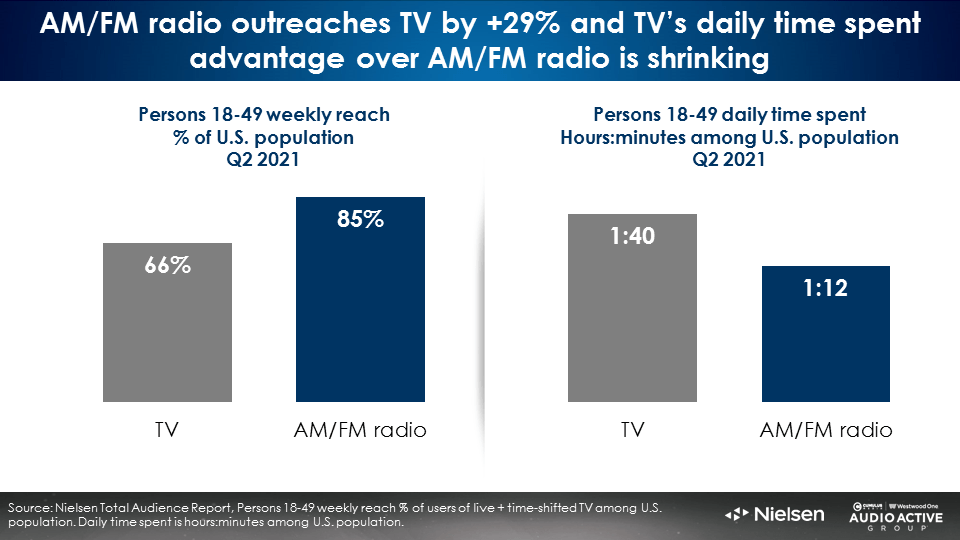

AM/FM radio beats TV 85% to 66% in persons 18-49 weekly reach

AM/FM radio’s +29% reach advantage over TV among persons 18-49 means putting AM/FM radio in the media plan supplements campaign reach. AM/FM radio’s daily time spent among persons 18-49 is only half an hour less than TV’s and that gap is narrowing quickly.

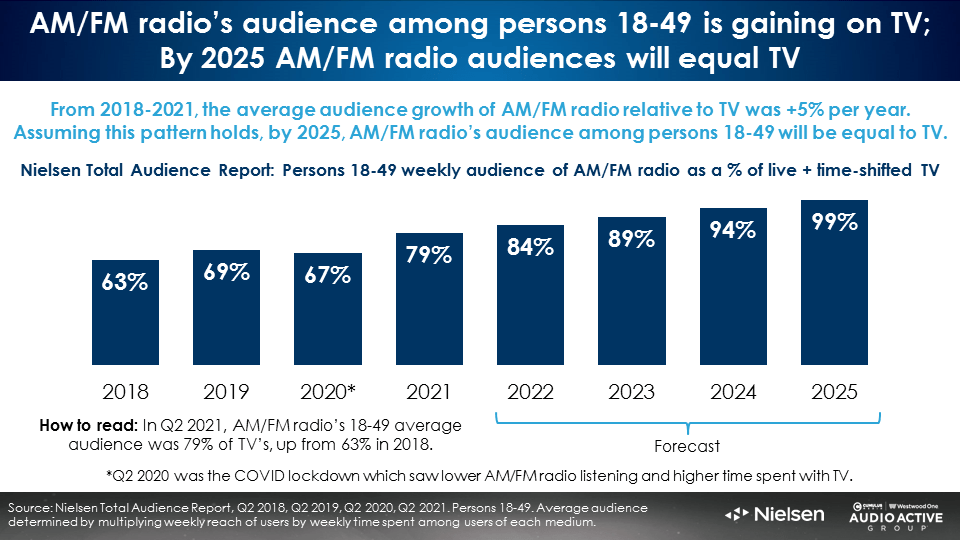

In three years, AM/FM radio ratings will overtake TV among persons 18-49

In 2018, AM/FM radio’s 18-49 average audience was 63% of television’s. In Nielsen’s latest Q2 2021 Total Audience Report, AM/FM radio’s 18-49 average audience is now 79% of TV. At this current pace, AM/FM radio’s average audiences will overtake TV in three years.

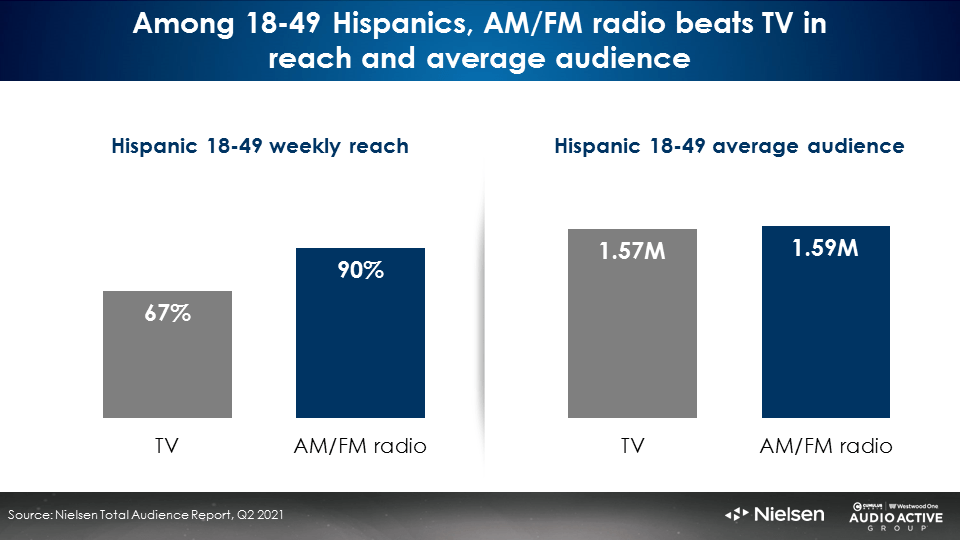

Among 18-49 Hispanics, AM/FM radio has already surpassed TV average audiences

AM/FM radio edges out TV in Hispanic 18-49 average audiences 1.59 million to 1.57 million. Among 18-49 Hispanics, AM/FM radio has a colossal weekly reach advantage over TV (90% to 67%). Among 18-49 African Americans, AM/FM radio outreaches TV 84% to 71%.

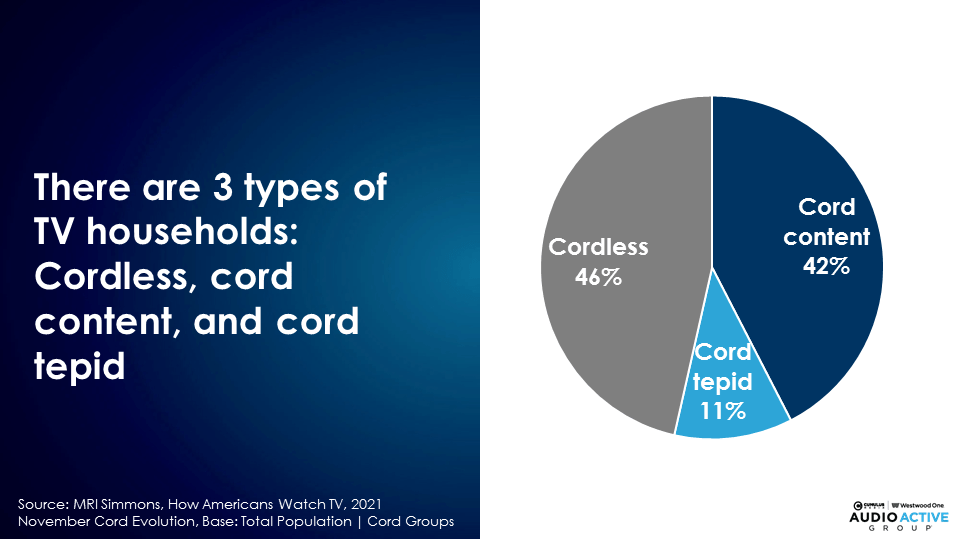

Cord cutting is a major driver of TV’s audience collapse

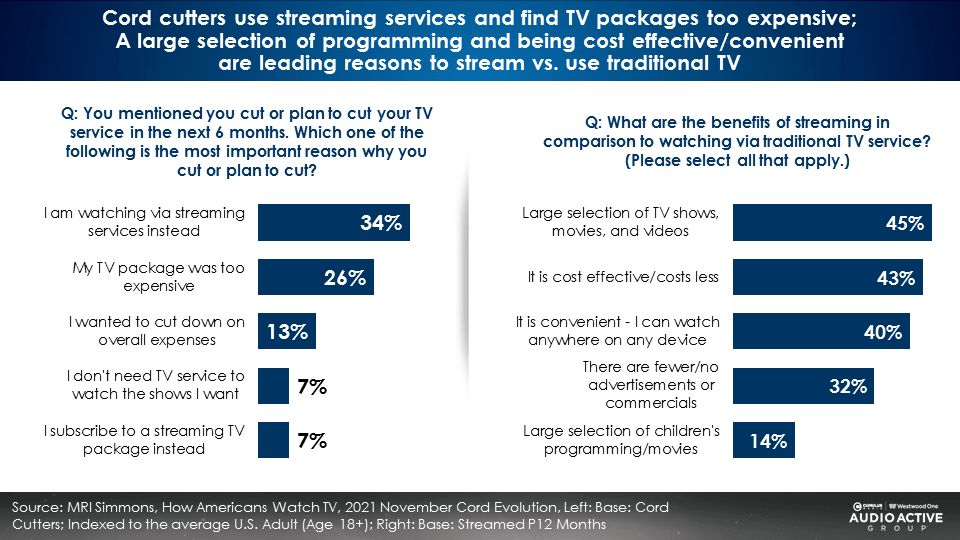

The MRI Simmons “How Americans Watch TV” report reveals 46% have cut the cord. Another 11% are “cord tepid,” meaning they have cut back on their cable TV package or are contemplating “cord shaving.” Only 42% of Americans are “cord content.”

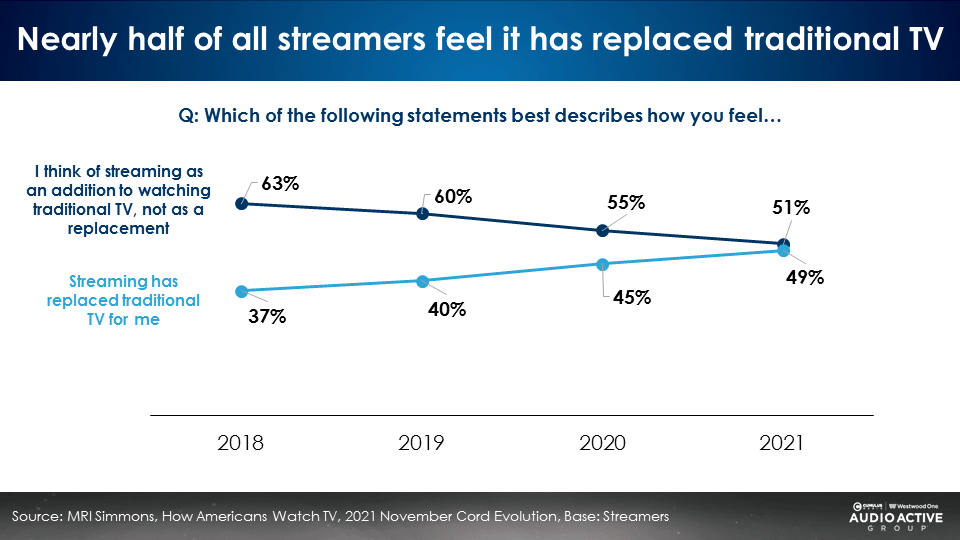

Streaming is now “TV”: Half of Americans say streaming has replaced traditional TV

MRI Simmons finds a major shift has occurred in the American mindset about streaming. Once thought as an “add on” to regular TV, streaming is increasingly seen as America’s primary television platform.

From 2018 to 2021, those who use video streaming and say “streaming has replaced traditional TV” has surged from 37% to 49%. The number of Americans who stream that perceive “streaming as an addition to TV rather than a replacement” dropped from 63% in 2018 to 51% in 2021.

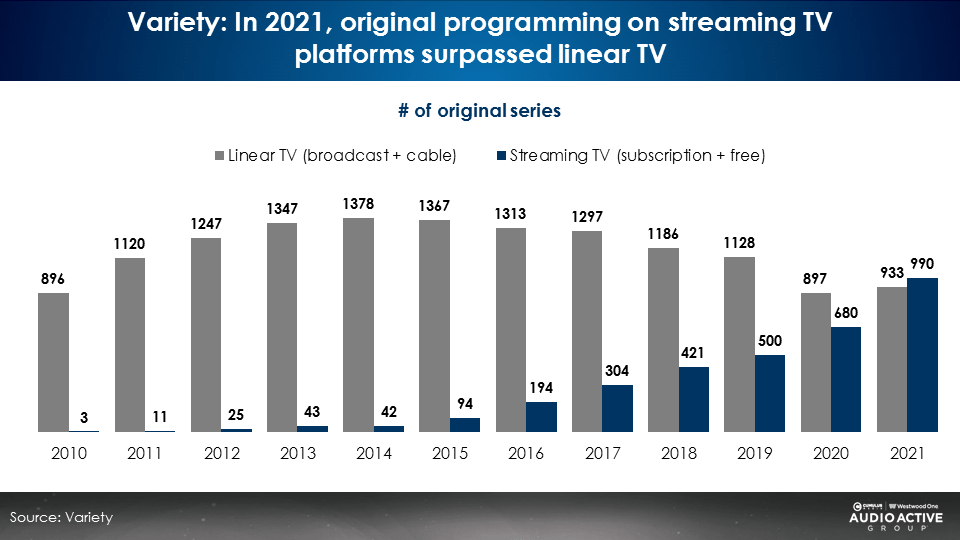

The number of original shows on streaming platforms has surpassed linear television for the first time

Variety reports that in 2021, streaming services produced 990 original series, more than broadcast TV and cable networks (933). While the number of original series on linear TV is down from prior highs, the number of streaming original series has exploded, tripling from 304 in 2017 to 990 in 2021.

Cord cutters love video streaming for the breadth of content, cost savings, and lack of ads

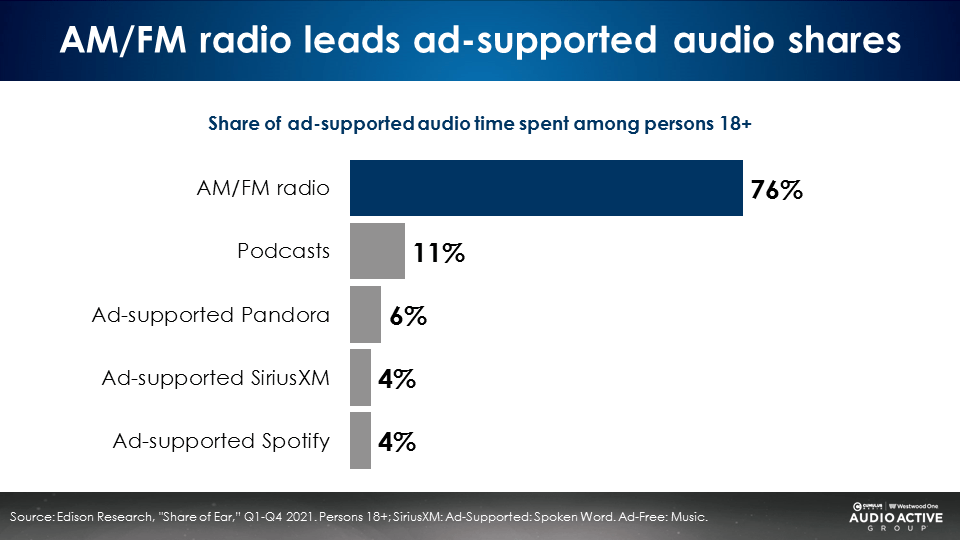

While a huge number of Americans have abandoned traditional TV for streaming, AM/FM radio remains the dominant audio platform

According to Edison Research’s Q4 2021 “Share of Ear,” AM/FM radio has a massive 76% share of U.S. ad-supported audio. AM/FM radio audience shares are over 7 times larger than ad-supported Pandora and ad-supported Spotify combined.

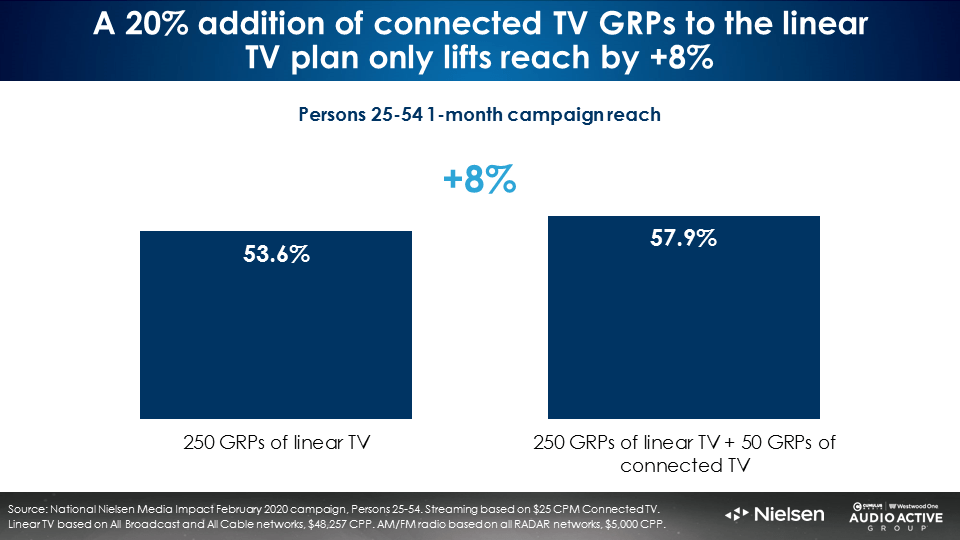

Connected TV cannot save linear TV: Adding CTV to a TV buy only modestly increases reach

According to Nielsen Media Impact, the media planning and optimization platform, adding 50 GRPs of connected TV to an existing TV buy lifts reach only +8%. In this scenario, the addition of CTV was an added investment, not a reallocation.

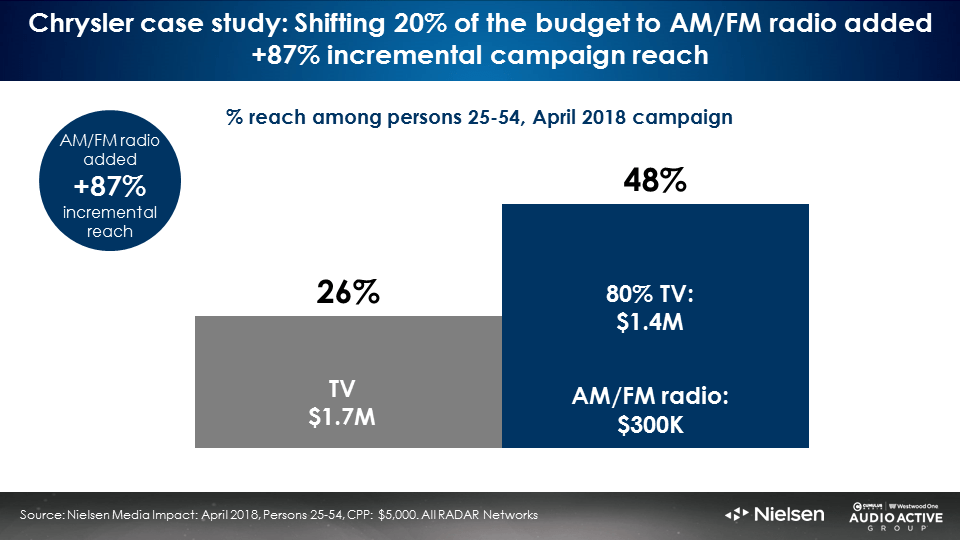

AM/FM radio makes your TV better: Regardless of budget, shifting 20% of the TV plan to AM/FM radio generates a massive lift in reach

When introduced into the media plan, AM/FM radio’s significant reach and ratings generate extraordinary incremental reach. Here is an example of a modest national TV buy. Chrysler spent $1.7 million on national TV in a month and reached 26% of Americans.

Shifting 20% of the TV budget to AM/FM radio causes campaign reach to soar from 26% to 48%. Reach nearly doubles (+87%) by adding AM/FM radio with no increase in budget.

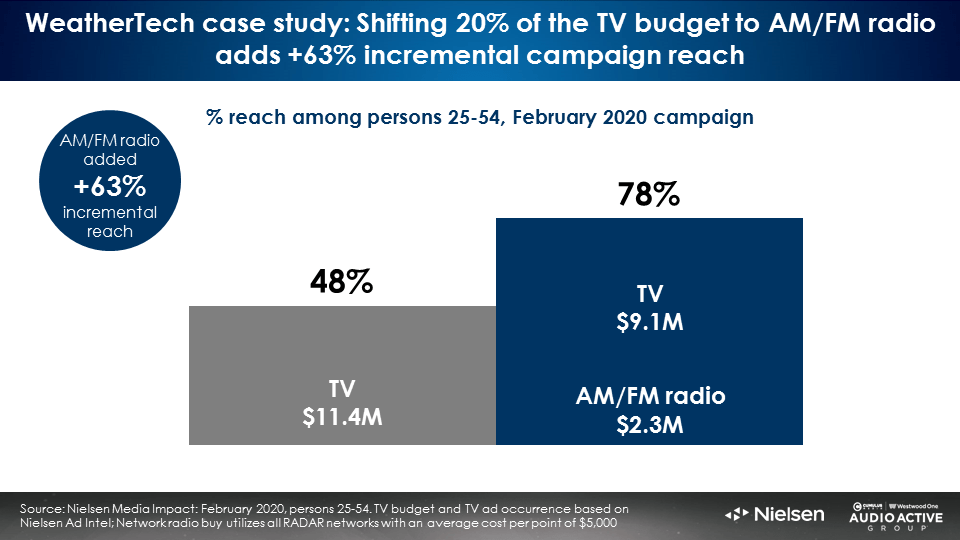

Here is an example of a TV campaign with a larger budget. WeatherTech spent $11.4 million on network TV in a month and reached 48% of Americans.

Shifting 20% of the TV budget to AM/FM radio causes campaign reach to soar from 48% to 78%. Due to the addition of AM/FM radio, campaign reach increases +63% with the same budget.

Key findings:

- In 2018, TV’s persons 18-34 average audience beat AM/FM radio by +25%. Today, AM/FM radio’s persons 18-34 average audience beats live and time-shifted TV by +11%. AM/FM radio has a significant 18-34 weekly reach advantage over TV (82% to 57%).

- Among 18-49 Hispanics, AM/FM radio beats TV in average audience and has a colossal weekly reach advantage (90% to 67%).

- Since 2018, U.S. live and time-shifted television’s persons 18-49 average audience is down -38%, driven by a -20% loss in reach and a -45% erosion in time spent.

- AM/FM radio’s persons 18-49 average audience will overtake live and time-shifted TV in three years. At present, AM/FM radio has a weekly reach advantage of 85% to 66%. AM/FM radio’s persons 18-49 average audience has grown from 63% of TV’s in 2018 to 79% today.

- Linear TV erosion is fueled by cord cutting and streaming. For those who steam, half say it has replaced traditional TV.

- AM/FM radio continues to have a dominant 76% share of ad-supported audio. When introduced into a TV media plan, AM/FM radio generates an extraordinary increase in campaign reach.

Click here to view a 13-minute video of the key findings.

Download your copy of the Audio Planning Guide

Pierre Bouvard is Chief Insights Officer at CUMULUS MEDIA | Westwood One and President of the CUMULUS MEDIA | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.