Never Before Seen Nielsen AM/FM Radio Streaming Data: Spoken Word Represents One-Third Of Streaming; There Is A Wide Variation Of Streaming By Market; Streaming Audiences Are Upscale And Employed; Fewer Ads Needed As Reach And Frequency Quickly Accumulates

Click here to view a 16-minute video of the key findings.

Click here to download your copy of the State of AM/FM Radio Streaming deck.

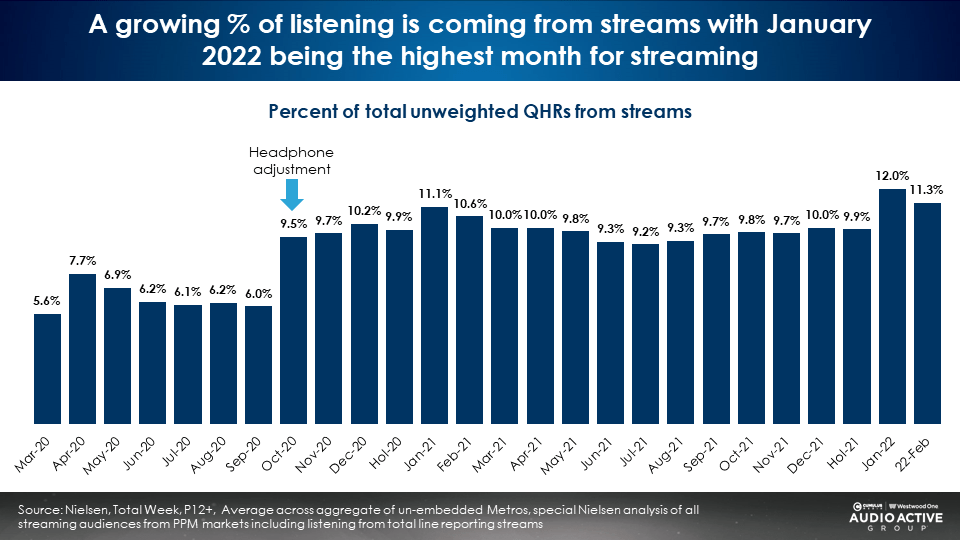

While audio streaming of AM/FM radio has been around for over 25 years, the proportion of total listening coming from the stream was, until recently, in the single digits. No longer.

With Nielsen’s introduction of the headphone enhancement to their Portable People Meter service in October 2020, streaming now represents 11% of total AM/FM radio listening among 12+ Americans. Among persons 25-54, streaming represents 12% of AM/FM radio listening.

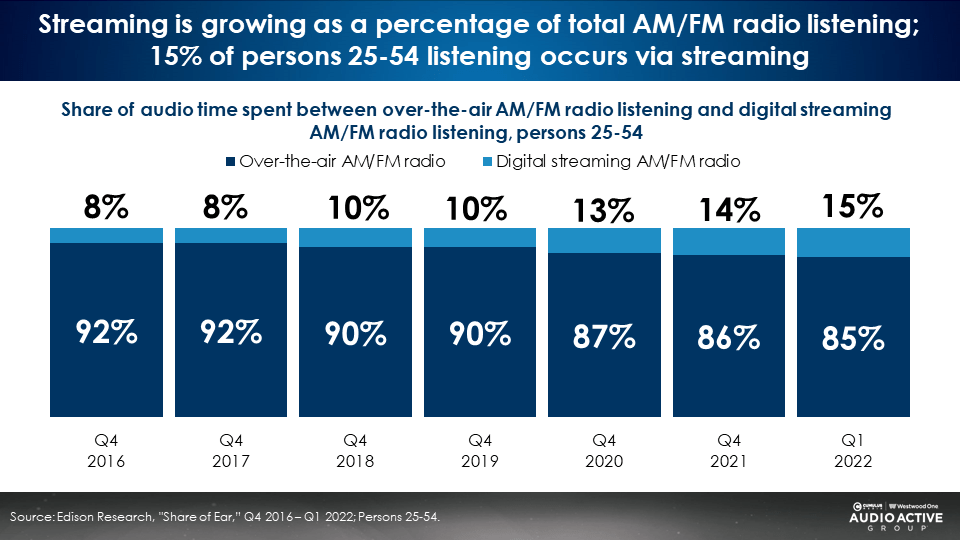

Edison Research’s “Share of Ear” study reports very similar amounts of AM/FM radio streaming. Over the last six years, Edison reports online streaming has grown from 8% of total listening to 15% among persons 25-54.

Edison reports over the last five years, AM/FM radio streaming shares have nearly doubled while Pandora’s audience has collapsed and Spotify shares remain small and stagnant.

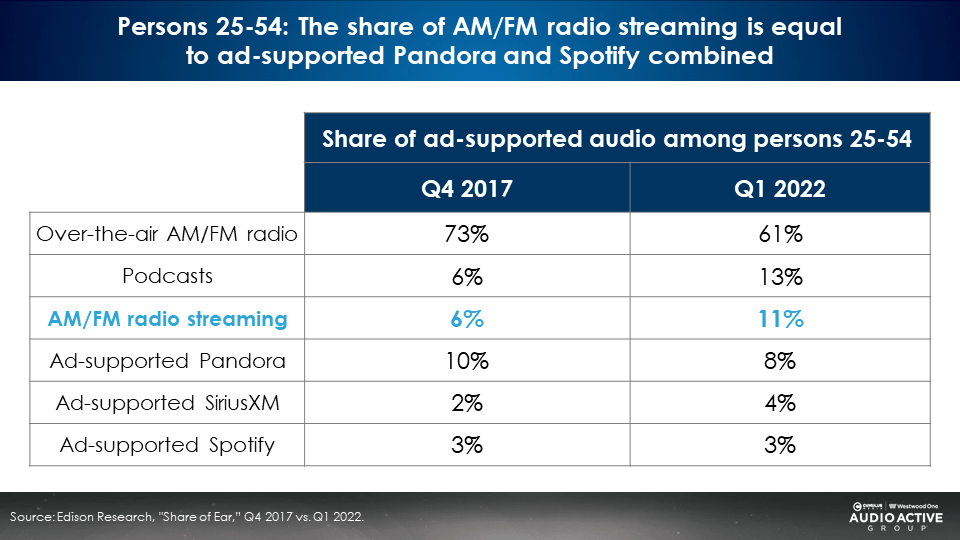

Since 2017, the two fastest growing audio platforms are podcasts and AM/FM radio streaming

“Share of Ear” data reveals AM/FM radio streaming shares of ad-supported audio have nearly doubled (6% to 11%). Over the last five years, podcasts’ shares have doubled from 6% to 13% among persons 25-54.

The current ad-supported share of AM/FM radio streaming (11%) is as big as the combined audiences of Pandora and Spotify (11%)

Over-the-air AM/FM radio remains the dominant audio platform at a 61% share of ad-supported audio. Pandora’s share has dropped steadily from a 10% in 2017 to 8% in 2022. AM/FM radio streaming beats Pandora 11% to 8%.

Over the five years, Spotify’s ad-supported shares are stagnant at a 3% share. AM/FM radio streaming’s audience is triple ad-supported Spotify.

First ever Nielsen study: An examination of all U.S. AM/FM radio streaming captured by the Portable People Meter

Left: Trish Craig, Manager, Group & Local Client Operations, Nielsen

Right: Tyler Plahanski, Vice President/Sales Director, Nielsen

Nielsen’s Trish Craig, Manager, Group & Local Client Operations, and Tyler Plahanski, Vice President/Sales Director, have produced a new study, which examines all streaming behavior captured by the Portable People Meter from the recently released February 2022 survey. Currently broadcasters in Nielsen’s PPM markets can elect to have their online streams reported separately or combined with their over-the-air audiences via “total line reporting.”

A large amount of streaming listening in Portable People Meter markets is combined with the over-the-air audience. As such, it has never been possible to examine all AM/FM radio station streaming in the U.S.

Craig and Plahanski have produced a first-ever view of all U.S. PPM AM/FM radio station streaming:

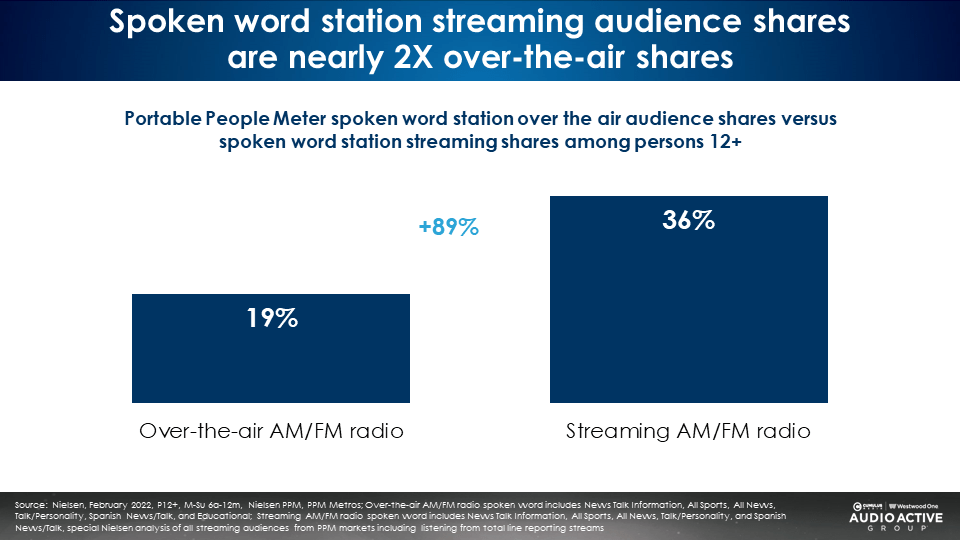

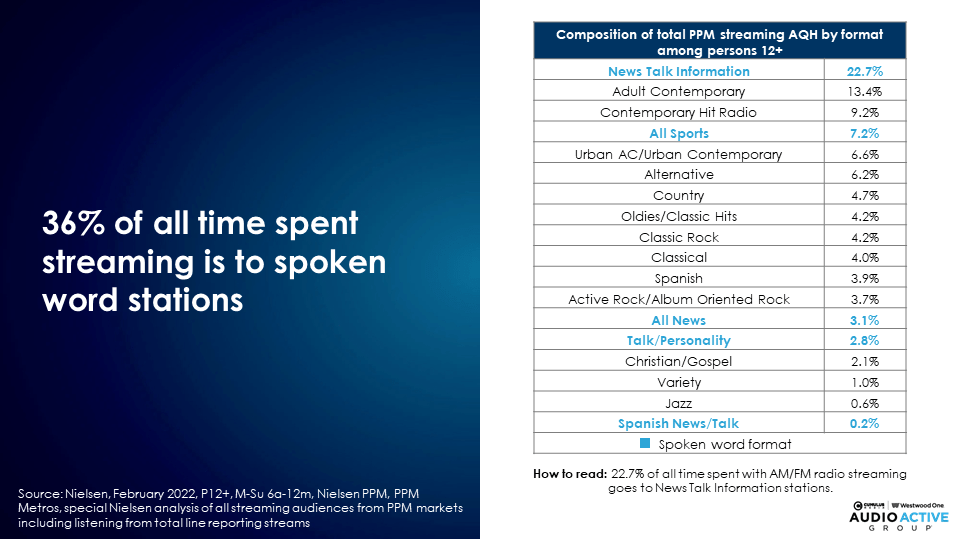

Spoken word streaming shares are nearly double their over-the-air shares

Spoken word AM/FM radio stations streams (News/Talk, Sports, Talk/Personality, Spanish News/Talk) represent 36% of all American streaming listening. That is +89% greater than spoken word station over-the-air shares (19%).

From the February 2022 Portable People Meter survey, News/Talk station streams have a 22.7% share of all U.S. online listening followed by AC (13.4%), Contemporary Hit Radio (9.2%), and Sports (7.2%).

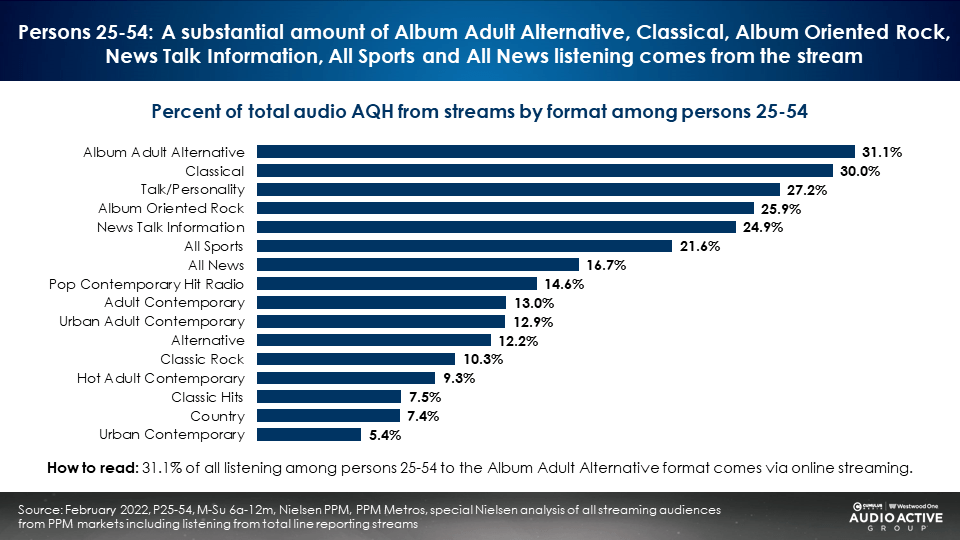

How important are streaming audiences? For some AM/FM radio programming formats, streaming represents 25% to 30% of all listening

The percentage of persons 25-54 listening to each AM/FM radio programming format that comes from the stream across Nielsen’s 48 PPM markets is significant for a number of formats:

- 30% of listening to Album Adult Alternative and Classical stations comes via the stream.

- 27% of listening to Talk/Personality stations comes via the stream.

- 25% of listening to Album Oriented Rock and News Talk Information stations comes via the stream.

- 22% of listening to Sports stations comes via the stream.

- 17% of listening to All News stations comes via the stream.

- 15% of listening to Pop Top 40 stations comes via the stream.

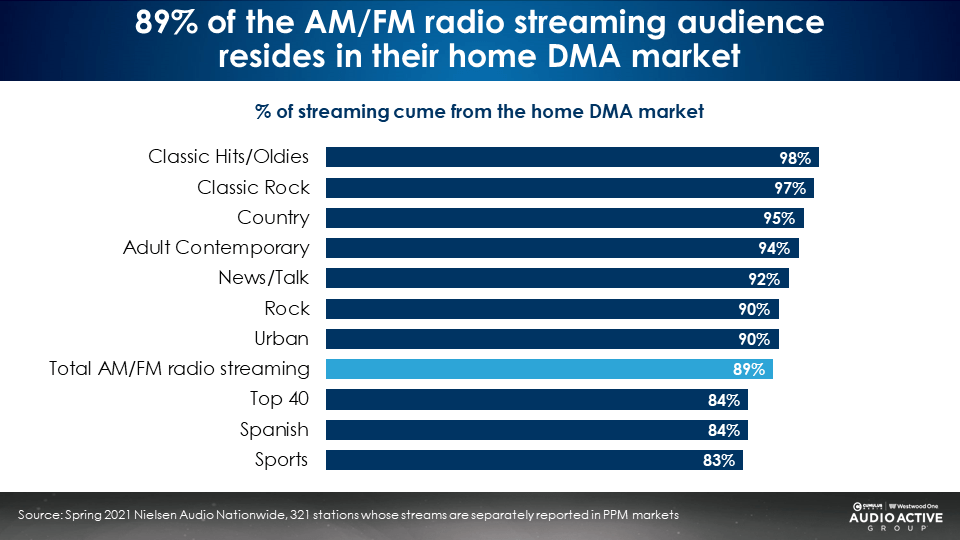

The vast majority of the AM/FM radio streaming audience resides in the home DMA market

Marketers can purchase time on AM/FM radio station streams knowing most of the audience is from that home market. An analysis of 321 AM/FM radio station streams separately reported by Nielsen finds 89% of streaming audiences come from home market stations.

Sports stations have 83% of streaming audiences coming from the home DMA market, slightly lower than the norm as out-of-town listeners craving news and discussion on their favorite local teams listen to the stream of sports stations.

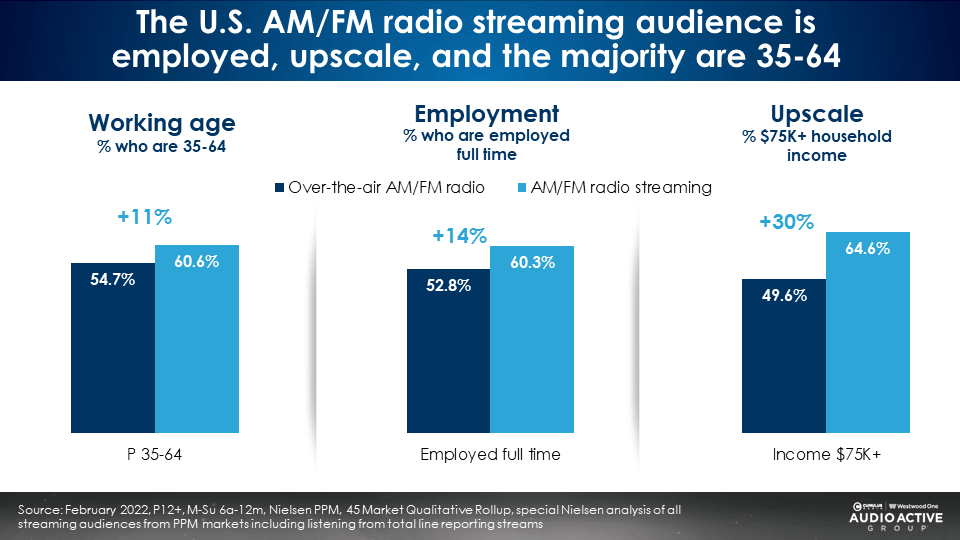

AM/FM radio streaming audiences are employed, upscale, and most are 35-64

The streams of AM/FM radio stations are highly desirable to advertisers. Compared to the over-the-air AM/FM radio audience in Nielsen’s 48 Portable People Meter markets, streaming audiences are:

- +14% more likely to be employed full time

- +30% more likely to have a $75K+ household income

- +11% more likely to be aged 35-64

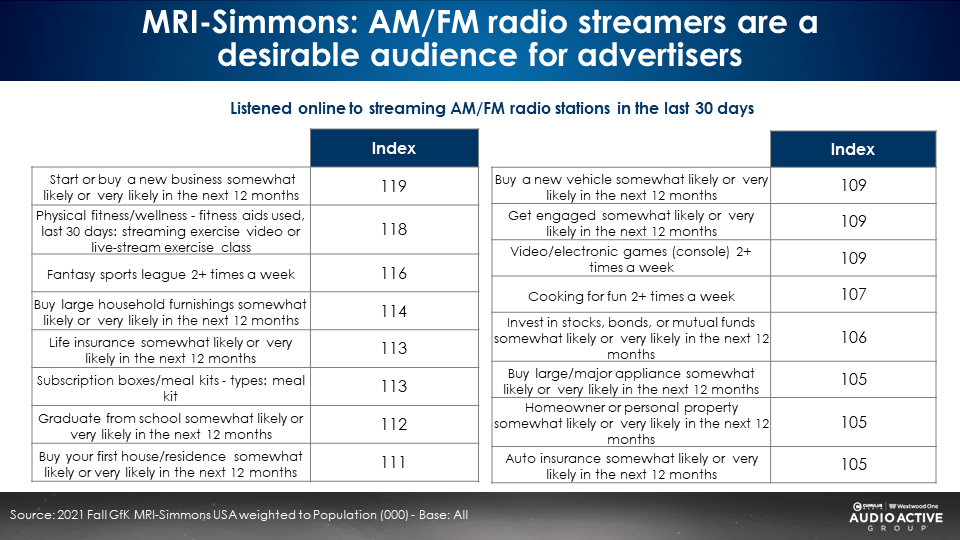

MRI-Simmons: The AM/FM radio streaming audience is far more likely to start a new business, make major purchases (new vehicle, new house, major appliance), make financial investments, or be in the market for insurance

According to MRI-Simmons, Americans who have listened to AM/FM radio station streams in the last 30 days are far more likely than the average to make a series of major purchases.

An index of 100 means the streaming audience is just like the U.S. average. An index of 109 means the streaming audience is 9% more likely than the U.S. average to make a purchase.

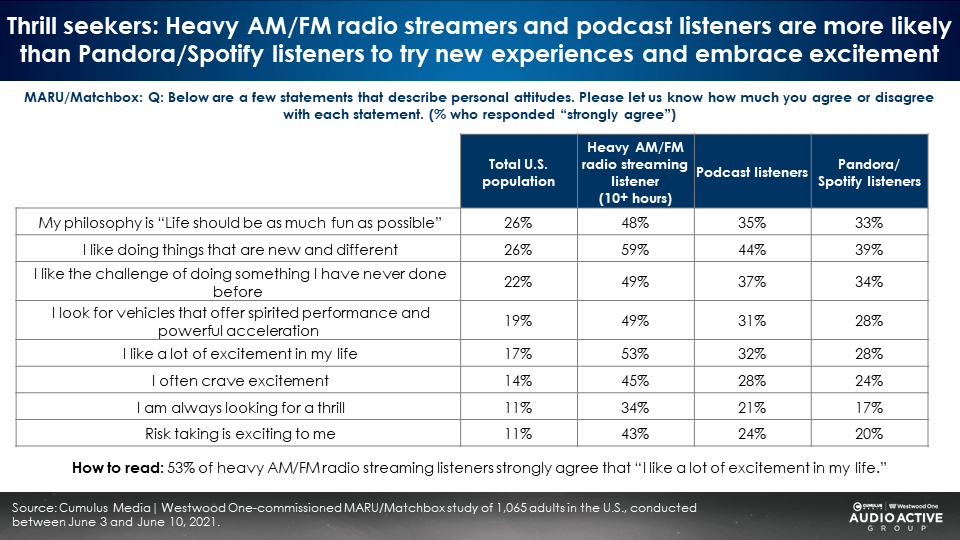

Thrill seekers: Compared to Pandora and Spotify listeners, the AM/FM radio streaming audience is far more adventurous and more likely to try new and different things

A MARU/Matchbox study conducted last year reveals the AM/FM radio streaming audience is twice as likely than the Pandora/Spotify audience to indicate they crave excitement and seek new challenges. 49% of heavy AM/FM radio streaming listeners say they “look for vehicles that offer spirited performance and powerful acceleration” compared to only 34% of Pandora/Spotify listeners.

Edison’s “Share of Ear” reveals the vast majority of Pandora/Spotify listening occurs at home. The use case of Pandora/Spotify is “softly playing music in the other room.” This passive listening environment attracts a passive, less adventurous audience with far less interest in trying new things.

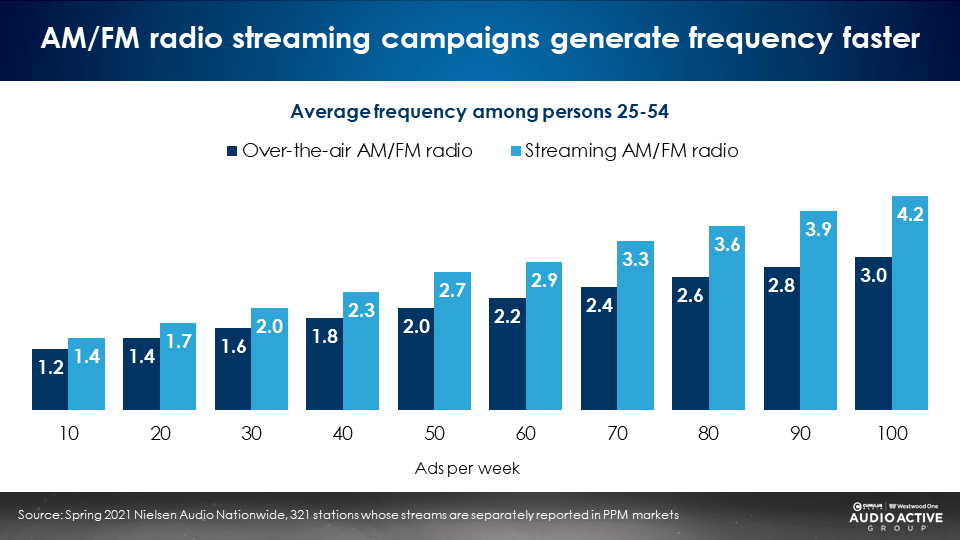

Fewer ads are needed in AM/FM radio streams as higher time spent means reach and frequency accumulate faster: Half the number of streaming ads achieve the same frequency as over-the-air AM/FM radio campaigns

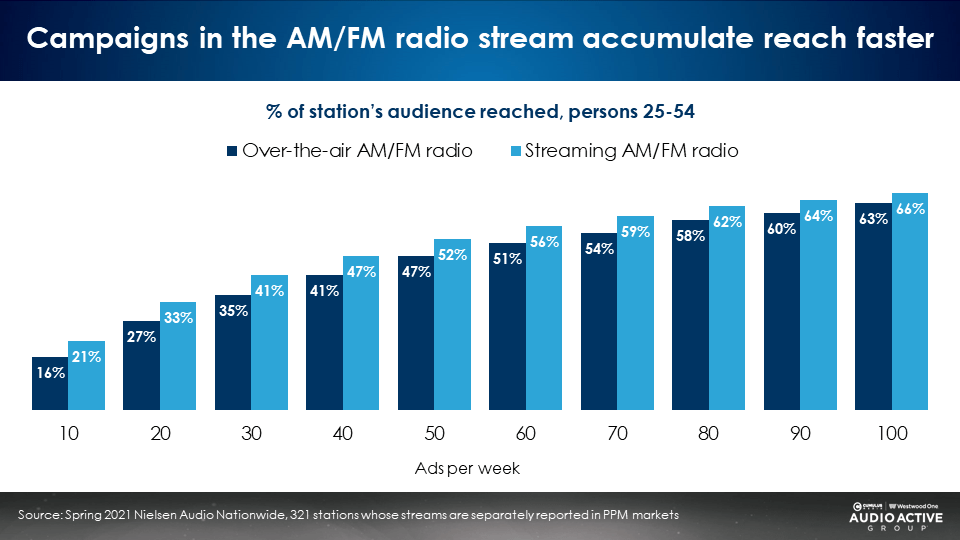

A reach and frequency analysis of 321 AM/FM radio stations whose streams are separately reported by Nielsen reveals strong time spent listening means ads aired in the online stream yield higher frequency than those aired over the air.

Frequency is the average number of times a person will hear a weekly ad campaign. 30 ads run in a week in AM/FM radio station streaming generate a two frequency. It takes 50 ads run over the air to achieve the same two frequency.

Be smart: Advertisers should avoid excessive frequency levels with online streaming. Half the number of streaming ads are needed to achieve the same level of frequency over the air.

Given the strong streaming time spent, it is no surprise that streaming campaigns reach larger proportions of audiences faster compared to over-the-air campaigns.

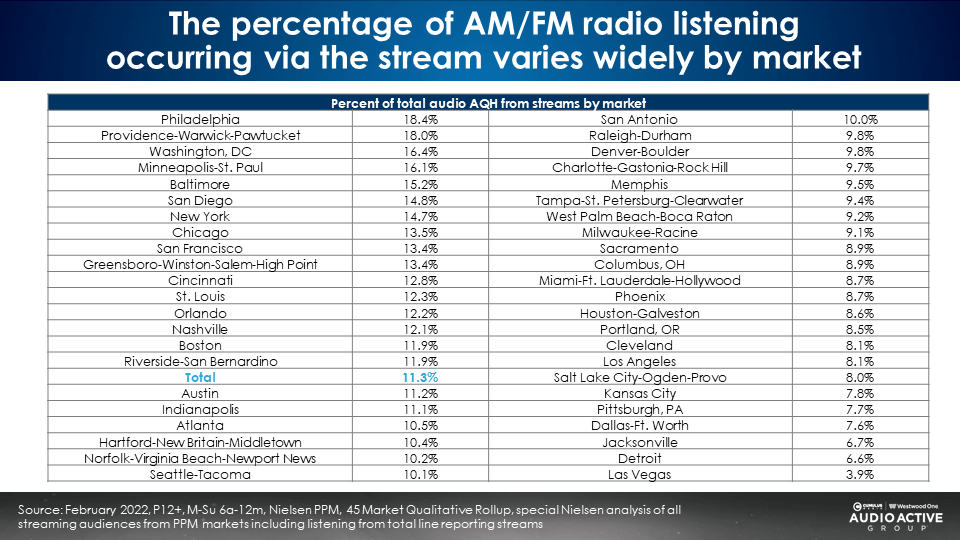

There is wide variation in the amount of AM/FM radio stream listening that occurs in local markets

This first-ever analysis of streaming listening by market reveals a surprise. There are major differences in the amount of streaming that is occurring across Nielsen’s PPM markets.

According to Nielsen’s analysis of the February 2022 Portable People Meter data, 18.4% of all AM/FM radio listening in Philadelphia occurs via the stream compared to only 3.9% of listening in Las Vegas. With an average of 11.3% of all PPM market listening coming from the stream, it is fascinating to see the large spread in the proportion of market listening that occurs via the stream.

It would be interesting for AM/FM radio stations to include questions in their local perceptual studies to understand what accounts for the broad variation in streaming across markets. Perhaps listeners in local markets are more aware of the ability to stream AM/FM radio stations than in other markets.

This historic new Nielsen study offers broadcasters and advertisers powerful insights on the American AM/FM radio streaming audience.

Broadcasters: Ensuring a quality and top-notch listening experience of online streams is more important than ever

With some local markets approaching 20% of listening via the stream and some formats with 30% of tuning via streaming, the quality of a listener’s experience with the stream is more vital than ever.

Advertisers: Why AM/FM radio streaming should be a $10+ CPM

- AM/FM radio streaming audiences are as big as Pandora/Spotify combined; Given the collapse of Pandora and the growth of AM/FM radio streaming, AM/FM radio streams will surpass Pandora/Spotify in the coming year

- The AM/FM radio streaming audience is more likely to be full time employed and have a $75K+ household income

- Versus Pandora and Spotify, the AM/FM radio streaming audience is far more adventurous and more likely to try new and different things

- The vast majority of the streaming audience resides in their home DMA market

- The AM/FM radio streaming audience is far more likely to start a new business, make major purchases (new vehicle, new house, major appliance), make financial investments, or be in the market for insurance

- Avoid excessive frequency; Half the number of ads is required in the AM/FM radio stream to achieve the same frequency levels of over-the-air AM/FM radio campaigns

Click here to view a 16-minute video of the key findings.

Download Your Copy of the State of AM/FM Radio Streaming deck

Pierre Bouvard is Chief Insights Officer at Cumulus Media | Westwood One and President of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.