Nielsen Office Supplies Retailer Sales Effect Study: AM/FM Radio Campaign Grows Sales +11%, Increases Customer Base +6%, And Expands Share Of Category Spend +21%

Click here to view a 9-minute video of the key findings.

Over the years, Nielsen has conducted dozens of sales effect studies quantifying AM/FM radio’s ability to generate strong sales growth and return on advertising spend. Post-pandemic, does AM/FM radio still generate impressive sales effect for retailers?

- Grew sales by +10%

- Increased the customer base by +17%

- Expanded the retailer’s share of category spend by +15%

New sales effect study: National office supplies retailer

In Summer 2021, a national office supplies retailer ran an AM/FM radio campaign across many radio networks. The Cumulus Media | Westwood One Audio Active Group®, in another historic new post-COVID study, commissioned a Nielsen sales effect study of the entire AM/FM radio campaign that included every AM/FM radio ad run by the retailer.

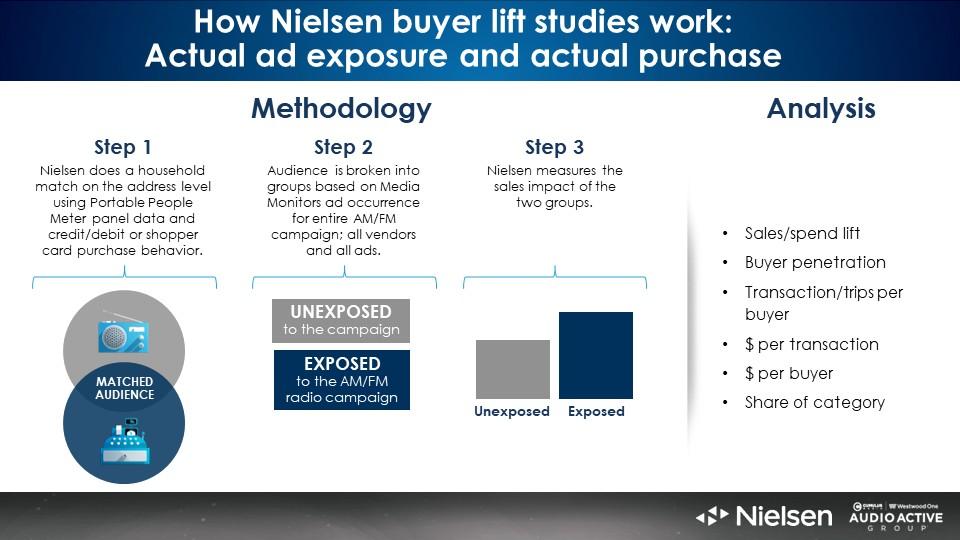

Nielsen matched commercial audiences from their Portable People Meter panel with credit and debit purchase data to reveal how AM/FM radio impacted sales for the major office supplies retailer. Nielsen’s analysis examined the campaign that ran from July 11, 2021 through October 23, 2021, comparing those who were exposed and unexposed to determine advertising effectiveness.

Actual ad exposure + actual customer spend = actual sales effect

Using Nielsen’s Portable People Meter panel of 80,000 respondents, campaign exposure was measured at the individual person level, not just at the household level.

Commercial audience exposure was matched to actual spend using credit and debit card spending from the home address associated with PPM advertising exposure.

Imagine 32 Main Street in Eastchester, NY is a Nielsen Portable People Meter home. Debit and credit card spending from that household address is matched to the individual person’s AM/FM radio commercial exposure to the retailer’s ads. So actual commercial exposure is matched to actual spend at the retailer from the same household.

The study was conducted among 20,091 Portable People Meter panelists in Nielsen’s 48 PPM markets who were the national office supply retailer customers. 8,114 were unexposed to the AM/FM radio campaign and 11,977 were exposed to the campaign.

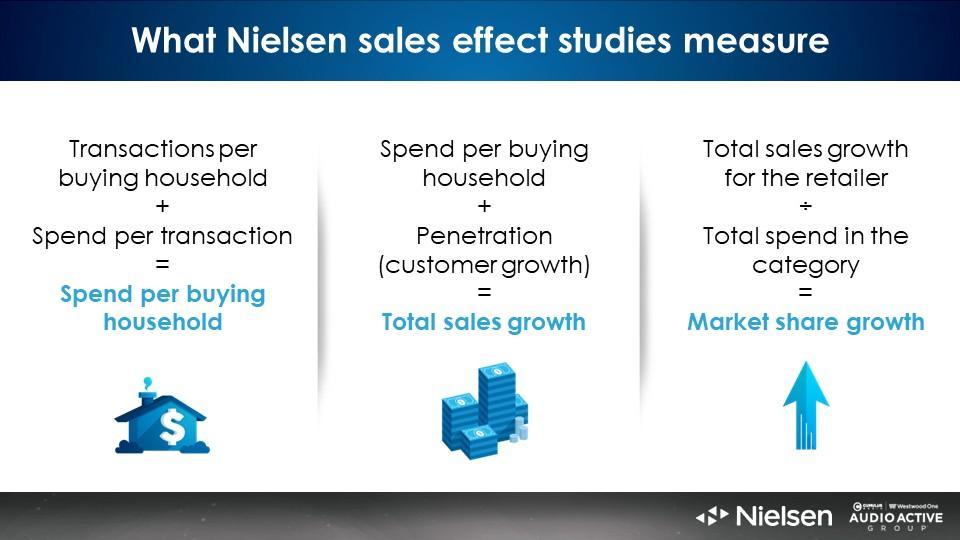

What Nielsen sales effect studies measure

Nielsen sales effect studies answer four key questions marketers want to know about the business outcomes of their AM/FM radio investment:

- What was the increase in spend per buying household?

- Did I grow my customer base (penetration)?

- What was my total sales growth?

- Did the sales growth translate into a revenue share increase within my category?

Why “real” sales effect studies are better than media mix modeling

It is not uncommon for brands to report that AM/FM radio does not perform well in media mix modeling studies. AM/FM radio is such a small part of many national media investments that the media mix model has a hard time generating a stable and reliable read.

Media mix modeling is a self-fulfilling prophecy. It reads well for the largest media investments in the plan. The small elements in the media plan experience “performance bounce” in sales volume and return on marketing investment metrics.

A far more effective and meaningful approach is to conduct “real” sales effect and return on ad spend studies with Nielsen. Actual media exposure is connected to actual consumer spend to determine actual sales effect.

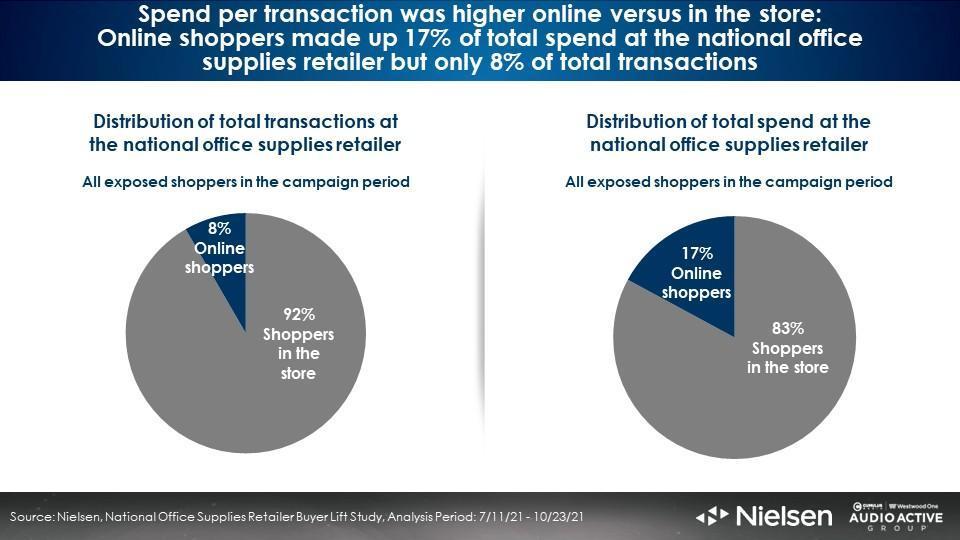

Nielsen measured purchases made both in the store and online

Online shopping generated greater spend per transaction. Online shoppers represented 17% of total spend from only 8% of total transactions.

Here are the key findings from the Nielsen study:

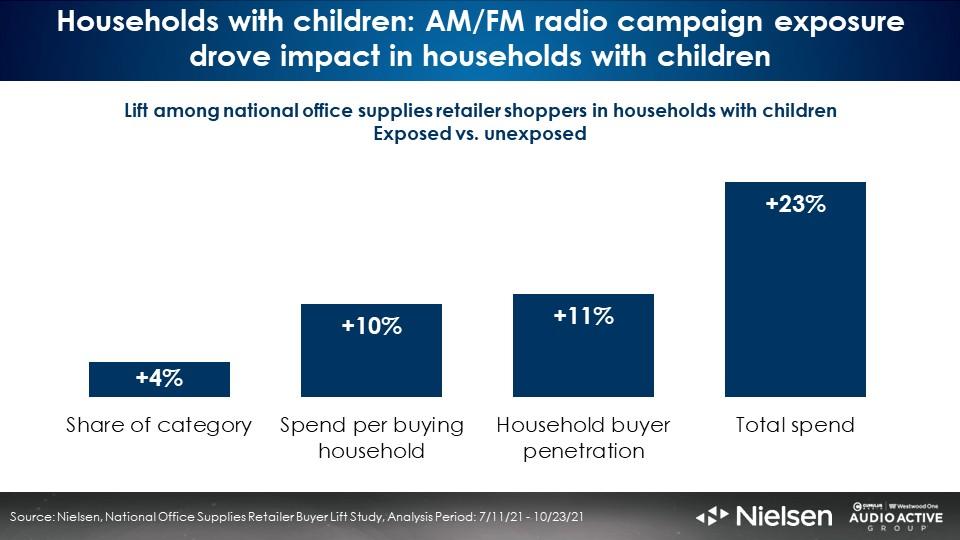

Back to school: The AM/FM radio campaign drove a +23% sales increase in households with children

The July/August/September time period represents the crucial back to school selling season with school supplies high on the shopping list of households with children.

Among households with children, the AM/FM radio campaign generated significant sales lift:

- +4% share of category spend

- +10% growth in spend per buying household

- +11% customer increase (buyer penetration)

- +23% total spend growth

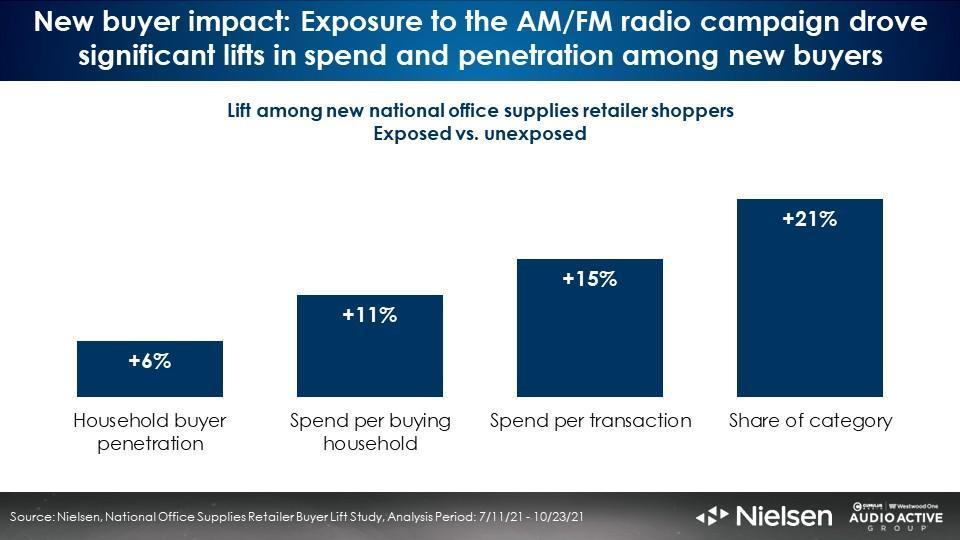

The AM/FM radio campaign drove significant new customer growth

According to Byron Sharp, Director of the renowned Ehrenberg-Bass Institute for Marketing Science and author of the best-selling book How Brands Grow, growth “never occurs without the brand increasing the size of its customer base (market penetration), and that requires building mental and physical availability.”

Mental availability means “being known before you are needed.” The AM/FM radio campaign generated stunning increases in new customers which drove major growth in spend and category share.

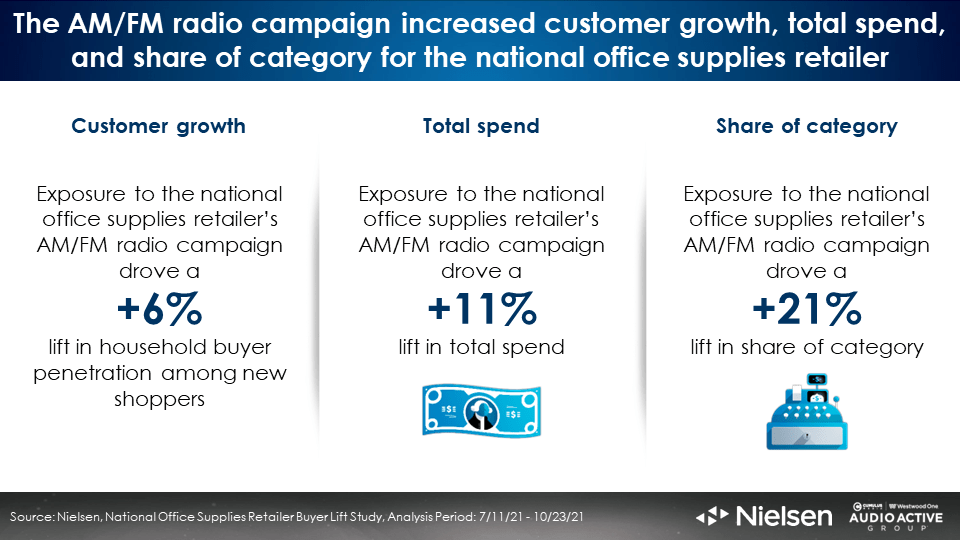

Total AM/FM radio sales impact: +6% customer growth, +11 sales lift, and +21% increase in share of category spend

This is hard evidence of AM/FM radio’s ability to drive significant business outcomes.

Key takeaways:

- Spend per transaction was higher online versus in the store: Online shoppers made up 17% of total spend at the national office supplies retailer but only 8% of total transactions.

- Strong back to school sales effect: AM/FM radio campaign exposure drove strong sales impact among households with children.

- New buyer impact: Exposure to the AM/FM radio campaign drove significant lifts in spend per transaction (+15%) and customer growth (penetration) among new buyers (+6%).

- Total campaign impact: Exposure to the AM/FM radio campaign drove significant lifts in customer base (+6%), total spend (+11%) and share of category (+21%).

Click here to view a 9-minute video of the key findings.

Pierre Bouvard is Chief Insights Officer at Cumulus Media | Westwood One and President of the Cumulus Media | Westwood One Audio Active Group®.

Contact the Insights team at CorpMarketing@westwoodone.com.